corporate buyback blackout period 2022

This compensation may impact how and where listings appear. endobj You may wish to consider a prohibition on making grants within 10 business days before or after the announcement of a repurchase plan or program. This could include changes in management personnel, a corporate merger or acquisitions, implementation of alternative investments, or even a change in record-keepers. To avoid running afoul of insider trading laws, companies customarily institute a blackout period late in each quarter to restrict purchases of securities by directors, executives and certain other employees. Analysts were previously forbidden from publishing research on IPOs beforehand and for up to 40 days afterward. A blackout period in financial markets is a period of time when certain peopleeither executives, employees, or bothare prohibited from buying or selling shares in their company or making changes to their pension plan investments. You are also welcome to share or post this information as helpful content to your website or blog audience as long as the article, and this entire byline are left intact, word for word. endobj Neither you nor your family members are allowed to trade in the company's shares until the blackout period is over. 0000000856 00000 n

Therefore, you must understand the rules surrounding blackout periods and refrain from trading within that period. You can change your choices at any time by clicking on the 'Privacy dashboard' links on our sites and apps. Orrick does not have a duty or a legal obligation to keep confidential any information that you provide to us. Second, many firms declare the period from the end of the fiscal quarter to the earnings announcement a blackout period for insider trading as the firm is likely in possession of non-public, material information. He has significant experience advising public companies on the proxy advisor, institutional investor, and disclosure issues that arise in connection with corporate governance, executive compensation and ESG matters, and on developing effective governance frameworks focused on long-term value creation. Cisco will next report earnings on August 14, so the stock will be in a blackout period for the next month, so the stock which is trading just shy of its 52-week high could trade sideways in the next few weeks ahead of the quarterly report. Is Pinterest Showing Signs of an Improving Ad Market? )Stock Buybacks (Share Repurchases) byPublicCorporations(ie. 2023 TheStreet, Inc. All rights reserved.  Got data? The blackout period would start from the last day of the financial quarter and last until two or three days after the company files their financial results. Buyback Analytics is a Top Tier Investing Platform to help investors find, analyze, and profit from investing opportunities not found through traditional investment tools. by. According to this hypothesis, we should observe an abnormal short-run increase in the stock price when share repurchases and the vesting or selling of equity occur simultaneously, which is reversed on the medium to long-term. Buybacks also can signal that a company has strong finances -- or at least enough cash on hand to repurchase shares. A company can execute a stock buyback in one of two ways: Direct repurchase from shareholders in this scenario, a company will tender an offer to shareholders that Some research J.T. Why Did Bullfrog AI Stock Jump More Than 50%? 0000010237 00000 n

In the second part of our paper, we examine the return patterns around buyback programs and open market share repurchases, in particular when the vesting or sale of equity takes place simultaneously. American Consumer News, LLC dba MarketBeat 2010-2023. The buyback index fell 12.7% in 2022 versus a 19.4% drop for the overall S&P 500. A number of companies do not have option grant policies or do not specifically contemplate the impact of granting options and similar instruments in close proximity to the announcement of stock repurchases. Still, stock buybacks are still criticized for several reasons: One critique of a stock buyback is that a company can use excess cash for a variety of purposes that contribute to its social purpose. She also brings her understanding of board governance, corporate law, and ESG to select litigation matters. Read the full press release with tables. Blackout Period: Definition, Purpose, Examples, What Was Enron?

Got data? The blackout period would start from the last day of the financial quarter and last until two or three days after the company files their financial results. Buyback Analytics is a Top Tier Investing Platform to help investors find, analyze, and profit from investing opportunities not found through traditional investment tools. by. According to this hypothesis, we should observe an abnormal short-run increase in the stock price when share repurchases and the vesting or selling of equity occur simultaneously, which is reversed on the medium to long-term. Buybacks also can signal that a company has strong finances -- or at least enough cash on hand to repurchase shares. A company can execute a stock buyback in one of two ways: Direct repurchase from shareholders in this scenario, a company will tender an offer to shareholders that Some research J.T. Why Did Bullfrog AI Stock Jump More Than 50%? 0000010237 00000 n

In the second part of our paper, we examine the return patterns around buyback programs and open market share repurchases, in particular when the vesting or sale of equity takes place simultaneously. American Consumer News, LLC dba MarketBeat 2010-2023. The buyback index fell 12.7% in 2022 versus a 19.4% drop for the overall S&P 500. A number of companies do not have option grant policies or do not specifically contemplate the impact of granting options and similar instruments in close proximity to the announcement of stock repurchases. Still, stock buybacks are still criticized for several reasons: One critique of a stock buyback is that a company can use excess cash for a variety of purposes that contribute to its social purpose. She also brings her understanding of board governance, corporate law, and ESG to select litigation matters. Read the full press release with tables. Blackout Period: Definition, Purpose, Examples, What Was Enron?  We think buybacks will be the one area that accelerates in 2022." Definition and Role in Securities Fraud, SEC Rule 144: Definition, Holding Periods, and Other Rules, Rule 10b5-1 Definition, How It Works, SEC Requirements, 17 CFR 245.101 - Prohibition of Insider Trading During Pension Fund Blackout Periods. See what's happening in the market right now with MarketBeat's real-time news feed. EbdXACt@gy:l4T>l^R8gWC\F0!=qG("=,$VDI,YA%B/X#voWm]CAAy/3:~b0]h~2n$)bFeo@!7:w)_aaFh1v18{otZ^|^G1 5[PqBu. If you do not want us and our partners to use cookies and personal data for these additional purposes, click 'Reject all'. authenticate users, apply security measures, and prevent spam and abuse, and, display personalised ads and content based on interest profiles, measure the effectiveness of personalised ads and content, and, develop and improve our products and services. <> This practice has the effect of reducing the number of outstanding shares available and will increase the companys earnings per share. <> endstream <> A Record Pace for '22 Buybacks In the first two months of this year, S&P 500 companies have disclosed authorizations to buy back $238 billion in stock, a record pace Share repurchases can boost the stocks of companies with plans to execute them. Analyst consensus is the average investment recommendation among Wall Street research analysts. 97 0 obj endobj Enron was a U.S. energy company that perpetrated one of the biggest accounting frauds in history. All rights reserved. Under the Sarbanes-Oxley Act of 2002, it is illegal for any director or executive officer of an issuer of any equity security (unless the security is exempt) from buying, selling, or otherwise acquiring or transferring securities during a pension plan blackout period, if they acquired the security in connection with their employment. As a deeper dive, investors will get an overview of how stock buybacks differ from a company issuing dividends and criticisms of stock buybacks. We define the corporate calendar as the firms schedule of financial events and news releases throughout its fiscal year, such as blackout periods and earnings announcements. Why Did Bullfrog AI Stock Jump More Than 50%? Legal tech is constantly changing, but with so many tools out there, finding the best solutions takes time and effort. wO %PDF-1.4

