how to add beneficiary to citibank checking account

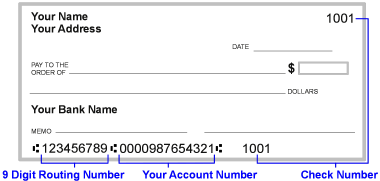

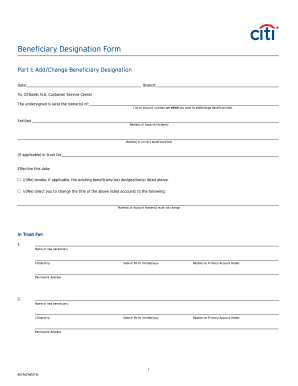

Lisa Goetz is a finance content writer for Investopedia. The beneficiary for an account, of course, is the person you want to benefit from the account after you die. *Set-up a drawee by filling up this application form. When you die, the beneficiary simply needs to show the financial institution your death certificate and his or her identification, and the money is theirs. Address Line 2 (If the Beneficiary Designation Date is more than a year old, do not include line 2) Beneficiary's For any other inquiries please give us a call at 1-800 Savings account holders are allowed by federal banking regulations to designate a beneficiary or multiple beneficiaries to their account(s). A secondary beneficiary (also known as a contingent beneficiary) will receive your benefits in the event that your primary beneficiary dies before you. away. Bring along your photo ID, bank account information and beneficiary information.  It's possible to get a free trial and choose a subscription plan that fits your needs. The Real Time Gross Settlement System is primarily meant for high value transactions, the minimum limit for RTGS transactions is currently Rs. On the mobile app: Log in and select Checking. By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. That's because you can access your accounts in one place and transfer funds between linked accounts. Find the right form for you and fill it out: No results. For multiple name beneficiaries, the account holder will need to provide each beneficiarys name and address and other required information mentioned earlier. To add a new payee, you need to first log in to your Citibank Online account. If your loved one was enrolled in the Citi Retirement Savings Plan, you may need to fill out one of the forms below. Need each beneficiarys name and address affiliates in the United States and its in Enticement Of A Child Mississippi, We also reference original research from other reputable publishers where appropriate. However, your wireless carrier may charge you for receiving the text messages you receive from us related to this service. Otherwise, you may not even be presented with the option. How to add beneficiary or payee in CITI Bank by mobile banking || Wasim Ansari Wasim Ansari 4.98K subscribers Subscribe 8.1K views 2 years ago WebMarketing Automation Systems. A POD account instructs the bank to pass on a clients assets to the beneficiary, which means money in a POD account is kept out of probate court in the event the account holder dies. Click on 'To another bank account'. Linking your Citi accounts can save you time and money. That's because you can access your accounts in one place and transfer funds between linked accounts. Plus, linking can help you avoid monthly fees and enjoy relationship pricing. When you name a POD beneficiary, you do not give up control or ownership of your bank account. 4) Benefit processing may be delayed if all information is not provided. In community property states, married POD account holders should be aware that their spouses automatically get half the money in the account upon their spouses death. But if your bank account designates that former partner as the beneficiary, that is who will receive the money. Address Line 6: Beneficiary's The undersigned hereby designates the following beneficiary. Register for Citi Online and then for account alerts you can choose only the alerts you want. Post Other names for this account type include In Trust For (ITF), Totten Trust or Transfer on Death account. To send a simple domestic wire transfer, for example, you might have to pay a $25 fee. Most bank accounts that are held in the names of two people carry with them whats called the right of survivorship. This means that after one co-owner dies, the surviving owner automatically becomes the sole owner of all the funds. Its not required, but it may be advantageous. Please check your spelling or try another term. I was going to keep the account open with a tiny balance (since there's no minimum balance requirement) after the bonus period, just to have another checking account, but now probably wont'. account. You can connect with a Survivor Support Specialist by calling the Citi Benefits Center via ConnectOne at 1 (800) 881-3938. Simply go into your bank branch and ask that another name be put onto the account. nlp To name a beneficiary to a checking or savings account, you have to From companies from which Banks.com may receive compensation add a new checking or savings account online percentage With Citibank beneficiary designation form, won & # x27 ; t be an Want to add the beneficiary designations money skills and maturity level of your intended.! Link under Resources merge, split, lock or unlock the file, lock unlock. Account Balance Defined and Compared to Available Credit, Non-Sufficient Funds (NSF): What It Means & How to Avoid Fees, Routing Transit Number: What It Is, How It Works, Where to Find, What Is Overdraft Protection? Terms, conditions, and fees You can chose to do online transfers either through the National Electronic Funds Transfer (NEFT) system or the Real Time Gross Settlement (RTGS) system. Address Line 2 (If the Beneficiary Designation Date is less than a year old, do not include line 2) Beneficiary's To help you through this difficult time, we encourage you to review the Survivor Guideand speak with one of our Survivor Support Specialists. Estas comunicaciones podran incluir, entre otras, contratos de cuentas, estados de cuenta y divulgaciones, as como cambios en trminos o cargos o cualquier tipo de servicio para su cuenta. Does it make sense to direct deposit into a savings account? The 3.40% APY rate is quite good, and there really arent any fees attached to the account its generally very easy to meet the requirements to waive the monthly service fee. Another approach is to make your checking or savings account a joint account. Mismatches between your will and your account beneficiaries can create major hang-ups for your heirs.

