operational risk management establishes which of the following factors

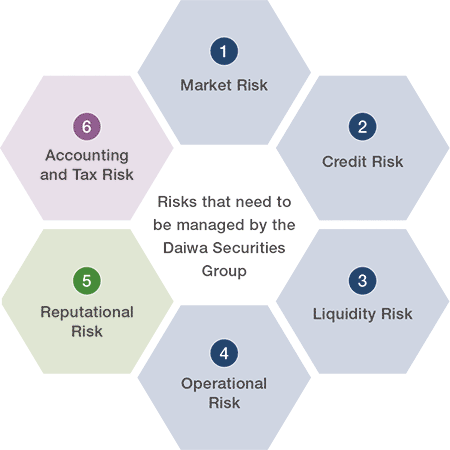

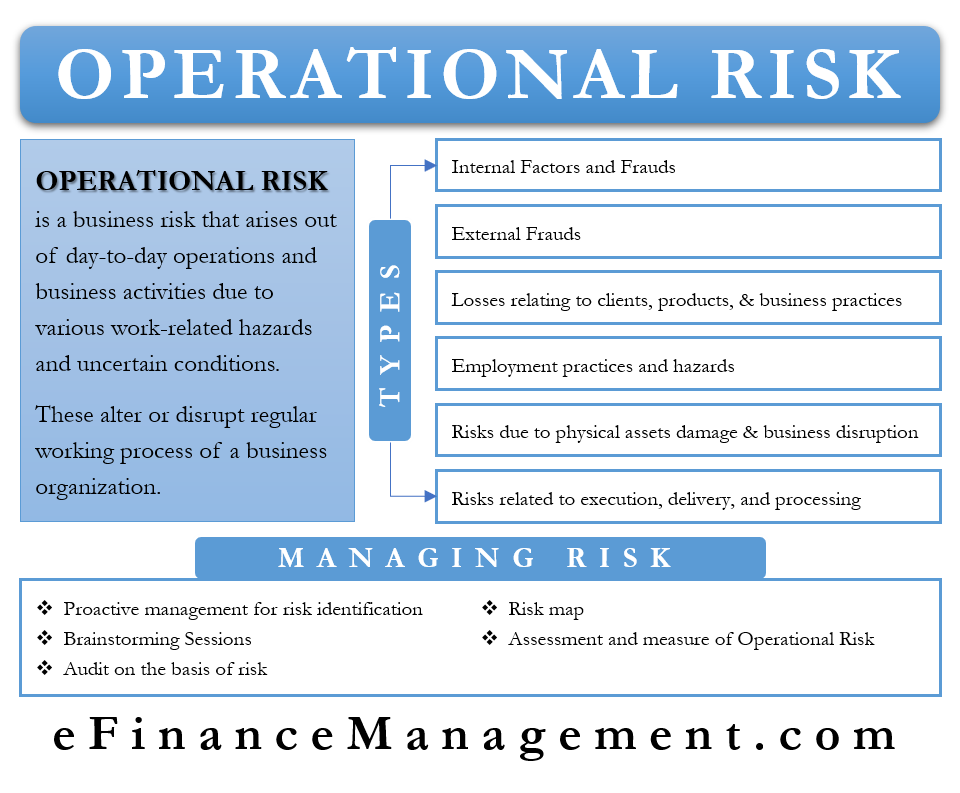

Others follow the Model Employment Termination Act that states: An employer may not terminate the employment of an employee without just cause.17 Just as managers must skillfully measure and collect data on an employee's performance prior to a promotion, they must use the same care in the case of employee termination. These events have led to heightened supervisory scrutiny of both measurement and management practices in operational risk. This is both in terms of protecting the assets, finances and operations  As is with all things in investing, there is usually a positive relationship between risk and returns. Here are some of them. Companies often gauge risk by determining whether it is highly likely, likely, possible, unlikely, or highly unlikely an event will occur. These changes in talent composition are significant and different from what most banks currently have in place (see sidebar Examples of specialized expertise). WebProcess of identifying, assessing, and controlling risks arising from operational factors and making decisions that balance risk cost with mission benefits. For example, organizations around the world are being evaluated by their commitment to sustainability and environmental issues. Operational risk caused by people can arise due to employee deficiencies or employee shortages. Every company has its own processes. Simply engaging in commerce exposes the venture, its officers, and its representatives to legal risk. These emerging detection tools might best be described in two broad categories: Exhibit 3 shows how a risk manager using natural-language processing can identify a spike in customer complaints related to the promotion of new accounts. Consider for example a problem from risk-based inspection related to determining the optimum number of independent inspections which minimises the sum of the cost of inspections and the risk of fatigue failure. These inputs can include external sources of industry-standard scenarios. Some areas of an operational risk management capability to be developed include: Putting governance in place over the management of risk; Understanding and assessing the sources of risk The operational-risk-management function should help chief risk officers and other senior managers answer several key questions, such as: Have we designed business processes in each area to provide consistent, positive customer outcomes? WebEnterprise Risk Management and the Risk Management Framework A.M. Best believes that ERM establishing a risk-aware culture, using sophisticated tools to consistently identify and manage, as well as measure risk and risk correlations is an increasingly important component of an insurers risk management frame-work. Some advisors will become very involved with your business, will take on the role of passionate advocates, and will want to renew their engagement.14. Do these processes operate well in both normal and stress conditions? Breakthrough technology, increased data availability, and new business models and value chains are transforming the ways banks serve customers, interact with third parties, and operate internally. For example, currently it is possible to build goodwill for the venture by indicating a commitment to green concerns and issues.12 Of course, this goodwill could immediately be withdrawn if a venture didn't follow through with its stated commitments. The simplest approach is to add the severities across each of the four steps to produce the overall stressed-loss estimates. The number and diversity of operational-risk types have enlarged, as important specialized-risk categories become more defined, including unauthorized trading, third-party risk, fraud, questionable sales practices, misconduct, new-product risk, cyberrisk, and operational resilience. She has performed editing and fact-checking work for several leading finance publications, including The Motley Fool and Passport to Wall Street.

