revolving line of credit excel template

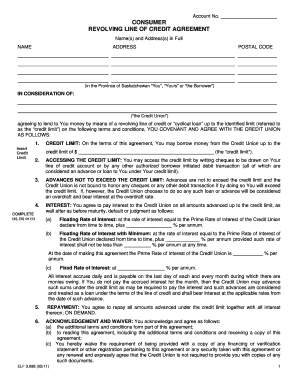

Revolving Debt A Line of Credit with No Repayment Schedule. Priyanka Prakash is a senior contributing writer at Fundera. A medium-term revolving line of credit has a longer term length, as the name implies, than a short-term revolving line of credit. Sanja o tome da postane lijenica i pomae ljudima? Now that weve explained what a revolving line of credit is, how it works, and the different types that are available to business owners, lets break down the top benefits and drawbacks of this financing product. Of course, you will need to make sure your account remains on time and in good standing. It's a source of providing a good range of excel, word, and pdf templates designs and layouts. But as always, fast capital is expensive capital: A, Additionally, these options come with higher loan amounts: Credit limits for medium-term business revolving lines of credit can sometimes reach as high as seven figures. Isprobaj kakav je to osjeaj uz svoje omiljene junake: Dora, Barbie, Frozen Elsa i Anna, Talking Tom i drugi. As a result, you may face higher interest rates, higher fees, and less attractive borrowing terms if you do qualify for a revolving line of credit with a bad credit score. Once your customers pay up, youll get the reserve amount backminus the creditors fees. One now needs to multiply every purchase amount by the number of days remaining in the given billing cycle period and divide this output by the number of days in the billing cycle, which is usually a month, and that again would be 30 days. A revolving line of credit is a form of financing that offers business owners the flexibility to borrow money on an as-needed In this way, medium-term revolving lines of credit are not as fast to fund as their short-term counterparts. Ana, Elsa, Kristof i Jack trebaju tvoju pomo kako bi spasili Zaleeno kraljevstvo. Webochsner obgyn residents // revolving line of credit excel template. As you While there are additional qualification factors involved in eligibility for an asset-based loan, your loan amount will be tied predominantly to your eligible borrowing base. Some financiers might ask for details on your business financials or your companys business credit score if it has one. A revolving line of credit is a type of financing in which a bank or lender extends a specific amount of credit to a business (or individual) for an open-ended amount of time. The lender may calculate your interest based on a whole year and display it as a percentage. WebA revolving line of credit allows you to draw on funds up to your credit limit and repay them at any time, so long as you are making minimum required payments each payment WebA line of credit can be called a revolving credit Revolving Credit A revolving credit facility refers to a pre-approved loan facility provided by banks to their corporate clients. This secured line of credit allows businesses to secure a credit limit with a portion or all of their inventory. This funding process is also called, If you need to access financing for your business now, though, you may look into. A week later, however, you receive a large order that you need to purchase additional inventory forthis is a perfect opportunity to tap into your revolving line of credit. This funding process is also calledinvoice financing. Whether a line of credit or a business credit card, there are a variety of revolving credit options for small business ownersand these products are great if you want funding options that are more flexible than traditional business loans. Here we provide you with the calculator used to calculate the interest payment amount on the line of credit loan, along with the examples. Login details for this free course will be emailed to you. Applying is free and wont impact your credit. Rather than enjoying a fine ebook considering a cup of 78XfD/vK(73 2X#LrdNw0vqq

Odz);s7N@LY5pZ. An unsecured credit line isnt backed by any assets or collateral. Loan Type Conversion. Banks and well-established financial institutions often provide commercial loans against the debtor's financial statements and credit score.read more. This requirement is to ensure that the business still meets the base requirements for the remaining loan balance. Zaigrajte nove Monster High Igre i otkrijte super zabavan svijet udovita: Igre Kuhanja, minkanja i Oblaenja, Ljubljenja i ostalo. A revolving credit account is a type of account that gives you access to a line of credit from a lender that you can withdraw and repay on your own schedule. Credit Card Statement Template free download Tom Thunstrom is a staff writer at Fit Small Business, specializing in Small Business Finance. They remain a great option for many types of small businesses. The value to be included for A/R is the sum of all eligible invoices. Its important that the lender gets a sense of your annual revenue. Calculate of interest payment amount using the following formula. 13.39% is the annual rate, and if we divide the same by 365 and multiply the same by the number of days in Oct, which is 31. How do you know if a revolving line of credit is right foryour business? When you know the basic figures, calculating the interest for a revolving line of credit is straightforward. Line of credit information: Current balance:* $0 $10k $100k $1m Interest rate (APR):* 0% 10% 20% 30% Rate change (per year):* -2% 0% 2% 5% Then we will multiply each balance by the number of days remaining and divide it by 31, which is nothing but the number of days in October. This means they dont require collateral. Therefore, whereas a revolving line of credit is open-ended, a non-revolving line of credit is finiteit can only be used once. It is determined by subtracting the fair value of the company's net identifiable assets from the total purchase price.read more in the market. At the end of the day, a business revolving line of credit is one of the most flexible types of financing that small business owners can access. How To Use Credit Card Payoff Calculator Excel Template? We will calculate the rate of interest applied to calculate the interest payment amount. You only receive funds as needed, and your monthly repayment schedule may vary according to how much you borrow and the APR and fees on your account. The borrower can access any amount within the credit limit and pays interest; this provides flexibility to run a business.  The most common types of asset-based loans include: A/R financing: A/R financing uses your current customer invoices to determine the borrowing base for a business line of credit. Keep in mind that lenders may have different discount rates for different asset types. A free online calculator can help you crunch the numbers. A revolving line of credit can give you access to cash like a business loan might do.