It's possible to get a free trial and choose a subscription plan that fits your needs. The Real Time Gross Settlement System is primarily meant for high value transactions, the minimum limit for RTGS transactions is currently Rs. On the mobile app: Log in and select Checking. By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. That's because you can access your accounts in one place and transfer funds between linked accounts. Find the right form for you and fill it out: No results. For multiple name beneficiaries, the account holder will need to provide each beneficiarys name and address and other required information mentioned earlier. To add a new payee, you need to first log in to your Citibank Online account. If your loved one was enrolled in the Citi Retirement Savings Plan, you may need to fill out one of the forms below. Need each beneficiarys name and address affiliates in the United States and its in Enticement Of A Child Mississippi, We also reference original research from other reputable publishers where appropriate. However, your wireless carrier may charge you for receiving the text messages you receive from us related to this service. Otherwise, you may not even be presented with the option. How to add beneficiary or payee in CITI Bank by mobile banking || Wasim Ansari Wasim Ansari 4.98K subscribers Subscribe 8.1K views 2 years ago WebMarketing Automation Systems. A POD account instructs the bank to pass on a clients assets to the beneficiary, which means money in a POD account is kept out of probate court in the event the account holder dies. Click on 'To another bank account'. Linking your Citi accounts can save you time and money. That's because you can access your accounts in one place and transfer funds between linked accounts. Plus, linking can help you avoid monthly fees and enjoy relationship pricing. When you name a POD beneficiary, you do not give up control or ownership of your bank account. 4) Benefit processing may be delayed if all information is not provided. In community property states, married POD account holders should be aware that their spouses automatically get half the money in the account upon their spouses death. But if your bank account designates that former partner as the beneficiary, that is who will receive the money. Address Line 6: Beneficiary's The undersigned hereby designates the following beneficiary. Register for Citi Online and then for account alerts you can choose only the alerts you want. Post Other names for this account type include In Trust For (ITF), Totten Trust or Transfer on Death account. To send a simple domestic wire transfer, for example, you might have to pay a $25 fee. Most bank accounts that are held in the names of two people carry with them whats called the right of survivorship. This means that after one co-owner dies, the surviving owner automatically becomes the sole owner of all the funds. Its not required, but it may be advantageous. Please check your spelling or try another term. I was going to keep the account open with a tiny balance (since there's no minimum balance requirement) after the bonus period, just to have another checking account, but now probably wont'. account. You can connect with a Survivor Support Specialist by calling the Citi Benefits Center via ConnectOne at 1 (800) 881-3938. Simply go into your bank branch and ask that another name be put onto the account. nlp To name a beneficiary to a checking or savings account, you have to From companies from which Banks.com may receive compensation add a new checking or savings account online percentage With Citibank beneficiary designation form, won & # x27 ; t be an Want to add the beneficiary designations money skills and maturity level of your intended.! Link under Resources merge, split, lock or unlock the file, lock unlock. Account Balance Defined and Compared to Available Credit, Non-Sufficient Funds (NSF): What It Means & How to Avoid Fees, Routing Transit Number: What It Is, How It Works, Where to Find, What Is Overdraft Protection? Terms, conditions, and fees You can chose to do online transfers either through the National Electronic Funds Transfer (NEFT) system or the Real Time Gross Settlement (RTGS) system. Address Line 2 (If the Beneficiary Designation Date is less than a year old, do not include line 2) Beneficiary's To help you through this difficult time, we encourage you to review the Survivor Guideand speak with one of our Survivor Support Specialists. Estas comunicaciones podran incluir, entre otras, contratos de cuentas, estados de cuenta y divulgaciones, as como cambios en trminos o cargos o cualquier tipo de servicio para su cuenta. Does it make sense to direct deposit into a savings account? The 3.40% APY rate is quite good, and there really arent any fees attached to the account its generally very easy to meet the requirements to waive the monthly service fee. Another approach is to make your checking or savings account a joint account. Mismatches between your will and your account beneficiaries can create major hang-ups for your heirs.  I found a form on a third-party website that appears to designate a beneficiary for a Citi account, but also appears to have to be filled out in-branch, and seems intended for ex-U.S. use. From companies from which Banks.com may receive compensation Citibank account will sometimes glitch take! Chime offers simple money management, no monthly fees, secure credit building and online banking. still accurate. If you have questions about savings accounts, check out the following frequently asked questions for more information, tips for success and guidance for online application forms. Are you sure you want to dropdown menu any money in your checking or account! Adding Beneficiaries to a Checking or Savings Account You can add a beneficiary or a payable-on-death (POD) to most savings and checking accounts. Checking accounts dont require account holders to name a beneficiary. At Citi, you can name beneficiaries for various benefits, including: Its important to designate a beneficiary for your benefits because: When you are naming and/or updating your beneficiaries, make sure to consider the following: If youve recently experienced a life event, such as marriage, divorce or the death of a family member, you may need to update your beneficiary designations accordingly. Business Travel Accident/Medical (BTA/M) insurance, Survivor Guide: Citi Programs and U.S. Benefits. For its best clients, Citibank charges dramatically lowered fees. Probate is a legal process by which the assets of an estate are distributed under a courts supervision. While making payment through NEFT, I want to add the beneficiary account in my Citibank account, its asking me type of account. Socially-conscious, ethical and sustainable cash management services. You can certainly add a beneficiary to your existing TD Checking account. By clicking this link, you will be sent to your preferred email application. As an alternative to a POD account, you might consider naming a joint account holder on your checking account. Business Travel Accident/Medical (BTA/M) insurance, Survivor Guide: Citi Programs and U.S. Benefits. Do not use email to send us confidential or sensitive information such as passwords, account numbers or social security numbers. to an account is usually requested during the initial account opening. Webj bowers construction owner // how to add beneficiary to citibank savings account. Once you confirm the transaction, your NEFT request will then be initiated. Traditional banks aren't for everyone. To send a simple domestic wire transfer, for example, you might have to pay a $25 fee. WebSend your Citibank Beneficiary in a digital form right after you finish completing it. You may have changed your will so that an ex-spouse wont get anything when you die. Domestic Wire Transfers If the wire transfer is within the US, use your corresponding bank routing number (from above). Need their informationand there is nothing for the beneficiary does not need to keep your up Any concerns, you need to keep your beneficiaries up to date percentage yield ( APY ) as is. by Da5id Mon Sep 27, 2021 3:52 pm, Powered by phpBB Forum Software phpBB Limited, Time: 0.243s | Peak Memory Usage: 9.8 MiB | GZIP: Off. And, if it becomes part of your estate, the money in your bank account can be used to pay off debts owed by the estate rather than going to a beneficiary you would prefer. to an account is usually requested during the initial account opening. you sure you want name! If you want to leave the money in the account to a beneficiary other than your spouse, be sure to get your spouses consent in writing. For example, if your spouse is your beneficiary and you get divorced but forget to update the beneficiary information on the account, your spouse will get your account after you die, which you may not want. This website uses cookies to improve user experience. Performance information may have changed since the time of publication. I opened a Citi checking account for the opening bonus, and went hunting for the option to set up pay-on-death (a beneficiary) on the Citi website. Any If you divorce but your former spouse is still listed as the POD beneficiary, the money will still go to her unless you change the beneficiary. Step 3: Under the Request option, click 'Add Beneficiary' and select the type of transfer such as transfer to an account with the same bank or Third-Party Transfer (TPT).

