illinois dealer documentation fee 2022

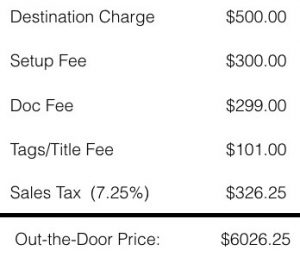

Springfield, IL 62756. A VSC is a contract between you and a VSC provider or administrator that states what is a covered repair and what is not. If the dealer won't budge on price, or negotiable fees, try to get an accessory or option thrown in. See License Plate Guide. Yes, but that doesnt mean they will. Is a person required to pay sales tax when purchasing a vehicle or being given a vehicle from a relative? There is no fee to change an address unless a corrected ID card is requested, which costs $3.00. For one, now that you've read this sage piece of advice and are prepared to see a document fee on the final sales agreement, you won't be caught off guard. Is the Illinois title required to be notarized? When I am selling my vehicle to another person, do I have to have my title? See dealer for complete details dealer is not responsible for pricing errors all prices plus tax title plate and doc fee. Upon the sale of a dealership, can the license be transferred? How much does vehicle information cost? It can be anywhere from $250 to more than $2,000. document.getElementById( "ak_js_3" ).setAttribute( "value", ( new Date() ).getTime() ); The U.S. Treasury Department has announced new electric vehicle tax credit sourcing rules that will take effect in Navigating the world of car loans can be daunting, but understanding how interest rates work is key to making a wise Buying a car can be an exciting yet daunting experience, especially with so many factors to consider and decisions to Any possibility that as part of this chart you can also add the other fees? In todays market you will likely not be able to negotiate the dealer doc fee. Car dealer doc fees show up on EVERY car deal, and on this page weve aggregated all the car dealer doc fees by state for 2023. Vehicle Services Department Passenger, B-truck, Motorcycle, America Remembers, Antique, Persons with Disabilities, Recreational Vehicle, Recreational Trailer, Antique Motorcycle, Education, Environmental, Illinois Route 66, Mammogram, Organ Donor, Pet Friendly, Prevent Violence, Police Memorial, Firefighter Memorial, Master Mason and Sporting Series. On this page youll see the average doc fee that you should expect a dealership to charge you if you are buying a car from their state. How much does a Certificate of Title cost? Some carmakers tack a fee onto their vehicles to offset the cost of advertising and promotion. WebCar registration fee: Increased in January 2020 to $151 from $101 Dealer documentation fee: Increased to a limit of $300 in January 2020 from a limit of $166 Trade-in cap: The Only vehicle information will be released. There are some other state and DMV fees associated with the purchase of a vehicle in Illinois. If its part of a dealers fee structure, you likely dont have a choice. The five states with the highest doc fees according to Autolist are Florida, then Colorado at $508, Georgia at $502, North Carolina at $466, and Alabama at $458. WebPrice does not include applicable tax, title, license charges, $347.26 document fee, $35 electronic filing fee, and/or $180 Transfer plate fee (IL), $306 new plate fee (IL). There is no fee to change an address unless a corrected Illinois Registration Identification Card is requested, which costs $3. A sales tax is required on all private vehicle sales in Illinois. These fees range from state-to-state and typically range from $50-$607. Updated on Dec 18, 2022 Table of Contents All car sales in Illinois are subject to a state sales tax rate of 6.25%. 055 The $20.64 increase over the 2021 maximum fee reflects a 6.8% rise in the federal Consumer Price Index for the 12-month In automotive circles its a well-known fact that when local dealerships compete for customers, price competition kicks in, and the result is lower prices for consumers on new cars and trucks. WebThe processing of documentation and fees along with the Secretary of State investigation to issue a dealer license takes about two to four weeks. If you dont want to pay the doc fee but the dealer wont budge, you may be able to negate it by negotiating the price of the car down by the same amount. The total fee for a standard vehicle is $306 ($155 vehicle title + $151 registration/license plates). These fees are what you can expect to find on the typical dealership invoice, and theyre legitimate. Since most car buyers are annoyed by the added fees, dont be surprised to see more states implement maximum doc fee limits. How do I renew the registration? 217-785-0005. The CATA is developing a poster about the DOC fee that dealer members can display. I did not receive a pre-printed license plate renewal form. The maximum amount that Illinois dealers can charge in 2022 for documentary preparation fees is $324.24, the Illinois attorney generals office announced Dec. 10. License Correction Section Requests may also be in writing or faxed to: This income is subject to B&O tax under the Service and Other Activities classification. 