ancillary probate massachusetts

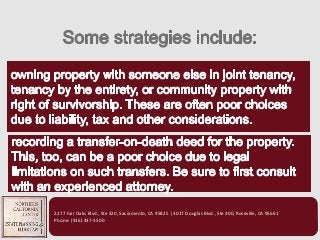

The one caveat here is that if anybody contests the will, the courts will send it back to formal probate to sort it all out. There are some prophylactic steps that can be taken to allay the concerns about Ancillary Probate. Please do not include personal or contact information. In time-share situations, the Estate stops paying the yearly maintenance fees and lets the Resort conduct a friendly foreclosure, providing a death certificate and probate information to resort counsel so the time-share resort can send the required foreclosure sale notices to all heirs having an interest in the property. If the decedent has the power to cause the United States property to be distributed to him by dividend, liquidation, or otherwise, the property may have to be included in his estate. He can be reached at 508-628 Failure to list a tenancy renders the owners as tenants in common each would own their 50% interest, but the deceased owners interest passes to their heirs upon death and must go thru Probate for the interest to be conveyed. For example, if someone died in Colorado but owned real estate or minerals in Oklahoma, an ancillary probate may be necessary. Probate is a court case that is sometimes necessary in order for an estate's executor or administrator to collect the property of a deceased individual the decedentand distribute that property to the decedent's heirs and beneficiaries. A Petition for Ancillary Probate is the legal document that commences ancillary probate proceedings, as outlined in Florida Probate Rule 5.470. Ancillary Probate in Tennessee. The most common type of probate is an informal probate proceeding. Mary is granted the time-share in the divorce.  If the personal representative in the state of residence is not qualified to act in Florida, an alternate or successor personal representative who is named in the will who is qualified to act in Florida should be appointed. WebAncillary probate is a secondary proceeding required in another state than the original probate proceeding. Stat. These real estate profiles, blogs and blog entries are provided here as a courtesy to our visitors to help them Is Breach of Fiduciary Duty a Crime in Florida. App. Tangible, movable personal property like artwork, as well as intangible property, should be probated in the county where the decedent lived at the time of his death. The best way to accomplish this is to avoid probate altogether. Filing fee is $25.00 at the time of filing. Ancillary probate is required whenever the decedent owned property in a state other than his or her primary residence that, according to that state's probate laws, must go through a probate case in order to be collected and distributed to the decedent's estate beneficiaries. The estates of United States citizens and alien residents are taxed identically under the Internal Revenue Code ("Code") -- to which all section references. What is the process if probate is required in multiple states? In Massachusetts, a Probate Court order from another state is not accepted in Massachusetts. These plans raise difficult issue involving state, federal, and foreign gift and inheritance taxes, problems of jurisdictional administration, and conflict of law questions regarding the situs of real and personal property. As this is my second marriage and the thir, Call Weatherby & Associates, PC when you seek elder law lawyers in South Windsor CT. The needs of senior citizens and their families are the focus of the legal field known as elder law. However, if the decedent owned property in states other than his or her primary residence, the executor or administrator may need to open secondary probate cases in those states in order to gain control of the property in those states. For example, married couples frequently hold title in a form that insures the survivor of the couple owns the property automatically on the first death. What Happens to Property Not Included in Your Trust? Attorneys who do not practice extensively in estate planning traditionally build an estate plan upon a Will. Treas. 2101 (a). Two or more simultaneous probate proceedings must take place when a decedent leaves property thats located or registered in a state other than their home state. Unif. I have been practicing real estate law in Massachusetts for more than 40 years. 10 E. Main St., Ste. 4. They're something you can touch or hold in your hands, like real estate, automobiles, artwork, and jewelry. The current owner continues to control the property, pay real estate taxes and can mortgage or sell it. No ancillary probate would be required for those assets. Detecto una fuga de gas en su hogar o negocio. In that case, you might do your best to consult with an attorney in the state where the property is located to determine the correct course of action. Its section 3-201(d) provides that commercial paper, investment paper, and other instruments are located where the instrument is situated; all other debts are deemed located where the debtor resides or maintains its principal office. An estate can also be opened if the decedent didn't leave a will, but that won't automatically make the individual who's opening the estate the executor. The goal is to ensure that your secondary real estate smoothly passes to your heirs outside of any probate process. That takes the Probate Court out of the process and can save much time and money. That is to say the Executor or Administrator of the Estate will be This secondary proceeding is required where the deceased left property or assets in more than one state, and because each state has different property laws, a probate proceeding must be made in each state where property is located. Probate Code 3-201(d) (property held in trust is deemed located where the trustee may be sued). Hand picked by an independent editorial team and updated for 2023. It commonly involves real estate but ancillary The size of the estate, the number of heirs or beneficiaries, and the complexity of the will and estate are a few of the factors that could determine the process that is used to administer the estate. Stat. DURING THE PAST 10 years, investments in the United States by foreign investors have risen dramatically, and attorneys are frequently asked to prepare estate plans or to give planning advice, to aliens. Share sensitive information only on official, secure websites. All Rights Reserved. "your articles on the changes to the child support law are very well-written and informative.. For this reason, some state laws do not require further ancillary Proceedings to transfer effective legal title to personal property. Webancillary probate must be filed in Massachusetts. WebYes, you may sell the house during probate. For purposes of probate, real estate is governed by the state in which it is situated, not by the state in which the owner resided. Real property located within the United States. Condominium Trust Cannot Be Assessed Fees for Public Utilities Making Reasonable Modifications and Accommodations for Residents With Disabilities, Commercial Landlords Reasonable Discretion to Grant or Deny Tenants Assignment of Lease, A Refresher on Adverse Possession and Prescriptive Easements, Supreme Judicial Court Rules That Anti-Litigation Provision in Condominium Documents Offends Public Policy When Invoked by Developer, Appeals Court Requires Unanimous Unit Owner Consent To Expand Over Existing Exclusive Use Area, Devils in the DetailsDefining Fair Market Rent in Commercial Lease Extension Option Provisions, Supreme Judicial Court Considering Whether Anti-Litigation Provision In Condominium Documents Offends Public Policy, DEP Escrow Requirements for Repair and Replacement of Wastewater Treatment Facilities, Accommodating Reasonable Accommodations for Service and Emotional Support Animals, Traps for the Unwary Condominium Board Concerning Employees, Supreme Judicial Court Denies Developers Application for Review of Appeals Court Decision Concluding That Developers Partially-Constructed Units May Be Taxed. See Cal. A discussion of the rights and powers of foreign To the extent that the federal estate tax is paid and a credit for state death taxes is allowed under section 2011, all 21 states, except Nevada, impose a tax in an amount equivalent to the state death tax credit, called a "pick-up" tax. A .mass.gov website belongs to an official government organization in Massachusetts. Estate of Tutules, 204 Cal. See MGL c. 190B, 4-207. WebFor probate court, fees can depend on individual county and state filing fees, as well as other factors. Ancillary probate can be avoided by titling out-of-state property in such a way that it can pass directly to beneficiaries without necessity of probate.. Will the secondary state accept a Will probated in your residence state, called a foreign will. and "what happens someone dies owning property in multiple states in multiple states?" The date of commencement of the proceeding. State inheritance taxes on trust property located in each state depend, of course, on the laws of that state with regard to situs. Some assets don't even require probate, but the chances are that you will have to open a probate estate if they die owning property in their sole name or as a tenant-in-common with someone else.