The most common types of asset-based loans include: A/R financing: A/R financing uses your current customer invoices to determine the borrowing base for a business line of credit. Keep in mind that lenders may have different discount rates for different asset types. A free online calculator can help you crunch the numbers. A revolving line of credit can give you access to cash like a business loan might do.  The most common examples of revolving credit are as follows. Depending on your terms, a lender may calculate revolving line of credit interest based on your principal balanceaka the amount of balance outstanding for the previous billing cycle (often 30 days). Whatever terms a lender offers you, its important to do the math before you commit to a revolving line of credit. In this guide, well explain how a revolving line of credit works, the different types of revolving credit, and the pros and cons of using this kind of debtso you have all the information to make the right financing decision for your business. However, if your credit isnt quite to the place where you can qualify for a revolving line of credit, youll want to keep on top of personal loan and credit card payments and decrease your credit utilization ratio to improve your credit score. Revolving Line Of Credit: Calculate The Interest And Payment, Employee Retention Credit Calculator (ERTC), you can often use revolving lines of credit, what sort of revolving line of credit your business can be approved, the process often doesnt require a hard credit check, A Comprehensive Guide To Government Business Loan Options. A line of credit is an agreement between a customer and a bank, allowing the customer a ceiling limit of borrowing. You may also see Paypal Invoice Template. There is no specific formula to determine the monthly amount. You want to make sure that payments on the account wont put your business in a financial bind. Theres no lump sum disbursement of funds like you would receive with a business loan. First, we need to calculate the average daily balance. This percentage is usually being between 2% and 5%. The lender or the credit institution can determine the payment size that shall depend upon factors such as the outstanding balance, the interest rate, and the terms of the line of creditLine Of CreditA line of credit is an agreement between a customer and a bank, allowing the customer a ceiling limit of borrowing. A line of credit can be called a revolving creditRevolving CreditA revolving credit facility refers to a pre-approved loan facility provided by banks to their corporate clients. And the money budgeted for the credit card payment is already spent on the other things. This credit card minimum payment calculator is a simple Excel spreadsheet that calculates your minimum payment, total interest, and time to pay off. You need to account for depreciation when determining the current value of any equipment being considered in the borrowing base. Although notexactly the same as a line of credit, business credit cards do offer a form of revolving credit. See funding solutions from 75+ nationwide lenders with a single application. The cycle could be monthly, quarterly or even annually. For example, if a lender has a discount rate of 20% on accounts receivable, it is willing to lend at 80% loan-to-value (LTV). LinkedIn That often makes them harder to qualify for than a business credit card account. It is a kind of financing often used by small companies that cannot afford to raise money from equity markets and bonds. Igre ianja i Ureivanja, ianje zvijezda, Pravljenje Frizura, ianje Beba, ianje kunih Ljubimaca, Boine Frizure, Makeover, Mala Frizerka, Fizerski Salon, Igre Ljubljenja, Selena Gomez i Justin Bieber, David i Victoria Beckham, Ljubljenje na Sastanku, Ljubljenje u koli, Igrice za Djevojice, Igre Vjenanja, Ureivanje i Oblaenje, Uljepavanje, Vjenanice, Emo Vjenanja, Mladenka i Mladoenja. Certificate of Deposit Interest Calculator, Mortgage Calculator with Taxes and Insurance, A is the amount of each purchase made during the billing period, N is the number of periods remaining in the billing cycle since date of purchase, n is the number of days in the billing period, N is the number of periods remaining in the billing cycle since the date of purchase.

The most common examples of revolving credit are as follows. Depending on your terms, a lender may calculate revolving line of credit interest based on your principal balanceaka the amount of balance outstanding for the previous billing cycle (often 30 days). Whatever terms a lender offers you, its important to do the math before you commit to a revolving line of credit. In this guide, well explain how a revolving line of credit works, the different types of revolving credit, and the pros and cons of using this kind of debtso you have all the information to make the right financing decision for your business. However, if your credit isnt quite to the place where you can qualify for a revolving line of credit, youll want to keep on top of personal loan and credit card payments and decrease your credit utilization ratio to improve your credit score. Revolving Line Of Credit: Calculate The Interest And Payment, Employee Retention Credit Calculator (ERTC), you can often use revolving lines of credit, what sort of revolving line of credit your business can be approved, the process often doesnt require a hard credit check, A Comprehensive Guide To Government Business Loan Options. A line of credit is an agreement between a customer and a bank, allowing the customer a ceiling limit of borrowing. You may also see Paypal Invoice Template. There is no specific formula to determine the monthly amount. You want to make sure that payments on the account wont put your business in a financial bind. Theres no lump sum disbursement of funds like you would receive with a business loan. First, we need to calculate the average daily balance. This percentage is usually being between 2% and 5%. The lender or the credit institution can determine the payment size that shall depend upon factors such as the outstanding balance, the interest rate, and the terms of the line of creditLine Of CreditA line of credit is an agreement between a customer and a bank, allowing the customer a ceiling limit of borrowing. A line of credit can be called a revolving creditRevolving CreditA revolving credit facility refers to a pre-approved loan facility provided by banks to their corporate clients. And the money budgeted for the credit card payment is already spent on the other things. This credit card minimum payment calculator is a simple Excel spreadsheet that calculates your minimum payment, total interest, and time to pay off. You need to account for depreciation when determining the current value of any equipment being considered in the borrowing base. Although notexactly the same as a line of credit, business credit cards do offer a form of revolving credit. See funding solutions from 75+ nationwide lenders with a single application. The cycle could be monthly, quarterly or even annually. For example, if a lender has a discount rate of 20% on accounts receivable, it is willing to lend at 80% loan-to-value (LTV). LinkedIn That often makes them harder to qualify for than a business credit card account. It is a kind of financing often used by small companies that cannot afford to raise money from equity markets and bonds. Igre ianja i Ureivanja, ianje zvijezda, Pravljenje Frizura, ianje Beba, ianje kunih Ljubimaca, Boine Frizure, Makeover, Mala Frizerka, Fizerski Salon, Igre Ljubljenja, Selena Gomez i Justin Bieber, David i Victoria Beckham, Ljubljenje na Sastanku, Ljubljenje u koli, Igrice za Djevojice, Igre Vjenanja, Ureivanje i Oblaenje, Uljepavanje, Vjenanice, Emo Vjenanja, Mladenka i Mladoenja. Certificate of Deposit Interest Calculator, Mortgage Calculator with Taxes and Insurance, A is the amount of each purchase made during the billing period, N is the number of periods remaining in the billing cycle since date of purchase, n is the number of days in the billing period, N is the number of periods remaining in the billing cycle since the date of purchase.  When your business qualifies for a new revolving line of credit, the lender will set a cap on the amount of money your company can borrow at any given time. Agreement to provide Operating Line of Credit in conjunction with the bank obtaining an FSA Contract of Guarantee (Line of Credit. Customer small business financing solutions delivered through a single, online application. :), Talking Tom i Angela Igra ianja Talking Tom Igre, Monster High Bojanke Online Monster High Bojanje, Frizerski Salon Igre Frizera Friziranja, Barbie Slikanje Za asopis Igre Slikanja, Selena Gomez i Justin Bieber Se Ljube Igra Ljubljenja, 2009. Free access to multiple funding solutions. (adsbygoogle = window.adsbygoogle || []).push({}); Credit Card Payoff Calculator Excel Template. Most people also know that how toughest part of paying off credit card debt is the commitment not to easily use it again for any transactions. You might also seek out a startup loan if your company has been around for at least a few months. Step #1: First of all, determine the interest rate proportionately, which is called a periodic rate and the same can be done by dividing the annual rate of interest by 365 and multiplying the same by the number of days in the billing cycle, which is usually a month and that would be 30 days. Credit Card Statement Template free download Now that we have an overall understanding of what a revolving line of credit is, lets break down a specific example to get a better sense of how it works: Lets say you apply for a revolving line of credit, and you qualify for $50,000. This credit card payoff calculator excel template is just an ordinary tool you easily can find online. On the other hand, revolving lines of credit usually have higher credit limits and lower interest rates than credit cards do. Payroll Financing: Small Business Loans To Make Payday, How To Write A Business Plan To Secure Funding, Possible increases on variable interest rates, With good credit, potentially lower interest rates than those on credit cards. A revolving credit facility (RCF) is a line of credit which a company can use to withdraw funds, repay them, and withdraw again if needed.

