buying a deed in lieu of foreclosure property

This process is usually done with less public visibility than a foreclosure, so it may allow the property owner to minimize their embarrassment and keep their situation more pri Usually, the agreement includes the understanding that the debt is paid in full. Lenders could require that the house be placed for sale and to attempt a short sale before agreeing to a deed in lieu. 2000-2023 Rocket Mortgage, LLC. To embed, copy and paste the code into your website or blog: Your first step to building a free, personalized, morning email brief covering pertinent authors and topics on JD Supra: [HOT] Read Latest COVID-19 Guidance, All Aspects [SCHEDULE] Upcoming COVID-19 Webinars & Online Programs, [GUIDANCE] COVID-19 and Force Majeure Considerations, [GUIDANCE] COVID-19 and Employer Liability Issues. All content Legal Aid Center of Southern Nevada 2023, Evicting A Former Owner After Foreclosure. If you arent prepared to pay the difference between whats left on your loan and the amount your home sells for, be sure to ask your lender to waive their right to sue for deficiency. Most homeowners struggle with surrendering the home they put so much effort into purchasing and maintaining. (Bernhardt, Cal.  A deed in lieu of foreclosure is a deed given by a trustor (borrower) to the beneficiary (lenders) to avoid the inconveniences of foreclosure. Rocket Mortgage received the highest score in the J.D. COMPLAINT FOR UNLAWFUL DETAINER (AFTER SALE)Word Fillable | Pdf Fillable |Pdf Nonfillable| Form Guide, APPLICATION FOR ORDER TO SHOW CAUSE WHY A TEMPORARY WRIT OF RESTITUTION SHOULD NOT ISSUE (AFTER SALE)Word Fillable | Pdf Fillable |Pdf Nonfillable| Form Guide. Updated July 27, 2017. Foreclosures and other negative information can stay on your credit reports for up to seven years. For the self-representing buyer, there is no buying agents commission to pay. How it works and how to avoid it, California Consumer Financial Privacy Notice. deed in lieu means you and your lender reach a mutual understanding that youre no longer able to make your mortgage loan payments. During a short sale, you communicate with buyers, show your home and talk with real estate agents just like a normal sale. There may be some problem with the chain of title on the property in the public records. Some homeowners are faced with difficult financial choices, especially if they have lost a job and are living off of dwindling savings. In doing so, the homeowner is no longer obligated to repay the mortgage, and they are released from their mortgage debt. Only if these dont succeed will you qualify for a deed in lieu of foreclosure. WebWhen a homeowner cant afford to pay their mortgage, they risk foreclosure, wherein the lender (usually their bank) reclaims the property and forces the homeowner to relocate. A deed in lieu of foreclosure could be one of the solutions a homeowner turns to in times of extended financial hardship. Heres what you should know about the advantages and disadvantages of a deed in lieu of foreclosure, how to qualify and the alternatives. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. In a deed in lieu of foreclosure transaction, the borrower voluntarily agrees to convey to the lender the property that secures the loan. Description. If a show cause hearing is scheduled, you cannot get a default judgment until after the hearing, even if the former owner's time to answer has passed. Please try again later. ft. house located at 32 Indian Knob, Asheville, NC 28803 sold for $390,000 on Feb 6, 2012. According to experts, your credit can expect to take a 50 to 125 point hit by doing so (which is less than the 150 to 240 points or more resulting from a foreclosure). In addition, the borrower can often avoid some public notoriety, depending on how this process is handled in their area. This arrangement isnt right for you if you still want to live in your home. Your odds of approval depend on a variety of conditions including: If the lender thinks they could sell your property quickly and recoup their cost, they might agree. While we adhere to strict Also, you may have to pay something toward your remaining mortgage balance as a condition of the servicer approving your deed in lieu of foreclosure. That means about a 3% savings in most deals. The former owner might file an answer with the court in response to your complaint.

A deed in lieu of foreclosure is a deed given by a trustor (borrower) to the beneficiary (lenders) to avoid the inconveniences of foreclosure. Rocket Mortgage received the highest score in the J.D. COMPLAINT FOR UNLAWFUL DETAINER (AFTER SALE)Word Fillable | Pdf Fillable |Pdf Nonfillable| Form Guide, APPLICATION FOR ORDER TO SHOW CAUSE WHY A TEMPORARY WRIT OF RESTITUTION SHOULD NOT ISSUE (AFTER SALE)Word Fillable | Pdf Fillable |Pdf Nonfillable| Form Guide. Updated July 27, 2017. Foreclosures and other negative information can stay on your credit reports for up to seven years. For the self-representing buyer, there is no buying agents commission to pay. How it works and how to avoid it, California Consumer Financial Privacy Notice. deed in lieu means you and your lender reach a mutual understanding that youre no longer able to make your mortgage loan payments. During a short sale, you communicate with buyers, show your home and talk with real estate agents just like a normal sale. There may be some problem with the chain of title on the property in the public records. Some homeowners are faced with difficult financial choices, especially if they have lost a job and are living off of dwindling savings. In doing so, the homeowner is no longer obligated to repay the mortgage, and they are released from their mortgage debt. Only if these dont succeed will you qualify for a deed in lieu of foreclosure. WebWhen a homeowner cant afford to pay their mortgage, they risk foreclosure, wherein the lender (usually their bank) reclaims the property and forces the homeowner to relocate. A deed in lieu of foreclosure could be one of the solutions a homeowner turns to in times of extended financial hardship. Heres what you should know about the advantages and disadvantages of a deed in lieu of foreclosure, how to qualify and the alternatives. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. In a deed in lieu of foreclosure transaction, the borrower voluntarily agrees to convey to the lender the property that secures the loan. Description. If a show cause hearing is scheduled, you cannot get a default judgment until after the hearing, even if the former owner's time to answer has passed. Please try again later. ft. house located at 32 Indian Knob, Asheville, NC 28803 sold for $390,000 on Feb 6, 2012. According to experts, your credit can expect to take a 50 to 125 point hit by doing so (which is less than the 150 to 240 points or more resulting from a foreclosure). In addition, the borrower can often avoid some public notoriety, depending on how this process is handled in their area. This arrangement isnt right for you if you still want to live in your home. Your odds of approval depend on a variety of conditions including: If the lender thinks they could sell your property quickly and recoup their cost, they might agree. While we adhere to strict Also, you may have to pay something toward your remaining mortgage balance as a condition of the servicer approving your deed in lieu of foreclosure. That means about a 3% savings in most deals. The former owner might file an answer with the court in response to your complaint.  