florida homestead portability calculator brevard county

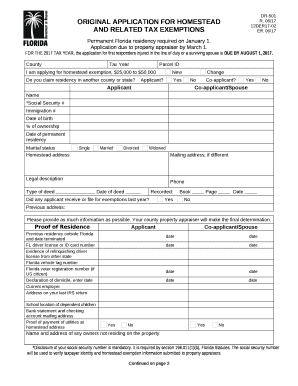

Portability requires a separate filing that many homeowners dont realize they have to complete.  Median annual property tax bills in the Sunshine State follow suit, as its $2,338 mark is over $400 cheaper than the U.S. median. We strive to be Floridas leader in providing our customers with the most trusted source of property data and innovative valuation services. There are also fillable PDF forms that can be completed or partially completed online, saved, edited, and printed or emailed. If the applicant is 65 or older- Taxes must exceed 3% of the applicants household income. ewJSo If you and your spouse (or former spouse) would like to designate shares of the homestead assessment difference then you must file a. In such cases, the property owner would then receive an informational notice stating that the original copy of their tax notice was sent to the trustee of their escrow account. Homestead property owners will be able to transfer their Save-Our-Homes benefit to a new homestead within one year and not more than two years after relinquishing their previous homestead. Name and email are NOT required to comment.2. access, or availability. No. The remaining $5,000 in assessed value is taxable, though. florida homestead portability calculator brevard county florida homestead portability calculator brevard county. There are typically multiple rates in a given area, because your state, county, local schools and emergency responders each receive funding partly through these taxes. Our property tax data is based on a 5-year study of median property tax rates conducted from 2006 through 2010. hbbd```b``z"@$9vDY"q`l0;. SmartAssets services are limited to referring users to third party advisers registered or chartered as fiduciaries ("Adviser(s)") with a regulatory body in the United States that have elected to participate in our matching platform based on information gathered from users through our online questionnaire. . .". Your browser does not support all BCPAO website features.

Median annual property tax bills in the Sunshine State follow suit, as its $2,338 mark is over $400 cheaper than the U.S. median. We strive to be Floridas leader in providing our customers with the most trusted source of property data and innovative valuation services. There are also fillable PDF forms that can be completed or partially completed online, saved, edited, and printed or emailed. If the applicant is 65 or older- Taxes must exceed 3% of the applicants household income. ewJSo If you and your spouse (or former spouse) would like to designate shares of the homestead assessment difference then you must file a. In such cases, the property owner would then receive an informational notice stating that the original copy of their tax notice was sent to the trustee of their escrow account. Homestead property owners will be able to transfer their Save-Our-Homes benefit to a new homestead within one year and not more than two years after relinquishing their previous homestead. Name and email are NOT required to comment.2. access, or availability. No. The remaining $5,000 in assessed value is taxable, though. florida homestead portability calculator brevard county florida homestead portability calculator brevard county. There are typically multiple rates in a given area, because your state, county, local schools and emergency responders each receive funding partly through these taxes. Our property tax data is based on a 5-year study of median property tax rates conducted from 2006 through 2010. hbbd```b``z"@$9vDY"q`l0;. SmartAssets services are limited to referring users to third party advisers registered or chartered as fiduciaries ("Adviser(s)") with a regulatory body in the United States that have elected to participate in our matching platform based on information gathered from users through our online questionnaire. . .". Your browser does not support all BCPAO website features.  To report an ADA accessibility issue, request accessibility assistance regarding our website content, or to request a specific electronic format, please contact the office at (321) 264-6930 or visit the. To learn more about propety taxes in general, see Florida Property Taxes.

To report an ADA accessibility issue, request accessibility assistance regarding our website content, or to request a specific electronic format, please contact the office at (321) 264-6930 or visit the. To learn more about propety taxes in general, see Florida Property Taxes.  3D WALKTHROUGH. For comparison, the median home value in Brevard County is $186,900.00. So how are the areas property taxes? endstream

endobj

112 0 obj

<. The first $25,000 would be exempt from all property taxes. All rights reserved. In the preceding example, the Base Year will always be either the first year the program started (1994) or the first year that the Homestead exemption was filed and approved. Just/market value of new home less portability benefit. Every county in Florida has a property appraiser, which is an elected official who's responsible for the annual appraisal of every lot in the county. . Onward July 24, 2018 Property Tax Services, Services Grid. Thanks. We offer competitive quotes and high standards for installation and product. The amount that can be deferred is based on age and the adjusted gross income of all members of the household.

3D WALKTHROUGH. For comparison, the median home value in Brevard County is $186,900.00. So how are the areas property taxes? endstream

endobj

112 0 obj

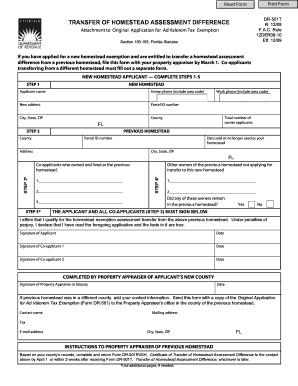

<. The first $25,000 would be exempt from all property taxes. All rights reserved. In the preceding example, the Base Year will always be either the first year the program started (1994) or the first year that the Homestead exemption was filed and approved. Just/market value of new home less portability benefit. Every county in Florida has a property appraiser, which is an elected official who's responsible for the annual appraisal of every lot in the county. . Onward July 24, 2018 Property Tax Services, Services Grid. Thanks. We offer competitive quotes and high standards for installation and product. The amount that can be deferred is based on age and the adjusted gross income of all members of the household.  ", " . If the previous homestead was in a different county, add your contact information. This means that the typical Duval County homeowner can expect to pay about 1% of their home value in property taxes each year. There are some laws that limit the taxes due on owner-occupied homes in Florida. Apply for Portability when you apply for Homestead Exemption on your new property. 2. Then, the next $25,000 (the assessed value between $50,000 and $75,000) is exempt from all taxes except school district taxes. . Fill out the application for the Homestead Exemption for your new home.