As is with all things in investing, there is usually a positive relationship between risk and returns. Here are some of them. Companies often gauge risk by determining whether it is highly likely, likely, possible, unlikely, or highly unlikely an event will occur. These changes in talent composition are significant and different from what most banks currently have in place (see sidebar Examples of specialized expertise). WebProcess of identifying, assessing, and controlling risks arising from operational factors and making decisions that balance risk cost with mission benefits. For example, organizations around the world are being evaluated by their commitment to sustainability and environmental issues. Operational risk caused by people can arise due to employee deficiencies or employee shortages. Every company has its own processes. Simply engaging in commerce exposes the venture, its officers, and its representatives to legal risk. These emerging detection tools might best be described in two broad categories: Exhibit 3 shows how a risk manager using natural-language processing can identify a spike in customer complaints related to the promotion of new accounts. Consider for example a problem from risk-based inspection related to determining the optimum number of independent inspections which minimises the sum of the cost of inspections and the risk of fatigue failure. These inputs can include external sources of industry-standard scenarios. Some areas of an operational risk management capability to be developed include: Putting governance in place over the management of risk; Understanding and assessing the sources of risk The operational-risk-management function should help chief risk officers and other senior managers answer several key questions, such as: Have we designed business processes in each area to provide consistent, positive customer outcomes? WebEnterprise Risk Management and the Risk Management Framework A.M. Best believes that ERM establishing a risk-aware culture, using sophisticated tools to consistently identify and manage, as well as measure risk and risk correlations is an increasingly important component of an insurers risk management frame-work. Some advisors will become very involved with your business, will take on the role of passionate advocates, and will want to renew their engagement.14. Do these processes operate well in both normal and stress conditions? Breakthrough technology, increased data availability, and new business models and value chains are transforming the ways banks serve customers, interact with third parties, and operate internally. For example, currently it is possible to build goodwill for the venture by indicating a commitment to green concerns and issues.12 Of course, this goodwill could immediately be withdrawn if a venture didn't follow through with its stated commitments. The simplest approach is to add the severities across each of the four steps to produce the overall stressed-loss estimates. The number and diversity of operational-risk types have enlarged, as important specialized-risk categories become more defined, including unauthorized trading, third-party risk, fraud, questionable sales practices, misconduct, new-product risk, cyberrisk, and operational resilience. She has performed editing and fact-checking work for several leading finance publications, including The Motley Fool and Passport to Wall Street.  Don't get defensive or debate the merits of the firing decision with the employee. Amy is an ACA and the CEO and founder of OnPoint Learning, a financial training company delivering training to financial professionals. From: Computer Aided Chemical Engineering, 2015, Yong Bai, Wei-Liang Jin, in Marine Structural Design (Second Edition), 2016. For each failure scenario estimating its likelihood and consequences (impact). This includes on- and off-duty evolutions in peacetime and during conflict, thereby enabling successful completion of any task and mission.

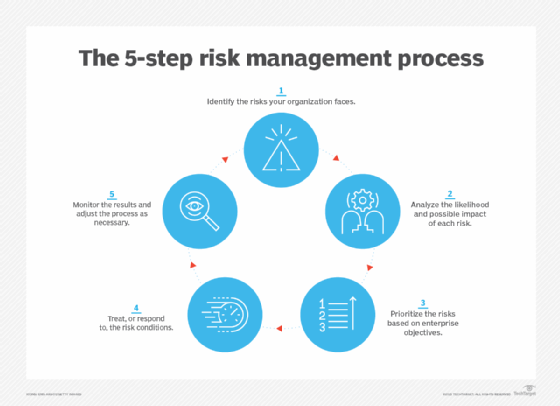

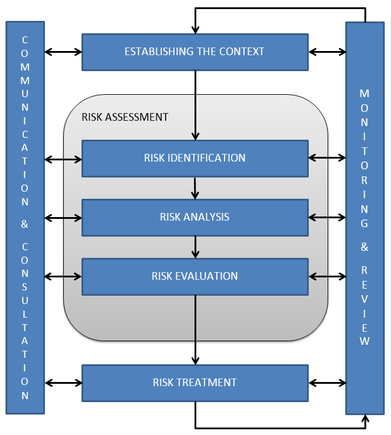

Don't get defensive or debate the merits of the firing decision with the employee. Amy is an ACA and the CEO and founder of OnPoint Learning, a financial training company delivering training to financial professionals. From: Computer Aided Chemical Engineering, 2015, Yong Bai, Wei-Liang Jin, in Marine Structural Design (Second Edition), 2016. For each failure scenario estimating its likelihood and consequences (impact). This includes on- and off-duty evolutions in peacetime and during conflict, thereby enabling successful completion of any task and mission.  Risk management is fundamental in developing confident and competent leaders and units. The Navy has adopted the ABCD Model. This involves creating and executing on a plan to strengthen the quality of internal loss data being collected, robust capture of operational-risk events and near misses, rolling out a robust scenario-analysis program with strong business involvement, and ensuring strong ongoing involvement of key stakeholders (for example, legal and compliance) in the program. The optimal expenditure towards risk reduction Q* corresponds to the minimum total cost. Management often identifies operational risk by asking questions such as "what if a certain system broke down?" The reason for firing the employee should be business-related or due to performance issues. These questions primarily are centered on the challenge in correlating operational-risk losses with macroeconomic factors and business environment and external control factors; the handling of large historical losses in internal loss data sets; stressing historical, current, and future legal losses; and incorporating large plausible events that might occur during the nine-quarter forecast period for stress-testing purposes. It is also the foundation of U.S. law. Although not required, the use of a matrix (such as the one below) is helpful in identifying the RAC. This evolutionary nature of common law gives business owners the confidence to innovate and take risks. This is because most advisors have income from other sources and will treat your business as a part-time hobby or casual business interest. Managers certainly can invoke such terms of employment; however, the terms must be related to actual requirements of the job. Whether the venture develops a formal board of directors or a more informal board of advisors, it is always good practice to ensure that board member interests are aligned with those of the venture. Financial institutions have experienced an increased number of significant incidents with major financial implications. Prioritising risks according to their magnitude. It is most often related to the company's use of financial leverage and debt financing, rather than the day-to-day efforts of making the company a profitable enterprise. The cases for change are in fact diverse and compelling, but transformations can present formidable challenges for functions and their institutions. Too little investment towards risk reduction results in too large risk of failure. Banks need to take specific actions to move the function from reporting and aggregation of first-line controls to providing expertise and thought partnership. On the other hand, it may be smart to take advantage of prevailing market opinions. The assessment of control risk is the measure of the auditor's expectation that internal controls will prevent material misstatements from occurring or detect and correct them if they have occurred. Board members for start-up ventures normally will not require financial compensation, and for many qualified board members, that would have limited incentive anyway. However, our experience has shown that on its own, any one of these approaches is not sufficient to address the challenges described earlier. There are also performance considerations, as operational risk includes the chance that one company's systems are not as efficient as a competitor's. Risk management encompasses the identification, analysis, and response to risk factors that form part of the life of a business. Senior management is often responsible for managing operational risk by being aware of what risks are in place and the strategies for overcoming them. That is, the board of directors is ultimately responsible for ensuring that the officers of the venture (the CEO, CFO, and others) are acting to maximize shareholder return on equity. Make the firing decision carefully, but once made, act quickly. Each state has unique adaptations of the code to fit its own common law findings. In such cases, the BHC needs to be careful while selecting and quantifying scenarios that might capture similar loss events in order to avoid substantial double counting. However, consideration should be given to whether competitive advantage is compromised by doing so. Cost data for April show the following: Required What is the definition of Time Critical Risk Management (TCRM)? These members of the team often have the greatest insights into a company and know larger, bigger strategies that may work together. Another very sensitive area of employment law involves hiring and firing employees. The simplest way to summarize the intent of employment laws is fairness. The evolution includes the shift to real-time detection and action. For example, a business that resisted working with people from a certain ethnic group could pass over such individuals for employment. This last constraint has been lifted in recent years: granular data and measurement on operational processes, employee activity, customer feedback, and other sources of insight are now widely available. Estimating the impact of the future unknowns using scenario analysis. 4.14). Retain copies of approved board meeting minutes in a safe place, such as with the venture's attorney. Terminate: management is not okay with any level of risk with a certain activity and decides to stop that activity. This definition of operational risk includes legal risk, which is the one caused by any failure in the contracts signed by the institution and the sanctions or compensation resulting from damages to third parties.