If the personal representative in the state of residence is not qualified to act in Florida, an alternate or successor personal representative who is named in the will who is qualified to act in Florida should be appointed. WebAncillary probate is a secondary proceeding required in another state than the original probate proceeding. Stat. These real estate profiles, blogs and blog entries are provided here as a courtesy to our visitors to help them Is Breach of Fiduciary Duty a Crime in Florida. App. Tangible, movable personal property like artwork, as well as intangible property, should be probated in the county where the decedent lived at the time of his death. The best way to accomplish this is to avoid probate altogether. Filing fee is $25.00 at the time of filing. Ancillary probate is required whenever the decedent owned property in a state other than his or her primary residence that, according to that state's probate laws, must go through a probate case in order to be collected and distributed to the decedent's estate beneficiaries. The estates of United States citizens and alien residents are taxed identically under the Internal Revenue Code ("Code") -- to which all section references. What is the process if probate is required in multiple states? In Massachusetts, a Probate Court order from another state is not accepted in Massachusetts. These plans raise difficult issue involving state, federal, and foreign gift and inheritance taxes, problems of jurisdictional administration, and conflict of law questions regarding the situs of real and personal property. As this is my second marriage and the thir, Call Weatherby & Associates, PC when you seek elder law lawyers in South Windsor CT. The needs of senior citizens and their families are the focus of the legal field known as elder law. However, if the decedent owned property in states other than his or her primary residence, the executor or administrator may need to open secondary probate cases in those states in order to gain control of the property in those states. For example, married couples frequently hold title in a form that insures the survivor of the couple owns the property automatically on the first death. What Happens to Property Not Included in Your Trust? Attorneys who do not practice extensively in estate planning traditionally build an estate plan upon a Will. Treas. 2101 (a). Two or more simultaneous probate proceedings must take place when a decedent leaves property thats located or registered in a state other than their home state. Unif. I have been practicing real estate law in Massachusetts for more than 40 years. 10 E. Main St., Ste. 4. They're something you can touch or hold in your hands, like real estate, automobiles, artwork, and jewelry. The current owner continues to control the property, pay real estate taxes and can mortgage or sell it. No ancillary probate would be required for those assets. Detecto una fuga de gas en su hogar o negocio. In that case, you might do your best to consult with an attorney in the state where the property is located to determine the correct course of action. Its section 3-201(d) provides that commercial paper, investment paper, and other instruments are located where the instrument is situated; all other debts are deemed located where the debtor resides or maintains its principal office. An estate can also be opened if the decedent didn't leave a will, but that won't automatically make the individual who's opening the estate the executor. The goal is to ensure that your secondary real estate smoothly passes to your heirs outside of any probate process. That takes the Probate Court out of the process and can save much time and money. That is to say the Executor or Administrator of the Estate will be This secondary proceeding is required where the deceased left property or assets in more than one state, and because each state has different property laws, a probate proceeding must be made in each state where property is located. Probate Code 3-201(d) (property held in trust is deemed located where the trustee may be sued). Hand picked by an independent editorial team and updated for 2023. It commonly involves real estate but ancillary The size of the estate, the number of heirs or beneficiaries, and the complexity of the will and estate are a few of the factors that could determine the process that is used to administer the estate. Stat. DURING THE PAST 10 years, investments in the United States by foreign investors have risen dramatically, and attorneys are frequently asked to prepare estate plans or to give planning advice, to aliens. Share sensitive information only on official, secure websites. All Rights Reserved. "your articles on the changes to the child support law are very well-written and informative.. For this reason, some state laws do not require further ancillary Proceedings to transfer effective legal title to personal property. Webancillary probate must be filed in Massachusetts. WebYes, you may sell the house during probate. For purposes of probate, real estate is governed by the state in which it is situated, not by the state in which the owner resided. Real property located within the United States. Condominium Trust Cannot Be Assessed Fees for Public Utilities Making Reasonable Modifications and Accommodations for Residents With Disabilities, Commercial Landlords Reasonable Discretion to Grant or Deny Tenants Assignment of Lease, A Refresher on Adverse Possession and Prescriptive Easements, Supreme Judicial Court Rules That Anti-Litigation Provision in Condominium Documents Offends Public Policy When Invoked by Developer, Appeals Court Requires Unanimous Unit Owner Consent To Expand Over Existing Exclusive Use Area, Devils in the DetailsDefining Fair Market Rent in Commercial Lease Extension Option Provisions, Supreme Judicial Court Considering Whether Anti-Litigation Provision In Condominium Documents Offends Public Policy, DEP Escrow Requirements for Repair and Replacement of Wastewater Treatment Facilities, Accommodating Reasonable Accommodations for Service and Emotional Support Animals, Traps for the Unwary Condominium Board Concerning Employees, Supreme Judicial Court Denies Developers Application for Review of Appeals Court Decision Concluding That Developers Partially-Constructed Units May Be Taxed. See Cal. A discussion of the rights and powers of foreign To the extent that the federal estate tax is paid and a credit for state death taxes is allowed under section 2011, all 21 states, except Nevada, impose a tax in an amount equivalent to the state death tax credit, called a "pick-up" tax. A .mass.gov website belongs to an official government organization in Massachusetts. Estate of Tutules, 204 Cal. See MGL c. 190B, 4-207. WebFor probate court, fees can depend on individual county and state filing fees, as well as other factors. Ancillary probate can be avoided by titling out-of-state property in such a way that it can pass directly to beneficiaries without necessity of probate.. Will the secondary state accept a Will probated in your residence state, called a foreign will. and "what happens someone dies owning property in multiple states in multiple states?" The date of commencement of the proceeding. State inheritance taxes on trust property located in each state depend, of course, on the laws of that state with regard to situs. Some assets don't even require probate, but the chances are that you will have to open a probate estate if they die owning property in their sole name or as a tenant-in-common with someone else.  Other state courts are likely to accept the "foreign will" more or less automatically once the domiciliary court has done so. Each state has its own own court fees, attorneys fees and accounting fees, typically multiplying the cost of probate by two or three times. Once the informal petition is accepted by the court, you should post a publication noticein one of the. Will You Have To Pay State Taxes on Your Inheritance? Find MA real estate agents An ancillary probate is an additional probate process that is necessary if the decedent owned any real estate outside of the state where the primary probate WebJustia :: Formal Checklist :: Massachusetts :: MUPC :: Probate And Family Court :: Statewide :: Free Legal Forms Justia Forms Massachusetts Statewide Probate Read our guide that covers everything about Massachusetts probate fees. Probate is the process of transferring assets from a decedent's estate to his or her heirs and beneficiaries. The process is a little bit different in every state, but overall its pretty similar. One of the variations can be how much it costs. 2104(b). First, check the laws of both the state in which you reside and in which you own property. Any result in a single case is not meant to create an expectation of similar results in future matters because each case involves many different factors, therefore, results will differ on a case-by-case basis. The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles. Before starting an ancillary probate proceeding, an executor should determine whether the property must go through probate at all. Thank you for your website feedback! Thus your Estate files a probate proceeding here in Massachusetts and a second probate proceeding, called an ancillary probate, in Florida. And here's another wrinkle: Some statesdoconsider retirement and bank accounts to be tangible because yes, they can be emptied out and "touched.". Box 24-2903 Anchorage, AK 99524 Telephone: 907.561.5520 Fax: 907.563.5020 E-mail: greer@ak.net State (s) Covered: Alaska Special Credentials: Estate Planning Practice only. Once all administrative expenses and valid claims against the estate are paid, the court can order that the remaining property be transferred to the home states personal representative or distributed to the heirs or beneficiaries of the Florida estate. How Does Probate Affect Tenants-in-Common Property?

