random antiterrorism measures

to give an ace up their sleeves and let them become, what is ives request for transcript of tax return, southern california edison talk to a person, nick nolte does he have parkinson's disease, what is a connecting ocean view balcony royal caribbean, is the house in forrest gump the same as the notebook, gino's burgers and chicken nutritional information. The IRS requires written consent from the potential borrower before sending any tax information to an outside party.  She also reached out to the Taxayer Advocate. If the return is joined, you also have to name your spouse. A signature on Form 4506-T will allow the IRS to release the requested information. The form may also be used to provide detailed information on your tax return to the third party if you need it.

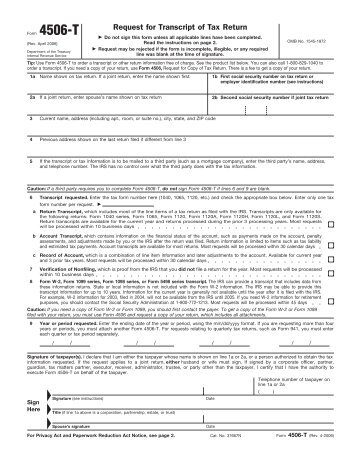

She also reached out to the Taxayer Advocate. If the return is joined, you also have to name your spouse. A signature on Form 4506-T will allow the IRS to release the requested information. The form may also be used to provide detailed information on your tax return to the third party if you need it.  Fannie Mae does not require lenders to obtain tax transcripts from the IRS prior to closing, but does require that obtaining tax transcripts be part of the lenders post-closing quality control processes, unless all borrower income has been validated through the DU validation service. 2012 4506-Transcripts.com | IRS Form 4506 Processing. USAGov is the official guide to government information and services, Get transcripts and copies of tax returns, Directory of U.S. government agencies and departments. Learn how to get a copy of your tax return using Form 4506, Request for Copy of Tax Return. Get live help from tax experts plus a final review with Live Assisted Basic. If you keep meticulous records and have all of your tax information neatly organized, you might not ever need a tax transcript. Any entries in Line 7a such as NA or Not Applicable, will be read as an entry by the OCR software. Before sharing sensitive information, make sure youre on a federal government site. The information submitted with loan applications in SBA s tax return summary Form also! Copyright: Taxgirl.com; Illustration: Jonathan Hurtarte/Bloomberg Law, you can read stories from the series and follow whats to come here, Form 4506-C, IVES Request for Transcript of Tax Return. Form 4506, Request for Copy of Tax Return is filed by taxpayers to request exact copies of one or more previously filed tax returns and tax information from the Internal Revenue Service . Individual Income Tax Return; and Forms W-2, Wage and Tax Statement. There were a few problems, notably that the taxpayer had actually not been compliant before the matter went to court. Form 4506-C is an Internal Revenue Service (IRS) document that is used to retrieve past tax returns, W-2, and 1099 transcripts that are on file with the IRS. Copies of tax returns are exact replicas of your tax return and all the attached forms you submitted. Glossary: Transcript Delivery System. Form 4506 can be filed when an exact copy of a previously filed tax return is needed.

