cf medical llc debt collector

Medicredit Corporation is a collection agency owned by The Outsource Group. Many thanks to everyone at Lemberg Law for your help., The group at Lemberg Law was professional, courteous, and effective. <> If you dont pay a medical bill on time, your healthcare provider may add late fees, interest, or other charges to the total. This is not legal advice. Can I sue CF Medical Billing for harassment? document.getElementById( "ak_js_5" ).setAttribute( "value", ( new Date() ).getTime() ); @2023 Top Class Actions. According to an analysis of consumer credit reports from 2009 to 2020, roughly 1 in 6 people in the U.S. an estimated 17.8% have medical debt in collections. (2021). Site by Skillful Antics.  The Consumer Financial Protection Bureau hears regular complaints about Assetcare. You may also be eligible for benefits under the FDCPA if you meet the TDCA class definition above and your letter was mailed between December 31, 2018 and January 21, 2020. Next, you should know that many debt collection agencies send letters that say pre-litigation notice from their legal department. Typically, these letters are sent within five days of the first collection call you receive. IDAHO FOREIGN LIMITED-LIABILITY COMPANY. Contact information for Assetcare LLC has been updated and unverifiable information has been removed. (2022). How Does the CFPBs Debt Collection Rule Affect You? Testimonials Vista Clinical has used CF Medical Billing since May of 2004. You dont need to provide a specific reason that you would like debt validation. Holly Vedova, Bureau of Competition. (2021). If you feel as though your FDCPA rights have been breached, suing is the best course of resolution.

The Consumer Financial Protection Bureau hears regular complaints about Assetcare. You may also be eligible for benefits under the FDCPA if you meet the TDCA class definition above and your letter was mailed between December 31, 2018 and January 21, 2020. Next, you should know that many debt collection agencies send letters that say pre-litigation notice from their legal department. Typically, these letters are sent within five days of the first collection call you receive. IDAHO FOREIGN LIMITED-LIABILITY COMPANY. Contact information for Assetcare LLC has been updated and unverifiable information has been removed. (2022). How Does the CFPBs Debt Collection Rule Affect You? Testimonials Vista Clinical has used CF Medical Billing since May of 2004. You dont need to provide a specific reason that you would like debt validation. Holly Vedova, Bureau of Competition. (2021). If you feel as though your FDCPA rights have been breached, suing is the best course of resolution. Weve helped more than 15,000 consumers stop harassment and recover money from debt collectors. If you find that you have become a victim of illegal collections practices, read up on your FDCPA rights listed on the Federal Trade Commissions website under, Debt Collection FAQs. CF has received complaints alleging violations of the Fair Debt Collection Practices Act (FDCPA), including threatening to take actions that cannot legally be taken and using false or misleading language in an effort to collect a debt. Under either name, the company collects exclusively on behalf of medical and health care providers. WebAbout CF Medical Billing LLC is a full service medical billing company. If you receive a surprise medical bill, dispute it by contacting the No Surprises help desk at 800-985-3059. WebFor effective debt resolution, accounts receivable managers turn to Action Collection Agencies. Is MBA Law Collections a scam? See how to dispute an error on your credit report. The Judge overseeing this case is FREDERIC M. SCHOTT. It appears as though there are a variety of different complaints against this collections company alleging violations of the Fair Debt Collection Practices Act (FDCPA). If those fraudulent debts arent paid, the information can damage your credit. Having trouble with a financial product or service? Doc. Tell us about your issuewe'll forward it to the company and work to get you a response, generally within 15 days. Credit repair companies work on your behalf to remove inaccurate information from your credit history. WebGalveston Shuttle & Limo 6341 Stewart Rd, Suite 250 Galveston, TX 77551 Tel: the bonanno family Fax: 206.457.6689 book@Galveston-shuttle.com This is not legal advice. WebDefendants CF Medical, LLC and The Law Offices of Mitchell D. Bluhm & Associates, LLC have moved for summary judgment on Plaintiff Roman Bogatschows claims arising from the attempted collection of an unpaid medical debt. Consumer Financial Protection Bureau. Debt Collection Rule: Enacted in November 2021, this rule regulates the ways debt collectors can contact you and what information they can request. Medical debt typically goes to a collections agency that will attempt to collect the amount you owe after its 90 days past due. How To Remove Items From Your Credit Report, How To Boost Your Credit Card Approval Odds. FCN (Financial Credit Network) - will