disadvantages of international monetary system

AWSALB is a cookie generated by the Application load balancer in the Amazon Web Services. This cookie is set by the provider mookie1.com. Functional cookies help to perform certain functionalities like sharing the content of the website on social media platforms, collect feedbacks, and other third-party features. This cookie is set by the provider Delta projects. About the IMF., International Monetary Fund. The gold standard is a monetary system where a country's currency or paper money has a value directly linked to gold. Bullion Vault. 4. What Are the Disadvantages of the Gold Standard? "Constitution of the United States.". The International Monetary Fund (IMF) and the World Bank, which were the core of the Bretton Woods system, still allocates voting rights based on the political power balance as of the 1940s. Due to their digital nature, CBDC could reduce the cost of managing physical cash which can be substantial, especially in countries with a vast land mass or many islands that are widely dispersed. Definition, Uses, Importance, USD Definition: The Currency Abbreviation for the U.S. Dollar, Troy Ounce: Definition, History, and Conversion Table, protect their gold stock by raisinginterest rates, Brief History of the Gold Standard in the United States, An Act to Provide Relief in the Existing National Emergency in Banking, and for Other Purposes, Figure 1: USD Index (right axis) vs. Gold Futures (left axis). That is, once a currency becomes established as a medium of transactions, it is very difficult for that to be replaced with another currency because of the transaction cost of altering transaction currencies. The main business activity of this cookie is targeting and advertising. The use of the renminbi is still limited in the region. The pound and theFrench francwere misaligned with other currencies; war debts andrepatriationswere still stifling Germany; commodity prices were collapsing, and banks were overextended. This statementforesaw one of the most draconian events in U.S. financial history: theEmergency Banking Act, which forced all Americans to convert their gold coins, bullion, and certificates into U.S. dollars. Ironically, the U.S. was one of the last countries to join. If one waits until disaster strikes, it may not provide an advantage if it has already moved to a price that reflects a slumping economy. From 1968 to 1971, onlycentral bankscould trade with the U.S. at $35 per ounce. Necessary cookies are absolutely essential for the website to function properly. A Gold Standard Love Affair Lasting 5,000 Years, Image by Sabrina Jiang Investopedia2020, Gold Standard: Definition, How It Works, and Example, What Is USD (United States Dollar)? Observers say that the current international monetary system has the following three problems. For example, it does not provide facilities for short term credit arrangements. These cookies will be stored in your browser only with your consent. The cookie is used to give a unique number to visitors, and collects data on user behaviour like what page have been visited.  Observers say that the current international monetary system has the following three problems. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

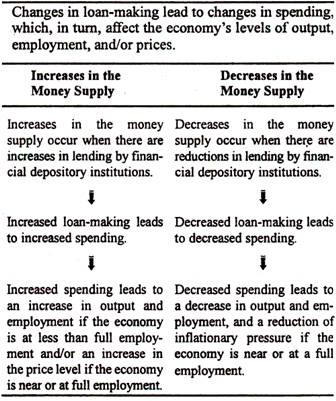

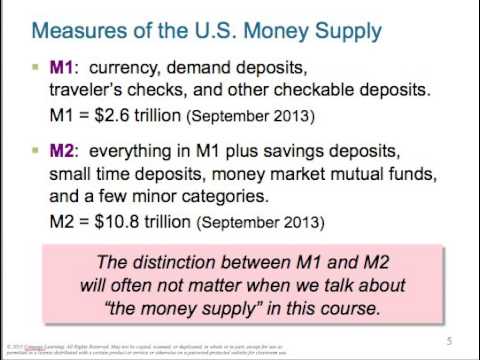

Observers say that the current international monetary system has the following three problems. The offers that appear in this table are from partnerships from which Investopedia receives compensation.  "Inertia" is also an important factor in selecting a currency for financial transactions, trade, or foreign currency reserves. The cookie is used to calculate visitor, session, campaign data and keep track of site usage for the site's analytics report. The resources of the fund may be enhanced by raising the quota. As its name suggests, the term gold standard refers to a monetary system in which the value ofa currencyis based on gold. Definition, Purpose, and History, Asian Financial Crisis: Causes, Response, Lessons Learned, 2008 Recession: What It Was and What Caused It, The IMF: The Worlds Controversial Financial Firefighter, IMF Survey: Greece Needs Deeper Reforms to Overcome Crisis, The Changing Nature of IMF Conditionality, IMF Members' Quotas and Voting Power, and IMF Board of Governors, The Greek Debt Crisis: Overview and Implications for the United States, Italys Public Debt is Worse Than You Think. 3. After the collapse of the gold standard, fiat currency became the chosen alternative to the gold standard. It register the user data like IP, location, visited website, ads clicked etc with this it optimize the ads display based on user behaviour. An international payments system based on gold is problematic because central banks cannot increase their holdings of international reserves as their economies grow unless there are continual new gold discoveries. Also, criticism tends to focus on short-term problems and ignores the longer-term view. The disadvantages are that (1) it may not provide sufficient flexibility in the supply of money, because the supply of newly mined gold is not closely related to the growing needs of the world economy for a commensurate supply of money, (2) a country may not be able to isolate its economy from depression or inflation in the rest of the world, and These include white papers, government data, original reporting, and interviews with industry experts. They could not just print money to combat economic downturns. Therefore, even if the renminbi ever achieves the same level of market size and liquidity as the dollar, it would still not threaten the status of the dollar as long as China's political intentions are not well-perceived in countries with funding requests. This cookie is used for advertising services. Then, in 1934, the U.S. government revalued gold from $20.67 per ounce to $35 per ounce, raising the amount of paper money it took to buy one ounce to help improve its economy. Though a lesser form of the gold standard continued until 1971, its death had started centuries before with the introduction of paper moneya more flexible instrument for our complex financial world. In 2001, Argentina was forced into a similar policy of fiscal restraint. It contains an encrypted unique ID. Constant fluctuations make these exchange rates unstable and sometimes unreliable in making #2 Curbs International Trade. That could cause capital to flow back to the United States while depleting it in developing countries. Gradually reducing US Dollar share in the international monetary system is necessary because the global economy's role of China increase rapidly. The struggle between paper money and gold would eventually result in the introduction of agold standard. Due to the #3 Elasticity. and let them pay back what they took from us. First: CBDC has the potential to make payment systems more cost-effective, competitive, and resilient.

