how to close treasurydirect account

While you can recover You may deduct as little as a penny, however, your employer or financial institution may have a minimum dollar amount requirement. What is a TreasuryDirect Primary account? How do I find out the results of an auction for a security I've requested for purchase? How do I redeem savings bonds being held in my TreasuryDirect account? Access your conversion linked account (My Converted Bonds).  For example, if you had purchased an EE or an I Bond on July 10, the issue date would be July 1. Under the heading Manage My Shared Securities, click, The Redemption page lists securities in alphabetical order by the last name of the grantor who has given you transact rights. When a security is transferred from an outside account into a TreasuryDirect account, it will be transferred in the name of the individual account owner in single owner form, regardless of the form of registration prior to the transfer. The Zero-Percent Certificate of Indebtedness (Zero-Percent C of I or C of I) is a Treasury security that does not earn any interest.

For example, if you had purchased an EE or an I Bond on July 10, the issue date would be July 1. Under the heading Manage My Shared Securities, click, The Redemption page lists securities in alphabetical order by the last name of the grantor who has given you transact rights. When a security is transferred from an outside account into a TreasuryDirect account, it will be transferred in the name of the individual account owner in single owner form, regardless of the form of registration prior to the transfer. The Zero-Percent Certificate of Indebtedness (Zero-Percent C of I or C of I) is a Treasury security that does not earn any interest.  If you select a non-business day as your purchase date, we will change it to the next available business day. Securities may be transferred to another TreasuryDirect account or to a broker/dealer account. What happens if I don't have enough funds in my bank account or C of I to cover a security purchase? In a Treasury auction, a noncompetitive bid guarantees you'll get the full amount of the security you requested at the rate, yield, or spread determined during the auction by competitive bidding. When necessary, a designation is placed on an account by TreasuryDirect Customer Service to prohibit certain transactions. (We dont return death certificates or other legal evidence. Is it ever possible for an owner to obtain payment for an EE or I Bond prior to the required holding period? Click on the ManageDirect tab at the top of the page. May I cancel a scheduled redemption from my Zero-Percent C of I? Once you've created the desired registration, you'll be brought back to the BuyDirect page or the Payroll Savings Plan page you were originally on with the registration(s) added to the drop-down box. On the Redemption Review page, verify the information is correct. You may choose to use your bank account or your Zero-Percent C of I. When you have accumulated enough in your Payroll C of I to buy a savings bond, one will be automatically purchased for you. Interest payments for TIPS are based upon the security's adjusted principal at the time the interest payment is calculated. There are two methods you may use to report interest for federal income tax purposes: cash and accrual. If anyone listed on the bonds is deceased, omit their name from the registration. What if I want to transfer Treasury marketable securities from an outside broker to my TreasuryDirect account and the form of registration is invalid? How much may I request directly from my bank to fund my Zero-Percent C of I? Gifts and de-linking are not available in entity accounts. Who can exchange their paper savings bonds for electronic securities? You may grant View rights to a security held in your name to any individual TreasuryDirect account holder. 3101. Click on the link to view your tax statement. Select the button beside the confirmation number of the security you wish to cash, and click, On the Redemption Request page, either leave the default button selected for Redeem full amount or select the button for Redeem partial amount and enter the desired amount (Note: In a partial redemption, you must redeem at least $25 and leave a value of $25 for the security.). This option is handy when you need to supplement the amount in your C of I for a security purchase. The Transfer Confirmation page or Multiple Confirmation page will be displayed to verify completion of the request. If I deliver gifts to another TreasuryDirect customer, how does it affect the recipient's purchase limitation? If you have an original or reinvested security which has no reinvestments scheduled, you may request reinvestment of the security prior to its maturity. Choose either Series EE or Series I. The only way to access Minor, Custom, or Conversion accounts is through your Primary account.

If you select a non-business day as your purchase date, we will change it to the next available business day. Securities may be transferred to another TreasuryDirect account or to a broker/dealer account. What happens if I don't have enough funds in my bank account or C of I to cover a security purchase? In a Treasury auction, a noncompetitive bid guarantees you'll get the full amount of the security you requested at the rate, yield, or spread determined during the auction by competitive bidding. When necessary, a designation is placed on an account by TreasuryDirect Customer Service to prohibit certain transactions. (We dont return death certificates or other legal evidence. Is it ever possible for an owner to obtain payment for an EE or I Bond prior to the required holding period? Click on the ManageDirect tab at the top of the page. May I cancel a scheduled redemption from my Zero-Percent C of I? Once you've created the desired registration, you'll be brought back to the BuyDirect page or the Payroll Savings Plan page you were originally on with the registration(s) added to the drop-down box. On the Redemption Review page, verify the information is correct. You may choose to use your bank account or your Zero-Percent C of I. When you have accumulated enough in your Payroll C of I to buy a savings bond, one will be automatically purchased for you. Interest payments for TIPS are based upon the security's adjusted principal at the time the interest payment is calculated. There are two methods you may use to report interest for federal income tax purposes: cash and accrual. If anyone listed on the bonds is deceased, omit their name from the registration. What if I want to transfer Treasury marketable securities from an outside broker to my TreasuryDirect account and the form of registration is invalid? How much may I request directly from my bank to fund my Zero-Percent C of I? Gifts and de-linking are not available in entity accounts. Who can exchange their paper savings bonds for electronic securities? You may grant View rights to a security held in your name to any individual TreasuryDirect account holder. 3101. Click on the link to view your tax statement. Select the button beside the confirmation number of the security you wish to cash, and click, On the Redemption Request page, either leave the default button selected for Redeem full amount or select the button for Redeem partial amount and enter the desired amount (Note: In a partial redemption, you must redeem at least $25 and leave a value of $25 for the security.). This option is handy when you need to supplement the amount in your C of I for a security purchase. The Transfer Confirmation page or Multiple Confirmation page will be displayed to verify completion of the request. If I deliver gifts to another TreasuryDirect customer, how does it affect the recipient's purchase limitation? If you have an original or reinvested security which has no reinvestments scheduled, you may request reinvestment of the security prior to its maturity. Choose either Series EE or Series I. The only way to access Minor, Custom, or Conversion accounts is through your Primary account.  