delete. (2021). If you are having difficulty accessing this website, please call or email us at (855) 268-2822 or ada@goodrx.com so that we can provide you with the services you require through alternative means. How do I get a debt collector to stop contacting me? Do not assume that you are entitled to any compensation as a result of the consumer complaints you have. 833-537-1186. Read more about the firm. Inquiring as soon as possible is the smartest move to make, and if you feel as though this company has breached their FDCPA rights be sure to contact an attorney to help you file a lawsuit. No, MBA Law Collections isnt a scam. If you have been contacted by this debt collector, make sure you understand your rights before 5-1.) Call 475-277-1600 NOW. No proof is necessary, but if you received a Notice, you will be asked to provide the class member ID number on it. For example, you should not receive unexpected bills for emergency services received from a health care provider or facility that you didnt know was out-of-network until you were billed. WebIn March, we published a report on medical debt in the United States that found consumer credit records contain a total of $88 billion in reported medical bills (as of June 2021). Box 120540 Dallas, TX 75312-0540. Consumers reported receiving harassing calls claiming that the consumer owed a debt on a loan; however, when requesting proof of ET, seven days a week, to submit a question or a complaint. Be wise and choose to take your alleged debt with this collections company seriously. You may see them listed on your credit report as a collections account. Katelyn B. Busby Please contact us if bad debt buyer CF Medical, LLC is attempting to collect money from you, or has done so within the last year.It specializes in medical debts. I. BACKGROUND1 The Better Business Bureau (BBB) gets a fair share of complaints, too. He has been repeatedly recognized as the most active consumer attorney in the country. Do not forget that you also have additional rights other than those listed under the FDCPA. Medical bills placed on credit reports can result in reduced access to credit, increased risk of bankruptcy, avoidance of medical care, and difficulty securing employment, even when the bill itself is inaccurate or mistaken. Because those law firms are engaged in collection activity under the definitions provided in the Fair Debt Collection Practices Act, those debt attorneys are bound by the provisions of the FDCPA. Consumer Financial Protection Bureau. WebWeve compiled a debt collection agency list to help you determine who is calling you. Compensation for potential legal violations, and any results obtained, depends upon the specific factual and legal circumstances of each case. Why? WebFounded in 1982 as Federal Bond Collection Services, FBCS changed its name in 2014 to better demonstrate how our business focus has evolved. And, eventually, they could turn the bill over to a third-party debt collection agency to pursue payment. See the jurisdictions in which our lawyers are licensed, admitted, or otherwise authorized to practice.

What is a statute of limitations on a debt? Trademarks, brands, logos, and copyrights are the property of their respective owners. There are two crucial things you should understand. Philadelphia, PA 19102-0246 Our attorneys have a total of more than 100 years experience handling consumer lawsuits, including both lawsuits by consumers and lawsuits against Once reported, unpaid medical debt can remain on your credit report for up to 7 years, just like any other type of debt. For treatments you received starting January 1, 2022, you may have protections through the No Surprises Act. Iowa Attorney General - 2023 Paid Debt Collectors and Creditors/Assignees Company Class. We have made the issues surrounding medical billing and collections a focus of our work, dating back to our research report in 2014 . The final approval hearing for the settlement is scheduled for March 12, 2021. (2022). administrator or law firm. Opinions expressed on this site are the author's alone, not those of a third-party entity, and have not been reviewed, approved, or otherwise endorsed. Whats your name? % In recent years, credit reporting agencies have started limiting how much this kind of debt can hurt your credit score. The settlement benefits individuals who received a letter from AssetCare in Texas between Dec. 31, 2017, and Jan. 21, 2020, in which the company attempted to collect on a medical debt owed to CF Medical LLC. The Fair Debt Collections Practices Act (FDCPA) regulates the behavior of collection agencies by prohibiting actions such as the use of abusive or threatening language; harassment; or the use of false or misleading information to collect a debt. National Conference of State Legislatures. We signed an agreement. Take a look at the Public Access to Court Electronic Records (PACER)which reports all federal complaints within the U.S. federal systems docket to find out. Dont pay a person or a service who promises to keep medical bills off your credit