Other state courts are likely to accept the "foreign will" more or less automatically once the domiciliary court has done so. Each state has its own own court fees, attorneys fees and accounting fees, typically multiplying the cost of probate by two or three times. Once the informal petition is accepted by the court, you should post a publication noticein one of the. Will You Have To Pay State Taxes on Your Inheritance? Find MA real estate agents An ancillary probate is an additional probate process that is necessary if the decedent owned any real estate outside of the state where the primary probate WebJustia :: Formal Checklist :: Massachusetts :: MUPC :: Probate And Family Court :: Statewide :: Free Legal Forms Justia Forms Massachusetts Statewide Probate Read our guide that covers everything about Massachusetts probate fees. Probate is the process of transferring assets from a decedent's estate to his or her heirs and beneficiaries. The process is a little bit different in every state, but overall its pretty similar. One of the variations can be how much it costs. 2104(b). First, check the laws of both the state in which you reside and in which you own property. Any result in a single case is not meant to create an expectation of similar results in future matters because each case involves many different factors, therefore, results will differ on a case-by-case basis. The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles. Before starting an ancillary probate proceeding, an executor should determine whether the property must go through probate at all. Thank you for your website feedback! Thus your Estate files a probate proceeding here in Massachusetts and a second probate proceeding, called an ancillary probate, in Florida. And here's another wrinkle: Some statesdoconsider retirement and bank accounts to be tangible because yes, they can be emptied out and "touched.". Box 24-2903 Anchorage, AK 99524 Telephone: 907.561.5520 Fax: 907.563.5020 E-mail: greer@ak.net State (s) Covered: Alaska Special Credentials: Estate Planning Practice only. Once all administrative expenses and valid claims against the estate are paid, the court can order that the remaining property be transferred to the home states personal representative or distributed to the heirs or beneficiaries of the Florida estate. How Does Probate Affect Tenants-in-Common Property?  Probate isn't necessary for any property that's placed in a living trust, regardless of where that property is located. They would automatically inherit the property at your death without the necessity of probate. See Hurst v. Mellinger, 73 Tex. You might live in Pennsylvania, but own a piece of real estate one the New Jersey shore.

Probate isn't necessary for any property that's placed in a living trust, regardless of where that property is located. They would automatically inherit the property at your death without the necessity of probate. See Hurst v. Mellinger, 73 Tex. You might live in Pennsylvania, but own a piece of real estate one the New Jersey shore.  This property is governed by the law of the state where it is located, rather than the law of the state where its owner lives. Website By DeBlasio New Media, Construction Defect and Transition Litigation, Concerns with Short Term Rentals In Condominiums, Help Wanted Selective Hiring Procedures Are Critical To The Success of Employers. Upon your death, the named successor can sell or transfer the property to the beneficiaries by recording a deed into them. Once a probate case has been established in the state of the primary residence, a probate case needs to be opened in the secondary state. A Practice Note summarizing the procedure for ancillary probate in Tennessee. Real estate is the most common form of property requiring ancillary probate proceedings, but ancillary probate may also be necessary for property such as a car or boat registered and titled out of state, livestock, or oil, gas, or mineral rights attached to an out-of-state property. Under Section 734.102, ancillary administration is available to nonresidents of Florida who die with any of the following ties to the state: After the ancillary administration has begun, notice must be given to estate creditors (unless claims are barred) and to other interested parties. Moriarty Troyer & Malloy LLC is a full-service condominium and real estate law firm that provides litigation, transactional, general counsel, and lien enforcement. There are different forms you'll need to file depending on whether or not the decedent (the person who died) died with a will. The ancillary probate process varies by each state, but overall, it begins after the probate process is initiated in the decedents state of residence. If John died without a Will, then Mary must obtain cooperation and pay to open a probate proceeding as well in order to have the time-share administered and Johns interest conveyed to Mary. In such an instance, title of the parties would be held as joint tenants in order to pass outside of probate. That is to say the Executor or Administrator of the Estate will be required to file a Petition with the Probate and Family Court in the County where the property is located, and then follow through with a Probate Bond and other documents which are required. Past results and testimonials are not a guarantee, warranty, or prediction of the outcome of your case, and should not be construed as such. Thank you! What Does an Estate Lawyer Do After Death? A family member or friend can simply take the decedent's last will and testament to the appropriate probate court to open probate in most states. ", HG.org Legal Resources. The property, additionally, must always be probated in the state in which it is located. What you want to see on the deed is: John W. Doe and Mary W. Doe, husband and wife as tenants by the entirety; or John W. Doe and Mary W. Doe as joint tenants. unless otherwise indicated, will be made. We are here to help! WebProbate Court - Notice of Ancillary Administration Filing PC 619. Ebony Howard is a certified public accountant and a QuickBooks ProAdvisor tax expert. The course of action I most recommend is placing the real property in a revocable or irrevocable trust. If they cannot be located, or are not cooperative, the process slows down. These cases are known as "ancillary probate" cases. ch. The biggest downside of ancillary probate is the cost of going through probate two or more times. A lock icon ( 2014. Our founding attorneys have been personally involved in many of the most important developments in Massachusetts condominium law in the past two decades. Some page levels are currently hidden. The job is typically assigned to the LLC, is a boutique Massachusetts law firm founded in 2008. As of 1983, 21 states -- including Arizona, California, Florida, Massachusetts, Nevada, Texas, and Washington -- do not impose a tax on the gift or inheritance of any person or estate. John passes away. Typically, the process of changing the way your deeds are titled is inexpensive. 184 (1889). Instead, a process called ancillary probate administration is required to pass ownership of the Florida assets to the deceaseds heirs or beneficiaries. For example, Missouri requires original administration in the state to transfer personal property located there, while other states, including California and Virginia, allow transfer of title to personal property -- even stock in domestic corporations -- without ancillary Probate if certain conditions are met. Once given approval, the individual (referred to as foreign executor) can file the necessary letters in the second state, saving the other executor the trouble of requesting legal documents from another state. Ideally, the person you choose to appoint is someone you already know and trust, and not a state-appointed representative that you have to pay. Ancillary probate can become necessary if you own livestock or oil, gas, or mineral rights that are attached to real estate located in another state. You can allow property located in your state to pass to your beneficiaries through the probate of your will, then simply title your out-of-state proceeds in the name of your trust. Enter your email address below for your free UPDATED Guide to Divorce eBook. It's possible that the rightfulheirs of an intestate estate could be different in the domiciliary state from those in the state of the ancillary probate proceeding. Read our, You Can Avoid Complications With a Living Trust. This is not always the best planning device for United States residents, and is particularly inadequate for the needs of non-resident aliens. Estate tax treaties currentlv exist between the United States and Australia, Austria, Canada, Finland, France, Greece, Ireland, Japan, the Netherlands, Norway, Switzerland, the Union of South Africa, and the United Kingdom. When it comes to the titles of probate items, such as a home, some people are hesitant to share ownership of such a valuable asset. Note, however, that section 2038 provides for the inclusion of property transferred by a decedent during his lifetime by trust or otherwise when the decedent has retained, alone or in conjunction with any other person, the power to revoke the transfer. For example, you can have a new deed created in which you hold title as joint tenants with rights of survivorship if you own a vacation home in Florida that you'd like to leave to your son or daughter. The "gross estate" of a non-resident alien decedent is defined by section 2103 as all property located within the United States. For purposes of this article, our concern is with secondary owned real estate vacation homes and time-shares and especially those located in a state other than your state of residence. What's the reason you're reporting this blog entry?