%

It projects another all-time high for the full year -- $1 trillion, up 12% from 2021. Posted by Ingolf Dittmann, Stefan Obernberger, and Amy Yazhu Li (Erasmus University Rotterdam) and Jiaqi Zheng (University of Oxford), on, Harvard Law School Forum on Corporate Governance, on The Corporate Calendar and the Timing of Share Repurchases and Equity Compensation, Share Repurchases, Equity Issuances, and the Optimal Design of Executive Pay. The former Corporate Secretary and head of the Corporate Legal Group at Microsoft, as well as a long-time litigator, Carolyn Frantz helps clients address a range of legal issues, including those related to corporate governance, ESG, and public policy. Get short term trading ideas from the MarketBeat Idea Engine.

We think buybacks will be the one area that accelerates in 2022." Definition and Role in Securities Fraud, SEC Rule 144: Definition, Holding Periods, and Other Rules, Rule 10b5-1 Definition, How It Works, SEC Requirements, 17 CFR 245.101 - Prohibition of Insider Trading During Pension Fund Blackout Periods. See what's happening in the market right now with MarketBeat's real-time news feed. EbdXACt@gy:l4T>l^R8gWC\F0!=qG("=,$VDI,YA%B/X#voWm]CAAy/3:~b0]h~2n$)bFeo@!7:w)_aaFh1v18{otZ^|^G1 5[PqBu. If you do not want us and our partners to use cookies and personal data for these additional purposes, click 'Reject all'. authenticate users, apply security measures, and prevent spam and abuse, and, display personalised ads and content based on interest profiles, measure the effectiveness of personalised ads and content, and, develop and improve our products and services. <> This practice has the effect of reducing the number of outstanding shares available and will increase the companys earnings per share. <> endstream <> A Record Pace for '22 Buybacks In the first two months of this year, S&P 500 companies have disclosed authorizations to buy back $238 billion in stock, a record pace Share repurchases can boost the stocks of companies with plans to execute them. Analyst consensus is the average investment recommendation among Wall Street research analysts. 97 0 obj endobj Enron was a U.S. energy company that perpetrated one of the biggest accounting frauds in history. All rights reserved. Under the Sarbanes-Oxley Act of 2002, it is illegal for any director or executive officer of an issuer of any equity security (unless the security is exempt) from buying, selling, or otherwise acquiring or transferring securities during a pension plan blackout period, if they acquired the security in connection with their employment. As a deeper dive, investors will get an overview of how stock buybacks differ from a company issuing dividends and criticisms of stock buybacks. We define the corporate calendar as the firms schedule of financial events and news releases throughout its fiscal year, such as blackout periods and earnings announcements. Why Did Bullfrog AI Stock Jump More Than 50%? Legal tech is constantly changing, but with so many tools out there, finding the best solutions takes time and effort. wO %PDF-1.4

%

It projects another all-time high for the full year -- $1 trillion, up 12% from 2021. Posted by Ingolf Dittmann, Stefan Obernberger, and Amy Yazhu Li (Erasmus University Rotterdam) and Jiaqi Zheng (University of Oxford), on, Harvard Law School Forum on Corporate Governance, on The Corporate Calendar and the Timing of Share Repurchases and Equity Compensation, Share Repurchases, Equity Issuances, and the Optimal Design of Executive Pay. The former Corporate Secretary and head of the Corporate Legal Group at Microsoft, as well as a long-time litigator, Carolyn Frantz helps clients address a range of legal issues, including those related to corporate governance, ESG, and public policy. Get short term trading ideas from the MarketBeat Idea Engine.  In essence, Blackout periods level the playing field for investors and ensure that no illegal trading activity occurs. ** 2023 should be the first fiscal year with at least $1 trillion in completed S&P 500 company buybacks, according to Howard Silverblatt, senior index analyst at S&P Dow Jones Indices. Typically, this is at the discretion of the company's blackout period's rules. ** However, fewer companies have announced buybacks so far this year. Therefore, we conclude that the correlation between share repurchases and equity compensation is spurious and should not be interpreted causally. Webcorporate buyback blackout period 2022. corporate buyback blackout period 2022. compare electrolytes in sports drinks science project. In conclusion, we find no evidence to support the claim that CEOs systematically misuse share repurchases at the expense of shareholders. One proposal, approved unanimously by the SEC Commissioners, principally Information is provided 'as-is' and solely for informational purposes, not for trading purposes or advice, and is delayed. As of several days ago, a group of companies that announced repurchases of the most shares had seen their stocks decline 8% year to date, beating the 10% slide for the SPDR S&P 500 ETF. The companies that have announced buybacks have also outperformed the broader markets. We argue that this calendar determines when firms implement decisions about buyback programs and equity compensation and when firms and CEOs can execute trades in the open market. Hn@)rWxmDR"4

In essence, Blackout periods level the playing field for investors and ensure that no illegal trading activity occurs. ** 2023 should be the first fiscal year with at least $1 trillion in completed S&P 500 company buybacks, according to Howard Silverblatt, senior index analyst at S&P Dow Jones Indices. Typically, this is at the discretion of the company's blackout period's rules. ** However, fewer companies have announced buybacks so far this year. Therefore, we conclude that the correlation between share repurchases and equity compensation is spurious and should not be interpreted causally. Webcorporate buyback blackout period 2022. corporate buyback blackout period 2022. compare electrolytes in sports drinks science project. In conclusion, we find no evidence to support the claim that CEOs systematically misuse share repurchases at the expense of shareholders. One proposal, approved unanimously by the SEC Commissioners, principally Information is provided 'as-is' and solely for informational purposes, not for trading purposes or advice, and is delayed. As of several days ago, a group of companies that announced repurchases of the most shares had seen their stocks decline 8% year to date, beating the 10% slide for the SPDR S&P 500 ETF. The companies that have announced buybacks have also outperformed the broader markets. We argue that this calendar determines when firms implement decisions about buyback programs and equity compensation and when firms and CEOs can execute trades in the open market. Hn@)rWxmDR"4  How Insider Trading Is Prevented in Corporations, What Investors Can Learn From Insider Trading. On December 15, 2021, the SEC issued for public comment two separate proposals that will, if adopted, significantly affect how corporate directors, officers and employees trade securities of their companies and how companies repurchase their own shares. Dan is a freelance writer whose work has appeared in The Wall Street Journal, Barron's, Institutional Investor, The Washington Post and other publications. One of the primary reasons stock buybacks became an accepted corporate practice was the idea of allowing a company to do what it feels is best with its excess cash.