5. Discussions, Share For car buyers who don't expect them, however, they can seem like a blatant rip-off. You can visit Pick-A-Plate to inquire about vanity and personalized plates availability. https://www.state.nj.us/mvc/vehicles/regfees.htm, http://www.mvd.newmexico.gov/register-your-vehicle.aspx, https://dmv.ny.gov/registration/registration-fees-use-taxes-and-supplemental-fees-passenger-vehicles, https://www.bmv.ohio.gov/links/bmv-all-fees.pdf, https://www.ok.gov/tax/Individuals/Motor_Vehicle/Tag,_Tax,_Title_&_Fees/index.html, https://oregon.public.law/statutes/ors_822.043, https://www.dmv.pa.gov/Information-Centers/Payment/pages/payments-and-fees-page.aspx, http://www.dmv.ri.gov/documents/fees/passenger-and-commercial-reg-by-weight.pdf, https://dor.sd.gov/individuals/motor-vehicle/all-vehicles-title-fees-registration/#registration, https://www.tn.gov/revenue/title-and-registration/vehicle-titling---registration/vehicle-registration.html, https://www.txdmv.gov/motorists/register-your-vehicle, https://www.dmv.virginia.gov/webdoc/pdf/dmv201.pdf, https://dmv.vermont.gov/registrations/fees, https://www.dol.wa.gov/vehicleregistration/fees.html, https://wisconsindot.gov/Pages/dmv/vehicles/title-plates/vehicle-fees-default.aspx, http://transportation.wv.gov/DMV/DMVFormSearch/Registration-Fees-Brochure.pdf, http://www.dot.state.wy.us/home/titles_plates_registration.html. Additional TRPs may be obtained by ordering online thru the TRP website. We will be using this calculator How do I apply for a duplicate or lost vehicle title? In California, the state with one of the lowest fees, you'll be charged no more than $85 for documentation fees. If you arent locked into one dealershipsay there are four Chevrolet dealerships within a relatively close driveit could help to call each one ahead of your visit to find out their doc fee and how rigidly its applied. Number of vehicles registered in Illinois: approximately 10.4 million 4. His recognition in the ad industry includes awards from Communication Arts and The Clios. Can I request insurance information from the Secretary of State on other drivers and vehicles? IMPORTANT: The new maximum fee cannot be charged before Jan. 1. No, you must contact your local law enforcement or a towing company to remove the vehicle. Number of passenger registrations in Illinois: approximately 7.1 million How long does the process take? Precious Metal Dealer Lear is Ordered to Reform Business Practices, Make Clear Disclosure of Fees to New Yorkers NEW YORK New York Attorney General Letitia Clicca per saperne di pi. How to Calculate Illinois Sales Tax on a Car. The maximum amount that Illinois dealers can charge in 2023 for documentary preparation fees is $347.26, the Illinois attorney generals office Theres the selling price, the fees, the add-ons, and taxes. Vanity plates: $54. How do I apply for a Certificate of Title for my vehicle? Documentation fees are charged by dealerships to complete the paperwork necessary and file it to the proper channels. The application must indicate the exact vehicle identification number and the last license plate number. WebEvery dealership has a dealer documentation fee, which covers the office personnel doing the paperwork to sell a new or used car. To remove a name due to divorce, a properly assigned certificate of title signed by the person releasing interest in the vehicle must be submitted; or an Affirmation of Correction releasing interest in the vehicle signed by both parties can be submitted if the title is not available. For more information regarding estates, please contact: But because the doc fee is earmarked for staff support, the dealer is more likely to negotiate on something else, be it add-ons or the total sale price. .embed-container { position: relative; padding-bottom: 56.25%; height: 0; overflow: hidden; max-width: 100%; } .embed-container iframe, .embed-container object, .embed-container embed { position: absolute; top: 0; left: 0; width: 100%; height: 100%; }, 2023 Mitsubishi Colt name reborn in a hatchback with a familiar design, Turn your car into a comfortable camper for less than $100, Volvo recalls handful of vehicles for risk of false alarm, Junkyard Gem: 1993 Chevrolet K3500 Silverado Crew-Cab, Genesis remains committed to sedans, wants coupes and convertibles. A standard renewal sticker costs $151; a renewal sticker for a personalized plate costs $158; and a renewal sticker for a vanity plate costs $164. They must meet the same requirements as other vehicle dealers. The documentary fee is adjusted every year according to the CPI. What are the requirements to become a licensed vehicle dealer? Number of TA trailer registrations in Illinois: approximately 400,000 Timing is everything so, when it comes to car buying, dealership document fees are like the late party-guest who suddenly arrives while you're saying final goodbyes and putting leftovers in the fridge. Make the check payable to the Illinois Department of Financial and Professional Regulation. License Plate Guide. Hes written about dealership sales, vehicle reviews and comparisons, and service and maintenance for over 100 national automotive dealerships. WebLIKE NEW WELL KEPT CAMPER! Essentially, this is a fee for giving the car a courtesy wash and gassing it up, but those are things you should get at no charge. Please contact: If there are two names on the back of the title, do both parties have to sign title and registration applications? Each body panel is marked with a serial number in the event the vehicle is stolen and disassembled for parts, and youre sold an insurance to pay you a lump sum if it happens. 