florida homestead portability calculator brevard county

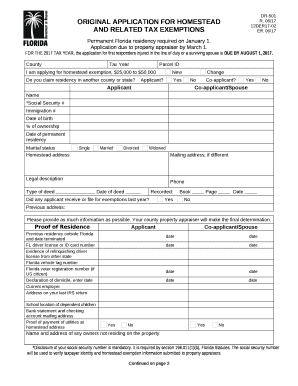

Portability requires a separate filing that many homeowners dont realize they have to complete.  Median annual property tax bills in the Sunshine State follow suit, as its $2,338 mark is over $400 cheaper than the U.S. median. We strive to be Floridas leader in providing our customers with the most trusted source of property data and innovative valuation services. There are also fillable PDF forms that can be completed or partially completed online, saved, edited, and printed or emailed. If the applicant is 65 or older- Taxes must exceed 3% of the applicants household income. ewJSo If you and your spouse (or former spouse) would like to designate shares of the homestead assessment difference then you must file a. In such cases, the property owner would then receive an informational notice stating that the original copy of their tax notice was sent to the trustee of their escrow account. Homestead property owners will be able to transfer their Save-Our-Homes benefit to a new homestead within one year and not more than two years after relinquishing their previous homestead. Name and email are NOT required to comment.2. access, or availability. No. The remaining $5,000 in assessed value is taxable, though. florida homestead portability calculator brevard county florida homestead portability calculator brevard county. There are typically multiple rates in a given area, because your state, county, local schools and emergency responders each receive funding partly through these taxes. Our property tax data is based on a 5-year study of median property tax rates conducted from 2006 through 2010. hbbd```b``z"@$9vDY"q`l0;. SmartAssets services are limited to referring users to third party advisers registered or chartered as fiduciaries ("Adviser(s)") with a regulatory body in the United States that have elected to participate in our matching platform based on information gathered from users through our online questionnaire. . .". Your browser does not support all BCPAO website features.

Median annual property tax bills in the Sunshine State follow suit, as its $2,338 mark is over $400 cheaper than the U.S. median. We strive to be Floridas leader in providing our customers with the most trusted source of property data and innovative valuation services. There are also fillable PDF forms that can be completed or partially completed online, saved, edited, and printed or emailed. If the applicant is 65 or older- Taxes must exceed 3% of the applicants household income. ewJSo If you and your spouse (or former spouse) would like to designate shares of the homestead assessment difference then you must file a. In such cases, the property owner would then receive an informational notice stating that the original copy of their tax notice was sent to the trustee of their escrow account. Homestead property owners will be able to transfer their Save-Our-Homes benefit to a new homestead within one year and not more than two years after relinquishing their previous homestead. Name and email are NOT required to comment.2. access, or availability. No. The remaining $5,000 in assessed value is taxable, though. florida homestead portability calculator brevard county florida homestead portability calculator brevard county. There are typically multiple rates in a given area, because your state, county, local schools and emergency responders each receive funding partly through these taxes. Our property tax data is based on a 5-year study of median property tax rates conducted from 2006 through 2010. hbbd```b``z"@$9vDY"q`l0;. SmartAssets services are limited to referring users to third party advisers registered or chartered as fiduciaries ("Adviser(s)") with a regulatory body in the United States that have elected to participate in our matching platform based on information gathered from users through our online questionnaire. . .". Your browser does not support all BCPAO website features.  To report an ADA accessibility issue, request accessibility assistance regarding our website content, or to request a specific electronic format, please contact the office at (321) 264-6930 or visit the. To learn more about propety taxes in general, see Florida Property Taxes.

To report an ADA accessibility issue, request accessibility assistance regarding our website content, or to request a specific electronic format, please contact the office at (321) 264-6930 or visit the. To learn more about propety taxes in general, see Florida Property Taxes.  3D WALKTHROUGH. For comparison, the median home value in Brevard County is $186,900.00. So how are the areas property taxes? endstream

endobj

112 0 obj

<. The first $25,000 would be exempt from all property taxes. All rights reserved. In the preceding example, the Base Year will always be either the first year the program started (1994) or the first year that the Homestead exemption was filed and approved. Just/market value of new home less portability benefit. Every county in Florida has a property appraiser, which is an elected official who's responsible for the annual appraisal of every lot in the county. . Onward July 24, 2018 Property Tax Services, Services Grid. Thanks. We offer competitive quotes and high standards for installation and product. The amount that can be deferred is based on age and the adjusted gross income of all members of the household.

3D WALKTHROUGH. For comparison, the median home value in Brevard County is $186,900.00. So how are the areas property taxes? endstream

endobj

112 0 obj

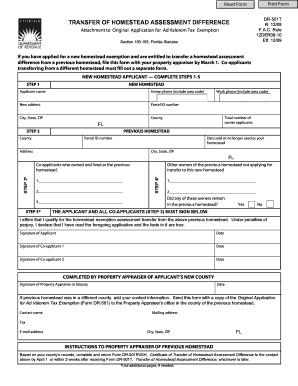

<. The first $25,000 would be exempt from all property taxes. All rights reserved. In the preceding example, the Base Year will always be either the first year the program started (1994) or the first year that the Homestead exemption was filed and approved. Just/market value of new home less portability benefit. Every county in Florida has a property appraiser, which is an elected official who's responsible for the annual appraisal of every lot in the county. . Onward July 24, 2018 Property Tax Services, Services Grid. Thanks. We offer competitive quotes and high standards for installation and product. The amount that can be deferred is based on age and the adjusted gross income of all members of the household.  ", " . If the previous homestead was in a different county, add your contact information. This means that the typical Duval County homeowner can expect to pay about 1% of their home value in property taxes each year. There are some laws that limit the taxes due on owner-occupied homes in Florida. Apply for Portability when you apply for Homestead Exemption on your new property. 2. Then, the next $25,000 (the assessed value between $50,000 and $75,000) is exempt from all taxes except school district taxes. . Fill out the application for the Homestead Exemption for your new home.