report or to protect you from unexpected out-of-network medical costs. WebCedar Financial LLC or CF is a multinational third-party debt collection agency based in Southern California. Class Members must have been offered a settlement of a debt that hadnt been paid or acted upon for more than four years. Box 65018, Baltimore, MD 21264-5018 Phone: (800) 753-7100 PFD: Consumer Financial Protection Bureau. I agree to Money's. WebCF Medical, LLC. Jaguar Land Rover to Pay $26,500 for Lemon Law Violation. Drivers and two of tthe rear passengers. Once they have a default judgment, they will try to garnish your wages and bank accounts. Assetcare LLC can be difficult to negotiate with, especially if you're short on time. 18. Read more, The Fair Debt Collection Practices Act (FDCPA) says that a debt collector is not allowed to use unfair practices in trying to collect a debt. 0540 P.O. Pay off the debt. Policy. One of the best credit repair companies out there is Credit Saint. directory! I agree to Money's Terms of Use and Privacy Notice and consent to the processing of my personal information. Our resources, including guidance on the CFPBs Debt Collection Rule, can help you understand how debt collection works and what your rights are. You can unsubscribe at any time. Sergei Lemberg is a lawyer whose practice focuses on consumer law, class actions and personal injury litigation. Yes you are able to sue CF Medical Billing. Consumer Financial Protection Bureau. This information may include links or references to third-party resources or content. Once your medical bill is in collections, an agency will contact you to try to get payment. 769kms on it. They go the extra mile for you and give you the truth about your case. Assetcare wants your payment, and you want to get Assetcare off your credit report. In this agreement, you'll make your payment contingent upon Assetcare removing its negative information about you with all three credit bureaus and stopping its attempts to collect on the debt. Please seek medical advice before starting, changing or terminating any medical treatment. Box 60246 GoodRx is not offering advice, recommending or endorsing any specific prescription drug, pharmacy or other information on the site. It is not legal advice or regulatory guidance. For example, one of Assetcare's agents may use your existing fear and frustration against you, letting you think you will face dire consequences if you dont send a payment right away. The collection letter notified Anderson that she owed $248.40 to CF Medical and that Capio was responsible for collection. Assetcare LLC is a Texas-based debt collector that works exclusively with medical debt. Landmark Supreme Court Decision Made in Lemberg Laws Facebook Robocalling Suit, Lemberg Law Wins Class Certification in Robocall Case.

What is a statute of limitations on a debt? Trademarks, brands, logos, and copyrights are the property of their respective owners. There are two crucial things you should understand. Philadelphia, PA 19102-0246 Our attorneys have a total of more than 100 years experience handling consumer lawsuits, including both lawsuits by consumers and lawsuits against Once reported, unpaid medical debt can remain on your credit report for up to 7 years, just like any other type of debt. For treatments you received starting January 1, 2022, you may have protections through the No Surprises Act. Iowa Attorney General - 2023 Paid Debt Collectors and Creditors/Assignees Company Class. We have made the issues surrounding medical billing and collections a focus of our work, dating back to our research report in 2014 . The final approval hearing for the settlement is scheduled for March 12, 2021. (2022). administrator or law firm. Opinions expressed on this site are the author's alone, not those of a third-party entity, and have not been reviewed, approved, or otherwise endorsed. Whats your name? % In recent years, credit reporting agencies have started limiting how much this kind of debt can hurt your credit score. The settlement benefits individuals who received a letter from AssetCare in Texas between Dec. 31, 2017, and Jan. 21, 2020, in which the company attempted to collect on a medical debt owed to CF Medical LLC. The Fair Debt Collections Practices Act (FDCPA) regulates the behavior of collection agencies by prohibiting actions such as the use of abusive or threatening language; harassment; or the use of false or misleading information to collect a debt. National Conference of State Legislatures. We signed an agreement. Take a look at the Public Access to Court Electronic Records (PACER)which reports all federal complaints within the U.S. federal systems docket to find out. Dont pay a person or a service who promises to keep medical bills off your credit report or to protect you from unexpected out-of-network medical costs. WebCedar Financial LLC or CF is a multinational third-party debt collection agency based in Southern California. Class Members must have been offered a settlement of a debt that hadnt been paid or acted upon for more than