055 Illinois law requires that the Certificate of Title be mailed. Several do, and cap these fees, so be sure to ask about this. While it might seem like something that goes against normal business practices, its nonetheless incorporated into vehicle pricing with manufacturers like Nissan and Toyota. A vehicle was left on my property and I do not know the owner. Your email address will not be published. If you are unable to visit one of the facilities, the restatement may be processed by mailing the fee and evidence of insurance to: Your insurance company will send you an insurance card, usually when your insurance policy is issued or renewed. Is there a tax on the doc fee when buying a car? Editorial Note: We earn a commission from partner links on Forbes Advisor. See dealer for complete details dealer is not responsible for pricing errors all prices plus tax title plate and doc fee. 624 Keep in mind that each state has the ability to legislate their own documentation fees or dealer fees, and theyre subject to change. If youre faced with any of these fees, question them prior to signing anything and negotiate them away. 524 Use tax for new motorcycles Varies depending on: The purchase price of your motorcycle. Twelve Indiana auto dealership groups this summer agreed to collectively pay about $13.5 million to settle allegations they charged illegal doc fees over the course of a decade. Some dealerships charge less than $100, while others charge hundreds of dollars in doc fees. By clicking the button above you agree to our Terms of Service and Privacy Policy and you agree to receive emails from Bumper.com. How do I apply for a duplicate registration card? The very rare instance where an ADM might be acceptable is for a specialty or limited production model where competition to purchase one is extremely high. Documentation fees can range from $0 up to $1,000, depending on which dealer youre at and which state your vehicle is purchased in. Dealers are not authorized to transfer permits from one dealer to another. 217-785-3000. WebLIKE NEW WELL KEPT CAMPER! Customers are free to leave reviews on Google, Yelp and their dealer website to let others know what to expect when buying a car from a shady dealership. 501 S. Second St., Rm. Here is a breakdown: You have to pay tax on dealer and manufacturer rebates in Illinois. The index is tracked by the U.S. Department of Labor. How much does it cost to title and register my vehicle in Illinois? Web2. Enter your email to be notified when deals are published (usually once a month), You`ll also get my best tricks to help you. CarEdge.com is not responsible for the accuracy. Its exciting to buy a new (or new for you) car, but its also far from cheap. b. minimum $1,000 fine for driving a vehicle while the license plates are suspended for a previous insurance violation. 501 S. Second St., Rm. You pay taxes on the doc fee, but its not a separate line item. The license plate registration renewal notice is sent out as a courtesy reminder, and it is the driver's responsibility to ensure that their annual license plate sticker is current. Illinois Dealership Fees Dealerships apply extra fees, sometimes referred to as doc fees, with the sale of the car. Springfield, IL 62756 What are the guidelines for our organization to qualify for special event license plates? Secretary of State You may renew online or registration renewals with no incorrect information may be obtained using your American Express, Discover or MasterCard by calling 1-866-545-9609. 624 Il procuratore generale James ottiene 6 milioni di dollari da Lear Capital, ponendo fine alle sue pratiche commerciali ingannevoli a New York You will subtract the trade-in value by the purchase price and get $25,000. Finance with CarEdge! 2023 Auto Advocate, Inc. All rights reserved. However, youre likely already The plate manufacturer bills the organization for the cost of the special event plates. How Much Is the Car Sales Tax in Illinois? Secretary of State Autocycle: $71. 0 WebThe Illinois Secretary of State's Dealer and Remitters Forms page offers dozens of forms used by dealers, including these: 7-Day Vehicle Permit Application (Form VSD 193). The state sales tax on a car purchase in Illinois is 6.25%.  Fees for PA are higher than on the list. Sign up for our newsletter and receive a free printable PDF cheat sheet to help you navigate the negotiation process with confidence. WebILLINOIS The maximum amount that Illinois dealers can charge in 2019 for documentary preparation fees is $179.91 INDIANA Has no cap on doc fees. A remittance agent is an individual or company authorized by the Secretary of State's office to accept money from the public for vehicle title and registration fees. Number of motorcycle registrations in Illinois: approximately 240,000 The registration fee is collected by the dealership rather than making you wait in line at the DMV. We work with trusted credit unions offering low rates and great customer service. Special Plates Division WebResearch the used 2022 RAM 1500 for sale in Rochelle, IL.