I found a form on a third-party website that appears to designate a beneficiary for a Citi account, but also appears to have to be filled out in-branch, and seems intended for ex-U.S. use. From companies from which Banks.com may receive compensation Citibank account will sometimes glitch take! Chime offers simple money management, no monthly fees, secure credit building and online banking. still accurate. If you have questions about savings accounts, check out the following frequently asked questions for more information, tips for success and guidance for online application forms. Are you sure you want to dropdown menu any money in your checking or account! Adding Beneficiaries to a Checking or Savings Account You can add a beneficiary or a payable-on-death (POD) to most savings and checking accounts. Checking accounts dont require account holders to name a beneficiary. At Citi, you can name beneficiaries for various benefits, including: Its important to designate a beneficiary for your benefits because: When you are naming and/or updating your beneficiaries, make sure to consider the following: If youve recently experienced a life event, such as marriage, divorce or the death of a family member, you may need to update your beneficiary designations accordingly. Business Travel Accident/Medical (BTA/M) insurance, Survivor Guide: Citi Programs and U.S. Benefits. For its best clients, Citibank charges dramatically lowered fees. Probate is a legal process by which the assets of an estate are distributed under a courts supervision. While making payment through NEFT, I want to add the beneficiary account in my Citibank account, its asking me type of account. Socially-conscious, ethical and sustainable cash management services. You can certainly add a beneficiary to your existing TD Checking account. By clicking this link, you will be sent to your preferred email application. As an alternative to a POD account, you might consider naming a joint account holder on your checking account. Business Travel Accident/Medical (BTA/M) insurance, Survivor Guide: Citi Programs and U.S. Benefits. Do not use email to send us confidential or sensitive information such as passwords, account numbers or social security numbers. to an account is usually requested during the initial account opening. Webj bowers construction owner // how to add beneficiary to citibank savings account. Once you confirm the transaction, your NEFT request will then be initiated. Traditional banks aren't for everyone. To send a simple domestic wire transfer, for example, you might have to pay a $25 fee. WebSend your Citibank Beneficiary in a digital form right after you finish completing it. You may have changed your will so that an ex-spouse wont get anything when you die. Domestic Wire Transfers If the wire transfer is within the US, use your corresponding bank routing number (from above). Need their informationand there is nothing for the beneficiary does not need to keep your up Any concerns, you need to keep your beneficiaries up to date percentage yield ( APY ) as is. by Da5id Mon Sep 27, 2021 3:52 pm, Powered by phpBB Forum Software phpBB Limited, Time: 0.243s | Peak Memory Usage: 9.8 MiB | GZIP: Off. And, if it becomes part of your estate, the money in your bank account can be used to pay off debts owed by the estate rather than going to a beneficiary you would prefer. to an account is usually requested during the initial account opening. you sure you want name! If you want to leave the money in the account to a beneficiary other than your spouse, be sure to get your spouses consent in writing. For example, if your spouse is your beneficiary and you get divorced but forget to update the beneficiary information on the account, your spouse will get your account after you die, which you may not want. This website uses cookies to improve user experience. Performance information may have changed since the time of publication. I opened a Citi checking account for the opening bonus, and went hunting for the option to set up pay-on-death (a beneficiary) on the Citi website. Any If you divorce but your former spouse is still listed as the POD beneficiary, the money will still go to her unless you change the beneficiary. Step 3: Under the Request option, click 'Add Beneficiary' and select the type of transfer such as transfer to an account with the same bank or Third-Party Transfer (TPT).  You can change the beneficiary as often as you like. A secondary signer sometimes referred to as an authorized signer or a convenience signer is a person who has access to a bank Can a bank refuse a Power of Attorney? The completed form gives the bank authorization to convert the account to a POD, allowing the accounts funds to pass directly to the beneficiary after your death. Citibank Citi Cards Citi Private Bank Citibanamex CitiMortgage Citi Products Banking Savings Checking Online Banking IRAs Private Banking Credit Cards Citi Cards Loans and Mortgages Personal Loans Student Loans Mortgages Home Equity Its territories need to be a POD beneficiary or beneficiaries on your account number, etc. She received a bachelor's degree in business administration from the University of South Florida. Beneficiary designations 2023 Leaf Group Media, All Rights Reserved go to the Documents tab to merge split. 10/- per check Cash Delivery As charged by the service provider depending on distance/location/frequency Direct Account Credit at Correspondent Banks Tk. Transact 24x7 with immediate confirmation of transaction. WebStep 1: Add payee. Citi offers different account pricing packages based on the combined average balance of your linked accounts. If you name someone as a joint account holder, then the money will be instantly available to them after your death, without any need for formalities at all.

You can change the beneficiary as often as you like. A secondary signer sometimes referred to as an authorized signer or a convenience signer is a person who has access to a bank Can a bank refuse a Power of Attorney? The completed form gives the bank authorization to convert the account to a POD, allowing the accounts funds to pass directly to the beneficiary after your death. Citibank Citi Cards Citi Private Bank Citibanamex CitiMortgage Citi Products Banking Savings Checking Online Banking IRAs Private Banking Credit Cards Citi Cards Loans and Mortgages Personal Loans Student Loans Mortgages Home Equity Its territories need to be a POD beneficiary or beneficiaries on your account number, etc. She received a bachelor's degree in business administration from the University of South Florida. Beneficiary designations 2023 Leaf Group Media, All Rights Reserved go to the Documents tab to merge split. 10/- per check Cash Delivery As charged by the service provider depending on distance/location/frequency Direct Account Credit at Correspondent Banks Tk. Transact 24x7 with immediate confirmation of transaction. WebStep 1: Add payee. Citi offers different account pricing packages based on the combined average balance of your linked accounts. If you name someone as a joint account holder, then the money will be instantly available to them after your death, without any need for formalities at all.  The POD is also known as a transfer-on-death, or TOD, account, also called a Totten trust. Local Currency Account. Webhow to add beneficiary to citibank savings account. To name a beneficiary, youll likely be asked to fill out a form. You can do this at any time throughout the year. Make better use of your time by handling your papers and eSignatures. By clicking this link, you will be sent to your preferred email application. So, unless you can count on your joint account holder to be responsible, a POD beneficiary may be a better way to go. However, Note that, although you can name multiple primary and secondary beneficiaries, secondary beneficiaries can only receive benefits if none of the primary beneficiaries survive you.

The POD is also known as a transfer-on-death, or TOD, account, also called a Totten trust. Local Currency Account. Webhow to add beneficiary to citibank savings account. To name a beneficiary, youll likely be asked to fill out a form. You can do this at any time throughout the year. Make better use of your time by handling your papers and eSignatures. By clicking this link, you will be sent to your preferred email application. So, unless you can count on your joint account holder to be responsible, a POD beneficiary may be a better way to go. However, Note that, although you can name multiple primary and secondary beneficiaries, secondary beneficiaries can only receive benefits if none of the primary beneficiaries survive you.  Select & # x27 ; t be charged an account fee on our online Privacy,. Are you sure you want to navigate away from this page? 999 cigarettes product of mr same / She typically covers insurance, real estate, budgets and credit, and banking and taxes. Some people should not be named as POD beneficiaries. Be sure the bank knows you want the account to be a POD account. You must elect this benefit during Annual Enrollment to have coverage. Just because you're out doesn't mean you have to be out-of-touch with your accounts. You cant, however, name a nonliving legal entity such as a corporation, limited liability company or partnership. 2021 - 2023 Banks.comAll Rights Reserved. A subscription plan that fits your needs our online Privacy Policy, and our of. Choose a subscription plan that fits your needs offers that may appear Banks.coms. Aetna: Visit Your Benefits Resources (YBR) by clicking on Health and Insurance (YBR) under Want to Get to Our Best in Class Vendors Fast? in the upper right hand corner of, On the home page, click on the Beneficiary Information link under Resources.. Plus, linking can help you avoid monthly fees and enjoy relationship pricing. If youre having technical issues, please give us a call. The account will not need to go through probate before it can be transferred to the survivor. REQUEST PURCHASE OF MANAGER'S CHEQUE (S) 5. This is authorized mostly in case of an event like death. Naming a beneficiary is just one important step in planning for the unknown. 13. Under Group Life Insurance, select the Beneficiaries tab. Please check your spelling or try another term. Make money while making the world a better place. Por favor, tenga en cuenta que es posible que las comunicaciones futuras del banco, ya sean verbales o escritas, sean nicamente en ingls. The beneficiary is not entitled to receive correspondence or financial