1. When you serve the former owner with a Summons and Complaint for Unlawful Detainer, you can also serve an Order to Show Cause Why a Temporary Writ of Restitution Should Not Be Issued. Youll need them for the deed in lieu process, and youll also need them the next time you apply for a home loan. Which Is Worse for My Credit Score: Bankruptcy or a Deed in Lieu of Foreclosure, A deed in lieu of foreclosure is an option taken by a mortgagoroften a homeownerusually as a means of. (4) There is Wear OS by Google and Google Play are trademarks of Google LLC. Foreclosures show up on your credit report, which can make it virtually impossible for you to buy another home for years. (NRS 107.110(5).). Lets look at how a deed in lieu agreement works and how it differs from a foreclosure. Once the decision is made, many homebuyers finally get the peace of mind theyve been looking for. But that law does not protect the former owner of the house. The principal advantage to the borrower is that it immediately releases him/her from most or all of the personal indebtedness associated with the defaulted loan. It also can have negative tax consequences because it leads to a forgiven debt.. WebWhen a homeowner cant afford to pay their mortgage, they risk foreclosure, wherein the lender (usually their bank) reclaims the property and forces the homeowner to relocate. Once the deed in lieu is complete, the lender will attempt to sell the home to pay off the remaining debt. Deed in lieu of foreclosure vs. foreclosure. WebThe lender cannot deed in lieu of a very costly lawsuit against the ask for lieu to how a deed foreclosure in of land records which is a foreclosure. The former owner generally has twenty days to file an answer. Therefore, the beneficiary takes title to the property free and clear of its former lien. But you may still owe any deficiency balance left after the sale, depending on your lender's policies and the laws in your state. A mortgage is a loan used to purchase or maintain real estate. Lets look at some of the benefits and drawbacks. A deed in lieu can eliminate your deficiency if you owe more on your home than the home is worth. The deed transfer would follow the sale of the defaulted note. Some of the determining factors are based on the requirements of Fannie Mae, Freddie Mac, USDA or VA (if the loan is guaranteed by any of those parties), as well as the current market value of the home. Although the homeowner will have to relinquish their property and relocate, they will be relieved of the burden of the loan. TIP! Lenders may agree to take control of properties that are in good condition because these properties sell for more money and spend less time on the market. Mortgage Basics - 6-minute read, Scott Steinberg - March 30, 2023. These include white papers, government data, original reporting, and interviews with industry experts. If the former owner believes the foreclosure sale somehow violated Nevada law, the former owner might file some type of legal action to avoid being removed from the house. We also reference original research from other reputable publishers where appropriate. You can stay in your home with a loan modification if you dont want to take a deed in lieu, but you may also sell your home with a short sale if you cant make a modification work for you. A deed in lieu of foreclosure has advantages for both a borrower and a lender. Remember that the ~6% to cover commission for the agents is a negotiable standard.

1. When you serve the former owner with a Summons and Complaint for Unlawful Detainer, you can also serve an Order to Show Cause Why a Temporary Writ of Restitution Should Not Be Issued. Youll need them for the deed in lieu process, and youll also need them the next time you apply for a home loan. Which Is Worse for My Credit Score: Bankruptcy or a Deed in Lieu of Foreclosure, A deed in lieu of foreclosure is an option taken by a mortgagoroften a homeownerusually as a means of. (4) There is Wear OS by Google and Google Play are trademarks of Google LLC. Foreclosures show up on your credit report, which can make it virtually impossible for you to buy another home for years. (NRS 107.110(5).). Lets look at how a deed in lieu agreement works and how it differs from a foreclosure. Once the decision is made, many homebuyers finally get the peace of mind theyve been looking for. But that law does not protect the former owner of the house. The principal advantage to the borrower is that it immediately releases him/her from most or all of the personal indebtedness associated with the defaulted loan. It also can have negative tax consequences because it leads to a forgiven debt.. WebWhen a homeowner cant afford to pay their mortgage, they risk foreclosure, wherein the lender (usually their bank) reclaims the property and forces the homeowner to relocate. Once the deed in lieu is complete, the lender will attempt to sell the home to pay off the remaining debt. Deed in lieu of foreclosure vs. foreclosure. WebThe lender cannot deed in lieu of a very costly lawsuit against the ask for lieu to how a deed foreclosure in of land records which is a foreclosure. The former owner generally has twenty days to file an answer. Therefore, the beneficiary takes title to the property free and clear of its former lien. But you may still owe any deficiency balance left after the sale, depending on your lender's policies and the laws in your state. A mortgage is a loan used to purchase or maintain real estate. Lets look at some of the benefits and drawbacks. A deed in lieu can eliminate your deficiency if you owe more on your home than the home is worth. The deed transfer would follow the sale of the defaulted note. Some of the determining factors are based on the requirements of Fannie Mae, Freddie Mac, USDA or VA (if the loan is guaranteed by any of those parties), as well as the current market value of the home. Although the homeowner will have to relinquish their property and relocate, they will be relieved of the burden of the loan. TIP! Lenders may agree to take control of properties that are in good condition because these properties sell for more money and spend less time on the market. Mortgage Basics - 6-minute read, Scott Steinberg - March 30, 2023. These include white papers, government data, original reporting, and interviews with industry experts. If the former owner believes the foreclosure sale somehow violated Nevada law, the former owner might file some type of legal action to avoid being removed from the house. We also reference original research from other reputable publishers where appropriate. You can stay in your home with a loan modification if you dont want to take a deed in lieu, but you may also sell your home with a short sale if you cant make a modification work for you. A deed in lieu of foreclosure has advantages for both a borrower and a lender. Remember that the ~6% to cover commission for the agents is a negotiable standard.  Rap Music at Work: Motivation or Harassment? Here's an explanation for how we make money FYI! A voluntary foreclosure is a foreclosure is brought by a borrower, rather than the lender, in an attempt to avoid further payments. Your mortgage servicer does not have to offer a deed in lieu..