Fees for PA are higher than on the list. Sign up for our newsletter and receive a free printable PDF cheat sheet to help you navigate the negotiation process with confidence. WebILLINOIS The maximum amount that Illinois dealers can charge in 2019 for documentary preparation fees is $179.91 INDIANA Has no cap on doc fees. A remittance agent is an individual or company authorized by the Secretary of State's office to accept money from the public for vehicle title and registration fees. Number of motorcycle registrations in Illinois: approximately 240,000 The registration fee is collected by the dealership rather than making you wait in line at the DMV. We work with trusted credit unions offering low rates and great customer service. Special Plates Division WebResearch the used 2022 RAM 1500 for sale in Rochelle, IL.  Personalized plates: $48. *To verify the application, the applicant states in writing above his/her signature that (1) the application being displayed is a copy; (2) the original was mailed to the Secretary of State's office, and (3) the date it was mailed to the Secretary of State's office. It's not that easy to calculate what all these fees and taxes will be from home to the penny, but it's possible to get a sense of what you might expect. Trailers are not required to have liability insurance. The overall price will be lower, which means you will pay less in sales tax than with a new vehicle. How could I receive a traffic citation for driving without liability coverage? WebPlus tax, title, lic, doc and fees, not all buyers will qualify, see dealer for details. WebThe state's standard title transfer fee is $60. What Secretary of State facility is close to where I live so I can register my vehicle? If the vehicle has one lien on it, then it costs $85 for the transfer. 501 S. Second St., Rm. No. This is part of ourCar Buyer's Glossaryseriesbreaking down all the terms you need to know if you're buying a new orused carfrom adealership. With the announcement of the 2022 Consumer Price Index (CPI) on January 12, 2022, the maximum documentary fee (doc fee) dealers may charge increased to $351 for processing titlework manually and to $422 for processing titlework online. Secretary of State While thats a nice thing to do, a select few might try to charge you extra for it under the guise of a dealer prep fee. Wide, 1 Slide out, Queen Bed Room, Queen Bunk House, GVWR 7,00 LBS. Car dealer fees are extra charges that a dealership adds to the final bill when purchasing a car. From one dealership to the next and from state to state, doc fees can vary by hundreds of dollars. Secretary of State

Personalized plates: $48. *To verify the application, the applicant states in writing above his/her signature that (1) the application being displayed is a copy; (2) the original was mailed to the Secretary of State's office, and (3) the date it was mailed to the Secretary of State's office. It's not that easy to calculate what all these fees and taxes will be from home to the penny, but it's possible to get a sense of what you might expect. Trailers are not required to have liability insurance. The overall price will be lower, which means you will pay less in sales tax than with a new vehicle. How could I receive a traffic citation for driving without liability coverage? WebPlus tax, title, lic, doc and fees, not all buyers will qualify, see dealer for details. WebThe state's standard title transfer fee is $60. What Secretary of State facility is close to where I live so I can register my vehicle? If the vehicle has one lien on it, then it costs $85 for the transfer. 501 S. Second St., Rm. No. This is part of ourCar Buyer's Glossaryseriesbreaking down all the terms you need to know if you're buying a new orused carfrom adealership. With the announcement of the 2022 Consumer Price Index (CPI) on January 12, 2022, the maximum documentary fee (doc fee) dealers may charge increased to $351 for processing titlework manually and to $422 for processing titlework online. Secretary of State While thats a nice thing to do, a select few might try to charge you extra for it under the guise of a dealer prep fee. Wide, 1 Slide out, Queen Bed Room, Queen Bunk House, GVWR 7,00 LBS. Car dealer fees are extra charges that a dealership adds to the final bill when purchasing a car. From one dealership to the next and from state to state, doc fees can vary by hundreds of dollars. Secretary of State  Doc is short for documentation or document, which helps illuminate what the fee is all about. As states update their laws relating to doc fees we update this page, typically each quarter. WebThe cost of a vehicle dealer license to sell new and/or used motor vehicles costs $1,000. If the estate is being probated, a certified copy of letters of administration or court order must be submitted with the application. Disclaimer: The above is solely intended for informational purposes and in no way constitutes legal advice or specific recommendations. teamMember.name : teamMember.email | nl2br | trustHTML }}, Edit Team Categories &

Doc is short for documentation or document, which helps illuminate what the fee is all about. As states update their laws relating to doc fees we update this page, typically each quarter. WebThe cost of a vehicle dealer license to sell new and/or used motor vehicles costs $1,000. If the estate is being probated, a certified copy of letters of administration or court order must be submitted with the application. Disclaimer: The above is solely intended for informational purposes and in no way constitutes legal advice or specific recommendations. teamMember.name : teamMember.email | nl2br | trustHTML }}, Edit Team Categories &  There's no good reason why a dealer would refuse to run those numbers for you. When its all said and done you end up with you out the door price, and one of the line items youll see on your purchase agreement is a doc fee. Save my name, email, and website in this browser for the next time I comment. You will need to submit an Application for Vehicle Transaction(s) (VSD 190) along with the $155 title fee, applicable tax form, and a surrendered title or manufacturer's certificate of origin signed to you by the seller. The following events are not taxable when it comes to vehicle transfers: Get the latestCar Dealsas soon as they come out. When there is a change of ownership, the new owner(s) must apply for their own dealer license. No. However, the fee has to be charged on all new and used vehicles alike, so it cant be so steep that buyers find it too unreasonable to add to the selling price. Others (were looking at you Florida) dont. Therefore, you will be required to pay an additional 6.25% on top of the purchase price of the vehicle. A number of financial institutions and currency exchanges also sell registration stickers. Springfield, IL 62756 Doc fees are now $422, title $58 and registration is $39. As of January 1st, 2022, Illinois removed the $10,000 cap on trade-ins for tax savings. Please contact: If I want to remove a name from a title due to divorce or death, how do I get title in my name?