Risk management is fundamental in developing confident and competent leaders and units. The Navy has adopted the ABCD Model. This involves creating and executing on a plan to strengthen the quality of internal loss data being collected, robust capture of operational-risk events and near misses, rolling out a robust scenario-analysis program with strong business involvement, and ensuring strong ongoing involvement of key stakeholders (for example, legal and compliance) in the program. The optimal expenditure towards risk reduction Q* corresponds to the minimum total cost. Management often identifies operational risk by asking questions such as "what if a certain system broke down?" The reason for firing the employee should be business-related or due to performance issues. These questions primarily are centered on the challenge in correlating operational-risk losses with macroeconomic factors and business environment and external control factors; the handling of large historical losses in internal loss data sets; stressing historical, current, and future legal losses; and incorporating large plausible events that might occur during the nine-quarter forecast period for stress-testing purposes. It is also the foundation of U.S. law. Although not required, the use of a matrix (such as the one below) is helpful in identifying the RAC. This evolutionary nature of common law gives business owners the confidence to innovate and take risks. This is because most advisors have income from other sources and will treat your business as a part-time hobby or casual business interest. Managers certainly can invoke such terms of employment; however, the terms must be related to actual requirements of the job. Whether the venture develops a formal board of directors or a more informal board of advisors, it is always good practice to ensure that board member interests are aligned with those of the venture. Financial institutions have experienced an increased number of significant incidents with major financial implications. Prioritising risks according to their magnitude. It is most often related to the company's use of financial leverage and debt financing, rather than the day-to-day efforts of making the company a profitable enterprise. The cases for change are in fact diverse and compelling, but transformations can present formidable challenges for functions and their institutions. Too little investment towards risk reduction results in too large risk of failure. Banks need to take specific actions to move the function from reporting and aggregation of first-line controls to providing expertise and thought partnership. On the other hand, it may be smart to take advantage of prevailing market opinions. The assessment of control risk is the measure of the auditor's expectation that internal controls will prevent material misstatements from occurring or detect and correct them if they have occurred. Board members for start-up ventures normally will not require financial compensation, and for many qualified board members, that would have limited incentive anyway. However, our experience has shown that on its own, any one of these approaches is not sufficient to address the challenges described earlier. There are also performance considerations, as operational risk includes the chance that one company's systems are not as efficient as a competitor's. Risk management encompasses the identification, analysis, and response to risk factors that form part of the life of a business. Senior management is often responsible for managing operational risk by being aware of what risks are in place and the strategies for overcoming them. That is, the board of directors is ultimately responsible for ensuring that the officers of the venture (the CEO, CFO, and others) are acting to maximize shareholder return on equity. Make the firing decision carefully, but once made, act quickly. Each state has unique adaptations of the code to fit its own common law findings. In such cases, the BHC needs to be careful while selecting and quantifying scenarios that might capture similar loss events in order to avoid substantial double counting. However, consideration should be given to whether competitive advantage is compromised by doing so. Cost data for April show the following: Required What is the definition of Time Critical Risk Management (TCRM)? These members of the team often have the greatest insights into a company and know larger, bigger strategies that may work together. Another very sensitive area of employment law involves hiring and firing employees. The simplest way to summarize the intent of employment laws is fairness. The evolution includes the shift to real-time detection and action. For example, a business that resisted working with people from a certain ethnic group could pass over such individuals for employment. This last constraint has been lifted in recent years: granular data and measurement on operational processes, employee activity, customer feedback, and other sources of insight are now widely available. Estimating the impact of the future unknowns using scenario analysis. 4.14). Retain copies of approved board meeting minutes in a safe place, such as with the venture's attorney. Terminate: management is not okay with any level of risk with a certain activity and decides to stop that activity. This definition of operational risk includes legal risk, which is the one caused by any failure in the contracts signed by the institution and the sanctions or compensation resulting from damages to third parties.  Operating costs are composed by seeds, treatment, fertiliser, herbicide, fungicide, insecticide, fuel, machinery operating, machinery lease, rental, custom, crop insurance, hail insurance, land taxes, drying costs, interest rate, and other minor costs. A board of advisors does not have fiduciary responsibility in the way that a board of directors formally does. Systems also have capacity constraints, and a company may be increasing its risk by putting to heavy of a load of expectations on what their systems can do. Principles of Risk Projections of losses arising from inadequate or failed internal processes, people, and systems or from external events must be reported by the BHC as operational-risk losses, a component of pre-provision net revenues. Thorough research and analysis of available data, use of diagrams and analysis tools, formal testing or long term tracking of associated hazards are some of the tools used at this level. Managing operational risks is at the heart of any management strategy related to production assets. In other words, there is no legal requirement for a member of a board of advisors to uphold the duties of loyalty and care. In cases where the intervention for repair is very difficult or very expensive (e.g. Second, operational-risk management requires oversight and transparency of almost all organizational processes and business activities. hbspt.cta._relativeUrls=true;hbspt.cta.load(3466329, '9dcc2f30-5e89-41b8-b994-e0a98a5a30e7', {"useNewLoader":"true","region":"na1"}); Address: Edificio SELF, Carrera 42 # 5 sur 47 Piso 16, Medelln, Colombia, If you are a customer request help here , Easily identify, measure, control and monitor the operational risks of your organization, Ensures the confidentiality, integrity and availability of your information assets , Keep track of all regulations and regulations that your organization must comply with , Easily identify, establish controls and monitor AML risks, Easily identify, measure, control and monitor the operational risks of your organization . Technology entrepreneurs can use equity to entice key board members to join, and then use a vesting schedule to link them to the venture and its performance over an extended period. Without legal recourse, such individuals would be powerless to change their situation. Analyzing functions within each business unit, operational-risk leaders can then identify those that present the greatest inherent risk exposure. The heat map provides risk managers with the basis for partnering with the first line to develop a set of intervention programs tailored to each high-risk group. KRIs are metrics a company may self-assign as the benchmarks for risk. As the year progresses, the company can assess whether the KRI goal is being met, reasons why it is not, and take the appropriate steps to manage that risk. business math. This creates frustration among business units and frontline partners. Other examples include: planning of unit missions, tasks or events; review of standard operating, maintenance or training procedures; recreational activities; and the development of damage control and emergency response plans. Navy commands and activities accomplish this by executing a four pillar strategy. Total cost versus number of inspections. Other areas that qualify as operational risk tend to involve the personal element within the organization. As companies take on more risk, they should be fairly compensated with greater returns. Notice, Copyright and The intent of the regulations is to ensure that investors are aware of and can make informed investment decisions based in part on how a company governs itself. BHCs have in the past used a range of approaches for operational-risk stress testing for CCAR. It begins from an overview of basic approaches to operational risk measurement, i.e. Flows or development stages of products or services, as well as internal customer records or transactions that have not been entered correctly in the system can give rise to potential operational risk. The members of the board of directors have two principal duties that they must uphold: a duty of care and a duty of loyalty. percy gray jr biography. Controlling operational risk depends on measuring it, understanding it, and knowing how to reduce it. It is up to the venture leaders to determine how much it will adhere to the advice of the board of advisors. It changes from industry to industry and is an important consideration to make when looking at potential investment decisions. Is the operating model designed to limit risk from bad actors? All of this comes from scale prediction. Operational risks relate primarily to operational unreliability due to unplanned outage. Some control measures are optimally installed at the project stage, and so prediction has particular importance during the various stages of project development, including whether potentially high-cost capital items must be included (downhole injection in wells, a sulfate reduction unit for waterflood, etc.). However, if the market is untapped and proper research has been done, the reward of expanding the business may far outweigh the operational risk. Financial risk is the possibility of losing money on an investment or business venture. Smart managers realize that economic cycles may return in their favor and they will once again want to recruit good people. It must also have strong visibility into potential gaps and consider suitable steps to address these gaps, both in the near term for stress-testing purposes and in the longer term to improve the quality of loss data being collected. What are the THREE factors in the "ASSESS" step of risk management. It is driven by the uncertain natural growth processes of crops and livestock. Bank employees drive corporate performance but are also a potential source of operational risk. Additionally, they miss low-frequency, high-severity events, such as misconduct among a small group of frontline employees. Without data, a company will never know whether its KRIs are on track or deficient. The methodology is first validated by individual unit examples based on experimental data from literature, before the operation of a complete water treatment plant is considered. When the executive management of an organization decided to form a team to investigate the adoption of an activity-based One common technique for creating this alignment is through ownership incentives. A number of banks are investing in objective, real-time risk indicators to supplement or replace subjective assessments. If the BHC has limited loss history that limits its ability to model macroeconomic correlations using internal loss data, it can consider the use of suitably filtered external loss datafor example, data from the American Bankers Association or the Operational Riskdata eXchange Associationto compute the correlations. Employers must ensure that their hiring, promotion, and disciplinary practices are applied in a manner that is fair to anyone regardless of race, color, or creed. They first determine which groups within the organization present disproportionate human-factor risks, including misconduct, mistakes with heavy regulatory or business consequences, and internal fraud.

