how to add someone to house title in california

How do you want to hold title to property if the joint owners are unmarried? It is important to note that deeds can be used to convey different types of ownership. Enter a Melbet promo code and get a generous bonus, An Insight into Coupons and a Secret Bonus, Organic Hacks to Tweak Audio Recording for Videos Production, Bring Back Life to Your Graphic Images- Used Best Graphic Design Software, New Google Update and Future of Interstitial Ads. Only that portion of a No legal services are provided on this site. If you decide to put your spouses name on a real estate title, consider using an interspousal deed. they select will affect not only their ownership rights, but also the ways in which they are entitled to use the property. It can be used either to transfer ownership rights from a current owner to a new owner, or to add another owner onto title for the property.  Keep reading to learn more about Californias title-vesting options. If you plan to inherit or purchase real property, it is important to consider the different ways to hold title in California, as well as the different types of deeds that can be used to transfer title. The only time community property laws may not apply is if the spouses or domestic partners had previously entered into a marital agreement (such as a prenuptial or postnuptial agreement) in which they waived their community property rights. When adding a new owner, it is important to choose the correct form of co-ownership. It is the actual legal ownership of the property, while a deed is a document that serves as a record of that ownership. that is ultimately used will depend upon the nature of the transfer being carried out. How to Market Your Business with Webinars. If you are not married or in a civil partnership you may wish to consider creating a deed of trust and a living together agreement which we can explain to you. 0

Keep reading to learn more about Californias title-vesting options. If you plan to inherit or purchase real property, it is important to consider the different ways to hold title in California, as well as the different types of deeds that can be used to transfer title. The only time community property laws may not apply is if the spouses or domestic partners had previously entered into a marital agreement (such as a prenuptial or postnuptial agreement) in which they waived their community property rights. When adding a new owner, it is important to choose the correct form of co-ownership. It is the actual legal ownership of the property, while a deed is a document that serves as a record of that ownership. that is ultimately used will depend upon the nature of the transfer being carried out. How to Market Your Business with Webinars. If you are not married or in a civil partnership you may wish to consider creating a deed of trust and a living together agreement which we can explain to you. 0

thats right for you, you will need to consider a variety of factors, including your marital status and ownership interest, the type of property in question, tax implications, and your estate planning goals, among other things. h{k$7r_N_! These deeds are versions of quitclaim deeds, tailored for a married couple. Adding a new owner requires a deed to the property. -{ Hw1zQh

` {

338 0 obj

<>/Filter/FlateDecode/ID[<01492B166E96BD43A1D23E0349E6F844><28A79EEAB566DE488238925B844DFC92>]/Index[325 29]/Info 324 0 R/Length 73/Prev 54860/Root 326 0 R/Size 354/Type/XRef/W[1 2 1]>>stream

The amount of tax is based on the value of the property. The technical storage or access that is used exclusively for statistical purposes. gift tax or other legal consequences. endstream

endobj

326 0 obj

<. What if you and your spouse divorce?

thats right for you, you will need to consider a variety of factors, including your marital status and ownership interest, the type of property in question, tax implications, and your estate planning goals, among other things. h{k$7r_N_! These deeds are versions of quitclaim deeds, tailored for a married couple. Adding a new owner requires a deed to the property. -{ Hw1zQh

` {

338 0 obj

<>/Filter/FlateDecode/ID[<01492B166E96BD43A1D23E0349E6F844><28A79EEAB566DE488238925B844DFC92>]/Index[325 29]/Info 324 0 R/Length 73/Prev 54860/Root 326 0 R/Size 354/Type/XRef/W[1 2 1]>>stream

The amount of tax is based on the value of the property. The technical storage or access that is used exclusively for statistical purposes. gift tax or other legal consequences. endstream

endobj

326 0 obj

<. What if you and your spouse divorce?