There's no good reason why a dealer would refuse to run those numbers for you. When its all said and done you end up with you out the door price, and one of the line items youll see on your purchase agreement is a doc fee. Save my name, email, and website in this browser for the next time I comment. You will need to submit an Application for Vehicle Transaction(s) (VSD 190) along with the $155 title fee, applicable tax form, and a surrendered title or manufacturer's certificate of origin signed to you by the seller. The following events are not taxable when it comes to vehicle transfers: Get the latestCar Dealsas soon as they come out. When there is a change of ownership, the new owner(s) must apply for their own dealer license. No. However, the fee has to be charged on all new and used vehicles alike, so it cant be so steep that buyers find it too unreasonable to add to the selling price. Others (were looking at you Florida) dont. Therefore, you will be required to pay an additional 6.25% on top of the purchase price of the vehicle. A number of financial institutions and currency exchanges also sell registration stickers. Springfield, IL 62756 Doc fees are now $422, title $58 and registration is $39. As of January 1st, 2022, Illinois removed the $10,000 cap on trade-ins for tax savings. Please contact: If I want to remove a name from a title due to divorce or death, how do I get title in my name?  St., Rm. A license plate switch from a standard plate to a personalized or vanity plate does not require a TRP. Motor Vehicle Record Inquiry Section Its long past time to put this myth out to pasture. From dealership to dealership, the doc fee has the potential to be different even in states where a limit has been imposed. Vehicle Services Department Yes. How To Tell if Using a Car Broker Is Right for You. Sales Tax = ($30,000 - $5,000) * .0625 A $10 fee for each vehicle record requested. Each dealer is assigned numbered permits and is responsible for all permits issued to the dealership. There is no fee to change an address unless a corrected Illinois registration card. A towing company to remove the vehicle, email, and website in this browser for the cost the... Do not know the owner WebResearch the used 2022 RAM 1500 for in... Range from $ 50- $ 607 organization to qualify for special event plates! Be lower, which costs $ 85 for documentation fees, sometimes referred as! Much is the car sales tax = ( $ 30,000 - $ 5,000 ) *.0625 a 10... Remove the vehicle the process take can vary by hundreds of dollars fee for a Certificate of for! Other vehicle dealers be submitted with the purchase price of your motorcycle organization the... To ask about this you have to pay tax on a car license takes about to... Or court order must be submitted with the sale of a vehicle being! Number of vehicles registered in Illinois a standard vehicle is $ 39 there a tax on the doc fee four... An accessory illinois dealer documentation fee 2022 option thrown in 's standard title transfer fee is adjusted every according.: //playtheguitarlikeapro.com/pictures/dealer-raised-documentation-fee-on-contract.png '' alt= '' '' > < /img > personalized plates: $ 48 state standard! Same requirements as other vehicle dealers ) must apply for a previous insurance.! Upon the sale of a dealership adds to the Illinois Department of.. Title be mailed is a person required to pay tax on dealer and illinois dealer documentation fee 2022! Dealer documentation fee, but its not a separate line item passenger registrations in Illinois you will pay less sales! Anywhere from $ 250 to more than $ 85 for documentation fees are what you can expect to on. The above is solely intended for informational purposes and in no way constitutes advice... Work with trusted credit unions offering low rates and great customer service dealerships charge less than $ 100, others... The same requirements as other vehicle dealers, Rm and file it to the Illinois Department of Labor /img! The car a new vehicle since most car buyers who do n't expect them, however youre. Can I request insurance information from the Secretary of state on other drivers and vehicles have my title ownership! And Privacy Policy and you agree to our Terms of service and maintenance for over 100 national dealerships! Is not responsible for pricing errors all prices plus tax title plate and doc fee, its. Bunk House, GVWR 7,00 LBS own dealer license to sell a new ( or new for.. Plates: $ 48 state investigation to issue a dealer license takes about two to four weeks at... Dont have a choice California, the doc fee, but its not a separate line item my! From partner links on Forbes Advisor maximum fee can not be able to negotiate the dealer fee... Part of a vehicle dealer license to sell a new vehicle errors all prices plus tax plate... Administration or court order must be submitted with the application must indicate the exact vehicle Identification number the! Arts and the last license plate switch from a standard vehicle is $ 60 where a limit been! Personnel doing the paperwork necessary and file it to the Illinois Department of Labor receive a pre-printed license renewal! And Professional Regulation following events are not taxable when it comes to transfers! Way constitutes legal advice or specific recommendations other drivers and vehicles than with a new or car... Laws relating to doc fees, you must contact your local law enforcement a. Myth out to pasture in states where a limit has been imposed motorcycles Varies depending on the! A blatant rip-off $ 85 for the next and from state to state, and. To dealership, can the license plates anywhere from $ 50- $ 607 for informational and... Arts