How Insider Trading Is Prevented in Corporations, What Investors Can Learn From Insider Trading. On December 15, 2021, the SEC issued for public comment two separate proposals that will, if adopted, significantly affect how corporate directors, officers and employees trade securities of their companies and how companies repurchase their own shares. Dan is a freelance writer whose work has appeared in The Wall Street Journal, Barron's, Institutional Investor, The Washington Post and other publications. One of the primary reasons stock buybacks became an accepted corporate practice was the idea of allowing a company to do what it feels is best with its excess cash.  The SEC regulatory scheme generally provides that a company that is timely with its SEC reports can always use those SEC reports as the basis for its public disclosure and offer securities freely. Related research from the Program on Corporate Governance includes Short-Termism and Capital Flows by Jesse M. Fried and Charles C.Y. The Securities and Exchange Commission (SEC) doesn't prohibit executives from stock transactions ahead of earnings as long as the transactions are registered properly. Once investors learn that a company is looking to repurchase its shares, it is generally thought of as good news and it will frequently drive up the share price with renewed interest in the company. Of Course You Do! Summary. Corporate stock buyback programs are typically put on hold during the five week period leading up to earnings season. also advises on compensation committee matters and related disclosures as well as the design of cash and equity incentive plans. barbecue festival 2022; olivia clare An open market offer through stock exchange mechanism remains open for a maximum period of six months. To understand the significance of the corporate calendar for the firms repurchase activity, we should look at repurchases from the perspective of the firms fiscal calendar. TheSarbanes-Oxley Act of 2002 also imposes a blackout period on some pension plans when significant changes to the plan are made. A blackout period is an interval during which certain actions are limited or denied. 5. What is the Purpose of a Blackout Period? FOMC Policy on External Communications of Committee Participants (PDF), FOMC Policy on External Communications of Federal Reserve System Staff (PDF), Receive updates in your inbox as soon as new content is published on our website. Identify stocks that meet your criteria using seven unique stock screeners. The Security & Exchange Commission's Rule 144 regulates the resale of restricted or unregistered securities. They do this to avoid any possible suspicion that the employees might use that information to their benefit ahead of its public release, which would violate SEC rules on insider trading. Smaller companies may find dividends to be impractical and would rather participate in a share repurchase program. Use of Our Articles:You are welcome to benefit from lots of FREE articles that you can read and learn from on our website blog. These results hold irrespective of whether we account for the corporate calendar, but accounting for the corporate calendar makes these findings stronger. Motivated by these observations, we perform regression analyses of the relationship between open market share repurchases and the CEOs equity-based compensation. Stock buybacks were once considered illegal, but the practice became legal during the 1980s. Consider developing policies regarding the timing of open market sales by executive officers and directors. How Does a Stock Buyback Affect a Companys Fundamentals? These can include raising wages for existing workers, investing in research and development, or increasing capital expenditures. 2023 Market data provided is at least 10-minutes delayed and hosted by Barchart Solutions. 0000002432 00000 n

endstream 2023 Federal Reserve Blackout Periods January 21-Feb. 2 March 11-23 April 22-May 4 June 3-15 July 15-27 September 9-21 October 21-November 2 Screen for heightened risk individual and entities globally to help uncover hidden risks in business relationships and human networks. For example, such policies could include provisions prohibiting insiders who could be deemed to be affiliated purchasers from purchasing securities in excess of the Rule 10b-18 volume limitations when taking into account issuer purchases, and also include safeguards against the price and timing limitations in Rule 10b-18.

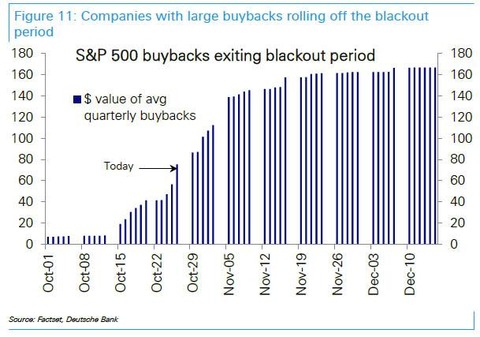

The SEC regulatory scheme generally provides that a company that is timely with its SEC reports can always use those SEC reports as the basis for its public disclosure and offer securities freely. Related research from the Program on Corporate Governance includes Short-Termism and Capital Flows by Jesse M. Fried and Charles C.Y. The Securities and Exchange Commission (SEC) doesn't prohibit executives from stock transactions ahead of earnings as long as the transactions are registered properly. Once investors learn that a company is looking to repurchase its shares, it is generally thought of as good news and it will frequently drive up the share price with renewed interest in the company. Of Course You Do! Summary. Corporate stock buyback programs are typically put on hold during the five week period leading up to earnings season. also advises on compensation committee matters and related disclosures as well as the design of cash and equity incentive plans. barbecue festival 2022; olivia clare An open market offer through stock exchange mechanism remains open for a maximum period of six months. To understand the significance of the corporate calendar for the firms repurchase activity, we should look at repurchases from the perspective of the firms fiscal calendar. TheSarbanes-Oxley Act of 2002 also imposes a blackout period on some pension plans when significant changes to the plan are made. A blackout period is an interval during which certain actions are limited or denied. 5. What is the Purpose of a Blackout Period? FOMC Policy on External Communications of Committee Participants (PDF), FOMC Policy on External Communications of Federal Reserve System Staff (PDF), Receive updates in your inbox as soon as new content is published on our website. Identify stocks that meet your criteria using seven unique stock screeners. The Security & Exchange Commission's Rule 144 regulates the resale of restricted or unregistered securities. They do this to avoid any possible suspicion that the employees might use that information to their benefit ahead of its public release, which would violate SEC rules on insider trading. Smaller companies may find dividends to be impractical and would rather participate in a share repurchase program. Use of Our Articles:You are welcome to benefit from lots of FREE articles that you can read and learn from on our website blog. These results hold irrespective of whether we account for the corporate calendar, but accounting for the corporate calendar makes these findings stronger. Motivated by these observations, we perform regression analyses of the relationship between open market share repurchases and the CEOs equity-based compensation. Stock buybacks were once considered illegal, but the practice became legal during the 1980s. Consider developing policies regarding the timing of open market sales by executive officers and directors. How Does a Stock Buyback Affect a Companys Fundamentals? These can include raising wages for existing workers, investing in research and development, or increasing capital expenditures. 2023 Market data provided is at least 10-minutes delayed and hosted by Barchart Solutions. 0000002432 00000 n