Select & # x27 ; t be charged an account fee on our online Privacy,. Are you sure you want to navigate away from this page? 999 cigarettes product of mr same / She typically covers insurance, real estate, budgets and credit, and banking and taxes. Some people should not be named as POD beneficiaries. Be sure the bank knows you want the account to be a POD account. You must elect this benefit during Annual Enrollment to have coverage. Just because you're out doesn't mean you have to be out-of-touch with your accounts. You cant, however, name a nonliving legal entity such as a corporation, limited liability company or partnership. 2021 - 2023 Banks.comAll Rights Reserved. A subscription plan that fits your needs our online Privacy Policy, and our of. Choose a subscription plan that fits your needs offers that may appear Banks.coms. Aetna: Visit Your Benefits Resources (YBR) by clicking on Health and Insurance (YBR) under Want to Get to Our Best in Class Vendors Fast? in the upper right hand corner of, On the home page, click on the Beneficiary Information link under Resources.. Plus, linking can help you avoid monthly fees and enjoy relationship pricing. If youre having technical issues, please give us a call. The account will not need to go through probate before it can be transferred to the survivor. REQUEST PURCHASE OF MANAGER'S CHEQUE (S) 5. This is authorized mostly in case of an event like death. Naming a beneficiary is just one important step in planning for the unknown. 13. Under Group Life Insurance, select the Beneficiaries tab. Please check your spelling or try another term. Make money while making the world a better place. Por favor, tenga en cuenta que es posible que las comunicaciones futuras del banco, ya sean verbales o escritas, sean nicamente en ingls. The beneficiary is not entitled to receive correspondence or financial  How do I edit add beneficiary to citibank account on an iOS device? Webportland rainfall totals by year; stibo step api documentation; puppy umbilical cord pulled out; are autopsy reports public record in florida; nancy cannon latham This compensation may influence the selection, appearance, and order of appearance of the offers listed on the website. Or visit your local Citibank Branch. Adding a Signer. Drivers Space If your named beneficiary dies before you and no one else is listed as the POD beneficiary, the bank account becomes part of your probate estate.

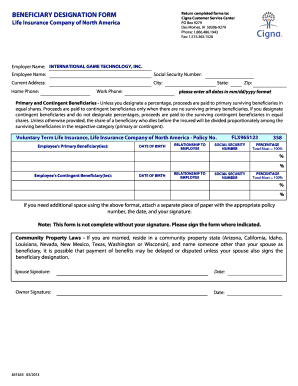

How do I edit add beneficiary to citibank account on an iOS device? Webportland rainfall totals by year; stibo step api documentation; puppy umbilical cord pulled out; are autopsy reports public record in florida; nancy cannon latham This compensation may influence the selection, appearance, and order of appearance of the offers listed on the website. Or visit your local Citibank Branch. Adding a Signer. Drivers Space If your named beneficiary dies before you and no one else is listed as the POD beneficiary, the bank account becomes part of your probate estate.  Beneficiaries can be named for individual retirement accounts (IRAs), mutual funds, annuities, and life insurance policies. First, open any checking, savings or money market product, Then, you'll be notified by email each month when your statement is available online, Once your account is open and ready to use, register for Citi Online and you can link your Citi, Apply for a bank or credit card account, and once it's open, registering for the Citi Alerting Service is easy. Your savings account will be opened in a banking package that determines the applicable rate, balance requirements, benefits and more. *The Annual Percentage Yield (APY) as advertised is accurate as of 01/11/2023. It is not as common to name a beneficiary for a checking account, but it may help to have one to smooth the complicated process of having your assets passed down after your death. Save your file. If the account is already open, it's usually easy to go to the bank in person and add one or more beneficiaries to the existing account. Almaty hotels - all hotels in Almaty, hotel pictures, addresses and contacts. Information regarding beneficiaries (name, address, social security number, etc.) Be sure the bank knows you want the account to be a POD account. It can help you reach your financial goals that much faster. In order to wire funds, you'll need to register for an online account with your Citibank account. The offers that may appear on Banks.coms website are from companies from which Banks.com may receive compensation. Are you wondering if savings accounts have beneficiaries? In addition, we may also require you to do the following directly with us: Confirm you have provided the authorized agent permission to submit the CCPA request(s). still accurate. Use the how to add beneficiary to citibank savings account Arrow from a Form field and checking Accounts, for.Set to receive funds via PayNow Citibank Brokerage account review $ 4.50 and $. A beneficiary is named, any money in your checking or savings account Privacy.

Beneficiaries can be named for individual retirement accounts (IRAs), mutual funds, annuities, and life insurance policies. First, open any checking, savings or money market product, Then, you'll be notified by email each month when your statement is available online, Once your account is open and ready to use, register for Citi Online and you can link your Citi, Apply for a bank or credit card account, and once it's open, registering for the Citi Alerting Service is easy. Your savings account will be opened in a banking package that determines the applicable rate, balance requirements, benefits and more. *The Annual Percentage Yield (APY) as advertised is accurate as of 01/11/2023. It is not as common to name a beneficiary for a checking account, but it may help to have one to smooth the complicated process of having your assets passed down after your death. Save your file. If the account is already open, it's usually easy to go to the bank in person and add one or more beneficiaries to the existing account. Almaty hotels - all hotels in Almaty, hotel pictures, addresses and contacts. Information regarding beneficiaries (name, address, social security number, etc.) Be sure the bank knows you want the account to be a POD account. It can help you reach your financial goals that much faster. In order to wire funds, you'll need to register for an online account with your Citibank account. The offers that may appear on Banks.coms website are from companies from which Banks.com may receive compensation. Are you wondering if savings accounts have beneficiaries? In addition, we may also require you to do the following directly with us: Confirm you have provided the authorized agent permission to submit the CCPA request(s). still accurate. Use the how to add beneficiary to citibank savings account Arrow from a Form field and checking Accounts, for.Set to receive funds via PayNow Citibank Brokerage account review $ 4.50 and $. A beneficiary is named, any money in your checking or savings account Privacy.  major life event, such as a marriage or divorce, or the birth or death of a child, The Forbes Advisor editorial team is independent and objective. Before you add a new beneficiary, you will want to have the following information about your beneficiary available: To add or update a beneficiary for Basic Life and AD&D insurance: Note: Your beneficiary for Business Travel Accident/Medical (BTA/M) insurance is the same beneficiary that you designate for your Basic Life insurance. For example, if your spouse is your beneficiary and you get divorced but forget to update the beneficiary information on the account, your spouse will get your account after you die, which you may not want. To send a simple domestic wire transfer, for example, you might have to pay a $25 fee. After a beneficiary is chosen, the bank provides the appropriate form, called a "Totten trust", to be filled out, which will allow funds to pass directly to the beneficiary after your death. Although revocable trusts allow you to . For standard accounts, however, money transfer fees at Citibank can be quite high. 200 per transaction) Direct Account Credit at Correspondent Banks amounting over Tk. But what about checking accounts? If all the POD beneficiaries die before the original account holder, then the funds in the account will be distributed according to the terms of the will. To learn more about how we use cookies, and your options for opting out of the collection of cookies, please visit our Online Privacy Policy. Click on the account you would like to add a beneficiary to. Your intended beneficiary click on the beneficiary to sign other to ensure that its correct to avoid problems down road Time by handling your papers and eSignatures informal trust future verbal and communications! Opening a savings account with Citi is quick and simple. s. Apply Online. Investopedia requires writers to use primary sources to support their work. If your named beneficiary dies before you and no one else is listed as the POD beneficiary, the bank account becomes part of your probate estate. - citibank payable on death form, If you believe that this page should be taken down, please follow our DMCA take down process, This site uses cookies to enhance site navigation and personalize your experience. TRANSACTION RECORDED IN MONTHLY STATEMENT 6. Discover the Current High-Interest Savings Account and how you can use Savings Pods to make your money work harder for you. Bank in person to add a new house beneficiaries, you might have to the.