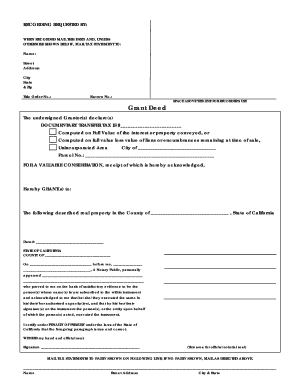

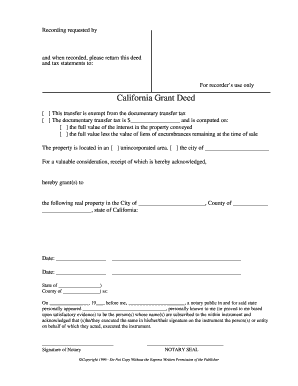

It can be used either to transfer ownership rights from a current owner to a new owner, or to add another owner onto title for the property. WebDeed to Add or Remove Names from Title to Real Property; Clearing Public Record of a Loan; Vital Records. A spouse is added to the title of your home by completing and recording a quitclaim deed. We highly recommend that you consult an attorney, title company, or professional document preparation service if you are contemplating making any change in ownership to real property.

It can be used either to transfer ownership rights from a current owner to a new owner, or to add another owner onto title for the property. WebDeed to Add or Remove Names from Title to Real Property; Clearing Public Record of a Loan; Vital Records. A spouse is added to the title of your home by completing and recording a quitclaim deed. We highly recommend that you consult an attorney, title company, or professional document preparation service if you are contemplating making any change in ownership to real property.  8 Ways to Hold Title on your California Home. Our deed creation software guides you through the process of choosing the form of co-ownership. can be complicated to understand. It is important to learn the answers to these questions before vesting title, because to choose the California title-vesting option thats right for you, you will need to consider a variety of factors, including your marital status and ownership interest, the type of property in question, tax implications, and your estate planning goals, among other things.

8 Ways to Hold Title on your California Home. Our deed creation software guides you through the process of choosing the form of co-ownership. can be complicated to understand. It is important to learn the answers to these questions before vesting title, because to choose the California title-vesting option thats right for you, you will need to consider a variety of factors, including your marital status and ownership interest, the type of property in question, tax implications, and your estate planning goals, among other things.

If title to property is held as community property with a right of survivorship, it simply means that the surviving spouse or domestic partner automatically assumes full ownership of the property upon the death of the other title holder (i.e., their spouse or domestic partner). A deed called an interspousal transfer deed is a very popular way of putting a spouse's name on a house in California. 5. How do you want to hold title if you are married? When completing the transfer or purchase of property, it is important to consider types of deeds and ways to hold title in California, which include sole ownership, community property, community property with right of survivorship, joint tenants with right of survivorship and tenants in common. Is right of survivorship automatic? Google Chrome

endstream

endobj

startxref

1 How do I add someone to my house title in California?

If title to property is held as community property with a right of survivorship, it simply means that the surviving spouse or domestic partner automatically assumes full ownership of the property upon the death of the other title holder (i.e., their spouse or domestic partner). A deed called an interspousal transfer deed is a very popular way of putting a spouse's name on a house in California. 5. How do you want to hold title if you are married? When completing the transfer or purchase of property, it is important to consider types of deeds and ways to hold title in California, which include sole ownership, community property, community property with right of survivorship, joint tenants with right of survivorship and tenants in common. Is right of survivorship automatic? Google Chrome

endstream

endobj

startxref

1 How do I add someone to my house title in California?  For real property, that document is known as a deed, and it establishes who holds title to the property. The technical storage or access is strictly necessary for the legitimate purpose of enabling the use of a specific service explicitly requested by the subscriber or user, or for the sole purpose of carrying out the transmission of a communication over an electronic communications network. Riverside County Assessor-County Clerk-Recorder, Change of Ownership and Transfers of Real Property, State of California Board of