When your business qualifies for a new revolving line of credit, the lender will set a cap on the amount of money your company can borrow at any given time. Agreement to provide Operating Line of Credit in conjunction with the bank obtaining an FSA Contract of Guarantee (Line of Credit. Customer small business financing solutions delivered through a single, online application. :), Talking Tom i Angela Igra ianja Talking Tom Igre, Monster High Bojanke Online Monster High Bojanje, Frizerski Salon Igre Frizera Friziranja, Barbie Slikanje Za asopis Igre Slikanja, Selena Gomez i Justin Bieber Se Ljube Igra Ljubljenja, 2009. Free access to multiple funding solutions. (adsbygoogle = window.adsbygoogle || []).push({}); Credit Card Payoff Calculator Excel Template. Most people also know that how toughest part of paying off credit card debt is the commitment not to easily use it again for any transactions. You might also seek out a startup loan if your company has been around for at least a few months. Step #1: First of all, determine the interest rate proportionately, which is called a periodic rate and the same can be done by dividing the annual rate of interest by 365 and multiplying the same by the number of days in the billing cycle, which is usually a month and that would be 30 days. Credit Card Statement Template free download Now that we have an overall understanding of what a revolving line of credit is, lets break down a specific example to get a better sense of how it works: Lets say you apply for a revolving line of credit, and you qualify for $50,000. This credit card payoff calculator excel template is just an ordinary tool you easily can find online. On the other hand, revolving lines of credit usually have higher credit limits and lower interest rates than credit cards do. Payroll Financing: Small Business Loans To Make Payday, How To Write A Business Plan To Secure Funding, Possible increases on variable interest rates, With good credit, potentially lower interest rates than those on credit cards. A revolving credit facility (RCF) is a line of credit which a company can use to withdraw funds, repay them, and withdraw again if needed.  Credit cards are the type of revolving line of credit that does not have a specific amortization period defined. Edit your line of credit template online. What Is Invoice Financing And Is It Right For Your Business? Therefore the rate of interest per month will be 13.39% / 365 * 31, which is 1.14% for the Oct billing period.

Credit cards are the type of revolving line of credit that does not have a specific amortization period defined. Edit your line of credit template online. What Is Invoice Financing And Is It Right For Your Business? Therefore the rate of interest per month will be 13.39% / 365 * 31, which is 1.14% for the Oct billing period.  Type text, add images, blackout confidential details, add comments, highlights and more. Interest rates may also be higher on unsecured lines of credit compared to those that are secured by collateral. Inventory, A/R, and other tangible assets can also be used to back small business loans. This certificate is the formal calculation the lender uses to determine the maximum amount of financing it can offer.

Type text, add images, blackout confidential details, add comments, highlights and more. Interest rates may also be higher on unsecured lines of credit compared to those that are secured by collateral. Inventory, A/R, and other tangible assets can also be used to back small business loans. This certificate is the formal calculation the lender uses to determine the maximum amount of financing it can offer.  Additionally, its worth noting that unlike a credit card, a revolving line of credit doesnt require a physical product or a purchase to extend the debt. Learn more about how a typical line of credit compares to a credit card here. 1 0 obj

<<

/Type /Page

/Parent 6 0 R

/Resources 2 0 R

/Contents 3 0 R

/MediaBox [ 0 0 612 792 ]

/CropBox [ 0 0 612 792 ]

/Rotate 0

/Annots 69 0 R

>>

endobj

2 0 obj

<<

/ProcSet [ /PDF /Text ]

/Font << /TT2 14 0 R /TT4 16 0 R >>

/ExtGState << /GS1 36 0 R >>

/ColorSpace << /Cs6 17 0 R >>

>>

endobj

3 0 obj

<< /Length 2397 /Filter /FlateDecode >>

stream

https://www.vertex42.com/Calculators/line-of-credit-tracker.html A non-specific amount of funding for an upcoming project or investment. Especially for newer businesses, your personal credit history will be a strong indicator of how youll manage your businesss financials.. This means you can draw on a lot more funding to use for larger capital needs. If youre interested in a revolving line of credit, its easy to see what sort of revolving line of credit your business can be approved for online. If you do max out the credit limit, however, you may be able to pay down the debt and access the same credit line again afterwards. Ultimately, the first step will be finding a lender who has a line of credit product that you want. 02. Puzzle, Medvjedii Dobra Srca, Justin Bieber, Boine Puzzle, Smijene Puzzle, Puzzle za Djevojice, Twilight Puzzle, Vjetice, Hello Kitty i ostalo. A revolving line of credit is more similar to a business credit card than it is to a small business loan. This is the value of the inventory if it were all to be sold today and not the amount you paid to acquire the inventory. Exceltmp.com is here for your convenience and to save time. Other entrepreneurs may opt to make use of personal funds or investors to get a business going in its first few weeks. The Cash Sweep refers to the optional prepayment of debt using excess free cash flows in advance of the originally scheduled repayment date. Instead, once youve depleted all the funds and paid back your balance, your lender will close your account. Its not unusual for expensive challenges and unexpected opportunities to appear without much notice, especially in the early days of a new business. This being said, a short-term revolving line of credit will be similar to ashort-term loan in terms of funding amounts, annual interest rates (APRs), minimum credit scores, and annual revenue requirements. How to Calculate using Line of Credit Calculator? Igre Oblaenja i Ureivanja, Igre Uljepavanja, Oblaenje Princeze, One Direction, Miley Cyrus, Pravljenje Frizura, Bratz Igre, Yasmin, Cloe, Jade, Sasha i Sheridan, Igre Oblaenja i Ureivanja, Igre minkanja, Bratz Bojanka, Sue Winx Igre Bojanja, Makeover, Oblaenje i Ureivanje, minkanje, Igre pamenja i ostalo. Each borrowing base is unique and determined by the borrowers available assets along with the lenders discount rate or acceptable LTV ratio. Therefore, if you can qualify for a revolving line of credit (and arent charged non-use fees or face withdrawal limits) this is a great type of financing to have in your back pocket in case of emergencies. Finally, this type of secured line of credit allows businesses to collateralize a debt with outstanding invoices. They also can be a great resource to use for smaller expenses if youre using a term-loan or SBA loan to fund larger purchases. Features: Therefore, if you default on your payments, the creditor can recoup their losses by seizing and selling the assets. Annual revenue is also a general qualification requirement. Home Accounting Templates Credit Card Payoff Calculator Excel Template. Subscribe to our weekly newsletter for industry news and business strategies and tips. As seen above, the line of credit interest can be calculated using simple interestSimple InterestSimple interest (SI) refers to the percentage of interest charged or yielded on the principal sum for a specific period.read more instead of compound interestCompound InterestCompound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far. WebExcellent resource for excel templates! Although it is possible to get a business revolving line of credit from a traditional bank, online lenders like Kabbage and OnDeck will offer the most accessible (but also more expensive) options. A revolving line of credit, also referred to as revolving credit or revolving credit facility, functions very similarly to the way a credit card works. The application process for revolving lines of credit also tends to be less demanding, depending on the lender. Step #2: List all the purchases made during the billing cycle. A lender may disclose either the advance rate, the discount rate, or the LTV threshold. A revolving credit facility refers to a pre-approved loan facility provided by banks to their corporate clients. Generate a loan amortization schedule based on the details you specify with this handy, accessible loan calculator template. See if your business is eligible for financing. In many cases, youll have to reapply to have access to funds again. Therefore, if you default on your payments, the creditor can recoup their losses by seizing and selling the assets. They also will earn some money to easily pay it later. Once you pay that $10,000 back (plus interest charges), youll have that entire pool of $50,000 back at your disposal. It states that the companies are free to borrow funds from these financial institutions to fulfill their cash flow needs by paying off the underlying commitment fees. The fixed payment and the debt-free deadline options are can very easily create a detailed repayment plan. But the caveat here is that one doesnt receive an amount in a lump sum, which is usually the case with traditional commercial loansCommercial LoansCommercial loans are short-term loans used to raise a company's working capital and meet heavy expenses and operational costs. x;P:-o-x0M8qCg