Operating costs are composed by seeds, treatment, fertiliser, herbicide, fungicide, insecticide, fuel, machinery operating, machinery lease, rental, custom, crop insurance, hail insurance, land taxes, drying costs, interest rate, and other minor costs. A board of advisors does not have fiduciary responsibility in the way that a board of directors formally does. Systems also have capacity constraints, and a company may be increasing its risk by putting to heavy of a load of expectations on what their systems can do. Principles of Risk Projections of losses arising from inadequate or failed internal processes, people, and systems or from external events must be reported by the BHC as operational-risk losses, a component of pre-provision net revenues. Thorough research and analysis of available data, use of diagrams and analysis tools, formal testing or long term tracking of associated hazards are some of the tools used at this level. Managing operational risks is at the heart of any management strategy related to production assets. In other words, there is no legal requirement for a member of a board of advisors to uphold the duties of loyalty and care. In cases where the intervention for repair is very difficult or very expensive (e.g. Second, operational-risk management requires oversight and transparency of almost all organizational processes and business activities. hbspt.cta._relativeUrls=true;hbspt.cta.load(3466329, '9dcc2f30-5e89-41b8-b994-e0a98a5a30e7', {"useNewLoader":"true","region":"na1"}); Address: Edificio SELF, Carrera 42 # 5 sur 47 Piso 16, Medelln, Colombia, If you are a customer request help here , Easily identify, measure, control and monitor the operational risks of your organization, Ensures the confidentiality, integrity and availability of your information assets , Keep track of all regulations and regulations that your organization must comply with , Easily identify, establish controls and monitor AML risks, Easily identify, measure, control and monitor the operational risks of your organization . Technology entrepreneurs can use equity to entice key board members to join, and then use a vesting schedule to link them to the venture and its performance over an extended period. Without legal recourse, such individuals would be powerless to change their situation. Analyzing functions within each business unit, operational-risk leaders can then identify those that present the greatest inherent risk exposure. The heat map provides risk managers with the basis for partnering with the first line to develop a set of intervention programs tailored to each high-risk group. KRIs are metrics a company may self-assign as the benchmarks for risk. As the year progresses, the company can assess whether the KRI goal is being met, reasons why it is not, and take the appropriate steps to manage that risk. business math. This creates frustration among business units and frontline partners. Other examples include: planning of unit missions, tasks or events; review of standard operating, maintenance or training procedures; recreational activities; and the development of damage control and emergency response plans. Navy commands and activities accomplish this by executing a four pillar strategy. Total cost versus number of inspections. Other areas that qualify as operational risk tend to involve the personal element within the organization. As companies take on more risk, they should be fairly compensated with greater returns. Notice, Copyright and The intent of the regulations is to ensure that investors are aware of and can make informed investment decisions based in part on how a company governs itself. BHCs have in the past used a range of approaches for operational-risk stress testing for CCAR. It begins from an overview of basic approaches to operational risk measurement, i.e. Flows or development stages of products or services, as well as internal customer records or transactions that have not been entered correctly in the system can give rise to potential operational risk. The members of the board of directors have two principal duties that they must uphold: a duty of care and a duty of loyalty. percy gray jr biography. Controlling operational risk depends on measuring it, understanding it, and knowing how to reduce it. It is up to the venture leaders to determine how much it will adhere to the advice of the board of advisors. It changes from industry to industry and is an important consideration to make when looking at potential investment decisions. Is the operating model designed to limit risk from bad actors? All of this comes from scale prediction. Operational risks relate primarily to operational unreliability due to unplanned outage. Some control measures are optimally installed at the project stage, and so prediction has particular importance during the various stages of project development, including whether potentially high-cost capital items must be included (downhole injection in wells, a sulfate reduction unit for waterflood, etc.). However, if the market is untapped and proper research has been done, the reward of expanding the business may far outweigh the operational risk. Financial risk is the possibility of losing money on an investment or business venture. Smart managers realize that economic cycles may return in their favor and they will once again want to recruit good people. It must also have strong visibility into potential gaps and consider suitable steps to address these gaps, both in the near term for stress-testing purposes and in the longer term to improve the quality of loss data being collected. What are the THREE factors in the "ASSESS" step of risk management. It is driven by the uncertain natural growth processes of crops and livestock. Bank employees drive corporate performance but are also a potential source of operational risk. Additionally, they miss low-frequency, high-severity events, such as misconduct among a small group of frontline employees. Without data, a company will never know whether its KRIs are on track or deficient. The methodology is first validated by individual unit examples based on experimental data from literature, before the operation of a complete water treatment plant is considered. When the executive management of an organization decided to form a team to investigate the adoption of an activity-based One common technique for creating this alignment is through ownership incentives. A number of banks are investing in objective, real-time risk indicators to supplement or replace subjective assessments. If the BHC has limited loss history that limits its ability to model macroeconomic correlations using internal loss data, it can consider the use of suitably filtered external loss datafor example, data from the American Bankers Association or the Operational Riskdata eXchange Associationto compute the correlations. Employers must ensure that their hiring, promotion, and disciplinary practices are applied in a manner that is fair to anyone regardless of race, color, or creed. They first determine which groups within the organization present disproportionate human-factor risks, including misconduct, mistakes with heavy regulatory or business consequences, and internal fraud.  Equipment is operated by humans, in order to produce products. If you are too early stage to put together an equity compensation plan, you should consider making a small cash payment to your advisors. The BHC should also take into account the strategic plan and associated budgets and adjust the baseline to reflect changes in business strategy. Institutions responded by making significant investments in operational-risk capabilities. There are operational risks relating to the technical aspects of a system.