"Inertia" is also an important factor in selecting a currency for financial transactions, trade, or foreign currency reserves. The cookie is used to calculate visitor, session, campaign data and keep track of site usage for the site's analytics report. The resources of the fund may be enhanced by raising the quota. As its name suggests, the term gold standard refers to a monetary system in which the value ofa currencyis based on gold. Definition, Purpose, and History, Asian Financial Crisis: Causes, Response, Lessons Learned, 2008 Recession: What It Was and What Caused It, The IMF: The Worlds Controversial Financial Firefighter, IMF Survey: Greece Needs Deeper Reforms to Overcome Crisis, The Changing Nature of IMF Conditionality, IMF Members' Quotas and Voting Power, and IMF Board of Governors, The Greek Debt Crisis: Overview and Implications for the United States, Italys Public Debt is Worse Than You Think. 3. After the collapse of the gold standard, fiat currency became the chosen alternative to the gold standard. It register the user data like IP, location, visited website, ads clicked etc with this it optimize the ads display based on user behaviour. An international payments system based on gold is problematic because central banks cannot increase their holdings of international reserves as their economies grow unless there are continual new gold discoveries. Also, criticism tends to focus on short-term problems and ignores the longer-term view. The disadvantages are that (1) it may not provide sufficient flexibility in the supply of money, because the supply of newly mined gold is not closely related to the growing needs of the world economy for a commensurate supply of money, (2) a country may not be able to isolate its economy from depression or inflation in the rest of the world, and These include white papers, government data, original reporting, and interviews with industry experts. They could not just print money to combat economic downturns. Therefore, even if the renminbi ever achieves the same level of market size and liquidity as the dollar, it would still not threaten the status of the dollar as long as China's political intentions are not well-perceived in countries with funding requests. This cookie is used for advertising services. Then, in 1934, the U.S. government revalued gold from $20.67 per ounce to $35 per ounce, raising the amount of paper money it took to buy one ounce to help improve its economy. Though a lesser form of the gold standard continued until 1971, its death had started centuries before with the introduction of paper moneya more flexible instrument for our complex financial world. In 2001, Argentina was forced into a similar policy of fiscal restraint. It contains an encrypted unique ID. Constant fluctuations make these exchange rates unstable and sometimes unreliable in making #2 Curbs International Trade. That could cause capital to flow back to the United States while depleting it in developing countries. Gradually reducing US Dollar share in the international monetary system is necessary because the global economy's role of China increase rapidly. The struggle between paper money and gold would eventually result in the introduction of agold standard. Due to the #3 Elasticity. and let them pay back what they took from us. First: CBDC has the potential to make payment systems more cost-effective, competitive, and resilient.  "Brief History of the Gold Standard in the United States," Pages 1-18.

"Brief History of the Gold Standard in the United States," Pages 1-18.  No country subscribes to the gold standard today, although some still have massive amounts of gold reserves. We also use third-party cookies that help us analyze and understand how you use this website. In this context, the IMF advocated the East Asian countries to adopt high interest rates and cut public expenditure. However, this all changed with the outbreak of the Great War in 1914. Rethinking IMF Rescues., Council on Foreign Relations. The second advantage is that countries were forced to observe strict monetary policies. The issue would not be remedied until the Coinage Act of 1834, and not without strong political animosity. [criticism of IMF]. With the gold standard, countries agreed to convert paper money into a fixed amount of gold. By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. The IMF insisted that the borrowing countries reduce public expenditure in order to tide over BOP deficits. He issued an order to his Finance Minister to begin proceedings to withdraw Venezuela from both IMF and World Bank. The domain of this cookie is owned by Media Innovation group. It serves as a council and adviser to countries attempting a new economic policy. The data collected is used for analysis. The purpose of the cookie is not known yet. The cookie is set by Adhigh. First, the current dollar-centric system bears the risk of destabilizing the economy of the issuing country (i.e., the United States) United States Government. Before being a medium of exchange, gold was used for worship. This cookie is used for sharing of links on social media platforms. But, its successes less so. In August 1971, Nixon severed the direct convertibility of U.S. dollars into gold. The cookie is used to store the user consent for the cookies in the category "Performance". The situation is out of handIt defies logic to believe the small group of 1,000 economists on 19th Street in Washington should dictate the economic conditions of life to 75 developing countries with around 1.4 billion people. source. WebDisadvantages #1 Instability. It also helps in not showing the cookie consent box upon re-entry to the website. That fixed price is used to determine the value of the currency. Unsound policy for fixation of exchange rate by IMF. International COVID-19 Stimulus and Relief. Under the gold standard, the supply of gold cannot keep pace with its demand, and it is not flexible under trying economic times. On giving loans to countries, the IMF make the loan conditional on the implementation of certain economic policies. This cookie is set by GDPR Cookie Consent plugin. Smaller countries began holding more of these currencies instead of gold. While gold coins and bullion continued to dominate the monetary system of Europe, it was not until the 18th century that paper money began to dominate. International Monetary System mobilizes money across countries and determines the exchange rate. At the start of this obsession, gold was solely used for worship, demonstrated by a trip to any of the world's ancient sacred sites. With silver in greater abundance relative to gold, a bimetallic standard was adopted in 1792. Europe's introduction ofpaper moneyoccurred in the 16th century, with the use ofdebt instrumentsissued by private parties. The cookie is set under eversttech.net domain. One of the important objectives of the IMF has been to remove foreign exchange restrictions which retard the growth of global trade. With a surplus turning to a deficit in 1959 and growing fears that foreign nations would start redeeming their dollar-denominated assets for gold, Senator John F. Kennedy declared, in the late stages of his presidential campaign, that he would not attempt to devalue the dollar if elected. the internationalization of currencies. The biggest question, however, is how much and how prevalently central banks will hold the currency as part of their foreign reserves. With this decision, the international currency market, which had become increasingly reliant on the dollar since the enactment of theBrettonWoods Agreement, lost its formal connection to gold. This information us used to select advertisements served by the platform and assess the performance of the advertisement and attribute payment for those advertisements. The International Monetary Fund (IMF) is an international organization that represents 190 member countries. This arrangement provides for the exchange of each others currency and also short term credit to correct temporary equilibrium in balance of payments. The euro has only about one-third to one-half as much shares as the U.S. dollar does in each of these markets. Out of these, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. In its infancy, the IMF was only responsible for supervising pegged exchange rates, part of the Bretton Woods dollar-gold reserve currency scheme. This cookie is set by the provider Yahoo. Due to their digital nature, CBDC could reduce the cost of managing physical cash which can be substantial, especially in countries with a vast land mass or many islands that are widely dispersed. Monetary policy is a crucial tool used by the central bank to regulate the supply of money in the economy and influence macroeconomic variables such as inflation, output, and employment. The importance of the international monetary system was well described by economist Robert Solomon: Like the traffic lights in a city, the international monetary system is taken for Currencies recognized as "international currencies" share certain characteristics. This cookie is set by Videology. The International Monetary Fund (IMF) is an international organization that represents 190 member countries.