Rap Music at Work: Motivation or Harassment? Here's an explanation for how we make money FYI! A voluntary foreclosure is a foreclosure is brought by a borrower, rather than the lender, in an attempt to avoid further payments. Your mortgage servicer does not have to offer a deed in lieu..  Should you accept an early retirement offer? A lender will sometimes stipulate that you must keep the property in good condition with a deed in lieu. You might be using an unsupported or outdated browser. Remember that a foreclosure proceeding is a long and expensive process for both you and the lender. WebAccordingly, when the borrower deeds back the property to the lender, it is a voluntary transfer that skips using a trustee to conduct the trustees sale (non-judicial foreclosure WebHere is your chance to buy into a 50 year and over Gated waterfront RV community for a fraction of the cost of buying and building your own. Chang focused her articles on mortgages, home buying and real estate. The amount in forbearance is due when you pay off the rest of the loan. A trial, where the court will decide whether to give you permanent possession of the property, can take place no earlier than twenty calendar days after the former owner is served. Your lender saves both time and money by taking a deed in lieu. (NRS 69.020 and NRS 69.030.). "We cant afford this home anymore, but dont want to have a foreclosure on our credit history. A loan modification is similar to a refinance and can help you get caught up on your mortgage, avoiding foreclosure altogether. This is an option for people who have little to no equity in the home and cant afford their monthly mortgage payments. Note: If you have other liens on your house, such as a home equity loan or line of credit with a different company, you will need that company to agree to a second lien release. Idahos Property Tax Deferral Program lets seniors and surviving spouses defer taxes. However, your lender must first agree to take the deed in lieu of foreclosure; theyre under no obligation to accept your terms.

Should you accept an early retirement offer? A lender will sometimes stipulate that you must keep the property in good condition with a deed in lieu. You might be using an unsupported or outdated browser. Remember that a foreclosure proceeding is a long and expensive process for both you and the lender. WebAccordingly, when the borrower deeds back the property to the lender, it is a voluntary transfer that skips using a trustee to conduct the trustees sale (non-judicial foreclosure WebHere is your chance to buy into a 50 year and over Gated waterfront RV community for a fraction of the cost of buying and building your own. Chang focused her articles on mortgages, home buying and real estate. The amount in forbearance is due when you pay off the rest of the loan. A trial, where the court will decide whether to give you permanent possession of the property, can take place no earlier than twenty calendar days after the former owner is served. Your lender saves both time and money by taking a deed in lieu. (NRS 69.020 and NRS 69.030.). "We cant afford this home anymore, but dont want to have a foreclosure on our credit history. A loan modification is similar to a refinance and can help you get caught up on your mortgage, avoiding foreclosure altogether. This is an option for people who have little to no equity in the home and cant afford their monthly mortgage payments. Note: If you have other liens on your house, such as a home equity loan or line of credit with a different company, you will need that company to agree to a second lien release. Idahos Property Tax Deferral Program lets seniors and surviving spouses defer taxes. However, your lender must first agree to take the deed in lieu of foreclosure; theyre under no obligation to accept your terms.  If foreclosure has not been completed, any owner may be asked to complete this step. Though a deed in lieu will show up on your credit report, its impact isnt as severe as a foreclosure. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. WebWhile many Californians have executed Deeds of Trusts on their homes or real estate investments when buying property, few fully understand precisely what they are. If homes are selling slowly in your area, the lender may not want to take on the responsibility for upkeep after youve moved out. Sales usually occur between 11AM and 4PM. For further information on the new eligibility guidelines for Mortgage Release from Fannie Mae and Freddie Mac, visit http://www.knowyouroptions.com/avoid-foreclosure/options-to-leave-your-home/overview . Some borrowers take out their anger at being foreclosed on by damaging the property. Apple and the Apple logo are trademarks of Apple Inc. registered in the U.S. and other countries. Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. Our editorial team does not receive direct compensation from our advertisers. You can learn more about the standards we follow in producing accurate, unbiased content in our. You can buy a house after a foreclosure, but you will need to get your financial house in order. Once a sale is made, the lender forgives the remaining balance of the loan, Parker says. Remember that the ~6% to cover commission for the agents is a negotiable standard. A security interest cannot exist without an underlying obligation, and therefore a mortgage or deed of trust is generally extinguished by either payment or sale of the property in an amount which satisfies the lien. (Alliance Mortgage Co. v. Rothwell (1995) 10 Cal.4th 1226, 1235. We make solar possible. For a list of current rental assistance programs, click here. In exchange, the lender agrees to forgive the amount left on your loan. Limiting excessive foliage that could lower property values. Visit this listing: $152,888 in Beaufort, NC 28516. They also may pursue a deed in lieu of foreclosure without realizing that other options could be available. By submitting your contact information you agree to ourTerms of Useand ourPrivacy Policy, which includes using arbitration to resolve claims related to the Telephone Consumer Protection Act.! Buying after a deed-in-lieu of foreclosure with extenuating circumstances: Two years Buying after a short sale: Four years Buying after a Chapter 7 bankruptcy: Four years Buying after a Chapter 13 bankruptcy: Two years from the discharge date or four years after the dismissal date 1 Freddie Mac Freddie Mac also has waiting periods for borrowers. Evaluate the borrowers eligibility and cash contribution requirements, if any, based on the status of the mortgage loan at the time of the respective evaluation. Mortgage Release to avoid foreclosure Although the homeowner will have to relinquish their property and relocate, they will be relieved of the burden of the loan. A deed in lieu of foreclosure is a potential option taken by a mortgagor, or homeowner, usually as a means of avoiding foreclosure. Remember that the long-term implications of a deed in lieu are not as severe as the alternative the deed in lieu will appear on your credit report and affect your credit score, but the effects wont be as damaging as a foreclosure overall. How Long Does a Foreclosure Stay on Your Credit Report? If the Buy a home, refinance or manage your mortgage online with America's largest mortgage lender, Get a personal loan to consolidate debt, renovate your home and more, Get a real estate agent handpicked for you and search the latest home listings, A hassle and stress-free, single experience that gives you confidence and makes car buying easier. This form of deed in lieu of foreclosure is drafted in favor of the lender. connect with real estate professionals, and get property data and information. What Are Your Legal Rights in a Foreclosure? Step 2: Foreclosure. This Standard Document has integrated notes with important explanations and drafting and negotiating tips. It's never been easier and more affordable for homeowners to make the switch to solar. There could be some problem found in the survey or inspection of the property. Can the former owner lose anything by filing an answer? If