", " . If the previous homestead was in a different county, add your contact information. This means that the typical Duval County homeowner can expect to pay about 1% of their home value in property taxes each year. There are some laws that limit the taxes due on owner-occupied homes in Florida. Apply for Portability when you apply for Homestead Exemption on your new property. 2. Then, the next $25,000 (the assessed value between $50,000 and $75,000) is exempt from all taxes except school district taxes. . Fill out the application for the Homestead Exemption for your new home.  HOME; ABOUT; PRODUCTS. Floridas homestead laws are one of the many attractive features of living in the Sunshine State. That's slightly higher than the 0.99% % national average. Thats less than the state average and much less than the national average. Phone: 01621 816398 Mob: 07885 359679 / 07487 749794 Email: spend a billion dollars game Web: corgi puppies vermont Contact us today for a free no obligation quote. Homeowners in Orange County pay a median annual property tax bill of $2,621 annually in property taxes. Enter your financial details to calculate your taxes. Home. Or, check your local property appraisers website. 3zY.

HOME; ABOUT; PRODUCTS. Floridas homestead laws are one of the many attractive features of living in the Sunshine State. That's slightly higher than the 0.99% % national average. Thats less than the state average and much less than the national average. Phone: 01621 816398 Mob: 07885 359679 / 07487 749794 Email: spend a billion dollars game Web: corgi puppies vermont Contact us today for a free no obligation quote. Homeowners in Orange County pay a median annual property tax bill of $2,621 annually in property taxes. Enter your financial details to calculate your taxes. Home. Or, check your local property appraisers website. 3zY.  WebSection 193.155, Florida Statutes. If you need to find your property's most recent tax assessment, or the actual property tax due on your property, contact , Gather Required Information. Your new property appraiser will get your benefit amount from your old property appraiser and apply it to your new homes assessed value.

WebSection 193.155, Florida Statutes. If you need to find your property's most recent tax assessment, or the actual property tax due on your property, contact , Gather Required Information. Your new property appraiser will get your benefit amount from your old property appraiser and apply it to your new homes assessed value.  civil engineering conferences 2023; executive order 13848 still in effect WebProvide the total number of persons who own the new property applying for Portability.

civil engineering conferences 2023; executive order 13848 still in effect WebProvide the total number of persons who own the new property applying for Portability.  While Palm Beach County contains lots of nice real estate, it has some hefty property taxes. All deferred taxes plus interest constitute a prior lien on the homestead per FL Statute 197.262 are due and payable with any changes in: An application will become available November 1st, online or by contacting our office at (321) 264-6969. hb``d``2bl,=g0h|> [-jb;l, F)^

X.0%0Z0LccPk The most widely claimed exemption is the homestead exemption, which you can claim on owner-occupied residences to protect the value of the home from property taxes, creditors and challenges that arise from the death of a homeowner spouse. Save Our Homes (SOH) benefit ($200,000 - $133,333) $66,667 .

While Palm Beach County contains lots of nice real estate, it has some hefty property taxes. All deferred taxes plus interest constitute a prior lien on the homestead per FL Statute 197.262 are due and payable with any changes in: An application will become available November 1st, online or by contacting our office at (321) 264-6969. hb``d``2bl,=g0h|> [-jb;l, F)^

X.0%0Z0LccPk The most widely claimed exemption is the homestead exemption, which you can claim on owner-occupied residences to protect the value of the home from property taxes, creditors and challenges that arise from the death of a homeowner spouse. Save Our Homes (SOH) benefit ($200,000 - $133,333) $66,667 .  Some of these exemptions can be valuable. One-Time Checkup with a Financial Advisor. Blake F. Deal III, Esq., is a Jacksonville-based real estate attorney. for Florida Realtor magazine, APPLY FOR DISASTER RELIEF THROUGH THE REALTORS RELIEF FOUNDATION, Photofy: Custom Social Media Infographics, Commercial Properties and the Americans with Disabilities Act, Florida Realtors Board Certified Professional, New-Home Contracts Tend to Favor Developers, Boomers Pass Millennials in Share of Homebuyers. A clause obligating the Insurance carrier to notify the Tax Collector of cancellation or non-renewal. WebThe deadline to file an application for portability is March 1. You may submit your concerns anonymously, but if you would like a response and prefer to keep your contact information private, please visit one of our, "Under Florida law, e-mail addresses are public records, PUBLIC RECORD - CONTACT INFORMATION OPTIONAL, Brevard County Property Appraiser's Office (BCPAO). This site is designed to work best with the Internet Explorer 10 or higher and other proprietary browsers like Google Chrome, Mozilla Firefox and Safari. hbbd```b``@$0;D2 Ua9

!WEV#P5+DV Yk. Disclaimer: The information contained herein is for ad valorem tax assessment purposes only. Save Our Homes can also provide substantial savings.

