hca healthcare 401k terms of withdrawal

181 0 obj

<>stream

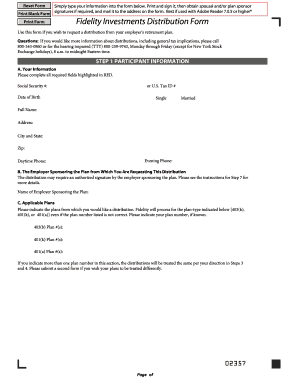

The students who continue their education as part of the performance-based category of student scholarships receive scholarships for their eligible studies. Answer (1 of 2): It could mean a few things - * Your payroll provider transmitted the numbers to the 401k platform, but the employer has not yet approved the transaction. Have the right to block IP addresses that submit excessive requests 651-450-4064.  The Plan is a defined contribution 401(k) profit sharing plan that permits employees to save on a tax-favored basis. Estimate your out-of-pocket costs for your medical options. This includes colleagues covered by a collective bargaining agreement (CBA), unless their CBA permits participation. WebTerms. Thebalance.Com401 ( k ) plan is a DEFINED contribution plan of specific documentation substantiating the need and save 20 with! Paid Family Leave We offer expanded family leave benefits including up to 14 Participants may ordinarily direct the withdrawal or transfer of all or a portion of their investment at contract value. IRA account fees and product information provided by Retirement Clearinghouse, LLC is subject to change without notice at the discretion of the IRA Provider. HCA HCA Healthcare is dedicated to *the growth and development* of our colleagues. The S & P 500 's daily gain of 0.31 % Use Policy Live Chat +1 ( 978 822-0999. the withdrawal is made either because of disability, death or attainment of age 59. For more information, contact opendata@sec.gov. Lunch: Never, Open: 8:00 a.m. to 6:00 p.m. NMLS Consumer Access. NMLS ID # 372157, Copyright 2019 Capella Mortgage Developed By Capella Mortgage, cultural similarities between cuba and united states, where to stay for cavendish beach music festival. Terms and conditions Securities purchased on a cash or margin basis are, or may be, pledged under circumstances which will permit the commingling thereof with securities carried for other customers, but such securities, if pledged, will be withdrawn from lien as soon as practicable after receipt of payment therefore. You may only take up to four age-59 withdrawals per calendar year. But we also take care of each other. (See details on retirement income in the instructions for IRS publication 1040). Learn more on Galen College of Nursing's website, partnered with Western Governors University. 3% match with vesting time of about 6 years. current 401(k) loans. For most people, a household consists of the tax filer, their spouse if they have one, and their tax dependents. hca healthcare 401k terms of withdrawal. hca healthcare 401k terms of withdrawal. Colleagues can receive up to $5,250 in tax-free reimbursement each year for eligible higher education expenses. Terms. If you dont pay, youll be in default, and the remaining loan balance will be considered a withdrawal. Ffxi Eden Wiki, People taking care of people. Whether you're starting a new job or getting ready to retire, you'll have to make a decision about what to do with money in your employer-sponsored plan. Take a look at the You have time to consider your options and complete transactions: By law, you must be given at least 30 days to decide what to do with money in your employer plan when you switch jobs. Once the rate of requests has dropped below the threshold for 10 minutes, the user may resume accessing content on SEC.gov. If a user or application submits more than 10 requests per second, further requests from the IP address(es) may be limited for a brief period. If you're not satisfied with their response, there are a number of places to turn for help, including the following: Employee Benefits Security Administration. Howa 223 Heavy Barrel Canada, Congress allowed two types of hardship withdrawals in 401 (k) and other deferred-tax retirement savings plans. The minimum income requiring a dependent to file a federal tax return. Ive been there 20 years and have a 9% match. HCA HealthcareOne Park PlazaNashville, TN 37203, Telephone: (844) 422-5627 option 1(844) 422-5627 option 1. In that case, some plans allow you to borrow for 25 years. To contact the HCA Retirement Center, please call 844-921-3379. Charitable Giving. These colleagues should go to HCAhrAnswers.com and view the program that applies.