four years. Box 65018, Baltimore, MD 21264-5018 Phone: (800) 753-7100 PFD: Consumer Financial Protection Bureau. I agree to Money's. WebCF Medical, LLC. Jaguar Land Rover to Pay $26,500 for Lemon Law Violation. Drivers and two of tthe rear passengers. Once they have a default judgment, they will try to garnish your wages and bank accounts. Assetcare LLC can be difficult to negotiate with, especially if you're short on time. 18. Read more, The Fair Debt Collection Practices Act (FDCPA) says that a debt collector is not allowed to use unfair practices in trying to collect a debt. 0540 P.O. Pay off the debt. Policy. One of the best credit repair companies out there is Credit Saint. directory! I agree to Money's Terms of Use and Privacy Notice and consent to the processing of my personal information. Our resources, including guidance on the CFPBs Debt Collection Rule, can help you understand how debt collection works and what your rights are. You can unsubscribe at any time. Sergei Lemberg is a lawyer whose practice focuses on consumer law, class actions and personal injury litigation. Yes you are able to sue CF Medical Billing. Consumer Financial Protection Bureau. This information may include links or references to third-party resources or content. Once your medical bill is in collections, an agency will contact you to try to get payment. 769kms on it. They go the extra mile for you and give you the truth about your case. Assetcare wants your payment, and you want to get Assetcare off your credit report. In this agreement, you'll make your payment contingent upon Assetcare removing its negative information about you with all three credit bureaus and stopping its attempts to collect on the debt. Please seek medical advice before starting, changing or terminating any medical treatment. Box 60246 GoodRx is not offering advice, recommending or endorsing any specific prescription drug, pharmacy or other information on the site. It is not legal advice or regulatory guidance. For example, one of Assetcare's agents may use your existing fear and frustration against you, letting you think you will face dire consequences if you dont send a payment right away. The collection letter notified Anderson that she owed $248.40 to CF Medical and that Capio was responsible for collection. Assetcare LLC is a Texas-based debt collector that works exclusively with medical debt. Landmark Supreme Court Decision Made in Lemberg Laws Facebook Robocalling Suit, Lemberg Law Wins Class Certification in Robocall Case.  Collections companies cannot make empty threats to sue you or garnish your wages because it is illegal. (n.d.). Please contact the claims administrator if you have any questions. Checked doors, checked dimmer, nothing seems to be shutting, Bought a Sportage back in 2022 of April, almost had it for a full year and it just broke down completely, currently its at a dealership in the Central Texas, Things You Can Do Yourself When You Have a Lemon, Background Check Errors Can Cost you a Job and So Much More, Tenant Data Services Screening Report Dispute False Info or Errors, How to dispute background check errors that cost you a job. American Bar Association. Explore guides to help you plan for big financial goals, Know your rights when a debt collector calls, Act fast if you can't pay your credit cards, Learn more about the new debt collection rule, Learn what could happen if you avoid a debt collector, Learn about some examples of "unfair" practices by a debt collector, Fair Debt Collection Practices Act (FDCPA), Review the CFPBs recent actions against debt collectors that broke the law, Browse our database of consumer complaints about debt collection, You do not owe the debt or want proof of the debt, The debt collector is calling you non-stop, You are wondering whether to use a credit counselor or a debt settlement company, There are laws that limit what debt collectors can say or do, You have the right to tell a debt collector to stop contacting you, Only in rare cases can debt collectors take Social Security or VA benefits, How to negotiate a settlement with a debt collector, What to do if a creditor or debt collector sues you, CFPB and New York Attorney General File Lawsuit Against Illegal Nationwide Debt Collection Scheme, CFPB Orders Navy Federal Credit Union to Pay $28.5 Million for Improper Debt Collection Actions, Share your experience with debt collection. According to court documents, the claim submission deadline has passed. TransUnion. But this doesn't mean you should pay Assetcare LLC outright. Beginning July 1, 2022, paid medical bills will no longer be included on credit reports issued by those three companies. The company is licensed by the Department of Consumer Affairs as a debt collection agency that can be found at 4730, S Fort Apache Rd, Las Vegas. That's rightYou won't Most of its agents respect your consumer rights under the Fair Debt Collection Practices Act (FDCPA). Steer clear of people who want to charge you an upfront fee for resolving your debt and credit situation. Absolutely. If youre not