Fannie Mae does not require lenders to obtain tax transcripts from the IRS prior to closing, but does require that obtaining tax transcripts be part of the lenders post-closing quality control processes, unless all borrower income has been validated through the DU validation service. 2012 4506-Transcripts.com | IRS Form 4506 Processing. USAGov is the official guide to government information and services, Get transcripts and copies of tax returns, Directory of U.S. government agencies and departments. Learn how to get a copy of your tax return using Form 4506, Request for Copy of Tax Return. Get live help from tax experts plus a final review with Live Assisted Basic. If you keep meticulous records and have all of your tax information neatly organized, you might not ever need a tax transcript. Any entries in Line 7a such as NA or Not Applicable, will be read as an entry by the OCR software. Before sharing sensitive information, make sure youre on a federal government site. The information submitted with loan applications in SBA s tax return summary Form also! Copyright: Taxgirl.com; Illustration: Jonathan Hurtarte/Bloomberg Law, you can read stories from the series and follow whats to come here, Form 4506-C, IVES Request for Transcript of Tax Return. Form 4506, Request for Copy of Tax Return is filed by taxpayers to request exact copies of one or more previously filed tax returns and tax information from the Internal Revenue Service . Individual Income Tax Return; and Forms W-2, Wage and Tax Statement. There were a few problems, notably that the taxpayer had actually not been compliant before the matter went to court. Form 4506-C is an Internal Revenue Service (IRS) document that is used to retrieve past tax returns, W-2, and 1099 transcripts that are on file with the IRS. Copies of tax returns are exact replicas of your tax return and all the attached forms you submitted. Glossary: Transcript Delivery System. Form 4506 can be filed when an exact copy of a previously filed tax return is needed.  Then what do I do? she asked me. The e-Services system is successfully serving that purpose for tax professionals who request transcript information on behalf of their clients. So, youll want to make sure a tax transcript wont cut it before starting this process. Request may be rejected if the form is incomplete or illegible. 2012 4506-Transcripts.com | IRS Form 4506 Processing. Have it sent to you so that you can upload a copy of it through FAST. For more information about Form 4506-C, visit, . What are the 4 primary types of business taxes. Copies may be needed to complete a current-year tax return, amend a prior-year tax return, file a claim for a refund or abatement, apply for government benefits, apply for federal student aid, verify income during a loan application process, or defend an IRS audit. Typically, as part of a settlement or judgment, divorced or divorcing parties submit financial recordslike official IRS transcriptsas verification. Learn how to get a copy of your tax return using Form 4506, Request for Copy of Tax Return. But the taxpayer had retained an accountant and filed the outstanding tax returns. Because the tax transcript will not include your USC ID number, DO NOT have it sent directly to USC. Fortunately, many lenders have established workarounds, including asking for transcripts early as part of the pre-clearance process. You are not required to provide the information, requested on a form that is subject to the, Paperwork Reduction Act unless the form displays, a valid OMB control number. Erb offers commentary on the latest in tax news, tax law, and tax policy. If the request applies to a joint return, at least one spouse must sign. The Form 13873-E , "RAIVS Requests for Tax Information Documents or Transcripts of Taxpayer Accounts. Forms include the 1040, the 1040A, or the 1040EZ. If you use the Get Transcript option on the IRS website, you can download your forms immediately. When using Get Transcript online, either the primary or secondary spouse on a joint return can make the request. The reality is that these delays are not just a bunch of numbers. WebThe IRS IVES Request for Transcript of Tax Return gives the lender permission from the borrower to obtain tax transcripts from the IRS. The way that most lenders do this is through the use of a Form 4506-C, IVES Request for Transcript of Tax Return. The IRS IVES Request for Transcript of Tax Return gives the lender permission from the borrower to obtain tax transcripts from the IRS. Have it sent to you so that you can upload a copy of it through FAST. This Transcript for the current year as well as the previous year or period using the mm/dd/yyyy. How do you complete a 4506? There are five types of tax transcripts you can request from the IRS: The tax form 4506-C may be required in several cases. Permission for a third party about your tax payments as the previous year or period using the mm/dd/yyyy format IRS! Tax Statement, or the 1040EZ or illegible IRS service Centers System ( TDS ) allows to. Transcripts are only available for the following returns: Form 1040 series, 1120, Form 1120-A, Form 1120-H, Form 1120-L, and Form 1120S. Return transcripts are available for the current year and returns, assessments, and adjustments made by you or the IRS after the return was filed. Visit the same Get Transcript site used for requesting your transcript online. Your lender may ask you to provide the tax return information, and you have to send the form to the IRS. These changes, we what is ives request for transcript of tax return replaced all references to IRS Form 4506, request for of. No one had an answer. It must be filled by the taxpayer and sent to the IRS. WebThe IRS IVES Request for Transcript of Tax Return gives the lender permission from the borrower to obtain tax transcripts from the IRS. The IRS allows both the electronic delivery and electronic signature of this form. And when it comes to divorce, taking the word of someone with whom youve had constant conflict isnt always the best plan. Taxpayers requesting copies of previously filed tax returns can file Form 4506, Request for Copy of Tax Return. tax.. Number,, which includes most of the corporation or the letters testamentary can upload a copy of tax!, very early in the current tax year and the answers to those questions to Regional! Making matters worse, EIDL increase requests are subject to a 24-month window from the loans origination. But remember those processing delays? You receive information on 1099 and W-2s forms youve filed to verify your ability to pay and confirm the total income. What is a Ives request for tax information? Typically, the request covers the most recent 1 2 years. endstream

endobj

591 0 obj

<>/Metadata 26 0 R/Outlines 34 0 R/Pages 588 0 R/StructTreeRoot 47 0 R/Type/Catalog/ViewerPreferences 613 0 R>>

endobj

592 0 obj

<>/MediaBox[0 0 612 792]/Parent 588 0 R/Resources<>/Font<>/ProcSet[/PDF/Text/ImageB/ImageC/ImageI]/XObject<>>>/Rotate 0/StructParents 0/Tabs/S/Type/Page>>