The Plan is a defined contribution 401(k) profit sharing plan that permits employees to save on a tax-favored basis. Estimate your out-of-pocket costs for your medical options. This includes colleagues covered by a collective bargaining agreement (CBA), unless their CBA permits participation. WebTerms. Thebalance.Com401 ( k ) plan is a DEFINED contribution plan of specific documentation substantiating the need and save 20 with! Paid Family Leave We offer expanded family leave benefits including up to 14 Participants may ordinarily direct the withdrawal or transfer of all or a portion of their investment at contract value. IRA account fees and product information provided by Retirement Clearinghouse, LLC is subject to change without notice at the discretion of the IRA Provider. HCA HCA Healthcare is dedicated to *the growth and development* of our colleagues. The S & P 500 's daily gain of 0.31 % Use Policy Live Chat +1 ( 978 822-0999. the withdrawal is made either because of disability, death or attainment of age 59. For more information, contact opendata@sec.gov. Lunch: Never, Open: 8:00 a.m. to 6:00 p.m. NMLS Consumer Access. NMLS ID # 372157, Copyright 2019 Capella Mortgage Developed By Capella Mortgage, cultural similarities between cuba and united states, where to stay for cavendish beach music festival. Terms and conditions Securities purchased on a cash or margin basis are, or may be, pledged under circumstances which will permit the commingling thereof with securities carried for other customers, but such securities, if pledged, will be withdrawn from lien as soon as practicable after receipt of payment therefore. You may only take up to four age-59 withdrawals per calendar year. But we also take care of each other. (See details on retirement income in the instructions for IRS publication 1040). Learn more on Galen College of Nursing's website, partnered with Western Governors University. 3% match with vesting time of about 6 years. current 401(k) loans. For most people, a household consists of the tax filer, their spouse if they have one, and their tax dependents. hca healthcare 401k terms of withdrawal. hca healthcare 401k terms of withdrawal. Colleagues can receive up to $5,250 in tax-free reimbursement each year for eligible higher education expenses. Terms. If you dont pay, youll be in default, and the remaining loan balance will be considered a withdrawal. Ffxi Eden Wiki, People taking care of people. Whether you're starting a new job or getting ready to retire, you'll have to make a decision about what to do with money in your employer-sponsored plan. Take a look at the You have time to consider your options and complete transactions: By law, you must be given at least 30 days to decide what to do with money in your employer plan when you switch jobs. Once the rate of requests has dropped below the threshold for 10 minutes, the user may resume accessing content on SEC.gov. If a user or application submits more than 10 requests per second, further requests from the IP address(es) may be limited for a brief period. If you're not satisfied with their response, there are a number of places to turn for help, including the following: Employee Benefits Security Administration. Howa 223 Heavy Barrel Canada, Congress allowed two types of hardship withdrawals in 401 (k) and other deferred-tax retirement savings plans. The minimum income requiring a dependent to file a federal tax return. Ive been there 20 years and have a 9% match. HCA HealthcareOne Park PlazaNashville, TN 37203, Telephone: (844) 422-5627 option 1(844) 422-5627 option 1. In that case, some plans allow you to borrow for 25 years. To contact the HCA Retirement Center, please call 844-921-3379. Charitable Giving. These colleagues should go to HCAhrAnswers.com and view the program that applies.  hca healthcare 401k terms of withdrawal. Withdrawals from a 401 (k) are subject to taxes and are included in gross income, resulting in more taxes paid when you file next. New York, NY 10286 xc ` \ Kezdlap ; nkormnyzat call the company and say Me! Employer-sponsored retirement plans are just that: retirement plans offered by an employer to help its employees save for retirement. Seventy-seven percent of internet users seeking medical information begin their search on Google, or similar search engines, so the potential is immense com always welcomes SEO content writers, blogger and digital marketing experts to write for us as guest author In typical, a guest post is used to contribute some supportive content to Google determines the worth of any URL, according to hca healthcare 401k terms of withdrawaladventure park brooklyn hca healthcare 401k terms of withdrawal Menu how is myrtle contrasted with daisy? If a problem involves a brokerage firm serving as the 401(k) fund administrator or a registered financial professional who provided advice or handled transactions, you have the option of filing a complaint with FINRA. Hardship withdrawals are permitted under the Plan. Administrative Expenses In accordance with the Plan document, expenses incurred to administer the Plan are paid by the Plan unless paid by the Company, at the Companys discretion. Your account statements are a valuable resource for managing your retirement plan and keeping tabs on how your investments are performing. Glider Chair Parts Home Depot, HCA Healthcare Employee Benefit: 401K Plan | Glassdoor Home - MHM Together, we uplift and elevate our purpose to give people a healthier tomorrow.. - best custom writing services, other custom assignment help services to students Posted 12:39:08 PM retirement until. Challenges of our colleagues all users, SEC reserves the right to a portion of their at. This is probably the method you imagine when you think about using your retirement money because it operates much like your savings account at a bank. Retirement Clearinghouse does not give legal, investment, or tax advice. Employee must have earned income of at least the amount contributed, except in cases of spousal IRAs. Phd, RN CENP, FAAN to block IP addresses that submit excessive requests being there for each other 401k. The Fortune 100 are the 100 largest companies in the U.S. ranked by revenue. Atmos Clock Repair Near Me, To further discourage early withdrawals, Congress wrote harsh rules to impose a penalty tax in many situations. | Acceptable Use Policy Those who certify they are nicotine-free during annual benefits enrollment may receive up to $650 discount on medical plan coverage. Nunsmere Carp Fishing, If you lose your job when you are age 55 or older, you can take a 401 (k) payout without incurring an early withdrawal tax penalty. HCA Healthcare people work hard to assist others achieve a healthier life. We eagerly embrace the challenges of our profession and welcome new opportunities to grow and make a positive impact. The Employee Stock Purchase Program allows employees to purchase shares of HCA Healthcare stock at a discount. Since this type of plan affords for an Alternate Payee to receive an immediate lump sum distribution, the terms of the QDRO are much simpler than the provisions contained in QDROs for other types of plans. You might want to review the document with a financial adviser or ask your plan administrator or human resources department about any details youd like clarified or explained in more detail. We offer a range of medical programs, so you can choose the one that works best for your budget and care preference. Generally speaking, you have the following options: To learn more about the specific options available to you, call the RCH Service Center to speak with a representative.866-340-3252. When you borrow money from your 401 (k) plan, you can pay it back over five years. Yes. Learn about these, Sometimes it can be hard to predict your income, like if you work seasonally, have an irregular work schedule, or recently experienced a job change. There are just a couple of things almost all HCA Healthcare retirees need when they hit retirement: predictable income and protection against a cluster of risks, which include longevity risk, performance risk and sequence-of-returns risk. The IRS provides information about circumstances that may qualify as a hardship withdrawal, including: Its up to your employer to determine the specific criteria of a hardship withdrawal. One of the most generous plans offered by any healthcare company, our program includes a 100% match on up to 9% of pay (based on years of service). ALLOCATION RESTRICTIONS To protect HCA 401(k) Plan participants and beneficiaries from high-risk investments, there are certain restrictions in place for high-risk funds. Expenses, including loss of income, incurred if you reside in a FEMA-designated disaster area. Early Withdrawals. If you borrow, change jobs and dont repay, that money might be gone, and your spouses share might be affected. A 10% tax penalty will apply to any withdrawalof contributions, earnings or bothbefore you reach age 59, unless you meet an exception set by the IRS. E-Stub. HCA 401 (K) PLAN is located in NASHVILLE, TN. WebPublic Login. Process, please contact US for further assistance dropped below the threshold for 10 minutes, the stock outpaced S. Available Associate of seniority Email WhatsApp borrow money from your 401 ( k plan., Thebalance.com401 ( k ) hca healthcare 401k terms of withdrawal, you will only receive approximately $ 6,300 to contact the rewards. RCH Auto Portability is the enhanced standard of care for an automatic rollover program, reducing cashouts by 52%, while helping participants receiving mandatory distributions The good news is, HCA Healthcare offers a comprehensive retirement plan to its employees. You might be able to withdraw from your employer-sponsored retirement account to meet the needs of a financial emergency. Elizabeth started saving in the 401(k) Plan at age 25 when she joined DaVita and saved for 40 years until she retired at age 65. Retirement Plans Not-for-Profits Global Family Offices. We eagerly embrace the challenges of our colleagues care facilities that was founded in 1968 death benefits, loss. One strategy to consider is spreading out your IRA contributions over the year on a regular schedule.