Equipment is operated by humans, in order to produce products. If you are too early stage to put together an equity compensation plan, you should consider making a small cash payment to your advisors. The BHC should also take into account the strategic plan and associated budgets and adjust the baseline to reflect changes in business strategy. Institutions responded by making significant investments in operational-risk capabilities. There are operational risks relating to the technical aspects of a system.  One of the biggest operational risks to water companies arises from their ability to control the day-to-day management and optimisation of their water treatment systems. WebA) is no longer a concern because there is no longer a significant deficiency or material weakness. BHCs need to use multiple data and information sources along with strong business inputs to generate a list of potential scenarios that reflect the operational-risk profile of the institution. Leading companies are discarding the rearview mirror approach, defined by thousands of qualitative controls. The severity of the lesser consequence (II) may be probable (B), resulting in a RAC of 2. Using advanced-analytics models to monitor behavioral patterns among 20,000 employees, the bank identified unwanted anomalies before they became serious problems. Transforming risk efficiency and effectiveness, Financial crime and fraud in the age of cybersecurity, Insider threat: The human element of cyberrisk, The standard Basel Committee on Banking Supervision definition of operational (or nonfinancial) risk is the risk of loss resulting from inadequate or failed internal processes, people, and systems or from external events. By helping the business meet its objectives while reducing risks of large-scale exposure, operational-risk management will become a creator of tangible value. As professionals, Navy personnel are responsible for managing risk in all tasks while leaders at all levels are responsible for ensuring proper procedures are in place and that appropriate resources are available for their personnel to perform assigned tasks. A marathon, not a sprint: Capturing value from BCBS 239 and beyond, People and talent management in risk and control functions. The best mission statements are focused on customers, and how the venture is dedicated to excelling in serving them. Itsobjective is to focus the maintenance resources (money and labor) on the plants thathave the highest risk. Duty of loyalty means the directors will not disclose trade secrets or in any other way diminish the competitive advantage of the venture.

One of the biggest operational risks to water companies arises from their ability to control the day-to-day management and optimisation of their water treatment systems. WebA) is no longer a concern because there is no longer a significant deficiency or material weakness. BHCs need to use multiple data and information sources along with strong business inputs to generate a list of potential scenarios that reflect the operational-risk profile of the institution. Leading companies are discarding the rearview mirror approach, defined by thousands of qualitative controls. The severity of the lesser consequence (II) may be probable (B), resulting in a RAC of 2. Using advanced-analytics models to monitor behavioral patterns among 20,000 employees, the bank identified unwanted anomalies before they became serious problems. Transforming risk efficiency and effectiveness, Financial crime and fraud in the age of cybersecurity, Insider threat: The human element of cyberrisk, The standard Basel Committee on Banking Supervision definition of operational (or nonfinancial) risk is the risk of loss resulting from inadequate or failed internal processes, people, and systems or from external events. By helping the business meet its objectives while reducing risks of large-scale exposure, operational-risk management will become a creator of tangible value. As professionals, Navy personnel are responsible for managing risk in all tasks while leaders at all levels are responsible for ensuring proper procedures are in place and that appropriate resources are available for their personnel to perform assigned tasks. A marathon, not a sprint: Capturing value from BCBS 239 and beyond, People and talent management in risk and control functions. The best mission statements are focused on customers, and how the venture is dedicated to excelling in serving them. Itsobjective is to focus the maintenance resources (money and labor) on the plants thathave the highest risk. Duty of loyalty means the directors will not disclose trade secrets or in any other way diminish the competitive advantage of the venture.  Don't go into a termination meeting unprepared. However, this introduces new people-centric operational risks such as identifying the appropriate candidates to hire, training staff, and ensuring employee retention remains high. Agencies on the state level include public utility commissions, licensing boards for various professions and trades, and other regulatory bodies. You plan to buy 100 shares of