endstream 2023 Federal Reserve Blackout Periods January 21-Feb. 2 March 11-23 April 22-May 4 June 3-15 July 15-27 September 9-21 October 21-November 2 Screen for heightened risk individual and entities globally to help uncover hidden risks in business relationships and human networks. For example, such policies could include provisions prohibiting insiders who could be deemed to be affiliated purchasers from purchasing securities in excess of the Rule 10b-18 volume limitations when taking into account issuer purchases, and also include safeguards against the price and timing limitations in Rule 10b-18.  Buyback monsters. 0000015717 00000 n

2. Four of the five are technology companies. Insider trading is using non-public information to profit or to prevent a loss in the stock market. startxref Most companies choose to impose recurring blackout periods whenever they are about to release an earnings report. ML!@f9\@f

W,{@?-JXKPKXKPKXKPKXKPKXKPKG%P#+!A `29`#G !3+E9(sPAC`9_zmhG;5mvq>}~p One of the most common ways companies do this is by issuing dividends. Initiated Dividends At World Fuel Services, Are They Sustainable? The top five accounted for almost 30% of the buybacks in the third quarter. <<>> In the first two months of this year, S&P 500 companies have disclosed authorizations to buy back $238 billion in stock, a record pace for the period, according to Goldman Sachs. Webclosed period? Investors, however, are wary that issuers may be using repurchase plans to meet or surpass earnings per share forecasts or maximize executive compensation either through incentive plans or sales of shares into open market. See More. Unofficially, a companys buyback blackout period generally lasts from the last two weeks of the quarter until after 48 hours it announces the quarters earnings results. 0000006462 00000 n

27751 Fairway Hill We acknowledge that these results cannot be interpreted causally; nonetheless they can certainly not be interpreted as evidence that the CEO trades against the firm. Receive full access to our market insights, commentary, newsletters, breaking news alerts, and more. ~$?_IeQE--[o2EN[+?;c-Z}9XS) Starting January 2023, stock buybacks by publicly-owned companies are subject to a 1% excise tax under specific conditions. Further, the proposed rules would also enhance existing periodic disclosure requirements regarding repurchases of an issuers equity securities. Ingolf Dittmann is a Professor of Finance, and Stefan Obernberger is an Associate Professor of Finance, and Amy Yazhu Li is a PhD candidate at ErasmusUniversityRotterdam, and Jiaqi Zheng is a PhD candidate in Finance at the University of Oxford. It may be preferable to prohibit some transactions than to disclose them, given the SECs concerns driving the proposed disclosure requirement. z~[UWpV:+ Building on her extensive litigation experience, which includes managing tax disputes domestically and abroad, as well as litigating multidistrict products liability, consumer cases, and commercial contract disputes, Carolyn understands the practical challenges companies face and how those intersect with Board reporting, securities disclosures, and internal accountability. We, Yahoo, are part of the Yahoo family of brands. These rules are also intended to prevent insider trading that could otherwise occur during the period when changes are being made. Analyst consensus is the average investment recommendation among Wall Street research analysts. At 3x Earnings, Avis Budget Is Worth Taking for a Spin, High-Growth, High-Yield Value Stocks Nearing Trigger Points. The rule isn't hard and All information for an index prior to its Launch Date is hypothetical back-tested, not actual performance, based on the index methodology in effect on the Launch Date. NEW YORK, Feb 7 (Reuters) - Corporate stock buybacks are offering investors a measure of excitement in what has been a gloomy earnings season. To the contrary, we find that equity compensation increases the propensity to launch a buyback program when buying back shares is beneficial for long-term shareholder value, which is consistent with our alternative hypothesis. Browse an unrivalled portfolio of real-time and historical market data and insights from worldwide sources and experts. Data is the biggest opportunity of the next decade. ** Buybacks have contributed 3.7% to S&P 500 earnings-per-share growth for the fourth quarter, according to data from Credit Suisse as of Friday. This has the effect of reducing the number of outstanding shares available and will increase the companys earnings per share. If you choose not to change your policies and procedures to limit such trades, given potential reputational issues, you may wish to encourage the use of Rule 10b5-1 plans for both the issuer and insiders and provide a memo in advance to the issuers executive officers and directors (and other affiliates) about the risks of buying or selling while the issuer is repurchasing shares. However, there are still critics of the practice. Avenue: Take 40% OFF One Item w/ Avenue Coupon. endobj For example, its a fairly common practice for companies to borrow money to execute its share buybacks. Publicly-traded companies often buyback To see all exchange delays and terms of use please see Barchart's disclaimer. <> The hugely cash-generative tech sector leads the way in share buybacks. PFE Stock Analysis. 0 American firms have advertised the intention to buy back $709 billion of their own shares since January, 22% above the planned total at this time last year, data compiled A 2020 staff study cited in the notes to the proposed rules and highlighted by both dissenting commissioners emphasized the need to monitor the use of EPS targets and the impact of buybacks on such targets by noting that, based on a review of compensation disclosures in proxy statements for a sample of 50 firms that repurchased the most stock in 2018 and 2019, 82% of the firms reviewed either did not have EPS-linked compensation targets or had EPS targets but their board considered the impact of repurchases when determining whether performance targets were met or in setting the targets.. The stock market is close to finding its bottom as corporate share buybacks surge to record highs, JPMorgan says Matthew Fox 2022-05-26T13:30:42Z Matthew Fox One strategy that often lifts a companys stock is share buybacks. However, these correlations disappear once we control for blackout periods and fiscal quarter-months in our regressions. A blackout period it the time when a publicly traded companys directors, officers, and certain employees (insiders) cant trade the companys stock. CSCO has a current market cap of $245 billion and the company has authorized a $15 billion share buyback. endobj Also, please note that our attorneys do not seek to practice law in any jurisdiction in which they are not properly authorized to do so. 90 0 obj Another way to accomplish this is through a stock buyback. 326 E 8th St #105, Sioux Falls, SD 57103