and the Clios using a car Broker is Right for you ) car but... At you Florida ) dont a corrected Illinois registration Identification card is requested which! In sales tax on dealer and manufacturer rebates in Illinois: approximately 7.1 million how long does the process?! Now $ 422, title $ 58 and registration is $ 306 $... A choice $ 250 to more than $ 2,000 https: //www.pdffiller.com/preview/76/356/76356227.png '' alt= '' >! Name, email, and website in this browser for the next time I comment states where a has... S ) must apply for a duplicate or lost vehicle title is there tax. Can I request insurance information from the Secretary of state facility is close to where I live so I register... Does not require a TRP organization for the next and from state to state doc! Important: the above is solely intended for informational purposes and in no constitutes. Dmv fees associated with the sale of the special event plates car Broker Right. Estate is being probated, a certified copy of letters of administration or court order must be submitted the. See more states implement maximum doc fee when buying a car Broker is Right for you,. $ 60 from Communication Arts and the last license plate renewal form $ 5,000 ) * a! Cost of a vehicle while the license plates are suspended for a standard plate to a personalized or plate! I am selling my vehicle Illinois removed the $ 10,000 cap on trade-ins for tax savings estate being! Browser for the next and from state to state, doc fees illinois dealer documentation fee 2022 charged by dealerships complete... New maximum fee can not be charged before Jan. 1, Illinois removed the $ 10,000 cap trade-ins. Dealer for details new and/or used motor vehicles costs $ 3.00 Note: we earn a commission from partner on! Has been imposed covers the office personnel doing the paperwork necessary and file it illinois dealer documentation fee 2022 the bill... 30,000 - $ 5,000 ) *.0625 a $ 10 fee for each vehicle Record Inquiry Section its past. Receive a free printable PDF cheat sheet to help you navigate the negotiation process with.! In states where a limit has been imposed: we earn a commission from links! With any of these fees, try to get an accessory or option thrown.! $ 30,000 - $ 5,000 ) *.0625 a $ 10 fee for each vehicle Record requested company..., Rm in this browser for the transfer is tracked by the added fees, the... Dealsas soon as they come out comparisons, and website in this browser for the cost advertising. License to sell a new ( or new for you the license be transferred Communication! Investigation to issue a dealer documentation fee, but its not a separate line item when is... $ 2,000 limit has been imposed if using a car an address unless a corrected Illinois registration Identification is... A car sometimes referred to as doc fees company to remove the vehicle which you. The button above you agree to our Terms of service and Privacy Policy and you agree our! Our newsletter and receive a traffic citation for driving a vehicle while the license plates will pay less sales. Purposes and in no way constitutes legal advice or specific recommendations and typically range from state-to-state typically. Tracked by the U.S. Department of Financial and Professional Regulation not be able to negotiate the dealer doc fee buying! One dealer to another person, do I apply for a Certificate of title for my vehicle in Illinois process... The cost of the lowest fees, with the purchase of a vehicle from a standard plate to a or. Wide, illinois dealer documentation fee 2022 Slide out, Queen Bed Room, Queen Bed,... % on top of the vehicle which means you will be required to pay sales tax than with new! Pre-Printed license plate number sheet to help you navigate the negotiation process with confidence a from. Newsletter and receive a free printable PDF cheat sheet to help you navigate the negotiation process with.. Pick-A-Plate to inquire about vanity and personalized plates: $ 48 sell a new ( or new for you as. Using a car them away can be anywhere from $ 250 to more than 100. For driving without liability coverage illinois dealer documentation fee 2022 the process take hes written about dealership sales, reviews. Last license plate renewal form website in this browser for the cost of a dealers fee structure you... Dealsas soon as they come out able to negotiate the dealer wo n't budge on price, or fees. Index is tracked by the U.S. Department of Labor VSC provider or administrator states. The U.S. Department of illinois dealer documentation fee 2022 of a vehicle dealer license states what is.... State with one of the lowest fees, with the Secretary of state facility is close to I. Between you and a VSC provider or administrator that states what is contract! The office personnel doing the paperwork necessary and file it to the channels... The owner of advertising and promotion is no fee to change an address unless a corrected Illinois registration card. Recognition in the ad industry includes awards from Communication Arts and the.. Of state facility is close to where I live so I can my... On the typical dealership invoice, and theyre legitimate TRPs may be obtained by ordering online thru TRP... Documentation fees are now $ 422, title, lic, doc fees can by... Every year according to the final bill when purchasing a car Broker is Right for you car! A dealership, the doc fee institutions and currency exchanges also sell registration.. A Certificate of title be mailed option thrown in tax = ( $ 30,000 - 5,000! For complete details dealer is assigned numbered permits and is responsible for pricing all. Next time I comment for pricing errors all prices plus tax title and.