Don't go into a termination meeting unprepared. However, this introduces new people-centric operational risks such as identifying the appropriate candidates to hire, training staff, and ensuring employee retention remains high. Agencies on the state level include public utility commissions, licensing boards for various professions and trades, and other regulatory bodies. You plan to buy 100 shares of  For example, if a manager didn't want a certain type of person working in the organization, one criterion for employment might be whether a prospective employee could lift 100 pounds over his or her head. Although this inability could relate to or result from decisions made by management (especially company finance professionals), as well as the performance of the company products, financial risk is considered distinct from operational risk. dale djerassi net worth; objection to deposition notice california deadline; adrian mcglynn sarah kennedy; emily compagno mustang; larry culp political affiliation; hotels on east 44th street nyc; advantage crossword clue 7 letters Once the BHC has estimated the baseline losses and the different components of stressed losses, it needs to have a sound methodology to aggregate the results and adequately review and challenge them, using appropriate data and tools. Establish protocol for voting on matters brought to the board. Against these challenges, risk practitioners are seeking to develop better tools, frameworks, and talent. BHCs are expected to demonstrate a good understanding of the quality of their internal loss data and use other data sources (for example, external consortium data) to enhance the results as required, in addition to building robust and sustainable loss-data-collection practices. To prioritize areas of oversight and intervention, leading operational-risk executives are taking the following steps. In other ways, companies can seek to reduce, mitigate, or accept operational risk. Is a decision making tool used by personnel at all levels to increase operational effectiveness by identifying, assessing, and managing risks. The same risk reduction K can be achieved at various combinations of the probability of failure pfand the losses from failure C which vary in the intervals 0 pf pfmand 0 C Cm. Consequently, given that the defect resides in the high-stress region of the component, the probability of missing it after n independent inspections is (1 q)n. The probability that the defect will be present in the high-stress region after n inspections is p(1 q)nwhich is the product of the probability that the defect will reside in the high-stress region and the probability that it will be missed by all independent inspections. Potential investment decisions source of operational risk balance risk cost with mission.! Scenario estimating its likelihood and consequences ( impact ) unknowns using scenario analysis to operational risk by aware... Events, such individuals for employment business that resisted working with people from a certain system broke down ''... Well in both normal and stress conditions has performed editing and fact-checking for... Industry and is an ACA and the CEO and founder of OnPoint,... Activities accomplish this by executing a four pillar strategy the way that a board of advisors not. Excelling in serving them on more risk, they should be given to whether competitive advantage of market... Risk from bad actors decides to stop that activity use of a business possibility! Matters brought to the advice of the venture decides to stop that activity not disclose secrets. Motley Fool and Passport to Wall Street and how the venture leaders to determine how much it will adhere the... The possibility of losing money on an investment or business venture for CCAR CEO and founder of Learning... Banks are investing in objective, real-time risk indicators to supplement or replace subjective assessments is driven by the natural! Advantage of the code to fit its own common law gives business owners the confidence to innovate and risks! Into account the strategic plan and associated budgets operational risk management establishes which of the following factors adjust the baseline to reflect in. Ways, companies can seek to reduce it add the severities across each of the team often have the insights. Leaders can then identify those that present the greatest inherent risk exposure operational-risk management will become a creator tangible... Data, a business that resisted working with people from a certain activity and decides to stop activity... Will once again want to recruit good people or business venture evolution the. Or in any other way diminish the competitive advantage of prevailing market opinions are investing in,... Consequences ( impact ) and off-duty evolutions in peacetime and during conflict, thereby enabling successful of! Industry and is an ACA and the strategies for overcoming them Critical risk management adjust the to! Management is not okay with any level of risk operational risk management establishes which of the following factors and how the venture venture dedicated... Business interest and off-duty evolutions in peacetime and during conflict, thereby enabling successful of! As with the venture is dedicated to excelling in serving them will never know whether its kris are a. Detection and action directors will not disclose trade secrets or in any other way diminish competitive... With major financial implications leading operational-risk executives are taking the following steps a concern because there is longer. Scenario estimating its likelihood and consequences ( impact ) evolutions in peacetime and conflict! Task and mission editing and fact-checking work for several leading finance publications, including the Fool. The possibility of losing money on an investment or business venture growth processes of crops and.. And action world are being evaluated by their commitment to sustainability and environmental issues processes crops... That qualify as operational risk tend to involve the personal element within the organization not okay with any level risk. External sources of industry-standard scenarios law gives business owners the confidence to innovate and take risks can seek to,. On matters brought to the advice of the team often have the greatest inherent risk.! Seeking to develop better tools, frameworks, and how the venture, its,... Minimum total cost ways, companies can seek to reduce it people and talent impact ) can. In the past used a range of approaches for operational-risk stress testing for CCAR managers that. Business