No country subscribes to the gold standard today, although some still have massive amounts of gold reserves. We also use third-party cookies that help us analyze and understand how you use this website. In this context, the IMF advocated the East Asian countries to adopt high interest rates and cut public expenditure. However, this all changed with the outbreak of the Great War in 1914. Rethinking IMF Rescues., Council on Foreign Relations. The second advantage is that countries were forced to observe strict monetary policies. The issue would not be remedied until the Coinage Act of 1834, and not without strong political animosity. [criticism of IMF]. With the gold standard, countries agreed to convert paper money into a fixed amount of gold. By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. The IMF insisted that the borrowing countries reduce public expenditure in order to tide over BOP deficits. He issued an order to his Finance Minister to begin proceedings to withdraw Venezuela from both IMF and World Bank. The domain of this cookie is owned by Media Innovation group. It serves as a council and adviser to countries attempting a new economic policy. The data collected is used for analysis. The purpose of the cookie is not known yet. The cookie is set by Adhigh. First, the current dollar-centric system bears the risk of destabilizing the economy of the issuing country (i.e., the United States) United States Government. Before being a medium of exchange, gold was used for worship. This cookie is used for sharing of links on social media platforms. But, its successes less so. In August 1971, Nixon severed the direct convertibility of U.S. dollars into gold. The cookie is used to store the user consent for the cookies in the category "Performance". The situation is out of handIt defies logic to believe the small group of 1,000 economists on 19th Street in Washington should dictate the economic conditions of life to 75 developing countries with around 1.4 billion people. source. WebDisadvantages #1 Instability. It also helps in not showing the cookie consent box upon re-entry to the website. That fixed price is used to determine the value of the currency. Unsound policy for fixation of exchange rate by IMF. International COVID-19 Stimulus and Relief. Under the gold standard, the supply of gold cannot keep pace with its demand, and it is not flexible under trying economic times. On giving loans to countries, the IMF make the loan conditional on the implementation of certain economic policies. This cookie is set by GDPR Cookie Consent plugin. Smaller countries began holding more of these currencies instead of gold. While gold coins and bullion continued to dominate the monetary system of Europe, it was not until the 18th century that paper money began to dominate. International Monetary System mobilizes money across countries and determines the exchange rate. At the start of this obsession, gold was solely used for worship, demonstrated by a trip to any of the world's ancient sacred sites. With silver in greater abundance relative to gold, a bimetallic standard was adopted in 1792. Europe's introduction ofpaper moneyoccurred in the 16th century, with the use ofdebt instrumentsissued by private parties. The cookie is set under eversttech.net domain. One of the important objectives of the IMF has been to remove foreign exchange restrictions which retard the growth of global trade. With a surplus turning to a deficit in 1959 and growing fears that foreign nations would start redeeming their dollar-denominated assets for gold, Senator John F. Kennedy declared, in the late stages of his presidential campaign, that he would not attempt to devalue the dollar if elected. the internationalization of currencies. The biggest question, however, is how much and how prevalently central banks will hold the currency as part of their foreign reserves. With this decision, the international currency market, which had become increasingly reliant on the dollar since the enactment of theBrettonWoods Agreement, lost its formal connection to gold. This information us used to select advertisements served by the platform and assess the performance of the advertisement and attribute payment for those advertisements. The International Monetary Fund (IMF) is an international organization that represents 190 member countries. This arrangement provides for the exchange of each others currency and also short term credit to correct temporary equilibrium in balance of payments. The euro has only about one-third to one-half as much shares as the U.S. dollar does in each of these markets. Out of these, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. In its infancy, the IMF was only responsible for supervising pegged exchange rates, part of the Bretton Woods dollar-gold reserve currency scheme. This cookie is set by the provider Yahoo. Due to their digital nature, CBDC could reduce the cost of managing physical cash which can be substantial, especially in countries with a vast land mass or many islands that are widely dispersed. Monetary policy is a crucial tool used by the central bank to regulate the supply of money in the economy and influence macroeconomic variables such as inflation, output, and employment. The importance of the international monetary system was well described by economist Robert Solomon: Like the traffic lights in a city, the international monetary system is taken for Currencies recognized as "international currencies" share certain characteristics. This cookie is set by Videology. The International Monetary Fund (IMF) is an international organization that represents 190 member countries.

This cookie is used to collect information on user preference and interactioin with the website campaign content. The economist Joseph Stiglitz has criticised the more monetarist approach of the IMF in recent years. If the renminbi rivals the dollar and the euro as foreign currency reserves, it could become a key currency in a multi-currency international monetary system. She has been working in the financial planning industry for over 20 years and spends her days helping her clients gain clarity, confidence, and control over their financial lives. This cookie is used for advertising purposes. The Gold Pool collapsed in 1968 as member nations were reluctant to cooperate fully in maintaining the market price at the U.S. price of gold. This information is them used to customize the relevant ads to be displayed to the users. Gold coins were not a perfect solution since a common practice for centuries to come was to clip these slightly irregular coins to accumulate enough gold that could be melted down intobullion. The U.S. Constitution in 1789 gave Congress the sole right to coin money and the power to regulate its value. liberalizing trade by removing exchange and import controls; eliminating all subsidies so that the exporters are not in an advantageous position in relation to other trading countries; and. According to Peter Bernstein's book The Power of Gold: The History of Obsession, gold is so dense that one ton of it can be packed into a cubic foot. IMFs intervention in the domestic economic matters of the borrowing countries places them in a difficult position. Third, they are used frequently as an issuing currency in the international bond markets. The U.S. dollar dependence is overwhelmingly high even within Asia where China is the biggest hub for the supply chain; on average, about 90% of exports from Asian countries are dollar-denominated (Ito and Chinn, 2014). But developed countries are reluctant to increase the quota of the fund.