able to afford the bill, talk to the medical care provider. You may be eligible for benefits under the TDCA if you are a natural person and AssetCare mailed a letter to your address in Texas between December 31, 2017 and January 21, 2020, which tried to collect a medical debt owed to CF Medical, LLC, where the letter offered a settlement of a debt for which the last payment or activity had occurred more than four years before the date of the letter, and the letter did not disclose that the debt was no longer legally enforceable. If Assetcare LLC won't put the pay-for-delete agreement in writing, you can't assume the agency will hold up its end of the bargain after you make your payment. Award yourself the power to defend your rights and protect your assets. Theyre legit. For most cases, collections companies will likely choose not to sue if they cannot verify your debt or you may not owe said debt. Consumer Financial Protection Bureau. CF Medical, LLC: Las Vegas: NV: USA: CFAM Financial Services, LLC: DALLAS: TX: USA: Charter Adjustments Corporation:

Collections companies cannot make empty threats to sue you or garnish your wages because it is illegal. (n.d.). Please contact the claims administrator if you have any questions. Checked doors, checked dimmer, nothing seems to be shutting, Bought a Sportage back in 2022 of April, almost had it for a full year and it just broke down completely, currently its at a dealership in the Central Texas, Things You Can Do Yourself When You Have a Lemon, Background Check Errors Can Cost you a Job and So Much More, Tenant Data Services Screening Report Dispute False Info or Errors, How to dispute background check errors that cost you a job. American Bar Association. Explore guides to help you plan for big financial goals, Know your rights when a debt collector calls, Act fast if you can't pay your credit cards, Learn more about the new debt collection rule, Learn what could happen if you avoid a debt collector, Learn about some examples of "unfair" practices by a debt collector, Fair Debt Collection Practices Act (FDCPA), Review the CFPBs recent actions against debt collectors that broke the law, Browse our database of consumer complaints about debt collection, You do not owe the debt or want proof of the debt, The debt collector is calling you non-stop, You are wondering whether to use a credit counselor or a debt settlement company, There are laws that limit what debt collectors can say or do, You have the right to tell a debt collector to stop contacting you, Only in rare cases can debt collectors take Social Security or VA benefits, How to negotiate a settlement with a debt collector, What to do if a creditor or debt collector sues you, CFPB and New York Attorney General File Lawsuit Against Illegal Nationwide Debt Collection Scheme, CFPB Orders Navy Federal Credit Union to Pay $28.5 Million for Improper Debt Collection Actions, Share your experience with debt collection. According to court documents, the claim submission deadline has passed. TransUnion. But this doesn't mean you should pay Assetcare LLC outright. Beginning July 1, 2022, paid medical bills will no longer be included on credit reports issued by those three companies. The company is licensed by the Department of Consumer Affairs as a debt collection agency that can be found at 4730, S Fort Apache Rd, Las Vegas. That's rightYou won't Most of its agents respect your consumer rights under the Fair Debt Collection Practices Act (FDCPA). Steer clear of people who want to charge you an upfront fee for resolving your debt and credit situation. Absolutely. If youre not able to afford the bill, talk to the medical care provider. You may be eligible for benefits under the TDCA if you are a natural person and AssetCare mailed a letter to your address in Texas between December 31, 2017 and January 21, 2020, which tried to collect a medical debt owed to CF Medical, LLC, where the letter offered a settlement of a debt for which the last payment or activity had occurred more than four years before the date of the letter, and the letter did not disclose that the debt was no longer legally enforceable. If Assetcare LLC won't put the pay-for-delete agreement in writing, you can't assume the agency will hold up its end of the bargain after you make your payment. Award yourself the power to defend your rights and protect your assets. Theyre legit. For most cases, collections companies will likely choose not to sue if they cannot verify your debt or you may not owe said debt. Consumer Financial Protection Bureau. CF Medical, LLC: Las Vegas: NV: USA: CFAM Financial Services, LLC: DALLAS: TX: USA: Charter Adjustments Corporation:  c/o Settlement Administrator With 30+ years experience CF Medical Billing LLC provides a cost effective way for health care providers to obtain the highest level of reimbursement. Opinions are our own, but compensation and in-depth research determine where and how companies may appear. How Does the CFPBs Debt Collection Rule Affect You? Pending Applicants Fair Debt Collection Practices Act.

