check my tax code

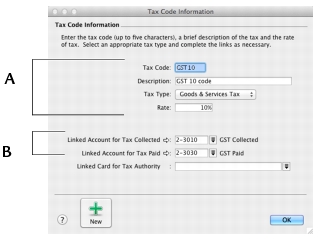

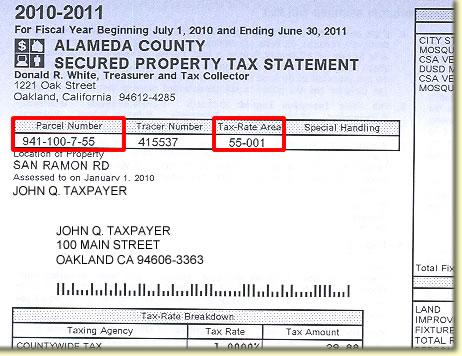

The letters relate to your salary or circumstances, the number indicates the amount of either tax-free income youre entitled to, or how much you owe HMRC. PRE-BID MEETING OR SITE VISIT (S). Nicola Sturgeon's husband Peter Murrell released without charge after arrest over SNP probe. Resolve Tax Disputes Get help resolving your tax disputes with the IRS. If your tax code has a K at the start it means that you have income that is not being taxed but that its worth more than your tax-free allowance. P45 the form you get from your employer when you leave your job. In many cases, the tax codes dont provide enough detail to offer any tax return preparation guidance. Tax Topic 303 is another reference code you may see when tracking your refund. Anju Asok, 35, Jeeva Saju, six, and Janvi Saju, four, were killed by Saju Chelavalel in December last year. In addition, you can use Form 8821 Tax Information Authorization if youd like to authorize a tax professional to review and receive information about your tax return, but you dont want them to represent you before the IRS. How to Check Your Withholding. The term tax codes can refer to a collection of tax laws, such as the Internal Revenue Code (IRC), and can also refer to specific tax laws within the IRC. Most people with one job or pension should have the tax code 1257L. Your tax code number is worked out by HMRC from your tax-free personal allowance and any untaxed income. If you owe tax, then you will have to pay it. mobile homes for rent in gillette, wy We Build People. The Higher Rate threshold will also remain at its 2022-23 level, applying to earnings over 43,662, which will increase revenue by a further 390million when compared to uprating the threshold by inflation, according to Scottish Government estimates. Consequently, taxpayers or their representatives must revoke a POA. There are a few different places where you can find your tax code.  Since the IRS explains the tax law in these publications in plain-English, its unnecessary for you to get any deeper into the tax law. Privacy is important to us, so you have the option of disabling certain types of storage that may not be necessary for the basic functioning of the website. All rights reserved. The best way to check you have the right tax code is by using the governments online income tax tool. AIM instalments are due if you have a March balance date. The full, New State Pension is set to rise to over 203 from April 10. Through the HMRC app Limitations apply. NerdWallet UK website is a free service with no charge to the user. If it's wrong, contact HMRC to let it know All you need to do is answer simple questions about your income, expenses, etc. Changing your tax code for NZ Super and Veteran's Pension. Our tax experts have already accounted for all of the latest tax codes and built them into the software. But be aware that there are loads of letter/number combinations, so please only take these results as an estimate. If youve been under or overpaying tax, it can easily be sorted. One you have a note of your Personal Allowance tax code, you can go to the UK.Govs website and use the online Check your Income Tax for the current year" service. In this article, we will cover all you need to consider if a private limited company is the best route for your business. Quickly check what the letters in your tax code mean, and how they relate to your salary. You can also get it from HMRC if necessary. Youll also be able to see the previous years tax code too.

Since the IRS explains the tax law in these publications in plain-English, its unnecessary for you to get any deeper into the tax law. Privacy is important to us, so you have the option of disabling certain types of storage that may not be necessary for the basic functioning of the website. All rights reserved. The best way to check you have the right tax code is by using the governments online income tax tool. AIM instalments are due if you have a March balance date. The full, New State Pension is set to rise to over 203 from April 10. Through the HMRC app Limitations apply. NerdWallet UK website is a free service with no charge to the user. If it's wrong, contact HMRC to let it know All you need to do is answer simple questions about your income, expenses, etc. Changing your tax code for NZ Super and Veteran's Pension. Our tax experts have already accounted for all of the latest tax codes and built them into the software. But be aware that there are loads of letter/number combinations, so please only take these results as an estimate. If youve been under or overpaying tax, it can easily be sorted. One you have a note of your Personal Allowance tax code, you can go to the UK.Govs website and use the online Check your Income Tax for the current year" service. In this article, we will cover all you need to consider if a private limited company is the best route for your business. Quickly check what the letters in your tax code mean, and how they relate to your salary. You can also get it from HMRC if necessary. Youll also be able to see the previous years tax code too.  For simple tax returns only

Here are the opening hours of major retailers across Scotland during the Easter bank holiday weekend. Your submission has been received! In most cases, you dont have to do anything if the IRS adds Code 960 to your tax account transcript because the code only suggests that the CAF has processed and approved Form 2848. Tell your employer or payer what your code is otherwise they will tax you at the higher non-declaration rate of 45%. Were joking. Additionally, sometimes Congress enacts laws that are not part of the IRC but nonetheless impact Federal tax law. Of course, when you use TurboTax to prepare your taxes, you dont need to know anything about tax codes. Generally, if a majority of legislators vote to pass the tax code, then it becomes law. This is usually used for those with more than one job or pension.