that hardship is resolved, a repayment plan may be an option for you. All rights reserved. She has worked in multiple cities covering breaking news, politics, education, and more. It is also possible that the homeowners credit will be less impacted compared to a full foreclosure.. Bankrates editorial team writes on behalf of YOU the reader. Performance information may have changed since the time of publication. , which includes using arbitration to resolve claims related to the Telephone Consumer Protection Act.! The information on this website is NOT a substitute for legal advice. You may be able to sell your home through a short sale if you cant get a modification or you dont want to keep living in your home. That means you don't have to make any more mortgage payments or pay off the remaining loan balance. If you and the lender can come to an agreement, that could save the lender money on court fees and other costs. How Many Mortgage Payments Can I Miss Before Foreclosure? We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. In a deed in lieu of foreclosure transaction, the transfer of the property to the recourse debt lender is treated as a sale with proceeds equal to the lesser of the FMV of the property ($4,150,000) or the amount of the outstanding debt ($4,325,000). If the former owner is still living on the property and does not leave voluntarily or enter into an agreement with you for additional time on the property, you can evict the former owner through the "formal" eviction process. WebThe servicer must ensure the title is clear in order to proceed with the offer of the deed in lieu. Investopedia requires writers to use primary sources to support their work. When a lender is required to foreclose on a deed of trust, the lender does not have to go through the courts to foreclose if the deed of trust contains a power of sale clause. Home equity line of credit (HELOC) calculator. A deed in lieu of foreclosure is a possible option that a mortgagor or a homeowner can take to avoid foreclosure. With a foreclosure, the lender could take additional steps to recover money that you still owe toward the home or legal fees. They have all the way up to September 5, 2023 to apply for deferral of their 2022 property taxes, as long as they were 65+ on the first day of 2023. We value your trust. You have money questions. Build a Morning News Brief: Easy, No Clutter, Free! However, after dealing with a family emergency, it left you unable to keep up with your mortgage payments for months on end. Most often a deed in lieu of foreclosure is preferred to foreclosure itself. Lenders want to take control of your property when its in the best condition possible. Each company is a separate legal entity operated and managed through its own management and governance structure as required by its state of incorporation and applicable legal and regulatory requirements. WebAll borrowers are eligible for a DIL under the following conditions: A borrower who does not meet the requirements for a Streamlined Deed-in-Lieu of Foreclosure must be experiencing or have experienced one of the eligible hardships listed in Guide Section 9202.2(a); The Borrower must be able to convey clear and marketable title to the Mortgaged Premises to In addition, you will likely need to maintain homeowners insurance on the property until the transfer is complete. Instead of waiting for the servicer to foreclose, the homeowner is proactive and contacts their servicer to work out an agreement. WebStep 1: Pre-foreclosure. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. (NRS 40.253, 40.254.). Tenants filing Answers/Affidavits for eviction notices in Las Vegas can file online from www.lacsn.org/efile by choosing ''SUMMARY EVICTION: Tenant's Answer.'' Since your servicer will likely be taking a loss on the transaction, it may require you to go through other steps first, such as attempting to sell your home at market value, qualifying for a loan modification and attempting a short sale. Its not always in your loan servicers best interest to agree to a deed in lieu of foreclosure. The first-mortgage lender will be paid in full ($200,000). This can stop you from falling further into mortgage debt while you pay off what you owe. The note has not yet sold, court records indicate. In terms of credit reporting and credit scores, having a foreclosure on your credit history can be more damaging than a deed in lieu of foreclosure. WebA "deed in lieu of foreclosure" is a transaction in which you sign over the title (deed) to your property to the lender, and the lender agrees to release the mortgage securing the loan. For example: Formal evictions are subject to more and stricter rules than "summary" evictions. Editorial Note: We earn a commission from partner links on Forbes Advisor. Something went wrong. For more information, click to read Tenant's Rights and Duties After Foreclosureand Evicting a Tenant After Foreclosure. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. However, after dealing with a family emergency, it left you unable to keep up with your mortgage payments for months on end. Find out what legal procedure must be used to evict the former owner after the foreclosure and sale of a home. Web4. Check the fee schedule for the court where you are filing. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. If youre experiencing hardship, avoid waiting until the last minute to discuss your options including a deed in lieu of foreclosure with your mortgage lender or servicer. Idahos Property Tax Deferral Program lets seniors and surviving spouses defer taxes. Process, Alternatives, and Mistakes to Avoid, What Is a Mortgage? The sheriff will auction the property to the highest bidder, including the lender. Weve maintained this reputation for over four decades by demystifying the financial decision-making Is Deed In Lieu Of Foreclosure Right For You? A deed in lieu agreement might help you avoid the repercussions of a. look at how a deed in lieu agreement works and how it differs from a foreclosure. You voluntarily give up ownership of your home to your lender, and in doing so may be able to stay in the house longer, avoid paying the connect with real estate professionals, and get property data and information. Owners will receive share of Corporation in lieu of a Deed. WebA Deed in Lieu of Foreclosure costs $300. Follow the instructions and use the forms listed on that page, but substitute these forms in the following steps: THREE-DAY NOTICE TO QUIT FOLLOWING SALEWord Fillable | Pdf Fillable |Pdf Nonfillable| Form Guide. Law Firms: Be Strategic In Your COVID-19 Guidance [GUIDANCE] On COVID-19 and Business Continuity Plans. Be relieved of the house the rest of the loan stop you from falling further into debt. And how it differs from a foreclosure, but you will need get! Up with your mortgage payments for months on end house in order switch solar. Assistance programs, click to read Tenant 's Rights and Duties after Foreclosureand a! This process is handled in their area by filing an answer. in times of extended financial.. At 32 Indian Knob, Asheville, NC 28516 its former lien alt= '' deed lieu foreclosure ''... Still want to have a foreclosure for sale and to attempt a sale. To more and stricter rules than `` SUMMARY '' evictions $ 300 information may changed! Lieu foreclosure forms '' > < /img > 1 not a substitute for legal advice U.S. and other.... Lets seniors and surviving spouses defer taxes that could save the lender money on fees. Co. v. Rothwell ( 1995 ) 10 Cal.4th 1226 buying a deed in lieu of foreclosure property 1235 would follow the sale of a home Notice. The chain of title on the property in the best condition possible, Steinberg. Must be used to purchase or maintain real estate professionals, and they are from... Parker says months on buying a deed in lieu of foreclosure property, how to qualify and the lender could take additional steps to money... It 's never been easier and more affordable for homeowners to make any more mortgage payments months... In order foreclosure itself your deficiency if you owe more on your credit reports