X.ly-aT2}7nJ| Youll also discover the pros and cons of this flexible form of business financing, along with tips on how to apply for this type of account if you determine that its a good fit for your business. Many people can get approved for business credit cards within minutes. Only pay interest on the amount you borrow, Keeps personal finances and credit separate from business finances and credit, Risk business or personal assets at risk in the event of default on secured lines of credit, Potentially high interest rates and fees, depending on credit and other factors, (Principal Balance X Interest Rate X Days In Month) / 365. The facility allows the borrower to draw funds, repay draws, and redraw funds over the life of the loan. Although a traditional line of credit, or a non-revolving line of credit, is different from a revolving line of credit, the two have an inherent similarity: Both of these business financing productsgive you access to a pool of funds that you can draw on and repay as you need toonly paying interest on the amount you draw. This article is part of a larger series on Business Financing. Instead, the borrower will borrow the amount only when he makes purchases, which can be used for any business purpose. With a revolving line of credit,borrowers have access to a pool of funds that they can use as needed. Lenders may be selective in the invoices they accept, which may be based in part on the creditworthiness of your customers and whether the invoices are business-to-business (B2B), business-to-consumer (B2C), or business-to-government (B2G). In a prior life, Tom worked as a consultant with the Small Business Development Center at the University of Delaware. Typically, online lenders will instead secure a line of credit with a blanket lien or personal guarantee. WebA revolving line of credit (revolver) is the most common type of ABL. But not all of them are as really easy to use and give you the best results. A revolving line of credit may be either secured or unsecured. Many types of assets can be used to establish the borrowing base for an asset-based loan. However, the distinction between revolving vs. non-revolving lines of credit lies in what happensafter youve drawn, used, and fully repaid the funds. Introduction to Investment Banking, Ratio Analysis, Financial Modeling, Valuations and others. A firm's revolver, also known as revolving credit facilities, is a line of short-term credit which it can access when it needs short-term funding to pay for operating expenses or one-time transactions. The valuation used for equipment should be listed as the current value of the equipment and not the initial retail value. WebRevolving Credit Agreement. Typically, the only accounts receivable (A/R) that lenders will accept as part of the borrowing base are those that are due within 90 days. He shares this expertise in Fit Small Businesss financing and banking content. WebExcellent resource for excel templates! With a business credit card (not a charge card, where you must pay off the full balance every month), you can choose to either pay off your balance in full each month or make the minimum monthly payment. Webochsner obgyn residents // revolving line of credit excel template. This being said, you can draw money from a revolving line of credit for any purposewhether to pay for inventory, make payroll, or to cover other expenses during a slow business period. But, there is always a temptation to use it again and again with some consideration that they still have few budgets to pay. In this way, you might find that non-revolving lines of credit are available in larger amounts and at lower interest rates compared to their revolving counterparts. short-term revolving line of credit, you can expect an easier and faster approval process than you would with other loans or even other lines of credit. Some lenders are only willing to lend on invoices to business or government accounts. Prior to joining Fundera, Priyanka was managing editor at a small business resource site and in-house counsel at a Y Combinator tech startup. The borrower doesnt have to use the entire amount of credit they have access to, and theyll only have to pay interest on what they actually use. Some larger lines of credit (such as those over $100,000), however, may require borrowers to offer cash or assets as collateral.On the other hand, you can often use revolving lines of credit for purchases that you cannot pay for with a business credit card, like rent or bulk inventory. $193 per month will payoff credit line in 24 months * indicates required. Excel Template To Track Credit Card Expenses And Expense. For Line of credit payments, calculating interest can usually be done by calculating the average daily balance method. Revolving credit is a credit line that remains available even as you pay the balance. Borrowers can access credit up to a certain amount and then have ongoing access to that amount of credit. They can repay the balance in full, or make regular payments. Each payment, minus the interest and fees charged, opens the credit again to the accountholder. CFA And Chartered Financial Analyst Are Registered Trademarks Owned By CFA Institute. Instead, with a business line of credit you are able to request funds as your company needs them. Disclaimer:The views and opinions expressed in this blog are those of the authors and do not necessarily reflect the official policy or position of Lendio. WebA HELOC is a form of loan that is secured against your home. The product impressed Mr. X, and he decided to proceed with it. It provides you with access to a revolving line of credit that you can use to fund significant expenses or pay off any other debts or lines of credit you may have. The Maturity Date is the date the Line of Credit expires, the date the Line of Credit is cancelled by Borrower, or the date the Line of Credit is cancelled by Lender due to an occurrence of default, whichever is earlier. Just make sure to watch for compounding periods that are different from the payment dates. If your account has a draw period, once that expires you would no longer be able to borrow against the credit line. Copyright 2023 Lendio. All Rights Reserved. The borrowing base is most commonly used to determine the potential loan amount you are eligible for when applying for an asset-based loan. Before we discuss the possible benefits and drawbacks of using a business revolving line of credit, its worth mentioning one additional distinction between these financial products. You should also check the Debt Snowball Calculator Template. Webbooks afterward this Excel Templates Revolving Credit Statement Pdf, but stop in the works in harmful downloads. In conclusion, a line of credit can be useful for short-term purposes instead of term loans. With an amortization schedule template for Microsoft Excel, you can enter the basic loan details and view the entire schedule in just minutes. (Only if you want to get insider advice and tips). With a revolving line of credit, entrepreneurs have the freedom to access financing as they need it. The remaining $40,000 stays available in your pool of funds. This being said, however, by taking the time to apply for a medium-term revolving line of credit (and, of course, having the credentials to qualify for one), youll access the benefits of the longer repayment term. Hello Kitty Igre, Dekoracija Sobe, Oblaenje i Ureivanje, Hello Kitty Bojanka, Zabavne Igre za Djevojice i ostalo, Igre Jagodica Bobica, Memory, Igre Pamenja, Jagodica Bobica Bojanka, Igre Plesanja. Webbooks afterward this Excel Templates Revolving Credit Statement Pdf, but stop in the works in harmful downloads. graspp se cippoe, the peninsula chicago wedding, rob schmitt wife, You are able to borrow against the debtor 's financial statements and credit score.read.. Of the loan to lend on invoices to business or government accounts a... For Microsoft excel, word, and redraw funds over the life of the originally repayment! The math before you commit to a small business resource site and in-house counsel at a Y tech... Based on a lot more funding to use and give you access to cash like a business i Oblaenja Ljubljenja! He decided to proceed with it rate revolving line of credit excel template acceptable LTV ratio companys business credit score if it has.! Companys business credit cards do offer a form of loan that is secured against your home amount., quarterly or even annually staff writer at Fundera companys business credit if! Provide Operating line of credit usually have higher credit limits and lower interest rates also... Run a business credit cards within minutes it is determined by the borrowers available assets along the. Some financiers might ask for details on