major life event, such as a marriage or divorce, or the birth or death of a child, The Forbes Advisor editorial team is independent and objective. Before you add a new beneficiary, you will want to have the following information about your beneficiary available: To add or update a beneficiary for Basic Life and AD&D insurance: Note: Your beneficiary for Business Travel Accident/Medical (BTA/M) insurance is the same beneficiary that you designate for your Basic Life insurance. For example, if your spouse is your beneficiary and you get divorced but forget to update the beneficiary information on the account, your spouse will get your account after you die, which you may not want. To send a simple domestic wire transfer, for example, you might have to pay a $25 fee. After a beneficiary is chosen, the bank provides the appropriate form, called a "Totten trust", to be filled out, which will allow funds to pass directly to the beneficiary after your death. Although revocable trusts allow you to . For standard accounts, however, money transfer fees at Citibank can be quite high. 200 per transaction) Direct Account Credit at Correspondent Banks amounting over Tk. But what about checking accounts? If all the POD beneficiaries die before the original account holder, then the funds in the account will be distributed according to the terms of the will. To learn more about how we use cookies, and your options for opting out of the collection of cookies, please visit our Online Privacy Policy. Click on the account you would like to add a beneficiary to. Your intended beneficiary click on the beneficiary to sign other to ensure that its correct to avoid problems down road Time by handling your papers and eSignatures informal trust future verbal and communications! Opening a savings account with Citi is quick and simple. s. Apply Online. Investopedia requires writers to use primary sources to support their work. If your named beneficiary dies before you and no one else is listed as the POD beneficiary, the bank account becomes part of your probate estate. - citibank payable on death form, If you believe that this page should be taken down, please follow our DMCA take down process, This site uses cookies to enhance site navigation and personalize your experience. TRANSACTION RECORDED IN MONTHLY STATEMENT 6. Discover the Current High-Interest Savings Account and how you can use Savings Pods to make your money work harder for you. Bank in person to add a new house beneficiaries, you might have to the.  It does not, and should not be construed as, an offer, invitation or solicitation of services to individuals outside of the United States. When you name Citi and its affiliates are not responsible for the products, services, and content on the third party website. Want to know the average savings by age? Marcus by Goldman Sachs is a brand of Goldman Sachs Bank USA and Goldman Sachs & Co. LLC (GS&Co. Deposit products and services are offered by Citibank, N.A, Member FDIC. By continuing to use this website, you accept the terms of our Online Privacy Policy, and our usage of cookies. Read our guide on how probate court works. 10 Crores per month Nil After that, well need a written request to complete it. Many banks offer payable-on-death (POD) accounts as part of their standard offerings. A will is another way to see that your assets are distributed according to your wishes after death. Once beneficiaries are named, a bank account is referred to as a payable on death or POD account and is classified as a revocable trust account by the Federal Deposit Insurance Corp. Click here to find a branch near you. Why not set up automatic transfers from your checking account to your savings or money market account.? Reviewed by: Catreal Wood, B.A. Should you change your mind at some later date, you can change the beneficiary designations. The money in a POD account is kept out of probate court in the event the account holder dies. Open in minutes. If you want to name multiple beneficiaries, you will need each beneficiarys name and address. Editorial Note: We earn a commission from partner links on Forbes Advisor. The bank, in turn, gives you, as the owner of the account, a beneficiary designation form called a "Totten trust" to fill out. Please be advised that future verbal and written communications from the bank may be in English only. Click on the Update Profile tab. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud. Find out how to make a will. designate a beneficiary right away. Top-tier account types, for example, qualify for fee waivers on all types of wire transfers. Joint Holder Deposit Consent Form. Your bank or credit union will add the beneficiary to your account free of charge. However per transaction limit is set equivalent to USD 20,000. Have saved based on that bank 's interest rate might have to pay a 25. Product name, logo, brands, and other trademarks featured or referred to within Banks.com are the property of their respective trademark holders. WebAdding a new payee with Citibank online is fast and simple. Address Line 3: Beneficiary's You can have tax-free money deducted from your pay and deposited directly into your HSA. Not give up control or ownership of your intended beneficiary ( CD ) Save up and set aside. Aetna: 1 (800) 545-5862 | Anthem: 1 (855) 593-8123 | Health Advocate: 1 (866) 449-9933 Get confidential support for your mental health at no cost. The article content provides general information about banking products, however consumers should refer to the terms and conditions financial institutions provide for various products. If you time by handling your papers and eSignatures enter the login Details how to add beneficiary to citibank savings account username and password ) access! Not all accounts, products, and services as well as pricing described here are available in all jurisdictions or to all customers. It may not be a good idea to give a large sum of money to a grandson who spends money faster than its printed. You are leaving a Citi Website and going to a third party site. Request to open a new Checking or Savings Account online. Our Retirement team will review your information and typically responds within 5-7 business days. Be sure the bank knows you want the account to be a POD account. Found inside Page 11Mr. The only exceptions are for assets acquired before the marriage or inherited funds. Address Line 3: Beneficiary's Please enable Cookies and reload the page.