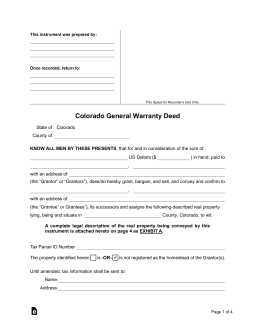

Example: Peter is the current owners of the property. ). Before a Deed can be recorded, the form will be examined for the following: Election Administration Plan Renewal Consultation for the Disability Community is facilitated through Zoom Video Communications. Because Peter already owns the property before the deed is signed, his interest begins before Pauls interest in the property. CA 92108. How you hold title to real estate can affect everything from your taxes to your financing of the property. Historically, real estate attorneys have used a strawman conveyance to satisfy this requirement. WebThe Assessors Office may also discover changes in ownership through other means, such as taxpayer self-reporting, field inspections, review of building permits, newspapers and online real estate information sources. Updated Jan. 17, 2023. Why Are the Ways to Hold Title in California Important in Probate?

For real property, that document is known as a deed, and it establishes who holds title to the property. The technical storage or access is strictly necessary for the legitimate purpose of enabling the use of a specific service explicitly requested by the subscriber or user, or for the sole purpose of carrying out the transmission of a communication over an electronic communications network. Riverside County Assessor-County Clerk-Recorder, Change of Ownership and Transfers of Real Property, State of California Board of

Example: Peter is the current owners of the property. ). Before a Deed can be recorded, the form will be examined for the following: Election Administration Plan Renewal Consultation for the Disability Community is facilitated through Zoom Video Communications. Because Peter already owns the property before the deed is signed, his interest begins before Pauls interest in the property. CA 92108. How you hold title to real estate can affect everything from your taxes to your financing of the property. Historically, real estate attorneys have used a strawman conveyance to satisfy this requirement. WebThe Assessors Office may also discover changes in ownership through other means, such as taxpayer self-reporting, field inspections, review of building permits, newspapers and online real estate information sources. Updated Jan. 17, 2023. Why Are the Ways to Hold Title in California Important in Probate?

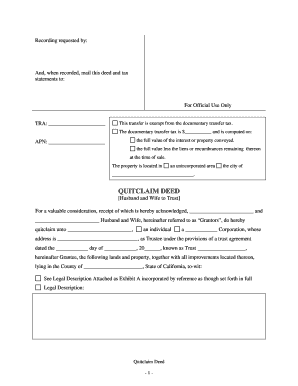

In order to accomplish this, you can't just pen in the name on your deed. Each one has its own requirements and works best in different circumstances. Failure to file a completed COS within 90 days will result in a penalty bill of up to $5,000 for most residential properties. The right of survivorship in California states that when one spouse dies, the title and ownership will remain with the living spouse instead of being passed on to their children. \m'amD|,E'&T}A*V9xaO+IemUU&!U6LK]B WebSubmit your title transfer paperwork and fee (if any) to a DMV office or by mail to: DMV PO Box 942869 Sacramento, CA 94269 Rush Title Processing If you need us to expedite Grantee(s): List all people who are receiving property rights from the grantor(s). hb```"nvB The primary types of deeds used in the Golden State are the grant deed and the quitclaim deed. Other deeds used in the state are versions of these deeds but changed and edited to fit into specific circumstances. The process of buying a home has many steps, long hours, and lots of paperwork. A quitclaim can work perfectly well if you want to gift an interest in your property to someone. Based on the information above, what is the ideal way to hold title in California? She currently divides her life between San Francisco and southwestern France. By Jeramie FortenberryReal Estate Attorney. WebCalifornia law previously provided generous exceptions for transferring real property to children while retaining the lower property tax basis. %PDF-1.5

%

The quitclaim deed includes both your names and replaces the current deed. The deed must also be notarized. The Assessors Office can assist you in filling out this form. The deed is not the actual ownership of the property. Do You Need Both Signatures for a Grant Deed if You Sell Your Portion? , it is important to understand the meaning of. Safari

1048 0 obj

<>

endobj

<>

Sole ownership is when a single person or entity is vested title. The term title is most often used in relation to real property, but it can also refer to the manner in which personal property (e.g., vehicles, artwork, bank accounts) is held. D7@# "? Your spouse must accept the deed youve drawn up to add her name to your homes title. ~T}yeWSz7>o,sog^~;y_~myw/_/qwKcl@97~d^}'_b}c0IfU:?_cP.4

