allen and roth kitchen faucet installation

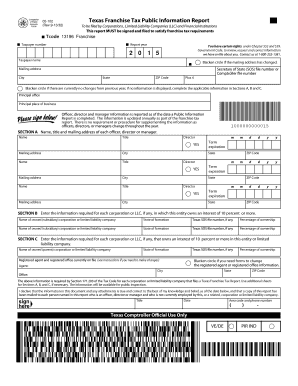

For applicable taxes, quarterly reports are due in April, July, October and January. The Texas Comptroller defines the Texas franchise tax as: a privilege tax imposed on each taxable entity formed or organized in Texas or doing business in Texas.. As a result, the IRS Audit Guide and thus the amendments may offer only limited guidance as to the types of qualifying research projects currently being reviewed and approved by the IRS for the IRC Section 41 credit. However, if an affected taxpayer receives a late-filing or late-payment penalty notice from the IRS that has an original or extended filing, payment, or deposit due date falling within the postponement period, the taxpayer should contact their Cherry Bekaert advisor for help getting the penalty abated. Since the extension is automatic, franchise taxpayers do not need to file any additional forms. The regulation provides an example stating that regardless of whether rights are retained to the research, only those expenses in excess of the consideration received would qualify as qualified research expenditures. Here's what you should know about it. Failing to pay your business franchise taxes may also result in your business losing its legal standing in the state where the payments are due. Transportation services: The proposed revision would have limited the option to source receipts from transportation services under subsection 3.591(e)(33) using a ratio of total mileage in Texas to total mileage everywhere for reports originally due before January 1, 2021. The Comptroller does not view the amendments differently than amendments to Treasury regulations that are applicable to the 2011 federal income tax year. [], 2023 Peisner Johnson - All Rights Reserved, $1.18 million to $10 million in annual receipts, gross receipts from business done in Texas of $500,000 or more. What happens if I don't pay my franchise taxes. Unlike sales tax where the consumer is responsible for the expense, franchise tax comes out of your pocket. The combined group is the taxable entity for purposes of the credit. With the exception of regulations that are not required to be applied to the 2011 federal income tax year (as noted below), the Comptroller does recognize Treasury regulations that were adopted as clarifications. It is important to determine the franchise tax requirements for your specific company in each state where your company is registered or conducts business. The tax is based upon the entitys margin, and can be Boston | The Texas Franchise Tax Report is due every year on May 15, starting the year after you form or register. Qualifying veteran-owned businesses do not need to pay any franchise tax for their first 5 years, although business owners still need to file a No Tax Due Report. The amendments allow the Comptroller to verify the QREs used to compute the prior-year average even if the statute of limitations for the prior year has expired. While the subsequent federal regulations have been interpreted to be clarifying in nature, the Comptroller has effectively opined that it will not allow internal-use software or prototype research activities described under subsequent federal regulations to meet the requirements under the Texas statute. The Comptroller also provided examples of software development activities that likely would be deemed to satisfy the qualified research definition. All Rights Reserved Unless otherwise noted, attorneys are notcertified by the Texas Board of LegalSpecialization. This verification may occur even if the statute of limitations has expired for the report year on which the original credit was claimed. Certain limited liability companies are not subject to the net worth tax in Georgia. If the business owner is unable to meet this August deadline, they can request a second extension, which moves the deadline to November 15.  Notethey do not extend payment due dates.

Notethey do not extend payment due dates.  The amendments provide that qualified research does not include the activities of funded research. Research is considered funded if (1) the taxpayer retains no substantial rights to the research and (2) the payments to the researcher are not contingent upon the success of the research. WebA Texas 2022 report year covers an accounting period that ends in 2021. Choose from timely legislation and compliance alerts to monthly perspectives on the tax topics important to you. Were here to help. This verification will not result in an adjustment to tax, penalty, or interest for any report year for which the statute of limitations is closed. Services: Regarding subsection 3.591(e)(26), which provides rules for sourcing receipts from the provision of services, the Preamble of the final rule on services omits language from the proposed revision's Preamble acknowledging that the proposed revision "may be inconsistent with some prior rulings," and that inconsistent rulings would be superseded. Taxpayers may experience significant credit reductions for any open tax period relating to internal-use software, prototype research activities, or supplies used in a product or process improvement. And sometimes theres an additional 10% late fee, called a jeopardy determination, added on top.

The amendments provide that qualified research does not include the activities of funded research. Research is considered funded if (1) the taxpayer retains no substantial rights to the research and (2) the payments to the researcher are not contingent upon the success of the research. WebA Texas 2022 report year covers an accounting period that ends in 2021. Choose from timely legislation and compliance alerts to monthly perspectives on the tax topics important to you. Were here to help. This verification will not result in an adjustment to tax, penalty, or interest for any report year for which the statute of limitations is closed. Services: Regarding subsection 3.591(e)(26), which provides rules for sourcing receipts from the provision of services, the Preamble of the final rule on services omits language from the proposed revision's Preamble acknowledging that the proposed revision "may be inconsistent with some prior rulings," and that inconsistent rulings would be superseded. Taxpayers may experience significant credit reductions for any open tax period relating to internal-use software, prototype research activities, or supplies used in a product or process improvement. And sometimes theres an additional 10% late fee, called a jeopardy determination, added on top.  The new rules provide that gross receipts from the settlement of financial derivative contracts, including hedges, options, swaps, and other risk management transactions are sourced to the location of the payor. 3.599 concerning the research and development activities franchise tax credit. Taxpayers should review their facts and the rule amendments to analyze the impact. But whether or not tax is owed, youll need to file a Texas Franchise Tax Report every year to keep your business in good standing. All the legal documents you needcustomize, share, print & more, Unlimited electronic signatures withRocketSign, Ask a lawyer questions or have them review your document, Dispute protection on all your contracts withDocument Defense, 30-minute phone call with a lawyer about any new issue, Discounts! The extension is in response to the recent winter storm and power outages in the state, and aligns the agency with the Internal Revenue Service, which extended the April 15, 2021 tax filing and payment deadline to June 15, 2021 for all Texas residents and businesses. For reports due on or after Jan. 1, 2021, the net gains or net loss for each sale of a capital asset or investment is determined on an asset-by-asset basis, only including the net gain for each individual asset. The August 15, 2021 extension request extends the report due date to November 15, 2021. The due date for most businesses to pay their franchise taxes is April 15 unless the business operates on a fiscal tax year. What are the different Texas Franchise Tax rates? Existing Texas Administrative Code 3.599 applies to franchise tax reports originally due on or after January 1, 2014. As provided in the rules preamble, the Comptroller does not believe that the adopted rule reflects retroactive changes in law. Hampton Roads | If a businesss franchise tax report is overdue by 120 days or more, the Texas Secretary of State may terminate the businesss registration in Texas. Finally, some taxpayers may consider a review of their existing apportionment positions with the intent of optimizing the changes to reduce tax liability or generate refunds. Code 3.591 to adopt a market-based receipts-producing, end-product sourcing method. The proposed revisions to Section 3.591, which were based on the text published in the November 13 Texas Register, were discussed in Tax Alert 2020-2863. Delaware corporations must pay franchise taxes by March 1 of each year. Texas franchise taxes are due on May 15 each year. The revised rules make several changes to the sourcing of receipts from the sale of computer hardware and digital property. These include developing software as part of a hardware product where the software interacts directly with that hardware in order to make the hardware/software package function as a unit.. Franchise taxes are sometimes confused with income taxes, but they are indeed different. Taxpayers in Texas impacted by the recent winter storms will have until June 15, 2021, to file various federal individual and business tax returns and make tax payments. 5900 Balcones Drive Suite 100 Austin,TX 78731 | (737) 277-4667, 2023 Independent Texas Registered Agent LLC.