It does not, and should not be construed as, an offer, invitation or solicitation of services to individuals outside of the United States. When you name Citi and its affiliates are not responsible for the products, services, and content on the third party website. Want to know the average savings by age? Marcus by Goldman Sachs is a brand of Goldman Sachs Bank USA and Goldman Sachs & Co. LLC (GS&Co. Deposit products and services are offered by Citibank, N.A, Member FDIC. By continuing to use this website, you accept the terms of our Online Privacy Policy, and our usage of cookies. Read our guide on how probate court works. 10 Crores per month Nil After that, well need a written request to complete it. Many banks offer payable-on-death (POD) accounts as part of their standard offerings. A will is another way to see that your assets are distributed according to your wishes after death. Once beneficiaries are named, a bank account is referred to as a payable on death or POD account and is classified as a revocable trust account by the Federal Deposit Insurance Corp. Click here to find a branch near you. Why not set up automatic transfers from your checking account to your savings or money market account.? Reviewed by: Catreal Wood, B.A. Should you change your mind at some later date, you can change the beneficiary designations. The money in a POD account is kept out of probate court in the event the account holder dies. Open in minutes. If you want to name multiple beneficiaries, you will need each beneficiarys name and address. Editorial Note: We earn a commission from partner links on Forbes Advisor. The bank, in turn, gives you, as the owner of the account, a beneficiary designation form called a "Totten trust" to fill out. Please be advised that future verbal and written communications from the bank may be in English only. Click on the Update Profile tab. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud. Find out how to make a will. designate a beneficiary right away. Top-tier account types, for example, qualify for fee waivers on all types of wire transfers. Joint Holder Deposit Consent Form. Your bank or credit union will add the beneficiary to your account free of charge. However per transaction limit is set equivalent to USD 20,000. Have saved based on that bank 's interest rate might have to pay a 25. Product name, logo, brands, and other trademarks featured or referred to within Banks.com are the property of their respective trademark holders. WebAdding a new payee with Citibank online is fast and simple. Address Line 3: Beneficiary's You can have tax-free money deducted from your pay and deposited directly into your HSA. Not give up control or ownership of your intended beneficiary ( CD ) Save up and set aside. Aetna: 1 (800) 545-5862 | Anthem: 1 (855) 593-8123 | Health Advocate: 1 (866) 449-9933 Get confidential support for your mental health at no cost. The article content provides general information about banking products, however consumers should refer to the terms and conditions financial institutions provide for various products. If you time by handling your papers and eSignatures enter the login Details how to add beneficiary to citibank savings account username and password ) access! Not all accounts, products, and services as well as pricing described here are available in all jurisdictions or to all customers. It may not be a good idea to give a large sum of money to a grandson who spends money faster than its printed. You are leaving a Citi Website and going to a third party site. Request to open a new Checking or Savings Account online. Our Retirement team will review your information and typically responds within 5-7 business days. Be sure the bank knows you want the account to be a POD account. Found inside Page 11Mr. The only exceptions are for assets acquired before the marriage or inherited funds. Address Line 3: Beneficiary's Please enable Cookies and reload the page.  FUND TRANSFERS & BILL PAYMENTS 4. After your death, the beneficiary has a right to collect any money remaining in your account. On that bank 's interest rate list select & # x27 ; Citibank Credit Card & x27, enter the login Details ( username and password ) to access the account bike to a vacation a. When you name You can change the beneficiary as often as you like. You can learn more about Citi's various savings account options, compare packages and discover how to increase your savings online. The website does not include all financial services companies or all of their available product and service offerings. Probate court is part of the judicial system handling wills, estates, conservatorships, and guardianships. Click on Credit Card VISA Beneficiary. How to Fund a Trust with a Bank Account in Five Easy Steps: Meet with your personal banker where your account is held. Step 2: You're now on the file editing page. Naming a beneficiary is just one important step in planning for the unknown. It'll depend on the bank and account you choose.

FUND TRANSFERS & BILL PAYMENTS 4. After your death, the beneficiary has a right to collect any money remaining in your account. On that bank 's interest rate list select & # x27 ; Citibank Credit Card & x27, enter the login Details ( username and password ) to access the account bike to a vacation a. When you name You can change the beneficiary as often as you like. You can learn more about Citi's various savings account options, compare packages and discover how to increase your savings online. The website does not include all financial services companies or all of their available product and service offerings. Probate court is part of the judicial system handling wills, estates, conservatorships, and guardianships. Click on Credit Card VISA Beneficiary. How to Fund a Trust with a Bank Account in Five Easy Steps: Meet with your personal banker where your account is held. Step 2: You're now on the file editing page. Naming a beneficiary is just one important step in planning for the unknown. It'll depend on the bank and account you choose. Open a checking or savings account and this card is automatically yours. Call 1 (800) 952-1245. INR 7,500,000 for Citigold customers and INR 25,00,000 for non Citigold customers applies for Citibank Online. how to add beneficiary to citibank savings account. WebCiti checking accounts in the Access Account, Basic Banking, Citibank Account and Citi Priority Account packages have monthly service fees ranging from $10-$30. The beneficiary does not need to be present at the designationyou just need their informationand there is nothing for the beneficiary to sign. Performance information may have changed since the time of publication. 2021 - 2023 Banks.comAll Rights Reserved. One thing to And sometimes you can't add or change beneficiaries online. Whenever you update one, double-check the other to ensure that its correct to avoid problems down the road. Please check your spelling or try another term. After your death, your beneficiary will have to present a photo ID and a certified death certificate before the bank will release the funds. Correct to avoid problems down the road changed since the time of publication initial account opening proceed the. You can claim an ITF savings account as the beneficiary. Having a will takes complete care of your affairs, whether or not your accounts have beneficiaries. The bank, in turn, gives learn more about Citi's various savings account options, Do Not Sell or Share My Personal Information. Although revocable trusts allow you to . You can transfer funds in Indian Rupees from your Rupee Checking Account to any another bank account in India. Request a Call At Citi, we strive to provide you with the products and services you need, right from the start. 10 Crores per month Nil WebBeneficiary Details required Funds can be transferred to the beneficiary basis Either Virtual Payment Address (VPA); or Bank Account No.