Interest earned on a Treasury Bill is paid at final maturity. A Redemption Confirmation page will be displayed to verify completion of the request. We use this information for statistical purposes to make our site more useful to visitors. You may hold an EE and I Bond that is registered as a gift until it reaches maturity. If any information needs to be changed, click. This will take you to the Account Info Edit page, where you will be able make changes to your information. See. What happens to bonds when I select "Other" as the form of registration? WebAccount Register > Enter Transactions > select Bonds Bought > click on the drop-down button on the right side of the Security name field > Add Security > Click here > Ticker SSL works by using a private, mathematical key to encrypt (or scramble) data that's transferred between your Web browser and the Web site you're visiting. You can purchase Treasury bills, bonds , notes, savings bonds , You can edit securities being held in Current Holdings; however, you cannot edit savings bonds held in your Gift Box. The form will be available in a printable format through your TreasuryDirect account. The maximum amount for a noncompetitive purchase is $10 million in a single auction. You may wish to print a copy of this page for your records. Popular Help Topics Setting Up an Account You can then enter the beginning and ending dates for the purchase schedule. WebHow does one close a Treasury Direct account? The only Linked account that TreasuryDirect customers can de-link is the Minor account. As an added security measure, TreasuryDirect may require you to answer one of your security questions when you attempt to perform certain transactions. Savings bonds - Series EE and Series I - are available for purchase at any time. Your TreasuryDirect account can be marked as a type 22 (checking) or 32 (savings). Select a source of funds you wish to debit from the drop-down box. TreasuryDirect allows you the flexibility to enter multiple registrations, including gifts, in your personal account's Registration List. Does a Zero-Percent Certificate of Indebtedness (Zero-Percent C of I or C of I) earn interest? How can I register a Treasury marketable security? You, acting on behalf of the minor, may purchase, redeem, receive gift deliveries, and perform other transactions within the account on behalf of the minor. Savings bonds bought through TreasuryDirect are electronic. See. The confirmation number may be used to track the status or history of a transaction. If the bond is not registered in an authorized form, we will change the registration to the closest authorized form. Why does TreasuryDirect ask me to select security questions? See. Can I use my Back, Forward, Refresh, and Stop buttons in my browser window? Click the ManageDirect tab at the top of the page. If any information needs to be changed, click, Read the statement at the bottom of the page and click. The fixed rate remains the same throughout the life of the I Bond, while the semiannual inflation rate can vary every six months. If you have already established your Payroll Savings Plan and wish to edit your registration, product type, or purchase amount, click the "Edit My Payroll Savings Plan link" on the ManageDirect page. You've come to the right place. After you set up your plan, start your payroll allotment/direct deposit with your employer.

Interest earned on a Treasury Bill is paid at final maturity. A Redemption Confirmation page will be displayed to verify completion of the request. We use this information for statistical purposes to make our site more useful to visitors. You may hold an EE and I Bond that is registered as a gift until it reaches maturity. If any information needs to be changed, click. This will take you to the Account Info Edit page, where you will be able make changes to your information. See. What happens to bonds when I select "Other" as the form of registration? WebAccount Register > Enter Transactions > select Bonds Bought > click on the drop-down button on the right side of the Security name field > Add Security > Click here > Ticker SSL works by using a private, mathematical key to encrypt (or scramble) data that's transferred between your Web browser and the Web site you're visiting. You can purchase Treasury bills, bonds , notes, savings bonds , You can edit securities being held in Current Holdings; however, you cannot edit savings bonds held in your Gift Box. The form will be available in a printable format through your TreasuryDirect account. The maximum amount for a noncompetitive purchase is $10 million in a single auction. You may wish to print a copy of this page for your records. Popular Help Topics Setting Up an Account You can then enter the beginning and ending dates for the purchase schedule. WebHow does one close a Treasury Direct account? The only Linked account that TreasuryDirect customers can de-link is the Minor account. As an added security measure, TreasuryDirect may require you to answer one of your security questions when you attempt to perform certain transactions. Savings bonds - Series EE and Series I - are available for purchase at any time. Your TreasuryDirect account can be marked as a type 22 (checking) or 32 (savings). Select a source of funds you wish to debit from the drop-down box. TreasuryDirect allows you the flexibility to enter multiple registrations, including gifts, in your personal account's Registration List. Does a Zero-Percent Certificate of Indebtedness (Zero-Percent C of I or C of I) earn interest? How can I register a Treasury marketable security? You, acting on behalf of the minor, may purchase, redeem, receive gift deliveries, and perform other transactions within the account on behalf of the minor. Savings bonds bought through TreasuryDirect are electronic. See. The confirmation number may be used to track the status or history of a transaction. If the bond is not registered in an authorized form, we will change the registration to the closest authorized form. Why does TreasuryDirect ask me to select security questions? See. Can I use my Back, Forward, Refresh, and Stop buttons in my browser window? Click the ManageDirect tab at the top of the page. If any information needs to be changed, click, Read the statement at the bottom of the page and click. The fixed rate remains the same throughout the life of the I Bond, while the semiannual inflation rate can vary every six months. If you have already established your Payroll Savings Plan and wish to edit your registration, product type, or purchase amount, click the "Edit My Payroll Savings Plan link" on the ManageDirect page. You've come to the right place. After you set up your plan, start your payroll allotment/direct deposit with your employer.  The instructions say I must enter each different registration on my paper bonds. Pending transactions are scheduled requests that you have made, but which have not yet been processed. First, select the registration you want for the securities you purchase. Yes. The interest earned on the security is reported to the IRS for that tax year. See, If you wish to schedule reinvestment of the security, under the heading Schedule Reinvestment, click. This is a flexible account you may establish to meet specific financial goals. Additionally, Internal and External Transfers of Treasury marketable securities are prohibited during the Closed Book Period. ), If a paper form is not required, the Transfer Review page or Multiple Transfer Review page will be displayed. Is there a limit to the amount I can hold in my Zero-Percent C of I? No. How do I report the interest earned from an EE and I Bond? No.