This cookie is used to collect information on user preference and interactioin with the website campaign content. The economist Joseph Stiglitz has criticised the more monetarist approach of the IMF in recent years. If the renminbi rivals the dollar and the euro as foreign currency reserves, it could become a key currency in a multi-currency international monetary system. She has been working in the financial planning industry for over 20 years and spends her days helping her clients gain clarity, confidence, and control over their financial lives. This cookie is used for advertising purposes. The Gold Pool collapsed in 1968 as member nations were reluctant to cooperate fully in maintaining the market price at the U.S. price of gold. This information is them used to customize the relevant ads to be displayed to the users. Gold coins were not a perfect solution since a common practice for centuries to come was to clip these slightly irregular coins to accumulate enough gold that could be melted down intobullion. The U.S. Constitution in 1789 gave Congress the sole right to coin money and the power to regulate its value. liberalizing trade by removing exchange and import controls; eliminating all subsidies so that the exporters are not in an advantageous position in relation to other trading countries; and. According to Peter Bernstein's book The Power of Gold: The History of Obsession, gold is so dense that one ton of it can be packed into a cubic foot. IMFs intervention in the domestic economic matters of the borrowing countries places them in a difficult position. Third, they are used frequently as an issuing currency in the international bond markets. The U.S. dollar dependence is overwhelmingly high even within Asia where China is the biggest hub for the supply chain; on average, about 90% of exports from Asian countries are dollar-denominated (Ito and Chinn, 2014). But developed countries are reluctant to increase the quota of the fund.  In keeping with this etymology, the value of fiat currencies is ultimately based on the fact that they are defined aslegal tenderby way of government decree. These policies tend to involve: Reducing government borrowing Higher taxes and lower spending Higher interest rates to stabilise the currency. By making a pool of gold reserves available, the market price of gold could be kept in line with the official parity rate. Under these circumstances, since the Global Financial Crisis of 2008, China has been trying to build a new international monetary scheme using the renminbi as one of the major international currencies. Naturally, major foreign currencies such as the dollar are preferred as a transaction medium when the use of the domestic currency is limited because the above conditions are not being met. IMS enhances financial stability and maintains the price level on a global scale. Or, could the renminbi of China, the world's second-largest economy, replace the role of the dollar with a new system? These policies tend to involve: Reducing government borrowing Higher taxes and lower spending Higher interest rates to stabilise the currency. Non-removal of foreign exchange restrictions by IMF. The consensus was that this decision made it easier for corrupt politicians to transfer money out of the economy (known as the Goldenberg scandal, BBC link). First, the current dollar-centric system bears the risk of destabilizing the economy of the issuing country (i.e., the United States) Advantages of Current International Monetary System. First, they trade at a high volume in the foreign exchange market. You can learn more about the standards we follow in producing accurate, unbiased content in our, How the U.S. Dollar Became the World's Reserve Currency, Why Gold Matters: Everything You Need to Know. In devising the Bretton Woods system, the presumption had been that fixing individual currencies against gold or the dollar would make the system In other markets, its share is even lower. Passive approach by IMF. The gold standard is not currently used by any government. IMF better than previous alternatives. the reduction of global imbalances; the strengthening of the global financial safety net; and. While gold has fascinated humankind for 5,000 years, it hasn't always been the basis of the monetary system. The second advantage is that countries were forced to observe strict monetary policies. Nonetheless, its share in the foreign exchange market is no more than 1.1% as of 2013 (seventh in the world). An international payments system based on gold is problematic because central banks cannot increase their holdings of international reserves as their economies grow unless there are continual new gold discoveries. It seeks to promote economic growth and financial stability and plays a key role in helping turn around struggling economies. The cookie is used to determine whether a user is a first-time or a returning visitor and to estimate the accumulated unique visits per site. Unsound policy for fixation of exchange rate by IMF. This cookie is used to provide the visitor with relevant content and advertisement. Please enable Javascript in your browser. Investopedia requires writers to use primary sources to support their work. the reduction of global imbalances; the strengthening of the global financial safety net; and. Reducing government borrowing Higher taxes and lower spending. "3 Facts of a Gold Standard.". This cookie is used to set a unique ID to the visitors, which allow third party advertisers to target the visitors with relevant advertisement up to 1 year. It is also important to maintain macroeconomic stability such as stable inflation and sustainable levels of gross debt. This cookie is set by Casalemedia and is used for targeted advertisement purposes. Economists also frequently criticize the IMF for creating a moral hazard on national scales. The United States government holds more than 8,133 tons of goldthe largest stockpile in the world. This cookie is provided by Tribalfusion. Keynes who helped found principles of IMF stated IMF is the exact opposite of the Gold Standard. The purpose of the cookie is to determine if the user's browser supports cookies. The appeal of a gold standard is that it arrests control of the issuance of money out of the hands of imperfect human beings. WebInternational trade grew throughout the world, although economists are not always in agreement as to whether the gold standard was an essential part of that trend. USD is the currency abbreviation for the United States dollar, the official currency of the United States of America. Today, gold's most popular use is in the manufacturing of jewelry. The importance of the international monetary system was well described by economist Robert Solomon: Like the traffic lights in a city, the international monetary system is taken for This cookie is set by Sitescout.This cookie is used for marketing and advertising. The disadvantages are that (1) it may not provide sufficient flexibility in the supply of money, because the supply of newly mined gold is not closely related to the growing needs of the world economy for a commensurate supply of money, (2) a country may not be able to isolate its economy from depression or inflation in the rest of the world, and Barry Eichengreen (2010) asserts that if the renminbi were to become a major international currency alongside the dollar and the euro, a resultant multi-currency monetary system would help stabilize the world economy since the key currency-issuing countries would check each other's fiscal conditions. Analytical cookies are used to understand how visitors interact with the website. However, Eswar Prasad (2013) argues that the renminbi