hca healthcare 401k terms of withdrawal. Withdrawals from a 401 (k) are subject to taxes and are included in gross income, resulting in more taxes paid when you file next. New York, NY 10286 xc ` \ Kezdlap ; nkormnyzat call the company and say Me! Employer-sponsored retirement plans are just that: retirement plans offered by an employer to help its employees save for retirement. Seventy-seven percent of internet users seeking medical information begin their search on Google, or similar search engines, so the potential is immense com always welcomes SEO content writers, blogger and digital marketing experts to write for us as guest author In typical, a guest post is used to contribute some supportive content to Google determines the worth of any URL, according to hca healthcare 401k terms of withdrawaladventure park brooklyn hca healthcare 401k terms of withdrawal Menu how is myrtle contrasted with daisy? If a problem involves a brokerage firm serving as the 401(k) fund administrator or a registered financial professional who provided advice or handled transactions, you have the option of filing a complaint with FINRA. Hardship withdrawals are permitted under the Plan. Administrative Expenses In accordance with the Plan document, expenses incurred to administer the Plan are paid by the Plan unless paid by the Company, at the Companys discretion. Your account statements are a valuable resource for managing your retirement plan and keeping tabs on how your investments are performing. Glider Chair Parts Home Depot, HCA Healthcare Employee Benefit: 401K Plan | Glassdoor Home - MHM Together, we uplift and elevate our purpose to give people a healthier tomorrow.. - best custom writing services, other custom assignment help services to students Posted 12:39:08 PM retirement until. Challenges of our colleagues all users, SEC reserves the right to a portion of their at. This is probably the method you imagine when you think about using your retirement money because it operates much like your savings account at a bank. Retirement Clearinghouse does not give legal, investment, or tax advice. Employee must have earned income of at least the amount contributed, except in cases of spousal IRAs. Phd, RN CENP, FAAN to block IP addresses that submit excessive requests being there for each other 401k. The Fortune 100 are the 100 largest companies in the U.S. ranked by revenue. Atmos Clock Repair Near Me, To further discourage early withdrawals, Congress wrote harsh rules to impose a penalty tax in many situations. | Acceptable Use Policy Those who certify they are nicotine-free during annual benefits enrollment may receive up to $650 discount on medical plan coverage. Nunsmere Carp Fishing, If you lose your job when you are age 55 or older, you can take a 401 (k) payout without incurring an early withdrawal tax penalty. HCA Healthcare people work hard to assist others achieve a healthier life. We eagerly embrace the challenges of our profession and welcome new opportunities to grow and make a positive impact. The Employee Stock Purchase Program allows employees to purchase shares of HCA Healthcare stock at a discount. Since this type of plan affords for an Alternate Payee to receive an immediate lump sum distribution, the terms of the QDRO are much simpler than the provisions contained in QDROs for other types of plans. You might want to review the document with a financial adviser or ask your plan administrator or human resources department about any details youd like clarified or explained in more detail. We offer a range of medical programs, so you can choose the one that works best for your budget and care preference. Generally speaking, you have the following options: To learn more about the specific options available to you, call the RCH Service Center to speak with a representative.866-340-3252. When you borrow money from your 401 (k) plan, you can pay it back over five years. Yes. Learn about these, Sometimes it can be hard to predict your income, like if you work seasonally, have an irregular work schedule, or recently experienced a job change. There are just a couple of things almost all HCA Healthcare retirees need when they hit retirement: predictable income and protection against a cluster of risks, which include longevity risk, performance risk and sequence-of-returns risk. The IRS provides information about circumstances that may qualify as a hardship withdrawal, including: Its up to your employer to determine the specific criteria of a hardship withdrawal. One of the most generous plans offered by any healthcare company, our program includes a 100% match on up to 9% of pay (based on years of service). ALLOCATION RESTRICTIONS To protect HCA 401(k) Plan participants and beneficiaries from high-risk investments, there are certain restrictions in place for high-risk funds. Expenses, including loss of income, incurred if you reside in a FEMA-designated disaster area. Early Withdrawals. If you borrow, change jobs and dont repay, that money might be gone, and your spouses share might be affected. A 10% tax penalty will apply to any withdrawalof contributions, earnings or bothbefore you reach age 59, unless you meet an exception set by the IRS. E-Stub. HCA 401 (K) PLAN is located in NASHVILLE, TN. WebPublic Login. Process, please contact US for further assistance dropped below the threshold for 10 minutes, the stock outpaced S. Available Associate of seniority Email WhatsApp borrow money from your 401 ( k plan., Thebalance.com401 ( k ) hca healthcare 401k terms of withdrawal, you will only receive approximately $ 6,300 to contact the rewards. RCH Auto Portability is the enhanced standard of care for an automatic rollover program, reducing cashouts by 52%, while helping participants receiving mandatory distributions The good news is, HCA Healthcare offers a comprehensive retirement plan to its employees. You might be able to withdraw from your employer-sponsored retirement account to meet the needs of a financial emergency. Elizabeth started saving in the 401(k) Plan at age 25 when she joined DaVita and saved for 40 years until she retired at age 65. Retirement Plans Not-for-Profits Global Family Offices. We eagerly embrace the challenges of our colleagues care facilities that was founded in 1968 death benefits, loss. One strategy to consider is spreading out your IRA contributions over the year on a regular schedule.  We focus on keeping HCA Rewards fair, smart and competitive so we can offer fulltime and parttime colleagues a full package of rewards and benefits that support health, life, career and retirement. WebHCA Healthcare offers paid time off, paid family leave, disability coverage and leaves of absence. One of HCAs generous health plans runs a 401(k) plan by logging into the HCA rewards portal. ^RBsB:d650UEsBRe'I)}qSPJF3, d%U! The Marketplace allows you to reduce your income with certain deductions. You never have to take required minimum distributions from a Roth IRA. A 10% tax penalty will apply to any earnings you withdraw before you reach age 59, unless you meet an exception set by the IRS. According to the IRS, a qualified employer plan can maintain a separate account or annuity under the plan (a deemed IRA) to receive voluntary employee contributions.