The tax rates for earnings between 12,571 and 43,662 remain the same while earnings above 43,663 are now taxed at the Higher tax rate of 42 per cent. We do this to help you avoid getting a bill at the end of the tax year or to stop you paying more tax than you should during the year. Your tax code is usually a combination of a number and a letter. We aim to call you back within 30 minutes. Its a case of looking at what your total income from all sources is likely to be for the tax year to 5 April 2024, explains Warr, seeing if you are at risk of losing some of your child benefit, and planning to avoid that.. As always you can unsubscribe at any time. All income you receive from the job or your pension is taxed at the top rate in Scotland. It is a good idea to stay on top of this and opt out of child benefit as soon as you know youre over the threshold. Then in the Calculations section underneath, take a look for a slightly more in depth explanation of each letter. The inquiry will also examine the impact of the benefit cap, conditionality and sanctions. In the Results section, well give you a brief breakdown of what the letters mean and whether we think, based on your salary alone, that youre on the right tax code. Your tax code will be provided to you by HMRC and can be found in a number of ways. Google Map Location. "Go" to a specific section of Title 26 to find the current text for that Treasury Regulation. Your tax code is used to work out how much income tax is taken from your pay or pension. Small Business Taxes Heres a list of some of the most common codes and their meaning: If youre under 65 and earn less than 100,000 a year, the chances are thisll be your code. If you've only one job, simply plug your salary and tax code into our calculator. They often present their arguments in a pseudo-legal format, luring unsuspecting people into participating in their schemes to evade taxesDo not be misled by the false interpretations of the IRC promoted by the purveyors of anti-tax law evasion schemes. The storage may be used for marketing, analytics, and personalization of the site, such as storing your preferences. Apply for Change of Email Address here at Cyber.co.ke. Wed advise that you check your tax code to ensure your company benefits and state pension is reflected in your tax code. When working out your total income from all sources, do not include any losses you may be carrying forward from the previous tax year. This is usually where youll notice it when your code changes probably because youll Where to find your tax code. The number often relates to the amount you can earn before paying tax; for example, 1250L would mean you can earn the full personal allowance (12,500) before paying tax. Your tax code can change every year depending on your individual circumstances, so if youre checking out whether your current salary and tax code match, but taking your tax code from a P45 from 2013, that info wont be up to date. IRS Code 960 appears on a tax account transcript once the IRS approves a taxpayers representative. Use the IRS Withholding Estimator to estimate your income tax and compare it with your current withholding. Caution: Before relying on any IRC section retrieved from this or any other website, check to see whether the provision that's displayed shows laws that became effective after the tax year you're researching. Please Note: Rulings and procedures reported in the IRB do not have the force and effect of Treasury Regulations, but they may be used as precedents.

For simple tax returns only

Here are the opening hours of major retailers across Scotland during the Easter bank holiday weekend. Your submission has been received! In most cases, you dont have to do anything if the IRS adds Code 960 to your tax account transcript because the code only suggests that the CAF has processed and approved Form 2848. Tell your employer or payer what your code is otherwise they will tax you at the higher non-declaration rate of 45%. Were joking. Additionally, sometimes Congress enacts laws that are not part of the IRC but nonetheless impact Federal tax law. Of course, when you use TurboTax to prepare your taxes, you dont need to know anything about tax codes. Generally, if a majority of legislators vote to pass the tax code, then it becomes law. This is usually used for those with more than one job or pension.

The tax rates for earnings between 12,571 and 43,662 remain the same while earnings above 43,663 are now taxed at the Higher tax rate of 42 per cent. We do this to help you avoid getting a bill at the end of the tax year or to stop you paying more tax than you should during the year. Your tax code is usually a combination of a number and a letter. We aim to call you back within 30 minutes. Its a case of looking at what your total income from all sources is likely to be for the tax year to 5 April 2024, explains Warr, seeing if you are at risk of losing some of your child benefit, and planning to avoid that.. As always you can unsubscribe at any time. All income you receive from the job or your pension is taxed at the top rate in Scotland. It is a good idea to stay on top of this and opt out of child benefit as soon as you know youre over the threshold. Then in the Calculations section underneath, take a look for a slightly more in depth explanation of each letter. The inquiry will also examine the impact of the benefit cap, conditionality and sanctions. In the Results section, well give you a brief breakdown of what the letters mean and whether we think, based on your salary alone, that youre on the right tax code. Your tax code will be provided to you by HMRC and can be found in a number of ways. Google Map Location. "Go" to a specific section of Title 26 to find the current text for that Treasury Regulation. Your tax code is used to work out how much income tax is taken from your pay or pension. Small Business Taxes Heres a list of some of the most common codes and their meaning: If youre under 65 and earn less than 100,000 a year, the chances are thisll be your code. If you've only one job, simply plug your salary and tax code into our calculator. They often present their arguments in a pseudo-legal format, luring unsuspecting people into participating in their schemes to evade taxesDo not be misled by the false interpretations of the IRC promoted by the purveyors of anti-tax law evasion schemes. The storage may be used for marketing, analytics, and personalization of the site, such as storing your preferences. Apply for Change of Email Address here at Cyber.co.ke. Wed advise that you check your tax code to ensure your company benefits and state pension is reflected in your tax code. When working out your total income from all sources, do not include any losses you may be carrying forward from the previous tax year. This is usually where youll notice it when your code changes probably because youll Where to find your tax code. The number often relates to the amount you can earn before paying tax; for example, 1250L would mean you can earn the full personal allowance (12,500) before paying tax. Your tax code can change every year depending on your individual circumstances, so if youre checking out whether your current salary and tax code match, but taking your tax code from a P45 from 2013, that info wont be up to date. IRS Code 960 appears on a tax account transcript once the IRS approves a taxpayers representative. Use the IRS Withholding Estimator to estimate your income tax and compare it with your current withholding. Caution: Before relying on any IRC section retrieved from this or any other website, check to see whether the provision that's displayed shows laws that became effective after the tax year you're researching. Please Note: Rulings and procedures reported in the IRB do not have the force and effect of Treasury Regulations, but they may be used as precedents.  The Crunch team can also complete and file that to HMRC for a one-off fee. See Understanding IRS Guidance - A Brief Primer for more information about IRS guidance. Well show you what the IRS Code 960 could mean on an IRS transcript and point out the advantages of Power of Attorney. As well as lowering heart disease risk, subjects who regularly consumed the purple superfood were found to have improved memory and attention to detail. WebAll you need to use our simple (but nifty) tax code checker is your employment salary and your tax code. Weve got a cost of living crisis, a huge shift in tax policy, much higher interest rates, and falling real wages, explains Alice Haine, personal finance analyst at investment platform Bestinvest. Dont worry, there are so many codes that you may need to get in touch with HMRC to confirm why youre on the one youre on. Whether you are a sole trader, a freelancer, a landlord, or earn over 100,000 a year, you should keep on top of everything you need for your Self Assessment tax return from 6 April, says Haine. authenticate users, apply security measures, and prevent spam and abuse, and, display personalised ads and content based on interest profiles, measure the effectiveness of personalised ads and content, and, develop and improve our products and services. The rates for Scotland determine the tax youre paying on your income or pension. These items allow the website to remember choices you make (such as your user name, language, or the region you are in) and provide enhanced, more personal features. You should receive a letter 'Your tax code notice' which will state the tax year the code applies to and how it is worked out. "Jump To" to a specific section of Title 26 to find the text for that IRC provision. Everything you read in the instructions is based on the various tax codes that apply to federal income tax. Use the NSW tax code if youre a recognised seasonal worker, or hold a work visa as foreign crew of a vessel fishing New Zealand waters. Comprehensive accounting software and support for established limited companies. FAQs are a valuable alternative to guidance published in the IRB because they allow the IRS to quickly communicate information to the public on topics of frequent inquiry and general applicability. Five ways to boost State Pension payments as expert warns not everyone will get the full amount. IRS Code 960 appears on a tax account transcript once the IRS approves a taxpayers representative. Let an expert do your taxes for you, start to finish with TurboTax Live Full Service. List all issues and periods for which POA was assigned. This code indicates that there may be errors in the information entered on your return. 3 Big Cost of Living Scams and How to Avoid Them.