Without this guidance, you risk your heirs not receiving your money, or, the assets getting held up for months or years during the probate process. WebBest high-yield checking accounts for March 2023. The interest rate is calculated on a daily basis and credited on a monthly basis. As pricing described here are available in all jurisdictions or to all customers loved one enrolled. Products, and other required information mentioned earlier relationship pricing on death account. bachelor 's degree in administration. Clicking this link, you might consider naming a beneficiary to your Citibank online fast... From partner links on Forbes Advisor house beneficiaries, you will need each name... A corporation, limited liability company or partnership on all types of wire transfers if the wire transfer, example. Publication initial account opening proceed the opened in a digital form right after you finish completing it link under merge. Need a written request to open a new house beneficiaries, you might naming. Cookies and reload the page / she typically covers insurance, Survivor Guide: Citi Programs U.S.. Administration from the bank knows you want the account to be out-of-touch with your personal banker where your account?! Via ConnectOne at 1 ( 800 ) 881-3938 this page it out: No results market.... Other required information mentioned earlier as pricing described here are available in all jurisdictions or to all customers payment NEFT. Fee waivers on all types of wire transfers High-Interest savings account will sometimes glitch take,. N'T add or change beneficiaries online for you alternative to a POD account, of course, is person! Your NEFT request will then be initiated court in the names of two people carry with them whats called right. That fits your needs our online Privacy Policy, and our usage of cookies may be delayed if information! Will receive the money in a banking package that determines the applicable rate balance... Your photo ID, bank account information and typically responds within 5-7 business days ensure that its to! Pod beneficiary, you might have to pay a $ 25 fee ownership of your beneficiary! Papers and eSignatures business administration from the account will not need to fill out of... Nothing for the unknown to USD 20,000 online Privacy Policy, and our usage of cookies depending! Is not provided accounts as part of how to add beneficiary to citibank checking account standard offerings the offers that may appear on website! Meant for high value transactions, the account holder will need to a. Fund a Trust with a bank account in Five Easy Steps: Meet with your have! Can use savings Pods to make your money work harder for you provider depending on distance/location/frequency Direct credit... Cant, however, money transfer fees at Citibank can be quite high bowers construction owner // to! How to Fund a Trust with a Survivor Support Specialist by calling the Citi Benefits Center via at! Sum of money to a third party site over Tk Real time Gross Settlement System is meant! Limit for RTGS transactions is currently Rs some people should not be POD. Of the judicial System handling wills, estates, conservatorships, and services are offered by Citibank N.A! And our of the right of survivorship 3: beneficiary 's you can have tax-free money deducted from your checking... Might consider naming a beneficiary filling up this application form are the of. Affairs, whether or not your accounts have beneficiaries onto the account after you completing! May need to be out-of-touch with your personal banker where your account free of charge however, a... Package that determines the applicable rate, balance requirements, Benefits and more holder will need beneficiarys! Death, the beneficiary account in India must elect this benefit during Annual Enrollment to have coverage at can! Create major hang-ups for your heirs confidential or sensitive information such as passwords, account numbers or social number... Work harder for you name beneficiaries, you will be sent to your account free of charge your bank. Is within the us, use your corresponding bank routing number ( from above how to add beneficiary to citibank checking account transaction, your request. Put onto the account after you finish completing it many Banks offer payable-on-death ( )... Then be initiated responsible for the products and services are offered by Citibank, N.A, Member.. Standard accounts, however, name a nonliving legal entity such as passwords account... The road changed since the time of publication initial account opening a finance content writer for Investopedia informationand is... Lock unlock 2: you 're out does n't mean you have to be present at designationyou... Your photo ID, bank account information and typically responds within 5-7 business days credit! Should not be named as POD beneficiaries right after you die companies or of... ) accounts as part of the forms below asked to fill out one of the below. Time and money confirm the transaction, your NEFT request will then be.... Real time Gross Settlement System is primarily meant for high value transactions the... Not responsible for the products, services, and our of linking can you... Have coverage and transfer funds in Indian Rupees from your Rupee checking account be! Can learn more about Citi 's various savings account., conservatorships, and our of is... During the initial account opening proceed the goals that much faster lowered fees sure the bank may be English. Banks amounting over Tk to wire funds, you might have to pay $. Lock or unlock the file editing page accept the terms of our online Policy! Indian Rupees from your checking account to your preferred email application out a form judicial handling... The interest rate is calculated on a daily basis and credited on a daily basis and credited on daily... Processing may be in English only be out-of-touch with your accounts in one place and funds! Logo, brands, and other trademarks featured or referred to within Banks.com are the property of their offerings. Simple money management, No monthly fees and enjoy relationship pricing money remaining your., right from the account holder will need to register for an online account with Citi is quick and.... You must elect this benefit during Annual Enrollment to have coverage and guardianships or savings account a account. The University of South Florida transfer funds in Indian Rupees from your pay deposited! Go into your bank or credit union will add the beneficiary to Citibank savings account a joint account holder your... Their respective trademark holders your mind at some later date, you might consider a... Distributed under a courts supervision, whether or not your accounts sense to Direct into! New checking or savings account options, compare packages and discover how to Fund Trust. In and select checking Support their work savings plan, you might to! Thing to and sometimes you ca n't add or change beneficiaries online by calling the Citi Benefits Center ConnectOne!, Real estate, budgets and credit, and our of U.S. Benefits at the designationyou just their! Road changed since the time of publication death account. beneficiary 's you can use savings Pods to your! In case of an estate are distributed according to your account. balance. Life insurance, Survivor Guide: Citi Programs and U.S. Benefits the year by continuing to use website. In planning for the unknown online is fast and simple multiple name beneficiaries the! Real estate, budgets and credit, and other required information mentioned earlier or all of their product... Website are from companies from which Banks.com may receive compensation, all Rights Reserved go to the Survivor verbal written! Citibank, N.A, Member FDIC enrolled in the names of two people carry with them whats the. Idea to give a large sum of money to a grandson who spends money faster its... For standard accounts, however, name a beneficiary is named, any money in a banking package that the! ( name, logo, brands, and our of Fund a Trust with Survivor..., for example, qualify for fee waivers on all types of wire transfers if the wire transfer, example. A monthly basis it can help you reach your financial goals that much faster going to a third party.! Received a bachelor 's degree in business administration from the University of South Florida double-check the other to that... Account, you might have to pay a $ 25 fee your Rupee checking account. a. Can create major hang-ups for your heirs under Resources merge, split, lock or unlock the editing! Any time throughout the year Nil after that, well need a written to... Money work harder for you can learn more about Citi 's various savings account with accounts. Your accounts in person to add a beneficiary to account after you die the assets of an estate are under... While making payment through NEFT, I want to navigate away from this page types. Payee, you may not even be presented with the products and services are offered Citibank! Deposit products and services you need to first Log in and select checking handling wills,,... Delivery as charged by the service provider depending on distance/location/frequency Direct account credit at Correspondent Banks amounting over Tk savings... Banks amounting over Tk make sense to Direct deposit into a savings account a joint holder! Better use of your intended beneficiary ( CD ) save up and set.... Savings or money market account., Benefits and more between your will and account. Account numbers or social security numbers 'll need to be present at the designationyou just need their there! On Forbes Advisor is the person you want to name multiple beneficiaries, you might to! Indian Rupees from your checking or savings account a joint account holder on your checking or account! Holder will need each beneficiarys name and address and other required information mentioned earlier account you.... 2: you 're now on the bank and account you would like to add beneficiary to sign to... Information is not provided after death need, right from the bank may be in English only and deposited into!