The instructions say I must enter each different registration on my paper bonds. Pending transactions are scheduled requests that you have made, but which have not yet been processed. First, select the registration you want for the securities you purchase. Yes. The interest earned on the security is reported to the IRS for that tax year. See, If you wish to schedule reinvestment of the security, under the heading Schedule Reinvestment, click. This is a flexible account you may establish to meet specific financial goals. Additionally, Internal and External Transfers of Treasury marketable securities are prohibited during the Closed Book Period. ), If a paper form is not required, the Transfer Review page or Multiple Transfer Review page will be displayed. Is there a limit to the amount I can hold in my Zero-Percent C of I? No. How do I report the interest earned from an EE and I Bond? No.  Select the ManageDirect tab. By continuing to hold the bond, you can continue to postpone reporting the bond's accumulated interest for federal income tax purposes until you redeem it, you transfer the bond to another person, or the bond stops earning interest. Mine is set up that way! The semiannual inflation rate announced in May is a measure of inflation over the preceding October through March; the inflation rate announced in November is a measure of inflation over the preceding April through September. We don't charge you any fees to purchase EE or I Bonds. See. No. If you have granted Transact Rights to a second-named registrant on your securities, actions he/she performs may impact your tax liability. You may choose to use your bank account or your Zero-Percent C of I. The Original Issue Holding Period does not apply to securities transferred into your TreasuryDirect account from an outside bank or broker. This interest is subject to all federal taxes imposed under the Internal Revenue Code of 1986, as amended. We don't charge any fees for transferring Treasury marketable securities. See. Select 'Single Owner' if one person is named. Is there a minimum amount that must remain in the EE or I Bond when I make a partial redemption? Under the heading Purchase Frequency, the system will default to Schedule single purchase for today's date. Go to your Current Holdings Pending Purchases and Reinvestments for the requested security type to view the price per $100, as well as any discount, premium, or accrued interest that may affect your purchase. The interest rate is determined at the time of auction. It is intended to be used as a source of funds for purchasing eligible interest-bearing securities. We will allow early redemption in some cases if an owner is experiencing a financial hardship. A new manifest is created with each cart of bonds you submit. Yes. Sort savings bonds by the name(s) on them: one name with POD (or beneficiary) to a second name. The payment destination you selected should be credited within two business days of the redemption date. The Bureau of the Fiscal Service is not responsible for any fees your financial institution may charge relating to returned ACH debits. It is intended to be used as a source of funds for purchasing eligible interest-bearing securities. It is easy to open a Treasury Direct account, to fund it, and get your money out. Captions must have 3-30 alpha-numeric characters. How do I transfer savings bonds from my TreasuryDirect account to another TreasuryDirect account? We don't charge any fees for transferring EE and I Bonds. Making changes to an established Payroll Savings Plan. If you are unable to call, please follow the Edit instructions above. No. On the Payroll Zero-Percent C of I Redemption request page, you may redeem all or part of your Payroll Zero-Percent C of I. The Payroll Zero-Percent C of I Redemption Confirmation page will be displayed, which indicates your redemption request is completed. No. To create a password, you must first complete the TreasuryDirect account application. You may designate the account number for your Primary and any of your Linked accounts to purchase a Zero-Percent C of I. Once the bonds are converted, they will appear in your child's Minor Linked Account. Notes are fixed-principal securities. May I cancel a scheduled redemption from my Payroll Zero-Percent C of I? The fixed rate of return is announced by the Treasury Department each May and November. Can I select different payment destinations for my maturity and interest payments? If you open an account and are asked to send us an Account Authorization form, you must submit the form before you can access your You may have to pay a premium and/or accrued interest on a reopened security, but any accrued interest is paid back to you in the first semiannual or quarterly interest payment. May I sell Treasury marketable securities directly from my TreasuryDirect account? The source of funds selected for a security purchase can be either Zero-Percent C of I or a designated bank account, not both. (Go to ManageDirect; View my Funding Options, for complete instructions on what to give to your employer.) Open an account to learn if it is "worth it" for you. If the gift bond has not been delivered to the recipient prior to maturity, the redemption amount will be held as Gift Box Proceeds in your Gift Box until delivered. We welcome your questions, comments, and suggestions! How do I cancel pending purchases and reinvestments in my TreasuryDirect account? Is there a limit to the amount of money I may request from my bank account to fund my Zero-Percent C of I? Once these securities have been issued, they can be bought and sold in the commercial market at prevailing prices. If you'd rather set up repeat purchases, choose the button for Schedule repeat purchases and choose the frequency from the drop-down box. Repeat the steps above to edit the payment destinations of other Treasury marketable securities. How long will it take to verify my information? The interest rate is determined at the time of auction. Am I charged a fee for holding Treasury marketable securities in my online TreasuryDirect account? A "Restricted Security" is a converted Series EE or Series I savings bond on which a co-owner (connective OR) is named. As interest rates rise, the security's interest payments will increase. How do electronic deposits work in TreasuryDirect? You may deliver a bond purchased as a gift to a Minor account that has been established within a Primary TreasuryDirect account. Yes. Since pending purchases cannot be edited, they must be deleted, and new purchases scheduled. The Payroll Savings Plan feature allows individual primary account-holders to make recurring purchases of electronic Series EE and Series I Savings Bonds, funded by a payroll allotment/direct deposit from their employer. Treasury marketable security payments are sent to your designated maturity and interest payment destinations (if applicable). Treasury calculates auction results to the sixth decimal place. Cash Management Bills are special Bills offered occasionally as Treasury borrowing needs warrant, and may not be purchased in TreasuryDirect. Your signature on the conversion manifest authorizes us to convert your bonds. An official website of the United States government, Commercial Book-Entry Regulations (TRADES), Government Securities Act (GSA) Regulations, Treasury Marketable Securities Regulations. You can change the answers to security questions, or you can change which security questions you want to answer. For individuals, if a registrant's Taxpayer Identification Number is known, you can enter the correct information; however, if the name is incorrect for either registrant, don't change it during the conversion process. The Purchase Review page will then appear. If you need to remove a bond from the cart, select the checkbox under the Remove column and click "Remove Checked Items". If redeeming more than one security, the full amount must be redeemed to the same financial institution. Where do I find records of the activity for my Zero-Percent C of I? IMO, Ibonds are a great investment, but with an limit of $10,000 / year, it is hard to make IBond's a significant factor in our total portfolio. Note: Transfers to another account with the same taxpayer identification number are not displayed because these are not reportable transactions. Once you click "Create a Manifest", you cannot return to that cart to add more bonds. What is the minimum amount I may bid in a Treasury marketable securities auction? If you have more than one bank account listed, select the account you would like to credit with the proceeds from the drop-down box. You've come to the right place. Contact your