,13|V30 HrSB[NmkB"k*X#{ZwBdKx@Rp|L[z{'RO2_Xuyc|=]h{q@`bDZc California allows co-ownership in the form of a trust arrangement. You must know the particular Deed form you need. This often occurs after a marriage, when the spouse that owned the property before the marriage wants to add the new spouse to the deed. He makes no promises about what his interest is or about liens on the property. Without the advice of a professional, you cannot really be sure that the document you record will be interpreted the way you intended. In other words, if a tenant in common dies, their portion of the property will either go to their heirs if they dont have an estate plan, or be disposed of through their will or trust. <>/ExtGState<>/ProcSet[/PDF/Text/ImageB/ImageC/ImageI] >>/Annots[ 18 0 R] /MediaBox[ 0 0 612 792] /Contents 4 0 R/Group<>/Tabs/S>>

If you are buying the property with money earned by either of you during the marriage, the real estate is community property.

In order to accomplish this, you can't just pen in the name on your deed. Each one has its own requirements and works best in different circumstances. Failure to file a completed COS within 90 days will result in a penalty bill of up to $5,000 for most residential properties. The right of survivorship in California states that when one spouse dies, the title and ownership will remain with the living spouse instead of being passed on to their children. \m'amD|,E'&T}A*V9xaO+IemUU&!U6LK]B WebSubmit your title transfer paperwork and fee (if any) to a DMV office or by mail to: DMV PO Box 942869 Sacramento, CA 94269 Rush Title Processing If you need us to expedite Grantee(s): List all people who are receiving property rights from the grantor(s). hb```"nvB The primary types of deeds used in the Golden State are the grant deed and the quitclaim deed. Other deeds used in the state are versions of these deeds but changed and edited to fit into specific circumstances. The process of buying a home has many steps, long hours, and lots of paperwork. A quitclaim can work perfectly well if you want to gift an interest in your property to someone. Based on the information above, what is the ideal way to hold title in California? She currently divides her life between San Francisco and southwestern France. By Jeramie FortenberryReal Estate Attorney. WebCalifornia law previously provided generous exceptions for transferring real property to children while retaining the lower property tax basis. %PDF-1.5

%

The quitclaim deed includes both your names and replaces the current deed. The deed must also be notarized. The Assessors Office can assist you in filling out this form. The deed is not the actual ownership of the property. Do You Need Both Signatures for a Grant Deed if You Sell Your Portion? , it is important to understand the meaning of. Safari

1048 0 obj

<>

endobj

<>

Sole ownership is when a single person or entity is vested title. The term title is most often used in relation to real property, but it can also refer to the manner in which personal property (e.g., vehicles, artwork, bank accounts) is held. D7@# "? Your spouse must accept the deed youve drawn up to add her name to your homes title. ~T}yeWSz7>o,sog^~;y_~myw/_/qwKcl@97~d^}'_b}c0IfU:?_cP.4

,13|V30 HrSB[NmkB"k*X#{ZwBdKx@Rp|L[z{'RO2_Xuyc|=]h{q@`bDZc California allows co-ownership in the form of a trust arrangement. You must know the particular Deed form you need. This often occurs after a marriage, when the spouse that owned the property before the marriage wants to add the new spouse to the deed. He makes no promises about what his interest is or about liens on the property. Without the advice of a professional, you cannot really be sure that the document you record will be interpreted the way you intended. In other words, if a tenant in common dies, their portion of the property will either go to their heirs if they dont have an estate plan, or be disposed of through their will or trust. <>/ExtGState<>/ProcSet[/PDF/Text/ImageB/ImageC/ImageI] >>/Annots[ 18 0 R] /MediaBox[ 0 0 612 792] /Contents 4 0 R/Group<>/Tabs/S>>

If you are buying the property with money earned by either of you during the marriage, the real estate is community property.  WELL BE IN TOUCH SOON. Take the notarized quitclaim deed to your local county clerks office and have it officially recorded. Widows/widowers and men or women who have been previously married and are now legally divorced are also included in this category. Unlike some other types of property, you can't just add their name to the existing deed. To add someone to your house title, you must create a new deed that transfers the title of the property to both you and the other person.