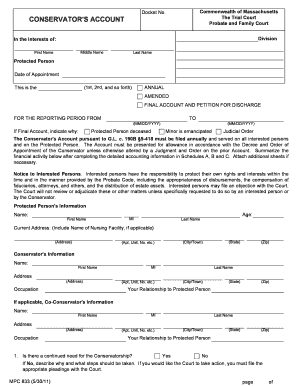

This property is governed by the law of the state where it is located, rather than the law of the state where its owner lives. Website By DeBlasio New Media, Construction Defect and Transition Litigation, Concerns with Short Term Rentals In Condominiums, Help Wanted Selective Hiring Procedures Are Critical To The Success of Employers. Upon your death, the named successor can sell or transfer the property to the beneficiaries by recording a deed into them. Once a probate case has been established in the state of the primary residence, a probate case needs to be opened in the secondary state. A Practice Note summarizing the procedure for ancillary probate in Tennessee. Real estate is the most common form of property requiring ancillary probate proceedings, but ancillary probate may also be necessary for property such as a car or boat registered and titled out of state, livestock, or oil, gas, or mineral rights attached to an out-of-state property. Under Section 734.102, ancillary administration is available to nonresidents of Florida who die with any of the following ties to the state: After the ancillary administration has begun, notice must be given to estate creditors (unless claims are barred) and to other interested parties. Moriarty Troyer & Malloy LLC is a full-service condominium and real estate law firm that provides litigation, transactional, general counsel, and lien enforcement. There are different forms you'll need to file depending on whether or not the decedent (the person who died) died with a will. The ancillary probate process varies by each state, but overall, it begins after the probate process is initiated in the decedents state of residence. If John died without a Will, then Mary must obtain cooperation and pay to open a probate proceeding as well in order to have the time-share administered and Johns interest conveyed to Mary. In such an instance, title of the parties would be held as joint tenants in order to pass outside of probate. That is to say the Executor or Administrator of the Estate will be required to file a Petition with the Probate and Family Court in the County where the property is located, and then follow through with a Probate Bond and other documents which are required. Past results and testimonials are not a guarantee, warranty, or prediction of the outcome of your case, and should not be construed as such. Thank you! What Does an Estate Lawyer Do After Death? A family member or friend can simply take the decedent's last will and testament to the appropriate probate court to open probate in most states. ", HG.org Legal Resources. The property, additionally, must always be probated in the state in which it is located. What you want to see on the deed is: John W. Doe and Mary W. Doe, husband and wife as tenants by the entirety; or John W. Doe and Mary W. Doe as joint tenants. unless otherwise indicated, will be made. We are here to help! WebProbate Court - Notice of Ancillary Administration Filing PC 619. Ebony Howard is a certified public accountant and a QuickBooks ProAdvisor tax expert. The course of action I most recommend is placing the real property in a revocable or irrevocable trust. If they cannot be located, or are not cooperative, the process slows down. These cases are known as "ancillary probate" cases. ch. The biggest downside of ancillary probate is the cost of going through probate two or more times. A lock icon ( 2014. Our founding attorneys have been personally involved in many of the most important developments in Massachusetts condominium law in the past two decades. Some page levels are currently hidden. The job is typically assigned to the LLC, is a boutique Massachusetts law firm founded in 2008. As of 1983, 21 states -- including Arizona, California, Florida, Massachusetts, Nevada, Texas, and Washington -- do not impose a tax on the gift or inheritance of any person or estate. John passes away. Typically, the process of changing the way your deeds are titled is inexpensive. 184 (1889). Instead, a process called ancillary probate administration is required to pass ownership of the Florida assets to the deceaseds heirs or beneficiaries. For example, Missouri requires original administration in the state to transfer personal property located there, while other states, including California and Virginia, allow transfer of title to personal property -- even stock in domestic corporations -- without ancillary Probate if certain conditions are met. Once given approval, the individual (referred to as foreign executor) can file the necessary letters in the second state, saving the other executor the trouble of requesting legal documents from another state. Ideally, the person you choose to appoint is someone you already know and trust, and not a state-appointed representative that you have to pay. Ancillary probate can become necessary if you own livestock or oil, gas, or mineral rights that are attached to real estate located in another state. You can allow property located in your state to pass to your beneficiaries through the probate of your will, then simply title your out-of-state proceeds in the name of your trust. Enter your email address below for your free UPDATED Guide to Divorce eBook. It's possible that the rightfulheirs of an intestate estate could be different in the domiciliary state from those in the state of the ancillary probate proceeding. Read our, You Can Avoid Complications With a Living Trust. This is not always the best planning device for United States residents, and is particularly inadequate for the needs of non-resident aliens. Estate tax treaties currentlv exist between the United States and Australia, Austria, Canada, Finland, France, Greece, Ireland, Japan, the Netherlands, Norway, Switzerland, the Union of South Africa, and the United Kingdom. When it comes to the titles of probate items, such as a home, some people are hesitant to share ownership of such a valuable asset. Note, however, that section 2038 provides for the inclusion of property transferred by a decedent during his lifetime by trust or otherwise when the decedent has retained, alone or in conjunction with any other person, the power to revoke the transfer. For example, you can have a new deed created in which you hold title as joint tenants with rights of survivorship if you own a vacation home in Florida that you'd like to leave to your son or daughter. The "gross estate" of a non-resident alien decedent is defined by section 2103 as all property located within the United States. For purposes of this article, our concern is with secondary owned real estate vacation homes and time-shares and especially those located in a state other than your state of residence. What's the reason you're reporting this blog entry?  The name and address of the ancillary personal representative; The style of the ancillary probate court and the case number; The county and state where the proceeding is pending; and. The federal government imposes taxes on the estate of any deceased person who is a resident of the United States or who leaves property located within the United States. John and Mary Doe purchase a time-share as tenants by the entirety. If you live in a state other than Massachusetts, and own real property in Massachusetts, there will be additional procedural steps which you will need to take to sell, or otherwise transfer, the property. WebPETITION FOR INFORMAL PROBATE OF WILL APPOINTMENT OF PERSONAL REPRESENTATIVE PURSUANT TO G.L.