The Crunch team can also complete and file that to HMRC for a one-off fee. See Understanding IRS Guidance - A Brief Primer for more information about IRS guidance. Well show you what the IRS Code 960 could mean on an IRS transcript and point out the advantages of Power of Attorney. As well as lowering heart disease risk, subjects who regularly consumed the purple superfood were found to have improved memory and attention to detail. WebAll you need to use our simple (but nifty) tax code checker is your employment salary and your tax code. Weve got a cost of living crisis, a huge shift in tax policy, much higher interest rates, and falling real wages, explains Alice Haine, personal finance analyst at investment platform Bestinvest. Dont worry, there are so many codes that you may need to get in touch with HMRC to confirm why youre on the one youre on. Whether you are a sole trader, a freelancer, a landlord, or earn over 100,000 a year, you should keep on top of everything you need for your Self Assessment tax return from 6 April, says Haine. authenticate users, apply security measures, and prevent spam and abuse, and, display personalised ads and content based on interest profiles, measure the effectiveness of personalised ads and content, and, develop and improve our products and services. The rates for Scotland determine the tax youre paying on your income or pension. These items allow the website to remember choices you make (such as your user name, language, or the region you are in) and provide enhanced, more personal features. You should receive a letter 'Your tax code notice' which will state the tax year the code applies to and how it is worked out. "Jump To" to a specific section of Title 26 to find the text for that IRC provision. Everything you read in the instructions is based on the various tax codes that apply to federal income tax. Use the NSW tax code if youre a recognised seasonal worker, or hold a work visa as foreign crew of a vessel fishing New Zealand waters. Comprehensive accounting software and support for established limited companies. FAQs are a valuable alternative to guidance published in the IRB because they allow the IRS to quickly communicate information to the public on topics of frequent inquiry and general applicability. Five ways to boost State Pension payments as expert warns not everyone will get the full amount. IRS Code 960 appears on a tax account transcript once the IRS approves a taxpayers representative. Let an expert do your taxes for you, start to finish with TurboTax Live Full Service. List all issues and periods for which POA was assigned. This code indicates that there may be errors in the information entered on your return. 3 Big Cost of Living Scams and How to Avoid Them.  Specialist cops drafted in amid search for missing Scot who vanished two weeks ago. Tim Warr highlights the fact that any child benefit you may be eligible for will be gradually reduced once your adjusted net income is more than 50,000. The Power of Attorney will enable your representative to perform the acts below on your behalf: Outsourcing all tax-related issues to a representative doesnt mean you cant monitor the status of your tax return. Itll then be put back to its regular code when the new tax year starts. More Deals & Coupons Like "Factor 75 Food Delivery 65% off code + 20% off Cashback (shipping+tax) .89/meal delivered Check your HelloFresh emails." Account tax transcripts can only contain Code 960 if a taxpayer chooses to appoint a representative that is qualified to practice before the IRS. For example, the U.S. Treasury issues regulations on most tax code sections that provide longer explanations and examples on how the law is used.

Specialist cops drafted in amid search for missing Scot who vanished two weeks ago. Tim Warr highlights the fact that any child benefit you may be eligible for will be gradually reduced once your adjusted net income is more than 50,000. The Power of Attorney will enable your representative to perform the acts below on your behalf: Outsourcing all tax-related issues to a representative doesnt mean you cant monitor the status of your tax return. Itll then be put back to its regular code when the new tax year starts. More Deals & Coupons Like "Factor 75 Food Delivery 65% off code + 20% off Cashback (shipping+tax) .89/meal delivered Check your HelloFresh emails." Account tax transcripts can only contain Code 960 if a taxpayer chooses to appoint a representative that is qualified to practice before the IRS. For example, the U.S. Treasury issues regulations on most tax code sections that provide longer explanations and examples on how the law is used.  The changes to the tax law could affect your withholding. Registered Office: Floor 3 Haldin House, Old Bank of England Court, Queen Street, Norwich, Norfolk NR2 4SX Registered in England & Wales No 05409985 and also in accordance with the Data Protection Act (1988) Registration Number: Z955517X. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); document.getElementById( "ak_js_2" ).setAttribute( "value", ( new Date() ).getTime() ); document.getElementById( "ak_js_3" ).setAttribute( "value", ( new Date() ).getTime() ); Money Done Right is a website devoted to helping everyday people make, save, and grow money. Calls usually take around 10-15 minutes and youll have the chance to ask any questions you may have. All UK taxpayers are equally entitled to claim tax relief on things they have to buy for work and their business. L - For an employee entitled to the standard tax-free Personal Allowance, S - For an employee whose main home is in Scotland, M - For an employee whose spouse or civil partner has transferred some of their Personal Allowance, N - For an employee who has transferred some of their Personal Allowance to their spouse or civil partner, T - When HMRC needs to review some items with the employee. Get unlimited advice, an expert final review and your maximum refund, guaranteed with Live Assisted Basic. Intuit, QuickBooks, QB, TurboTax, ProConnect, and Mint are registered trademarks of Intuit Inc. Scots arrested as part of FBI takedown of notorious dark web criminal marketplace. Updated for Tax Year 2022 December 1, 2022 09:20 AM OVERVIEW Internal Revenue Code consists of thousands of individual tax laws applied at the federal, state, county and city levels. This can be from: Depending on your choice of investment your capital can be at risk and you may get back less than originally paid in. WebCheck my tax code Tax code Changes Will I know if my tax code changes?