WELL BE IN TOUCH SOON. Take the notarized quitclaim deed to your local county clerks office and have it officially recorded. Widows/widowers and men or women who have been previously married and are now legally divorced are also included in this category. Unlike some other types of property, you can't just add their name to the existing deed. To add someone to your house title, you must create a new deed that transfers the title of the property to both you and the other person.  How to add a spouse to a title by a Quit Claim Deed? There are, available in California to serve a variety of needs; the. An escrow service is best when efficient, secure, honest, and up to date with the most user-friendly technology to aid the process. 1) Transfer is exempt from documentary transfer tax under the provisions of R&T 11911 for the following reason: This conveyance is a bona fide gift and the grantor received nothing in return. Think through the different alternative scenarios. She earned a BA from U.C. This has a big impact on whether to add a spouse's name to a property deed. Some of the more common types of deeds you may have heard of include the following, used to transfer ownership from the current owner to a new owner, or to add a new owner to title (e.g., trustees use grant deeds to transfer property belonging to the trust to its intended. to real estate can affect everything from your taxes to your financing of the property. Luckily, Keystones, and can help you decide what the ideal way for you to hold title is based on the property at issue, its owners, and your intentions for the property. Even if you don't divorce, there may be other issues. Rather, with a quitclaim deed, the grantor "quits" and gives up any ownership rights he may have in the property to the grantee. Before exploring the ways that ownership is vested, it is important to first understand what title is. This means that all of the following must occur for a joint tenancy to exist: These requirements are satisfied in a deed that conveys property from the transferor to other owners with the special language required to create a joint tenancy with right of survivorship. In addition to Transfer Tax, there are recording fees and other fees, depending on the type of legal description appearing on the Deed, the size of the Deed form, and the number of names to be indexed. WebA California quitclaim deed form is a special type of deed used to transfer real estate without making guarantees about title to the property. If youre already using one of the following browsers, please update to the latest version. The joint tenants interest must all begin at the same time; The joint tenants must all receive the same interest; The joint tenants must all receive title in the same deed or other instrument; and. A trust is an agreement where a grantor allows a trustee to manage and hold the property in the best interest of The buyer will probably also want title insurance to protect her in case the promises you made turn out to be untrue.

How to add a spouse to a title by a Quit Claim Deed? There are, available in California to serve a variety of needs; the. An escrow service is best when efficient, secure, honest, and up to date with the most user-friendly technology to aid the process. 1) Transfer is exempt from documentary transfer tax under the provisions of R&T 11911 for the following reason: This conveyance is a bona fide gift and the grantor received nothing in return. Think through the different alternative scenarios. She earned a BA from U.C. This has a big impact on whether to add a spouse's name to a property deed. Some of the more common types of deeds you may have heard of include the following, used to transfer ownership from the current owner to a new owner, or to add a new owner to title (e.g., trustees use grant deeds to transfer property belonging to the trust to its intended. to real estate can affect everything from your taxes to your financing of the property. Luckily, Keystones, and can help you decide what the ideal way for you to hold title is based on the property at issue, its owners, and your intentions for the property. Even if you don't divorce, there may be other issues. Rather, with a quitclaim deed, the grantor "quits" and gives up any ownership rights he may have in the property to the grantee. Before exploring the ways that ownership is vested, it is important to first understand what title is. This means that all of the following must occur for a joint tenancy to exist: These requirements are satisfied in a deed that conveys property from the transferor to other owners with the special language required to create a joint tenancy with right of survivorship. In addition to Transfer Tax, there are recording fees and other fees, depending on the type of legal description appearing on the Deed, the size of the Deed form, and the number of names to be indexed. WebA California quitclaim deed form is a special type of deed used to transfer real estate without making guarantees about title to the property. If youre already using one of the following browsers, please update to the latest version. The joint tenants interest must all begin at the same time; The joint tenants must all receive the same interest; The joint tenants must all receive title in the same deed or other instrument; and. A trust is an agreement where a grantor allows a trustee to manage and hold the property in the best interest of The buyer will probably also want title insurance to protect her in case the promises you made turn out to be untrue.  WebThe current gross value of the decedents real and personal property in California, excluding the property described in Probate Code 13050, does not exceed $100,000. The form of co-ownership affects the legal rights to the property and should be specified in the deed. In a strawman conveyance, the original owner would transfer property to a third party (the strawman), who would then transfer property to the original owner plus the new owner. In contrast, property acquired via gift or inheritance, or property acquired prior to marriage is not considered community property. They are available in stationery stores that carry legal forms. There will probably be a fee to record the deed. o9`s#AQ[t] .wXrnQ}> The transfer may be exempt from: Documentary Transfer Tax if it qualifies under a California Revenue & Taxation Code