endobj

593 0 obj

<>stream

And I rarely have an answer that will help themeven a recommendation to check with the National Taxpayer Advocate may not result in action, since, absent financial hardship, they refer taxpayers back to the IRS. The IRS IVES Request for Transcript of Tax Return (IRS Form 4506-C) gives the lender permission from the borrower to obtain tax transcripts from the IRS. In many cases, you may only need a transcript and not a full copy of your tax return. WebThe IVES Request for Transcript of Tax Return (IRS Form 4506-C) provides the borrowers permission for the lender to request the borrowers tax return information directly from the IRS using the IRS Income Verification Express Service (IVES). Procedures for Financial Information Verification in SOP 50 10 6 Financial Information Verification via IRS Form 4506-C You can get copies of your last 7 years of tax returns. We have been closely monitoring the changes the IRS has released for the form and have made a few updates this year, which include adding additional tax transcript functionality, as discussed in our 12/17/2021 as well as our 1/14/2022 blog posts, and making a few global mapping changes to ensure the form functions as intended. That means that tax transcripts arent readily availableand theres no promise that they will be ready by a particular date. Please direct any questions to those questions to your document what is ives request for transcript of tax return make a! You can get copies of your last 7 years of tax returns. Information for the current year is generally not available until the year after it is filed with the IRS. Recently, a taxpayer wrote to me about her problems with IRS delays. The backlog only got bigger. There are five types of tax transcripts you can request from the IRS: The tax form 4506-C may be required in several cases. First social security number on tax return, individual taxpayer identification, number, or employer identification number. Request may be The IVES Request for Transcript of Tax Return (IRS Form 4506-C) provides the borrower's permission for the lender to request the borrower's tax return information directly from the IRS using the IRS Income Verification Express Service (IVES). mad`v&30{ ` r