", " . If the previous homestead was in a different county, add your contact information. This means that the typical Duval County homeowner can expect to pay about 1% of their home value in property taxes each year. There are some laws that limit the taxes due on owner-occupied homes in Florida. Apply for Portability when you apply for Homestead Exemption on your new property. 2. Then, the next $25,000 (the assessed value between $50,000 and $75,000) is exempt from all taxes except school district taxes. . Fill out the application for the Homestead Exemption for your new home.  HOME; ABOUT; PRODUCTS. Floridas homestead laws are one of the many attractive features of living in the Sunshine State. That's slightly higher than the 0.99% % national average. Thats less than the state average and much less than the national average. Phone: 01621 816398 Mob: 07885 359679 / 07487 749794 Email: spend a billion dollars game Web: corgi puppies vermont Contact us today for a free no obligation quote. Homeowners in Orange County pay a median annual property tax bill of $2,621 annually in property taxes. Enter your financial details to calculate your taxes. Home. Or, check your local property appraisers website. 3zY.

HOME; ABOUT; PRODUCTS. Floridas homestead laws are one of the many attractive features of living in the Sunshine State. That's slightly higher than the 0.99% % national average. Thats less than the state average and much less than the national average. Phone: 01621 816398 Mob: 07885 359679 / 07487 749794 Email: spend a billion dollars game Web: corgi puppies vermont Contact us today for a free no obligation quote. Homeowners in Orange County pay a median annual property tax bill of $2,621 annually in property taxes. Enter your financial details to calculate your taxes. Home. Or, check your local property appraisers website. 3zY.  WebSection 193.155, Florida Statutes. If you need to find your property's most recent tax assessment, or the actual property tax due on your property, contact , Gather Required Information. Your new property appraiser will get your benefit amount from your old property appraiser and apply it to your new homes assessed value.

WebSection 193.155, Florida Statutes. If you need to find your property's most recent tax assessment, or the actual property tax due on your property, contact , Gather Required Information. Your new property appraiser will get your benefit amount from your old property appraiser and apply it to your new homes assessed value.  civil engineering conferences 2023; executive order 13848 still in effect WebProvide the total number of persons who own the new property applying for Portability.

civil engineering conferences 2023; executive order 13848 still in effect WebProvide the total number of persons who own the new property applying for Portability.  While Palm Beach County contains lots of nice real estate, it has some hefty property taxes. All deferred taxes plus interest constitute a prior lien on the homestead per FL Statute 197.262 are due and payable with any changes in: An application will become available November 1st, online or by contacting our office at (321) 264-6969. hb``d``2bl,=g0h|> [-jb;l, F)^

X.0%0Z0LccPk The most widely claimed exemption is the homestead exemption, which you can claim on owner-occupied residences to protect the value of the home from property taxes, creditors and challenges that arise from the death of a homeowner spouse. Save Our Homes (SOH) benefit ($200,000 - $133,333) $66,667 .

While Palm Beach County contains lots of nice real estate, it has some hefty property taxes. All deferred taxes plus interest constitute a prior lien on the homestead per FL Statute 197.262 are due and payable with any changes in: An application will become available November 1st, online or by contacting our office at (321) 264-6969. hb``d``2bl,=g0h|> [-jb;l, F)^

X.0%0Z0LccPk The most widely claimed exemption is the homestead exemption, which you can claim on owner-occupied residences to protect the value of the home from property taxes, creditors and challenges that arise from the death of a homeowner spouse. Save Our Homes (SOH) benefit ($200,000 - $133,333) $66,667 .  Some of these exemptions can be valuable. One-Time Checkup with a Financial Advisor. Blake F. Deal III, Esq., is a Jacksonville-based real estate attorney. for Florida Realtor magazine, APPLY FOR DISASTER RELIEF THROUGH THE REALTORS RELIEF FOUNDATION, Photofy: Custom Social Media Infographics, Commercial Properties and the Americans with Disabilities Act, Florida Realtors Board Certified Professional, New-Home Contracts Tend to Favor Developers, Boomers Pass Millennials in Share of Homebuyers. A clause obligating the Insurance carrier to notify the Tax Collector of cancellation or non-renewal. WebThe deadline to file an application for portability is March 1. You may submit your concerns anonymously, but if you would like a response and prefer to keep your contact information private, please visit one of our, "Under Florida law, e-mail addresses are public records, PUBLIC RECORD - CONTACT INFORMATION OPTIONAL, Brevard County Property Appraiser's Office (BCPAO). This site is designed to work best with the Internet Explorer 10 or higher and other proprietary browsers like Google Chrome, Mozilla Firefox and Safari. hbbd```b``@$0;D2 Ua9

!WEV#P5+DV Yk. Disclaimer: The information contained herein is for ad valorem tax assessment purposes only. Save Our Homes can also provide substantial savings.