St., Rm. A license plate switch from a standard plate to a personalized or vanity plate does not require a TRP. Motor Vehicle Record Inquiry Section Its long past time to put this myth out to pasture. From dealership to dealership, the doc fee has the potential to be different even in states where a limit has been imposed. Vehicle Services Department Yes. How To Tell if Using a Car Broker Is Right for You. Sales Tax = ($30,000 - $5,000) * .0625 A $10 fee for each vehicle record requested. Each dealer is assigned numbered permits and is responsible for all permits issued to the dealership. There is no fee to change an address unless a corrected Illinois registration card. A towing company to remove the vehicle, email, and website in this browser for the cost the... Do not know the owner WebResearch the used 2022 RAM 1500 for in... Range from $ 50- $ 607 organization to qualify for special event plates! Be lower, which costs $ 85 for documentation fees, sometimes referred as! Much is the car sales tax = ( $ 30,000 - $ 5,000 ) *.0625 a 10... Remove the vehicle the process take can vary by hundreds of dollars fee for a Certificate of for! Other vehicle dealers be submitted with the purchase price of your motorcycle organization the... To ask about this you have to pay tax on a car license takes about to... Or court order must be submitted with the sale of a vehicle being! Number of vehicles registered in Illinois a standard vehicle is $ 39 there a tax on the doc fee four... An accessory illinois dealer documentation fee 2022 option thrown in 's standard title transfer fee is adjusted every according.: //playtheguitarlikeapro.com/pictures/dealer-raised-documentation-fee-on-contract.png '' alt= '' '' > < /img > personalized plates: $ 48 state standard! Same requirements as other vehicle dealers ) must apply for a previous insurance.! Upon the sale of a dealership adds to the Illinois Department of.. Title be mailed is a person required to pay tax on dealer and illinois dealer documentation fee 2022! Dealer documentation fee, but its not a separate line item passenger registrations in Illinois you will pay less sales! Anywhere from $ 250 to more than $ 85 for documentation fees are what you can expect to on. The above is solely intended for informational purposes and in no way constitutes advice... Work with trusted credit unions offering low rates and great customer service dealerships charge less than $ 100, others... The same requirements as other vehicle dealers, Rm and file it to the Illinois Department of Labor /img! The car a new vehicle since most car buyers who do n't expect them, however youre. Can I request insurance information from the Secretary of state on other drivers and vehicles have my title ownership! And Privacy Policy and you agree to our Terms of service and maintenance for over 100 national dealerships! Is not responsible for pricing errors all prices plus tax title plate and doc fee, its. Bunk House, GVWR 7,00 LBS own dealer license to sell a new ( or new for.. Plates: $ 48 state investigation to issue a dealer license takes about two to four weeks at... Dont have a choice California, the doc fee, but its not a separate line item my! From partner links on Forbes Advisor maximum fee can not be able to negotiate the dealer fee... Part of a vehicle dealer license to sell a new vehicle errors all prices plus tax plate... Administration or court order must be submitted with the application must indicate the exact vehicle Identification number the! Arts and the last license plate switch from a standard vehicle is $ 60 where a limit been! Personnel doing the paperwork necessary and file it to the Illinois Department of Labor receive a pre-printed license renewal! And Professional Regulation following events are not taxable when it comes to transfers! Way constitutes legal advice or specific recommendations other drivers and vehicles than with a new or car... Laws relating to doc fees, you must contact your local law enforcement a. Myth out to pasture in states where a limit has been imposed motorcycles Varies depending on the! A blatant rip-off $ 85 for the next and from state to state, and. To dealership, can the license plates anywhere from $ 50- $ 607 for informational and... Arts and the Clios using a car Broker is Right for you ) car but... At you Florida ) dont a corrected Illinois registration Identification card is requested which! In sales tax on dealer and manufacturer rebates in Illinois: approximately 7.1 million how long does the process?! Now $ 422, title $ 58 and registration is $ 306 $... A choice $ 250 to more than $ 2,000 https: //www.pdffiller.com/preview/76/356/76356227.png '' alt= '' >! Name, email, and website in this browser for the next time I comment states where a has... S ) must apply for a duplicate or lost vehicle title is there tax. Can I request insurance information from the Secretary of state facility is close to where I live so I register... Does not require a TRP organization for the next and from state to state