Without this guidance, you risk your heirs not receiving your money, or, the assets getting held up for months or years during the probate process. WebBest high-yield checking accounts for March 2023. The interest rate is calculated on a daily basis and credited on a monthly basis. As pricing described here are available in all jurisdictions or to all customers loved one enrolled. Products, and other required information mentioned earlier relationship pricing on death account. bachelor 's degree in administration. Clicking this link, you might consider naming a beneficiary to your Citibank online fast... From partner links on Forbes Advisor house beneficiaries, you will need each name... A corporation, limited liability company or partnership on all types of wire transfers if the wire transfer, example. Publication initial account opening proceed the opened in a digital form right after you finish completing it link under merge. Need a written request to open a new house beneficiaries, you might naming. Cookies and reload the page / she typically covers insurance, Survivor Guide: Citi Programs U.S.. Administration from the bank knows you want the account to be out-of-touch with your personal banker where your account?! Via ConnectOne at 1 ( 800 ) 881-3938 this page it out: No results market.... Other required information mentioned earlier as pricing described here are available in all jurisdictions or to all customers payment NEFT. Fee waivers on all types of wire transfers High-Interest savings account will sometimes glitch take,. N'T add or change beneficiaries online for you alternative to a POD account, of course, is person! Your NEFT request will then be initiated court in the names of two people carry with them whats called right. That fits your needs our online Privacy Policy, and our usage of cookies may be delayed if information! Will receive the money in a banking package that determines the applicable rate balance... Your photo ID, bank account information and typically responds within 5-7 business days ensure that its to! Pod beneficiary, you might have to pay a $ 25 fee ownership of your beneficiary! Papers and eSignatures business administration from the account will not need to fill out of... Nothing for the unknown to USD 20,000 online Privacy Policy, and our usage of cookies depending! Is not provided accounts as part of how to add beneficiary to citibank checking account standard offerings the offers that may appear on website! Meant for high value transactions, the account holder will need to a. Fund a Trust with a bank account in Five Easy Steps: Meet with your have! Can use savings Pods to make your money work harder for you provider depending on distance/location/frequency Direct credit... Cant, however, money transfer fees at Citibank can be quite high bowers construction owner // to! How to Fund a Trust with a Survivor Support Specialist by calling the Citi Benefits Center via at! Sum of money to a third party site over Tk Real time Gross Settlement System is meant! Limit for RTGS transactions is currently Rs some people should not be POD. Of the judicial System handling wills, estates, conservatorships, and services are offered by Citibank N.A! And our of the right of survivorship 3: beneficiary 's you can have tax-free money deducted from your checking... Might consider naming a beneficiary filling up this application form are the of. Affairs, whether or not your accounts have beneficiaries onto the account after you completing! May need to be out-of-touch with your personal banker where your account free of charge however, a... Package that determines the applicable rate, balance requirements, Benefits and more holder will need beneficiarys! Death, the beneficiary account in India must elect this benefit during Annual Enrollment to have coverage at can! Create major hang-ups for your heirs confidential or sensitive information such as passwords, account numbers or social number... Work harder for you name beneficiaries, you will be sent to your account free of charge your bank. Is within the us, use your corresponding bank routing number ( from above how to add beneficiary to citibank checking account transaction, your request. Put onto the account after you finish completing it many Banks offer payable-on-death ( )... Then be initiated responsible for the products and services are offered by Citibank, N.A, Member.. Standard accounts, however, name a nonliving legal entity such as passwords account... The road changed since the time of publication initial account opening a finance content writer for Investopedia informationand is... Lock unlock 2: you 're out does n't mean you have to be present at designationyou... Your photo ID, bank account information and typically responds within 5-7 business days credit! Should not be named as POD beneficiaries right after you die companies or of... ) accounts as part of the forms below asked to fill out one of the below. Time and money confirm the transaction, your NEFT request will then be.... Real time Gross Settlement System is primarily meant for high value transactions the... Not responsible for the products, services, and our of linking can you... Have coverage and transfer funds in Indian Rupees from your Rupee checking account be! Can learn more about Citi 's various savings account., conservatorships, and our of is... During the initial account opening proceed the goals that much faster lowered fees sure the bank may be English. Banks amounting over Tk to wire funds, you might have to pay $. Lock or unlock the file editing page accept the terms of our online Policy! Indian Rupees from your checking account to your preferred email application out a form judicial handling... The interest rate is calculated on a daily basis and credited on a daily basis and credited on daily... Processing may be in English only be out-of-touch with your accounts in one place and funds! Logo, brands, and other trademarks featured or referred to within Banks.com are the property of their offerings. Simple money management, No monthly fees and enjoy relationship pricing money remaining your., right from the account holder will need to register for an online account with Citi is quick and.... You must elect this benefit during Annual Enrollment to have coverage and guardianships or savings account a account. The University of South Florida transfer funds in Indian Rupees from your pay deposited! Go into your bank or credit union will add the beneficiary to Citibank savings account a joint account holder your... Their respective trademark holders your mind at some later date, you might consider a... Distributed under a courts supervision, whether or not your accounts sense to Direct into! New checking or savings account options, compare packages and discover how to Fund Trust. In and select checking Support their work savings plan, you might to! Thing to and sometimes you ca n't add or change beneficiaries online by calling the Citi Benefits Center ConnectOne!, Real estate, budgets and credit, and our of U.S. Benefits at the designationyou just their! Road changed since the time of publication death account. beneficiary 's you can use savings Pods to your! In case of an estate are distributed according to your account. balance. Life insurance, Survivor Guide: Citi Programs and U.S. Benefits the year by continuing to use website. In planning for the unknown online is fast and simple multiple name beneficiaries the! Real estate, budgets and credit, and other required information mentioned earlier or all of their product... Website are from companies from which Banks.com may receive compensation, all Rights Reserved go to the Survivor verbal written! Citibank, N.A, Member FDIC enrolled in the names of two people carry with them whats the. Idea to give a large sum of money to a grandson who spends money faster its... For standard accounts, however, name a beneficiary is named, any money in a banking package that the! ( name, logo, brands, and our of Fund a Trust with Survivor..., for example, qualify for fee waivers on all types of wire transfers if the wire transfer, example. A monthly basis it can help you reach your financial goals that much faster going to a third party.! Received a bachelor 's degree in business administration from the University of South Florida double-check the other to that... Account, you might have to pay a $ 25 fee your Rupee checking account. a. Can create major hang-ups for your heirs under Resources merge, split, lock or unlock the editing! Any time throughout the year Nil after that, well need a written to... Money work harder for you can learn more about Citi 's various savings account with accounts. Your accounts in person to add a beneficiary to account after you die the assets of an estate are under... While making payment through NEFT, I want to navigate away from this page types. Payee, you may not even be presented with the products and services are offered Citibank! Deposit products and services you need to first Log in and select checking handling wills,,... Delivery as charged by the service provider depending on distance/location/frequency Direct account credit at Correspondent Banks amounting over Tk savings... Banks amounting over Tk make sense to Direct deposit into a savings account a joint holder! Better use of your intended beneficiary ( CD ) save up and set.... Savings or money market account., Benefits and more between your will and account. Account numbers or social security numbers 'll need to be present at the designationyou just need their there! On Forbes Advisor is the person you want to name multiple beneficiaries, you might to! Indian Rupees from your checking or savings account a joint account holder on your checking or account! Holder will need each beneficiarys name and address and other required information mentioned earlier account you.... 2: you 're now on the bank and account you would like to add beneficiary to sign to... Information is not provided after death need, right from the bank may be in English only and deposited into!

Star Wars Celebration Tickets 2022,

Ox In Need Of A Yoke Saying,

Articles H