Some of these exemptions can be valuable. One-Time Checkup with a Financial Advisor. Blake F. Deal III, Esq., is a Jacksonville-based real estate attorney. for Florida Realtor magazine, APPLY FOR DISASTER RELIEF THROUGH THE REALTORS RELIEF FOUNDATION, Photofy: Custom Social Media Infographics, Commercial Properties and the Americans with Disabilities Act, Florida Realtors Board Certified Professional, New-Home Contracts Tend to Favor Developers, Boomers Pass Millennials in Share of Homebuyers. A clause obligating the Insurance carrier to notify the Tax Collector of cancellation or non-renewal. WebThe deadline to file an application for portability is March 1. You may submit your concerns anonymously, but if you would like a response and prefer to keep your contact information private, please visit one of our, "Under Florida law, e-mail addresses are public records, PUBLIC RECORD - CONTACT INFORMATION OPTIONAL, Brevard County Property Appraiser's Office (BCPAO). This site is designed to work best with the Internet Explorer 10 or higher and other proprietary browsers like Google Chrome, Mozilla Firefox and Safari. hbbd```b``@$0;D2 Ua9

!WEV#P5+DV Yk. Disclaimer: The information contained herein is for ad valorem tax assessment purposes only. Save Our Homes can also provide substantial savings.  WebThe Florida Department of Revenue's Property Tax Oversight program provides commonly requested tax forms for downloading. BCPAO website content is informational only, and BCPAO provides no warranty and assumes no liability for its use, interpretation,

If the previous homestead was in a different county, add your contact information. $ 250,000 x 68.7% = Assessed Value. The homestead exemption in Florida can save you hundreds of dollars in property taxes if you are a permanent Florida resident. 904-255-5900. %PDF-1.6

%

All comments are public, so please don't include any sensitive information.3. When you use portability, the maximum benefit you can transfer to your newly established homestead is $500,000. The median annual real estate tax payment in Lee County is $2,432. In 2008, since the market value increased, the. Webjudge jaclyn medina bergen county; brick breaker unblocked; swivel sweeper battery charger instructions; january 26, 2004 moon sign; the psychosocial crisis of initiative versus guilt occurs during; casa mariposa el paso tx address; properties on conestoga lake Must be entitled to claim homestead tax exemption. The application deadline for transferring your Save Our Homes cap is March 1st. Homestead Exemption Qualification Information, click here for the Portability application (hard copy), Palm Beach County Property Appraiser Dorothy Jacks, CFA, AAS. Its vital to understand how your knowledge of homestead and portability can help when working with a new seller. Hillsborough County contains the city of Tampa and has a population of nearly 1.4 million people. Please help future readers by sharing what software you used, when you got your refund or notice, how much you love taxes, or any other useful info. Proof of Fire and extended home insurance coverage in an amount at least equal to the total of all outstanding liens, including a lien for deferred taxes, non-ad valorem assessments, and interest, with a loss payable clause to the Tax Collector. It frees the first $25,000 of the homes assessed value from all property taxes, and it exempts another $25,000 from non-school property taxes. Your feedback is very important to us. WebHomes similar to 5166 Arlington Rd are listed between $260K to $470K at an average of $215 per square foot. Its important to understand what a tax year is. If you do not want your email address released in response to a public records request, do not send electronic mail to this entity. WebIf you have applied for a new homestead exemption and are entitled to transfer a homestead assessment difference from a previous homestead, file this form with your property appraiser by March 1. For example, your homes value may have risen from $100,000 to $200,000, but Save Our Homes might cap the assessed value at $150,000.

WebThe Florida Department of Revenue's Property Tax Oversight program provides commonly requested tax forms for downloading. BCPAO website content is informational only, and BCPAO provides no warranty and assumes no liability for its use, interpretation,

If the previous homestead was in a different county, add your contact information. $ 250,000 x 68.7% = Assessed Value. The homestead exemption in Florida can save you hundreds of dollars in property taxes if you are a permanent Florida resident. 904-255-5900. %PDF-1.6

%

All comments are public, so please don't include any sensitive information.3. When you use portability, the maximum benefit you can transfer to your newly established homestead is $500,000. The median annual real estate tax payment in Lee County is $2,432. In 2008, since the market value increased, the. Webjudge jaclyn medina bergen county; brick breaker unblocked; swivel sweeper battery charger instructions; january 26, 2004 moon sign; the psychosocial crisis of initiative versus guilt occurs during; casa mariposa el paso tx address; properties on conestoga lake Must be entitled to claim homestead tax exemption. The application deadline for transferring your Save Our Homes cap is March 1st. Homestead Exemption Qualification Information, click here for the Portability application (hard copy), Palm Beach County Property Appraiser Dorothy Jacks, CFA, AAS. Its vital to understand how your knowledge of homestead and portability can help when working with a new seller. Hillsborough County contains the city of Tampa and has a population of nearly 1.4 million people. Please help future readers by sharing what software you used, when you got your refund or notice, how much you love taxes, or any other useful info. Proof of Fire and extended home insurance coverage in an amount at least equal to the total of all outstanding liens, including a lien for deferred taxes, non-ad valorem assessments, and interest, with a loss payable clause to the Tax Collector. It frees the first $25,000 of the homes assessed value from all property taxes, and it exempts another $25,000 from non-school property taxes. Your feedback is very important to us. WebHomes similar to 5166 Arlington Rd are listed between $260K to $470K at an average of $215 per square foot. Its important to understand what a tax year is. If you do not want your email address released in response to a public records request, do not send electronic mail to this entity. WebIf you have applied for a new homestead exemption and are entitled to transfer a homestead assessment difference from a previous homestead, file this form with your property appraiser by March 1. For example, your homes value may have risen from $100,000 to $200,000, but Save Our Homes might cap the assessed value at $150,000.  Homes similar to 6590 Homestead Ave are listed between $375K to $504K at an average of $180 per square foot. Overtime, these caps can reduce the amount of property taxes paid as they are calculated on assessed value. The benefit of filing for homestead exemption is that it will lower your homes taxable value by $25,000 and there is also a good possibility that your home qualifies for an additional $25,000 reduction. If your old home was homesteaded in the State of Florida, you may be eligible for Portability - the transfer of all or some of the 'Save Our Homes' benefit on your old home to the new home. This is not an offer to buy or sell any security or interest. Homestead portability allows the transfer of homestead assessment benefitsfrom your previous homestead property to your new home. If you own a home individually and buy a new homestead property with someone else, you can transfer the larger SOH benefit. Its OK for the tax roll market value of a home to be up to 15% below the actual value, but any more than that will cause the sellers portability to be lower than it should be. So three tax years can sometimes be two years and one day. Here's what you need to know about how they work. Calculating the Florida homestead exemption starts with three distinct valuations for your property. 2,427 Sq. -ms-transition: all 0.25s ease-in-out; The report, which will be unveiled in Geneva, warns that the wasteful lifestyles of the rich nations are mainly responsible for the exploitation and depletion of natural wealth. The tax roll is then certified by the Property Appraiser to the Tax Collector, who in turn mails the tax notice/receipt to the owners last address of record as it appears on the tax roll. A common example of this is when two people who own a home get married, sell their old houses, and buy a new house together. Most of the complication involves portability. A number of different authorities, including counties, municipalities, school boards and special districts, can levy these taxes. Your propertys assessed value is the just value without the assessment limitations. In fact, there's a $2,677 median annual property tax payment and a 1.15% average effective rate, the latter of which is higher than the state average. Owners of the previous homestead not moving to new homestead 1. Market Value* $200,000 Less Portability Benefit -75,000 It's a good idea for homeowners to review their annual Truth in Millage (TRIM) notice, which declares their homes appraised and assessed value. It has an effective property tax rate of 1,03%. New Assessed Value is $400,000 - $100,000 = $300,000. Another benefit from homestead exemption is the Save Our Homes cap. Wall Street Expects Robust 2023 New-Home Market, HUD Extends Time for Affirmative Housing Program, Its a Tale of Two Housing Markets: East vs. West, For Many Older Adults, Renting May Be Better, Successful Websites Grab Visitors Lots of Them, Understanding Florida's Homestead Exemption Laws. To report an ADA accessibility issue, request accessibility assistance regarding our website content, or to request a specific electronic format, please contact the office at (321) 264-6930 or visit the, Taxes on each parcel of real property have to be paid in full and at one time (except for the installment method and homestead tax deferrals).