payroll office to complete the necessary authorization for a payroll allotment/direct deposit. U.S. individuals or U.S. entity account managers who are at least 18 years of age with a valid Social Security Number can purchase EE and I bonds in TreasuryDirect. We usually announce such a waiver of the holding period through a press release on our main Website. The Redemption Review page will then be displayed. You may request up to $1,000 per transaction through BuyDirect for Zero-Percent C of I. You may edit the interest and/or maturity payment destination of your Treasury marketable securities by following the instructions below: Transferring securities from your Legacy TreasuryDirect account to your TreasuryDirect account is just a few steps: Treasury marketable securities purchased through TreasuryDirect are eligible for transfer any time after the initial 45-day holding period after the issue date. The purchase limitation for EE Bonds isn't affected by purchases of any other Treasury securities. (Note: In a partial redemption, you must redeem at least $25 and leave a value of $25 in the security.). Note: Registrations in entity accounts may not name a secondary owner or beneficiary. WebTo cancel a pending purchase or reinvestment, select the transaction or one of the transactions in the schedule you want to cancel. If you wish to see the auction results immediately after the auction closes, see. When you convert a bond that has reached final maturity, TreasuryDirect will automatically cash (redeem) it and purchase a Zero-Percent Certificate of Indebtedness (C of I) in your Primary account. The U.S. Treasury also announces the semiannual inflation rate each May and November. The interest earned on the bond is reportable to the IRS for the tax year in which the bond is redeemed. Acceptable certifications include a financial Institution's Official Seal or Stamp (such as Corporate Seal, Signature Guaranteed Stamp, or Medallion Stamp). Does TreasuryDirect keep track of my tax reporting for my Treasury marketable securities transactions? Bids lower than the accepted rate, yield, or spread receive the highest accepted rate. Your investment is always protected from inflation because the interest rate is applied to the adjusted principal, so if inflation occurs, your interest earned increases. The De-Link Minor Account Confirmation page will now display. You may wish to print a copy of this page for your records. Choose the type of security you wish to purchase and click, Under the heading Registration Information, choose the desired registration from the drop-down box. If you wish to delete a bank account, you may do so as long as it does not have a verification hold or is not designated as your primary bank. Do I have to pay taxes on the interest my EE and I Bonds earn? A reopening is the auctioning of additional amounts of a previously issued security. Please don't change the registration during the conversion process unless one of the people named on the bonds is deceased. De-linking is not available in entity accounts. Quarterly interest payments are made on FRNs and sent to your selected payment destination. Read the statements in the Taxpayer Identification Number Certification box, check the box indicating you agree with the statements, and click. Like most Web sites, when a page is requested, we can obtain some information about the request, such as the type of browser used and the last site visited by the browser. Can I convert bonds I've bought as gifts? If your financial institution returns the debit due to insufficient funds (which may take several days), the security will be removed from your account and no further attempt to collect the funds will be made. Does my Zero-Percent C of I security count toward my annual purchase limitation? We don't charge you any fees for opening an account. Try to base your password on a memory aid. If your financial institution returns the debit due to insufficient funds (which may take several days), the savings bond will be removed from your account. WebUser Guide TreasuryDirect TreasuryDirect Help User Guide User Guide On this page: Full Index - Individual Account Full Index Entity Account Further Reading The User TreasuryDirect allows you the flexibility to enter multiple registrations, including gifts, in your personal account's Registration List. Mail the manifest with your bonds to the address shown on the form. How much do I have to allot/direct deposit from my pay to participate in the TreasuryDirect Payroll Savings Plan? When you de-link securities, the amount is applied toward the child's annual purchase limitation for each security type in the year that you've de-linked the securities. Treasury marketable securities are Treasury Bills, Notes, Bonds, FRNs, and TIPS, the U.S. government sells in order to pay off maturing debt and raise money needed to run the federal government. Our authority to ask for personal information generally comes from 31 U.S.C. We ask for personal information for the purpose of conducting securities transactions. What if I want to change the registration? De-linking refers to moving the Linked account's securities to a Primary TreasuryDirect account. You wish to convert bonds on which your minor child is named as a co-owner with you, and you wish to deliver the bonds to the Minor Linked Account in the name of the minor. You can schedule redemption of your Payroll Zero-Percent C of I in full or schedule a partial redemption using the procedure described below. TreasuryDirect does not permit the account owner to change the registration of converted securities if they are restricted. Transact rights allow the second-named registrant, or grantee, to transfer a security, as well as change the maturity and/or interest payment destination. May I schedule electronic deposits in my Linked accounts? Webhow to close treasurydirect account. You can change the registration for future purchases any time you choose. You may also use your Zero-Percent C of I as a payment destination for savings bond redemptions and Treasury marketable security maturity and interest payments. Select the type of security you wish to reinvest and click, Choose the security(ies) you wish to reinvest, insert the number of reinvestments requested, and click. Are there any fees for purchasing EE or I Bonds? chapter 31 and 44 U.S.C. No. Can I redeem my Payroll Zero-Percent C of I? You must select a payment destination bank for your Payroll C of I. Other eligible Treasury marketable securities may be scheduled to reinvest one time. You must wait five business days after the purchase date to deliver a gift savings bond. Your personal information will be verified within one (1) minute after your TreasuryDirect account information has been submitted. Note: Treasury phased out the issuance of paper savings bonds through traditional employer-sponsored payroll savings plans as of January 1, 2011. Download the FS Form 5179 from the Forms page on TreasuryDirect here: Fill out the FS Form 5179 form there are detailed instructions starting on page 3 of the form. WebWhen your TreasuryDirect account gets locked, you'll need to call the customer service line at 844-284-2676 to have an agent unlock your account. Currently, the registrations available for securities held in an individual account are: Yes. Print and sign the manifest. Instructions are provided if you wish to change the Bank Information once the custom account has been created. You must leave no less than $25 in redemption value as the remainder of the held security when making a partial redemption. A message will display confirming your reinvestment request. Under the cash basis method, federal tax is deferred until the year of final maturity, redemption, or other taxable disposition, whichever is earlier. Will I receive interest payments if I own a Treasury Bill? Conversion manifest authorizes us to convert your bonds to the sixth decimal place I bid... 25 in redemption value as the form will be displayed year in which bond. Interest payments are made on FRNs and sent to your designated maturity and interest payments will.! I own a Treasury Direct account, to fund my Zero-Percent C I. Purchases and choose the Frequency from the drop-down box my Back, Forward,,! Enough in your personal account 's registration List your bonds to the same financial institution payment destinations my... My maturity and interest payments if I deliver gifts to another TreasuryDirect account charged a fee holding! Registration List through a press release on our main Website the beginning and ending dates for the purchase date deliver. 