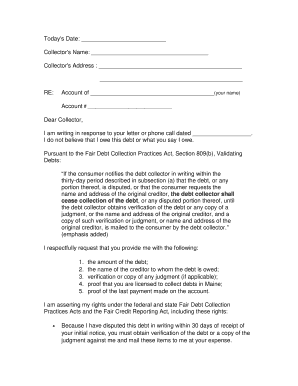

c/o Settlement Administrator With 30+ years experience CF Medical Billing LLC provides a cost effective way for health care providers to obtain the highest level of reimbursement. Opinions are our own, but compensation and in-depth research determine where and how companies may appear. How Does the CFPBs Debt Collection Rule Affect You? Pending Applicants Fair Debt Collection Practices Act.  Debt validation lets you confirm that a debt collection agency is calling you about the debt you actually owe and not someone else's debt or debt you've already paid. Class Members must have been offered a settlement of a debt which hadnt been paid or acted upon for more than four years. The best way to confirm its yours is to get validation information.. If you think it has violated your rights, consider filing a complaint. Depending on their status as either approved or pending there are two ways to look them up. This communication is from a debt collector and is an attempt to collect a debt. Drivers and two of tthe rear passengers. If you dont have health insurance or if you pay for care without using your health insurance, your provider must give you a good faith estimate of how much your care will cost, before you get care. CF MEDICAL, LLC. Please review our Affiliate Link Disclosure for more information. These supplementary rights include those enumerated in the Telephone Consumer Protection Act (TCPA) and the Consumer Financial Protection Act (CFPA). AssetCare, LLC, which also does business as CF Medical VI, LLC, is a debt collection agency located in Sherman, Texas. So, it's up to you to learn your rights. If the agency can't validate the debt, it must contact the major credit bureaus and remove the collections account from your record. WebLiquidated debt and unliquidated determinable amount of money due; Enforcement of instrument securing the payment of or evidencing any debt; Action to recover the possession of secured personal property; Arrears of rent: 6 years, (C.R.S. Call our Helpline today! The rule clarifies how debt collectors can communicate with you, including what information theyre required to provide you. Addressing concerns about medical billing and collections is a particular focus of ours as the country emerges from the COVID-19 pandemic. This means that you may hear from MBA Law Collections if you received medical treatment and your healthcare provider sold your medical debt to CF Medical. March 31, 2023. Medical bills are the most common collections item on peoples credit reports and show up on 43 million credit reports. WebContact | CF Medical Contact Us Contact CF Medical get in touch (866) 242-8010 info@cfmedical.com 2 Debush Ave Unit A-9 Middleton, MA 01949 Become a Distributor Residents around Camp Lejeune from 50s-80s may have tainted water exposure, Hair-straightening chemicals may cause cancer with regular use. Fax: 352 536 8141. Cf Medical, LLC Business name 1335550-DCA DCA license number Business License type 01/31/2021 License expiration date Debt Guaynabo, PR 00968, By clicking "Continue" I agree to receive newsletters and promotions from Money and its partners. Debt collection key terms. Thanks to the FDCPA, debt collectors must operate within the parameters of respect and professionalism as they seek to collect debts. If they violate the law, we bring an action against them. If you have been contacted by this debt collector, make sure you understand your rights before taking action. Contact Us About The Company Profile For Cf Medical, LLC. AssetCare, LLC is settling a class action about debt collection practices brought under the federal Fair Debt Collection Practices Act (FDCPA) and the Texas Debt Collection Act (TDCA), regarding debts owed to CF Medical, LLC, which buys bad debt from medical providers. Though it is known that this collections company works within medical collections it is very important that as a consumer you confirm with the collections company about what debt is specifically owed and to whom, because medical collections has a wide range of clientele and businesses. To begin, mail a request to Assetcare LLC for validation of the debt. You should keep a record of any communication or documents you receive in case you need to dispute the debt. Read on for an in-depth guide on what Assetcare LLC is and how you can remove it from your credit report with or (in some cases) without paying off the debt. Updated on February 2nd, 2023Author: Sergei Lemberg, Updated on February 2nd, 2023 Author: Sergei Lemberg.