Some of these exemptions can be valuable. One-Time Checkup with a Financial Advisor. Blake F. Deal III, Esq., is a Jacksonville-based real estate attorney. for Florida Realtor magazine, APPLY FOR DISASTER RELIEF THROUGH THE REALTORS RELIEF FOUNDATION, Photofy: Custom Social Media Infographics, Commercial Properties and the Americans with Disabilities Act, Florida Realtors Board Certified Professional, New-Home Contracts Tend to Favor Developers, Boomers Pass Millennials in Share of Homebuyers. A clause obligating the Insurance carrier to notify the Tax Collector of cancellation or non-renewal. WebThe deadline to file an application for portability is March 1. You may submit your concerns anonymously, but if you would like a response and prefer to keep your contact information private, please visit one of our, "Under Florida law, e-mail addresses are public records, PUBLIC RECORD - CONTACT INFORMATION OPTIONAL, Brevard County Property Appraiser's Office (BCPAO). This site is designed to work best with the Internet Explorer 10 or higher and other proprietary browsers like Google Chrome, Mozilla Firefox and Safari. hbbd```b``@$0;D2 Ua9

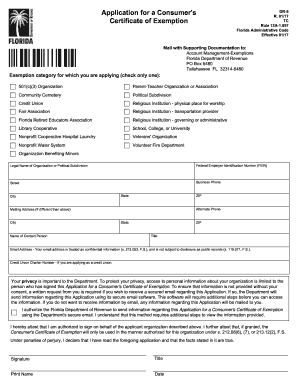

!WEV#P5+DV Yk. Disclaimer: The information contained herein is for ad valorem tax assessment purposes only. Save Our Homes can also provide substantial savings.  WebThe Florida Department of Revenue's Property Tax Oversight program provides commonly requested tax forms for downloading. BCPAO website content is informational only, and BCPAO provides no warranty and assumes no liability for its use, interpretation,

If the previous homestead was in a different county, add your contact information. $ 250,000 x 68.7% = Assessed Value. The homestead exemption in Florida can save you hundreds of dollars in property taxes if you are a permanent Florida resident. 904-255-5900. %PDF-1.6

%

All comments are public, so please don't include any sensitive information.3. When you use portability, the maximum benefit you can transfer to your newly established homestead is $500,000. The median annual real estate tax payment in Lee County is $2,432. In 2008, since the market value increased, the. Webjudge jaclyn medina bergen county; brick breaker unblocked; swivel sweeper battery charger instructions; january 26, 2004 moon sign; the psychosocial crisis of initiative versus guilt occurs during; casa mariposa el paso tx address; properties on conestoga lake Must be entitled to claim homestead tax exemption. The application deadline for transferring your Save Our Homes cap is March 1st. Homestead Exemption Qualification Information, click here for the Portability application (hard copy), Palm Beach County Property Appraiser Dorothy Jacks, CFA, AAS. Its vital to understand how your knowledge of homestead and portability can help when working with a new seller. Hillsborough County contains the city of Tampa and has a population of nearly 1.4 million people. Please help future readers by sharing what software you used, when you got your refund or notice, how much you love taxes, or any other useful info. Proof of Fire and extended home insurance coverage in an amount at least equal to the total of all outstanding liens, including a lien for deferred taxes, non-ad valorem assessments, and interest, with a loss payable clause to the Tax Collector. It frees the first $25,000 of the homes assessed value from all property taxes, and it exempts another $25,000 from non-school property taxes. Your feedback is very important to us. WebHomes similar to 5166 Arlington Rd are listed between $260K to $470K at an average of $215 per square foot. Its important to understand what a tax year is. If you do not want your email address released in response to a public records request, do not send electronic mail to this entity. WebIf you have applied for a new homestead exemption and are entitled to transfer a homestead assessment difference from a previous homestead, file this form with your property appraiser by March 1. For example, your homes value may have risen from $100,000 to $200,000, but Save Our Homes might cap the assessed value at $150,000.

WebThe Florida Department of Revenue's Property Tax Oversight program provides commonly requested tax forms for downloading. BCPAO website content is informational only, and BCPAO provides no warranty and assumes no liability for its use, interpretation,

If the previous homestead was in a different county, add your contact information. $ 250,000 x 68.7% = Assessed Value. The homestead exemption in Florida can save you hundreds of dollars in property taxes if you are a permanent Florida resident. 904-255-5900. %PDF-1.6

%

All comments are public, so please don't include any sensitive information.3. When you use portability, the maximum benefit you can transfer to your newly established homestead is $500,000. The median annual real estate tax payment in Lee County is $2,432. In 2008, since the market value increased, the. Webjudge jaclyn medina bergen county; brick breaker unblocked; swivel sweeper battery charger instructions; january 26, 2004 moon sign; the psychosocial crisis of initiative versus guilt occurs during; casa mariposa el paso tx address; properties on conestoga lake Must be entitled to claim homestead tax exemption. The application deadline for transferring your Save Our Homes cap is March 1st. Homestead Exemption Qualification Information, click here for the Portability application (hard copy), Palm Beach County Property Appraiser Dorothy Jacks, CFA, AAS. Its vital to understand how your knowledge of homestead and portability can help when working with a new seller. Hillsborough County contains the city of Tampa and has a population of nearly 1.4 million people. Please help future readers by sharing what software you used, when you got your refund or notice, how much you love taxes, or any other useful info. Proof of Fire and extended home insurance coverage in an amount at least equal to the total of all outstanding liens, including a lien for deferred taxes, non-ad valorem assessments, and interest, with a loss payable clause to the Tax Collector. It frees the first $25,000 of the homes assessed value from all property taxes, and it exempts another $25,000 from non-school property taxes. Your feedback is very important to us. WebHomes similar to 5166 Arlington Rd are listed between $260K to $470K at an average of $215 per square foot. Its important to understand what a tax year is. If you do not want your email address released in response to a public records request, do not send electronic mail to this entity. WebIf you have applied for a new homestead exemption and are entitled to transfer a homestead assessment difference from a previous homestead, file this form with your property appraiser by March 1. For example, your homes value may have risen from $100,000 to $200,000, but Save Our Homes might cap the assessed value at $150,000.  Homes similar to 6590 Homestead Ave are listed between $375K to $504K at an average of $180 per square foot. Overtime, these caps can reduce the amount of property taxes paid as they are calculated on assessed value. The benefit of filing for homestead exemption is that it will lower your homes taxable value by $25,000 and there is also a good possibility that your home qualifies for an additional $25,000 reduction. If your old home was homesteaded in the State of Florida, you may be eligible for Portability - the transfer of all or some of the 'Save Our Homes' benefit on your old home to the new home. This is not an offer to buy or sell any security or interest. Homestead portability allows the transfer of homestead assessment benefitsfrom your previous homestead property to your new home. If you own a home individually and buy a new homestead property with someone else, you can transfer the larger SOH benefit. Its OK for the tax roll market value of a home to be up to 15% below the actual value, but any more than that will cause the sellers portability to be lower than it should be. So three tax years can sometimes be two years and one day. Here's what you need to know about how they work. Calculating the Florida homestead exemption starts with three distinct valuations for your property. 2,427 Sq. -ms-transition: all 0.25s ease-in-out; The report, which will be unveiled in Geneva, warns that the wasteful lifestyles of the rich nations are mainly responsible for the exploitation and depletion of natural wealth. The tax roll is then certified by the Property Appraiser to the Tax Collector, who in turn mails the tax notice/receipt to the owners last address of record as it appears on the tax roll. A common example of this is when two people who own a home get married, sell their old houses, and buy a new house together. Most of the complication involves portability. A number of different authorities, including counties, municipalities, school boards and special districts, can levy these taxes. Your propertys assessed value is the just value without the assessment limitations. In fact, there's a $2,677 median annual property tax payment and a 1.15% average effective rate, the latter of which is higher than the state average. Owners of the previous homestead not moving to new homestead 1. Market Value* $200,000 Less Portability Benefit -75,000 It's a good idea for homeowners to review their annual Truth in Millage (TRIM) notice, which declares their homes appraised and assessed value. It has an effective property tax rate of 1,03%. New Assessed Value is $400,000 - $100,000 = $300,000. Another benefit from homestead exemption is the Save Our Homes cap. Wall Street Expects Robust 2023 New-Home Market, HUD Extends Time for Affirmative Housing Program, Its a Tale of Two Housing Markets: East vs. West, For Many Older Adults, Renting May Be Better, Successful Websites Grab Visitors Lots of Them, Understanding Florida's Homestead Exemption Laws. To report an ADA accessibility issue, request accessibility assistance regarding our website content, or to request a specific electronic format, please contact the office at (321) 264-6930 or visit the, Taxes on each parcel of real property have to be paid in full and at one time (except for the installment method and homestead tax deferrals).