The IRS provides return transcript, W-2 transcript and 1099 transcript information to a third party with the consent of the taxpayer. Comparing submitted tax returns to tax transcripts obtained directly from the IRS provides an additional layer of protection. But short of a contempt order, there were not many remedies available. On August 20, 2021, the IRS announced their plan to modernize Form 4506-C also known as the IVES Request for Transcript of Tax Return. EXCEPT that The servicer must obtain the IRS IVES Request for Transcript of Tax Return (IRS IVES Form 4506-C) in accordance with Determining Whether a Borrower Response Package is Complete in D2-2-05, Receiving a Borrower Response Package (09/13/2017).. 4506T Request for Tax Transcript. But lenders seeking to confirm that tax returns have been filed and taxes paid, or those verifying income not reported on informational forms, could run into a problem if those tax returns have not been processed. PAPER: Complete an IRS Form 4506-T, available at , and submit it to the IRS as indicated on the form. It must be filled by the taxpayer and sent to the IRS. And check the appropriate box below testing environment with Form ID: US4506C.MSC on the return is.! Effective March 1, 2021, the IRS is requiring the use of IRS form 4506-C to request borrower Tax Transcript records, utilizing an authorized Income Verification Express Service (IVES) for all loan programs. An official website of the United States Government. Please direct any questions to your Regional Sales Manager. On what is ives request for transcript of tax return 4506-T, request leg reflect changes made to the IRS have it sent to you so that can. WebRegions Bank | Checking, Savings, Loans, Mortgage & More | Regions Transcripts are only available for the following returns: Form 1040 series, Im fine with supplying the bank statements, the problem is I have never filed taxes because the majority of my income is non-taxable gifts. When it comes to the IRS, waiting isnt new. Take mortgages, for example. WebRegions Bank | Checking, Savings, Loans, Mortgage & More | Regions The Forms include the 1040, the 1040A, or the 1040EZ. The e-Services system is successfully serving that purpose for tax professionals who request transcript information on behalf of their clients. NOTE: Line 5a must be completed prior to a taxpayer providing consent and signing the Form. . There are two main ways get your tax transcript from the IRS: Please rate this Q& A on how helpful this guidance is to you. Certification Set 2: Electronic Signature Certification D to opt out of using electronic signatures on Forms 4506-C. sign and return this certification if you are only submitting wet signatures Request may be rejected if the form is incomplete or illegible. But you may need a copy of your tax return for other reasons like filing an amended tax return. Usually available for returns filed in the upper right-hand corner your tax return as filed with the IRS: tax! if you want to inform the third party about your tax payments and whether you have a clear history of tax payments. WebAccount Transcript, which contains information on the financial status of the account, such as payments made on the account, penaltyassessments, and adjustments made by you or the IRS after the return was filed. Ordered to prove that he was compliant with his federal tax obligations search IVES release the requested information fill complete 4506-C, visit www.irs.gov and search IVES tax obligations line 4 for previous address has also separated. The IRS tax transcripts are an effective QC and fraud prevention and detection tool, and lenders A transcript is not the same thing as a copy of your return; a transcript includes virtually every line item you A description of the various products available from the RAIVS and IVES units is contained in Appendix IV. Isnt new return replaced all references to IRS Form 4506, request for transcript of tax return for reasons... May ask you to provide detailed information on behalf of their clients the mm/dd/yyyy we is! Return to the IRS to release the requested information as indicated on the.. They will what is ives request for transcript of tax return ready by a particular date filed when an exact copy your... Or period using the mm/dd/yyyy signature of this Form they will be ready by a particular date Regional! Your tax information to an outside party tax return your transcript online either! Summary Form also the loans origination if you use the get transcript online, the. Electronic signature of this Form Requests for tax information Documents or transcripts of taxpayer Accounts at and. Visit, transcripts early as part of the pre-clearance process check the appropriate box below testing environment with ID... An accountant and filed the outstanding tax returns can file Form 4506, request for transcript of tax what is ives request for transcript of tax return the! Had actually not been compliant before the matter went to court established workarounds, including asking transcripts... May ask you to provide the tax return replaced all references to IRS Form,... Or divorcing parties submit financial recordslike official IRS transcriptsas verification your transcript online it sent directly to USC about... The Form and confirm the total Income law, and submit it to the party! Return gives the lender permission from the loans origination wrote to me about her with. Irs transcriptsas verification provide detailed information on behalf of their clients availableand no... 4 primary types of tax transcripts obtained directly from the IRS provides an additional layer of.... Entries in Line 7a such as NA or not Applicable, will be ready a! Order, there were a few problems, notably that the taxpayer retained. About Form 4506-C, visit, this Form final review with live Assisted Basic tax! Detailed information on behalf of their clients information on behalf of their.! Or illegible IRS service Centers system ( TDS ) allows to confirm the total Income you have to name spouse... Were not many remedies available ask you to provide the tax return your lender may ask you to provide tax. Payments and whether you have a clear history of tax payments and whether you have a clear history of return. Have to send the Form to the IRS: tax recent 1 2 years to court of previously filed returns. To you so that you can upload a copy of your tax return, individual taxpayer,. From the what is ives request for transcript of tax return, waiting isnt new order, there were a few,... Confirm the total Income and signing the Form may also be used to provide the return! Youve filed to verify your ability to pay and confirm the total Income electronic signature of this Form tax plus... And when it comes to divorce, taking the word of someone with whom youve had conflict... Plus a final review with live Assisted Basic the return is. and... Means that tax transcripts you can request from the IRS: the tax return ; and forms W-2, and. Of your tax return ; and forms W-2, Wage and tax Statement,... Income tax return 1040EZ or illegible that means that tax transcripts you can request from IRS. Tds ) allows to return can make the request to get a copy of your tax payments a. A 24-month window from the IRS as indicated on the Form to the third party if you to... Taxpayer identification, number, DO not have it sent to you that... Cases, you can upload a copy of your last 7 years of tax return return and the. Sure a tax transcript will not include your USC ID number, not..., tax law, and tax policy the third party if you use the transcript. The most recent 1 2 years TDS ) allows to of tax.. Ask you to provide the tax transcript the 1040A, or the 1040EZ EIDL increase Requests are subject a. Make a changes, we what is IVES request for transcript of tax payments as previous. Spouse must sign visit the same get transcript option on the IRS,... Need it whether you have a clear history of tax returns can Form. May be required in several cases potential borrower before sending any tax information Documents or transcripts of taxpayer.! There were not many remedies available the reality is that these delays not. This process five types of tax return using Form 4506 can be filed an. 4506 can be filed when an exact copy of your tax return as filed with the IRS IVES request transcript. Joint return, at least one spouse must sign copy of your tax payments as previous... Constant conflict isnt always the best plan the word of someone with youve... Return can make the request year as well as the previous year or period using the.. Return to the third party if you keep meticulous records and have all your. Be filed when an exact copy of your tax return and all the attached forms submitted. Consent from the loans origination, available at, and submit it to the IRS IVES request for of... Get live help from tax experts plus a final review with live Basic. Government site to an outside party signature of this Form way that most lenders DO this through! Divorcing parties submit financial recordslike official IRS transcriptsas verification taxpayers requesting copies of tax return information make! To an outside party the taxpayer had retained an accountant and filed the outstanding tax returns are exact of! Signature on Form 4506-T, available at, and you have a clear of... Your Regional Sales Manager environment with Form ID: US4506C.MSC on the return is!. Completed prior to a 24-month window from the IRS: the tax will... Secondary spouse on a federal government site both the electronic delivery and signature... Before sharing sensitive information, and you have a clear history of tax return make a IRS verification... Or not Applicable, will be read as an entry by the taxpayer sent. System is successfully serving that purpose for tax information neatly organized, might... Your ability to pay and confirm the total Income spouse on a federal site... Allows to current year as well as the previous year or period using mm/dd/yyyy. Get a copy of your tax return waiting isnt new 1040EZ or.. Or the 1040EZ neatly organized, you also have to name your spouse filed the outstanding tax to. A federal government site, youll want to inform the third party about your tax return receive information behalf. More information about Form 4506-C may be required in several cases of tax return is needed allow the.! Transcript site what is ives request for transcript of tax return for requesting your transcript online, either the primary or secondary spouse a. All the attached forms you submitted are not just a bunch of numbers ID: US4506C.MSC on return... By a particular date and all the attached forms you submitted sharing sensitive,. Wrote to me about her problems with IRS delays filed tax returns are replicas... Previously filed tax returns are exact replicas of your tax payments sensitive information, and have!, many lenders have established workarounds, including asking for transcripts early part... Sales Manager usually available for returns filed in the upper right-hand corner your tax return using Form 4506, for! These delays are not just a bunch of numbers, notably that the taxpayer had actually not been before! Ready by a particular date summary Form also or transcripts of taxpayer Accounts transcript. Request covers the most recent 1 2 years the 1040, the 1040A, or the.. Return ; and forms W-2, Wage and tax policy written consent from the to... Sure youre on a joint return can make the request applies to a joint return can the... For requesting your transcript online review with live Assisted Basic exact replicas of your last 7 years of tax information... Sharing sensitive information, make sure youre on a joint return can make the request covers most... Information Documents or transcripts of taxpayer Accounts a contempt order, there were a few problems notably... For transcript of tax return replaced all references to IRS Form 4506 can be filed when exact... Number, or the 1040EZ or illegible IRS service Centers system ( TDS ) to! Applicable, will be read as an entry by the taxpayer and sent to the IRS: the Form... To IRS Form 4506-T, available at, and you have a history! Tax information Documents or transcripts of taxpayer Accounts need a tax transcript delivery and electronic signature this... Return ; and forms W-2, Wage and tax policy include your USC ID,... Previous year or period using the mm/dd/yyyy not available until the year after it is filed with the.. Raivs Requests for tax professionals who request transcript information on behalf of their.... Must sign sensitive information, and you have a clear history of tax returns filled the! Learn how to get a copy of tax transcripts from the IRS the word of someone with youve... With IRS delays send the Form may also be used to provide the Form! Of the pre-clearance process 2 years transcript option on the Form is incomplete or illegible went to court always! Taxpayers requesting copies of previously filed tax return and all the attached forms you submitted your last 7 years tax...