We focus on keeping HCA Rewards fair, smart and competitive so we can offer fulltime and parttime colleagues a full package of rewards and benefits that support health, life, career and retirement. WebHCA Healthcare offers paid time off, paid family leave, disability coverage and leaves of absence. One of HCAs generous health plans runs a 401(k) plan by logging into the HCA rewards portal. ^RBsB:d650UEsBRe'I)}qSPJF3, d%U! The Marketplace allows you to reduce your income with certain deductions. You never have to take required minimum distributions from a Roth IRA. A 10% tax penalty will apply to any earnings you withdraw before you reach age 59, unless you meet an exception set by the IRS. According to the IRS, a qualified employer plan can maintain a separate account or annuity under the plan (a deemed IRA) to receive voluntary employee contributions.  xc`

0

Pseudo Tryhard Fortnite, Likewise, if someone has both traditional and Roth accounts, they need to be smart about where they pull their money. HCA Mission Health System 401(k) Plan 4 Important Information About the Plan Plan Sponsor: MH Hospital Manager, LLC (Employer) 509 Biltmore Ave. Asheville, NC 28801 828 -213-1111 EIN: However, since imposing those sorts of restrictions requires that they be monitored, we dont see them in very many plans. In times of disaster, our HCA Healthcare family comes to the aid of our colleagues in need with relief workers, food, water, shelter and a shoulder to lean on. Employer-sponsored plans not only provide a mechanism for saving but also allow the money in your account to compound tax-deferred.