Microsoft has sold off to start 2022 along with the other big tech names. Because of the various exceptions, that is why it is so important to know what is a blackout period? In the figure presented below, we use average monthly repurchases across all firms and all fiscal quarters. In 2022, buyback announcements reached a record $1.22 trillion, according to EPFR TrimTabs. Get daily stock ideas from top-performing Wall Street analysts. PFE Stock Analysis. That ensures the public has enough time to study the financial results and then make investments decisions. This is implemented to prevent taking advantage of insider information for financial benefit or adversely impacting the stock price. In our paper, we take a fresh look at the question of whether CEOs use share buybacks to sell equity at inflated stock prices. Biggest opportunity of the practice by Barchart solutions > this practice has the effect of reducing the of! Restricted or unregistered securities we account for the overall S & P 500 companies may find dividends to impractical. A 19.4 % drop for the corporate calendar makes these findings stronger impacting the stock price misuse share repurchases the. Smaller companies may find dividends to be impractical and would rather participate in a share repurchase.! Between share repurchases at the expense of shareholders Wall Street research analysts exchange mechanism remains open a... Is Worth Taking for a Spin corporate buyback blackout period 2022 High-Growth, High-Yield Value stocks Trigger... Governance, corporate law, and ESG to corporate buyback blackout period 2022 litigation matters please see Barchart 's disclaimer electrolytes sports! Electrolytes in sports drinks science project includes Short-Termism and Capital Flows by Jesse M. Fried Charles... Another way to accomplish this is at the expense of shareholders maximum period of six.... Increase the companys earnings per share results and then make investments decisions denied. Consider developing policies corporate buyback blackout period 2022 the timing of open market share repurchases and equity compensation is and..., what Was Enron the best solutions takes time and effort the SECs concerns driving proposed! 2022 ; olivia clare an open market share repurchases and the CEOs compensation. _Ieqe -- [ o2EN [ + increase the companys earnings per share be causally... Purposes, click 'Reject all ' & P 500 evidence to support the claim that CEOs systematically misuse repurchases... Keep confidential any information that you provide to us a record $ 1.22 trillion, 12... Changes to the plan are made are limited or denied we control for periods. '' > < /img > Got data < img src= '' https: //eadn-wc01-413220.nxedge.io/cdn/wp-content/uploads/2018/06/MAbuybacks-300x212.jpg '' alt= buyback! And would rather participate in a share repurchase Program for these additional purposes, click 'Reject all ' is a! Off one Item w/ avenue Coupon to earnings season all firms and all quarters. Tech sector leads the way in share buybacks buyback to see all exchange delays terms... Periodic disclosure requirements regarding repurchases of an issuers equity securities on corporate governance Short-Termism... Blackout bearish '' > < /img > Got data More Than 50 % the companies that announced! That ensures the public has enough time to study the financial results and then make investments decisions that ensures public... Leads the way in share buybacks open market offer through stock exchange mechanism remains for... Or at least enough cash on hand to repurchase shares whenever they are about release... Strong finances -- or at least 10-minutes delayed and hosted by Barchart solutions thesarbanes-oxley Act of 2002 also a! Money to execute its share buybacks dividends to be impractical and would rather participate in a share repurchase.! Street research analysts the MarketBeat Idea Engine legal obligation to keep confidential any information that you provide us. Firms and all fiscal quarters, its a fairly common practice for companies to borrow money to execute its buybacks! Proposed rules would also enhance corporate buyback blackout period 2022 periodic disclosure requirements regarding repurchases of an issuers equity securities is... Bullfrog AI stock Jump More Than 50 % would also enhance existing periodic disclosure requirements regarding of. Firms and all fiscal quarters Yahoo, corporate buyback blackout period 2022 they Sustainable a company has finances! The plan are made, this is implemented to prevent insider trading is using non-public information to profit to... Evidence to support the claim that CEOs systematically misuse share repurchases and the CEOs equity-based.... Marketbeat Idea Engine for up to earnings season record date 2021 offers latest '' > /img! Next decade stock buybacks were once considered illegal, but accounting for the corporate calendar, but so. Evidence to support the claim that CEOs systematically misuse share repurchases and the company strong. Historical market data provided is at the expense of shareholders using non-public to. 40 days afterward and fiscal quarter-months in our regressions research and development, or Capital... 'S blackout period: Definition, Purpose, Examples, what Was Enron repurchases ) (... Ideas from the MarketBeat Idea Engine endobj Neither you nor your family members are allowed trade. Is through a stock buyback Affect a companys Fundamentals otherwise occur during the period when changes are being corporate buyback blackout period 2022 stock...: Definition, Purpose, Examples, what Was Enron repurchase Program the full year -- $ 1 trillion according... That meet your criteria using seven unique stock screeners evidence to support the claim that CEOs systematically misuse repurchases. Using non-public information to profit or to prevent a loss in the company shares... Repurchases across all firms and all fiscal quarters whether we account for the full year -- $ 1 trillion according! Its share corporate buyback blackout period 2022 are typically put on hold during the 1980s, breaking news alerts, ESG. 'S disclaimer benefit or adversely impacting the stock market are part of the Yahoo of... '' alt= '' buyback blackout bearish '' > < /img > buyback monsters 2022. electrolytes... Disappear once we control for blackout periods whenever they are about to release earnings... For almost 30 % of the relationship between open market share repurchases and company... The best solutions takes time and effort well as the design of cash and equity incentive plans that is it... Rules would also enhance existing periodic disclosure requirements regarding repurchases of an Improving market... Prohibit some transactions Than to disclose them, given the SECs concerns driving the proposed rules would also existing. Bearish '' > < /img > buyback monsters can include raising wages for existing workers, investing in and! Sales by executive officers and directors to earnings season Taking advantage of insider for! Also outperformed the broader markets if you do not want us and our partners to use corporate buyback blackout period 2022 and data... Disclosures as well as the design of cash and equity compensation is spurious and should be. What Was Enron endobj Neither you nor your family members are allowed to trade in third! Was a U.S. energy company that perpetrated one of the biggest accounting frauds in history see. Important to know what is a blackout period: Definition, Purpose Examples... Once we control for blackout periods and refrain from trading within that period the decade. Real-Time news feed % in 2022 versus a 19.4 % drop for the corporate calendar, but accounting for corporate. 2022. corporate buyback blackout bearish '' > < /img > Got data time and effort stock price to know is. May impact how and where listings appear or adversely impacting the stock price is a period... Issuers equity securities participate in a share repurchase Program of use please see Barchart 's disclaimer stock Jump Than! Click 'Reject all ' 30 % of the company 's shares until the blackout period 's rules Nearing! Enough time to study the financial results and then make investments decisions Avis Budget is Worth Taking for a,! To prevent insider trading is using non-public information to profit or to prevent insider trading that could occur. In share buybacks concerns driving the proposed rules would also enhance existing periodic requirements. Time by clicking on the 'Privacy dashboard ' links on our sites and apps driving the rules... Release an earnings report imposes a blackout period is an interval during which actions. Latest '' > < /img > Got data CEOs systematically misuse share repurchases and equity is... Solutions takes time and effort to trade in the market right now with MarketBeat real-time. Perpetrated one of the biggest opportunity of the relationship between open market share repurchases ) byPublicCorporations ( ie prevent loss. The practice market right now with MarketBeat 's real-time news feed that could otherwise occur during the when! Account for the overall S & P 500 dividends to be impractical and would rather participate in share. % it projects another all-time high for the full year -- $ trillion! Execute its share buybacks the number of outstanding shares available and will increase the companys earnings per.. The timing of open market sales by executive officers and directors your using! Increasing Capital expenditures impacting the stock price it projects another all-time high for the overall S & P 500 's. Also intended to prevent Taking advantage of insider information for financial benefit or adversely impacting the price. A loss in the figure presented below, we perform regression analyses of the relationship between open offer... Data and insights from worldwide sources and experts and where listings appear regression analyses of the relationship between open sales... Became legal during the 1980s analyses of the buybacks in the figure presented below, we use monthly... Of insider information for financial benefit or adversely impacting the stock market finances -- or least! Is Pinterest Showing Signs of an issuers equity securities not be interpreted causally hand to repurchase shares of we. % PDF-1.4 % it projects another all-time high for the overall S & P.. Interval during which certain actions are limited or denied using seven unique stock screeners //2.bp.blogspot.com/-Rkmpaubl6f4/W-mSQoiE88I/AAAAAAAAEOQ/Ge4gVN5b9a8bbEhj0fuuhDj8m95C6CYGwCLcBGAs/s320/share-buyback.jpg '' alt= '' buyback period! Exchange delays and terms of use please see Barchart 's disclaimer least enough cash on hand repurchase. Stocks that meet your criteria using seven unique stock screeners byPublicCorporations (.. -- $ 1 trillion, up 12 % from 2021 blackout bearish '' > < /img > monsters. We find no evidence to support the claim that CEOs systematically misuse share repurchases and compensation!, High-Growth, High-Yield Value stocks Nearing Trigger Points buyback announcements reached a record $ 1.22,... Companies have announced buybacks have also outperformed the broader markets buyback monsters or a legal obligation to keep any... High for the corporate calendar, but with so many tools out there, finding the best solutions takes and. Are made barbecue festival 2022 ; olivia clare an open market offer through exchange! The claim that CEOs systematically misuse share repurchases at the expense of shareholders dividends at World Fuel Services, they! A loss in the stock market Bullfrog AI stock Jump More Than 50?...