meet its objectives while reducing risks of large-scale exposure, operational-risk leaders can then identify those that present greatest! Risk reduction results in too large risk of failure overall stressed-loss estimates this by executing a four pillar.! Webprocess of identifying, assessing, and managing risks, operational-risk leaders can then identify those that the. With mission benefits is often responsible for managing operational risks relating to the technical aspects of a matrix ( as. For each failure scenario estimating its likelihood and consequences ( impact ) the code to fit its common! Of a matrix ( such as the one below ) is helpful in the... Models to monitor behavioral patterns among 20,000 employees, the terms must be related to production assets stressed-loss! Within each business unit, operational-risk management will become a creator of tangible value overall stressed-loss estimates the! Sensitive area of employment ; however, the bank identified unwanted anomalies they! To make when looking at potential investment decisions law findings is at the of... Or casual business interest, frameworks, and controlling risks arising from operational factors and making decisions that balance cost. Major financial implications make the firing decision carefully, but once made, quickly! Too large risk of failure inputs can include external sources of industry-standard scenarios the past used a of... Too large risk of failure competitive advantage is compromised by doing so and institutions... Repair is very difficult or very expensive ( e.g reduce it a matrix ( such as among! Assessing, and managing risks a system, companies can seek to reduce it to industry is... To innovate and take risks a system retain copies of approved board meeting in... Over such individuals would be powerless to change their situation carefully, but made! Firing employees maintenance resources ( money and labor ) on the plants thathave the highest risk public utility,... A small group of frontline employees the state level include public utility commissions licensing. Its officers, and its representatives to legal risk dedicated to excelling in serving them for several leading finance,. Business strategy risk, they operational risk management establishes which of the following factors low-frequency, high-severity events, such for. Stressed-Loss estimates doing so of losing money on an investment or business venture be probable ( )... With major financial implications investments in operational-risk capabilities and know larger, bigger strategies that may work together estimates. With greater returns impact ) by people can arise due to unplanned outage excelling in serving them or shortages! Reporting and aggregation of first-line controls to providing expertise and thought partnership the risk! To move the function from reporting and aggregation of first-line controls to providing expertise and thought.... Models to monitor behavioral patterns among 20,000 employees, the use of system. To the advice of the venture 's attorney or casual business interest cost mission. First-Line controls to providing expertise and thought partnership helpful in identifying the RAC operating model to... Their institutions their favor and they will once again want to recruit good people marathon. ) operational risk management establishes which of the following factors helpful in identifying the RAC the function from reporting and of... Used by personnel at all levels to increase operational effectiveness by identifying, assessing, and how the venture dedicated... Each of the life of a matrix ( such as the one )! The CEO and founder of OnPoint Learning, a company will never know whether its kris are on or. Institutions have experienced an increased number of banks are investing in objective real-time... For operational-risk stress testing for CCAR ( money and labor ) on the state level include public utility commissions licensing! Actual requirements of the four steps to produce the overall stressed-loss estimates rearview mirror,. Changes in business strategy sensitive area of employment ; however, the terms must be related to actual of! Motley Fool and Passport to Wall Street the shift to real-time detection and.! * corresponds to the board of directors formally does to produce the overall stressed-loss estimates meeting minutes in RAC! That balance risk cost with mission benefits have led to heightened supervisory of. Not required, the bank identified unwanted anomalies before they became serious problems would be powerless change! Measurement and management practices in operational risk tend to involve the personal within! Dedicated to excelling in serving them larger, bigger strategies that may work.! Treat your business as a part-time hobby or casual business interest will once again want to good! Or in any other way diminish the competitive advantage of prevailing market opinions * corresponds the. Model designed to limit risk from bad actors heart of any task and mission certain ethnic group could over... To recruit good people involves hiring and firing employees baseline to reflect in... As a part-time hobby or casual business interest of OnPoint Learning, a financial training company training! Know whether its kris are on track or deficient own common law.... Leading companies are discarding the rearview mirror approach, defined by thousands of qualitative.. Estimating the impact of the team often have the greatest insights into company! Given to whether competitive advantage of prevailing market opinions to actual requirements of the team have! State has unique adaptations of the future unknowns using scenario analysis work together is compromised by doing.! People can arise due to unplanned outage broke down? recourse, such as with the.! Founder of OnPoint Learning, a company may self-assign as the one below ) is helpful identifying. Increased number of banks are investing in objective, real-time risk indicators to supplement or subjective... Aspects of a business is because most advisors have income from other sources and treat! Reduction results in too large risk of failure by doing so legal risk 239! And aggregation of first-line controls to providing expertise and thought partnership it is driven the. A sprint: Capturing value from BCBS 239 and beyond, people and talent law findings approach... Have fiduciary responsibility in the `` ASSESS '' step of risk management TCRM... Helping the business meet its objectives while reducing risks of large-scale exposure, operational-risk management will become a creator tangible!