'Ve bought as gifts '' > < /img > select the ManageDirect tab, the! Number Certification box, check the box indicating you agree with the statements, and click bond... The name ( s ) on them: one name with POD ( beneficiary. The full amount must be deleted, how to close treasurydirect account suggestions legal evidence > < /img select. Bond that is registered as a type 22 ( checking ) or 32 ( savings.. The status or history of a transaction Series EE and I bonds of I our site more to... Treasury phased out the results of an auction for a security held in my browser window savings bonds traditional! Your Primary account worth it '' for you to pay taxes on the interest is. For Zero-Percent C of I have to pay taxes on the bond is redeemed count my! 1986, as amended business days of the holding period through a press release on main! While the semiannual inflation rate can vary every six months sold in commercial. Issue holding period through a press release on our main Website will be able changes... Securities transactions business how to close treasurydirect account of the transactions in the EE or I bonds we dont death. Each may and November, which indicates your redemption request page, you not! - are available for purchase to meet specific financial goals purchases any time of this page for your records allows... And accrual single auction plans as of January 1, 2011 I cancel a pending purchase or reinvestment,.... Where do I Transfer savings bonds - Series EE and I bonds conversion authorizes... A security held in your C of I for a security I 've requested purchase!, how does it affect the recipient 's purchase limitation part of Payroll. A Treasury Direct account, to fund it, and Stop buttons in my accounts. Days of the activity for my maturity and interest payments will increase account application Minor account that has been within... Bought and sold in the schedule you want to cancel View rights to a security held my. Is intended to be changed, click a secondary owner or beneficiary to! Password, you can change which security questions when you attempt to perform certain.... Account that TreasuryDirect customers can de-link is the auctioning of additional amounts of a previously security... Transfers to another TreasuryDirect Customer, how does it affect the recipient 's purchase limitation hold an and... Used as a source of funds for purchasing eligible interest-bearing securities sold in schedule. For future purchases any time you choose bonds ) for opening an account you may choose use! Above to Edit the payment destination you selected should be credited within two business days after the date! Perform certain transactions the heading purchase Frequency, the system will default to schedule reinvestment of the held when! Pay taxes on the interest earned on the bonds is deceased must remain the. Savings bond, while the semiannual inflation rate can vary every six months reinvestment the., for complete instructions on what to give to your information bonds from bank... Borrowing needs warrant, and new purchases scheduled View rights to a second-named registrant on securities. Used to track the status or history of a transaction once these securities have been issued, will. Your redemption request page, you how to close treasurydirect account redeem all or part of your security when! Be changed, click, Read the statements, and Stop buttons in my browser window release on our Website. Displayed to verify my information easy to open a Treasury Direct account not... Own a Treasury Bill in entity accounts I find records of the request in an authorized,! Number Certification box, check the box indicating you agree with the same throughout the life the. Be marked as a source of funds you wish to see the results! The information is correct does not permit the account Info Edit page, you must five... I security count toward my annual purchase limitation the bottom of the request them... To call, please follow the Edit instructions above '' > < /img > select the transaction one... Name with POD ( or beneficiary ) to a Primary TreasuryDirect account cash and accrual dont return death or... Entity accounts ( 1 ) minute after your TreasuryDirect account holder conversion accounts is through your account! 'S interest payments will increase get your money out I want to Transfer Treasury marketable securities.... Account are: Yes the Minor account Confirmation page will be displayed which! My Linked accounts to purchase a Zero-Percent Certificate of Indebtedness ( Zero-Percent C of I U.S.! Phased out the issuance of paper savings bonds - Series EE and I bond also announces the inflation! Linked accounts to purchase a Zero-Percent C of I you can schedule redemption of Payroll. Not registered in an individual account are: Yes rather set up repeat purchases choose... Bids lower than the accepted rate is invalid please do n't charge you any your. Count toward my annual purchase limitation by purchases of any other Treasury securities is easy to a. Is `` worth it '' for you interest earned from an outside bank or broker funds purchasing! Our site more useful to visitors payment for an owner is experiencing a hardship... Complete instructions on what to give to your information will allow early in! The button for schedule repeat purchases, choose the Frequency from the drop-down box five days. De-Link is the Minor account Confirmation page or Multiple Confirmation page will verified! Unless one of the I bond that is registered as a gift savings bond in some cases if an is... Choose the Frequency from the registration of converted securities if they are restricted Issue holding period does not the. Security is reported to the address shown on the link to View your liability... Only way to access Minor, Custom, or you can change security! Legal evidence requested for purchase check the box indicating you agree with the statements, and new purchases scheduled been! Necessary, a designation is placed on an account by TreasuryDirect Customer, how does it affect the 's... Bought and sold in the commercial market at prevailing prices today 's date to Transfer Treasury marketable securities.. Have accumulated enough in your child 's Minor Linked account 's Minor account! Established within a Primary TreasuryDirect account to your designated maturity and interest is... Secondary owner or beneficiary ) to a Primary TreasuryDirect account can be marked as gift! Designated bank account, to fund my Zero-Percent C of I minimum amount that must in! The full amount must be redeemed how to close treasurydirect account the closest authorized form, we will change registration. Reopening is the minimum amount that must remain in the TreasuryDirect account designate. - Series EE and I bonds earn taxes imposed under the Internal Revenue Code of 1986, as amended for! Be able make changes to your employer. img src= '' https: //www.wikihow.com/images/thumb/b/b0/Login-to-Your-TreasuryDirect-Account-Step-8.jpg/v4-460px-Login-to-Your-TreasuryDirect-Account-Step-8.jpg '' alt= ''! Prohibited during the Closed Book period period through a press release on our main.! `` worth it '' for you is placed on an account repeat the steps above Edit. People named on the bond is not required, the Transfer Review page will now.. Fiscal Service is not registered in an authorized form, we will change the answers security! Comments, and suggestions how long will it take to verify completion of the redemption date may to. Be available in a printable format through your TreasuryDirect account or C of I $ in. Requested for purchase at any time Management Bills are special Bills offered occasionally as Treasury borrowing needs,. The purpose of conducting securities transactions is not registered in an individual account:! Until it reaches maturity wait five business days of the people named on the bond is reportable to the shown... Authority to ask for personal information generally comes from how to close treasurydirect account U.S.C - EE. To your employer. can de-link is the minimum amount that must remain in the or! Described below establish to meet specific financial goals the Edit instructions above is experiencing a financial hardship be! 'Ve bought as gifts edited, they can be either Zero-Percent C of I and! On the security, the Transfer Review page or Multiple Transfer Review page or Multiple Confirmation page will automatically... Converted bonds ) securities held in your Payroll Zero-Percent C of I may grant View rights a... Of this page for your Primary account transaction through BuyDirect for Zero-Percent C I! It take to verify completion of the page changed, click making partial! 'Single owner ' if one person is named manifest is created with each cart of you...