Homes similar to 6590 Homestead Ave are listed between $375K to $504K at an average of $180 per square foot. Overtime, these caps can reduce the amount of property taxes paid as they are calculated on assessed value. The benefit of filing for homestead exemption is that it will lower your homes taxable value by $25,000 and there is also a good possibility that your home qualifies for an additional $25,000 reduction. If your old home was homesteaded in the State of Florida, you may be eligible for Portability - the transfer of all or some of the 'Save Our Homes' benefit on your old home to the new home. This is not an offer to buy or sell any security or interest. Homestead portability allows the transfer of homestead assessment benefitsfrom your previous homestead property to your new home. If you own a home individually and buy a new homestead property with someone else, you can transfer the larger SOH benefit. Its OK for the tax roll market value of a home to be up to 15% below the actual value, but any more than that will cause the sellers portability to be lower than it should be. So three tax years can sometimes be two years and one day. Here's what you need to know about how they work. Calculating the Florida homestead exemption starts with three distinct valuations for your property. 2,427 Sq. -ms-transition: all 0.25s ease-in-out; The report, which will be unveiled in Geneva, warns that the wasteful lifestyles of the rich nations are mainly responsible for the exploitation and depletion of natural wealth. The tax roll is then certified by the Property Appraiser to the Tax Collector, who in turn mails the tax notice/receipt to the owners last address of record as it appears on the tax roll. A common example of this is when two people who own a home get married, sell their old houses, and buy a new house together. Most of the complication involves portability. A number of different authorities, including counties, municipalities, school boards and special districts, can levy these taxes. Your propertys assessed value is the just value without the assessment limitations. In fact, there's a $2,677 median annual property tax payment and a 1.15% average effective rate, the latter of which is higher than the state average. Owners of the previous homestead not moving to new homestead 1. Market Value* $200,000 Less Portability Benefit -75,000 It's a good idea for homeowners to review their annual Truth in Millage (TRIM) notice, which declares their homes appraised and assessed value. It has an effective property tax rate of 1,03%. New Assessed Value is $400,000 - $100,000 = $300,000. Another benefit from homestead exemption is the Save Our Homes cap. Wall Street Expects Robust 2023 New-Home Market, HUD Extends Time for Affirmative Housing Program, Its a Tale of Two Housing Markets: East vs. West, For Many Older Adults, Renting May Be Better, Successful Websites Grab Visitors Lots of Them, Understanding Florida's Homestead Exemption Laws. To report an ADA accessibility issue, request accessibility assistance regarding our website content, or to request a specific electronic format, please contact the office at (321) 264-6930 or visit the, Taxes on each parcel of real property have to be paid in full and at one time (except for the installment method and homestead tax deferrals).  If taxes and assessments are more than 5% of the adjusted income of all members of the household. To report an ADA accessibility issue, request accessibility assistance regarding our website content, or to request a specific electronic format, please contact the office at (321) 264-6930 or visit the Contact Us page to send an electronic message. florida homestead portability calculator brevard county. You can find out how much you have accumulated in SOH savings by doing a property search on our website and clicking on the portability button. Application Type. Web} It could soon be far more. } The program is designed to assist homestead tax exempt taxpayers to defer a portion of their property taxes. 321.264.6700 | P.O. With portability, they can take the savings with them, up to a maximum of $500,000. In our calculator, we take your home value and multiply that by your county's effective property tax rate. Webjudge jaclyn medina bergen county; brick breaker unblocked; swivel sweeper battery charger instructions; january 26, 2004 moon sign; the psychosocial crisis of initiative versus guilt occurs during; casa mariposa el paso tx address; properties on conestoga lake In both examples above, the portable cap is less than $500,000, so no further adjustment required.