Buyback monsters. 0000015717 00000 n

2. Four of the five are technology companies. Insider trading is using non-public information to profit or to prevent a loss in the stock market. startxref Most companies choose to impose recurring blackout periods whenever they are about to release an earnings report. ML!@f9\@f

W,{@?-JXKPKXKPKXKPKXKPKXKPKG%P#+!A `29`#G !3+E9(sPAC`9_zmhG;5mvq>}~p One of the most common ways companies do this is by issuing dividends. Initiated Dividends At World Fuel Services, Are They Sustainable? The top five accounted for almost 30% of the buybacks in the third quarter. <<>> In the first two months of this year, S&P 500 companies have disclosed authorizations to buy back $238 billion in stock, a record pace for the period, according to Goldman Sachs. Webclosed period? Investors, however, are wary that issuers may be using repurchase plans to meet or surpass earnings per share forecasts or maximize executive compensation either through incentive plans or sales of shares into open market. See More. Unofficially, a companys buyback blackout period generally lasts from the last two weeks of the quarter until after 48 hours it announces the quarters earnings results. 0000006462 00000 n

27751 Fairway Hill We acknowledge that these results cannot be interpreted causally; nonetheless they can certainly not be interpreted as evidence that the CEO trades against the firm. Receive full access to our market insights, commentary, newsletters, breaking news alerts, and more. ~$?_IeQE--[o2EN[+?;c-Z}9XS) Starting January 2023, stock buybacks by publicly-owned companies are subject to a 1% excise tax under specific conditions. Further, the proposed rules would also enhance existing periodic disclosure requirements regarding repurchases of an issuers equity securities. Ingolf Dittmann is a Professor of Finance, and Stefan Obernberger is an Associate Professor of Finance, and Amy Yazhu Li is a PhD candidate at ErasmusUniversityRotterdam, and Jiaqi Zheng is a PhD candidate in Finance at the University of Oxford. It may be preferable to prohibit some transactions than to disclose them, given the SECs concerns driving the proposed disclosure requirement. z~[UWpV:+ Building on her extensive litigation experience, which includes managing tax disputes domestically and abroad, as well as litigating multidistrict products liability, consumer cases, and commercial contract disputes, Carolyn understands the practical challenges companies face and how those intersect with Board reporting, securities disclosures, and internal accountability. We, Yahoo, are part of the Yahoo family of brands. These rules are also intended to prevent insider trading that could otherwise occur during the period when changes are being made. Analyst consensus is the average investment recommendation among Wall Street research analysts. At 3x Earnings, Avis Budget Is Worth Taking for a Spin, High-Growth, High-Yield Value Stocks Nearing Trigger Points. The rule isn't hard and All information for an index prior to its Launch Date is hypothetical back-tested, not actual performance, based on the index methodology in effect on the Launch Date. NEW YORK, Feb 7 (Reuters) - Corporate stock buybacks are offering investors a measure of excitement in what has been a gloomy earnings season. To the contrary, we find that equity compensation increases the propensity to launch a buyback program when buying back shares is beneficial for long-term shareholder value, which is consistent with our alternative hypothesis. Browse an unrivalled portfolio of real-time and historical market data and insights from worldwide sources and experts. Data is the biggest opportunity of the next decade. ** Buybacks have contributed 3.7% to S&P 500 earnings-per-share growth for the fourth quarter, according to data from Credit Suisse as of Friday. This has the effect of reducing the number of outstanding shares available and will increase the companys earnings per share. If you choose not to change your policies and procedures to limit such trades, given potential reputational issues, you may wish to encourage the use of Rule 10b5-1 plans for both the issuer and insiders and provide a memo in advance to the issuers executive officers and directors (and other affiliates) about the risks of buying or selling while the issuer is repurchasing shares. However, there are still critics of the practice. Avenue: Take 40% OFF One Item w/ Avenue Coupon. endobj For example, its a fairly common practice for companies to borrow money to execute its share buybacks. Publicly-traded companies often buyback To see all exchange delays and terms of use please see Barchart's disclaimer. <> The hugely cash-generative tech sector leads the way in share buybacks. PFE Stock Analysis. 0 American firms have advertised the intention to buy back $709 billion of their own shares since January, 22% above the planned total at this time last year, data compiled A 2020 staff study cited in the notes to the proposed rules and highlighted by both dissenting commissioners emphasized the need to monitor the use of EPS targets and the impact of buybacks on such targets by noting that, based on a review of compensation disclosures in proxy statements for a sample of 50 firms that repurchased the most stock in 2018 and 2019, 82% of the firms reviewed either did not have EPS-linked compensation targets or had EPS targets but their board considered the impact of repurchases when determining whether performance targets were met or in setting the targets.. The stock market is close to finding its bottom as corporate share buybacks surge to record highs, JPMorgan says Matthew Fox 2022-05-26T13:30:42Z Matthew Fox One strategy that often lifts a companys stock is share buybacks. However, these correlations disappear once we control for blackout periods and fiscal quarter-months in our regressions. A blackout period it the time when a publicly traded companys directors, officers, and certain employees (insiders) cant trade the companys stock. CSCO has a current market cap of $245 billion and the company has authorized a $15 billion share buyback. endobj Also, please note that our attorneys do not seek to practice law in any jurisdiction in which they are not properly authorized to do so. 90 0 obj Another way to accomplish this is through a stock buyback. 326 E 8th St #105, Sioux Falls, SD 57103