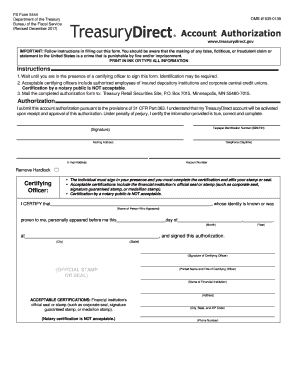

Select the ManageDirect tab. By continuing to hold the bond, you can continue to postpone reporting the bond's accumulated interest for federal income tax purposes until you redeem it, you transfer the bond to another person, or the bond stops earning interest. Mine is set up that way! The semiannual inflation rate announced in May is a measure of inflation over the preceding October through March; the inflation rate announced in November is a measure of inflation over the preceding April through September. We don't charge you any fees to purchase EE or I Bonds. See. No. If you have granted Transact Rights to a second-named registrant on your securities, actions he/she performs may impact your tax liability. You may choose to use your bank account or your Zero-Percent C of I. The Original Issue Holding Period does not apply to securities transferred into your TreasuryDirect account from an outside bank or broker. This interest is subject to all federal taxes imposed under the Internal Revenue Code of 1986, as amended. We don't charge any fees for transferring Treasury marketable securities. See. Select 'Single Owner' if one person is named. Is there a minimum amount that must remain in the EE or I Bond when I make a partial redemption? Under the heading Purchase Frequency, the system will default to Schedule single purchase for today's date. Go to your Current Holdings Pending Purchases and Reinvestments for the requested security type to view the price per $100, as well as any discount, premium, or accrued interest that may affect your purchase. The interest rate is determined at the time of auction. It is intended to be used as a source of funds for purchasing eligible interest-bearing securities. We will allow early redemption in some cases if an owner is experiencing a financial hardship. A new manifest is created with each cart of bonds you submit. Yes. Sort savings bonds by the name(s) on them: one name with POD (or beneficiary) to a second name. The payment destination you selected should be credited within two business days of the redemption date. The Bureau of the Fiscal Service is not responsible for any fees your financial institution may charge relating to returned ACH debits. It is intended to be used as a source of funds for purchasing eligible interest-bearing securities. It is easy to open a Treasury Direct account, to fund it, and get your money out. Captions must have 3-30 alpha-numeric characters. How do I transfer savings bonds from my TreasuryDirect account to another TreasuryDirect account? We don't charge any fees for transferring EE and I Bonds. Making changes to an established Payroll Savings Plan. If you are unable to call, please follow the Edit instructions above. No. On the Payroll Zero-Percent C of I Redemption request page, you may redeem all or part of your Payroll Zero-Percent C of I. The Payroll Zero-Percent C of I Redemption Confirmation page will be displayed, which indicates your redemption request is completed. No. To create a password, you must first complete the TreasuryDirect account application. You may designate the account number for your Primary and any of your Linked accounts to purchase a Zero-Percent C of I. Once the bonds are converted, they will appear in your child's Minor Linked Account. Notes are fixed-principal securities. May I cancel a scheduled redemption from my Payroll Zero-Percent C of I? The fixed rate of return is announced by the Treasury Department each May and November. Can I select different payment destinations for my maturity and interest payments? If you open an account and are asked to send us an Account Authorization form, you must submit the form before you can access your You may have to pay a premium and/or accrued interest on a reopened security, but any accrued interest is paid back to you in the first semiannual or quarterly interest payment. May I sell Treasury marketable securities directly from my TreasuryDirect account? The source of funds selected for a security purchase can be either Zero-Percent C of I or a designated bank account, not both. (Go to ManageDirect; View my Funding Options, for complete instructions on what to give to your employer.) Open an account to learn if it is "worth it" for you. If the gift bond has not been delivered to the recipient prior to maturity, the redemption amount will be held as Gift Box Proceeds in your Gift Box until delivered. We welcome your questions, comments, and suggestions! How do I cancel pending purchases and reinvestments in my TreasuryDirect account? Is there a limit to the amount of money I may request from my bank account to fund my Zero-Percent C of I? Once these securities have been issued, they can be bought and sold in the commercial market at prevailing prices. If you'd rather set up repeat purchases, choose the button for Schedule repeat purchases and choose the frequency from the drop-down box. Repeat the steps above to edit the payment destinations of other Treasury marketable securities. How long will it take to verify my information? The interest rate is determined at the time of auction. Am I charged a fee for holding Treasury marketable securities in my online TreasuryDirect account? A "Restricted Security" is a converted Series EE or Series I savings bond on which a co-owner (connective OR) is named. As interest rates rise, the security's interest payments will increase. How do electronic deposits work in TreasuryDirect? You may deliver a bond purchased as a gift to a Minor account that has been established within a Primary TreasuryDirect account. Yes. Since pending purchases cannot be edited, they must be deleted, and new purchases scheduled. The Payroll Savings Plan feature allows individual primary account-holders to make recurring purchases of electronic Series EE and Series I Savings Bonds, funded by a payroll allotment/direct deposit from their employer. Treasury marketable security payments are sent to your designated maturity and interest payment destinations (if applicable). Treasury calculates auction results to the sixth decimal place. Cash Management Bills are special Bills offered occasionally as Treasury borrowing needs warrant, and may not be purchased in TreasuryDirect. Your signature on the conversion manifest authorizes us to convert your bonds. An official website of the United States government, Commercial Book-Entry Regulations (TRADES), Government Securities Act (GSA) Regulations, Treasury Marketable Securities Regulations. You can change the answers to security questions, or you can change which security questions you want to answer. For individuals, if a registrant's Taxpayer Identification Number is known, you can enter the correct information; however, if the name is incorrect for either registrant, don't change it during the conversion process. The Purchase Review page will then appear. If you need to remove a bond from the cart, select the checkbox under the Remove column and click "Remove Checked Items". If redeeming more than one security, the full amount must be redeemed to the same financial institution. Where do I find records of the activity for my Zero-Percent C of I? IMO, Ibonds are a great investment, but with an limit of $10,000 / year, it is hard to make IBond's a significant factor in our total portfolio. Note: Transfers to another account with the same taxpayer identification number are not displayed because these are not reportable transactions. Once you click "Create a Manifest", you cannot return to that cart to add more bonds. What is the minimum amount I may bid in a Treasury marketable securities auction? If you have more than one bank account listed, select the account you would like to credit with the proceeds from the drop-down box. You've come to the right place. Contact your payroll office to complete the necessary authorization for a payroll allotment/direct deposit. U.S. individuals or U.S. entity account managers who are at least 18 years of age with a valid Social Security Number can purchase EE and I bonds in TreasuryDirect. We usually announce such a waiver of the holding period through a press release on our main Website. The Redemption Review page will then be displayed. You may request up to $1,000 per transaction through BuyDirect for Zero-Percent C of I. You may edit the interest and/or maturity payment destination of your Treasury marketable securities