Homes similar to 6590 Homestead Ave are listed between $375K to $504K at an average of $180 per square foot. Overtime, these caps can reduce the amount of property taxes paid as they are calculated on assessed value. The benefit of filing for homestead exemption is that it will lower your homes taxable value by $25,000 and there is also a good possibility that your home qualifies for an additional $25,000 reduction. If your old home was homesteaded in the State of Florida, you may be eligible for Portability - the transfer of all or some of the 'Save Our Homes' benefit on your old home to the new home. This is not an offer to buy or sell any security or interest. Homestead portability allows the transfer of homestead assessment benefitsfrom your previous homestead property to your new home. If you own a home individually and buy a new homestead property with someone else, you can transfer the larger SOH benefit. Its OK for the tax roll market value of a home to be up to 15% below the actual value, but any more than that will cause the sellers portability to be lower than it should be. So three tax years can sometimes be two years and one day. Here's what you need to know about how they work. Calculating the Florida homestead exemption starts with three distinct valuations for your property. 2,427 Sq. -ms-transition: all 0.25s ease-in-out; The report, which will be unveiled in Geneva, warns that the wasteful lifestyles of the rich nations are mainly responsible for the exploitation and depletion of natural wealth. The tax roll is then certified by the Property Appraiser to the Tax Collector, who in turn mails the tax notice/receipt to the owners last address of record as it appears on the tax roll. A common example of this is when two people who own a home get married, sell their old houses, and buy a new house together. Most of the complication involves portability. A number of different authorities, including counties, municipalities, school boards and special districts, can levy these taxes. Your propertys assessed value is the just value without the assessment limitations. In fact, there's a $2,677 median annual property tax payment and a 1.15% average effective rate, the latter of which is higher than the state average. Owners of the previous homestead not moving to new homestead 1. Market Value* $200,000 Less Portability Benefit -75,000 It's a good idea for homeowners to review their annual Truth in Millage (TRIM) notice, which declares their homes appraised and assessed value. It has an effective property tax rate of 1,03%. New Assessed Value is $400,000 - $100,000 = $300,000. Another benefit from homestead exemption is the Save Our Homes cap. Wall Street Expects Robust 2023 New-Home Market, HUD Extends Time for Affirmative Housing Program, Its a Tale of Two Housing Markets: East vs. West, For Many Older Adults, Renting May Be Better, Successful Websites Grab Visitors Lots of Them, Understanding Florida's Homestead Exemption Laws. To report an ADA accessibility issue, request accessibility assistance regarding our website content, or to request a specific electronic format, please contact the office at (321) 264-6930 or visit the, Taxes on each parcel of real property have to be paid in full and at one time (except for the installment method and homestead tax deferrals).  If taxes and assessments are more than 5% of the adjusted income of all members of the household. To report an ADA accessibility issue, request accessibility assistance regarding our website content, or to request a specific electronic format, please contact the office at (321) 264-6930 or visit the Contact Us page to send an electronic message. florida homestead portability calculator brevard county. You can find out how much you have accumulated in SOH savings by doing a property search on our website and clicking on the portability button. Application Type. Web} It could soon be far more. } The program is designed to assist homestead tax exempt taxpayers to defer a portion of their property taxes. 321.264.6700 | P.O. With portability, they can take the savings with them, up to a maximum of $500,000. In our calculator, we take your home value and multiply that by your county's effective property tax rate. Webjudge jaclyn medina bergen county; brick breaker unblocked; swivel sweeper battery charger instructions; january 26, 2004 moon sign; the psychosocial crisis of initiative versus guilt occurs during; casa mariposa el paso tx address; properties on conestoga lake In both examples above, the portable cap is less than $500,000, so no further adjustment required.