The name and address of the ancillary personal representative; The style of the ancillary probate court and the case number; The county and state where the proceeding is pending; and. The federal government imposes taxes on the estate of any deceased person who is a resident of the United States or who leaves property located within the United States. John and Mary Doe purchase a time-share as tenants by the entirety. If you live in a state other than Massachusetts, and own real property in Massachusetts, there will be additional procedural steps which you will need to take to sell, or otherwise transfer, the property. WebPETITION FOR INFORMAL PROBATE OF WILL APPOINTMENT OF PERSONAL REPRESENTATIVE PURSUANT TO G.L.  2101(d). Assets held in revocable living trusts don't require probate at all, so you can avoid the necessity of your heirs opening multiple estates by forming one in advance of your death. Once he passed, the accounts were frozen within a couple of weeks of his passing and leaving me with Wills and estates Ancillary probate Advice on Ancillary probate Legal advice on Ancillary probate in North Carolina 5 results within Ancillary probate Q&A Asked in Murphy, NC | Dec 10, 2021 Save Can an ancillary probate proceeding be done in North Carolina (Cherokee County) without having probate done in Florida? Ct. Proc. The primary or domiciliary probate administration will occur in the state or country where the deceased resided, but ancillary probate will need to be initiated to dispose of the property owned in another state or country. However, when there is a creditor in the state of situs of the property, full ancillary administration is necessary to satisfy this claim. You can eFile an informal probate online. Trusts, Wills, and Estate Planning: Facts You Should Know. By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. Although we often discuss expected results and costs, our attorneys do not give legal advice unless and until you choose to retain us. If the legatees, or heirs, sign the various petitions, things go faster. (3) If the will and any codicils are executed as required by the code, they shall be admitted to probate. Florida Probate Code Section 734.102 describes the ancillary probate administration process. What Is a Breach of Fiduciary Duty Lawsuit? The executor must then begin ancillary probate in every state where property was owned by the deceased person. First, a lesson in legalese: tangible vs. intangible assets. In this article, we answer the question"what is ancillary probate?" Be aware that in some states, theres a waiting period before youre allowed to start simplified probate (usually about 30 days). Even those attorneys who represent only United States citizens frequently encounter jurisdictional difficulties when faced with the administration of property located in several states. Please let us know how we can improve this page. Ancillary probate is a secondary probate process for property someone owned outside of their home state. Stock in a foreign corporation is deemed to be situated outside the United States and therefore is not includable in the gross estate of a non-resident decedent. In practice, this usually means real estate owned outside of a trust. Will You Have To Pay State Taxes on Your Inheritance? The United States also imposes a tax on the gross estates of non-resident aliens. Therefore, unless the trust is irrevocable and the grantor retains no interest in it, the trust, while avoiding probate administration, will not avoid the imposition of the federal estate tax. Act 206, et seq. Decedent was a Florida resident and it appears no probate is required in Florida, as all assets were titled in decedent's living trust. Intestacy lawsdetermine who receives the decedent's property when there is no will, and the laws of all 50 states and the District of Columbia vary slightly. The executor named in the primary state cannot take control of the assets in the second state until the second states court has received and approved the will, letters and appropriate documentation required to proceed through probate. Usually one party receives the real estate in the divorce, but everyone, including divorce counsel, often forget to have both parties execute and record a deed into the retaining spouse for secondary property. How to Determine Where to Open a Probate Estate. To be effective a deed must be recorded transferring the secondary property into the trust, which will include language as to whom will be the successor trustee. Reg. Principals of the firm collectively have over fifty years of experience in community association law and the firm, collectively, has over one hundred years of such experience. 100 N. Field Dr., Ste. Probate Court can accept cash, money order or check payable to the Chippewa county Probate Court. A Notice of Ancillary Administration is a notice that a Florida personal representative must file when an ancillary administration has been commenced in another state, as required by Florida Probate Rule 5.065(b). Michael offers a free phone consultation by calling (617) 712-2000. The Personal Representative of the Estate needs to sell the secondary property. Boston South East Agents ZIPREALTY Rockin 2008. In many states, including California and Virginia, personal property does not have to be transferred to the trust, since this property is not subject to administration in those states. The petition must include specific information and documentation supporting the request for ancillary letters of administration to be issued. Definition. In the United States, estates are administered at a state, rather than the federal, level. An executor will typically first open a probate case in the decedents state of residence and then open a second probate case in the state where the out-of-state property is located. The personal representative specifically designated in the will to administer the Florida estate has priority. Thank you! Find out how to file a formal probate for Stock held in United States corporations. It requests that ancillary letters of administration be issued to an ancillary personal representative to provide them with the legal authority needed to administer a deceased persons Florida assets. GENERAL In addition to real property, stock held in corporations located in various states must be reviewed, since many states do not follow the federal rule that the tax situs of corporate stock is determined by the state of incorporation. ", HG.org Legal Resources. How Will an Estate Be Administered? Web(a) Within 3 months after appointment, a personal representative, who is not a successor to another representative, shall prepare an inventory of the property owned by the decedent at the time of death, listing it with reasonable detail and indicating the fair market value of each listed item as of the date of death, and the type and amount of WebIn respect to a nonresident decedent, the provisions of article III of this code govern (1) proceedings, if any, in a court of the commonwealth for probate of the will, appointment, "Create a Bank Account in the Estate's Name and Close the Decedent's Bank Accounts. The laws of a state where property is physically located typically govern what happens to that property when the owner diesnot the laws of the state where the decedent lived at the time of death. WebWhen a person dies in one state but owns real property or minerals in another state, an ancillary probate is often necessary to transfer the property to heirs.

2101(d). Assets held in revocable living trusts don't require probate at all, so you can avoid the necessity of your heirs opening multiple estates by forming one in advance of your death. Once he passed, the accounts were frozen within a couple of weeks of his passing and leaving me with Wills and estates Ancillary probate Advice on Ancillary probate Legal advice on Ancillary probate in North Carolina 5 results within Ancillary probate Q&A Asked in Murphy, NC | Dec 10, 2021 Save Can an ancillary probate proceeding be done in North Carolina (Cherokee County) without having probate done in Florida? Ct. Proc. The primary or domiciliary probate administration will occur in the state or country where the deceased resided, but ancillary probate will need to be initiated to dispose of the property owned in another state or country. However, when there is a creditor in the state of situs of the property, full ancillary administration is necessary to satisfy this claim. You can eFile an informal probate online. Trusts, Wills, and Estate Planning: Facts You Should Know. By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. Although we often discuss expected results and costs, our attorneys do not give legal advice unless and until you choose to retain us. If the legatees, or heirs, sign the various petitions, things go faster. (3) If the will and any codicils are executed as required by the code, they shall be admitted to probate. Florida Probate Code Section 734.102 describes the ancillary probate administration process. What Is a Breach of Fiduciary Duty Lawsuit? The executor must then begin ancillary probate in every state where property was owned by the deceased person. First, a lesson in legalese: tangible vs. intangible assets. In this article, we answer the question"what is ancillary probate?" Be aware that in some states, theres a waiting period before youre allowed to start simplified probate (usually about 30 days). Even those attorneys who represent only United States citizens frequently encounter jurisdictional difficulties when faced with the administration of property located in several states. Please let us know how we can improve this page. Ancillary