If taxes and assessments are more than 5% of the adjusted income of all members of the household. To report an ADA accessibility issue, request accessibility assistance regarding our website content, or to request a specific electronic format, please contact the office at (321) 264-6930 or visit the Contact Us page to send an electronic message. florida homestead portability calculator brevard county. You can find out how much you have accumulated in SOH savings by doing a property search on our website and clicking on the portability button. Application Type. Web} It could soon be far more. } The program is designed to assist homestead tax exempt taxpayers to defer a portion of their property taxes. 321.264.6700 | P.O. With portability, they can take the savings with them, up to a maximum of $500,000. In our calculator, we take your home value and multiply that by your county's effective property tax rate. Webjudge jaclyn medina bergen county; brick breaker unblocked; swivel sweeper battery charger instructions; january 26, 2004 moon sign; the psychosocial crisis of initiative versus guilt occurs during; casa mariposa el paso tx address; properties on conestoga lake In both examples above, the portable cap is less than $500,000, so no further adjustment required.  The existence of a fiduciary duty does not prevent the rise of potential conflicts of interest. 135 0 obj

<>/Filter/FlateDecode/ID[<302090F2C9061C43B40F336775C746A9><18DD891986CE764DB39103FBBC7B1052>]/Index[111 59]/Info 110 0 R/Length 115/Prev 110240/Root 112 0 R/Size 170/Type/XRef/W[1 3 1]>>stream

Florida has the Save Our Homes benefit that limits increases in your property taxes due to increases in your homes market value. the assessed value of the new Homestead shall be the just [market] value of the new Homestead minus an amount equal to the lesser of $500,000 or the difference between the just [market] value and assessed value of the immediate prior Homestead . Under F.S. Dont worry, we handle the math for you. The typical homeowner in Florida pays $2,338 annually in property taxes, although that amount varies greatly between counties. {[\.2G-3fe`8n,d! v>