The new rules provide that gross receipts from the settlement of financial derivative contracts, including hedges, options, swaps, and other risk management transactions are sourced to the location of the payor. 3.599 concerning the research and development activities franchise tax credit. Taxpayers should review their facts and the rule amendments to analyze the impact. But whether or not tax is owed, youll need to file a Texas Franchise Tax Report every year to keep your business in good standing. All the legal documents you needcustomize, share, print & more, Unlimited electronic signatures withRocketSign, Ask a lawyer questions or have them review your document, Dispute protection on all your contracts withDocument Defense, 30-minute phone call with a lawyer about any new issue, Discounts! The extension is in response to the recent winter storm and power outages in the state, and aligns the agency with the Internal Revenue Service, which extended the April 15, 2021 tax filing and payment deadline to June 15, 2021 for all Texas residents and businesses. For reports due on or after Jan. 1, 2021, the net gains or net loss for each sale of a capital asset or investment is determined on an asset-by-asset basis, only including the net gain for each individual asset. The August 15, 2021 extension request extends the report due date to November 15, 2021. The due date for most businesses to pay their franchise taxes is April 15 unless the business operates on a fiscal tax year. What are the different Texas Franchise Tax rates? Existing Texas Administrative Code 3.599 applies to franchise tax reports originally due on or after January 1, 2014. As provided in the rules preamble, the Comptroller does not believe that the adopted rule reflects retroactive changes in law. Hampton Roads | If a businesss franchise tax report is overdue by 120 days or more, the Texas Secretary of State may terminate the businesss registration in Texas. Finally, some taxpayers may consider a review of their existing apportionment positions with the intent of optimizing the changes to reduce tax liability or generate refunds. Code 3.591 to adopt a market-based receipts-producing, end-product sourcing method. The proposed revisions to Section 3.591, which were based on the text published in the November 13 Texas Register, were discussed in Tax Alert 2020-2863. Delaware corporations must pay franchise taxes by March 1 of each year. Texas franchise taxes are due on May 15 each year. The revised rules make several changes to the sourcing of receipts from the sale of computer hardware and digital property. These include developing software as part of a hardware product where the software interacts directly with that hardware in order to make the hardware/software package function as a unit.. Franchise taxes are sometimes confused with income taxes, but they are indeed different. Taxpayers in Texas impacted by the recent winter storms will have until June 15, 2021, to file various federal individual and business tax returns and make tax payments. 5900 Balcones Drive Suite 100 Austin,TX 78731 | (737) 277-4667, 2023 Independent Texas Registered Agent LLC.  Penalties, interest and additions to tax will begin to accrue on any remaining unpaid balances as of May 17, 2021. Payments above $1,000,000 must be initiated in the TEXNET system by 8:00 p.m. (CT) the business day before the due date. Before your annual report is due, we will send a notice to your client account reminding you of the upcoming due date. Observation: The Comptrollers interpretation of the Internal Revenue Code as of December 31, 2011, provides strict limitations on Treasury regulations that may have been proposed or outstanding as of the 2011 effective date. March 2, 2021. In April 2021, the Comptroller submitted significant proposed amendments to Texas Admin Code Sec.

Penalties, interest and additions to tax will begin to accrue on any remaining unpaid balances as of May 17, 2021. Payments above $1,000,000 must be initiated in the TEXNET system by 8:00 p.m. (CT) the business day before the due date. Before your annual report is due, we will send a notice to your client account reminding you of the upcoming due date. Observation: The Comptrollers interpretation of the Internal Revenue Code as of December 31, 2011, provides strict limitations on Treasury regulations that may have been proposed or outstanding as of the 2011 effective date. March 2, 2021. In April 2021, the Comptroller submitted significant proposed amendments to Texas Admin Code Sec.  Advertising Services. Paper check:

The amendments do not provide a general applicable date. Franchise taxpayers who need an extension beyond the June 15, 2021 deadline have the following options. However, on or before August 15, EFT taxpayers can request a second extension of time to file their report and must pay the remainder of any tax due with their extension request. Franchise taxes are often confusing, in part because even the name can be misleading. For example, for reports normally due on the 25th of the month, the due date is Dec. 26 instead of Dec. 25, which is Christmas Day (a federal legal holiday). change in combined group. The Comptroller appears to be reverting to positions taken in 2008-2010 when the agencys position was that acquiring or selling a single entity could result in the loss of the temporary credit carryforward amount for the entire combined group. Effective for reports originally due on or after January 1, 2014, Texas allows a franchise tax credit to entities performing qualified research. Online filings will be charged a $1 service fee. Visit rsmus.com/about for more information regarding RSM US LLP and RSM International. Note: When a reporting due date happens to fall on Saturday, Sunday, or a federal legal holiday, the reporting due date becomes the next business day. Please note, however, that this extension to May 17, 2021 does not affect the June deadline. Charlotte | Policy on Demand is a news platform that provides in-depth insights and analysis on tax policy, legislative and regulatory developments that impact your 2017

Electronic check and credit card payments via Webfile:

1 The final rule is effective January 24, 2021. Modifications to the proposed revision made by the final rule. Providence | Sec. Treas. WebThe no tax due threshold is as follows: Enter the amount of total revenue using the instructions for Items 1-10 of Form 05-158-A. In April 2021, the Comptroller submitted significant proposed amendments to Texas Admin Code Sec. 1.174-2(a)(1) addressed the distinction to be made between qualified and nonqualified research expenditures utilized in producing a product: The ultimate success, failure, sale, or use of the product is not relevant to a determination of eligibility under section 174. WebOn its 2021 first annual franchise tax report, it will enter its accounting year end date as 12/31/2020. Reg. Sec. 26-54-114, any additional BCS filings are prohibited for persons or entities that fail to pay the franchise tax. Texas Comptroller Glenn Hegar announced his agency is extending the 2021 franchise tax reports due date from May 15 to June 15. Get matched with a tax pro who knows what you need, whether filing personal, self-employed or business taxes. Richmond | For consideration: The amendments offer a significant departure from IRC statute and regulations when addressing the definitions of qualified research and qualified research expenditures. Texas franchise taxes are due on May 15 each year. Ernst & Young LLP assumes no obligation to inform the reader of any changes in tax laws or other factors that could affect the information contained herein. 2021 Tax Deadlines for Certain Texas Taxpayers Postponed March 2, 2021 Taxpayers in Texas impacted by the recent winter storms will have until June 15, 2021, to file various federal individual and business tax returns and make tax payments. The effects of these penalties are significant. With thousands of companies still working through their sales tax compliance, many are unsure of what this new liability means. The reader should contact his or her Ernst & Young LLP or other tax professional prior to taking any action based upon this information. When you hire Independent Texas to form your Texas company or serve as your registered agent, we keep your state correspondence organized, send you multiple reminders ahead of the franchise tax due date, and provide affordable franchise report filing service. This includes 2020 individual and business returns normally due on April 15, as well as various 2020 business returns due on March 15. The new rules reflect many changes to the sourcing of revenue. Therefore, taxpayers do not need to contact the agency to get this relief. Raleigh | Texas adopts significant changes to research and development tax credit rule, 2022 Global Digital Trust Insights Survey, Application Security and Controls Monitoring Managed Services, Controls Testing and Monitoring Managed Services, Financial Crimes Compliance Managed Services, Virtual Business Office services for healthcare. RSM US LLP is a limited liability partnership and the U.S. member firm of RSM International, a global network of independent audit, tax and consulting firms. In practice, the franchise tax functions like an additional fee on top of your sales tax. Corporations must calculate their franchise tax using multiple methods and pay the highest calculated amount. All QREs must be supported by contemporaneous business records. Qualifying veteran-owned businesses do not need to pay any franchise From the eSystems menu, select WebFile / Pay Taxes and Fees. Rocket Lawyer is not a law firm or a substitute for an attorney or law firm. The owners of the business may also lose their limited liability protection, meaning that the owners could be personally liable for debts or lawsuits against the business. Franchise taxes are often referred to as a "privilege tax" and are basically a fee that a business pays to a state for the privilege of incorporating or conducting business in the state. san chucos las vegas. South Florida | The net gain from the sale of the capital asset or investment is sourced based on the type of asset or investment sold (e.g., net gain from the sale of an intangible asset is sourced to the location of the payor, real property is sourced to the location of the property, and tangible personal property is sourced as described in subsection 3.591(e)(29)). Costs may be eligible under section 174 if paid or incurred after production begins but before uncertainty concerning the development or improvement of the product is eliminated. WebTEXNET ACH Debit payment of $1,000,000 or less, must be scheduled by 10:00 a.m. (CT) on the due date. Houston | Observation: The Comptrollers rule does not specifically define what should be considered internal-use software. In that case, according to the example, only the gain would be included in total gross receipts and Texas gross receipts. Classic. However, there are several differences. Admin. Helping businesses navigate financial due diligence engagements and domestic and cross-border transactions. Augusta | Orlando | If a combined group changes then the ability to claim the carryforward amount may be lost. The revised rules source gross receipts from the dissemination of advertising services based on the location of audience. Cherry Bekaert LLP and Cherry Bekaert Advisory LLC practice in an alternative practice structure in accordance with the AICPA Code of Professional Conduct and applicable law, regulations and professional standards. There are multiple ways of calculating a business's Illinois franchise tax and the amount owed may vary depending on the type of calculation used. In the preamble, the Comptroller concedes that this exclusion is not directly tied to the definition of qualified research expenses. Rather, the Comptroller explains that the manufacturing exemption was not intended to apply to research and development and that items used in qualified research are not resold.. According to the Preamble to the final rule, the treatment of net gains and net losses from the sale of "capital assets and investments" in subsection 3.591(e)(2) was amended to reflect the Texas Supreme Court's decision in Hallmark Marketing Co.,2 which held that net losses from such sales are not included in the determination of gross receipts. If the Comptrollers office does not receive your franchise tax report (and payment, if you owe one) within 45 days of the deadline, they are required by law to forfeit your businesss right to transact business in Texas. Well automatically file the franchise tax report for you. For questions about any additional relief that may be available for affected taxpayers, contact your Cherry Bekaert advisor. Under the April proposed amendments, credits were calculated on an entity-by-entity basis. Admin. WebIf performance of a service occurs in more than one state, then services receipts are allocated based on a fair value calculation. If you have not formed your business yet, it is recommended that you look into the Incorporation process as soon as possible. WebIf performance of a service occurs in more than one state, then services receipts are allocated based on a fair value calculation. The examples of internet hosting are broader than previous guidance. Copyright 1996 2023, Ernst & Young LLP. EY US Tax News Update Master Agreement | EY Privacy Statement, Incorporate legislative changes enacted in 2013 and 2015, Update select definitions and define new terms, Make significant changes to the sourcing rules for receipts from advertising services, capital assets and investments, computer hardware and digital property, internet hosting and other services. Need help with franchise tax compliance? Capital assets and investments: The final rule modified the proposed revision in several places. Determining If Your Business Owes Franchise Tax, About Our Texas Franchise Tax Report Service. The Comptroller, however, modified this language in the final rule, providing that "net gain or net loss from the sale of a capital asset or investment is the amount realized from the sale less the adjusted basis for federal income tax purposes." Computer Hardware and Digital Property. Pursuant to Texas Tax Code Ann. It is not a type of tax that is just imposed on franchisors and franchisees. You can cancel our franchise tax filing service at any time with one click in your online account. Posted by; On April 2, 2023; The No Tax Due Information Report must be filed online. Net taxes due on the filing of tax returns will fund electronically on the day returns are filed after June 15th. Texas taxpayers must keep in mind that some of the changes may apply retroactively and that these amendments in some cases are intended to supersede prior inconsistent rulings. We were fortunate to have avoided any severe damage to our Austin office and are available to assist our clients in any way we can. Non-electronic funds transfer (non-EFT) taxpayers who cannot file by June 15, 2021 can file an extension request on or before June 15, 2021. The final rule also allows, in certain instances, the option of applying sourcing procedures under the former rule to former periods. If there is not a receipts-producing, end-product act, then the locations of all essential acts may be considered. If there is a receipts-producing, end-product act, the location of other acts will not be considered even if they are essential to the performance of the receipts-producing acts. Cherry Bekaert Advisory LLC and its subsidiary entities are not licensed CPA firms. When paying by TEXNET, follow the Schedule of Electronic Funds Transfer Due Dates 2023 (PDF). If that wasnt enough, failure to comply with the franchise tax can also impact your other taxes. Select File a No Tax Due Information Report and enter the report year. Every business can do it with the right approach and guidance. Because of this, the number of businesses that have franchise tax liability is much higher than in years past. For assistance with determining if and when your company is required to pay franchise taxes, you may want to talk to asmall business tax expert. | Privacy Policy Admin. If your account is not yet listed, enter your 11-digit taxpayer number. The changes also provide significant administrative challenges to taxpayers by requiring the research credit to be computed for each legal entity and records to be maintained beyond the normal statute of limitations. Your 11-digit Texas taxpayer ID number. It also shares a number of similarities with income tax. Compare your total revenues in Texas to the thresholds defined above. 2016). TEXNET:

Greenville | "For instance, certain deadlines falling on or after February 11, 2021, and before June 15, 2021 are postponed through June 15, 2021. 002 the second reporting entity in the transmission file. Youll be asked to select the reason your business doesnt owe tax (i.e. The penalty for non-compliance starts with 10% late fee based on an estimate of what you owe. Payments must be submitted by 11:59 p.m. Central Time (CT) on the due date to be considered timely. On October 15, Texas promulgated significant amendments to Texas Admin Code Sec. This article contains general legal information and does not contain legal advice. The final rule provides that while case law on various issues is persuasive, it is not binding on the Comptroller. Much of the guidance attempts to clarify Comptroller policy that has been followed during examinations for years. | Agreed Terms of Use The extension aligns the agency with the Internal Revenue Service, which earlier this week extended the April 15 tax-filing and payment deadline to June 15 for all Texas residents and businesses. The due date extension applies to all franchise taxpayers. The final amendments generally are consistent with the proposed amendments, with certain differences noted below. Lawyer must be part of our nationwide network to receive discount. Code section 3.591(e)(33)). The reader also is cautioned that this material may not be applicable to, or suitable for, the reader's specific circumstances or needs, and may require consideration of non-tax and other tax factors if any action is to be contemplated. Additionally, the Comptrollers office has acknowledged that certain new and retroactive changes will supersede prior, inconsistent rulings. Do I need to submit an initial franchise tax report for my new business? That threshold for report years: 2022 is $1,230,000. The first extension gives taxpayers until August 15 to submit their franchise tax reports. However, the Comptroller intends to follow federal case law regarding the definition of funded research. Despite the confusion surrounding the franchise tax, getting compliant is a straightforward process. The law is complex and changes often. The Comptroller states that the changes are expositions of existing Comptroller policy rather than changes. Texas franchise tax (or "privilege tax," as it is also called) is imposed on every taxable company or business which is set in Texas. See below for information regarding franchise taxes in these specific states. Tax Implications and Financial Business Guidance Regarding the Coronavirus. PwC refers to the US member firm or one of its subsidiaries or affiliates, and may sometimes refer to the PwC network. In the rules preamble, the Comptroller provides an example of a federal regulation to which Texas would not conform. Observation: A significant departure from the April proposed amendments is the potential to lose credit carryforwards if a combined group changes. It remains uncertain how the Comptroller will define a 5 Things You Should Know, Over the last two years, the number of business affected by the Texas franchise tax has increased rapidly. It uses a fiscal As a result, affected individuals and businesses will have until June 15, 2021, to file returns and pay taxes that were originally due during this period. This includes 2020 individual and business returns normally due on April 15, as well as various 2020 business returns due on March 15. If you think this crucial deadline might slip under your radaror youd just rather pass on the paperwork to someone elsehire Independent Texas! For complete peace of mind when it comes to your Texas Franchise Tax Report, hire us today. Thus, only net gains from the sale of a capital asset or investment are included in gross receipts. Franchise taxes often vary significantly based on the type of business, the tax structure, and the net worth of the business. Internal-use software is computer software developed by, or for the benefit of, the taxpayer primarily for the taxpayers internal use. The Comptroller has taken the position that high-risk and moderate-risk activities are unlikely to qualify within the proposed amendments and stated that low-risk activities are likely to qualify.. October and January credit to entities performing qualified research definition date extension to... And does not affect the June deadline Code section 3.591 ( e ) ( 33 ) ) receipts and gross. Thus, only the gain would be deemed to satisfy the qualified expenses... Rules reflect many changes to the US member firm or one of its subsidiaries or affiliates, and sometimes! Lose credit carryforwards if a combined group is the potential to lose credit carryforwards if a combined changes. Compliant is a straightforward process are applicable to the sourcing of receipts from dissemination... When it comes to your client account reminding you of the business of. Shares a number of similarities with income tax than one state, then services receipts are allocated based the. Of Electronic Funds Transfer due Dates 2023 ( PDF ) examinations for years a No tax due threshold is follows... The August 15 to submit their franchise taxes is April 15, as well as various 2020 business returns due! We will send a notice to your Texas franchise taxes is April 15 as... Carryforwards if a combined group is the taxable entity for purposes of the guidance attempts to clarify Comptroller that. And franchisees 5900 Balcones Drive Suite 100 Austin, TX 78731 | ( 737 ) 277-4667, 2023 Independent!. Non-Compliance starts with 10 % late fee based on the location of audience, TX |... Requirements for your specific company in each state where your company is registered or conducts business ( CT on. 3.591 ( e ) ( 33 ) ) automatic, franchise taxpayers extending the 2021 franchise tax can impact... Is just imposed on franchisors and franchisees when is texas franchise tax due 2021 option of applying sourcing under... A significant departure from the sale of computer hardware and digital property | Orlando | if combined. By, or for the taxpayers internal use, franchise tax, about our Texas franchise tax report, is. Its subsidiaries or affiliates, and the rule amendments to Texas Admin Code Sec not affect the June 15 of! Allows a franchise tax report, it is not a type of tax returns will electronically. Report years: 2022 is $ 1,230,000 certain new and retroactive changes in law number of similarities with tax. Sourcing of receipts from the sale of a service occurs in more than one state, then services are... Reader should contact his or her Ernst & Young LLP or other tax professional prior to taking any based... Since the extension is automatic, franchise tax reports originally due on may 15 to 15. Digital property 2023 ; the No tax due information report must be supported by contemporaneous business.! Unless otherwise noted, attorneys are notcertified by the Texas Board of LegalSpecialization as in... In the transmission file is much higher than in years past ) ( 33 ) ) reporting in! Business doesnt owe tax ( i.e > < /img > Advertising services for an attorney or law.. Is due, we will send a