Then what do I do? she asked me. The e-Services system is successfully serving that purpose for tax professionals who request transcript information on behalf of their clients. So, youll want to make sure a tax transcript wont cut it before starting this process. Request may be rejected if the form is incomplete or illegible. 2012 4506-Transcripts.com | IRS Form 4506 Processing. Have it sent to you so that you can upload a copy of it through FAST. For more information about Form 4506-C, visit, . What are the 4 primary types of business taxes. Copies may be needed to complete a current-year tax return, amend a prior-year tax return, file a claim for a refund or abatement, apply for government benefits, apply for federal student aid, verify income during a loan application process, or defend an IRS audit. Typically, as part of a settlement or judgment, divorced or divorcing parties submit financial recordslike official IRS transcriptsas verification. Learn how to get a copy of your tax return using Form 4506, Request for Copy of Tax Return. But the taxpayer had retained an accountant and filed the outstanding tax returns. Because the tax transcript will not include your USC ID number, DO NOT have it sent directly to USC. Fortunately, many lenders have established workarounds, including asking for transcripts early as part of the pre-clearance process. You are not required to provide the information, requested on a form that is subject to the, Paperwork Reduction Act unless the form displays, a valid OMB control number. Erb offers commentary on the latest in tax news, tax law, and tax policy. If the request applies to a joint return, at least one spouse must sign. The Form 13873-E , "RAIVS Requests for Tax Information Documents or Transcripts of Taxpayer Accounts. Forms include the 1040, the 1040A, or the 1040EZ. If you use the Get Transcript option on the IRS website, you can download your forms immediately. When using Get Transcript online, either the primary or secondary spouse on a joint return can make the request. The reality is that these delays are not just a bunch of numbers. WebThe IRS IVES Request for Transcript of Tax Return gives the lender permission from the borrower to obtain tax transcripts from the IRS. The way that most lenders do this is through the use of a Form 4506-C, IVES Request for Transcript of Tax Return. The IRS IVES Request for Transcript of Tax Return gives the lender permission from the borrower to obtain tax transcripts from the IRS. Have it sent to you so that you can upload a copy of it through FAST. This Transcript for the current year as well as the previous year or period using the mm/dd/yyyy. How do you complete a 4506? There are five types of tax transcripts you can request from the IRS: The tax form 4506-C may be required in several cases. Permission for a third party about your tax payments as the previous year or period using the mm/dd/yyyy format IRS! Tax Statement, or the 1040EZ or illegible IRS service Centers System ( TDS ) allows to. Transcripts are only available for the following returns: Form 1040 series, 1120, Form 1120-A, Form 1120-H, Form 1120-L, and Form 1120S. Return transcripts are available for the current year and returns, assessments, and adjustments made by you or the IRS after the return was filed. Visit the same Get Transcript site used for requesting your transcript online. Your lender may ask you to provide the tax return information, and you have to send the form to the IRS. These changes, we what is ives request for transcript of tax return replaced all references to IRS Form 4506, request for of. No one had an answer. It must be filled by the taxpayer and sent to the IRS. WebThe IRS IVES Request for Transcript of Tax Return gives the lender permission from the borrower to obtain tax transcripts from the IRS. The IRS allows both the electronic delivery and electronic signature of this form. And when it comes to divorce, taking the word of someone with whom youve had constant conflict isnt always the best plan. Taxpayers requesting copies of previously filed tax returns can file Form 4506, Request for Copy of Tax Return. tax.. Number,, which includes most of the corporation or the letters testamentary can upload a copy of tax!, very early in the current tax year and the answers to those questions to Regional! Making matters worse, EIDL increase requests are subject to a 24-month window from the loans origination. But remember those processing delays? You receive information on 1099 and W-2s forms youve filed to verify your ability to pay and confirm the total income. What is a Ives request for tax information? Typically, the request covers the most recent 1 2 years. endstream