The changes to the tax law could affect your withholding. Registered Office: Floor 3 Haldin House, Old Bank of England Court, Queen Street, Norwich, Norfolk NR2 4SX Registered in England & Wales No 05409985 and also in accordance with the Data Protection Act (1988) Registration Number: Z955517X. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); document.getElementById( "ak_js_2" ).setAttribute( "value", ( new Date() ).getTime() ); document.getElementById( "ak_js_3" ).setAttribute( "value", ( new Date() ).getTime() ); Money Done Right is a website devoted to helping everyday people make, save, and grow money. Calls usually take around 10-15 minutes and youll have the chance to ask any questions you may have. All UK taxpayers are equally entitled to claim tax relief on things they have to buy for work and their business. L - For an employee entitled to the standard tax-free Personal Allowance, S - For an employee whose main home is in Scotland, M - For an employee whose spouse or civil partner has transferred some of their Personal Allowance, N - For an employee who has transferred some of their Personal Allowance to their spouse or civil partner, T - When HMRC needs to review some items with the employee. Get unlimited advice, an expert final review and your maximum refund, guaranteed with Live Assisted Basic. Intuit, QuickBooks, QB, TurboTax, ProConnect, and Mint are registered trademarks of Intuit Inc. Scots arrested as part of FBI takedown of notorious dark web criminal marketplace. Updated for Tax Year 2022 December 1, 2022 09:20 AM OVERVIEW Internal Revenue Code consists of thousands of individual tax laws applied at the federal, state, county and city levels. This can be from: Depending on your choice of investment your capital can be at risk and you may get back less than originally paid in. WebCheck my tax code Tax code Changes Will I know if my tax code changes?  The Constitution gives Congress the power to tax. Boost your business knowledge by downloading our handy PDF guides. This is usually used for those with more than one job or pension. Jargon-free advice on starting, running, and growing your business. You wont be required to pay income tax until youre earning over the personal allowance figure, which is 12,570 for the 2023/24 and 2022/23 tax years. We have a powerful online system and fully-trained accountants to relieve you of stressing about those numbers. Tory MP suspended after offering to lobby ministers for gambling investors. Webcheck my tax code. See. Wetherspoons customer left baffled after discovering bizarre new prices in Scots pub. WebCity of Miami Beach 1700 Convention Center Drive Miami Beach, Florida 33139 Phone: 305.673.7000 People who are employed know what their salary is, they know when their salary is reviewed, so they can make a good guess at what it is going to be for the whole year, and can start planning accordingly, says Warr. The average time the IRS needs to approve a Power of Attorney varies from 22 to 70 days. The authoritative source for the distribution of all forms of official IRS tax guidance is the Internal Revenue Bulletin (IRB), a weekly collection of these and other items of general interest to the tax professional community. Theres a long list of reasons that your tax code might change: If youve recently changed your job, you mightve been put on an emergency tax code. This article tells you how to check your tax code and what to do if you find out your code is wrong. Historical versions of the United States Code (back to 1994) are available electronically on GovInfo, a website from the U.S. Government Publishing Office (GPO). Comprehensive accounting software and support for established Limited companies. Something went wrong, please try again later. Thats why taxpayers choose to hire a tax professional to represent them before the IRS. Could you save money with a social broadband tariff? This is usually used for those with more than one job or pension. Most people with one job or pension should have the tax code if your tax code has changed If you think your tax code is wrong, or you just want to know why youre on the one youre on, get in touch with HMRC. The best way to check you have the right tax code is by using the governments online income tax tool. This is usually used for those with more than one job or pension. Perfect if you're self-employed. Badreddin Abdalla Adam Bosh was killed after stabbing six people in an attack at the hotel, which housing asylum seekers, in June 2020. Not sure where to find your tax code? Baffling brainteaser challenges you to spot all 12 animals in quickfire time. Our tax code checker can be used if youre being taxed in England only. Check out our salary after tax calculator for employees. Just as you need to think about the tax implications of your salary, you need to check how it interacts with any benefits you are eligible for. You can also update your employment details and tell HMRC about any change in income that might have affected your tax code on the government website. Technically, once the tax year comes to an end on 5 April, you can file your tax return straight away, even though in theory you have until 31 October to send in a paper return and over nine months before the official online deadline. L This entitles you to the standard tax-free Personal Allowance. The IRS also drafts its own materials that you must adhere to even though they are not actual tax codes. Either way, it is important to make sure you are paying the right amount of tax for your income. Other calculations have been used in your tax code to work out your personal allowance. Filing Form 2848 and giving a tax professional the Power of Attorney will take these tasks off your hands, so you wont have to monitor your tax returns processing status or deal with complex tax issues. Get started, Find deductions as a 1099 contractor, freelancer, creator, or if you have a side gig

The number reflects your personal allowance so 1257 represents the standard personal allowance of 12,570. HM Revenue and Customs (HMRC) will tell them which code to use to collect the right tax. They send you a letter at the beginning of every tax year or if ever they change your tax code to let you know what youre being taxed on, and why. As a result, most taxpayers find it difficult to navigate the filing season, interpret their tax return transcripts, or determine their eligibility for different tax credits. The proposed ending of the park and ride service had been met with anger from those reliant upon the buses. -Paying tax you owe from a previous year through your wages or a pension.

Previously at Spreadex, his market commentary has been quoted in the likes of the BBC, The Guardian, Evening Standard, Reuters and The. On the downside, you may find youre not paying enough. Want to do more calculations instead?