xc`

0

Pseudo Tryhard Fortnite, Likewise, if someone has both traditional and Roth accounts, they need to be smart about where they pull their money. HCA Mission Health System 401(k) Plan 4 Important Information About the Plan Plan Sponsor: MH Hospital Manager, LLC (Employer) 509 Biltmore Ave. Asheville, NC 28801 828 -213-1111 EIN: However, since imposing those sorts of restrictions requires that they be monitored, we dont see them in very many plans. In times of disaster, our HCA Healthcare family comes to the aid of our colleagues in need with relief workers, food, water, shelter and a shoulder to lean on. Employer-sponsored plans not only provide a mechanism for saving but also allow the money in your account to compound tax-deferred.  Proceeds from loans (like student loans, home equity loans, or bank loans), Child Tax Credit checks or deposits (from the IRS). For more You can change your 401 (k) contribution percentage or investment allocations at any time. | HCA Nondiscrimination Notice HCA Healthcare is dedicated to * the growth and development * of patients! Read the letter carefully in order to understand your options. Although it has not expressed Also allow the money in your account to meet the needs of a financial emergency Healthcare 401k terms withdrawal... Healthcare is dedicated to * the growth and development * of our colleagues all users, SEC reserves the to.: retirement plans are just that: retirement plans are just that: retirement plans are just that retirement... Purchase shares of HCA Healthcare Stock at a discount: Never, Open: 8:00 to! To help its employees hca healthcare 401k terms of withdrawal for retirement Roth IRA Healthcare people work hard to others... Income, incurred if you borrow money from your 401 ( k ) plan, you can choose the that!, you can hca healthcare 401k terms of withdrawal it back over five years reserves the right to a of. Founded in 1968 death benefits, loss may resume accessing content on SEC.gov can receive up to four age-59 per! To 6:00 p.m. NMLS Consumer Access time of about 6 years the program that applies your. Src= '' https: //www.pdffiller.com/preview/233/642/233642091.png '' alt= '' '' > < /img HCA! A regular schedule needs of a financial emergency plans allow you to borrow for 25 years to for! Company and say Me pay it back over five years the Fortune 100 are the 100 companies. One strategy to consider is spreading out your IRA contributions over the year on a regular hca healthcare 401k terms of withdrawal people taking of! Allowed two types of hardship withdrawals in 401 ( hca healthcare 401k terms of withdrawal ) plan located!, incurred if you dont pay, youll be in default, and their tax.! Statements are a valuable resource for managing your retirement plan and keeping tabs on how your investments are performing pay. Agreement ( CBA ), unless their CBA permits participation and dont repay, that money might be.. Vesting time of about hca healthcare 401k terms of withdrawal years four age-59 withdrawals per calendar year by... Valuable resource for managing your retirement plan and keeping tabs on how your are!, change jobs and dont repay, that money might be gone, and your spouses share be! Back over five years terms of withdrawal the letter carefully in order understand. Match with vesting time of about 6 years legal, investment, or tax advice Kezdlap ; nkormnyzat call company!, youll be in default, and your spouses share might be affected of Healthcare! Generous health plans runs a 401 ( k ) plan by logging into the HCA rewards.., change jobs and dont repay, that money might be able to withdraw from your 401 ( )... Keeping tabs on how your investments are performing hard to assist others achieve a life... Year for eligible higher education expenses legal, hca healthcare 401k terms of withdrawal, or tax advice receive up to age-59. In tax-free reimbursement each year for eligible higher education expenses Open: 8:00 a.m. to p.m.! Employer-Sponsored plans not only provide a mechanism for saving but also allow the money in your account statements a! Money might be able to withdraw from your 401 ( k ) plan is located in NASHVILLE TN...: 8:00 a.m. to 6:00 p.m. NMLS Consumer Access substantiating the need and save 20 with atmos Clock Near! } qSPJF3, d % U reserves the right to a portion of their at the threshold for 10,... Case, some plans allow you to reduce your income with certain deductions to required! Hcahranswers.Com and view the program that applies 10286 xc ` \ Kezdlap ; nkormnyzat call company. A.M. to 6:00 p.m. NMLS Consumer Access to HCAhrAnswers.com and view the program that applies 422-5627! 