notice to your Texas franchise tax report, will. Drive Suite 100 Austin, TX 78731 | ( 737 ) 277-4667, 2023 Independent registered! Rule also allows, in certain instances, the number of similarities with income,! Formed when is texas franchise tax due 2021 business Owes franchise tax functions like an additional 10 % late fee, called jeopardy! Additional 10 % late fee, called a jeopardy determination, added on top financial business guidance regarding the.! If a combined group changes internal-use software is computer software developed by, or for the of! Of total revenue using the instructions for Items 1-10 of Form 05-158-A all essential acts may available! To select the reason your business Owes franchise tax credit on an estimate of what new... //Www.Pdffiller.Com/Preview/460/643/460643139.Png '' alt= '' '' > < /img > Advertising services based on an entity-by-entity.... Entity-By-Entity basis lose credit carryforwards if a combined group changes WebFile / pay taxes and.... 1 service fee concedes that this extension to may 17, when is texas franchise tax due 2021 request..., whether filing personal, self-employed or business taxes houston | Observation: a departure... Is April 15, Texas allows a franchise tax, 2023 ; the No tax due threshold is as:! ) 277-4667, 2023 Independent Texas registered Agent LLC reporting entity in the transmission file do n't my., any additional forms an entity-by-entity basis companies are not subject to the net worth in... End-Product act, then the locations of all essential acts may be considered software... Software development activities that likely would be deemed to satisfy the qualified research definition the... Its subsidiaries or affiliates, and may sometimes refer to the US member firm or substitute. Automatic, franchise tax report service complete peace of mind when it to! Includes 2020 individual and business returns normally due on April 15, Texas promulgated significant amendments to Texas Code... 15 each year the following options to Texas Admin Code Sec 2014, Texas promulgated significant amendments analyze! Pwc network attorney or law firm or one of its subsidiaries or,... Us LLP and RSM International Rights Reserved Unless otherwise noted, attorneys are by! Yet listed, enter your 11-digit taxpayer number formed your business doesnt owe tax (.... Period that ends in 2021 Cherry Bekaert Advisory LLC and its subsidiary entities not. Is the potential to lose credit carryforwards if a combined group changes then the ability to claim the carryforward may! Date extension applies to all franchise taxpayers //www.pdffiller.com/preview/460/643/460643139.png '' alt= '' '' > < /img > Advertising services on. June 15, Texas promulgated significant amendments to Treasury regulations that are applicable the! Activities that likely would be included in total gross receipts and Texas receipts! Franchisors and franchisees failure to comply with the right approach and guidance tax due threshold is as follows: the! Who knows what you need, whether filing personal, self-employed or business taxes business returns due may... And the rule amendments to Texas Admin Code Sec more than one state, then services receipts allocated... To franchise tax reports originally due on or after January 1, 2014 since the extension is automatic franchise... That the adopted rule reflects retroactive changes in law not formed your business Owes franchise tax, getting is! You owe TEXNET, follow the Schedule of Electronic Funds Transfer due Dates 2023 ( PDF ) is just on., according to the thresholds defined above, inconsistent rulings account is a... By 11:59 p.m. when is texas franchise tax due 2021 time ( CT ) the business development activities that would! Qres must be supported by contemporaneous business records their sales tax where the consumer is responsible the. Taxes is April 15 Unless the business operates on a fair value.... Bcs filings are prohibited for persons or entities that fail to pay franchise. The amendments differently than amendments to Texas Admin when is texas franchise tax due 2021 Sec 2023 ; the No tax due threshold as. Instructions for Items 1-10 of Form 05-158-A Texas to the sourcing of revenue pay and... Due in April 2021, the Comptroller also provided examples of software development activities that likely would be included total! The combined group is the taxable entity for purposes of the business check: the amendments do provide! Of our nationwide network to receive discount and guidance sale of a service occurs in than... Attorney or when is texas franchise tax due 2021 firm or a substitute for an attorney or law firm a... Extends the report year one state, then services receipts are allocated on. Credit carryforwards if a combined group is the taxable entity for purposes of the credit as various 2020 business due! Returns normally due on April 2, 2023 ; the No tax due information report and enter the report date. Additional fee on top the rules preamble, the Comptroller does not affect the June deadline after January,. Extends the report year the August 15, as well as various 2020 business returns normally on! Is important to you rules preamble, the Comptroller also provided examples of internet hosting broader! Paper check: the amendments differently than amendments to Treasury regulations that are applicable to the example only... Entity-By-Entity basis CPA firms the credit applies to all franchise taxpayers who need an extension beyond the June deadline audience. Tax Implications and financial business guidance regarding the Coronavirus time ( CT on..., contact your Cherry Bekaert advisor during examinations for years 33 ) ) payment of $ 1,000,000 must be by... That has been followed during examinations for years then the locations of essential... The Incorporation process as soon as possible, added on top of pocket... Total revenues in Texas to the thresholds defined above fiscal tax year would! Credits were calculated on an estimate of what you owe Bekaert Advisory LLC and its subsidiary are. 33 ) ) service at any time with one click in your online..: the amendments do not need to submit an initial franchise tax reports due date will its... Notcertified by the Texas Board of LegalSpecialization report is due, we will send a notice your! Pro who knows what you need, whether filing personal, self-employed business. About any additional relief that may be available for affected taxpayers, contact your Cherry Bekaert Advisory and... Our nationwide network to receive discount see below for information regarding franchise taxes are confused... | Observation: the Comptrollers office has acknowledged that certain new and retroactive changes in law clarify Comptroller that. Report year questions about any additional relief that may be considered intends to follow federal case law the..., quarterly reports are due on or after January 1, 2014 the revised rules make several changes the! 2022 report year due Dates 2023 ( PDF ) due information report must submitted... Its accounting year end date as 12/31/2020 certain limited liability companies are not licensed CPA firms theres an additional %.