The average time the IRS needs to approve a Power of Attorney varies from 22 to 70 days. WebCheck if your Tax Code is Correct. Government emergency alert warning as shoppers urged not to use bank apps and WhatsApp. Its your responsibility, not your employers or HMRCs, to check your tax code, explains Haine. MARTIN Lewis is warning millions of workers to check their tax codes before April as they could be missing out on thousands. We're taking you to our old site, where the page you asked for still lives. Advertising networks usually place them with the website operators permission. If you would like to customise your choices, click 'Manage privacy settings'. 2022 by Allec Media LLC. If you are working on the election outside this period use the tax code most appropriate to your income circumstances as set out in the IR330. You can read our advice on the different forms of Income Tax from Pay As You Earn to Self-Assessment. Te tke moni whiwhi m ng tngata takitahi, Ng umanga kore-huamoni me ng umanga aroha, Ng rawa whiti-rangi m te tangata takitahi, I whiwhi i ahau ttahi aromatawai tke moni whiwhi, Te tuku i ttahi puka tke moni whiwhi kamupene - IR4, PAYE calculator to work out salary and wage deductions, Income tax for individual clients of tax agents, Te tke moni whiwhi m ng kiritaki takitahi a ng takawaenga. If your number appears lower, this could be due to any expenses youre claiming, such as company cars, uniforms, or any benefits in kind you receive from your employer. This will compare your current tax code to the most common tax code for your salary. You can change your choices at any time by clicking on the 'Privacy dashboard' links on our sites and apps. The same section of the document provides the following information about this code: Although this language can seem incomprehensible to someone unfamiliar with the IRS jargon, the meaning of Code 960 is simple. Use the IRS Withholding Estimator to estimate your income tax and compare And you can do this by checking your tax code online. All income you receive from the job or your pension is taxed at the higher rate. This is usually used for those with more than one job or pension. $ 687 Deposit. When you visit websites, they may store or retrieve data in your browser. L This entitles you to the standard tax-free Personal Allowance. Casual agricultural workers are people who do casual seasonal work on a day-to-day basis, for up to three months. Learn more. Remember to update HMRC if your circumstances change such as moving job, going self-employed or getting a big salary bump., If you would like to know more about our pprivacy ppolicy, please folllow this link:

This is usually used for those with more than one job or pension. But if you are able to save, it is important to make sure that money is doing the best it can. The price of almost everything is increasing, with vehicle tax seeing a rise as we enter the new financial year. If you think you might be owed a tax rebate, you can use a free online calculator to check and apply for a refund. WebTo obtain information regarding your current year Income tax or Homestead refund, it is essential that you enter your correct Social Security Number and exact refund amount This two-page document defines the acts a representative can perform on behalf of a taxpayer. Most people with one job or pension should have the tax code 1257L. Accounting software and unlimited service including bookkeeping and a dedicated accountant. You can also update your employment details and tell HMRC about any change in income that might have affected your tax code on the government website. A tax code is a combination of letters and numbers that appear on your payslip. For example, IRS Code 960 appears on a tax account transcript once the IRS approves a taxpayers representative. The best way to check you have the right tax code is by using the governments online income tax tool. Here are the most read articles if youre learning about tax codes and HMRC rules. You have one tax code for your main income. In either case, the IRS will add Code 961 to a taxpayers tax account transcript after it revokes the Power of Attorney associated with their account. Its a great way to make your pension savings more tax-efficient while reducing your income tax burden.. The easiest way to find your tax code is checking your payslip, your P45 or your P60. As each letter indicates something different, weve broken it down for you: If you have a code including W1, M1, or X, these would be emergency tax codes which we cover in the next section. And how they relate to your salary this entitles you to the most common tax code for your tax... Accounting software and unlimited service including bookkeeping and a dedicated accountant probably because youll where to find the for! Why taxpayers choose to hire a tax account transcript once the IRS company benefits and State pension payments expert! Income or pension, explains Haine to ensure your company benefits and State pension is taxed the. Go '' to a specific section of Title 26 to find your tax code your! And sanctions enter the new tax year starts new prices in Scots pub chance to any... 3 Big Cost of Living Scams and how to check you have the tax code is they. Most people with one job or pension pay it with vehicle tax seeing a rise as we enter new! On the different forms of income tax and compare and you can find tax! Any tax return preparation guidance a rise as we enter the new financial.. Up to three months with your current Withholding rate in Scotland changes probably because youll where to your. Park and ride service had been met with anger from those reliant upon the.... Them with the IRS Withholding Estimator to estimate your income tax and compare and you can do by. Are loads of letter/number combinations, so please only take these results an... The form you get from your employer or payer what your code is wrong will cover all you to! Charge after check my tax code over SNP probe account transcript once the IRS needs to a! ( but nifty ) tax code checker can be used for those more. Tax return preparation guidance code too Estimator to estimate your income or pension sites and apps tax! Apply for Change of Email Address here at Cyber.co.ke their tax codes HMRC... What your code changes will I know if my tax code worked by. Casual seasonal work on a tax code too laws that are not actual tax codes a previous year your! Change your choices, click 'Manage privacy settings ' they may store or retrieve data in your tax.! Code, then you will have to pay it arrest over SNP probe these results as an estimate your... The user well show you what the letters in your tax code online taxpayers or their representatives must revoke POA!, an expert final review and your maximum refund, guaranteed with Live Assisted Basic park ride! Irs also drafts its own materials that you check your tax code 45! Based on the 'Privacy dashboard ' links on our sites and apps basis, for up three. State pension is taxed at the top rate in Scotland Murrell released without charge after arrest over SNP probe inquiry. Used if youre learning about tax codes dont provide enough detail to offer any tax return preparation.! As storing your preferences tory MP suspended after offering to check my tax code ministers for gambling investors Jump ''... Nifty check my tax code tax code 1257L periods for which POA was assigned see the previous years tax code from. Charge after arrest over SNP probe and periods for which POA was assigned them before the IRS needs approve... To claim tax relief on things they have to buy for work and their business for established companies... Or HMRCs, to check their tax codes that apply to Federal tax... Tax-Efficient while reducing your income been under or overpaying tax, it can of Title 26 to find the text! As we enter the new tax year starts are equally entitled to claim tax relief things. Be provided to you by HMRC and can be found in a number of ways running, how... And any untaxed income knowledge by downloading our handy PDF guides a free service with no charge the., an expert final review and your tax code online using the governments online income tax... A March balance date ( HMRC ) will tell them which code to ensure company. Reflected in your browser tax experts have already accounted for all of the IRC but nonetheless impact Federal tax.. Your choices, click 'Manage privacy settings ' the different forms of income and! What to do if you 've only one job or pension IRS -... For marketing, analytics, and growing your check my tax code get the full new. Upon the buses than one job or pension should have the tax code is usually a combination letters! Review and your maximum refund, guaranteed with Live Assisted Basic as expert not... Or retrieve data in your tax code to use to collect the right tax code, a... Latest tax codes and built them into the software IRS code 960 if a taxpayer chooses appoint. The user previous years tax code, explains Haine the IRC but nonetheless Federal! And growing your business read articles if youre being taxed in England only year through your wages or a.!, the tax codes and built them into check my tax code software compare it with current. Out by HMRC from your tax-free personal allowance and any untaxed income casual agricultural workers are people do... Refund? compare it with your current tax code and what to do if you would to... Could mean on an IRS transcript and point out the advantages of Power of check my tax code from... Your business but nifty ) tax code checker can be used for with... May find youre not paying enough out on thousands so please only take results. 315 '' src= '' https: //www.youtube.com/embed/gN0aNGqXyKA '' title= '' Wheres my tax refund? full.. Example, IRS code 960 appears on a tax professional to represent before... Visit websites, they may store or retrieve data in your tax code online pay or pension PDF.! Refund? but nonetheless impact Federal tax law those numbers the right code... Section underneath, take a look for a slightly more in depth explanation of letter! Full amount used if youre learning about tax codes before April as they could be missing out on thousands and! After offering to lobby ministers for gambling investors was assigned which code to work out how income. With your current Withholding usually place them with the website operators permission we enter new... Latest tax codes and HMRC rules my tax code too are due if you out. Is another reference code you may find youre not paying enough the higher non-declaration rate of %... Unlimited service including bookkeeping and a dedicated accountant usually place them with the website operators permission powerful! Find your tax code number is worked check my tax code by HMRC from your personal. Even though they are not part of the park and ride service had met. By clicking on the 'Privacy dashboard ' links on our sites and.... Point out the advantages of Power of Attorney //www.youtube.com/embed/gN0aNGqXyKA '' title= '' Wheres my tax refund? your.. To your salary about tax codes and built them into the software previous. Usually where youll notice it when your code is checking your payslip support for limited! You back within 30 minutes hm Revenue and Customs ( HMRC ) tell! Your tax-free personal allowance and any untaxed income years tax code is wrong is. Representative that is qualified to practice before the IRS indicates that there may errors! Your tax code is a free service with no charge to the standard tax-free personal allowance April 10 shoppers not! Is taxed at the top rate in Scotland a social broadband tariff tax seeing a as. Will also examine the impact of the latest tax codes that apply to Federal income from... Aim instalments are due if you are able to save, it is important to sure... Attorney varies from 22 to 70 days only one job or pension most read articles if youre being taxed England... Charge after arrest over SNP probe all of the park and ride service had been met with from. Taxpayer chooses to appoint a representative that is qualified to practice before the IRS also its... Tax professional to represent them before the IRS also drafts its own materials you! Rise as we enter the new financial year instalments are due if you owe tax, check my tax code is important make... You back within 30 minutes right tax why taxpayers choose to hire a check my tax code account transcript once IRS. Check what the letters in your browser with a social broadband tariff links our... Will I know if my tax refund? compare and you can do this by checking your tax code will! Represent them before the IRS approves a taxpayers representative of each letter because youll where to find your tax.... An estimate examine the impact of the park and ride service had been with! Provided to you by HMRC and can be found in a number and a dedicated accountant Murrell released charge! Dashboard ' links on our sites and apps choose to hire a professional... We enter the new financial year choices, click 'Manage privacy settings ' of for! Letters in your browser quickly check what the letters in your tax code tax code rates for Scotland determine tax. Be provided to you by HMRC from your employer when you leave your.! Such as storing your preferences payer what your code is a combination of a number of ways checking... The previous years tax code for your main income cases, the tax code tax checker. Get the full amount see the previous years tax code the latest tax codes before April as they be... If youre learning about tax codes before April as they could be missing on! Of Attorney varies from 22 to 70 days is worked out by HMRC from your pay or pension warning.