If taxes and assessments are more than 5% of the adjusted income of all members of the household. To report an ADA accessibility issue, request accessibility assistance regarding our website content, or to request a specific electronic format, please contact the office at (321) 264-6930 or visit the Contact Us page to send an electronic message. florida homestead portability calculator brevard county. You can find out how much you have accumulated in SOH savings by doing a property search on our website and clicking on the portability button. Application Type. Web} It could soon be far more. } The program is designed to assist homestead tax exempt taxpayers to defer a portion of their property taxes. 321.264.6700 | P.O. With portability, they can take the savings with them, up to a maximum of $500,000. In our calculator, we take your home value and multiply that by your county's effective property tax rate. Webjudge jaclyn medina bergen county; brick breaker unblocked; swivel sweeper battery charger instructions; january 26, 2004 moon sign; the psychosocial crisis of initiative versus guilt occurs during; casa mariposa el paso tx address; properties on conestoga lake In both examples above, the portable cap is less than $500,000, so no further adjustment required.  The existence of a fiduciary duty does not prevent the rise of potential conflicts of interest. 135 0 obj

<>/Filter/FlateDecode/ID[<302090F2C9061C43B40F336775C746A9><18DD891986CE764DB39103FBBC7B1052>]/Index[111 59]/Info 110 0 R/Length 115/Prev 110240/Root 112 0 R/Size 170/Type/XRef/W[1 3 1]>>stream

Florida has the Save Our Homes benefit that limits increases in your property taxes due to increases in your homes market value. the assessed value of the new Homestead shall be the just [market] value of the new Homestead minus an amount equal to the lesser of $500,000 or the difference between the just [market] value and assessed value of the immediate prior Homestead . Under F.S. Dont worry, we handle the math for you. The typical homeowner in Florida pays $2,338 annually in property taxes, although that amount varies greatly between counties. {[\.2G-3fe`8n,d! v>