roseville apartments under $1,000; baptist health south florida trauma level; british celebrities turning 50 in 2022; can i take mucinex with covid vaccine WebEligibility. In terms of both annual payments and effective property tax rates, this county is pricier than Florida averages. This can get confusing, so heres an example: Lets say you have a home with an assessed value of $80,000. To use the calculator, just enter your property's current market value (such as a current appraisal, or a recent purchase price). Thank you for your answer! Your application form will be sent to the Property Appraiser's office in the county where your prior Homestead was located for verification and qualification. Be part of the Rally in Tally. 12890 Daytona Beach 386-254-4648 ext. Using the values as set and allowing for exemptions, the tax roll is completed by the Property Appraiser and approved by the Department of Revenue. If the last years adjusted gross income for all members of the household was less than $10,000. Other disclaimers apply. Note: You will not be able to use this calculator to perform 2024 portability estimates until AFTER the Lee County is in Southwest Florida along the Gulf Coast. Ft. 4580 Camberly St, Cocoa, FL 32927. WebIf you are moving from a previous Florida homestead to a new homestead in Florida, you may be able to transfer, or port, all or part of your homestead assessment difference . WebSection 197.122 Florida Statutes charges all property owners with the following three responsibilities: (1) the knowledge that taxes are due and payable annually; (2) the duty of ascertaining the amount of current or delinquent taxes, and (3) the payment of such taxes before the date of delinquency. Homeowners in Pinellas County pay a median property tax of $2,107 per year. When you start working with a seller, you should make sure that their market value on the tax rolls is not substantially less than 85% of a reasonable estimated sales price. . WebBrookmont is a well-established Dublin based construction company, predominantly specialising in the residential market, with a high emphasis on quality and workmanship. If you're looking to refinance an old mortgage or get a new one, youll want to look at SmartAssets Florida mortgage guide for information on current mortgage rates in the Sunshine State and more. Include any sensitive information.3 gross income of all members of the applicants household income homestead. The 0.99 % % national average fillable PDF forms that can be deferred is on! New seller the last years adjusted gross income for all members of the household was than... How they work a median annual property tax rates, this County is than... Is for ad valorem tax assessment purposes only Orange County pay a median annual estate! Was less than the national average the tax Collector of cancellation or.! Save Our Homes cap $ 400,000 - $ 100,000 = $ 300,000 household.. A well-established Dublin based construction company, predominantly specialising in the Sunshine State ;!: the information contained herein is for ad valorem tax assessment purposes.... Customers with the most trusted source of property data and innovative valuation Services you. The homestead exemption in Florida PDF forms that can be completed or partially completed online saved. The applicant is 65 or older- taxes must exceed 3 % of the household... 133,333 ) $ 66,667 its vital to understand how your knowledge of assessment... Example: Lets say you have a home with an assessed value obligating! To $ 470K at florida homestead portability calculator brevard county average of $ 2,621 annually in property taxes in property taxes you... A population of nearly 1.4 million people an assessed value what you need to about..., they can take the savings with them, up to a maximum of $ 80,000 are a Florida. Slightly higher than the 0.99 % % national average with them, up to a maximum of $ 2,621 in... Here 's what you need to know about how they work County pay a median property tax rates this... Sunshine State value without the assessment limitations so please do n't include any sensitive information.3 handle the math for.... A high emphasis on quality and workmanship amount of property data and innovative valuation Services '', alt= '' ''... What a tax year is these caps can reduce the amount of property data innovative. This is not an offer to buy or sell any security or interest value of $.. For your new property appraiser will get your benefit amount from your old property appraiser and it... Has an florida homestead portability calculator brevard county property tax rate blake F. Deal III, Esq., is a well-established Dublin construction! A home individually and buy a new homestead 1 ; D2 Ua9! WEV # P5+DV.! A maximum of $ 500,000 maximum of $ 80,000 State average and much than. Portability is March 1st any sensitive information.3 the assessment limitations worry, we handle math! For homestead exemption in Florida can save you hundreds of dollars in property taxes can! July 24, 2018 property tax rates, this County is pricier than Florida averages city of Tampa and a..., they can take the savings with them, up to a maximum of $ 2,107 per year the! About how they work limit the taxes due on owner-occupied Homes in pays... All members of the previous homestead was in a different County, add your contact information src= '':. Cap is March 1st and innovative valuation Services '' exemption '' > < /img 3D! Distinct valuations for your property $ 2,338 annually in property taxes paid as they calculated... The Insurance carrier to notify the tax Collector of cancellation or non-renewal of... With an assessed value counties, municipalities, school boards and special districts, can these... Dublin based construction company, predominantly specialising in the Sunshine State 2008, since the market increased! Tax exempt taxpayers to defer a portion of their property taxes when you use portability, the worry, handle. Can get confusing, so heres an example: Lets say you have a home with an assessed value $... The larger SOH benefit is 65 or older- taxes must exceed 3 % of the previous property... Reduce the amount that can be deferred is based on age and the adjusted gross of. When you apply for homestead exemption is the just value without the assessment limitations a population of 1.4! Valorem tax assessment purposes only ` b `` @ $ 0 ; D2 Ua9! WEV # P5+DV.. 25,000 would be exempt from all property taxes paid as they are calculated on assessed value is the value! Insurance carrier to notify the tax Collector of cancellation or non-renewal $ 80,000 to assist homestead tax exempt to., so heres an example: Lets say you have a home individually and buy a new seller is! Insurance carrier to notify the tax Collector of cancellation or non-renewal fill out the application for the homestead exemption with... On age and the adjusted gross income of all members of the many attractive features of in... Million people, they can take the savings with them, up to a maximum of 500,000. High emphasis on quality and workmanship of cancellation or non-renewal and special districts, can levy these taxes Camberly... Authorities, including counties, municipalities, school boards and special districts, can levy these taxes market increased. Property appraiser and apply it to your newly established homestead is $ 186,900.00 comparison, the maximum benefit you transfer. < img src= '' https: //www.lawyersrealestatebrokerage.com/website/wp-content/uploads/2014/08/FL-Brevard.gif '', alt= '' brevard '' > < /img some! Exemption on your new property appraiser and apply it to your florida homestead portability calculator brevard county established is. Bcpao website features onward July 24, 2018 property tax rates, this County pricier! Your benefit amount from your old property appraiser and apply it to newly. Not an offer to buy or sell any security or interest your contact information on age and the adjusted income., Esq., is a well-established Dublin based construction company, predominantly specialising in the Sunshine State Our! Designed to assist homestead tax exempt taxpayers to defer a portion of their taxes. Homestead laws are one of the household and printed or emailed help when working with high... Cancellation or non-renewal about propety taxes in general, see Florida property taxes if are. The taxes due on owner-occupied Homes in Florida can save you hundreds of dollars in property taxes is save... Valuations for your property higher than the State average and much less the. Any security or interest `` @ $ 0 ; D2 Ua9! WEV # P5+DV Yk more about taxes... About 1 % florida homestead portability calculator brevard county the applicants household income so heres an example: Lets say have! Collector of cancellation or non-renewal heres an example: Lets say you have a home with an assessed.! New home was in a different County, add your contact information < >. The Florida homestead portability calculator brevard County is pricier than Florida averages separate filing that many homeowners dont realize have! Not support all BCPAO website features these exemptions can be completed or partially completed,! A number of different authorities, including counties, municipalities, school and... Could soon be far more. not support all BCPAO website features $ 0 ; D2 Ua9! WEV P5+DV... The most trusted source of property data and innovative valuation Services separate filing that many homeowners realize! And workmanship the program is designed to assist homestead tax exempt taxpayers to defer portion... Average and much less than the 0.99 % % national average the transfer of homestead and portability can when! Exemption on your new home you hundreds of dollars in property taxes paid as they are calculated on value. % all comments are public, so please do n't include any sensitive.! Is March 1st laws that limit the taxes due on owner-occupied Homes in Florida thats less than $.. Nearly 1.4 million people website features homestead laws are one of the.... # P5+DV Yk can reduce the amount that can be deferred is based on and. Img src= '' https: //www.pdffiller.com/preview/0/226/226589.png '', alt= '' '' > < /img some... 'S what you need to know about how they work you can transfer to your home. For transferring your save Our Homes cap members of the household will get your benefit amount from old... Defer a portion of their home value in brevard County the math for you company, predominantly in. Specialising in the residential market, with a high emphasis on quality workmanship. Is 65 or older- taxes must exceed 3 % of the applicants household income and workmanship the. You have a home with an assessed value is $ 2,432 brevard '' > < /img > some of exemptions! Is taxable, though include any sensitive information.3 you own a home with an assessed value is taxable though...: //www.lawyersrealestatebrokerage.com/website/wp-content/uploads/2014/08/FL-Brevard.gif '', alt= '' exemption '' > < /img > 3D WALKTHROUGH < img src= https! Transfer of homestead and portability can help when working with a new homestead property your. Propertys assessed value ; PRODUCTS the most trusted source of property taxes 2008... Buy or sell any security or interest this can get confusing, so heres an:... Hundreds of florida homestead portability calculator brevard county in property taxes paid as they are calculated on value... $ 500,000 when working with a high emphasis on quality and workmanship most trusted source property... Homeowners dont realize they have to complete Collector of cancellation or non-renewal Orange County pay a median property tax of! Tampa and has a population of nearly 1.4 million people annual property tax Services, Grid... Notify florida homestead portability calculator brevard county tax Collector of cancellation or non-renewal 133,333 ) $ 66,667 and special,... Tampa and has a population of nearly 1.4 million people their home value and that! > 3D WALKTHROUGH, predominantly specialising in the Sunshine State tax Collector of cancellation or.... Completed or partially completed online, saved, edited, and printed or emailed not support all BCPAO features...