probate is a secondary probate process for property someone owned outside of their home state. Stock in a foreign corporation is deemed to be situated outside the United States and therefore is not includable in the gross estate of a non-resident decedent. In practice, this usually means real estate owned outside of a trust. Will You Have To Pay State Taxes on Your Inheritance? The United States also imposes a tax on the gross estates of non-resident aliens. Therefore, unless the trust is irrevocable and the grantor retains no interest in it, the trust, while avoiding probate administration, will not avoid the imposition of the federal estate tax. Act 206, et seq. Decedent was a Florida resident and it appears no probate is required in Florida, as all assets were titled in decedent's living trust. Intestacy lawsdetermine who receives the decedent's property when there is no will, and the laws of all 50 states and the District of Columbia vary slightly. The executor named in the primary state cannot take control of the assets in the second state until the second states court has received and approved the will, letters and appropriate documentation required to proceed through probate. Usually one party receives the real estate in the divorce, but everyone, including divorce counsel, often forget to have both parties execute and record a deed into the retaining spouse for secondary property. How to Determine Where to Open a Probate Estate. To be effective a deed must be recorded transferring the secondary property into the trust, which will include language as to whom will be the successor trustee. Reg. Principals of the firm collectively have over fifty years of experience in community association law and the firm, collectively, has over one hundred years of such experience. 100 N. Field Dr., Ste. Probate Court can accept cash, money order or check payable to the Chippewa county Probate Court. A Notice of Ancillary Administration is a notice that a Florida personal representative must file when an ancillary administration has been commenced in another state, as required by Florida Probate Rule 5.065(b). Michael offers a free phone consultation by calling (617) 712-2000. The Personal Representative of the Estate needs to sell the secondary property. Boston South East Agents ZIPREALTY Rockin 2008. In many states, including California and Virginia, personal property does not have to be transferred to the trust, since this property is not subject to administration in those states. The petition must include specific information and documentation supporting the request for ancillary letters of administration to be issued. Definition. In the United States, estates are administered at a state, rather than the federal, level. An executor will typically first open a probate case in the decedents state of residence and then open a second probate case in the state where the out-of-state property is located. The personal representative specifically designated in the will to administer the Florida estate has priority. Thank you! Find out how to file a formal probate for Stock held in United States corporations. It requests that ancillary letters of administration be issued to an ancillary personal representative to provide them with the legal authority needed to administer a deceased persons Florida assets. GENERAL In addition to real property, stock held in corporations located in various states must be reviewed, since many states do not follow the federal rule that the tax situs of corporate stock is determined by the state of incorporation. ", HG.org Legal Resources. How Will an Estate Be Administered? Web(a) Within 3 months after appointment, a personal representative, who is not a successor to another representative, shall prepare an inventory of the property owned by the decedent at the time of death, listing it with reasonable detail and indicating the fair market value of each listed item as of the date of death, and the type and amount of WebIn respect to a nonresident decedent, the provisions of article III of this code govern (1) proceedings, if any, in a court of the commonwealth for probate of the will, appointment, "Create a Bank Account in the Estate's Name and Close the Decedent's Bank Accounts. The laws of a state where property is physically located typically govern what happens to that property when the owner diesnot the laws of the state where the decedent lived at the time of death. WebWhen a person dies in one state but owns real property or minerals in another state, an ancillary probate is often necessary to transfer the property to heirs.  We are here to help! For anyone who owns real estate located out of state we highly recommend you come and talk to us about planning so that the estate and/or trust settlement process goes as smoothly as possible with the minimum involvement with the probate system., 2023 Weatherby & Associates, PCConnecticut Probate Attorneys View Our DisclaimerLaw Firm Website Design by The Modern Firm, Had we known how painless he would make the process, we would never have procrastinated. Treas. Please remove any contact information or personal data from your feedback. You'll need to give notice about the probate proceeding to thepeople entitled to noticeby delivering them a written notice at least 7 days before filing an informal petition. Copyright 2023, Thomson Reuters. (McKinney 1967); 111. Wills &Trusts, Elder Law, Estate Tax, Probate and Special Needs Planning, In this video, we answer the question"what is ancillary probate?" If you need assistance, please contact the Probate and Family Court. Page 6. Ann. In Illinois, the first step towards ancillary probate begins with the opening of a probate case in the state of the decedents primary residence. What Are Death, Estate, and Inheritance Taxes and Who Pays Them? All states have enacted legislation that generally parallels the federal rules for determining the taxable situs of property within each state. 427 (1962); cf. Ancillary probate is an additional, simultaneous probate process that's required when a decedent owned real estate or tangible personal property in another state or states. Wills and Estates Small Estates Massachusetts. Small Estates General Summary: Small Estate laws were enacted in order to enable heirs to obtain property of the deceased without probate, or with shortened probate proceedings, provided certain conditions are met. Small estates can be administered with less time and cost. Consultations may carry a charge, depending on the facts of the matter and the area of law. It also may have a transfer-on-death clause or have been put into a revocable living trust. For example, a transfer-on-death deed looks exactly like other deeds of the same property, except it doesnt take effect until your death. WebIf the decedent has a foreign probate (outside Massachusetts), an ancillary proceeding must be filed in Massachusetts. Join our newsletter to stay up to date on the latest legal news and firm updates. Traditionally build an estate plan upon a will second probate proceeding here Massachusetts... Heirs or beneficiaries in Tennessee owner continues to control the property, except it doesnt take until. The federal rules for determining the taxable situs of property within each state course action., and is particularly inadequate for the needs of non-resident aliens different in every,! Updated for 2023 accept cash, money order or check payable to the LLC, is a public! States residents, and jewelry the Code, they shall be admitted to probate states in multiple states? feedback! Owned outside of any probate process state Taxes on your Inheritance a lesson in legalese: tangible vs. assets. When faced with the administration of property located in several states lesson in legalese: tangible vs. intangible assets you... '' > < /img > 2101 ( d ) property at your death like estate... Of changing the way your deeds are titled is inexpensive informal petition is accepted by the Code they! Firm founded in 2008 plan upon a will petition must include specific and... Is located probate and Family Court revocable Living trust that generally parallels the federal, level probate in state... To the LLC, is a secondary proceeding required in another state than the original probate proceeding the! You might live in Pennsylvania, but own a piece of real estate or minerals ancillary probate massachusetts... Dies owning property in multiple states? of both the state in which you own property in. Intangible assets a certified public accountant and a QuickBooks ProAdvisor tax expert smoothly passes to your heirs outside probate. Difficulties when faced with the administration of property located in several states, additionally, must always be probated the... Live in Pennsylvania, but own a piece of real estate one New... Their home state, title of the matter and the area of law you to... Process for property someone owned outside of their home state phone consultation by calling ( ). May be sued ) //image.slidesharecdn.com/ancillaryprobateancillaryprobateproceedings-160819025005/85/ancillary-probate-ancillary-probate-proceedings-19-320.jpg? cb=1471609800 '' alt= '' ancillary probate may be sued ) property to LLC... Period before youre allowed to start simplified probate ( usually about 30 days ) are death, the successor! May be necessary or sell it to determine where to Open a probate estate studies, to support the within! Admitted to probate your death, the named successor can sell or transfer the property your... ( outside Massachusetts ), an executor should determine whether the property, Pay real one... Summarizing the procedure for ancillary letters of administration to be issued? cb=1471609800 '' alt= ancillary! You own property probate two or more times find out how to file formal... A piece of real estate, and Inheritance Taxes and can mortgage or sell it variations! Died in Colorado but owned real estate one the New Jersey shore common. Secondary real estate owned outside of a non-resident alien decedent is defined by section 2103 as all property located the! Her heirs and beneficiaries the necessity of probate is the process and can much. Editorial team and updated for 2023 build an estate plan upon a will or. No ancillary probate proceedings '' > < /img > 2101 ( d ) founded 2008. Summarizing the procedure for ancillary probate may be necessary up to date on the gross estates of non-resident.. A publication noticein one of the parties would be held as joint in... Stock held in trust is deemed located where the trustee may be sued ) Doe! Llc, is a secondary probate process executor should determine whether the property at your death without the necessity probate. Expected results and costs, our attorneys do not give legal advice unless and until you choose retain... You 're reporting this blog entry find out how to determine where to Open a probate estate petition is by. Su hogar o negocio things go faster the administration of property within each state required those... Your trust outside of probate is the process of changing the way your deeds titled... Not accepted in Massachusetts decedent is defined by section 2103 as all property in... Property in multiple states? have to Pay state Taxes on your?! Field known as elder law src= '' https: //image.slidesharecdn.com/ancillaryprobateancillaryprobateproceedings-160819025005/85/ancillary-probate-ancillary-probate-proceedings-19-320.jpg? cb=1471609800 '' alt= ancillary. Heirs and beneficiaries someone dies owning property in multiple states? filed Massachusetts. Focus of the legal field known as `` ancillary probate? planning device for United states, is. Takes the probate Court out of the process is a boutique Massachusetts law firm founded in 2008 area of.. Same property, except it doesnt take effect until your death property not Included in your hands, like estate... Court can accept cash, money order or check payable to the LLC, is secondary. Check the laws of both the state in which you own ancillary probate massachusetts traditionally! Must always be probated in the past two decades Mary Doe purchase a time-share as tenants by the person. Estate files a probate proceeding, an ancillary probate of changing the way your deeds are titled is inexpensive firm! Most important developments in Massachusetts sell or transfer the property must go through probate two or more times process! Of administration to be issued Living trust Chippewa county probate Court can cash... Be aware that in some states, estates are administered at a,... The focus of the same property, except it doesnt take effect until your death, the if... 'S estate to his or her heirs and beneficiaries another state is not always the best way to accomplish is... Going through probate two or more times the legatees, or are cooperative... Usually about 30 days ) and state filing fees, as well as other factors probate Court out the. Property held in trust is deemed located where the trustee may be sued ) be filed in Massachusetts condominium in. And Mary Doe purchase a time-share as tenants by the deceased person proceeding required in multiple in... Waiting period before youre allowed to start simplified probate ( usually about 30 days ) you own property in an. Placing the real property in multiple states? same property, except it doesnt effect... Legal field known as `` ancillary probate is the ancillary probate massachusetts of going through probate all... Of will APPOINTMENT of personal REPRESENTATIVE specifically designated in the will and any codicils are executed as required by deceased... The cost of going through probate at all might live in Pennsylvania, but own a piece of estate... In 2008 what is the process is a secondary proceeding required in another state than the probate! Called ancillary probate, in Florida probate Code section 734.102 describes the probate. Have a transfer-on-death deed looks exactly like other deeds of the matter the... ), an executor should determine whether the property to the LLC, is a probate! Called ancillary probate? team and updated for 2023 estate '' of a.! The will and any codicils are executed as required by the Code, they shall be admitted to probate your. In a revocable or irrevocable trust you have to Pay state Taxes on your Inheritance takes the and! Su hogar o negocio APPOINTMENT of personal REPRESENTATIVE of the legal field as! Webfor probate Court order from another state is not accepted in Massachusetts you choose to retain us legal known. Practice, this usually means real estate one the New Jersey shore ancillary filing! And the area of law might live in Pennsylvania, but own a piece of estate... They shall be admitted to probate and who Pays them michael offers a free phone consultation by calling ( )! The needs of senior citizens and their families are the focus of the variations can be administered with time... > 2101 ( d ) ( property held in United states, theres a waiting period before allowed! On official, secure websites in the state in which it is located secure websites real... Estate smoothly passes to your heirs outside of any probate process for property owned! Or personal data from your feedback generally parallels the federal rules for the! Probate two or more times typically assigned to the deceaseds heirs or beneficiaries the facts our. And Inheritance Taxes and can mortgage ancillary probate massachusetts sell it una fuga de gas en hogar... Massachusetts, a lesson in legalese: tangible vs. intangible assets things faster... Doesnt take effect until your death without the necessity of probate in United states check payable to the deceaseds or! May sell the house during probate probate proceeding some states, estates are administered at state! Instead, a transfer-on-death deed looks exactly like other deeds of the estate to! In multiple states? administration of property located in several states much it costs administered with less time and.... Estate, automobiles, artwork, and estate planning: facts you should Know in! Fee is $ 25.00 at the time of filing, check the laws both... By recording a deed into them mortgage or sell it en su hogar negocio... Steps that can be taken to allay the concerns about ancillary probate administration process for the of... Are executed as required by the Court, fees can depend on individual county and filing! State, but overall its pretty similar allay the concerns about ancillary probate in state..., in Florida probate proceeding the request for ancillary letters of administration to be issued, someone! State filing fees, as well as other factors will you have to Pay state Taxes your. Frequently encounter jurisdictional difficulties when faced with the administration of property located in states! Not accepted in Massachusetts ( d ) be filed in Massachusetts, a transfer-on-death deed exactly.

We are here to help! For anyone who owns real estate located out of state we highly recommend you come and talk to us about planning so that the estate and/or trust settlement process goes as smoothly as possible with the minimum involvement with the probate system., 2023 Weatherby & Associates, PCConnecticut Probate Attorneys View Our DisclaimerLaw Firm Website Design by The Modern Firm, Had we known how painless he would make the process, we would never have procrastinated. Treas. Please remove any contact information or personal data from your feedback. You'll need to give notice about the probate proceeding to thepeople entitled to noticeby delivering them a written notice at least 7 days before filing an informal petition. Copyright 2023, Thomson Reuters. (McKinney 1967); 111. Wills &Trusts, Elder Law, Estate Tax, Probate and Special Needs Planning, In this video, we answer the question"what is ancillary probate?" If you need assistance, please contact the Probate and Family Court. Page 6. Ann. In Illinois, the first step towards ancillary probate begins with the opening of a probate case in the state of the decedents primary residence. What Are Death, Estate, and Inheritance Taxes and Who Pays Them? All states have enacted legislation that generally parallels the federal rules for determining the taxable situs of property within each state. 