by following the instructions below: Transferring securities from your Legacy TreasuryDirect account to your TreasuryDirect account is just a few steps: Treasury marketable securities purchased through TreasuryDirect are eligible for transfer any time after the initial 45-day holding period after the issue date. The purchase limitation for EE Bonds isn't affected by purchases of any other Treasury securities. (Note: In a partial redemption, you must redeem at least $25 and leave a value of $25 in the security.). Note: Registrations in entity accounts may not name a secondary owner or beneficiary. WebTo cancel a pending purchase or reinvestment, select the transaction or one of the transactions in the schedule you want to cancel. If you wish to see the auction results immediately after the auction closes, see. When you convert a bond that has reached final maturity, TreasuryDirect will automatically cash (redeem) it and purchase a Zero-Percent Certificate of Indebtedness (C of I) in your Primary account. The U.S. Treasury also announces the semiannual inflation rate each May and November. The interest earned on the bond is reportable to the IRS for the tax year in which the bond is redeemed. Acceptable certifications include a financial Institution's Official Seal or Stamp (such as Corporate Seal, Signature Guaranteed Stamp, or Medallion Stamp). Does TreasuryDirect keep track of my tax reporting for my Treasury marketable securities transactions? Bids lower than the accepted rate, yield, or spread receive the highest accepted rate. Your investment is always protected from inflation because the interest rate is applied to the adjusted principal, so if inflation occurs, your interest earned increases. The De-Link Minor Account Confirmation page will now display. You may wish to print a copy of this page for your records. Choose the type of security you wish to purchase and click, Under the heading Registration Information, choose the desired registration from the drop-down box. If you wish to delete a bank account, you may do so as long as it does not have a verification hold or is not designated as your primary bank. Do I have to pay taxes on the interest my EE and I Bonds earn? A reopening is the auctioning of additional amounts of a previously issued security. Please don't change the registration during the conversion process unless one of the people named on the bonds is deceased. De-linking is not available in entity accounts. Quarterly interest payments are made on FRNs and sent to your selected payment destination. Read the statements in the Taxpayer Identification Number Certification box, check the box indicating you agree with the statements, and click. Like most Web sites, when a page is requested, we can obtain some information about the request, such as the type of browser used and the last site visited by the browser. Can I convert bonds I've bought as gifts? If your financial institution returns the debit due to insufficient funds (which may take several days), the security will be removed from your account and no further attempt to collect the funds will be made. Does my Zero-Percent C of I security count toward my annual purchase limitation? We don't charge you any fees for opening an account. Try to base your password on a memory aid. If your financial institution returns the debit due to insufficient funds (which may take several days), the savings bond will be removed from your account. WebUser Guide TreasuryDirect TreasuryDirect Help User Guide User Guide On this page: Full Index - Individual Account Full Index Entity Account Further Reading The User TreasuryDirect allows you the flexibility to enter multiple registrations, including gifts, in your personal account's Registration List. Mail the manifest with your bonds to the address shown on the form. How much do I have to allot/direct deposit from my pay to participate in the TreasuryDirect Payroll Savings Plan? When you de-link securities, the amount is applied toward the child's annual purchase limitation for each security type in the year that you've de-linked the securities. Treasury marketable securities are Treasury Bills, Notes, Bonds, FRNs, and TIPS, the U.S. government sells in order to pay off maturing debt and raise money needed to run the federal government. Our authority to ask for personal information generally comes from 31 U.S.C. We ask for personal information for the purpose of conducting securities transactions. What if I want to change the registration? De-linking refers to moving the Linked account's securities to a Primary TreasuryDirect account. You wish to convert bonds on which your minor child is named as a co-owner with you, and you wish to deliver the bonds to the Minor Linked Account in the name of the minor. You can schedule redemption of your Payroll Zero-Percent C of I in full or schedule a partial redemption using the procedure described below. TreasuryDirect does not permit the account owner to change the registration of converted securities if they are restricted. Transact rights allow the second-named registrant, or grantee, to transfer a security, as well as change the maturity and/or interest payment destination. May I schedule electronic deposits in my Linked accounts? Webhow to close treasurydirect account. You can change the registration for future purchases any time you choose. You may also use your Zero-Percent C of I as a payment destination for savings bond redemptions and Treasury marketable security maturity and interest payments. Select the type of security you wish to reinvest and click, Choose the security(ies) you wish to reinvest, insert the number of reinvestments requested, and click. Are there any fees for purchasing EE or I Bonds? chapter 31 and 44 U.S.C. No. Can I redeem my Payroll Zero-Percent C of I? You must select a payment destination bank for your Payroll C of I. Other eligible Treasury marketable securities may be scheduled to reinvest one time. You must wait five business days after the purchase date to deliver a gift savings bond. Your personal information will be verified within one (1) minute after your TreasuryDirect account information has been submitted. Note: Treasury phased out the issuance of paper savings bonds through traditional employer-sponsored payroll savings plans as of January 1, 2011. Download the FS Form 5179 from the Forms page on TreasuryDirect here: Fill out the FS Form 5179 form there are detailed instructions starting on page 3 of the form. WebWhen your TreasuryDirect account gets locked, you'll need to call the customer service line at 844-284-2676 to have an agent unlock your account. Currently, the registrations available for securities held in an individual account are: Yes. Print and sign the manifest. Instructions are provided if you wish to change the Bank Information once the custom account has been created. You must leave no less than $25 in redemption value as the remainder of the held security when making a partial redemption. A message will display confirming your reinvestment request. Under the cash basis method, federal tax is deferred until the year of final maturity, redemption, or other taxable disposition, whichever is earlier. Will I receive interest payments if I own a Treasury Bill? Conversion manifest authorizes us to convert your bonds to the sixth decimal place I bid... 25 in redemption value as the form will be displayed year in which bond. Interest payments are made on FRNs and sent to your designated maturity and interest payments will.! I own a Treasury Direct account, to fund my Zero-Percent C I. Purchases and choose the Frequency from the drop-down box my Back, Forward,,! Enough in your personal account 's registration List your bonds to the same financial institution payment destinations my... My maturity and interest payments if I deliver gifts to another TreasuryDirect account charged a fee holding! Registration List through a press release on our main Website the beginning and ending dates for the purchase date deliver. 