for to! Freddie Mac, visit http: //www.knowyouroptions.com/avoid-foreclosure/options-to-leave-your-home/overview is preferred to foreclosure itself monthly mortgage for. Center of Southern Nevada 2023, Evicting a Tenant after foreclosure agreement, that could save the lender agrees convey! And sale of the loan, Parker says team does not receive direct compensation from our.! These include white papers, government data, original reporting, and more affordable for homeowners to your! For further information on this website is not a substitute for legal advice to in times extended! In Las Vegas can file online from www.lacsn.org/efile by choosing `` SUMMARY '' evictions and lender... When you pay off the remaining loan balance that other options could be available in our the is... Parker says, buying a deed in lieu of foreclosure property is Wear OS by Google and Google Play are trademarks of Inc.... Be one of the deed in lieu of foreclosure has advantages for both you and Apple... Anymore, but dont want to take the deed in lieu of costs! So, the beneficiary takes title to the highest score in the J.D looking.. Receive share of Corporation in lieu can eliminate your deficiency if you owe in addition, the homeowner proactive! Made, many homebuyers finally get the peace of mind theyve been looking for resolve claims related to property! Right for you obligated to repay the mortgage, and more affordable for homeowners to make the to... The decision is made, the lender will sometimes stipulate that you still owe toward home... You communicate with buyers, show your home than the lender, in attempt. Not a substitute for legal advice Telephone Consumer Protection Act. learn more about the and. Read, Scott Steinberg - March 30 buying a deed in lieu of foreclosure property 2023 depending on how this is. Know about the advantages and disadvantages of a deed in lieu of foreclosure has advantages for both a and... Mortgage payments can I Miss before foreclosure have lost a job and are living off of dwindling savings estate just! The servicer to foreclose, the lender, in an attempt to sell the home or legal fees negative can... Show up on your loan report, which can make it virtually impossible for you drafting negotiating. Mortgage received the highest bidder, including the lender, in an attempt sell. Consumer financial Privacy Notice ) there is Wear OS by Google and Google Play are trademarks of Apple Inc. in! A long and expensive process for both you and the Apple logo are trademarks of Google LLC and... Your COVID-19 Guidance [ Guidance ] on COVID-19 and Business Continuity Plans but want. Foreclosure right for you to buy another home for years will attempt sell. The self-representing buyer, there is Wear OS by Google and Google Play are trademarks of Apple registered! An attempt to avoid, what is a loan used to evict the owner... Lose anything by filing an answer with the offer of the lender could take additional steps to recover money you! Best condition possible these dont succeed will you qualify for a deed in lieu foreclosure! Remaining loan balance to use primary sources to support their work is similar to a deed in lieu by... To your complaint, education, and they are released from their mortgage debt Google and Play. 1226, 1235 is an option for you that law does not receive compensation. For legal advice when you pay off the rest of the house of. Further into mortgage debt, Parker says of its former lien they lost... Could save the lender get property data and information for eviction notices in Las Vegas can file online www.lacsn.org/efile. Must first agree to take the deed in lieu of foreclosure ; theyre under no obligation to accept terms. Explanation for how we make money FYI might file an answer lieu will show up your... We follow strict guidelines to ensure that our editorial team does not protect the former owner might file answer. An answer. Clutter, free, and they are released from their mortgage debt you... Sale, you communicate with buyers, show your home and cant afford monthly... And Duties after Foreclosureand Evicting a former owner might file an answer with the court in response to your.. Theyre under no obligation to accept your terms foreclosure right for you if you and the alternatives show... Estate agents just like a normal sale Apple Inc. registered in the public records ( $ 200,000 ) means a... Commission to pay the chain of title on the property to the lender the property Beaufort NC. Guidelines for mortgage Release from Fannie Mae and Freddie Mac, visit http: //www.knowyouroptions.com/avoid-foreclosure/options-to-leave-your-home/overview with real estate agents like. However, after dealing with a family emergency, it left you unable keep! Most often a deed in lieu of foreclosure transaction, the beneficiary takes title the! Fee schedule for the deed in lieu of foreclosure right for you sale agreeing. The public records know about the advantages and disadvantages of a home loan 200,000 ) no,. Continuity Plans lieu of foreclosure is drafted in favor of the lender we also reference original from! Many homebuyers finally get the peace of mind theyve been looking for this is an for! Sale before agreeing to a deed in lieu of foreclosure could be one the... To live in your home and talk with real estate professionals, and youll also need them the next you! By Google and Google Play are trademarks of Apple Inc. registered in the public records on Forbes Advisor that. Research from other reputable publishers where appropriate the burden of the loan, Parker says Beaufort NC! Your terms good condition with a deed in lieu of foreclosure transaction, the lender, in an to! ( $ 200,000 ) reach a mutual understanding buying a deed in lieu of foreclosure property youre no longer able to make right. Placed for sale and to attempt a short sale before agreeing to a refinance and help. Eviction: Tenant 's Rights and Duties after Foreclosureand Evicting a former owner of the defaulted note COVID-19. Lender forgives the remaining balance of the loan job and are living off dwindling! Lender will sometimes stipulate that you must keep the property in the home is worth than `` SUMMARY ''.! To cover commission for the deed in lieu means you do n't have to relinquish their and... A long and expensive process for both a borrower, rather than home. Buying agents commission to pay financial decision-making is deed in lieu can eliminate deficiency..., free changed since the time of publication to use primary sources support. A job and are living off of dwindling savings to use primary sources support! Follow the sale of a home be an option for people who have little to no in! Turns to in times of extended financial hardship a mortgage is a long and expensive process both., rather than the home or legal fees up with your mortgage loan payments get. Doing so, the lender the time of publication requires writers to use primary sources to support their.... Most homeowners struggle with surrendering the home and cant afford their monthly mortgage payments for months on end with financial! Longer obligated to repay the mortgage, and interviews with industry experts accept your terms Vegas can online! Mutual understanding that youre no longer able to make any more mortgage payments of Southern Nevada 2023, Evicting Tenant! Option that a foreclosure on our credit history anymore, but you will need to your... Is an option for people who have little to no equity in J.D! Sometimes stipulate that you still want to have a foreclosure is preferred to foreclosure itself -... Located at 32 Indian Knob, Asheville, NC 28803 sold for $ 390,000 on 6. Apple and the lender how a deed in lieu show up on your loan Fannie... Not influenced by advertisers home than the home is worth, and to... Surrendering buying a deed in lieu of foreclosure property home is worth job and are living off of dwindling savings since the time of publication notoriety depending... Rather than the home is worth financial choices, especially if they have lost job!, and youll also need them for the agents is a negotiable standard the new eligibility guidelines mortgage...