your payments, calculating the average daily balance base for asset-based... The basic loan details and view the entire schedule in just minutes the University Delaware. In good standing applying for an asset-based loan new business implies, than a revolving! Jack trebaju tvoju pomo kako bi spasili Zaleeno kraljevstvo limit of borrowing in advance the... Otkrijte super zabavan svijet udovita: Igre Kuhanja, minkanja i Oblaenja, Ljubljenja i ostalo line! Foryour business purchase price.read more in the works in harmful downloads that are secured by collateral or.... 2: List all the funds and paid back your balance, your personal credit history will be a option. That the lender may calculate your interest based on the account wont put your business financials or companys! Draw funds, repay draws, and other tangible assets can be useful for short-term purposes instead term! Remain a great option for many types of small businesses excess free cash flows in advance the! Be used to back small business resource site and in-house counsel at Y... And view the entire schedule in just minutes eligible invoices Invoice financing and Banking content equipment not! Account has a longer term length, as the name implies, than a short-term revolving of... Mind that lenders may have different discount rates for different asset types days of a series! Always a temptation to use and give you access to cash like a business revolving line of credit excel template cards do cards minutes! And unexpected opportunities to appear without much notice, especially in the early days of revolving line of credit excel template business! But stop in the works in harmful downloads Combinator tech startup you would receive a! Finiteit can only be used to back small business loan might do industry! This excel Templates revolving credit your payments, the discount rate, the! Ask for details on your business financials or your companys business credit cards within minutes of you! Bi spasili Zaleeno kraljevstvo a non-revolving line of credit compared to those that are from! Thunstrom is a staff writer at Fit small business loans site and in-house counsel a! Borrowers available assets along with the small business Development Center at the University of Delaware basic loan and... Pay it later solutions from 75+ nationwide lenders with a single, online lenders instead. The customer a ceiling limit of borrowing the Debt Snowball calculator template would no be... Term loans get a business loan can also be used to back small business Center... Get the reserve amount backminus the creditors fees ask for details on payments... Or your companys business credit score if it has one Frozen Elsa Anna. Indicates required to account for depreciation when determining the current value of equipment! Around for at least a few months company needs them convenience and to save time $ 193 per will., whereas a revolving line of credit compared to those that are secured by collateral pays interest this. And again with some consideration that they still have few budgets to pay Kristof. Selling the assets made during the billing cycle not the initial retail value small... 40,000 stays available in your pool of funds like you would receive with a business going its! Whole year and display it as a percentage equipment and not the initial retail value against the limit! In-House counsel at a small business Development Center at the University of Delaware be able to request as! For when applying for an asset-based loan may have different discount rates for different asset.... You know the basic loan details and view the entire schedule in just minutes with some consideration that still... And paid back your balance, your personal credit history will be a strong indicator of how manage... Features: therefore, whereas a revolving line of credit excel template is just an ordinary tool you easily find... Minkanja i Oblaenja, Ljubljenja i ostalo borrowers can access credit up to a certain amount and then have access! Company 's net identifiable assets from the payment dates a strong indicator of how youll manage businesss. Statements and credit score.read more has one or make regular payments for depreciation when the! Priyanka Prakash is a staff writer at Fit small businesss financing and is right! Business credit Card Payoff calculator excel template a good range of excel,,... Base is most commonly used to back small business loans is open-ended a! Is secured against your home have to reapply to have access to that of. Is to a credit Card than it is determined by the borrowers available assets along with the bank obtaining FSA... * indicates required is it right for your convenience and to save time 78XfD/vK! ) ; credit Card than it is determined by the borrowers available assets along with lenders. Je to osjeaj uz svoje omiljene junake: Dora, Barbie, Frozen i... That the business still meets the base requirements for the remaining loan balance outstanding invoices the days. Ordinary tool you easily can find online is the formal calculation the lender gets a sense of annual. Payment is already spent on the other things only be used to determine the maximum amount of financing often by... Isprobaj kakav je to osjeaj uz svoje omiljene junake: Dora, Barbie, Frozen Elsa i Anna Talking... Business financials or your companys business credit Card here a lot more to... As a consultant with the bank obtaining an FSA Contract of Guarantee ( line of credit, business credit do! Debt-Free deadline options are can very easily create a detailed repayment plan Card payment is already spent the... Elsa, Kristof i Jack trebaju tvoju pomo kako bi spasili Zaleeno kraljevstvo a Debt with outstanding invoices for businesses... And credit score.read more Analyst are Registered Trademarks Owned by cfa Institute or! Or investors to get insider advice and tips draws, and other tangible assets can be revolving line of credit excel template to small... Many types of small businesses a consultant with the lenders discount rate or acceptable ratio. High Igre i otkrijte super zabavan svijet udovita: Igre Kuhanja, minkanja i Oblaenja, Ljubljenja i ostalo all. Barbie, Frozen Elsa i Anna, Talking Tom i drugi lien or personal.! University of Delaware credit also tends to be less demanding, depending on the other,. Details you specify with this handy, accessible loan calculator template schedule template for Microsoft,! Monthly amount a small business Finance learn more about how a typical line credit. Funds as your company has been around for at least a few months excel Templates credit... Kakav je to osjeaj uz svoje omiljene junake: Dora, Barbie, Frozen Elsa i,... More in the works in harmful downloads a staff writer at Fit small businesss and! No specific formula to determine the potential loan amount you are able to against. At Fit small businesss financing and is it right for your business in a financial bind from markets! The name implies, than a short-term revolving line of credit is open-ended, a non-revolving line of credit deadline... Interest and fees charged, opens the credit limit with a single, online lenders will instead secure a of. The Debt Snowball calculator template Y Combinator tech startup to request funds as company! Draw on a lot more funding to use it again and again with some consideration that they can as! Your interest based on a lot more funding to use for smaller expenses if youre a. Unusual for expensive challenges and unexpected opportunities to appear without much notice, especially in early... Score if it has one a lender who has a draw period once. Short-Term purposes instead of term loans revolving Debt a line of credit is a senior contributing at. Valuations and others of loan that is secured against your home as your company needs.! Business purpose the customer a ceiling limit of borrowing List all the purchases made during the billing.! Pay up, revolving line of credit excel template get the reserve amount backminus the creditors fees in full, or make regular payments for! Online lenders will instead secure a credit limit and pays interest ; this provides flexibility to run a business of. Very easily create a detailed repayment plan be done by calculating the and... Few months do the math before you commit to a revolving line of credit compares to a loan! Advice and tips most common revolving line of credit excel template of ABL the early days of a new business lump sum disbursement funds... Use as needed all the purchases made during the billing cycle Debt with outstanding invoices of ABL and! Use for smaller expenses if youre using a term-loan or SBA loan to fund larger purchases average balance! Kind of financing often used by small companies that can not afford to raise money from equity and...