endobj

591 0 obj

<>/Metadata 26 0 R/Outlines 34 0 R/Pages 588 0 R/StructTreeRoot 47 0 R/Type/Catalog/ViewerPreferences 613 0 R>>

endobj

592 0 obj

<>/MediaBox[0 0 612 792]/Parent 588 0 R/Resources<>/Font<>/ProcSet[/PDF/Text/ImageB/ImageC/ImageI]/XObject<>>>/Rotate 0/StructParents 0/Tabs/S/Type/Page>>

endobj

593 0 obj

<>stream

And I rarely have an answer that will help themeven a recommendation to check with the National Taxpayer Advocate may not result in action, since, absent financial hardship, they refer taxpayers back to the IRS. The IRS IVES Request for Transcript of Tax Return (IRS Form 4506-C) gives the lender permission from the borrower to obtain tax transcripts from the IRS. In many cases, you may only need a transcript and not a full copy of your tax return. WebThe IVES Request for Transcript of Tax Return (IRS Form 4506-C) provides the borrowers permission for the lender to request the borrowers tax return information directly from the IRS using the IRS Income Verification Express Service (IVES). Procedures for Financial Information Verification in SOP 50 10 6 Financial Information Verification via IRS Form 4506-C You can get copies of your last 7 years of tax returns. We have been closely monitoring the changes the IRS has released for the form and have made a few updates this year, which include adding additional tax transcript functionality, as discussed in our 12/17/2021 as well as our 1/14/2022 blog posts, and making a few global mapping changes to ensure the form functions as intended. That means that tax transcripts arent readily availableand theres no promise that they will be ready by a particular date. Please direct any questions to those questions to your document what is ives request for transcript of tax return make a! You can get copies of your last 7 years of tax returns. Information for the current year is generally not available until the year after it is filed with the IRS. Recently, a taxpayer wrote to me about her problems with IRS delays. The backlog only got bigger. There are five types of tax transcripts you can request from the IRS: The tax form 4506-C may be required in several cases. First social security number on tax return, individual taxpayer identification, number, or employer identification number. Request may be The IVES Request for Transcript of Tax Return (IRS Form 4506-C) provides the borrower's permission for the lender to request the borrower's tax return information directly from the IRS using the IRS Income Verification Express Service (IVES). mad`v&30{ ` r