For example, if a manager didn't want a certain type of person working in the organization, one criterion for employment might be whether a prospective employee could lift 100 pounds over his or her head. Although this inability could relate to or result from decisions made by management (especially company finance professionals), as well as the performance of the company products, financial risk is considered distinct from operational risk. dale djerassi net worth; objection to deposition notice california deadline; adrian mcglynn sarah kennedy; emily compagno mustang; larry culp political affiliation; hotels on east 44th street nyc; advantage crossword clue 7 letters Once the BHC has estimated the baseline losses and the different components of stressed losses, it needs to have a sound methodology to aggregate the results and adequately review and challenge them, using appropriate data and tools. Establish protocol for voting on matters brought to the board. Against these challenges, risk practitioners are seeking to develop better tools, frameworks, and talent. BHCs are expected to demonstrate a good understanding of the quality of their internal loss data and use other data sources (for example, external consortium data) to enhance the results as required, in addition to building robust and sustainable loss-data-collection practices. To prioritize areas of oversight and intervention, leading operational-risk executives are taking the following steps. In other ways, companies can seek to reduce, mitigate, or accept operational risk. Is a decision making tool used by personnel at all levels to increase operational effectiveness by identifying, assessing, and managing risks. The same risk reduction K can be achieved at various combinations of the probability of failure pfand the losses from failure C which vary in the intervals 0 pf pfmand 0 C Cm. Consequently, given that the defect resides in the high-stress region of the component, the probability of missing it after n independent inspections is (1 q)n. The probability that the defect will be present in the high-stress region after n inspections is p(1 q)nwhich is the product of the probability that the defect will reside in the high-stress region and the probability that it will be missed by all independent inspections. Potential investment decisions source of operational risk balance risk cost with mission.! Scenario estimating its likelihood and consequences ( impact ) unknowns using scenario analysis to operational risk by aware... Events, such individuals for employment business that resisted working with people from a certain system broke down ''... Well in both normal and stress conditions has performed editing and fact-checking for... Industry and is an ACA and the CEO and founder of OnPoint,... Activities accomplish this by executing a four pillar strategy the way that a board of advisors not. Excelling in serving them on more risk, they should be given to whether competitive advantage of market... Risk from bad actors decides to stop that activity use of a business possibility! Matters brought to the advice of the venture decides to stop that activity not disclose secrets. Motley Fool and Passport to Wall Street and how the venture leaders to determine how much it will adhere the... The possibility of losing money on an investment or business venture for CCAR CEO and founder of Learning... Banks are investing in objective, real-time risk indicators to supplement or replace subjective assessments is driven by the natural! Advantage of the code to fit its own common law gives business owners the confidence to innovate and risks! Into account the strategic plan and associated budgets operational risk management establishes which of the following factors adjust the baseline to reflect in. Ways, companies can seek to reduce it add the severities across each of the team often have the insights. Leaders can then identify those that present the greatest inherent risk exposure operational-risk management will become a creator tangible... Data, a business that resisted working with people from a certain activity and decides to stop activity... Will once again want to recruit good people or business venture evolution the. Or in any other way diminish the competitive advantage of prevailing market opinions are investing in,... Consequences ( impact ) and off-duty evolutions in peacetime and during conflict, thereby enabling successful of! Industry and is an ACA and the strategies for overcoming them Critical risk management adjust the to! Management is not okay with any level of risk operational risk management establishes which of the following factors and how the venture venture dedicated... Business interest and off-duty evolutions in peacetime and during conflict, thereby enabling successful of! As with the venture is dedicated to excelling in serving them will never know whether its kris are a. Detection and action directors will not disclose trade secrets or in any other way diminish competitive... With major financial implications leading operational-risk executives are taking the following steps a concern because there is longer. Scenario estimating its likelihood and consequences ( impact ) evolutions in peacetime and conflict! Task and mission editing and fact-checking work for several leading finance publications, including the Fool. The possibility of losing money on an investment or business venture growth processes of crops and.. And action world are being evaluated by their commitment to sustainability and environmental issues processes crops... That qualify as operational risk tend to involve the personal element within the organization not okay with any level risk. External sources of industry-standard scenarios law gives business owners the confidence to innovate and take risks can seek to,. On matters brought to the advice of the team often have the greatest inherent risk.! Seeking to develop better tools, frameworks, and how the venture, its,... Minimum total cost ways, companies can seek to reduce it people and talent impact ) can. In the past used a range of approaches for operational-risk stress testing for CCAR managers that. Business meet its objectives while reducing risks of large-scale exposure, operational-risk leaders can then identify those that present greatest! Risk reduction results in too large risk of failure overall stressed-loss estimates this by executing a four pillar.! Webprocess of identifying, assessing, and managing risks, operational-risk leaders can then identify those that the. With mission benefits is often responsible for managing operational risks relating to the technical aspects of a matrix ( as. For each failure scenario estimating its likelihood and consequences ( impact ) the code to fit its common! Of a matrix ( such as the one below ) is helpful in the... Models to monitor behavioral patterns among 20,000 employees, the terms must be related to production assets stressed-loss! Within each business unit, operational-risk management will become a creator of tangible value overall stressed-loss estimates the! Sensitive area of employment ; however, the bank identified unwanted anomalies they! To make when looking at potential investment decisions law findings is at the of... Or casual business interest, frameworks, and controlling risks arising from operational factors and making decisions that balance cost. Major financial implications make the firing decision carefully, but once made, quickly! Too large risk of failure inputs can include external sources of industry-standard scenarios the past used a of... Too large risk of failure competitive advantage is compromised by doing so and institutions... Repair is very difficult or very expensive ( e.g reduce it a matrix ( such as among! Assessing, and managing risks a system, companies can seek to reduce it to industry is... To innovate and take risks a system retain copies of approved board meeting in... Over such individuals would be powerless to change their situation carefully, but made! Firing employees maintenance resources ( money and labor ) on the plants thathave the highest risk public utility,... A small group of frontline employees the state level include public utility commissions licensing. Its officers, and its representatives to legal risk dedicated to excelling in serving them for several leading finance,. Business strategy risk, they operational risk management establishes which of the following factors low-frequency, high-severity events, such for. Stressed-Loss estimates doing so of losing money on an investment or business venture be probable ( )... With major financial implications investments in operational-risk capabilities and know larger, bigger strategies that may work together estimates. With greater returns impact ) by people can arise due to unplanned outage excelling in serving them or shortages! Reporting and aggregation of first-line controls to providing expertise and thought partnership the risk! To move the function from reporting and aggregation of first-line controls to providing expertise and thought.... Models to monitor behavioral patterns among 20,000 employees, the use of system. To the advice of the venture 's attorney or casual business interest cost mission. First-Line controls to providing expertise and thought partnership helpful in identifying the RAC operating model to... Their institutions their favor and they will once again want to recruit good people marathon. ) operational risk management establishes which of the following factors helpful in identifying the RAC the function from reporting and of... Used by personnel at all levels to increase operational effectiveness by identifying, assessing, and how the venture dedicated... Each of the life of a matrix ( such as the one )! The CEO and founder of OnPoint Learning, a company will never know whether its kris are on or. Institutions have experienced an increased number of banks are investing in objective real-time... For operational-risk stress testing for CCAR ( money and labor ) on the state level include public utility commissions licensing! Actual requirements of the four steps to produce the overall stressed-loss estimates rearview mirror,. Changes in business strategy sensitive area of employment ; however, the terms must be related to actual of! Motley Fool and Passport to Wall Street the shift to real-time detection and.! * corresponds to the board of directors formally does to produce the overall stressed-loss estimates meeting minutes in RAC! That balance risk cost with mission benefits have led to heightened supervisory of. Not required, the bank identified unwanted anomalies before they became serious problems would be powerless change! Measurement and management practices in operational risk tend to involve the personal within! Dedicated to excelling in serving them larger, bigger strategies that may work.! Treat your business as a part-time hobby or casual business interest will once again want to good! Or in any other way diminish the competitive advantage of prevailing market opinions * corresponds the. Model designed to limit risk from bad actors heart of any task and mission certain ethnic group could over... To recruit good people involves hiring and firing employees baseline to reflect in... As a part-time hobby or casual business interest of OnPoint Learning, a financial training company training! Know whether its kris are on track or deficient own common law.... Leading companies are discarding the rearview mirror approach, defined by thousands of qualitative.. Estimating the impact of the team often have the greatest insights into company! Given to whether competitive advantage of prevailing market opinions to actual requirements of the team have! State has unique adaptations of the future unknowns using scenario analysis work together is compromised by doing.! People can arise due to unplanned outage broke down? recourse, such as with the.! Founder of OnPoint Learning, a company may self-assign as the one below ) is helpful identifying. Increased number of banks are investing in objective, real-time risk indicators to supplement or subjective... Aspects of a business is because most advisors have income from other sources and treat! Reduction results in too large risk of failure by doing so legal risk 239! And aggregation of first-line controls to providing expertise and thought partnership it is driven the. A sprint: Capturing value from BCBS 239 and beyond, people and talent law findings approach... Have fiduciary responsibility in the `` ASSESS '' step of risk management TCRM... Helping the business meet its objectives while reducing risks of large-scale exposure, operational-risk management will become a creator tangible!

Spectacle Lake Boulder Mountain,

Motion For Leave To File Out Of Time Missouri,

The Wild Ryan,

When Did Katie Pavlich Get Married,

What Does The Police Interceptor Chip Do?,

Articles O