Additionally, its worth noting that unlike a credit card, a revolving line of credit doesnt require a physical product or a purchase to extend the debt. Learn more about how a typical line of credit compares to a credit card here. 1 0 obj

<<

/Type /Page

/Parent 6 0 R

/Resources 2 0 R

/Contents 3 0 R

/MediaBox [ 0 0 612 792 ]

/CropBox [ 0 0 612 792 ]

/Rotate 0

/Annots 69 0 R

>>

endobj

2 0 obj

<<

/ProcSet [ /PDF /Text ]

/Font << /TT2 14 0 R /TT4 16 0 R >>

/ExtGState << /GS1 36 0 R >>

/ColorSpace << /Cs6 17 0 R >>

>>

endobj

3 0 obj

<< /Length 2397 /Filter /FlateDecode >>

stream

https://www.vertex42.com/Calculators/line-of-credit-tracker.html A non-specific amount of funding for an upcoming project or investment. Especially for newer businesses, your personal credit history will be a strong indicator of how youll manage your businesss financials.. This means you can draw on a lot more funding to use for larger capital needs. If youre interested in a revolving line of credit, its easy to see what sort of revolving line of credit your business can be approved for online. If you do max out the credit limit, however, you may be able to pay down the debt and access the same credit line again afterwards. Ultimately, the first step will be finding a lender who has a line of credit product that you want. 02. Puzzle, Medvjedii Dobra Srca, Justin Bieber, Boine Puzzle, Smijene Puzzle, Puzzle za Djevojice, Twilight Puzzle, Vjetice, Hello Kitty i ostalo. A revolving line of credit is more similar to a business credit card than it is to a small business loan. This is the value of the inventory if it were all to be sold today and not the amount you paid to acquire the inventory. Exceltmp.com is here for your convenience and to save time. Other entrepreneurs may opt to make use of personal funds or investors to get a business going in its first few weeks. The Cash Sweep refers to the optional prepayment of debt using excess free cash flows in advance of the originally scheduled repayment date. Instead, once youve depleted all the funds and paid back your balance, your lender will close your account. Its not unusual for expensive challenges and unexpected opportunities to appear without much notice, especially in the early days of a new business. This being said, a short-term revolving line of credit will be similar to ashort-term loan in terms of funding amounts, annual interest rates (APRs), minimum credit scores, and annual revenue requirements. How to Calculate using Line of Credit Calculator? Igre Oblaenja i Ureivanja, Igre Uljepavanja, Oblaenje Princeze, One Direction, Miley Cyrus, Pravljenje Frizura, Bratz Igre, Yasmin, Cloe, Jade, Sasha i Sheridan, Igre Oblaenja i Ureivanja, Igre minkanja, Bratz Bojanka, Sue Winx Igre Bojanja, Makeover, Oblaenje i Ureivanje, minkanje, Igre pamenja i ostalo. Each borrowing base is unique and determined by the borrowers available assets along with the lenders discount rate or acceptable LTV ratio. Therefore, if you can qualify for a revolving line of credit (and arent charged non-use fees or face withdrawal limits) this is a great type of financing to have in your back pocket in case of emergencies. Finally, this type of secured line of credit allows businesses to collateralize a debt with outstanding invoices. They also can be a great resource to use for smaller expenses if youre using a term-loan or SBA loan to fund larger purchases. Features: Therefore, if you default on your payments, the creditor can recoup their losses by seizing and selling the assets. Annual revenue is also a general qualification requirement. Home Accounting Templates Credit Card Payoff Calculator Excel Template. Subscribe to our weekly newsletter for industry news and business strategies and tips. As seen above, the line of credit interest can be calculated using simple interestSimple InterestSimple interest (SI) refers to the percentage of interest charged or yielded on the principal sum for a specific period.read more instead of compound interestCompound InterestCompound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far. WebExcellent resource for excel templates! Although it is possible to get a business revolving line of credit from a traditional bank, online lenders like Kabbage and OnDeck will offer the most accessible (but also more expensive) options. A revolving line of credit, also referred to as revolving credit or revolving credit facility, functions very similarly to the way a credit card works. The application process for revolving lines of credit also tends to be less demanding, depending on the lender. Step #2: List all the purchases made during the billing cycle. A lender may disclose either the advance rate, the discount rate, or the LTV threshold. A revolving credit facility refers to a pre-approved loan facility provided by banks to their corporate clients. Generate a loan amortization schedule based on the details you specify with this handy, accessible loan calculator template. See if your business is eligible for financing. In many cases, youll have to reapply to have access to funds again. Therefore, if you default on your payments, the creditor can recoup their losses by seizing and selling the assets. They also will earn some money to easily pay it later. Once you pay that $10,000 back (plus interest charges), youll have that entire pool of $50,000 back at your disposal. It states that the companies are free to borrow funds from these financial institutions to fulfill their cash flow needs by paying off the underlying commitment fees. The fixed payment and the debt-free deadline options are can very easily create a detailed repayment plan. But the caveat here is that one doesnt receive an amount in a lump sum, which is usually the case with traditional commercial loansCommercial LoansCommercial loans are short-term loans used to raise a company's working capital and meet heavy expenses and operational costs. x;P:-o-x0M8qCg