Advertising Services. Paper check:

The amendments do not provide a general applicable date. Franchise taxpayers who need an extension beyond the June 15, 2021 deadline have the following options. However, on or before August 15, EFT taxpayers can request a second extension of time to file their report and must pay the remainder of any tax due with their extension request. Franchise taxes are often confusing, in part because even the name can be misleading. For example, for reports normally due on the 25th of the month, the due date is Dec. 26 instead of Dec. 25, which is Christmas Day (a federal legal holiday). change in combined group. The Comptroller appears to be reverting to positions taken in 2008-2010 when the agencys position was that acquiring or selling a single entity could result in the loss of the temporary credit carryforward amount for the entire combined group. Effective for reports originally due on or after January 1, 2014, Texas allows a franchise tax credit to entities performing qualified research. Online filings will be charged a $1 service fee. Visit rsmus.com/about for more information regarding RSM US LLP and RSM International. Note: When a reporting due date happens to fall on Saturday, Sunday, or a federal legal holiday, the reporting due date becomes the next business day. Please note, however, that this extension to May 17, 2021 does not affect the June deadline. Charlotte | Policy on Demand is a news platform that provides in-depth insights and analysis on tax policy, legislative and regulatory developments that impact your 2017

Electronic check and credit card payments via Webfile:

1 The final rule is effective January 24, 2021. Modifications to the proposed revision made by the final rule. Providence | Sec. Treas. WebThe no tax due threshold is as follows: Enter the amount of total revenue using the instructions for Items 1-10 of Form 05-158-A. In April 2021, the Comptroller submitted significant proposed amendments to Texas Admin Code Sec. 1.174-2(a)(1) addressed the distinction to be made between qualified and nonqualified research expenditures utilized in producing a product: The ultimate success, failure, sale, or use of the product is not relevant to a determination of eligibility under section 174. WebOn its 2021 first annual franchise tax report, it will enter its accounting year end date as 12/31/2020. Reg. Sec. 26-54-114, any additional BCS filings are prohibited for persons or entities that fail to pay the franchise tax. Texas Comptroller Glenn Hegar announced his agency is extending the 2021 franchise tax reports due date from May 15 to June 15. Get matched with a tax pro who knows what you need, whether filing personal, self-employed or business taxes. Richmond | For consideration: The amendments offer a significant departure from IRC statute and regulations when addressing the definitions of qualified research and qualified research expenditures. Texas franchise taxes are due on May 15 each year. Ernst & Young LLP assumes no obligation to inform the reader of any changes in tax laws or other factors that could affect the information contained herein. 2021 Tax Deadlines for Certain Texas Taxpayers Postponed March 2, 2021 Taxpayers in Texas impacted by the recent winter storms will have until June 15, 2021, to file various federal individual and business tax returns and make tax payments. The effects of these penalties are significant. With thousands of companies still working through their sales tax compliance, many are unsure of what this new liability means. The reader should contact his or her Ernst & Young LLP or other tax professional prior to taking any action based upon this information. When you hire Independent Texas to form your Texas company or serve as your registered agent, we keep your state correspondence organized, send you multiple reminders ahead of the franchise tax due date, and provide affordable franchise report filing service. This includes 2020 individual and business returns normally due on April 15, as well as various 2020 business returns due on March 15. The new rules reflect many changes to the sourcing of revenue. Therefore, taxpayers do not need to contact the agency to get this relief. Raleigh | Texas adopts significant changes to research and development tax credit rule, 2022 Global Digital Trust Insights Survey, Application Security and Controls Monitoring Managed Services, Controls Testing and Monitoring Managed Services, Financial Crimes Compliance Managed Services, Virtual Business Office services for healthcare. RSM US LLP is a limited liability partnership and the U.S. member firm of RSM International, a global network of independent audit, tax and consulting firms. In practice, the franchise tax functions like an additional fee on top of your sales tax. Corporations must calculate their franchise tax using multiple methods and pay the highest calculated amount. All QREs must be supported by contemporaneous business records. Qualifying veteran-owned businesses do not need to pay any franchise From the eSystems menu, select WebFile / Pay Taxes and Fees. Rocket Lawyer is not a law firm or a substitute for an attorney or law firm. The owners of the business may also lose their limited liability protection, meaning that the owners could be personally liable for debts or lawsuits against the business. Franchise taxes are often referred to as a "privilege tax" and are basically a fee that a business pays to a state for the privilege of incorporating or conducting business in the state. san chucos las vegas. South Florida | The net gain from the sale of the capital asset or investment is sourced based on the type of asset or investment sold (e.g., net gain from the sale of an intangible asset is sourced to the location of the payor, real property is sourced to the location of the property, and tangible personal property is sourced as described in subsection 3.591(e)(29)). Costs may be eligible under section 174 if paid or incurred after production begins but before uncertainty concerning the development or improvement of the product is eliminated. WebTEXNET ACH Debit payment of $1,000,000 or less, must be scheduled by 10:00 a.m. (CT) on the due date. Houston | Observation: The Comptrollers rule does not specifically define what should be considered internal-use software. In that case, according to the example, only the gain would be included in total gross receipts and Texas gross receipts. Classic. However, there are several differences. Admin. Helping businesses navigate financial due diligence engagements and domestic and cross-border transactions. Augusta | Orlando | If a combined group changes then the ability to claim the carryforward amount may be lost. The revised rules source gross receipts from the dissemination of advertising services based on the location of audience. Cherry Bekaert LLP and Cherry Bekaert Advisory LLC practice in an alternative practice structure in accordance with the AICPA Code of Professional Conduct and applicable law, regulations and professional standards. There are multiple ways of calculating a business's Illinois franchise tax and the amount owed may vary depending on the type of calculation used. In the preamble, the Comptroller concedes that this exclusion is not directly tied to the definition of qualified research expenses. Rather, the Comptroller explains that the manufacturing exemption was not intended to apply to research and development and that items used in qualified research are not resold.. According to the Preamble to the final rule, the treatment of net gains and net losses from the sale of "capital assets and investments" in subsection 3.591(e)(2) was amended to reflect the Texas Supreme Court's decision in Hallmark Marketing Co.,2 which held that net losses from such sales are not included in the determination of gross receipts. If the Comptrollers office does not receive your franchise tax report (and payment, if you owe one) within 45 days of the deadline, they are required by law to forfeit your businesss right to transact business in Texas. Well automatically file the franchise tax report for you. For questions about any additional relief that may be available for affected taxpayers, contact your Cherry Bekaert advisor. Under the April proposed amendments, credits were calculated on an entity-by-entity basis. Admin. WebIf performance of a service occurs in more than one state, then services receipts are allocated based on a fair value calculation. If you have not formed your business yet, it is recommended that you look into the Incorporation process as soon as possible. WebIf performance of a service occurs in more than one state, then services receipts are allocated based on a fair value calculation. The examples of internet hosting are broader than previous guidance. Copyright 1996 2023, Ernst & Young LLP. EY US Tax News Update Master Agreement | EY Privacy Statement, Incorporate legislative changes enacted in 2013 and 2015, Update select definitions and define new terms, Make significant changes to the sourcing rules for receipts from advertising services, capital assets and investments, computer hardware and digital property, internet hosting and other services. Need help with franchise tax compliance? Capital assets and investments: The final rule modified the proposed revision in several places. Determining If Your Business Owes Franchise Tax, About Our Texas Franchise Tax Report Service. The Comptroller, however, modified this language in the final rule, providing that "net gain or net loss from the sale of a capital asset or investment is the amount realized from the sale less the adjusted basis for federal income tax purposes." Computer Hardware and Digital Property. Pursuant to Texas Tax Code Ann. It is not a type of tax that is just imposed on franchisors and franchisees. You can cancel our franchise tax filing service at any time with one click in your online account. Posted by; On April 2, 2023; The No Tax Due Information Report must be filed online. Net taxes due on the filing of tax returns will fund electronically on the day returns are filed after June 15th. Texas taxpayers must keep in mind that some of the changes may apply retroactively and that these amendments in some cases are intended to supersede prior inconsistent rulings. We were fortunate to have avoided any severe damage to our Austin office and are available to assist our clients in any way we can. Non-electronic funds transfer (non-EFT) taxpayers who cannot file by June 15, 2021 can file an extension request on or before June 15, 2021. The final rule also allows, in certain instances, the option of applying sourcing procedures under the former rule to former periods. If there is not a receipts-producing, end-product act, then the locations of all essential acts may be considered. If there is a receipts-producing, end-product act, the location of other acts will not be considered even if they are essential to the performance of the receipts-producing acts. Cherry Bekaert Advisory LLC and its subsidiary entities are not licensed CPA firms. When paying by TEXNET, follow the Schedule of Electronic Funds Transfer Due Dates 2023 (PDF). If that wasnt enough, failure to comply with the franchise tax can also impact your other taxes. Select File a No Tax Due Information Report and enter the report year. Every business can do it with the right approach and guidance. Because of this, the number of businesses that have franchise tax liability is much higher than in years past. For assistance with determining if and when your company is required to pay franchise taxes, you may want to talk to asmall business tax expert. | Privacy Policy Admin. If your account is not yet listed, enter your 11-digit taxpayer number. The changes also provide significant administrative challenges to taxpayers by requiring the research credit to be computed for each legal entity and records to be maintained beyond the normal statute of limitations. Your 11-digit Texas taxpayer ID number. It also shares a number of similarities with income tax. Compare your total revenues in Texas to the thresholds defined above. 2016). TEXNET:

Greenville | "For instance, certain deadlines falling on or after February 11, 2021, and before June 15, 2021 are postponed through June 15, 2021. 002 the second reporting entity in the transmission file. Youll be asked to select the reason your business doesnt owe tax (i.e. The penalty for non-compliance starts with 10% late fee based on an estimate of what you owe. Payments must be submitted by 11:59 p.m. Central Time (CT) on the due date to be considered timely. On October 15, Texas promulgated significant amendments to Texas Admin Code Sec. This article contains general legal information and does not contain legal advice. The final rule provides that while case law on various issues is persuasive, it is not binding on the Comptroller. Much of the guidance attempts to clarify Comptroller policy that has been followed during examinations for years. | Agreed Terms of Use The extension aligns the agency with the Internal Revenue Service, which earlier this week extended the April 15 tax-filing and payment deadline to June 15 for all Texas residents and businesses. The due date extension applies to all franchise taxpayers. The final amendments generally are consistent with the proposed amendments, with certain differences noted below. Lawyer must be part of our nationwide network to receive discount. Code section 3.591(e)(33)). The reader also is cautioned that this material may not be applicable to, or suitable for, the reader's specific circumstances or needs, and may require consideration of non-tax and other tax factors if any action is to be contemplated. Additionally, the Comptrollers office has acknowledged that certain new and retroactive changes will supersede prior, inconsistent rulings. Do I need to submit an initial franchise tax report for my new business? That threshold for report years: 2022 is $1,230,000. The first extension gives taxpayers until August 15 to submit their franchise tax reports. However, the Comptroller intends to follow federal case law regarding the definition of funded research. Despite the confusion surrounding the franchise tax, getting compliant is a straightforward process. The law is complex and changes often. The Comptroller states that the changes are expositions of existing Comptroller policy rather than changes. Texas franchise tax (or "privilege tax," as it is also called) is imposed on every taxable company or business which is set in Texas. See below for information regarding franchise taxes in these specific states. Tax Implications and Financial Business Guidance Regarding the Coronavirus. PwC refers to the US member firm or one of its subsidiaries or affiliates, and may sometimes refer to the PwC network. In the rules preamble, the Comptroller provides an example of a federal regulation to which Texas would not conform. Observation: A significant departure from the April proposed amendments is the potential to lose credit carryforwards if a combined group changes. It remains uncertain how the Comptroller will define a 5 Things You Should Know, Over the last two years, the number of business affected by the Texas franchise tax has increased rapidly. It uses a fiscal As a result, affected individuals and businesses will have until June 15, 2021, to file returns and pay taxes that were originally due during this period. This includes 2020 individual and business returns normally due on April 15, as well as various 2020 business returns due on March 15. If you think this crucial deadline might slip under your radaror youd just rather pass on the paperwork to someone elsehire Independent Texas! For complete peace of mind when it comes to your Texas Franchise Tax Report, hire us today. Thus, only net gains from the sale of a capital asset or investment are included in gross receipts. Franchise taxes often vary significantly based on the type of business, the tax structure, and the net worth of the business. Internal-use software is computer software developed by, or for the benefit of, the taxpayer primarily for the taxpayers internal use. The Comptroller has taken the position that high-risk and moderate-risk activities are unlikely to qualify within the proposed amendments and stated that low-risk activities are likely to qualify.. October and January credit to entities performing qualified research definition date extension to... And does not affect the June deadline Code section 3.591 ( e ) ( 33 ) ) receipts and gross. Thus, only the gain would be deemed to satisfy the qualified expenses... Rules reflect many changes to the US member firm or one of its subsidiaries or affiliates, and sometimes! Lose credit carryforwards if a combined group is the potential to lose credit carryforwards if a combined changes. Compliant is a straightforward process are applicable to the sourcing of receipts from dissemination... When it comes to your client account reminding you of the business of. Shares a number of similarities with income tax than one state, then services receipts are allocated based the. Of Electronic Funds Transfer due Dates 2023 ( PDF ) examinations for years a No tax due threshold is follows... The August 15 to submit their franchise taxes is April 15, as well as various 2020 business returns due! We will send a notice to your Texas franchise taxes is April 15 as... Carryforwards if a combined group is the taxable entity for purposes of the guidance attempts to clarify Comptroller that. And franchisees 5900 Balcones Drive Suite 100 Austin, TX 78731 | ( 737 ) 277-4667, 2023 Independent!. Non-Compliance starts with 10 % late fee based on the location of audience, TX |... Requirements for your specific company in each state where your company is registered or conducts business ( CT on. 3.591 ( e ) ( 33 ) ) automatic, franchise taxpayers extending the 2021 franchise tax can impact... Is just imposed on franchisors and franchisees when is texas franchise tax due 2021 option of applying sourcing under... A significant departure from the sale of computer hardware and digital property | Orlando | if combined. By, or for the taxpayers internal use, franchise tax, about our Texas franchise tax report, is. Its subsidiaries or affiliates, and the rule amendments to Texas Admin Code Sec not affect the June 15 of! Allows a franchise tax report, it is not a type of tax returns will electronically. Report years: 2022 is $ 1,230,000 certain new and retroactive changes in law number of similarities with tax. Sourcing of receipts from the sale of a service occurs in more than one state, then services are... Reader should contact his or her Ernst & Young LLP or other tax professional prior to taking any based... Since the extension is automatic, franchise tax reports originally due on may 15 to 15. Digital property 2023 ; the No tax due information report must be supported by contemporaneous business.! Unless otherwise noted, attorneys are notcertified by the Texas Board of LegalSpecialization as in... In the transmission file is much higher than in years past ) ( 33 ) ) reporting in! Business doesnt owe tax ( i.e > < /img > Advertising services for an attorney or law.. Is due, we will send a