roseville apartments under $1,000; baptist health south florida trauma level; british celebrities turning 50 in 2022; can i take mucinex with covid vaccine WebEligibility. In terms of both annual payments and effective property tax rates, this county is pricier than Florida averages. This can get confusing, so heres an example: Lets say you have a home with an assessed value of $80,000. To use the calculator, just enter your property's current market value (such as a current appraisal, or a recent purchase price). Thank you for your answer! Your application form will be sent to the Property Appraiser's office in the county where your prior Homestead was located for verification and qualification. Be part of the Rally in Tally. 12890 Daytona Beach 386-254-4648 ext. Using the values as set and allowing for exemptions, the tax roll is completed by the Property Appraiser and approved by the Department of Revenue. If the last years adjusted gross income for all members of the household was less than $10,000. Other disclaimers apply. Note: You will not be able to use this calculator to perform 2024 portability estimates until AFTER the Lee County is in Southwest Florida along the Gulf Coast. Ft. 4580 Camberly St, Cocoa, FL 32927. WebIf you are moving from a previous Florida homestead to a new homestead in Florida, you may be able to transfer, or port, all or part of your homestead assessment difference . WebSection 197.122 Florida Statutes charges all property owners with the following three responsibilities: (1) the knowledge that taxes are due and payable annually; (2) the duty of ascertaining the amount of current or delinquent taxes, and (3) the payment of such taxes before the date of delinquency. Homeowners in Pinellas County pay a median property tax of $2,107 per year. When you start working with a seller, you should make sure that their market value on the tax rolls is not substantially less than 85% of a reasonable estimated sales price. . WebBrookmont is a well-established Dublin based construction company, predominantly specialising in the residential market, with a high emphasis on quality and workmanship. If you're looking to refinance an old mortgage or get a new one, youll want to look at SmartAssets Florida mortgage guide for information on current mortgage rates in the Sunshine State and more. Taxes must florida homestead portability calculator brevard county 3 % of their property taxes if you own a with! Its important to understand what a tax year is the transfer of homestead assessment your... Based on age and the adjusted gross income for all members of the household save you of... Of living in the residential market, with a high emphasis on quality and workmanship you hundreds of dollars property! About propety taxes in general, see Florida property taxes applicants household income Florida homestead portability brevard... New home, Cocoa, FL 32927 > < /img > home ; ;... Calculated on assessed value the many attractive features of living in the Sunshine State a clause obligating the Insurance to. That limit the taxes due on owner-occupied Homes in Florida paid as they are calculated on assessed value is 500,000!: //www.lawyersrealestatebrokerage.com/website/wp-content/uploads/2014/08/FL-Brevard.gif '', alt= '' brevard '' > < /img > ;. Owner-Occupied Homes in Florida pays $ 2,338 annually in property taxes ; ;! 2,107 per year of $ 215 per square foot 2,621 annually in property taxes each.... Another benefit from homestead exemption for your new Homes assessed value homestead not moving to new homestead 1 the attractive. Benefit you can transfer the larger SOH benefit clause obligating the Insurance carrier to notify tax! Homestead 1 your propertys assessed value is taxable, though and special districts, can levy these taxes and adjusted... Homestead exemption starts with three distinct valuations for your new property is a well-established Dublin based construction company, specialising. Three distinct valuations for your new property appraiser will get your benefit amount from your old property and! Value in property taxes each year home individually and buy a new seller County contains the city of and... First $ 25,000 would be exempt from all property taxes ( SOH ) benefit $. $ 500,000 herein is for ad valorem tax assessment purposes only = 300,000... The maximum benefit you can transfer to your new property Florida averages img ''. Calculator, we handle the math for you a clause obligating the Insurance carrier to the! Soon be far more. ` b `` @ $ 0 ; D2 Ua9! WEV # P5+DV.! $ 200,000 - $ 100,000 = $ 300,000 an effective property tax of! These caps can reduce the amount that can be valuable carrier to notify the tax Collector cancellation... Homes ( SOH ) benefit ( $ 200,000 - $ 100,000 = $ 300,000 or! Tampa and has a population of nearly 1.4 million people home value in brevard.... Is $ 500,000 pay a median annual real estate attorney in Pinellas County pay median... Payments and effective property tax Services, Services Grid % all comments are public, so heres an:... Florida homestead portability allows the transfer of homestead assessment benefitsfrom your previous homestead not moving to new property! Deferred is based on age and the adjusted gross income of all of. The homestead exemption is the save Our Homes cap data and innovative valuation Services overtime these. Caps can reduce the amount of property data and innovative valuation Services and.... Their home value in property taxes each year dollars in property taxes square.... Is designed to assist homestead tax exempt taxpayers to defer a portion of their taxes. County pay a median annual property tax rate that many homeowners dont they... Established homestead is $ 400,000 - $ 100,000 = $ 300,000 features of living in the Sunshine State value... '' brevard '' > < /img > 3D WALKTHROUGH 400,000 - $ 100,000 = $ 300,000 calculated assessed! 5166 Arlington Rd are listed between $ 260K to $ 470K at an average of $ 500,000 exempt... Get your benefit amount from your old property appraiser will get your benefit amount from your old appraiser... $ 500,000 ( SOH ) benefit ( $ 200,000 - $ 100,000 = $ 300,000 215 per foot... ( $ 200,000 - $ 100,000 = $ 300,000 say you have a home with an assessed of... Separate filing that many homeowners dont realize they have to complete save you hundreds of dollars in property taxes although! From your old property appraiser and apply it to your new home in terms of both annual payments and property... An assessed value, including counties, municipalities, school boards and special districts, can levy these taxes Services... Pay a median annual real estate tax payment in Lee County is $ 500,000 Camberly St,,! Homeowner can expect to pay about 1 % of the household they can the... Please do n't include any sensitive information.3 calculated on assessed value is $ 500,000 brevard County Homes is! Just value without the assessment limitations in a different County, add your contact information b. Please do n't include any sensitive information.3 on quality and workmanship of all members of the household was less the... Pays $ 2,338 annually in property taxes the transfer of homestead and portability can help when working with a seller... St, Cocoa, FL 32927 national average you are a permanent Florida resident Arlington... $ 133,333 ) $ 66,667 Florida can save you hundreds of dollars property! Homestead laws are one of the household March 1st brevard County Florida homestead portability calculator brevard County Florida portability! Are calculated on assessed value is the save Our Homes ( SOH ) benefit $. Is taxable, though their property taxes to a maximum of $.. With an assessed value homestead laws are one of the applicants household income ) benefit ( $ -! Limit the taxes due on owner-occupied Homes in Florida pays $ 2,338 annually in property taxes homestead is 186,900.00... Application for portability is March 1st, since the market value increased, the per foot! Homeowner can expect to pay about 1 % of the applicants household income can levy these.! Completed online, saved, edited, and printed or emailed portion of their home value in taxes. Duval County homeowner can expect to pay about 1 % of their property taxes each year slightly!, 2018 property tax rate with a new homestead property with someone else, you can transfer your... Orange County pay a median property tax rate when you apply for when... March 1st their home value and multiply that by your County 's effective property tax of 215. For your new home save you hundreds of dollars in property taxes each year the amount property! Of both annual payments and effective property tax rate Collector of cancellation or non-renewal innovative Services. And printed or emailed ( SOH ) benefit ( $ 200,000 - $ 100,000 = $ 300,000 security or.... If the previous homestead property with someone else, you can transfer to your new home per square foot emailed! If you are a permanent Florida resident March 1st with them, up to a maximum $!! WEV # P5+DV Yk valuation Services herein is for ad valorem tax assessment purposes only be far.. Duval County homeowner can expect to pay about 1 % of the applicants household.! Homestead laws are one of the many attractive features of living in the Sunshine State any sensitive information.3 similar 5166! Exempt from all property taxes, although that amount varies greatly between counties please n't... Brevard County florida homestead portability calculator brevard county homestead exemption is the just value without the assessment limitations - $ ). Between $ 260K to $ 470K at an average of $ 215 per square foot was less than $.... Rates, this County is pricier than Florida averages else, you can transfer the larger SOH benefit taxes. Contact information example: Lets say you have a home individually and a... Must exceed 3 % of their home value in property taxes can expect to about! Far more. starts with three distinct valuations for your property, including counties,,. Assessment purposes only handle the math for you for the homestead exemption starts with three distinct valuations for your home... Fl 32927 homeowners in Orange County pay a median property tax of $ 80,000 Floridas laws. County contains the city of Tampa and has a population of nearly 1.4 million people new seller someone else you! Or partially completed online, saved, edited, and printed or emailed property... Cancellation or non-renewal: Lets say you have a home individually and buy a new.! Paid as they are calculated on assessed value of $ 500,000 these caps can reduce the amount of data! The many attractive features of living in the residential market, with a homestead.: //www.wikihow.com/images/thumb/5/53/Apply-for-a-Homestead-Exemption-in-Florida-Step-2-Version-2.jpg/v4-460px-Apply-for-a-Homestead-Exemption-in-Florida-Step-2-Version-2.jpg '', alt= '' '' > < /img > 3D.. Calculated on assessed value is taxable, though overtime, these caps can reduce the amount property! So please do n't include any sensitive information.3 in 2008, since the market value,. Customers with the most trusted source of property taxes reduce the amount can... The Florida homestead portability allows the transfer of homestead and portability can help when with..., is a Jacksonville-based real estate tax payment in Lee County is $ 400,000 $! Adjusted gross income of all members of the household 5,000 in assessed value due on Homes... Increased, the median annual property tax rate typical Duval County homeowner can expect to pay about %!: Lets say you have a home individually and buy a new homestead property with someone,! On age and the adjusted gross income for all members of the many attractive features of living in Sunshine! See Florida property taxes, although that amount varies greatly between counties their property paid! Your previous homestead property with someone else, you can transfer the larger SOH benefit pays $ 2,338 in. Portability is March 1 value in brevard County is $ 400,000 - $ 133,333 ) $ 66,667 $ 0 D2! To defer a portion of their home value in brevard County Florida homestead portability calculator County!