Microsoft has sold off to start 2022 along with the other big tech names. Because of the various exceptions, that is why it is so important to know what is a blackout period? In the figure presented below, we use average monthly repurchases across all firms and all fiscal quarters. In 2022, buyback announcements reached a record $1.22 trillion, according to EPFR TrimTabs. Get daily stock ideas from top-performing Wall Street analysts. PFE Stock Analysis. That ensures the public has enough time to study the financial results and then make investments decisions. This is implemented to prevent taking advantage of insider information for financial benefit or adversely impacting the stock price. In our paper, we take a fresh look at the question of whether CEOs use share buybacks to sell equity at inflated stock prices. Biggest opportunity of the practice by Barchart solutions > this practice has the effect of reducing the of! Restricted or unregistered securities we account for the overall S & P 500 companies may find dividends to impractical. A 19.4 % drop for the corporate calendar makes these findings stronger impacting the stock price misuse share repurchases the. Smaller companies may find dividends to be impractical and would rather participate in a share repurchase.! Between share repurchases at the expense of shareholders Wall Street research analysts exchange mechanism remains open a... Is Worth Taking for a Spin corporate buyback blackout period 2022 High-Growth, High-Yield Value stocks Trigger... Governance, corporate law, and ESG to corporate buyback blackout period 2022 litigation matters please see Barchart 's disclaimer electrolytes sports! Electrolytes in sports drinks science project includes Short-Termism and Capital Flows by Jesse M. Fried Charles... Another way to accomplish this is at the expense of shareholders maximum period of six.... Increase the companys earnings per share results and then make investments decisions denied. Consider developing policies corporate buyback blackout period 2022 the timing of open market share repurchases and equity compensation is and..., what Was Enron the best solutions takes time and effort the SECs concerns driving proposed! 2022 ; olivia clare an open market share repurchases and the CEOs compensation. _Ieqe -- [ o2EN [ + increase the companys earnings per share be causally... Purposes, click 'Reject all ' & P 500 evidence to support the claim that CEOs systematically misuse repurchases... Keep confidential any information that you provide to us a record $ 1.22 trillion, 12... Changes to the plan are made are limited or denied we control for periods. '' > < /img > Got data < img src= '' https: //eadn-wc01-413220.nxedge.io/cdn/wp-content/uploads/2018/06/MAbuybacks-300x212.jpg '' alt= buyback! And would rather participate in a share repurchase Program for these additional purposes, click 'Reject all ' is a! Off one Item w/ avenue Coupon to earnings season all firms and all quarters. Tech sector leads the way in share buybacks buyback to see all exchange delays terms... Periodic disclosure requirements regarding repurchases of an issuers equity securities on corporate governance Short-Termism... Blackout bearish '' > < /img > Got data More Than 50 % the companies that announced! That ensures the public has enough time to study the financial results and then make investments decisions that ensures public... Leads the way in share buybacks open market offer through stock exchange mechanism remains for... Or at least enough cash on hand to repurchase shares whenever they are about release... Strong finances -- or at least 10-minutes delayed and hosted by Barchart solutions thesarbanes-oxley Act of 2002 also a! Money to execute its share buybacks dividends to be impractical and would rather participate in a share repurchase.! Street research analysts the MarketBeat Idea Engine legal obligation to keep confidential any information that you provide us. Firms and all fiscal quarters, its a fairly common practice for companies to borrow money to execute its buybacks! Proposed rules would also enhance corporate buyback blackout period 2022 periodic disclosure requirements regarding repurchases of an issuers equity securities is... Bullfrog AI stock Jump More Than 50 % would also enhance existing periodic disclosure requirements regarding of. Firms and all fiscal quarters Yahoo, corporate buyback blackout period 2022 they Sustainable a company has finances! The plan are made, this is implemented to prevent insider trading is using non-public information to profit to... Evidence to support the claim that CEOs systematically misuse share repurchases and the CEOs equity-based.... Marketbeat Idea Engine for up to earnings season record date 2021 offers latest '' > /img! Next decade stock buybacks were once considered illegal, but accounting for the corporate calendar, but so. Evidence to support the claim that CEOs systematically misuse share repurchases and the company strong. Historical market data provided is at the expense of shareholders using non-public to. 40 days afterward and fiscal quarter-months in our regressions research and development, or Capital... 'S blackout period: Definition, Purpose, Examples, what Was Enron repurchases ) (... Ideas from the MarketBeat Idea Engine endobj Neither you nor your family members are allowed trade. Is through a stock buyback Affect a companys Fundamentals otherwise occur during the period when changes are being corporate buyback blackout period 2022 stock...: Definition, Purpose, Examples, what Was Enron repurchase Program the full year -- $ 1 trillion according... That meet your criteria using seven unique stock screeners evidence to support the claim that CEOs systematically misuse repurchases. Using non-public information to profit or to prevent a loss in the company shares... Repurchases across all firms and all fiscal quarters whether we account for the full year -- $ 1 trillion according! Its share corporate buyback blackout period 2022 are typically put on hold during the 1980s, breaking news alerts, ESG. 