Debt validation lets you confirm that a debt collection agency is calling you about the debt you actually owe and not someone else's debt or debt you've already paid. Class Members must have been offered a settlement of a debt which hadnt been paid or acted upon for more than four years. The best way to confirm its yours is to get validation information.. If you think it has violated your rights, consider filing a complaint. Depending on their status as either approved or pending there are two ways to look them up. This communication is from a debt collector and is an attempt to collect a debt. Drivers and two of tthe rear passengers. If you dont have health insurance or if you pay for care without using your health insurance, your provider must give you a good faith estimate of how much your care will cost, before you get care. CF MEDICAL, LLC. Please review our Affiliate Link Disclosure for more information. These supplementary rights include those enumerated in the Telephone Consumer Protection Act (TCPA) and the Consumer Financial Protection Act (CFPA). AssetCare, LLC, which also does business as CF Medical VI, LLC, is a debt collection agency located in Sherman, Texas. So, it's up to you to learn your rights. If the agency can't validate the debt, it must contact the major credit bureaus and remove the collections account from your record. WebLiquidated debt and unliquidated determinable amount of money due; Enforcement of instrument securing the payment of or evidencing any debt; Action to recover the possession of secured personal property; Arrears of rent: 6 years, (C.R.S. Call our Helpline today! The rule clarifies how debt collectors can communicate with you, including what information theyre required to provide you. Addressing concerns about medical billing and collections is a particular focus of ours as the country emerges from the COVID-19 pandemic. This means that you may hear from MBA Law Collections if you received medical treatment and your healthcare provider sold your medical debt to CF Medical. March 31, 2023. Medical bills are the most common collections item on peoples credit reports and show up on 43 million credit reports. WebContact | CF Medical Contact Us Contact CF Medical get in touch (866) 242-8010 info@cfmedical.com 2 Debush Ave Unit A-9 Middleton, MA 01949 Become a Distributor Residents around Camp Lejeune from 50s-80s may have tainted water exposure, Hair-straightening chemicals may cause cancer with regular use. Fax: 352 536 8141. Cf Medical, LLC Business name 1335550-DCA DCA license number Business License type 01/31/2021 License expiration date Debt Guaynabo, PR 00968, By clicking "Continue" I agree to receive newsletters and promotions from Money and its partners. Debt collection key terms. Thanks to the FDCPA, debt collectors must operate within the parameters of respect and professionalism as they seek to collect debts. If they violate the law, we bring an action against them. If you have been contacted by this debt collector, make sure you understand your rights before taking action. Contact Us About The Company Profile For Cf Medical, LLC. AssetCare, LLC is settling a class action about debt collection practices brought under the federal Fair Debt Collection Practices Act (FDCPA) and the Texas Debt Collection Act (TDCA), regarding debts owed to CF Medical, LLC, which buys bad debt from medical providers. Though it is known that this collections company works within medical collections it is very important that as a consumer you confirm with the collections company about what debt is specifically owed and to whom, because medical collections has a wide range of clientele and businesses. To begin, mail a request to Assetcare LLC for validation of the debt. You should keep a record of any communication or documents you receive in case you need to dispute the debt. Read on for an in-depth guide on what Assetcare LLC is and how you can remove it from your credit report with or (in some cases) without paying off the debt. Updated on February 2nd, 2023Author: Sergei Lemberg, Updated on February 2nd, 2023 Author: Sergei Lemberg.