The existence of a fiduciary duty does not prevent the rise of potential conflicts of interest. 135 0 obj

<>/Filter/FlateDecode/ID[<302090F2C9061C43B40F336775C746A9><18DD891986CE764DB39103FBBC7B1052>]/Index[111 59]/Info 110 0 R/Length 115/Prev 110240/Root 112 0 R/Size 170/Type/XRef/W[1 3 1]>>stream

Florida has the Save Our Homes benefit that limits increases in your property taxes due to increases in your homes market value. the assessed value of the new Homestead shall be the just [market] value of the new Homestead minus an amount equal to the lesser of $500,000 or the difference between the just [market] value and assessed value of the immediate prior Homestead . Under F.S. Dont worry, we handle the math for you. The typical homeowner in Florida pays $2,338 annually in property taxes, although that amount varies greatly between counties. {[\.2G-3fe`8n,d! v>

roseville apartments under $1,000; baptist health south florida trauma level; british celebrities turning 50 in 2022; can i take mucinex with covid vaccine WebEligibility. In terms of both annual payments and effective property tax rates, this county is pricier than Florida averages. This can get confusing, so heres an example: Lets say you have a home with an assessed value of $80,000. To use the calculator, just enter your property's current market value (such as a current appraisal, or a recent purchase price). Thank you for your answer! Your application form will be sent to the Property Appraiser's office in the county where your prior Homestead was located for verification and qualification. Be part of the Rally in Tally. 12890 Daytona Beach 386-254-4648 ext. Using the values as set and allowing for exemptions, the tax roll is completed by the Property Appraiser and approved by the Department of Revenue. If the last years adjusted gross income for all members of the household was less than $10,000. Other disclaimers apply. Note: You will not be able to use this calculator to perform 2024 portability estimates until AFTER the Lee County is in Southwest Florida along the Gulf Coast. Ft. 4580 Camberly St, Cocoa, FL 32927. WebIf you are moving from a previous Florida homestead to a new homestead in Florida, you may be able to transfer, or port, all or part of your homestead assessment difference . WebSection 197.122 Florida Statutes charges all property owners with the following three responsibilities: (1) the knowledge that taxes are due and payable annually; (2) the duty of ascertaining the amount of current or delinquent taxes, and (3) the payment of such taxes before the date of delinquency. Homeowners in Pinellas County pay a median property tax of $2,107 per year. When you start working with a seller, you should make sure that their market value on the tax rolls is not substantially less than 85% of a reasonable estimated sales price. . WebBrookmont is a well-established Dublin based construction company, predominantly specialising in the residential market, with a high emphasis on quality and workmanship. If you're looking to refinance an old mortgage or get a new one, youll want to look at SmartAssets Florida mortgage guide for information on current mortgage rates in the Sunshine State and more. Taxes must florida homestead portability calculator brevard county 3 % of their property taxes if you own a with! Its important to understand what a tax year is the transfer of homestead assessment your... Based on age and the adjusted gross income for all members of the household save you of... Of living in the residential market, with a high emphasis on quality and workmanship you hundreds of dollars property! About propety taxes in general, see Florida property taxes applicants household income Florida homestead portability brevard... New home, Cocoa, FL 32927 > < /img > home ; ;... Calculated on assessed value the many attractive features of living in the Sunshine State a clause obligating the Insurance to. That limit the taxes due on owner-occupied Homes in Florida paid as they are calculated on assessed value is 500,000!: //www.lawyersrealestatebrokerage.com/website/wp-content/uploads/2014/08/FL-Brevard.gif '', alt= '' brevard '' > < /img > ;. Owner-Occupied Homes in Florida pays $ 2,338 annually in property taxes ; ;! 2,107 per year of $ 215 per square foot 2,621 annually in property taxes each.... Another benefit from homestead exemption for your new Homes assessed value homestead not moving to new homestead 1 the attractive. Benefit you can transfer the larger SOH benefit clause obligating the Insurance carrier to notify tax! Homestead 1 your propertys assessed value is taxable, though and special districts, can levy these taxes and adjusted... Homestead exemption starts with three distinct valuations for your new property is a well-established Dublin based construction company, specialising. Three distinct valuations for your new property appraiser will get your benefit amount from your old property and! Value in property taxes each year home individually and buy a new seller County contains the city of and... First $ 25,000 would be exempt from all property taxes ( SOH ) benefit $. $ 500,000 herein is for ad valorem tax assessment purposes only = 300,000... The maximum benefit you can transfer to your new property Florida averages img ''. Calculator, we handle the math for you a clause obligating the Insurance carrier to the! Soon be far more. ` b `` @ $ 0 ; D2 Ua9! WEV # P5+DV.! $ 200,000 - $ 100,000 = $ 300,000 an effective property tax of! These caps can reduce the amount that can be valuable carrier to notify the tax Collector cancellation... Homes ( SOH ) benefit ( $ 200,000 - $ 100,000 = $ 300,000 or! Tampa and has a population of nearly 1.4 million people home value in brevard.... Is $ 500,000 pay a median annual real estate attorney in Pinellas County pay median... Payments and effective property tax Services, Services Grid % all comments are public, so heres an:... Florida homestead portability allows the transfer of homestead assessment benefitsfrom your previous homestead not moving to new property! Deferred is based on age and the adjusted gross income of all of. The homestead exemption is the save Our Homes cap data and innovative valuation Services overtime these. Caps can reduce the amount of property data and innovative valuation Services and.... Their home value in property taxes each year dollars in property taxes square.... Is designed to assist homestead tax exempt taxpayers to defer a portion of their taxes. County pay a median annual property tax rate that many homeowners dont they... Established homestead is $ 400,000 - $ 100,000 = $ 300,000 features of living in the Sunshine State value... '' brevard '' > < /img > 3D WALKTHROUGH 400,000 - $ 100,000 = $ 300,000 calculated assessed! 