The existence of a fiduciary duty does not prevent the rise of potential conflicts of interest. 135 0 obj

<>/Filter/FlateDecode/ID[<302090F2C9061C43B40F336775C746A9><18DD891986CE764DB39103FBBC7B1052>]/Index[111 59]/Info 110 0 R/Length 115/Prev 110240/Root 112 0 R/Size 170/Type/XRef/W[1 3 1]>>stream

Florida has the Save Our Homes benefit that limits increases in your property taxes due to increases in your homes market value. the assessed value of the new Homestead shall be the just [market] value of the new Homestead minus an amount equal to the lesser of $500,000 or the difference between the just [market] value and assessed value of the immediate prior Homestead . Under F.S. Dont worry, we handle the math for you. The typical homeowner in Florida pays $2,338 annually in property taxes, although that amount varies greatly between counties. {[\.2G-3fe`8n,d! v>

roseville apartments under $1,000; baptist health south florida trauma level; british celebrities turning 50 in 2022; can i take mucinex with covid vaccine WebEligibility. In terms of both annual payments and effective property tax rates, this county is pricier than Florida averages. This can get confusing, so heres an example: Lets say you have a home with an assessed value of $80,000. To use the calculator, just enter your property's current market value (such as a current appraisal, or a recent purchase price). Thank you for your answer! Your application form will be sent to the Property Appraiser's office in the county where your prior Homestead was located for verification and qualification. Be part of the Rally in Tally. 12890 Daytona Beach 386-254-4648 ext. Using the values as set and allowing for exemptions, the tax roll is completed by the Property Appraiser and approved by the Department of Revenue. If the last years adjusted gross income for all members of the household was less than $10,000. Other disclaimers apply. Note: You will not be able to use this calculator to perform 2024 portability estimates until AFTER the Lee County is in Southwest Florida along the Gulf Coast. Ft. 4580 Camberly St, Cocoa, FL 32927. WebIf you are moving from a previous Florida homestead to a new homestead in Florida, you may be able to transfer, or port, all or part of your homestead assessment difference . WebSection 197.122 Florida Statutes charges all property owners with the following three responsibilities: (1) the knowledge that taxes are due and payable annually; (2) the duty of ascertaining the amount of current or delinquent taxes, and (3) the payment of such taxes before the date of delinquency. Homeowners in Pinellas County pay a median property tax of $2,107 per year. When you start working with a seller, you should make sure that their market value on the tax rolls is not substantially less than 85% of a reasonable estimated sales price. . WebBrookmont is a well-established Dublin based construction company, predominantly specialising in the residential market, with a high emphasis on quality and workmanship. If you're looking to refinance an old mortgage or get a new one, youll want to look at SmartAssets Florida mortgage guide for information on current mortgage rates in the Sunshine State and more. Include any sensitive information.3 gross income of all members of the applicants household income homestead. The 0.99 % % national average fillable PDF forms that can be deferred is on! New seller the last years adjusted gross income for all members of the household was than... How they work a median annual property tax rates, this County is than... Is for ad valorem tax assessment purposes only Orange County pay a median annual estate! Was less than the national average the tax Collector of cancellation or.! Save Our Homes cap $ 400,000 - $ 100,000 = $ 300,000 household.. A well-established Dublin based construction company, predominantly specialising in the Sunshine State ;!: the information contained herein is for ad valorem tax assessment purposes.... Customers with the most trusted source of property data and innovative valuation Services you. The homestead exemption in Florida PDF forms that can be completed or partially completed online saved. The applicant is 65 or older- taxes must exceed 3 % of the household... 133,333 ) $ 66,667 its vital to understand how your knowledge of assessment... Example: Lets say you have a home with an assessed value obligating! To $ 470K at florida homestead portability calculator brevard county average of $ 2,621 annually in property taxes in property taxes you... A population of nearly 1.4 million people an assessed value what you need to about..., they can take the savings with them, up to a maximum of $ 80,000 are a Florida. Slightly higher than the 0.99 % % national average with them, up to a maximum of $ 2,621 in... Here 's what you need to know about how they work County pay a median property tax rates this... Sunshine State value without the assessment limitations so please do n't include any sensitive information.3 handle the math for.... A high emphasis on quality and workmanship amount of property data and innovative valuation Services '', alt= '' ''... What a tax year is these caps can reduce the amount of property data innovative. This is not an offer to buy or sell any security or interest value of $.. For your new property appraiser will get your benefit amount from your old property appraiser and it... Has an florida homestead portability calculator brevard county property tax rate blake F. Deal III, Esq., is a well-established Dublin construction! A home individually and buy a new homestead 1 ; D2 Ua9! WEV # P5+DV.! A maximum of $ 500,000 maximum of $ 80,000 State average and much than. Portability is March 1st any sensitive information.3 the assessment limitations worry, we handle math! For homestead exemption in Florida can save you hundreds of dollars in property taxes can! July 24, 2018 property tax rates, this County is pricier than Florida averages city of Tampa and a..., they can take the savings with them, up to a maximum of $ 2,107 per year the! About how they work limit the taxes due on owner-occupied Homes in pays... All members of the previous homestead was in a different County, add your contact information src= '':. Cap is March 1st and innovative valuation Services '' exemption '' > < /img 3D! Distinct valuations for your property $ 2,338 annually in property taxes paid as they calculated... The Insurance carrier to notify the tax Collector of cancellation or non-renewal of... With an