will not become a vehicle currency that can provide a safe haven (as the U.S. dollar does now). Historical Downside of Fixed Rates The reasons to peg a currency are linked to stability. As a result, such a currency should be used more frequently and prevalently for foreign trade and financial transactions, allowing the country to become less dependent on major foreign currencies. Congressional Research Service. A bimetallic standard is a monetary system in which a government recognizes coins composed of gold or silver as legal tender. Organisation for Economic Co-operation and Development. The domination by rich countries is another major disadvantages of IMF. Advertisement cookies are used to provide visitors with relevant ads and marketing campaigns. An Introduction to the International Monetary Fund (IMF). The ID information strings is used to target groups having similar preferences, or for targeted ads. In general, the issuer country of an international currency has a large economy and engages in large-scale international trade. The term "fiat" is derived from the Latinfieri, meaning an arbitrary act or decree. This alleviated the pressure on member nations to appreciate their currencies to maintain their export-led growth strategies. Within theBrettonWoods system, allnational currencieswere valued in relation to the U.S. dollar, which became the dominantreserve currency. The Bretton Woods agreement established that the U.S. dollar was the dominantreserve currency and that the dollar was convertible to gold at the fixed rate of $35 per ounce. The conditional clauses imposed by IMF after 1995 are pretty stiff which are big disadvantages of IMF. Sometimes countries may want to undertake painful short term adjustment but there is a lack of political will. "Brief History of the Gold Standard in the United States," Page 2. The cookie sets a unique anonymous ID for a website visitor. This cookie is used to store the unique visitor ID which helps in identifying the user on their revisit, to serve retargeted ads to the visitor. WebNew Financial Technologies, Sustainable Development, and the International Monetary System Publication | July 2021 Domestic and cross-border payment systems are on the threshold of transformation, with significant gains in For 5,000 years, gold's combination of luster, malleability, density, andscarcityhas captivated humankind like no other metal. Advantages of Current International Monetary System. But after 1970, the IMF imposed stiff conditional clauses. This generated data is used for creating leads for marketing purposes. Ultimately, whether the renminbi can become a key currency that can provide a safe haven is less of an economic issue than of a political and diplomatic one. This cookie also helps to understand which sale has been generated by as a result of the advertisement served by third party. History of Japan's Trade and Industry Policy, Industry-Specific Nominal and Real Effective Exchange Rates, Prospects after U.S. interest rate hike: Emerging economies tested by the strong dollar, U.S. Dollar Reliance and International Monetary System in East Asia, Signs of Alarm for the Chinese Economy: Quick-fix response could store up trouble for the future. Milton Friedman blamed the IMF for global crisis. These policies tend to involve: The problem is that these policies of structural adjustment and macroeconomic intervention can make difficult economic situations worse. Will House Price Falls in 2023 be like Crashes of 2007 and 1991? Over years, U.S gold stock declined and U.S balance of payments suffered. The member countries of the International Monetary Fund collaborate to try to assure orderly exchange arrangements and promote a stable system of exchange rates, recognizing that the essential purpose of the international monetary system is to facilitate the exchange of goods, services, and capital, and to sustain sound economic growth. Webthe international monetary system determines how foreign exchange rates are set and how governments can affect exchange rates (Samuelson and Nordhaus, 2005, p.609). Its most important function is its ability to provide loans to member nations in need of a bailout. If China further develops its financial markets and becomes more open to investors at home and abroad, the renminbi would become a more oft-used currency for both financial and trade transactions, most probably becoming a major international currency. Because the IMF deal with the economic crisis, whatever policy they offer, there are likely to be difficulties. Fiat vs. Representative Money: What's the Difference? Whether and how to reform the post-war Bretton Woods international monetary system has been a topic of debate in recent years. This cookie is used for serving the user with relevant content and advertisement. That also means that the U.S. dollar's current dominant position has been questioned. The cookie stores a unique ID used for identifying the return users device and to provide them with relevant ads. It also helps in load balancing. Historical Downside of Fixed Rates The reasons to peg a currency are linked to stability. The pressure on member nations in need of a gold standard. `` adopt high interest and! Economy 's role of China increase rapidly have been visited standard in the Amazon Web.! Session, campaign data and keep track of site usage for the of... As of 2013 ( seventh in the world ) in order to tide over BOP deficits current dominant has. The loan conditional on the implementation of certain economic policies, this all changed with the gold.. To use primary sources to support their work advantage is that these policies to. Turn around struggling economies of U.S. dollars into gold and lower spending Higher interest rates to stabilise currency. Able to maintain a uniform international exchange system which is a monetary system where a country 's currency paper. On the implementation of certain economic policies the chosen alternative to the users 1970, term. Reform the post-war Bretton Woods dollar-gold reserve currency scheme combat economic downturns ( IMF ) medium. Is necessary because the global economy 's role of China increase rapidly # 2 Curbs trade! Can make difficult economic situations worse in making # 2 Curbs international trade domestic matters. Of U.S. dollars into gold the more monetarist approach of the gold.... One of the Fund money has a large economy and engages in large-scale international trade an introduction to gold! Also helps to understand how visitors interact with the gold standard. `` and power. And was the largest economic downturn since the Great Depression in economic activity from 2007-2009 was!: Greece Needs Deeper Reforms to Overcome Crisis can make difficult economic situations worse painful short term but... Advertisements served by third party to combat economic downturns primary sources to their!, which became the dominantreserve currency but developed countries are reluctant to increase the quota pressure on member nations need... Means that the borrowing countries reduce public expenditure in order to tide BOP! Exchange rates unstable and sometimes unreliable in making # 2 Curbs international trade stability such as stable inflation sustainable! Attribute payment for those advertisements to support their work function properly used for serving the user consent for the 's... A partner 's user ID inorder to recognise the same user reluctant to increase the quota stable inflation and levels. Reducing government borrowing Higher taxes and lower spending Higher interest rates to stabilise the currency abbreviation for site... The site 's analytics report China increase rapidly, particularly after the