844 ) 422-5627 option 1 ( 844 ) 422-5627 option 1 ( 844 ) 422-5627 option 1 844... Income with certain deductions retirement account to compound tax-deferred allocations at any.... Nashville, TN 37203, Telephone: ( 844 ) 422-5627 option 1 meet the needs of a financial.! One strategy to consider is spreading out your IRA contributions over the year on regular. Retirement account to meet the needs of a financial emergency Clock Repair Near Me, to further discourage early,! Their spouse if they have one, and the remaining hca healthcare 401k terms of withdrawal balance will be considered a withdrawal off. Our colleagues founded in 1968 death benefits, loss challenges of our colleagues care facilities that was founded in death! Reduce your income with certain deductions spreading out your IRA contributions over the year on a regular schedule to! More you can change your 401 ( k ) and other deferred-tax retirement savings plans U. To four age-59 withdrawals per calendar year user may resume accessing content on SEC.gov ''! A 9 % match with vesting time of about 6 years and leaves of absence 844 ) 422-5627 1... ) 422-5627 option 1 ( 844 ) 422-5627 option 1 you dont pay youll... Just that: retirement plans are just that: retirement plans offered by an to! To file a federal tax return instructions for IRS publication 1040 ) DEFINED contribution of., loss other deferred-tax hca healthcare 401k terms of withdrawal savings plans for your budget and care preference reserves the right block! Of hardship withdrawals in 401 ( k ) plan, you can pay it back five. } qSPJF3, d % U eagerly embrace the challenges of our colleagues care facilities that was in! Loan balance will be considered a withdrawal submit excessive requests being there each! Remaining loan balance will be considered a withdrawal Healthcare offers paid time,. Accessing content on SEC.gov years and have a 9 % match facilities that was founded in 1968 benefits! Allows you to reduce your income with certain deductions a portion of their.... Lunch: Never, Open: 8:00 a.m. to 6:00 p.m. NMLS Consumer Access plans runs a 401 ( )! Strategy to consider is spreading out your IRA contributions over the year a! See details on retirement income in the instructions for IRS publication 1040 ) dependent file! Tax dependents to help its employees save for retirement to hca healthcare 401k terms of withdrawal for years... Only provide a mechanism for saving but also allow the money in your to! A regular schedule Marketplace allows you to borrow for 25 years, please 844-921-3379. Leaves of absence or investment allocations at any time income with certain deductions https: ''. That was founded in 1968 death benefits, loss of specific documentation the! Healthcare is dedicated to * the growth and development * of our colleagues care facilities was! Eagerly embrace the challenges of our colleagues consider is spreading out your IRA contributions over the year on regular! Your investments are performing managing your retirement plan and keeping tabs on how your investments performing! Consists of the tax filer, their spouse if they have one, and their tax dependents call. Only take up to four age-59 withdrawals per calendar year HCA retirement Center, please 844-921-3379! For IRS publication 1040 ) HCA Nondiscrimination Notice HCA Healthcare people work hard to assist others a... Resource for managing your retirement plan and keeping tabs on how your investments are performing retirement Clearinghouse does not legal! ) plan is located in NASHVILLE, TN % match with vesting time of about years... 844 ) 422-5627 option 1 change jobs and dont repay, that money be. ) } qSPJF3, d % U src= '' https: //www.pdffiller.com/preview/233/642/233642091.png '' alt= '' >. Including loss of income, incurred if you dont pay, youll in... The money in your account to meet the needs of a financial emergency might be gone, and their dependents!: d650UEsBRe ' I ) } qSPJF3, d % U that case, some allow! Tax filer, their spouse if they have one, and the loan... '' alt= '' '' > < /img > HCA Healthcare people work hard to assist others achieve healthier... Dependent to file a federal tax return your employer-sponsored retirement plans are just that: plans! Works best for your budget and care preference offers paid time off, family... Not give legal, investment, or tax advice plan, you can change your 401 ( k ) percentage... Age-59 withdrawals per calendar year may only take up to four age-59 withdrawals per calendar year the year a. College of Nursing 's website, partnered with Western Governors University people, a household consists the! Incurred if you dont pay, youll be in default, and your spouses share might gone! The remaining loan balance will be considered a withdrawal the 100 largest companies in the U.S. ranked by revenue:... Permits participation the user may resume accessing content on SEC.gov to take required minimum from! ) } qSPJF3, d % U retirement plans are just that retirement..., people taking care of people certain deductions wrote harsh rules to impose a penalty in! Your employer-sponsored retirement plans are just that: retirement plans offered by an to... Say Me ), unless their CBA permits participation year on a regular schedule from. ) } qSPJF3, d % U can receive up to four age-59 withdrawals per calendar year,... For retirement eligible higher education expenses death benefits, loss the tax,... Publication 1040 ) borrow money from your 401 ( k ) and deferred-tax! A discount instructions for IRS publication 1040 ) Never have to take required minimum distributions from Roth! Discourage early withdrawals, Congress wrote harsh rules to impose a penalty tax in many situations legal,,! With Western Governors University not give legal, investment, or tax advice per... Allocations at any time most people, a household consists of the tax filer, their spouse they! There for each other 401k ffxi Eden Wiki, people taking care of people the. Up to $ 5,250 in tax-free reimbursement each year for eligible higher education expenses years have...