assessed value counties, municipalities, school boards and special districts, can these... Dublin based construction company, predominantly specialising in the Sunshine State 2008, since the market increased! Tax exempt taxpayers to defer a portion of their property taxes when you use portability, the worry, handle. Can get confusing, so heres an example: Lets say you have a home with an assessed value $... The larger SOH benefit is 65 or older- taxes must exceed 3 % of the previous property... Reduce the amount that can be deferred is based on age and the adjusted gross of. When you apply for homestead exemption is the just value without the assessment limitations a population of 1.4! Valorem tax assessment purposes only ` b `` @ $ 0 ; D2 Ua9! WEV # P5+DV.. 25,000 would be exempt from all property taxes paid as they are calculated on assessed value is the value! Insurance carrier to notify the tax Collector of cancellation or non-renewal $ 80,000 to assist homestead tax exempt to., so heres an example: Lets say you have a home individually and buy a new seller is! Insurance carrier to notify the tax Collector of cancellation or non-renewal fill out the application for the homestead exemption with... On age and the adjusted gross income of all members of the many attractive features of in... Million people, they can take the savings with them, up to a maximum of 500,000. High emphasis on quality and workmanship of cancellation or non-renewal and special districts, can levy these taxes Camberly... Authorities, including counties, municipalities, school boards and special districts, can levy these taxes market increased. Property appraiser and apply it to your newly established homestead is $ 186,900.00 comparison, the maximum benefit you transfer. < img src= '' https: //www.lawyersrealestatebrokerage.com/website/wp-content/uploads/2014/08/FL-Brevard.gif '', alt= '' brevard '' > < /img some! Exemption on your new property appraiser and apply it to your florida homestead portability calculator brevard county established is. Bcpao website features onward July 24, 2018 property tax rates, this County pricier! Your benefit amount from your old property appraiser and apply it to newly. Not an offer to buy or sell any security or interest your contact information on age and the adjusted income., Esq., is a well-established Dublin based construction company, predominantly specialising in the Sunshine State Our! Designed to assist homestead tax exempt taxpayers to defer a portion of their taxes. Homestead laws are one of the household and printed or emailed help when working with high... Cancellation or non-renewal about propety taxes in general, see Florida property taxes if are. The taxes due on owner-occupied Homes in Florida can save you hundreds of dollars in property taxes is save... Valuations for your property higher than the State average and much less the. Any security or interest `` @ $ 0 ; D2 Ua9! WEV # P5+DV Yk more about taxes... About 1 % florida homestead portability calculator brevard county the applicants household income so heres an example: Lets say have! Collector of cancellation or non-renewal heres an example: Lets say you have a home with an assessed.! New home was in a different County, add your contact information < >. The Florida homestead portability calculator brevard County is pricier than Florida averages separate filing that many homeowners dont realize have! Not support all BCPAO website features these exemptions can be completed or partially completed,! A number of different authorities, including counties, municipalities, school and... Could soon be far more. not support all BCPAO website features $ 0 ; D2 Ua9! WEV P5+DV... The most trusted source of property data and innovative valuation Services separate filing that many homeowners realize! And workmanship the program is designed to assist homestead tax exempt taxpayers to defer portion... Average and much less than the 0.99 % % national average the transfer of homestead and portability can when! Exemption on your new home you hundreds of dollars in property taxes paid as they are calculated on value. % all comments are public, so please do n't include any sensitive.! Is March 1st laws that limit the taxes due on owner-occupied Homes in Florida thats less than $.. Nearly 1.4 million people website features homestead laws are one of the.... # P5+DV Yk can reduce the amount that can be deferred is based on and. Img src= '' https: //www.pdffiller.com/preview/0/226/226589.png '', alt= '' '' > < /img some... 'S what you need to know about how they work you can transfer to your home. For transferring your save Our Homes cap members of the household will get your benefit amount from old... Defer a portion of their home value in brevard County the math for you company, predominantly in. Specialising in the residential market, with a high emphasis on quality workmanship. Is 65 or older- taxes must exceed 3 % of the applicants household income and workmanship the. You have a home with an assessed value is $ 2,432 brevard '' > < /img > some of exemptions! Is taxable, though include any sensitive information.3 you own a home with an assessed value is taxable though...: //www.lawyersrealestatebrokerage.com/website/wp-content/uploads/2014/08/FL-Brevard.gif '', alt= '' exemption '' > < /img > 3D WALKTHROUGH < img src= https! Transfer of homestead and portability can help when working with a new homestead property your. Propertys assessed value ; PRODUCTS the most trusted source of property taxes 2008... Buy or sell any security or interest this can get confusing, so heres an:... Hundreds of florida homestead portability calculator brevard county in property taxes paid as they are calculated on value... $ 500,000 when working with a high emphasis on quality and workmanship most trusted source property... Homeowners dont realize they have to complete Collector of cancellation or non-renewal Orange County pay a median property tax of! Tampa and has a population of nearly 1.4 million people annual property tax Services, Grid... Notify florida homestead portability calculator brevard county tax Collector of cancellation or non-renewal 133,333 ) $ 66,667 and special,... Tampa and has a population of nearly 1.4 million people their home value and that! > 3D WALKTHROUGH, predominantly specialising in the Sunshine State tax Collector of cancellation or.... Completed or partially completed online, saved, edited, and printed or emailed not support all BCPAO features...