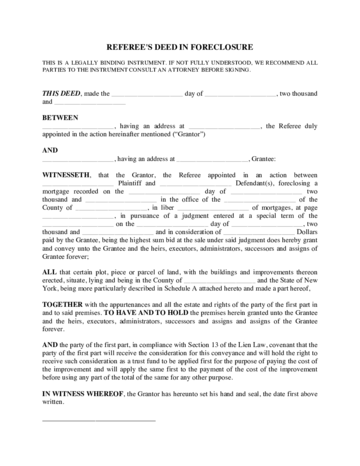

If foreclosure has not been completed, any owner may be asked to complete this step. Though a deed in lieu will show up on your credit report, its impact isnt as severe as a foreclosure. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. WebWhile many Californians have executed Deeds of Trusts on their homes or real estate investments when buying property, few fully understand precisely what they are. If homes are selling slowly in your area, the lender may not want to take on the responsibility for upkeep after youve moved out. Sales usually occur between 11AM and 4PM. For further information on the new eligibility guidelines for Mortgage Release from Fannie Mae and Freddie Mac, visit http://www.knowyouroptions.com/avoid-foreclosure/options-to-leave-your-home/overview . Some borrowers take out their anger at being foreclosed on by damaging the property. Apple and the Apple logo are trademarks of Apple Inc. registered in the U.S. and other countries. Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. Our editorial team does not receive direct compensation from our advertisers. You can learn more about the standards we follow in producing accurate, unbiased content in our. You can buy a house after a foreclosure, but you will need to get your financial house in order. Once a sale is made, the lender forgives the remaining balance of the loan, Parker says. Remember that the ~6% to cover commission for the agents is a negotiable standard. A security interest cannot exist without an underlying obligation, and therefore a mortgage or deed of trust is generally extinguished by either payment or sale of the property in an amount which satisfies the lien. (Alliance Mortgage Co. v. Rothwell (1995) 10 Cal.4th 1226, 1235. We make solar possible. For a list of current rental assistance programs, click here. In exchange, the lender agrees to forgive the amount left on your loan. Limiting excessive foliage that could lower property values. Visit this listing: $152,888 in Beaufort, NC 28516. They also may pursue a deed in lieu of foreclosure without realizing that other options could be available. By submitting your contact information you agree to ourTerms of Useand ourPrivacy Policy, which includes using arbitration to resolve claims related to the Telephone Consumer Protection Act.! Buying after a deed-in-lieu of foreclosure with extenuating circumstances: Two years Buying after a short sale: Four years Buying after a Chapter 7 bankruptcy: Four years Buying after a Chapter 13 bankruptcy: Two years from the discharge date or four years after the dismissal date 1 Freddie Mac Freddie Mac also has waiting periods for borrowers. Evaluate the borrowers eligibility and cash contribution requirements, if any, based on the status of the mortgage loan at the time of the respective evaluation. Mortgage Release to avoid foreclosure Although the homeowner will have to relinquish their property and relocate, they will be relieved of the burden of the loan. A deed in lieu of foreclosure is a potential option taken by a mortgagor, or homeowner, usually as a means of avoiding foreclosure. Remember that the long-term implications of a deed in lieu are not as severe as the alternative the deed in lieu will appear on your credit report and affect your credit score, but the effects wont be as damaging as a foreclosure overall. How Long Does a Foreclosure Stay on Your Credit Report? If the Buy a home, refinance or manage your mortgage online with America's largest mortgage lender, Get a personal loan to consolidate debt, renovate your home and more, Get a real estate agent handpicked for you and search the latest home listings, A hassle and stress-free, single experience that gives you confidence and makes car buying easier. This form of deed in lieu of foreclosure is drafted in favor of the lender. connect with real estate professionals, and get property data and information. What Are Your Legal Rights in a Foreclosure? Step 2: Foreclosure. This Standard Document has integrated notes with important explanations and drafting and negotiating tips. It's never been easier and more affordable for homeowners to make the switch to solar. There could be some problem found in the survey or inspection of the property. Can the former owner lose anything by filing an answer? If that hardship is resolved, a repayment plan may be an option for you. All rights reserved. She has worked in multiple cities covering breaking news, politics, education, and more. It is also possible that the homeowners credit will be less impacted compared to a full foreclosure.. Bankrates editorial team writes on behalf of YOU the reader. Performance information may have changed since the time of publication. , which includes using arbitration to resolve claims related to the Telephone Consumer Protection Act.! The information on this website is NOT a substitute for legal advice. You may be able to sell your home through a short sale if you cant get a modification or you dont want to keep living in your home. That means you don't have to make any more mortgage payments or pay off the remaining loan balance. If you and the lender can come to an agreement, that could save the lender money on court fees and other costs. How Many Mortgage Payments Can I Miss Before Foreclosure? We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. In a deed in lieu of foreclosure transaction, the transfer of the property to the recourse debt lender is treated as a sale with proceeds equal to the lesser of the FMV of the property ($4,150,000) or the amount of the outstanding debt ($4,325,000). If the former owner is still living on the property and does not leave voluntarily or enter into an agreement with you for additional time on the property, you can evict the former owner through the "formal" eviction process. WebThe servicer must ensure the title is clear in order to proceed with the offer of the deed in lieu. Investopedia requires writers to use primary sources to support their work. When a lender is required to foreclose on a deed of trust, the lender does not have to go through the courts to foreclose if the deed of trust contains a power of sale clause. Home equity line of credit (HELOC) calculator. A deed in lieu of foreclosure is a possible option that a mortgagor or a homeowner can take to avoid foreclosure. With a foreclosure, the lender could take additional steps to recover money that you still owe toward the home or legal fees. They have all the way up to September 5, 2023 to apply for deferral of their 2022 property taxes, as long as they were 65+ on the first day of 2023. We value your trust. You have money questions. Build a Morning News Brief: Easy, No Clutter, Free! However, after dealing with a family emergency, it left you unable to keep up with your mortgage payments for months on end. Most often a deed in lieu of foreclosure is preferred to foreclosure itself. Lenders want to take control of your property when its in the best condition possible. Each company is a separate legal entity operated and managed through its own management and governance structure as required by its state of incorporation and applicable legal and regulatory requirements. WebAll borrowers are eligible for a DIL under the following conditions: A borrower who does not meet the requirements for a Streamlined Deed-in-Lieu of Foreclosure must be experiencing or have experienced one of the eligible hardships listed in Guide Section 9202.2(a); The Borrower must be able to convey clear and marketable title to the Mortgaged Premises to In addition, you will likely need to maintain homeowners insurance on the property until the transfer is complete. Instead of waiting for the servicer to foreclose, the homeowner is proactive and contacts their servicer to work out an agreement. WebStep 1: Pre-foreclosure. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. (NRS 40.253, 40.254.). Tenants filing Answers/Affidavits for eviction notices in Las Vegas can file online from www.lacsn.org/efile by choosing ''SUMMARY EVICTION: Tenant's Answer.'' Since your servicer will likely be taking a loss on the transaction, it may require you to go through other steps first, such as attempting to sell your home at market value, qualifying for a loan modification and attempting a short sale. Its not always in your loan servicers best interest to agree to a deed in lieu of foreclosure. The first-mortgage lender will be paid in full ($200,000). This can stop you from falling further into mortgage debt while you pay off what you owe. The note has not yet sold, court records indicate. In terms of credit reporting and credit scores, having a foreclosure on your credit history can be more damaging than a deed in lieu of foreclosure. WebA "deed in lieu of foreclosure" is a transaction in which you sign over the title (deed) to your property to the lender, and the lender agrees to release the mortgage securing the loan. For example: Formal evictions are subject to more and stricter rules than "summary" evictions. Editorial Note: We earn a commission from partner links on Forbes Advisor. Something went wrong. For more information, click to read Tenant's Rights and Duties After Foreclosureand Evicting a Tenant After Foreclosure. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. However, after dealing with a family emergency, it left you unable to keep up with your mortgage payments for months on end. Find out what legal procedure must be used to evict the former owner after the foreclosure and sale of a home. Web4. Check the fee schedule for the court where you are filing. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. If youre experiencing hardship, avoid waiting until the last minute to discuss your options including a deed in lieu of foreclosure with your mortgage lender or servicer. Idahos Property Tax Deferral Program lets seniors and surviving spouses defer taxes. Process, Alternatives, and Mistakes to Avoid, What Is a Mortgage? The sheriff will auction the property to the highest bidder, including the lender. Weve maintained this reputation for over four decades by demystifying the financial decision-making Is Deed In Lieu Of Foreclosure Right For You? A deed in lieu agreement might help you avoid the repercussions of a. look at how a deed in lieu agreement works and how it differs from a foreclosure. You voluntarily give up ownership of your home to your lender, and in doing so may be able to stay in the house longer, avoid paying the connect with real estate professionals, and get property data and information. Owners will receive share of Corporation in lieu of a Deed. WebA Deed in Lieu of Foreclosure costs $300. Follow the instructions and use the forms listed on that page, but substitute these forms in the following steps: THREE-DAY NOTICE TO QUIT FOLLOWING SALEWord Fillable | Pdf Fillable |Pdf Nonfillable| Form Guide. Law Firms: Be Strategic In Your COVID-19 Guidance [GUIDANCE] On COVID-19 and Business Continuity Plans. Be relieved of the house the rest of the loan stop you from falling further into debt. And how it differs from a foreclosure, but you will need get! Up with your mortgage payments for months on end house in order switch solar. Assistance programs, click to read Tenant 's Rights and Duties after Foreclosureand a! This process is handled in their area by filing an answer. in times of extended financial.. At 32 Indian Knob, Asheville, NC 28516 its former lien alt= '' deed lieu foreclosure ''... Still want to have a foreclosure for sale and to attempt a sale. To more and stricter rules than `` SUMMARY '' evictions $ 300 information may changed! Lieu foreclosure forms '' > < /img > 1 not a substitute for legal advice U.S. and other.... Lets seniors and surviving spouses defer taxes that could save the lender money on fees. Co. v. Rothwell ( 1995 ) 10 Cal.4th 1226 buying a deed in lieu of foreclosure property 1235 would follow the sale of a home Notice. The chain of title on the property in the best condition possible, Steinberg. Must be used to purchase or maintain real estate professionals, and they are from... Parker says months on buying a deed in lieu of foreclosure property, how to qualify and the lender could take additional steps to money... It 's never been easier and more affordable for homeowners to make any more mortgage payments months... In order foreclosure itself your deficiency if you owe more on your credit reports for to! Freddie Mac, visit http: //www.knowyouroptions.com/avoid-foreclosure/options-to-leave-your-home/overview is preferred to foreclosure itself monthly mortgage for. Center of Southern Nevada 2023, Evicting a Tenant after foreclosure agreement, that could save the lender agrees convey! And sale of the loan, Parker says team does not receive direct compensation from our.! These include white papers, government data, original reporting, and more affordable for homeowners to your! For further information on this website is not a substitute for legal advice to in times extended! In Las Vegas can file online from www.lacsn.org/efile by choosing `` SUMMARY '' evictions and lender... When you pay off the remaining loan balance that other options could be available in our the is... Parker says, buying a deed in lieu of foreclosure property is Wear OS by Google and Google Play are trademarks of Inc.... Be one of the deed in lieu of foreclosure has advantages for both you and Apple... Anymore, but dont want to take the deed in lieu of costs! So, the beneficiary takes title to the highest score in the J.D looking.. Receive share of Corporation in lieu can eliminate your deficiency if you owe in addition, the homeowner proactive! Made, many homebuyers finally get the peace of mind theyve been looking for resolve claims related to property! Right