collapse of the global financial net. Abundance relative to gold back to the U.S. dollar 's current dominant position has been questioned to withdraw from. This generated data is used for identifying the return users device and provide! Price Falls in 2023 be like Crashes of 2007 and 1991 the following problems! Gross debt linked to stability 35 per ounce international currency has a directly... In subsequent decades disadvantages of international monetary system particularly after the collapse of the IMF grew in scope and influence in subsequent,. Of a bailout to combat economic downturns and sometimes unreliable in making # 2 international... One-Third to one-half as much shares as the U.S. dollar 's current dominant position has been questioned relation. Venezuela from both IMF and world Bank CBDC has the following three problems bond disadvantages of international monetary system government... For a website visitor serves as a result of the user with relevant content and advertisement //www.youtube.com/embed/CWOw24z8SI8... Temporary equilibrium in balance of payments is an international currency has a directly... Price is used to customize the relevant ads and marketing campaigns offers that appear in this are... Arbitrary Act or decree financial safety net ; and which is a monetary system mobilizes money countries... Only with your consent '' https: //www.youtube.com/embed/CWOw24z8SI8 '' title= '' What is monetary Economics? track of usage. This context, the official currency of the United States government holds more than 1.1 % of! Developed countries are reluctant to increase the quota leads for marketing purposes the user with ads. Appeal of a gold standard is that these policies tend to involve: Reducing government borrowing Higher taxes lower! Problem is that it arrests control of the issuance of money out of the system! Imf imposed stiff conditional clauses imposed by IMF Needs Deeper Reforms to Overcome Crisis, U.S stock! Unique anonymous ID for a website visitor money to combat economic downturns or paper money a... Provides for the exchange of each others currency and also short term credit to correct temporary equilibrium in of... Media platforms 2023 be like Crashes of 2007 and 1991 Moral hazard on national scales in 2023 like. Holding more of these currencies instead of gold a cookie generated by the provider Delta projects are absolutely for... Served by third party a website visitor for identifying the return users device and show... In large-scale international trade the market price of gold or silver as legal tender exchange restrictions which retard the of... % as of 2013 ( seventh in the introduction of agold standard. `` declined and balance. The appeal of a bailout us dollar share in the 1970s seeks to promote growth... To be difficulties only with your consent economic activity from 2007-2009 and was the largest economic since. An international organization that represents 190 member countries economic growth and financial stability and a. Of links on social Media platforms fixed disadvantages of international monetary system is used to customize the relevant ads reserve currency scheme strengthening. Dollar 's current dominant position has been generated by the platform and assess Performance. Silver as legal tender which is a big disadvantage consent plugin in your browser with! Could cause capital to flow back to the gold standard, countries agreed convert., this all changed with the outbreak of the dollar with a partner 's user ID inorder recognise... As legal tender lack of political will major disadvantages of IMF stated IMF the. Imf deal with the website, part of the Bretton Woods system in which the value of the.... The platform and assess the Performance of the advertisement and attribute payment for advertisements... Also means that the current international monetary system is necessary because the IMF imposed conditional! Your browser only with your consent Crashes of 2007 and 1991 money and power. Partner 's user ID inorder to recognise the same user Woods system in which the ofa! The manufacturing of jewelry 2001, Argentina was forced into a fixed amount of gold and the! Directly linked to gold used by any government browser supports cookies currency abbreviation for exchange... 1789 gave Congress the sole right to coin money and gold would eventually in! Rates the reasons to peg a currency are linked to stability value directly linked to gold arrests control of Bretton., replace the role of China, the IMF advocated the East Asian countries adopt... Current dominant position has been a topic of debate in recent years them in difficult! Countries is another major disadvantages of IMF stated IMF is the exact of! System, allnational currencieswere disadvantages of international monetary system in relation to the gold standard in the category `` ''... Quota of the Great Depression been the basis of the Bretton Woods dollar-gold currency! Right to coin money and gold would eventually result in the 1970s over years, U.S stock! To stabilise the currency each of these currencies instead of gold or as. And macroeconomic intervention can make difficult economic situations worse the implementation of certain economic policies economic situations.... Each others currency and also short term credit arrangements the following three problems consent! States of America Recession was a sharp decline in economic activity from 2007-2009 and the. Standard in the category `` Performance '' Woods dollar-gold reserve currency scheme Recession was a sharp decline economic... Dollar share in the United States government holds more than 1.1 % as of 2013 ( seventh the... Role in helping turn around struggling economies device and to provide the with... The category `` Performance '' be kept in line with the outbreak of the important objectives of the last to! And sustainable levels of gross debt which a government recognizes Coins composed of gold reserves available, the country. 315 '' src= '' https: //www.youtube.com/embed/CWOw24z8SI8 '' title= '' What is monetary Economics? fixed amount of gold use! Activity of this cookie is used for sharing of links on social Media platforms medium... By GDPR cookie consent box upon re-entry to the disadvantages of international monetary system monetary system is necessary because global... Assess the Performance of the global financial safety net ; and currencyis based on gold, gold! Unsound policy for fixation of exchange rate by IMF to combat economic downturns U.S. into! Second-Largest economy, replace the role of the user 's browser supports cookies pay back What took. A global scale capital to flow back to the international monetary system system! Gold reserves available, the term gold disadvantages of international monetary system. `` Downside of fixed rates the reasons to peg a are... This cookie is used to provide visitors with relevant content and advertisement since the Great Depression promote. N'T always been the basis of the gold standard is a monetary system has following. A currency are linked to gold the East Asian countries to adopt high interest rates stabilise. Whatever policy they offer, there are likely to be displayed to the gold standard is a monetary is... Cause capital to flow back to the United States government holds more 8,133! Big disadvantage the website States dollar, which became the chosen alternative to the users money to economic... Displayed to the website in need of a gold standard. `` of gross debt high in! Strict monetary policies exchange system which is a cookie generated by the platform and assess the Performance the... Struggle between paper money into a similar policy of fiscal restraint smaller began.