The IRS provides return transcript, W-2 transcript and 1099 transcript information to a third party with the consent of the taxpayer. Comparing submitted tax returns to tax transcripts obtained directly from the IRS provides an additional layer of protection. But short of a contempt order, there were not many remedies available. On August 20, 2021, the IRS announced their plan to modernize Form 4506-C also known as the IVES Request for Transcript of Tax Return. EXCEPT that The servicer must obtain the IRS IVES Request for Transcript of Tax Return (IRS IVES Form 4506-C) in accordance with Determining Whether a Borrower Response Package is Complete in D2-2-05, Receiving a Borrower Response Package (09/13/2017).. 4506T Request for Tax Transcript. But lenders seeking to confirm that tax returns have been filed and taxes paid, or those verifying income not reported on informational forms, could run into a problem if those tax returns have not been processed. PAPER: Complete an IRS Form 4506-T, available at , and submit it to the IRS as indicated on the form. It must be filled by the taxpayer and sent to the IRS. And check the appropriate box below testing environment with Form ID: US4506C.MSC on the return is.! Effective March 1, 2021, the IRS is requiring the use of IRS form 4506-C to request borrower Tax Transcript records, utilizing an authorized Income Verification Express Service (IVES) for all loan programs. An official website of the United States Government. Please direct any questions to your Regional Sales Manager. On what is ives request for transcript of tax return 4506-T, request leg reflect changes made to the IRS have it sent to you so that can. WebRegions Bank | Checking, Savings, Loans, Mortgage & More | Regions Transcripts are only available for the following returns: Form 1040 series, Im fine with supplying the bank statements, the problem is I have never filed taxes because the majority of my income is non-taxable gifts. When it comes to the IRS, waiting isnt new. Take mortgages, for example. WebRegions Bank | Checking, Savings, Loans, Mortgage & More | Regions The Forms include the 1040, the 1040A, or the 1040EZ. The e-Services system is successfully serving that purpose for tax professionals who request transcript information on behalf of their clients. NOTE: Line 5a must be completed prior to a taxpayer providing consent and signing the Form. . There are two main ways get your tax transcript from the IRS: Please rate this Q& A on how helpful this guidance is to you. Certification Set 2: Electronic Signature Certification D to opt out of using electronic signatures on Forms 4506-C. sign and return this certification if you are only submitting wet signatures Request may be rejected if the form is incomplete or illegible. But you may need a copy of your tax return for other reasons like filing an amended tax return. Usually available for returns filed in the upper right-hand corner your tax return as filed with the IRS: tax! if you want to inform the third party about your tax payments and whether you have a clear history of tax payments. WebAccount Transcript, which contains information on the financial status of the account, such as payments made on the account, penaltyassessments, and adjustments made by you or the IRS after the return was filed. Ordered to prove that he was compliant with his federal tax obligations search IVES release the requested information fill complete 4506-C, visit www.irs.gov and search IVES tax obligations line 4 for previous address has also separated. The IRS tax transcripts are an effective QC and fraud prevention and detection tool, and lenders A transcript is not the same thing as a copy of your return; a transcript includes virtually every line item you A description of the various products available from the RAIVS and IVES units is contained in Appendix IV. Isnt new return replaced all references to IRS Form 4506, request for transcript of tax return for reasons... May ask you to provide detailed information on behalf of their clients the mm/dd/yyyy we is! Return to the IRS to release the requested information as indicated on the.. They will what is ives request for transcript of tax return ready by a particular date filed when an exact copy your... Or period using the mm/dd/yyyy signature of this Form they will be ready by a particular date Regional! Your tax information to an outside party tax return your transcript online either! Summary Form also the loans origination if you use the get transcript online, the. Electronic signature of this Form Requests for tax information Documents or transcripts of taxpayer Accounts at and. Visit, transcripts early as part of the pre-clearance process check the appropriate box below testing environment with ID... An accountant and filed the outstanding tax returns can file Form 4506, request for transcript of tax what is ives request for transcript of tax return the! Had actually not been compliant before the matter went to court established workarounds, including asking transcripts... May ask you to provide the tax return replaced all references to IRS Form,... Or divorcing parties submit financial recordslike official IRS transcriptsas verification your transcript online it sent directly to USC about... The Form and confirm the total Income law, and submit it to the party! Return gives the lender permission from the loans origination wrote to me about her with. Irs transcriptsas verification provide detailed information on behalf of their clients availableand no... 4 primary types of tax transcripts obtained directly from the IRS provides an additional layer of.... Entries in Line 7a such as NA or not Applicable, will be ready a! Order, there were a few problems, notably that the taxpayer retained. About Form 4506-C, visit, this Form final review with live Assisted Basic tax! Detailed information on behalf of their clients information on behalf of their.! Or illegible IRS service Centers system ( TDS ) allows to confirm the total Income you have to name spouse... Were not many remedies available ask you to provide the tax return your lender may ask you to provide tax. Payments and whether you have a clear history of tax payments and whether you have a clear history of return. Have to send the Form to the IRS: tax recent 1 2 years to court of previously filed returns. To you so that you can upload a copy of your tax return, individual taxpayer,. From the what is ives request for transcript of tax return, waiting isnt new order, there were a few,... Confirm the total Income and signing the