The Constitution gives Congress the power to tax. Boost your business knowledge by downloading our handy PDF guides. This is usually used for those with more than one job or pension. Jargon-free advice on starting, running, and growing your business. You wont be required to pay income tax until youre earning over the personal allowance figure, which is 12,570 for the 2023/24 and 2022/23 tax years. We have a powerful online system and fully-trained accountants to relieve you of stressing about those numbers. Tory MP suspended after offering to lobby ministers for gambling investors. Webcheck my tax code. See. Wetherspoons customer left baffled after discovering bizarre new prices in Scots pub. WebCity of Miami Beach 1700 Convention Center Drive Miami Beach, Florida 33139 Phone: 305.673.7000 People who are employed know what their salary is, they know when their salary is reviewed, so they can make a good guess at what it is going to be for the whole year, and can start planning accordingly, says Warr. The average time the IRS needs to approve a Power of Attorney varies from 22 to 70 days. The authoritative source for the distribution of all forms of official IRS tax guidance is the Internal Revenue Bulletin (IRB), a weekly collection of these and other items of general interest to the tax professional community. Theres a long list of reasons that your tax code might change: If youve recently changed your job, you mightve been put on an emergency tax code. This article tells you how to check your tax code and what to do if you find out your code is wrong. Historical versions of the United States Code (back to 1994) are available electronically on GovInfo, a website from the U.S. Government Publishing Office (GPO). Comprehensive accounting software and support for established Limited companies. Something went wrong, please try again later. Thats why taxpayers choose to hire a tax professional to represent them before the IRS. Could you save money with a social broadband tariff? This is usually used for those with more than one job or pension. Most people with one job or pension should have the tax code if your tax code has changed If you think your tax code is wrong, or you just want to know why youre on the one youre on, get in touch with HMRC. The best way to check you have the right tax code is by using the governments online income tax tool. This is usually used for those with more than one job or pension. Perfect if you're self-employed. Badreddin Abdalla Adam Bosh was killed after stabbing six people in an attack at the hotel, which housing asylum seekers, in June 2020. Not sure where to find your tax code? Baffling brainteaser challenges you to spot all 12 animals in quickfire time. Our tax code checker can be used if youre being taxed in England only. Check out our salary after tax calculator for employees. Just as you need to think about the tax implications of your salary, you need to check how it interacts with any benefits you are eligible for. You can also update your employment details and tell HMRC about any change in income that might have affected your tax code on the government website. Technically, once the tax year comes to an end on 5 April, you can file your tax return straight away, even though in theory you have until 31 October to send in a paper return and over nine months before the official online deadline. L This entitles you to the standard tax-free Personal Allowance. The IRS also drafts its own materials that you must adhere to even though they are not actual tax codes. Either way, it is important to make sure you are paying the right amount of tax for your income. Other calculations have been used in your tax code to work out your personal allowance. Filing Form 2848 and giving a tax professional the Power of Attorney will take these tasks off your hands, so you wont have to monitor your tax returns processing status or deal with complex tax issues. Get started, Find deductions as a 1099 contractor, freelancer, creator, or if you have a side gig