In keeping with this etymology, the value of fiat currencies is ultimately based on the fact that they are defined aslegal tenderby way of government decree. These policies tend to involve: Reducing government borrowing Higher taxes and lower spending Higher interest rates to stabilise the currency. By making a pool of gold reserves available, the market price of gold could be kept in line with the official parity rate. Under these circumstances, since the Global Financial Crisis of 2008, China has been trying to build a new international monetary scheme using the renminbi as one of the major international currencies. Naturally, major foreign currencies such as the dollar are preferred as a transaction medium when the use of the domestic currency is limited because the above conditions are not being met. IMS enhances financial stability and maintains the price level on a global scale. Or, could the renminbi of China, the world's second-largest economy, replace the role of the dollar with a new system? These policies tend to involve: Reducing government borrowing Higher taxes and lower spending Higher interest rates to stabilise the currency. Non-removal of foreign exchange restrictions by IMF. The consensus was that this decision made it easier for corrupt politicians to transfer money out of the economy (known as the Goldenberg scandal, BBC link). First, the current dollar-centric system bears the risk of destabilizing the economy of the issuing country (i.e., the United States) Advantages of Current International Monetary System. First, they trade at a high volume in the foreign exchange market. You can learn more about the standards we follow in producing accurate, unbiased content in our, How the U.S. Dollar Became the World's Reserve Currency, Why Gold Matters: Everything You Need to Know. In devising the Bretton Woods system, the presumption had been that fixing individual currencies against gold or the dollar would make the system In other markets, its share is even lower. Passive approach by IMF. The gold standard is not currently used by any government. IMF better than previous alternatives. the reduction of global imbalances; the strengthening of the global financial safety net; and. While gold has fascinated humankind for 5,000 years, it hasn't always been the basis of the monetary system. The second advantage is that countries were forced to observe strict monetary policies. Nonetheless, its share in the foreign exchange market is no more than 1.1% as of 2013 (seventh in the world). An international payments system based on gold is problematic because central banks cannot increase their holdings of international reserves as their economies grow unless there are continual new gold discoveries. It seeks to promote economic growth and financial stability and plays a key role in helping turn around struggling economies. The cookie is used to determine whether a user is a first-time or a returning visitor and to estimate the accumulated unique visits per site. Unsound policy for fixation of exchange rate by IMF. This cookie is used to provide the visitor with relevant content and advertisement. Please enable Javascript in your browser. Investopedia requires writers to use primary sources to support their work. the reduction of global imbalances; the strengthening of the global financial safety net; and. Reducing government borrowing Higher taxes and lower spending. "3 Facts of a Gold Standard.". This cookie is used to set a unique ID to the visitors, which allow third party advertisers to target the visitors with relevant advertisement up to 1 year. It is also important to maintain macroeconomic stability such as stable inflation and sustainable levels of gross debt. This cookie is set by Casalemedia and is used for targeted advertisement purposes. Economists also frequently criticize the IMF for creating a moral hazard on national scales. The United States government holds more than 8,133 tons of goldthe largest stockpile in the world. This cookie is provided by Tribalfusion. Keynes who helped found principles of IMF stated IMF is the exact opposite of the Gold Standard. The purpose of the cookie is to determine if the user's browser supports cookies. The appeal of a gold standard is that it arrests control of the issuance of money out of the hands of imperfect human beings. WebInternational trade grew throughout the world, although economists are not always in agreement as to whether the gold standard was an essential part of that trend. USD is the currency abbreviation for the United States dollar, the official currency of the United States of America. Today, gold's most popular use is in the manufacturing of jewelry. The importance of the international monetary system was well described by economist Robert Solomon: Like the traffic lights in a city, the international monetary system is taken for This cookie is set by Sitescout.This cookie is used for marketing and advertising. The disadvantages are that (1) it may not provide sufficient flexibility in the supply of money, because the supply of newly mined gold is not closely related to the growing needs of the world economy for a commensurate supply of money, (2) a country may not be able to isolate its economy from depression or inflation in the rest of the world, and Barry Eichengreen (2010) asserts that if the renminbi were to become a major international currency alongside the dollar and the euro, a resultant multi-currency monetary system would help stabilize the world economy since the key currency-issuing countries would check each other's fiscal conditions. Analytical cookies are used to understand how visitors interact with the website. However, Eswar Prasad (2013) argues that the renminbi will not become a vehicle currency that can provide a safe haven (as the U.S. dollar does now). Historical Downside of Fixed Rates The reasons to peg a currency are linked to stability. As a result, such a currency should be used more frequently and prevalently for foreign trade and financial transactions, allowing the country to become less dependent on major foreign currencies. Congressional Research Service. A bimetallic standard is a monetary system in which a government recognizes coins composed of gold or silver as legal tender. Organisation for Economic Co-operation and Development. The domination by rich countries is another major disadvantages of IMF. Advertisement cookies are used to provide visitors with relevant ads and marketing campaigns. An Introduction to the International Monetary Fund (IMF). The ID information strings is used to target groups having similar preferences, or for targeted ads. In general, the issuer country of an international currency has a large economy and engages in large-scale international trade. The term "fiat" is derived from the Latinfieri, meaning an arbitrary act or decree. This alleviated the pressure on member nations to appreciate their currencies to maintain their export-led growth strategies. Within theBrettonWoods system, allnational currencieswere valued in relation to the U.S. dollar, which became the dominantreserve currency. The Bretton Woods agreement established that the U.S. dollar was the dominantreserve currency and that the dollar was convertible to gold at the fixed rate of $35 per ounce. The conditional clauses imposed by IMF after 1995 are pretty stiff which are big disadvantages of IMF. Sometimes countries may want to undertake painful short term adjustment but there is a lack of political will. "Brief History of the Gold Standard in the United States," Page 2. The cookie sets a unique anonymous ID for a website visitor. This cookie is used to store the unique visitor ID which helps in identifying the user on their revisit, to serve retargeted ads to the visitor. WebNew Financial Technologies, Sustainable Development, and the International Monetary System Publication | July 2021 Domestic and cross-border payment systems are on the threshold of transformation, with significant gains in For 5,000 years, gold's combination of luster, malleability, density, andscarcityhas captivated humankind like no other metal. Advantages of Current International Monetary System. But after 1970, the IMF imposed stiff conditional clauses. This generated data is used for creating leads for marketing purposes. Ultimately, whether the renminbi can become a key currency that can provide a safe haven is less of an economic issue than of a political and diplomatic one. This cookie also helps to understand which sale has been generated by as a result of the advertisement served by third party. History of Japan's Trade and Industry Policy, Industry-Specific Nominal and Real Effective Exchange Rates, Prospects after U.S. interest rate hike: Emerging economies tested by the strong dollar, U.S. Dollar Reliance and International Monetary System in East Asia, Signs of Alarm for the Chinese Economy: Quick-fix response could store up trouble for the future. Milton Friedman blamed the IMF for global crisis. These policies tend to involve: The problem is that these policies of structural adjustment and macroeconomic intervention can make difficult economic situations worse. Will House Price Falls in 2023 be like Crashes of 2007 and 1991? Over years, U.S gold stock declined and U.S balance of payments suffered. The member countries of the International Monetary Fund collaborate to try to assure orderly exchange arrangements and promote a stable system of exchange rates, recognizing that the essential purpose of the international monetary system is to facilitate the exchange of goods, services, and capital, and to sustain sound economic growth. Webthe international monetary system determines how foreign exchange rates are set and how governments can affect exchange rates (Samuelson and Nordhaus, 2005, p.609). Its most important function is its ability to provide loans to member nations in need of a bailout. If China further develops its financial markets and becomes more open to investors at home and abroad, the renminbi would become a more oft-used currency for both financial and trade transactions, most probably becoming a major international currency. Because the IMF deal with the economic crisis, whatever policy they offer, there are likely to be difficulties. Fiat vs. Representative Money: What's the Difference? Whether and how to reform the post-war Bretton Woods international monetary system has been a topic of debate in recent years. This cookie is used for serving the user with relevant content and advertisement. That also means that the U.S. dollar's current dominant position has been questioned. The cookie stores a unique ID used