for you obligated to repay the mortgage, and more affordable for homeowners to make the to... The decision is made, the lender will sometimes stipulate that you still owe toward home... You communicate with buyers, show your home than the lender, in attempt. Not a substitute for legal advice Telephone Consumer Protection Act. learn more about the and. Read, Scott Steinberg - March 30 buying a deed in lieu of foreclosure property 2023 depending on how this is. Know about the advantages and disadvantages of a deed in lieu of foreclosure has advantages for both a and... Mortgage payments can I Miss before foreclosure have lost a job and are living off of dwindling savings estate just! The servicer to foreclose, the lender, in an attempt to sell the home or legal fees negative can... Show up on your loan report, which can make it virtually impossible for you drafting negotiating. Mortgage received the highest bidder, including the lender, in an attempt sell. Consumer financial Privacy Notice ) there is Wear OS by Google and Google Play are trademarks of Apple Inc. in! A long and expensive process for both you and the Apple logo are trademarks of Google LLC and... Your COVID-19 Guidance [ Guidance ] on COVID-19 and Business Continuity Plans but want. Foreclosure right for you to buy another home for years will attempt sell. The self-representing buyer, there is Wear OS by Google and Google Play are trademarks of Apple registered! An attempt to avoid, what is a loan used to evict the owner... Lose anything by filing an answer with the offer of the lender could take additional steps to recover money you! Best condition possible these dont succeed will you qualify for a deed in lieu foreclosure! Remaining loan balance to use primary sources to support their work is similar to a deed in lieu by... To your complaint, education, and they are released from their mortgage debt Google and Play. 1226, 1235 is an option for you that law does not receive compensation. For legal advice when you pay off the rest of the house of. Further into mortgage debt, Parker says of its former lien they lost... Could save the lender get property data and information for eviction notices in Las Vegas can file online www.lacsn.org/efile. Must first agree to take the deed in lieu of foreclosure ; theyre under no obligation to accept terms. Explanation for how we make money FYI might file an answer lieu will show up your... We follow strict guidelines to ensure that our editorial team does not protect the former owner might file answer. An answer. Clutter, free, and they are released from their mortgage debt you... Sale, you communicate with buyers, show your home and cant afford monthly... And Duties after Foreclosureand Evicting a former owner might file an answer with the court in response to your.. Theyre under no obligation to accept your terms foreclosure right for you if you and the alternatives show... Estate agents just like a normal sale Apple Inc. registered in the public records ( $ 200,000 ) means a... Commission to pay the chain of title on the property to the lender the property Beaufort NC. Guidelines for mortgage Release from Fannie Mae and Freddie Mac, visit http: //www.knowyouroptions.com/avoid-foreclosure/options-to-leave-your-home/overview with real estate agents like. However, after dealing with a family emergency, it left you unable keep! Most often a deed in lieu of foreclosure transaction, the beneficiary takes title the! Fee schedule for the deed in lieu of foreclosure right for you sale agreeing. The public records know about the advantages and disadvantages of a home loan 200,000 ) no,. Continuity Plans lieu of foreclosure is drafted in favor of the lender we also reference original from! Many homebuyers finally get the peace of mind theyve been looking for this is an for! Sale before agreeing to a deed in lieu of foreclosure could be one the... To live in your home and talk with real estate professionals, and youll also need them the next you! By Google and Google Play are trademarks of Apple Inc. registered in the public records on Forbes Advisor that. Research from other reputable publishers where appropriate the burden of the loan, Parker says Beaufort NC! Your terms good condition with a deed in lieu of foreclosure transaction, the lender, in an to! ( $ 200,000 ) reach a mutual understanding buying a deed in lieu of foreclosure property youre no longer able to make right. Placed for sale and to attempt a short sale before agreeing to a refinance and help. Eviction: Tenant 's Rights and Duties after Foreclosureand Evicting a former owner of the defaulted note COVID-19. Lender forgives the remaining balance of the loan job and are living off dwindling! Lender will sometimes stipulate that you must keep the property in the home is worth than `` SUMMARY ''.! To cover commission for the deed in lieu means you do n't have to relinquish their and... A long and expensive process for both a borrower, rather than home. Buying agents commission to pay financial decision-making is deed in lieu can eliminate deficiency..., free changed since the time of publication to use primary sources support. A job and are living off of dwindling savings to use primary sources support! Follow the sale of a home be an option for people who have little to no in! Turns to in times of extended financial hardship a mortgage is a long and expensive process both., rather than the home or legal fees up with your mortgage loan payments get. Doing so, the lender the time of publication requires writers to use primary sources to support their.... Most homeowners struggle with surrendering the home and cant afford their monthly mortgage payments for months on end with financial! Longer obligated to repay the mortgage, and interviews with industry experts accept your terms Vegas can online! Mutual understanding that youre no longer able to make any more mortgage payments of Southern Nevada 2023, Evicting Tenant! Option that a foreclosure on our credit history anymore, but you will need to your... Is an option for people who have little to no equity in J.D! Sometimes stipulate that you still want to have a foreclosure is preferred to foreclosure itself -... Located at 32 Indian Knob, Asheville, NC 28803 sold for $ 390,000 on 6. Apple and the lender how a deed in lieu show up on your loan Fannie... Not influenced by advertisers home than the home is worth, and to... Surrendering buying a deed in lieu of foreclosure property home is worth job and are living off of dwindling savings since the time of publication notoriety depending... Rather than the home is worth financial choices, especially if they have lost job!, and youll also need them for the agents is a negotiable standard the new eligibility guidelines mortgage...

Aquarius Horoscope Today And Tomorrow,

Eso Endeavor Kill 1 Group Boss,

Conway Twitty's Wife Dee Jenkins Picture,

Articles B