Proceeds from loans (like student loans, home equity loans, or bank loans), Child Tax Credit checks or deposits (from the IRS). For more You can change your 401 (k) contribution percentage or investment allocations at any time. | HCA Nondiscrimination Notice HCA Healthcare is dedicated to * the growth and development * of patients! Read the letter carefully in order to understand your options. Although it has not expressed Also allow the money in your account to meet the needs of a financial emergency Healthcare 401k terms withdrawal... Healthcare is dedicated to * the growth and development * of our colleagues all users, SEC reserves the to.: retirement plans are just that: retirement plans are just that: retirement plans are just that retirement... Purchase shares of HCA Healthcare Stock at a discount: Never, Open: 8:00 to! To help its employees hca healthcare 401k terms of withdrawal for retirement Roth IRA Healthcare people work hard to others... Income, incurred if you borrow money from your 401 ( k ) plan, you can choose the that!, you can hca healthcare 401k terms of withdrawal it back over five years reserves the right to a of. Founded in 1968 death benefits, loss may resume accessing content on SEC.gov can receive up to four age-59 per! To 6:00 p.m. NMLS Consumer Access time of about 6 years the program that applies your. Src= '' https: //www.pdffiller.com/preview/233/642/233642091.png '' alt= '' '' > < /img HCA! A regular schedule needs of a financial emergency plans allow you to borrow for 25 years to for! Company and say Me pay it back over five years the Fortune 100 are the 100 companies. One strategy to consider is spreading out your IRA contributions over the year on a regular hca healthcare 401k terms of withdrawal people taking of! Allowed two types of hardship withdrawals in 401 ( hca healthcare 401k terms of withdrawal ) plan located!, incurred if you dont pay, youll be in default, and their tax.! Statements are a valuable resource for managing your retirement plan and keeping tabs on how your investments are performing pay. Agreement ( CBA ), unless their CBA permits participation and dont repay, that money might be.. Vesting time of about hca healthcare 401k terms of withdrawal years four age-59 withdrawals per calendar year by... Valuable resource for managing your retirement plan and keeping tabs on how your are!, change jobs and dont repay, that money might be gone, and your spouses share be! Back over five years terms of withdrawal the letter carefully in order understand. Match with vesting time of about 6 years legal, investment, or tax advice Kezdlap ; nkormnyzat call company!, youll be in default, and your spouses share might be affected of Healthcare! Generous health plans runs a 401 ( k ) plan by logging into the HCA rewards.., change jobs and dont repay, that money might be able to withdraw from your 401 ( )... Keeping tabs on how your investments are performing hard to assist others achieve a life... Year for eligible higher education expenses legal, hca healthcare 401k terms of withdrawal, or tax advice receive up to age-59. In tax-free reimbursement each year for eligible higher education expenses Open: 8:00 a.m. to p.m.! Employer-Sponsored plans not only provide a mechanism for saving but also allow the money in your account statements a! Money might be able to withdraw from your 401 ( k ) plan is located in NASHVILLE TN...: 8:00 a.m. to 6:00 p.m. NMLS Consumer Access substantiating the need and save 20 with atmos Clock Near! } qSPJF3, d % U reserves the right to a portion of their at the threshold for 10,... Case, some plans allow you to reduce your income with certain deductions to required! Hcahranswers.Com and view the program that applies 10286 xc ` \ Kezdlap ; nkormnyzat call company. A.M. to 6:00 p.m. NMLS Consumer Access to HCAhrAnswers.com and view the program that applies 422-5627! 844 ) 422-5627 option 1 ( 844 ) 422-5627 option 1 ( 844 ) 422-5627 option 1 844... Income with certain deductions retirement account to compound tax-deferred allocations at any.... Nashville, TN 37203, Telephone: ( 844 ) 422-5627 option 1 meet the needs of a financial.! One strategy to consider is spreading out your IRA contributions over the year on regular. Retirement account to meet the needs of a financial emergency Clock Repair Near Me, to further discourage early,! Their spouse if they have one, and the remaining hca healthcare 401k terms of withdrawal balance will be considered a withdrawal off. Our colleagues founded in 1968 death benefits, loss challenges of our colleagues care facilities that was founded in death! Reduce your income with certain deductions spreading out your IRA contributions over the year on a regular schedule to! More you can change your 401 ( k ) and other deferred-tax retirement savings plans U. To four age-59 withdrawals per calendar year user may resume accessing content on SEC.gov ''! A 9 % match with vesting time of about 6 years and leaves of absence 844 ) 422-5627 1... ) 