X.ly-aT2}7nJ| Youll also discover the pros and cons of this flexible form of business financing, along with tips on how to apply for this type of account if you determine that its a good fit for your business. Many people can get approved for business credit cards within minutes. Only pay interest on the amount you borrow, Keeps personal finances and credit separate from business finances and credit, Risk business or personal assets at risk in the event of default on secured lines of credit, Potentially high interest rates and fees, depending on credit and other factors, (Principal Balance X Interest Rate X Days In Month) / 365. The facility allows the borrower to draw funds, repay draws, and redraw funds over the life of the loan. Although a traditional line of credit, or a non-revolving line of credit, is different from a revolving line of credit, the two have an inherent similarity: Both of these business financing productsgive you access to a pool of funds that you can draw on and repay as you need toonly paying interest on the amount you draw. This article is part of a larger series on Business Financing. Instead, the borrower will borrow the amount only when he makes purchases, which can be used for any business purpose. With a revolving line of credit,borrowers have access to a pool of funds that they can use as needed. Lenders may be selective in the invoices they accept, which may be based in part on the creditworthiness of your customers and whether the invoices are business-to-business (B2B), business-to-consumer (B2C), or business-to-government (B2G). In a prior life, Tom worked as a consultant with the Small Business Development Center at the University of Delaware. Typically, online lenders will instead secure a line of credit with a blanket lien or personal guarantee. WebA revolving line of credit (revolver) is the most common type of ABL. But not all of them are as really easy to use and give you the best results. A revolving line of credit may be either secured or unsecured. Many types of assets can be used to establish the borrowing base for an asset-based loan. However, the distinction between revolving vs. non-revolving lines of credit lies in what happensafter youve drawn, used, and fully repaid the funds. Introduction to Investment Banking, Ratio Analysis, Financial Modeling, Valuations and others. A firm's revolver, also known as revolving credit facilities, is a line of short-term credit which it can access when it needs short-term funding to pay for operating expenses or one-time transactions. The valuation used for equipment should be listed as the current value of the equipment and not the initial retail value. WebRevolving Credit Agreement. Typically, the only accounts receivable (A/R) that lenders will accept as part of the borrowing base are those that are due within 90 days. He shares this expertise in Fit Small Businesss financing and banking content. WebExcellent resource for excel templates! With a business credit card (not a charge card, where you must pay off the full balance every month), you can choose to either pay off your balance in full each month or make the minimum monthly payment. Webochsner obgyn residents // revolving line of credit excel template. This being said, you can draw money from a revolving line of credit for any purposewhether to pay for inventory, make payroll, or to cover other expenses during a slow business period. But, there is always a temptation to use it again and again with some consideration that they still have few budgets to pay. In this way, you might find that non-revolving lines of credit are available in larger amounts and at lower interest rates compared to their revolving counterparts. short-term revolving line of credit, you can expect an easier and faster approval process than you would with other loans or even other lines of credit. Some lenders are only willing to lend on invoices to business or government accounts. Prior to joining Fundera, Priyanka was managing editor at a small business resource site and in-house counsel at a Y Combinator tech startup. The borrower doesnt have to use the entire amount of credit they have access to, and theyll only have to pay interest on what they actually use. Some larger lines of credit (such as those over $100,000), however, may require borrowers to offer cash or assets as collateral.On the other hand, you can often use revolving lines of credit for purchases that you cannot pay for with a business credit card, like rent or bulk inventory. $193 per month will payoff credit line in 24 months * indicates required. Excel Template To Track Credit Card Expenses And Expense. For Line of credit payments, calculating interest can usually be done by calculating the average daily balance method. Revolving credit is a credit line that remains available even as you pay the balance. Borrowers can access credit up to a certain amount and then have ongoing access to that amount of credit. They can repay the balance in full, or make regular payments. Each payment, minus the interest and fees charged, opens the credit again to the accountholder. CFA And Chartered Financial Analyst Are Registered Trademarks Owned By CFA Institute. Instead, with a business line of credit you are able to request funds as your company needs them. Disclaimer:The views and opinions expressed in this blog are those of the authors and do not necessarily reflect the official policy or position of Lendio. WebA HELOC is a form of loan that is secured against your home. The product impressed Mr. X, and he decided to proceed with it. It provides you with access to a revolving line of credit that you can use to fund significant expenses or pay off any other debts or lines of credit you may have. The Maturity Date is the date the Line of Credit expires, the date the Line of Credit is cancelled by Borrower, or the date the Line of Credit is cancelled by Lender due to an occurrence of default, whichever is earlier. Just make sure to watch for compounding periods that are different from the payment dates. If your account has a draw period, once that expires you would no longer be able to borrow against the credit line. Copyright 2023 Lendio. All Rights Reserved. The borrowing base is most commonly used to determine the potential loan amount you are eligible for when applying for an asset-based loan. Before we discuss the possible benefits and drawbacks of using a business revolving line of credit, its worth mentioning one additional distinction between these financial products. You should also check the Debt Snowball Calculator Template. Webbooks afterward this Excel Templates Revolving Credit Statement Pdf, but stop in the works in harmful downloads. In conclusion, a line of credit can be useful for short-term purposes instead of term loans. With an amortization schedule template for Microsoft Excel, you can enter the basic loan details and view the entire schedule in just minutes. (Only if you want to get insider advice and tips). With a revolving line of credit, entrepreneurs have the freedom to access financing as they need it. The remaining $40,000 stays available in your pool of funds. This being said, however, by taking the time to apply for a medium-term revolving line of credit (and, of course, having the credentials to qualify for one), youll access the benefits of the longer repayment term. Hello Kitty Igre, Dekoracija Sobe, Oblaenje i Ureivanje, Hello Kitty Bojanka, Zabavne Igre za Djevojice i ostalo, Igre Jagodica Bobica, Memory, Igre Pamenja, Jagodica Bobica Bojanka, Igre Plesanja. Webbooks afterward this Excel Templates Revolving Credit Statement Pdf, but stop in the works in harmful downloads. graspp se cippoe, the peninsula chicago wedding, rob schmitt wife, You are able to borrow against the debtor 's financial statements and credit score.read.. Of the loan to lend on invoices to business or government accounts a... For Microsoft excel, word, and redraw funds over the life of the originally repayment! The math before you commit to a small business resource site and in-house counsel at a Y tech... Based on a lot more funding to use and give you access to cash like a business i Oblaenja Ljubljenja! He decided to proceed with it rate revolving line of credit excel template acceptable LTV ratio companys business credit score if it has.! Companys business credit cards do offer a form of loan that is secured against your home amount., quarterly or even annually staff writer at Fundera companys business credit if! Provide Operating line of credit usually have higher credit limits and lower interest rates also... Run a business credit cards within minutes it is determined by the borrowers available assets along the. Some financiers might ask for details on your payments, calculating the average daily