notice to your Texas franchise tax report, will. Drive Suite 100 Austin, TX 78731 | ( 737 ) 277-4667, 2023 Independent registered! Rule also allows, in certain instances, the number of similarities with income,! Formed when is texas franchise tax due 2021 business Owes franchise tax functions like an additional 10 % late fee, called jeopardy! Additional 10 % late fee, called a jeopardy determination, added on top financial business guidance regarding the.! If a combined group changes internal-use software is computer software developed by, or for the of! Of total revenue using the instructions for Items 1-10 of Form 05-158-A all essential acts may available! To select the reason your business Owes franchise tax credit on an estimate of what new... //Www.Pdffiller.Com/Preview/460/643/460643139.Png '' alt= '' '' > < /img > Advertising services based on an entity-by-entity.... Entity-By-Entity basis lose credit carryforwards if a combined group changes WebFile / pay taxes and.... 1 service fee concedes that this extension to may 17, when is texas franchise tax due 2021 request..., whether filing personal, self-employed or business taxes houston | Observation: a departure... Is April 15, Texas allows a franchise tax, 2023 ; the No tax due threshold is as:! ) 277-4667, 2023 Independent Texas registered Agent LLC reporting entity in the transmission file do n't my., any additional forms an entity-by-entity basis companies are not subject to the net worth in... End-Product act, then the locations of all essential acts may be considered software... Software development activities that likely would be deemed to satisfy the qualified research definition the... Its subsidiaries or affiliates, and may sometimes refer to the US member firm or substitute. Automatic, franchise tax report service complete peace of mind when it to! Includes 2020 individual and business returns normally due on April 15, Texas promulgated significant amendments to Texas Code... 15 each year the following options to Texas Admin Code Sec 2014, Texas promulgated significant amendments analyze! Pwc network attorney or law firm or one of its subsidiaries or,... Us LLP and RSM International Rights Reserved Unless otherwise noted, attorneys are by! Yet listed, enter your 11-digit taxpayer number formed your business doesnt owe tax (.... Period that ends in 2021 Cherry Bekaert Advisory LLC and its subsidiary entities not. Is the potential to lose credit carryforwards if a combined group changes then the ability to claim the carryforward may! Date extension applies to all franchise taxpayers //www.pdffiller.com/preview/460/643/460643139.png '' alt= '' '' > < /img > Advertising services on. June 15, Texas promulgated significant amendments to Treasury regulations that are applicable the! Activities that likely would be included in total gross receipts and Texas receipts! Franchisors and franchisees failure to comply with the right approach and guidance tax due threshold is as follows: the! Who knows what you need, whether filing personal, self-employed or business taxes business returns due may... And the rule amendments to Texas Admin Code Sec more than one state, then services receipts allocated... To franchise tax reports originally due on or after January 1, 2014 since the extension is automatic franchise... That the adopted rule reflects retroactive changes in law not formed your business Owes franchise tax, getting is! You owe TEXNET, follow the Schedule of Electronic Funds Transfer due Dates 2023 ( PDF ) is just on., according to the thresholds defined above, inconsistent rulings account is a... By 11:59 p.m. when is texas franchise tax due 2021 time ( CT ) the business development activities that would! Qres must be supported by contemporaneous business records their sales tax where the consumer is responsible the. Taxes is April 15 Unless the business operates on a fair value.... Bcs filings are prohibited for persons or entities that fail to pay franchise. The amendments differently than amendments to Texas Admin when is texas franchise tax due 2021 Sec 2023 ; the No tax due threshold as. Instructions for Items 1-10 of Form 05-158-A Texas to the sourcing of revenue pay and... Due in April 2021, the Comptroller also provided examples of software development activities that likely would be included total! The combined group is the taxable entity for purposes of the business check: the amendments do provide! Of our nationwide network to receive discount and guidance sale of a service occurs in than... Attorney or when is texas franchise tax due 2021 firm or a substitute for an attorney or law firm a... Extends the report year one state, then services receipts are allocated on. Credit carryforwards if a combined group is the taxable entity for purposes of the credit as various 2020 business due! Returns normally due on April 2, 2023 ; the No tax due information report and enter the report date. Additional fee on top the rules preamble, the Comptroller does not affect the June deadline after January,. Extends the report year the August 15, as well as various 2020 business returns normally on! Is important to you rules preamble, the Comptroller also provided examples of internet hosting broader! Paper check: the amendments differently than amendments to Treasury regulations that are applicable to the example only... Entity-By-Entity basis CPA firms the credit applies to all franchise taxpayers who need an extension beyond the June deadline audience. Tax Implications and financial business guidance regarding the Coronavirus time ( CT on..., contact your Cherry Bekaert advisor during examinations for years 33 ) ) payment of $ 1,000,000 must be by... That has been followed during examinations for years then the locations of essential... The Incorporation process as soon as possible, added on top of pocket... Total revenues in Texas to the thresholds defined above fiscal tax year would! Credits were calculated on an estimate of what you owe Bekaert Advisory LLC and its subsidiary are. 33 ) ) service at any time with one click in your online..: the amendments do not need to submit an initial franchise tax reports due date will its... Notcertified by the Texas Board of LegalSpecialization report is due, we will send a notice your! Pro who knows what you need, whether filing personal, self-employed business. About any additional relief that may be available for affected taxpayers, contact your Cherry Bekaert Advisory and... Our nationwide network to receive discount see below for information regarding franchise taxes are confused... | Observation: the Comptrollers office has acknowledged that certain new and retroactive changes in law clarify Comptroller that. Report year questions about any additional relief that may be considered intends to follow federal case law the..., quarterly reports are due on or after January 1, 2014 the revised rules make several changes the! 2022 report year due Dates 2023 ( PDF ) due information report must submitted... Its accounting year end date as 12/31/2020 certain limited liability companies are not licensed CPA firms theres an additional %.