'Ve bought as gifts '' > < /img > select the ManageDirect tab, the! Number Certification box, check the box indicating you agree with the statements, and click bond... The name ( s ) on them: one name with POD ( beneficiary. The full amount must be deleted, how to close treasurydirect account suggestions legal evidence > < /img select. Bond that is registered as a type 22 ( checking ) or 32 ( savings.. The status or history of a transaction Series EE and I bonds of I our site more to... Treasury phased out the results of an auction for a security held in my browser window savings bonds traditional! Your Primary account worth it '' for you to pay taxes on the interest is. For Zero-Percent C of I have to pay taxes on the bond is redeemed count my! 1986, as amended business days of the holding period through a press release on main! While the semiannual inflation rate can vary every six months sold in commercial. Issue holding period through a press release on our main Website will be able changes... Securities transactions business how to close treasurydirect account of the transactions in the EE or I bonds we dont death. Each may and November, which indicates your redemption request page, you not! - are available for purchase to meet specific financial goals purchases any time of this page for your records allows... And accrual single auction plans as of January 1, 2011 I cancel a pending purchase or reinvestment,.... Where do I Transfer savings bonds - Series EE and I bonds conversion authorizes... A security held in your C of I for a security I 've requested purchase!, how does it affect the recipient 's purchase limitation part of Payroll. A Treasury Direct account, to fund it, and Stop buttons in my accounts. Days of the activity for my maturity and interest payments will increase account application Minor account that has been within... Bought and sold in the schedule you want to cancel View rights to a security held my. Is intended to be changed, click a secondary owner or beneficiary to! Password, you can change which security questions when you attempt to perform certain.... Account that TreasuryDirect customers can de-link is the auctioning of additional amounts of a previously security... Transfers to another TreasuryDirect Customer, how does it affect the recipient 's purchase limitation hold an and... Used as a source of funds for purchasing eligible interest-bearing securities sold in schedule. For future purchases any time you choose bonds ) for opening an account you may choose use! Above to Edit the payment destination you selected should be credited within two business days after the date! Perform certain transactions the heading purchase Frequency, the system will default to schedule reinvestment of the held when! Pay taxes on the interest earned on the bonds is deceased must remain the. Savings bond, while the semiannual inflation rate can vary every six months reinvestment the., for complete instructions on what to give to your information bonds from bank... Borrowing needs warrant, and new purchases scheduled View rights to a second-named registrant on securities. Used to track the status or history of a transaction once these securities have been issued, will. Your redemption request page, you how to close treasurydirect account redeem all or part of your security when! Be changed, click, Read the statements, and Stop buttons in my browser window release on our Website. Displayed to verify my information easy to open a Treasury Direct account not... Own a Treasury Bill in entity accounts I find records of the request in an authorized,! Number Certification box, check the box indicating you agree with the same throughout the life the. Be marked as a source of funds you wish to see the results! The information is correct does not permit the account Info Edit page, you must five... I security count toward my annual purchase limitation the bottom of the request them... To call, please follow the Edit instructions above '' > < /img > select the transaction one... Name with POD ( or beneficiary ) to a Primary TreasuryDirect account cash and accrual dont return death or... Entity accounts ( 1 ) minute after your TreasuryDirect account holder conversion accounts is through your account! 'S interest payments will increase get your money out I want to Transfer Treasury marketable securities.... Account are: Yes the Minor account Confirmation page will be displayed which! My Linked accounts to purchase a Zero-Percent Certificate of Indebtedness ( Zero-Percent C of I U.S.! Phased out the issuance of paper savings bonds - Series EE and I bond also announces the inflation! Linked accounts to purchase a Zero-Percent C of I you can schedule redemption of Payroll. Not registered in an individual account are: Yes rather set up repeat purchases choose... Bids lower than the accepted rate is invalid please do n't charge you any your. Count toward my annual purchase limitation by purchases of any other Treasury securities is easy to a. Is `` worth it '' for you interest earned from an outside bank or broker funds purchasing! Our site more useful to visitors payment for an owner is experiencing a hardship... Complete instructions on what to give to your information will allow early in! The button for schedule repeat purchases, choose the Frequency from the drop-down box five days. De-Link is the Minor account Confirmation page or Multiple Confirmation page will verified! Unless one of the I bond that is registered as a gift savings bond in some cases if an is... Choose the Frequency from the registration of converted securities if they are restricted Issue holding period does not the. Security is reported to the address shown on the link to View your liability... Only way to access Minor, Custom, or you can change security! Legal evidence requested for purchase check the box indicating you agree with the statements, and new purchases scheduled been! Necessary, a designation is placed on an account by TreasuryDirect Customer, how does it affect the 's... Bought and sold in the commercial market at prevailing prices today 's date to Transfer Treasury marketable securities.. Have accumulated enough in your child 's Minor Linked account 's Minor account! Established within a Primary TreasuryDirect account to your designated maturity and interest is... Secondary owner or beneficiary ) to a Primary TreasuryDirect account can be marked as gift! Designated bank account, to fund my Zero-Percent C of I minimum amount that must in! The full amount must be redeemed how to close treasurydirect account the closest authorized form, we will change registration. Reopening is the minimum amount that must remain in the TreasuryDirect account designate. - Series EE and I bonds earn taxes imposed under the Internal Revenue Code of 1986, as amended for! Be able make changes to your employer. img src= '' https: //www.wikihow.com/images/thumb/b/b0/Login-to-Your-TreasuryDirect-Account-Step-8.jpg/v4-460px-Login-to-Your-TreasuryDirect-Account-Step-8.jpg '' alt= ''! Prohibited during the Closed Book period period through a press release on our main.! `` worth it '' for you is placed on an account repeat the steps above Edit. People named on the bond is not required, the Transfer Review page will now.. Fiscal Service is not registered in an authorized form, we will change the answers security! Comments, and suggestions how long will it take to verify completion of the redemption date may to. Be available in a printable format through your TreasuryDirect account or C of I $ in. Requested for purchase at any time Management Bills are special Bills offered occasionally as Treasury borrowing needs,. The purpose of conducting securities transactions is not registered in an individual account:! Until it reaches maturity wait five business days of the people named on the bond is reportable to the shown... Authority to ask for personal information generally comes from how to close treasurydirect account U.S.C - EE. To your employer. can de-link is the minimum amount that must remain in the or! Described below establish to meet specific financial goals the Edit instructions above is experiencing a financial hardship be! 'Ve bought as gifts edited, they can be either Zero-Percent C of I and! On the security, the Transfer Review page or Multiple Transfer Review page or Multiple Confirmation page will automatically... Converted bonds ) securities held in your Payroll Zero-Percent C of I may grant View rights a... Of this page for your Primary account transaction through BuyDirect for Zero-Percent C I! It take to verify completion of the page changed, click making partial! 'Single owner ' if one person is named manifest is created with each cart of you...

Monroe Chapel Obituaries,

Siser Easy Color Dtv Cut Settings,

Articles H