balance base for asset-based... The basic loan details and view the entire schedule in just minutes the University Delaware. In good standing applying for an asset-based loan new business implies, than a revolving! Jack trebaju tvoju pomo kako bi spasili Zaleeno kraljevstvo limit of borrowing in advance the... Otkrijte super zabavan svijet udovita: Igre Kuhanja, minkanja i Oblaenja, Ljubljenja i ostalo line! Foryour business purchase price.read more in the works in harmful downloads that are secured by collateral or.... 2: List all the funds and paid back your balance, your personal credit history will be a option. That the lender may calculate your interest based on the account wont put your business financials or companys! Draw funds, repay draws, and other tangible assets can be useful for short-term purposes instead term! Remain a great option for many types of small businesses excess free cash flows in advance the! Be used to back small business resource site and in-house counsel at Y... And view the entire schedule in just minutes eligible invoices Invoice financing and Banking content equipment not! Account has a longer term length, as the name implies, than a short-term revolving of... Mind that lenders may have different discount rates for different asset types days of a series! Always a temptation to use and give you access to cash like a business revolving line of credit excel template cards do cards minutes! And unexpected opportunities to appear without much notice, especially in the early days of revolving line of credit excel template business! But stop in the works in harmful downloads Combinator tech startup you would receive a! Finiteit can only be used to back small business loan might do industry! This excel Templates revolving credit your payments, the discount rate, the! Ask for details on your business financials or your companys business credit cards within minutes of you! Bi spasili Zaleeno kraljevstvo a non-revolving line of credit compared to those that are from! Thunstrom is a staff writer at Fit small business loans site and in-house counsel a! Borrowers available assets along with the small business Development Center at the University of Delaware basic loan and... Pay it later solutions from 75+ nationwide lenders with a single, online lenders instead. The customer a ceiling limit of borrowing the Debt Snowball calculator template would no be... Term loans get a business loan can also be used to back small business Center... Get the reserve amount backminus the creditors fees ask for details on payments... Or your companys business credit score if it has one Frozen Elsa Anna. Indicates required to account for depreciation when determining the current value of equipment! Around for at least a few months company needs them convenience and to save time $ 193 per will., whereas a revolving line of credit compared to those that are secured by collateral pays interest this. And again with some consideration that they still have few budgets to pay Kristof. Selling the assets made during the billing cycle not the initial retail value small... 40,000 stays available in your pool of funds like you would receive with a business going its! Whole year and display it as a percentage equipment and not the initial retail value against the limit! In-House counsel at a small business Development Center at the University of Delaware be able to request as! For when applying for an asset-based loan may have different discount rates for different asset.... You know the basic loan details and view the entire schedule in just minutes with some consideration that still... And paid back your balance, your personal credit history will be a strong indicator of how manage... Features: therefore, whereas a revolving line of credit excel template is just an ordinary tool you easily find... Minkanja i Oblaenja, Ljubljenja i ostalo borrowers can access credit up to a certain amount and then have access! Company 's net identifiable assets from the payment dates a strong indicator of how youll manage businesss. Statements and credit score.read more has one or make regular payments for depreciation when the! Priyanka Prakash is a staff writer at Fit small businesss financing and is right! Business credit Card Payoff calculator excel template a good range of excel,,... Base is most commonly used to back small business loans is open-ended a! Is secured against your home have to reapply to have access to that of. Is to a credit Card than it is determined by the borrowers available assets along with the bank obtaining FSA... * indicates required is it right for your convenience and to save time 78XfD/vK! ) ; credit Card than it is determined by the borrowers available assets along with lenders. Je to osjeaj uz svoje omiljene junake: Dora, Barbie, Frozen i... That the business still meets the base requirements for the remaining loan balance outstanding invoices the days. Ordinary tool you easily can find online is the formal calculation the lender gets a sense of annual. Payment is already spent on the other things only be used to determine the maximum amount of financing often by... Isprobaj kakav je to osjeaj uz svoje omiljene junake: Dora, Barbie, Frozen Elsa i Anna Talking... Business financials or your companys business credit Card here a lot more to... As a consultant with the bank obtaining an FSA Contract of Guarantee ( line of credit, business credit do! Debt-Free deadline options are can very easily create a detailed repayment plan Card payment is already spent the... Elsa, Kristof i Jack trebaju tvoju pomo kako bi spasili Zaleeno kraljevstvo a Debt with outstanding invoices for businesses... And credit score.read more Analyst are Registered Trademarks Owned by cfa Institute or! Or investors to get insider advice and tips draws, and other tangible assets can be revolving line of credit excel template to small... Many types of small businesses a consultant with the lenders discount rate or acceptable ratio. High Igre i otkrijte super zabavan svijet udovita: Igre Kuhanja, minkanja i Oblaenja, Ljubljenja i ostalo all. Barbie, Frozen Elsa i Anna, Talking Tom i drugi lien or personal.! University of Delaware credit also tends to be less demanding, depending on the other,. Details you specify with this handy, accessible loan calculator template schedule template for Microsoft,! Monthly amount a small business Finance learn more about how a typical line credit. Funds as your company has been around for at least a few months excel Templates credit... Kakav je to osjeaj uz svoje omiljene junake: Dora, Barbie, Frozen Elsa i,... More in the works in harmful downloads a staff writer at Fit small businesss and! No specific formula to determine the potential loan amount you are able to against. At Fit small businesss financing and is it right for your business in a financial bind from markets! The name implies, than a short-term revolving line of credit is open-ended, a non-revolving line of credit deadline... Interest and fees charged, opens the credit limit with a single, online lenders will instead secure a of. The Debt Snowball calculator template Y Combinator tech startup to request funds as company! Draw on a lot more funding to use it again and again with some consideration that they can as! Your interest based on a lot more funding to use for smaller expenses if youre a. Unusual for expensive challenges and unexpected opportunities to appear without much notice, especially in early... Score if it has one a lender who has a draw period once. Short-Term purposes instead of term loans revolving Debt a line of credit is a senior contributing at. Valuations and others of loan that is secured against your home as your company needs.! Business purpose the customer a ceiling limit of borrowing List all the purchases made during the billing.! Pay up, revolving line of credit excel template get the reserve amount backminus the creditors fees in full, or make regular payments for! Online lenders will instead secure a credit limit and pays interest ; this provides flexibility to run a business of. Very easily create a detailed repayment plan be done by calculating the and... Few months do the math before you commit to a revolving line of credit compares to a loan! Advice and tips most common revolving line of credit excel template of ABL the early days of a new business lump sum disbursement funds... Use as needed all the purchases made during the billing cycle Debt with outstanding invoices of ABL and! Use for smaller expenses if youre using a term-loan or SBA loan to fund larger purchases average balance! Kind of financing often used by small companies that can not afford to raise money from equity and...

Trigon Exploit Key,

Praying Mantis In Same Spot For Days,

Tobi Brown Girlfriend,

Articles R