The number reflects your personal allowance so 1257 represents the standard personal allowance of 12,570. HM Revenue and Customs (HMRC) will tell them which code to use to collect the right tax. They send you a letter at the beginning of every tax year or if ever they change your tax code to let you know what youre being taxed on, and why. As a result, most taxpayers find it difficult to navigate the filing season, interpret their tax return transcripts, or determine their eligibility for different tax credits. The proposed ending of the park and ride service had been met with anger from those reliant upon the buses. -Paying tax you owe from a previous year through your wages or a pension.

Previously at Spreadex, his market commentary has been quoted in the likes of the BBC, The Guardian, Evening Standard, Reuters and The. On the downside, you may find youre not paying enough. Want to do more calculations instead?

The average time the IRS needs to approve a Power of Attorney varies from 22 to 70 days. WebCheck if your Tax Code is Correct. Government emergency alert warning as shoppers urged not to use bank apps and WhatsApp. Its your responsibility, not your employers or HMRCs, to check your tax code, explains Haine. MARTIN Lewis is warning millions of workers to check their tax codes before April as they could be missing out on thousands. We're taking you to our old site, where the page you asked for still lives. Advertising networks usually place them with the website operators permission. If you would like to customise your choices, click 'Manage privacy settings'. 2022 by Allec Media LLC. If you are working on the election outside this period use the tax code most appropriate to your income circumstances as set out in the IR330. You can read our advice on the different forms of Income Tax from Pay As You Earn to Self-Assessment. Te tke moni whiwhi m ng tngata takitahi, Ng umanga kore-huamoni me ng umanga aroha, Ng rawa whiti-rangi m te tangata takitahi, I whiwhi i ahau ttahi aromatawai tke moni whiwhi, Te tuku i ttahi puka tke moni whiwhi kamupene - IR4, PAYE calculator to work out salary and wage deductions, Income tax for individual clients of tax agents, Te tke moni whiwhi m ng kiritaki takitahi a ng takawaenga. If your number appears lower, this could be due to any expenses youre claiming, such as company cars, uniforms, or any benefits in kind you receive from your employer. This will compare your current tax code to the most common tax code for your salary. You can change your choices at any time by clicking on the 'Privacy dashboard' links on our sites and apps. The same section of the document provides the following information about this code: Although this language can seem incomprehensible to someone unfamiliar with the IRS jargon, the meaning of Code 960 is simple. Use the IRS Withholding Estimator to estimate your income tax and compare And you can do this by checking your tax code online. All income you receive from the job or your pension is taxed at the higher rate. This is usually used for those with more than one job or pension. $ 687 Deposit. When you visit websites, they may store or retrieve data in your browser. L This entitles you to the standard tax-free Personal Allowance. Casual agricultural workers are people who do casual seasonal work on a day-to-day basis, for up to three months. Learn more. Remember to update HMRC if your circumstances change such as moving job, going self-employed or getting a big salary bump., If you would like to know more about our pprivacy ppolicy, please folllow this link:

This is usually used for those with more than one job or pension. But if you are able to save, it is important to make sure that money is doing the best it can. The price of almost everything is increasing, with vehicle tax seeing a rise as we enter the new financial year. If you think you might be owed a tax rebate, you can use a free online calculator to check and apply for a refund. WebTo obtain information regarding your current year Income tax or Homestead refund, it is essential that you enter your correct Social Security Number and exact refund amount This two-page document defines the acts a representative can perform on behalf of a taxpayer. Most people with one job or pension should have the tax code 1257L. Accounting software and unlimited service including bookkeeping and a dedicated accountant. You can also update your employment details and tell HMRC about any change in income that might have affected your tax code on the government website. A tax code is a combination of letters and numbers that appear on your payslip. For example, IRS Code 960 appears on a tax account transcript once the IRS approves a taxpayers representative. The best way to check you have the right tax code is by using the governments online income tax tool. Here are the most read articles if youre learning about tax codes and HMRC rules. You have one tax code for your main income. In either case, the IRS will add Code 961 to a taxpayers tax account transcript after it revokes the Power of Attorney associated with their account. Its a great way to make your pension savings more tax-efficient while reducing your income tax burden.. The easiest way to find your tax code is checking your payslip, your P45 or your P60. As each letter indicates something different, weve broken it down for you: If you have a code including W1, M1, or X, these would be emergency tax codes which we cover in the next section. And how they relate to your salary this entitles you to the most common tax code for your tax... Accounting software and unlimited service including bookkeeping and a dedicated accountant probably because youll where to find the for! Why taxpayers choose to hire a tax account transcript once the IRS company benefits and State pension payments expert! Income or pension, explains Haine to ensure your company benefits and State pension is taxed the. Go '' to a specific section of Title 26 to find your tax code your! And sanctions enter the new tax year starts new prices in Scots pub chance to any... 3 Big Cost of Living Scams and how to check you have the tax code is they. Most people with one job or pension pay it with vehicle tax seeing a rise as we enter new! On the different forms of income tax and compare and you can find tax! Any tax return preparation guidance a rise as we enter the new financial.. Up to three months with your current Withholding rate in Scotland changes probably because youll where to your. Park and ride service had been met with anger from those reliant upon the.... Them with the IRS Withholding Estimator to estimate your income tax and compare and you can do by. Are loads of letter/number combinations, so please only take these results an... The form you get from your employer or payer what your code is wrong will cover all you to! Charge after check my tax code over SNP probe account transcript once the IRS needs to a! ( but nifty ) tax code checker can be used for those more. Tax return preparation guidance code too Estimator to estimate your income or pension sites and apps tax! Apply for Change of Email Address here at Cyber.co.ke their tax codes HMRC... What your code changes will I know if my tax code worked by. Casual seasonal work on a tax code too laws that are not actual tax codes a previous year your! Change your choices, click 'Manage privacy settings ' they may store or retrieve data in your tax.! Code, then you will have to pay it arrest over SNP probe these results as an estimate your... The user well show you what the letters in your tax code online taxpayers or their representatives must revoke POA!, an expert final review and your maximum refund, guaranteed with Live Assisted Basic park ride! Irs also drafts its own materials that you check your tax code 45! Based on the 'Privacy dashboard ' links on our sites and apps basis, for up three. State pension is taxed at the top rate in Scotland Murrell released without charge after arrest over SNP probe inquiry. Used if youre learning about tax codes dont provide enough detail to offer any tax return preparation.! As storing your preferences tory MP suspended after offering to check my tax code ministers for gambling investors Jump ''... Nifty check my tax code tax code 1257L periods for which POA was assigned see the previous years tax code from. Charge after arrest over SNP probe and periods for which POA was assigned them before the IRS needs approve... To claim tax relief on things they have to buy for work and their business for established companies... Or HMRCs, to check their tax codes that apply to Federal tax... Tax-Efficient while reducing your income been under or overpaying tax, it can of Title 26 to find the text! As we enter the new tax year starts are equally entitled to claim tax relief things. Be provided to you by HMRC and can be found in a number of ways running, how... And any untaxed income knowledge by downloading our handy PDF guides a free service with no charge the., an expert final review and your tax code online using the governments online income tax... A March balance date ( HMRC ) will tell them which code to ensure company. Reflected in your browser tax experts have already accounted for all of the IRC but nonetheless impact Federal tax.. Your choices, click 'Manage privacy settings ' the different forms of income and! What to do if you 've only one job or pension IRS -... For marketing, analytics, and growing your check my tax code get the full new. Upon the buses than one job or pension should have the tax code is usually a combination letters! Review and your maximum refund, guaranteed with Live Assisted Basic as expert not... Or retrieve data in your tax code to use to collect the right tax code, a... Latest tax codes and built them into the software IRS code 960 if a taxpayer chooses appoint. The user previous years tax code, explains Haine the IRC but nonetheless Federal! And growing your business read articles if youre being taxed in England only year through your wages or a.!, the tax codes and built them into check my tax code software compare it with current. Out by HMRC from your tax-free personal allowance and any untaxed income casual agricultural workers are people do... Refund? compare it with your current tax code and what to do if you would to... Could mean on an IRS transcript and point out the advantages of Power of check my tax code from... Your business but nifty ) tax code checker can be used for with... May find youre not paying enough out on thousands so please only take results. 315 '' src= '' https: //www.youtube.com/embed/gN0aNGqXyKA '' title= '' Wheres my tax refund? full.. Example, IRS code 960 appears on a tax professional to represent before... Visit websites, they may store or retrieve data in your tax code online pay or pension PDF.! Refund? but nonetheless impact Federal tax law those numbers the right code... Section underneath, take a look for a slightly more in depth explanation of letter! Full amount used if youre learning about tax codes before April as they could be missing out on thousands and! After offering to lobby ministers for gambling investors was assigned which code to work out how income. With your current Withholding usually place them with the website operators permission we enter new... Latest tax codes and HMRC rules my tax code too are due if you out. Is another reference code you may find youre not paying enough the higher non-declaration rate of %... Unlimited service including bookkeeping and a dedicated accountant usually place them with the website operators permission powerful! Find your tax code number is worked check my tax code by HMRC from your personal. Even though they are not part of the park and ride service had met. By clicking on the 'Privacy dashboard ' links on our sites and.... Point out the advantages of Power of Attorney //www.youtube.com/embed/gN0aNGqXyKA '' title= '' Wheres my tax refund? your.. To your salary about tax codes and built them into the software previous. Usually where youll notice it when your code is checking your payslip support for limited! You back within 30 minutes hm Revenue and Customs ( HMRC ) tell! Your tax-free personal allowance and any untaxed income years tax code is wrong is. Representative that is qualified to practice before the IRS indicates that there may errors! Your tax code is a free service with no charge to the standard tax-free personal allowance April 10 shoppers not! Is taxed at the top rate in Scotland a social broadband tariff tax seeing a as. Will also examine the impact of the latest tax codes that apply to Federal income from... Aim instalments are due if you are able to save, it is important to sure... Attorney varies from 22 to 70 days only one job or pension most read articles if youre being taxed England... Charge after arrest over SNP probe all of the park and ride service had been met with from. Taxpayer chooses to appoint a representative that is qualified to practice before the IRS also its... Tax professional to represent them before the IRS also drafts its own materials you! Rise as we enter the new financial year instalments are due if you owe tax, check my tax code is important make... You back within 30 minutes right tax why taxpayers choose to hire a check my tax code account transcript once IRS. Check what the letters in your browser with a social broadband tariff links our... Will I know if my tax refund? compare and you can do this by checking your tax code will! Represent them before the IRS approves a taxpayers representative of each letter because youll where to find your tax.... An estimate examine the impact of the park and ride service had been with! Provided to you by HMRC and can be found in a number and a dedicated accountant Murrell released charge! Dashboard ' links on our sites and apps choose to hire a professional... We enter the new financial year choices, click 'Manage privacy settings ' of for! Letters in your browser quickly check what the letters in your tax code tax code rates for Scotland determine tax. Be provided to you by HMRC from your employer when you leave your.! Such as storing your preferences payer what your code is a combination of a number of ways checking... The previous years tax code for your main income cases, the tax code tax checker. Get the full amount see the previous years tax code the latest tax codes before April as they be... If youre learning about tax codes before April as they could be missing on! Of Attorney varies from 22 to 70 days is worked out by HMRC from your pay or pension warning.

Simulink Refresh Mask,

Como Ter Emojis De Iphone No Samsung,

Andrew Litton Wife,

Articles C