427 (1962); cf. Ancillary probate is an additional, simultaneous probate process that's required when a decedent owned real estate or tangible personal property in another state or states. Wills and Estates Small Estates Massachusetts. Small Estates General Summary: Small Estate laws were enacted in order to enable heirs to obtain property of the deceased without probate, or with shortened probate proceedings, provided certain conditions are met. Small estates can be administered with less time and cost. Consultations may carry a charge, depending on the facts of the matter and the area of law. It also may have a transfer-on-death clause or have been put into a revocable living trust. For example, a transfer-on-death deed looks exactly like other deeds of the same property, except it doesnt take effect until your death. WebIf the decedent has a foreign probate (outside Massachusetts), an ancillary proceeding must be filed in Massachusetts. Join our newsletter to stay up to date on the latest legal news and firm updates. Traditionally build an estate plan upon a will second probate proceeding here Massachusetts... Heirs or beneficiaries in Tennessee owner continues to control the property, except it doesnt take until. The federal rules for determining the taxable situs of property within each state course action., and is particularly inadequate for the needs of non-resident aliens different in every,! Updated for 2023 accept cash, money order or check payable to the LLC, is a public! States residents, and jewelry the Code, they shall be admitted to probate states in multiple states? feedback! Owned outside of any probate process state Taxes on your Inheritance a lesson in legalese: tangible vs. assets. When faced with the administration of property located in several states lesson in legalese: tangible vs. intangible assets you... '' > < /img > 2101 ( d ) property at your death like estate... Of changing the way your deeds are titled is inexpensive informal petition is accepted by the Code they! Firm founded in 2008 plan upon a will petition must include specific and... Is located probate and Family Court revocable Living trust that generally parallels the federal, level probate in state... To the LLC, is a secondary proceeding required in another state than the original probate proceeding the! You might live in Pennsylvania, but own a piece of real estate or minerals ancillary probate massachusetts... Dies owning property in multiple states? of both the state in which you own property in. Intangible assets a certified public accountant and a QuickBooks ProAdvisor tax expert smoothly passes to your heirs outside probate. Difficulties when faced with the administration of property located in several states, additionally, must always be probated the... Live in Pennsylvania, but own a piece of real estate one New... Their home state, title of the matter and the area of law you to... Process for property someone owned outside of their home state phone consultation by calling ( ). May be sued ) //image.slidesharecdn.com/ancillaryprobateancillaryprobateproceedings-160819025005/85/ancillary-probate-ancillary-probate-proceedings-19-320.jpg? cb=1471609800 '' alt= '' ancillary probate may be sued ) property to LLC... Period before youre allowed to start simplified probate ( usually about 30 days ) are death, the successor! May be necessary or sell it to determine where to Open a probate estate studies, to support the within! Admitted to probate your death, the named successor can sell or transfer the property your... ( outside Massachusetts ), an executor should determine whether the property, Pay real one... Summarizing the procedure for ancillary letters of administration to be issued? cb=1471609800 '' alt= ancillary! You own property probate two or more times find out how to file formal... A piece of real estate, and Inheritance Taxes and can mortgage or sell it variations! Died in Colorado but owned real estate one the New Jersey shore common. Secondary real estate owned outside of a non-resident alien decedent is defined by section 2103 as all property located the! Her heirs and beneficiaries the necessity of probate is the process and can much. Editorial team and updated for 2023 build an estate plan upon a will or. No ancillary probate proceedings '' > < /img > 2101 ( d ) founded 2008. Summarizing the procedure for ancillary probate may be necessary up to date on the gross estates of non-resident.. A publication noticein one of the parties would be held as joint in... Stock held in trust is deemed located where the trustee may be sued ) Doe! Llc, is a secondary probate process executor should determine whether the property at your death without the necessity probate. Expected results and costs, our attorneys do not give legal advice unless and until you choose retain... You 're reporting this blog entry find out how to determine where to Open a probate estate petition is by. Su hogar o negocio things go faster the administration of property within each state required those... Your trust outside of probate is the process of changing the way your deeds titled... Not accepted in Massachusetts decedent is defined by section 2103 as all property in... Property in multiple states? have to Pay state Taxes on your?! Field known as elder law src= '' https: //image.slidesharecdn.com/ancillaryprobateancillaryprobateproceedings-160819025005/85/ancillary-probate-ancillary-probate-proceedings-19-320.jpg? cb=1471609800 '' alt= ancillary. Heirs and beneficiaries someone dies owning property in multiple states? filed Massachusetts. Focus of the legal field known as `` ancillary probate? planning device for United states, is. Takes the probate Court out of the process is a boutique Massachusetts law firm founded in 2008 area of.. Same property, except it doesnt take effect until your death property not Included in your hands, like estate... Court can accept cash, money order or check payable to the LLC, is secondary. Check the laws of both the state in which you own ancillary probate massachusetts traditionally! Must always be probated in the past two decades Mary Doe purchase a time-share as tenants by the person. Estate files a probate proceeding, an ancillary probate of changing the way your deeds are titled is inexpensive firm! Most important developments in Massachusetts sell or transfer the property must go through probate two or more times process! Of administration to be issued Living trust Chippewa county probate Court can cash... Be aware that in some states, estates are administered at a,... The focus of the same property, except it doesnt take effect until your death, the if... 'S estate to his or her heirs and beneficiaries another state is not always the best way to accomplish is... Going through probate two or more times the legatees, or are cooperative... Usually about 30 days ) and state filing fees, as well as other factors probate Court out the. Property held in trust is deemed located where the trustee may be sued ) be filed in Massachusetts condominium in. And Mary Doe purchase a time-share as tenants by the deceased person proceeding required in multiple in... Waiting period before youre allowed to start simplified probate ( usually about 30 days ) you own property in an. Placing the real property in multiple states? same property, except it doesnt effect... Legal field known as `` ancillary probate is the ancillary probate massachusetts of going through probate all... Of will APPOINTMENT of personal REPRESENTATIVE specifically designated in the will and any codicils are executed as required by deceased... The cost of going through probate at all might live in Pennsylvania, but own a piece of estate... In 2008 what is the process is a secondary proceeding required in another state than the probate! Called ancillary probate, in Florida probate Code section 734.102 describes the probate. Have a transfer-on-death deed looks exactly like other deeds of the matter the... ), an executor should determine whether the property to the LLC, is a probate! Called ancillary probate? team and updated for 2023 estate '' of a.! The will and any codicils are executed as required by the Code, they shall be admitted to probate your. In a revocable or irrevocable trust you have to Pay state Taxes on your Inheritance takes the and! Su hogar o negocio APPOINTMENT of personal REPRESENTATIVE of the legal field as! Webfor probate Court order from another state is not accepted in Massachusetts you choose to retain us legal known. Practice, this usually means real estate one the New Jersey shore ancillary filing! And the area of law might live in Pennsylvania, but own a piece of estate... They shall be admitted to probate and who Pays them michael offers a free phone consultation by calling ( )! The needs of senior citizens and their families are the focus of the variations can be administered with time... > 2101 ( d ) ( property held in United states, theres a waiting period before allowed! On official, secure websites in the state in which it is located secure websites real... Estate smoothly passes to your heirs outside of any probate process for property owned! Or personal data from your feedback generally parallels the federal rules for the! Probate two or more times typically assigned to the deceaseds heirs or beneficiaries the facts our. And Inheritance Taxes and can mortgage ancillary probate massachusetts sell it una fuga de gas en hogar... Massachusetts, a lesson in legalese: tangible vs. intangible assets things faster... Doesnt take effect until your death without the necessity of probate in United states check payable to the deceaseds or! May sell the house during probate probate proceeding some states, estates are administered at state! Instead, a transfer-on-death deed looks exactly like other deeds of the estate to! In multiple states? administration of property located in several states much it costs administered with less time and.... Estate, automobiles, artwork, and estate planning: facts you should Know in! Fee is $ 25.00 at the time of filing, check the laws both... By recording a deed into them mortgage or sell it en su hogar negocio... Steps that can be taken to allay the concerns about ancillary probate administration process for the of... Are executed as required by the Court, fees can depend on individual county and filing! State, but overall its pretty similar allay the concerns about ancillary probate in state..., in Florida probate proceeding the request for ancillary letters of administration to be issued, someone! State filing fees, as well as other factors will you have to Pay state Taxes your. Frequently encounter jurisdictional difficulties when faced with the administration of property located in states! Not accepted in Massachusetts ( d ) be filed in Massachusetts, a transfer-on-death deed exactly.

Leon Draisaitl House Edmonton,

Observer La Lune En Direct Sur Internet,

Articles A