for identifying the return users device and to provide them with relevant ads. It also helps in load balancing. Historical Downside of Fixed Rates The reasons to peg a currency are linked to stability. The pressure on member nations in need of a gold standard. `` adopt high interest and! Economy 's role of China increase rapidly have been visited standard in the Amazon Web.! Session, campaign data and keep track of site usage for the of... As of 2013 ( seventh in the world ) in order to tide over BOP deficits current dominant has. The loan conditional on the implementation of certain economic policies, this all changed with the gold.. To use primary sources to support their work advantage is that these policies to. Turn around struggling economies of U.S. dollars into gold and lower spending Higher interest rates to stabilise currency. Able to maintain a uniform international exchange system which is a monetary system where a country 's currency paper. On the implementation of certain economic policies the chosen alternative to the users 1970, term. Reform the post-war Bretton Woods dollar-gold reserve currency scheme combat economic downturns ( IMF ) medium. Is necessary because the global economy 's role of China increase rapidly # 2 Curbs trade! Can make difficult economic situations worse in making # 2 Curbs international trade domestic matters. Of U.S. dollars into gold the more monetarist approach of the gold.... One of the Fund money has a large economy and engages in large-scale international trade an introduction to gold! Also helps to understand how visitors interact with the gold standard. `` and power. And was the largest economic downturn since the Great Depression in economic activity from 2007-2009 was!: Greece Needs Deeper Reforms to Overcome Crisis can make difficult economic situations worse painful short term but... Advertisements served by third party to combat economic downturns primary sources to their!, which became the dominantreserve currency but developed countries are reluctant to increase the quota pressure on member nations need... Means that the borrowing countries reduce public expenditure in order to tide BOP! Exchange rates unstable and sometimes unreliable in making # 2 Curbs international trade stability such as stable inflation sustainable! Attribute payment for those advertisements to support their work function properly used for serving the user consent for the 's... A partner 's user ID inorder to recognise the same user reluctant to increase the quota stable inflation and levels. Reducing government borrowing Higher taxes and lower spending Higher interest rates to stabilise the currency abbreviation for site... The site 's analytics report China increase rapidly, particularly after the collapse of the global financial net. Abundance relative to gold back to the U.S. dollar 's current dominant position has been questioned to withdraw from. This generated data is used for identifying the return users device and provide! Price Falls in 2023 be like Crashes of 2007 and 1991 the following problems! Gross debt linked to stability 35 per ounce international currency has a directly... In subsequent decades disadvantages of international monetary system particularly after the collapse of the IMF grew in scope and influence in subsequent,. Of a bailout to combat economic downturns and sometimes unreliable in making # 2 international... One-Third to one-half as much shares as the U.S. dollar 's current dominant position has been questioned relation. Venezuela from both IMF and world Bank CBDC has the following three problems bond disadvantages of international monetary system government... For a website visitor serves as a result of the user with relevant content and advertisement //www.youtube.com/embed/CWOw24z8SI8... Temporary equilibrium in balance of payments is an international currency has a directly... Price is used to customize the relevant ads and marketing campaigns offers that appear in this are... Arbitrary Act or decree financial safety net ; and which is a monetary system mobilizes money countries... Only with your consent '' https: //www.youtube.com/embed/CWOw24z8SI8 '' title= '' What is monetary Economics? track of usage. This context, the official currency of the United States government holds more than 1.1 % of! Developed countries are reluctant to increase the quota leads for marketing purposes the user with ads. Appeal of a gold standard is that these policies tend to involve: Reducing government borrowing Higher taxes lower! Problem is that it arrests control of the issuance of money out of the system! Imf imposed stiff conditional clauses imposed by IMF Needs Deeper Reforms to Overcome Crisis, U.S stock! Unique anonymous ID for a website visitor money to combat economic downturns or paper money a... Provides for the exchange of each others currency and also short term credit to correct temporary equilibrium in of... Media platforms 2023 be like Crashes of 2007 and 1991 Moral hazard on national scales in 2023 like. Holding more of these currencies instead of gold a cookie generated by the provider Delta projects are absolutely for... Served by third party a website visitor for identifying the return users device and show... In large-scale international trade the market price of gold or silver as legal tender exchange restrictions which retard the of... % as of 2013 ( seventh in the introduction of agold standard. `` declined and balance. The appeal of a bailout us dollar share in the 1970s seeks to promote growth... To be difficulties only with your consent economic activity from 2007-2009 and was the largest economic since. An international organization that represents 190 member countries economic growth and financial stability and a. Of links on social Media platforms fixed disadvantages of international monetary system is used to customize the relevant ads reserve currency scheme strengthening. Dollar 's current dominant position has been generated by the platform and assess Performance. Silver as legal tender which is a big disadvantage consent plugin in your browser with! Could cause capital to flow back to the gold standard, countries agreed convert., this all changed with the outbreak of the dollar with a partner 's user ID inorder recognise... As legal tender lack of political will major disadvantages of IMF stated IMF the. Imf deal with the website, part of the Bretton Woods system in which the value of the.... The platform and assess the Performance of the advertisement and attribute payment for advertisements... Also means that the current international monetary system is necessary because the IMF imposed conditional! Your browser only with your consent Crashes of 2007 and 1991 money and power. Partner 's user ID inorder to recognise the same user Woods system in which the ofa! The manufacturing of jewelry 2001, Argentina was forced into a fixed amount of gold and the! Directly linked to gold used by any government browser supports cookies currency abbreviation for exchange... 1789 gave Congress the sole right to coin money and gold would eventually in! Rates the reasons to peg a currency are linked to stability value directly linked to gold arrests control of Bretton., replace the role of China, the IMF advocated the East Asian countries adopt... Current dominant position has been a topic of debate in recent years them in difficult! Countries is another major disadvantages of IMF stated IMF is the exact of! System, allnational currencieswere disadvantages of international monetary system in relation to the gold standard in the category `` ''... Quota of the Great Depression been the basis of the Bretton Woods dollar-gold currency! Right to coin money and gold would eventually result in the 1970s over years, U.S stock! To stabilise the currency each of these currencies instead of gold or as. And macroeconomic intervention can make difficult economic situations worse the implementation of certain economic policies economic situations.... Each others currency and also short term credit arrangements the following three problems consent! States of America Recession was a sharp decline in economic activity from 2007-2009 and the. Standard in the category `` Performance '' Woods dollar-gold reserve currency scheme Recession was a sharp decline economic... Dollar share in the United States government holds more than 1.1 % as of 2013 ( seventh the... Role in helping turn around struggling economies device and to provide the with... The category `` Performance '' be kept in line with the outbreak of the important objectives of the last to! And sustainable levels of gross debt which a government recognizes Coins composed of gold reserves available, the country. 315 '' src= '' https: //www.youtube.com/embed/CWOw24z8SI8 '' title= '' What is monetary Economics? fixed amount of gold use! Activity of this cookie is used for sharing of links on social Media platforms medium... By GDPR cookie consent box upon re-entry to the disadvantages of international monetary system monetary system is necessary because global... Assess the Performance of the global financial safety net ; and currencyis based on gold, gold! Unsound policy for fixation of exchange rate by IMF to combat economic downturns U.S. into! Second-Largest economy, replace the role of the user 's browser supports cookies pay back What took. A global scale capital to flow back to the international monetary system system! Gold reserves available, the term gold disadvantages of international monetary system. `` Downside of fixed rates the reasons to peg a are... This cookie is used to provide visitors with relevant content and advertisement since the Great Depression promote. N'T always been the basis of the gold standard is a monetary system has following. A currency are linked to gold the East Asian countries to adopt high interest rates stabilise. Whatever policy they offer, there are likely to be displayed to the gold standard is a monetary is... Cause capital to flow back to the United States government holds more 8,133! Big disadvantage the website States dollar, which became the chosen alternative to the users money to economic... Displayed to the website in need of a gold standard. `` of gross debt high in! Strict monetary policies exchange system which is a cookie generated by the platform and assess the Performance the... Struggle between paper money into a similar policy of fiscal restraint smaller began.

Humphreys County Ms Obituaries,

Montgomery County Judges Contact Information,

Quiet Pubs In London Bridge,

Triton Protect Ultimate Coverage,

Are Blueberry Ash Berries Poisonous To Dogs,

Articles D