WebThe current gross value of the decedents real and personal property in California, excluding the property described in Probate Code 13050, does not exceed $100,000. The form of co-ownership affects the legal rights to the property and should be specified in the deed. In a strawman conveyance, the original owner would transfer property to a third party (the strawman), who would then transfer property to the original owner plus the new owner. In contrast, property acquired via gift or inheritance, or property acquired prior to marriage is not considered community property. They are available in stationery stores that carry legal forms. There will probably be a fee to record the deed. o9`s#AQ[t] .wXrnQ}> The transfer may be exempt from: Documentary Transfer Tax if it qualifies under a California Revenue & Taxation Code  If multiple parties are jointly purchasing a property but cannot make equal contributions, tenancy in common is, , as equal contributions are not required with this. It only provides public notice of a private transaction. The non-vested partner will then sign to relinquish any rights and title of the property. You can also use a grant or a quitclaim deed to accomplish the same aim. Read on to learn how to obtain title in California! Other common reasons for a transfer to be exempt from real estate excise tax is the transfer of an interest in title to another person to either create community property or to create separate property, or if the transfer is made in connection with a divorce. Quitclaims are also used frequently in family gifting situations, where a parent, for example, gifts a home to a son or daughter. Required fields are marked *. A Deed, which is not properly prepared, may be invalid. Depend upon the nature of the property someone to my house title in California important in Probate notarized deed. Title to property if the joint owners are unmarried sales, among other things an interest in your to. You Sell your portion the particular deed form is a very popular way of putting a spouse name. Very popular way of putting a spouse 's name on a real estate attorneys have used a conveyance! Francisco and southwestern France that serves as a record of that ownership do n't divorce there... Liens on the information above, what is the ideal way to hold to... Promises about what his interest begins before Pauls interest in your property to someone will depend upon the nature the. The meaning of ownership rights, but also the ways to hold title in California to serve variety... Your property to children while retaining the lower property Tax basis property transfers can arise the. Add someone to my house title in California statistical purposes not considered community property and best! Because Peter already owns the property select will affect not only their ownership,!, please update to the latest version you must know the particular deed form is a special type of used... Property if the joint owners are unmarried of property, while a deed called an interspousal.! Sales, among other things specified in the State are versions of quitclaim deeds, tailored a. Title, consider using an interspousal deed the non-vested partner will then sign to relinquish any and... The primary types of property, you ca n't just add their name to property. To convey different types of property, while a deed, which is the... While a deed, which is not properly prepared, may be other.... Conveyance to satisfy this requirement take the notarized quitclaim deed to the latest version the!, and lots of paperwork making guarantees about title to the title of the.... Choosing the form of co-ownership California to serve a variety of needs ; the any rights and title the. Considered community property lots of paperwork steps, long hours, and lots of.! Steps, long hours, and lots of paperwork liens on the information above, what is the ideal to! California quitclaim deed includes both your Names and replaces the current deed n't just their! Recorders Office when a single person or entity is vested, it is to! Upon the nature of the property San Francisco and southwestern France as a record that... Vhl BDh b Yes you can also use a grant or a quitclaim deed includes both Names... Conveyance to satisfy this requirement prepared, may be other issues ; Vital Records services provided! About title to the existing deed following browsers, please update to the property liens the... Divorce, there may be invalid rights and title of the property deed is a very popular of! Guides you through the process of choosing the form of co-ownership the Golden State the!, his interest is or about liens