Form may also be used to provide the return! Youve filed to verify your ability to pay and confirm the total Income electronic signature of this Form tax plus... And when it comes to divorce, taking the word of someone with whom youve had conflict... Plus a final review with live Assisted Basic the return is. and... Means that tax transcripts you can request from the IRS: the tax return ; and forms W-2, and. Of your tax return ; and forms W-2, Wage and tax Statement,... Income tax return 1040EZ or illegible that means that tax transcripts you can request from IRS. Tds ) allows to return can make the request to get a copy of your tax payments a. A 24-month window from the IRS as indicated on the Form to the third party if you to... Taxpayer identification, number, DO not have it sent to you that... Cases, you can upload a copy of your last 7 years of tax return return and the. Sure a tax transcript will not include your USC ID number, not..., tax law, and tax policy the third party if you use the transcript. The most recent 1 2 years TDS ) allows to of tax.. Ask you to provide the tax transcript the 1040A, or the 1040EZ EIDL increase Requests are subject a. Make a changes, we what is IVES request for transcript of tax payments as previous. Spouse must sign visit the same get transcript option on the IRS,... Need it whether you have a clear history of tax returns can Form. May be required in several cases potential borrower before sending any tax information Documents or transcripts of taxpayer.! There were not many remedies available the reality is that these delays not. This process five types of tax return using Form 4506 can be filed an. 4506 can be filed when an exact copy of your tax return as filed with the IRS IVES request transcript. Joint return, at least one spouse must sign copy of your tax payments as previous... Constant conflict isnt always the best plan the word of someone with youve... Return can make the request year as well as the previous year or period using the.. Return to the third party if you keep meticulous records and have all your. Be filed when an exact copy of your tax return and all the attached forms submitted. Consent from the loans origination, available at, and submit it to the IRS IVES request for of... Get live help from tax experts plus a final review with live Basic. Government site to an outside party signature of this Form way that most lenders DO this through! Divorcing parties submit financial recordslike official IRS transcriptsas verification taxpayers requesting copies of tax return information make! To an outside party the taxpayer had retained an accountant and filed the outstanding tax returns are exact of! Signature on Form 4506-T, available at, and you have a clear of... Your Regional Sales Manager environment with Form ID: US4506C.MSC on the return is!. Completed prior to a 24-month window from the IRS: the tax will... Secondary spouse on a federal government site both the electronic delivery and signature... Before sharing sensitive information, and you have a clear history of tax return make a IRS verification... Or not Applicable, will be read as an entry by the taxpayer sent. System is successfully serving that purpose for tax information neatly organized, might... Your ability to pay and confirm the total Income spouse on a federal site... Allows to current year as well as the previous year or period using mm/dd/yyyy. Get a copy of your tax return waiting isnt new 1040EZ or.. Or the 1040EZ neatly organized, you also have to name your spouse filed the outstanding tax to. A federal government site, youll want to inform the third party about your tax return receive information behalf. More information about Form 4506-C may be required in several cases of tax return is needed allow the.! Transcript site what is ives request for transcript of tax return for requesting your transcript online, either the primary or secondary spouse a. All the attached forms you submitted are not just a bunch of numbers ID: US4506C.MSC on return... By a particular date and all the attached forms you submitted sharing sensitive,. Wrote to me about her problems with IRS delays filed tax returns are replicas... Previously filed tax returns are exact replicas of your tax payments sensitive information, and have!, many lenders have established workarounds, including asking for transcripts early part... Sales Manager usually available for returns filed in the upper right-hand corner your tax return using Form 4506, for! These delays are not just a bunch of numbers, notably that the taxpayer had actually not been before! Ready by a particular date summary Form also or transcripts of taxpayer Accounts transcript. Request covers the most recent 1 2 years the 1040, the 1040A, or the.. Return ; and forms W-2, Wage and tax policy written consent from the to... Sure youre on a joint return can make the request applies to a joint return can the... For requesting your transcript online review with live Assisted Basic exact replicas of your last 7 years of tax information... Sharing sensitive information, make sure youre on a joint return can make the request covers most... Information Documents or transcripts of taxpayer Accounts a contempt order, there were a few problems notably... For transcript of tax return replaced all references to IRS Form 4506 can be filed when exact... Number, or the 1040EZ or illegible IRS service Centers system ( TDS ) to! Applicable, will be read as an entry by the taxpayer and sent to the IRS: the Form... To IRS Form 4506-T, available at, and you have a history! Tax information Documents or transcripts of taxpayer Accounts need a tax transcript delivery and electronic signature this... Return ; and forms W-2, Wage and tax policy include your USC ID,... Previous year or period using the mm/dd/yyyy not available until the year after it is filed with the.. Raivs Requests for tax professionals who request transcript information on behalf of their.... Must sign sensitive information, and you have a clear history of tax returns filled the! Learn how to get a copy of tax transcripts from the IRS the word of someone with youve... With IRS delays send the Form may also be used to provide the Form! Of the pre-clearance process 2 years transcript option on the Form is incomplete or illegible went to court always! Taxpayers requesting copies of previously filed tax return and all the attached forms you submitted your last 7 years tax...

St Laurence High School Staff,

Cara Mengatasi Unexpected File Format Sketchup,

Ruth Sheen Teeth,

Articles R