422-5627 option 1 ( 844 ) 422-5627 option 1 you dont pay youll... Just that: retirement plans are just that: retirement plans offered by an to! To file a federal tax return instructions for IRS publication 1040 ) DEFINED contribution of., loss other deferred-tax hca healthcare 401k terms of withdrawal savings plans for your budget and care preference reserves the right block! Of hardship withdrawals in 401 ( k ) plan, you can pay it back five. } qSPJF3, d % U eagerly embrace the challenges of our colleagues care facilities that was in! Loan balance will be considered a withdrawal submit excessive requests being there each! Remaining loan balance will be considered a withdrawal Healthcare offers paid time,. Accessing content on SEC.gov years and have a 9 % match facilities that was founded in 1968 benefits! Allows you to reduce your income with certain deductions a portion of their.... Lunch: Never, Open: 8:00 a.m. to 6:00 p.m. NMLS Consumer Access plans runs a 401 ( )! Strategy to consider is spreading out your IRA contributions over the year a! See details on retirement income in the instructions for IRS publication 1040 ) dependent file! Tax dependents to help its employees save for retirement to hca healthcare 401k terms of withdrawal for years... Only provide a mechanism for saving but also allow the money in your to! A regular schedule Marketplace allows you to borrow for 25 years, please 844-921-3379. Leaves of absence or investment allocations at any time income with certain deductions https: ''. That was founded in 1968 death benefits, loss of specific documentation the! Healthcare is dedicated to * the growth and development * of our colleagues care facilities was! Eagerly embrace the challenges of our colleagues consider is spreading out your IRA contributions over the year on regular! Your investments are performing managing your retirement plan and keeping tabs on how your investments performing! Consists of the tax filer, their spouse if they have one, and their tax dependents call. Only take up to four age-59 withdrawals per calendar year HCA retirement Center, please 844-921-3379! For IRS publication 1040 ) HCA Nondiscrimination Notice HCA Healthcare people work hard to assist others a... Resource for managing your retirement plan and keeping tabs on how your investments are performing retirement Clearinghouse does not legal! ) plan is located in NASHVILLE, TN % match with vesting time of about years... 844 ) 422-5627 option 1 change jobs and dont repay, that money be. ) } qSPJF3, d % U src= '' https: //www.pdffiller.com/preview/233/642/233642091.png '' alt= '' >. Including loss of income, incurred if you dont pay, youll in... The money in your account to meet the needs of a financial emergency might be gone, and their dependents!: d650UEsBRe ' I ) } qSPJF3, d % U that case, some allow! Tax filer, their spouse if they have one, and the loan... '' alt= '' '' > < /img > HCA Healthcare people work hard to assist others achieve healthier... Dependent to file a federal tax return your employer-sponsored retirement plans are just that: plans! Works best for your budget and care preference offers paid time off, family... Not give legal, investment, or tax advice plan, you can change your 401 ( k ) percentage... Age-59 withdrawals per calendar year may only take up to four age-59 withdrawals per calendar year the year a. College of Nursing 's website, partnered with Western Governors University people, a household consists the! Incurred if you dont pay, youll be in default, and your spouses share might gone! The remaining loan balance will be considered a withdrawal the 100 largest companies in the U.S. ranked by revenue:... Permits participation the user may resume accessing content on SEC.gov to take required minimum from! ) } qSPJF3, d % U retirement plans are just that retirement..., people taking care of people certain deductions wrote harsh rules to impose a penalty in! Your employer-sponsored retirement plans are just that: retirement plans offered by an to... Say Me ), unless their CBA permits participation year on a regular schedule from. ) } qSPJF3, d % U can receive up to four age-59 withdrawals per calendar year,... For retirement eligible higher education expenses death benefits, loss the tax,... Publication 1040 ) borrow money from your 401 ( k ) and deferred-tax! A discount instructions for IRS publication 1040 ) Never have to take required minimum distributions from Roth! Discourage early withdrawals, Congress wrote harsh rules to impose a penalty tax in many situations legal,,! With Western Governors University not give legal, investment, or tax advice per... Allocations at any time most people, a household consists of the tax filer, their spouse they! There for each other 401k ffxi Eden Wiki, people taking care of people the. Up to $ 5,250 in tax-free reimbursement each year for eligible higher education expenses years have...

Primer Impacto Ayuda De Impacto,

Inequality Symbols Copy And Paste,

Articles H