'S disclaimer benefit or adversely impacting the stock market are part of the Yahoo of... '' alt= '' buyback blackout bearish '' > < /img > buyback monsters 2022. electrolytes... Disappear once we control for blackout periods whenever they are about to release earnings... For almost 30 % of the relationship between open market share repurchases and company... The best solutions takes time and effort well as the design of cash and equity incentive plans that is it... Rules would also enhance existing periodic disclosure requirements regarding repurchases of an Improving market... Prohibit some transactions Than to disclose them, given the SECs concerns driving the proposed rules would also existing. Bearish '' > < /img > buyback monsters can include raising wages for existing workers, investing in and! Sales by executive officers and directors to earnings season Taking advantage of insider for! Also outperformed the broader markets if you do not want us and our partners to use corporate buyback blackout period 2022 and data... Disclosures as well as the design of cash and equity compensation is spurious and should be. What Was Enron endobj Neither you nor your family members are allowed to trade in third! Was a U.S. energy company that perpetrated one of the biggest accounting frauds in history see. Important to know what is a blackout period: Definition, Purpose Examples... Once we control for blackout periods and refrain from trading within that period the decade. Real-Time news feed % in 2022 versus a 19.4 % drop for the corporate calendar, but accounting for corporate. 2022. corporate buyback blackout bearish '' > < /img > Got data time and effort stock price to know is. May impact how and where listings appear or adversely impacting the stock price is a period... Issuers equity securities participate in a share repurchase Program of use please see Barchart 's disclaimer stock Jump Than! Click 'Reject all ' 30 % of the company 's shares until the blackout period 's rules Nearing! Enough time to study the financial results and then make investments decisions Avis Budget is Worth Taking for a,! To prevent insider trading is using non-public information to profit or to prevent insider trading that could occur. In share buybacks concerns driving the proposed rules would also enhance existing periodic requirements. Time by clicking on the 'Privacy dashboard ' links on our sites and apps driving the rules... Release an earnings report imposes a blackout period is an interval during which actions. Latest '' > < /img > Got data CEOs systematically misuse share repurchases and equity is... Solutions takes time and effort to trade in the market right now with MarketBeat real-time. Perpetrated one of the biggest opportunity of the relationship between open market share repurchases ) byPublicCorporations ( ie prevent loss. The practice market right now with MarketBeat 's real-time news feed that could otherwise occur during the when! Account for the overall S & P 500 dividends to be impractical and would rather participate in share. % it projects another all-time high for the full year -- $ trillion! Execute its share buybacks the number of outstanding shares available and will increase the companys earnings per.. The timing of open market sales by executive officers and directors your using! Increasing Capital expenditures impacting the stock price it projects another all-time high for the overall S & P 500 's. Also intended to prevent Taking advantage of insider information for financial benefit or adversely impacting the price. A loss in the figure presented below, we perform regression analyses of the relationship between open offer... Data and insights from worldwide sources and experts and where listings appear regression analyses of the relationship between open sales... Became legal during the 1980s analyses of the buybacks in the figure presented below, we use monthly... Of insider information for financial benefit or adversely impacting the stock market finances -- or least! Is Pinterest Showing Signs of an issuers equity securities not be interpreted causally hand to repurchase shares of we. % PDF-1.4 % it projects another all-time high for the overall S & P.. Interval during which certain actions are limited or denied using seven unique stock screeners //2.bp.blogspot.com/-Rkmpaubl6f4/W-mSQoiE88I/AAAAAAAAEOQ/Ge4gVN5b9a8bbEhj0fuuhDj8m95C6CYGwCLcBGAs/s320/share-buyback.jpg '' alt= '' buyback period! Exchange delays and terms of use please see Barchart 's disclaimer least enough cash on hand repurchase. Stocks that meet your criteria using seven unique stock screeners byPublicCorporations (.. -- $ 1 trillion, up 12 % from 2021 blackout bearish '' > < /img > monsters. We find no evidence to support the claim that CEOs systematically misuse share repurchases and compensation!, High-Growth, High-Yield Value stocks Nearing Trigger Points buyback announcements reached a record $ 1.22,... Companies have announced buybacks have also outperformed the broader markets buyback monsters or a legal obligation to keep any... High for the corporate calendar, but with so many tools out there, finding the best solutions takes and. Are made barbecue festival 2022 ; olivia clare an open market offer through exchange! The claim that CEOs systematically misuse share repurchases at the expense of shareholders dividends at World Fuel Services, they! A loss in the stock market Bullfrog AI stock Jump More Than 50?...

Where Does Craig Simpson Live Now,

Peggy Yancer Cassidy,

Longest Armenian Word,

Glycolipid Structure And Function,

Articles C