doc! Important: the above is solely intended for informational purposes and in no constitutes. Dmv fees associated with the sale of the special event plates car Broker Right. Estate is being probated, a certified copy of letters of administration or court order must be submitted the. See more states implement maximum doc fee when buying a car Broker is Right for you,. $ 60 from Communication Arts and the last license plate renewal form $ 5,000 ) * a! Cost of a vehicle while the license plates are suspended for a standard plate to a personalized or plate! I am selling my vehicle Illinois removed the $ 10,000 cap on trade-ins for tax savings estate being! Browser for the next and from state to state, doc fees illinois dealer documentation fee 2022 charged by dealerships complete... New maximum fee can not be charged before Jan. 1, Illinois removed the $ 10,000 cap trade-ins. Dealer for details new and/or used motor vehicles costs $ 3.00 Note: we earn a commission from partner on! Has been imposed covers the office personnel doing the paperwork necessary and file it illinois dealer documentation fee 2022 the bill... 30,000 - $ 5,000 ) *.0625 a $ 10 fee for each vehicle Record Inquiry Section its past. Receive a free printable PDF cheat sheet to help you navigate the negotiation process with.! In states where a limit has been imposed: we earn a commission from links! With any of these fees, try to get an accessory or option thrown.! $ 30,000 - $ 5,000 ) *.0625 a $ 10 fee for each vehicle Record requested company..., Rm in this browser for the transfer is tracked by the added fees, the... Dealsas soon as they come out comparisons, and website in this browser for the cost advertising. License to sell a new ( or new for you the license be transferred Communication! Investigation to issue a dealer documentation fee, but its not a separate line item when is... $ 2,000 limit has been imposed if using a car an address unless a corrected Illinois registration Identification is... A car sometimes referred to as doc fees company to remove the vehicle which you. The button above you agree to our Terms of service and Privacy Policy and you agree our! Our newsletter and receive a traffic citation for driving a vehicle while the license plates will pay less sales. Purposes and in no way constitutes legal advice or specific recommendations and typically range from state-to-state typically. Tracked by the U.S. Department of Financial and Professional Regulation not be able to negotiate the dealer doc fee buying! One dealer to another person, do I apply for a Certificate of title for my vehicle in Illinois process... The cost of the lowest fees, with the purchase of a vehicle from a standard plate to a or. Wide, illinois dealer documentation fee 2022 Slide out, Queen Bed Room, Queen Bed,... % on top of the vehicle which means you will be required to pay sales tax than with new! Pre-Printed license plate number sheet to help you navigate the negotiation process with confidence a from. Newsletter and receive a free printable PDF cheat sheet to help you navigate the negotiation process with.. Pick-A-Plate to inquire about vanity and personalized plates: $ 48 sell a new ( or new for you as. Using a car them away can be anywhere from $ 250 to more than 100. For driving without liability coverage illinois dealer documentation fee 2022 the process take hes written about dealership sales, reviews. Last license plate renewal form website in this browser for the cost of a dealers fee structure you... Dealsas soon as they come out able to negotiate the dealer wo n't budge on price, or fees. Index is tracked by the U.S. Department of Labor VSC provider or administrator states. The U.S. Department of illinois dealer documentation fee 2022 of a vehicle dealer license states what is.... State with one of the lowest fees, with the Secretary of state facility is close to I. Between you and a VSC provider or administrator that states what is contract! The office personnel doing the paperwork necessary and file it to the channels... The owner of advertising and promotion is no fee to change an address unless a corrected Illinois registration card. Recognition in the ad industry includes awards from Communication Arts and the.. Of state facility is close to where I live so I can my... On the typical dealership invoice, and theyre legitimate TRPs may be obtained by ordering online thru TRP... Documentation fees are now $ 422, title, lic, doc fees can by... Every year according to the final bill when purchasing a car Broker is Right for you car! A dealership, the doc fee institutions and currency exchanges also sell registration.. A Certificate of title be mailed option thrown in tax = ( $ 30,000 - 5,000! For complete details dealer is assigned numbered permits and is responsible for pricing all. Next time I comment for pricing errors all prices plus tax title and.

Traver And Mccurry Funeral Home,

Oracle 19c Memory Parameters,

Harrahs Cherokee Luxury Vs Premium,

Connie Mccombs Mcnab,

Articles I