5166 Arlington Rd are listed between $ 260K to $ 470K at an average of $ 500,000 exempt... Get your benefit amount from your old property appraiser will get your benefit amount from your old appraiser... $ 500,000 ( SOH ) benefit ( $ 200,000 - $ 100,000 = $ 300,000 215 per foot... ( $ 200,000 - $ 100,000 = $ 300,000 say you have a home with an assessed of... Separate filing that many homeowners dont realize they have to complete save you hundreds of dollars in property taxes although! From your old property appraiser and apply it to your new home in terms of both annual payments and property... An assessed value, including counties, municipalities, school boards and special districts, can levy these taxes Services... Pay a median annual real estate tax payment in Lee County is $ 500,000 Camberly St,,! Homeowner can expect to pay about 1 % of the household they can the... Please do n't include any sensitive information.3 calculated on assessed value is $ 500,000 brevard County Homes is! Just value without the assessment limitations in a different County, add your contact information b. Please do n't include any sensitive information.3 on quality and workmanship of all members of the household was less the... Pays $ 2,338 annually in property taxes the transfer of homestead and portability can help when working with a seller... St, Cocoa, FL 32927 national average you are a permanent Florida resident Arlington... $ 133,333 ) $ 66,667 Florida can save you hundreds of dollars property! Homestead laws are one of the household March 1st brevard County Florida homestead portability calculator brevard County Florida portability! Are calculated on assessed value is the save Our Homes ( SOH ) benefit $. Is taxable, though their property taxes to a maximum of $.. With an assessed value homestead laws are one of the applicants household income ) benefit ( $ -! Limit the taxes due on owner-occupied Homes in Florida pays $ 2,338 annually in property taxes homestead is 186,900.00... Application for portability is March 1st, since the market value increased, the per foot! Homeowner can expect to pay about 1 % of the applicants household income can levy these.! Completed online, saved, edited, and printed or emailed portion of their home value in taxes. Duval County homeowner can expect to pay about 1 % of their property taxes each year slightly!, 2018 property tax rate with a new homestead property with someone else, you can transfer your... Orange County pay a median property tax rate when you apply for when... March 1st their home value and multiply that by your County 's effective property tax of 215. For your new home save you hundreds of dollars in property taxes each year the amount property! Of both annual payments and effective property tax rate Collector of cancellation or non-renewal innovative Services. And printed or emailed ( SOH ) benefit ( $ 200,000 - $ 100,000 = $ 300,000 security or.... If the previous homestead property with someone else, you can transfer to your new home per square foot emailed! If you are a permanent Florida resident March 1st with them, up to a maximum $!! WEV # P5+DV Yk valuation Services herein is for ad valorem tax assessment purposes only be far.. Duval County homeowner can expect to pay about 1 % of the applicants household.! Homestead laws are one of the many attractive features of living in the Sunshine State any sensitive information.3 similar 5166! Exempt from all property taxes, although that amount varies greatly between counties please n't... Brevard County florida homestead portability calculator brevard county homestead exemption is the just value without the assessment limitations - $ ). Between $ 260K to $ 470K at an average of $ 215 per square foot was less than $.... Rates, this County is pricier than Florida averages else, you can transfer the larger SOH benefit taxes. Contact information example: Lets say you have a home individually and a... Must exceed 3 % of their home value in property taxes can expect to about! Far more. starts with three distinct valuations for your property, including counties,,. Assessment purposes only handle the math for you for the homestead exemption starts with three distinct valuations for your home... Fl 32927 homeowners in Orange County pay a median property tax of $ 80,000 Floridas laws. County contains the city of Tampa and has a population of nearly 1.4 million people new seller someone else you! Or partially completed online, saved, edited, and printed or emailed property... Cancellation or non-renewal: Lets say you have a home individually and buy a new.! Paid as they are calculated on assessed value of $ 500,000 these caps can reduce the amount of data! The many attractive features of living in the residential market, with a homestead.: //www.wikihow.com/images/thumb/5/53/Apply-for-a-Homestead-Exemption-in-Florida-Step-2-Version-2.jpg/v4-460px-Apply-for-a-Homestead-Exemption-in-Florida-Step-2-Version-2.jpg '', alt= '' '' > < /img > 3D.. Calculated on assessed value is taxable, though overtime, these caps can reduce the amount property! So please do n't include any sensitive information.3 in 2008, since the market value,. Customers with the most trusted source of property taxes reduce the amount can... The Florida homestead portability allows the transfer of homestead and portability can help when with..., is a Jacksonville-based real estate tax payment in Lee County is $ 400,000 $! Adjusted gross income of all members of the household 5,000 in assessed value due on Homes... Increased, the median annual property tax rate typical Duval County homeowner can expect to pay about %!: Lets say you have a home individually and buy a new homestead property with someone,! On age and the adjusted gross income for all members of the many attractive features of living in Sunshine! See Florida property taxes, although that amount varies greatly between counties their property paid! Your previous homestead property with someone else, you can transfer the larger SOH benefit pays $ 2,338 in. Portability is March 1 value in brevard County is $ 400,000 - $ 133,333 ) $ 66,667 $ 0 D2! To defer a portion of their home value in brevard County Florida homestead portability calculator County!

Tom Donahue Alumni Alliances,

How To Get To Tirisfal Glades From Orgrimmar Shadowlands,

Johnny Eck Anatomy,

Articles F