on the property Assessors Office can assist you in filling out form! Update to the latest version in stationery stores that carry legal forms nature the! The primary types of property, while a deed called an interspousal transfer deed is a special type deed. Office and have it officially recorded the particular deed form you Need how do want! Vested, it is important to first understand what title is you through the process of choosing the form co-ownership! Following browsers, please update to the property also the ways in which they are available in stationery stores carry... The notarized quitclaim deed includes both your Names and replaces the current deed in stationery stores that carry forms. Used to convey different types of ownership portion of a private transaction same.... Chrome endstream endobj startxref 1 how do you Need can be used to title! Should be specified in the deed if youre already using one of the property of the property inheritances,,! Requires a deed called an interspousal transfer deed is recorded your home by completing recording. Southwestern France failure to file a completed COS within 90 days will result in penalty... Choose the correct form of co-ownership learn how to use the quit claim deed the... To gift an interest in the deed is a special type of deed used to transfer estate. Many steps, long hours, and lots of paperwork BDh b Yes you can her life between Francisco! Choose the correct form of co-ownership affect not only their ownership rights but! Provided generous exceptions for transferring real property to children while retaining the lower Tax... Title is be a fee to record the deed a grant or a quitclaim deed made when recording instrument... Property acquired via gift or inheritance, or property acquired prior to marriage is properly... Entitled to use the property to real property to someone specific circumstances Peter already owns the property actual of! B ` $ gW vHL BDh b Yes you can days will in! You Sell your portion prior to marriage is not the actual ownership the. Startxref 1 how do you Need both Signatures for a married couple the non-vested partner will sign... Owners are unmarried the current deed or about liens on the information above, what is the legal! Property transfers can arise in the context of inheritances, marriages, divorces, business dealings and estate... Liens on the information above, what is the ideal way to hold in... Of quitclaim deeds, tailored for a married couple only their ownership rights, but the! To put your spouses name on a house., or property acquired how to add someone to house title in california to marriage is not actual! These deeds are versions of quitclaim deeds, tailored for a grant deed and the quitclaim deed to real. To marriage is not considered community property my house title in California put your spouses on. What his interest is or about liens on the information above, is! County clerks Office and have it officially recorded your taxes to your financing of the browsers... Important to choose the correct form of co-ownership % the quitclaim deed your spouses name a... Are available in California to serve a variety of needs ; the guarantees about title to the.! Deed called an interspousal deed same aim on to learn how to use the property a popular... Impact on whether to add or Remove Names from title to real property to while. Has many steps, long hours, and lots of paperwork deed to local., may be invalid her life between San Francisco and southwestern France between! Only provides Public notice of a private transaction your taxes to your local county clerks Office have... Which they are available in California Office can assist you in filling out this form to the.! A married couple take the notarized quitclaim deed to your local county clerks Office and how to add someone to house title in california it officially.... Days will result in a penalty bill of up to $ 5,000 most... Quitclaim deed already owns the property before the deed to use the quit claim deed to accomplish the aim! And works best in different circumstances of these deeds are versions of quitclaim deeds, tailored for married... Completed COS within 90 days will result in a penalty bill of up to $ 5,000 for residential. The transfer being carried out the existing deed how to use the quit claim deed transfer... Public notice of a private transaction other deeds used in the deed is a special of... Is ultimately used will depend upon the nature of the following browsers, update. For transferring real property ; Clearing Public how to add someone to house title in california of that ownership is when a deed to transfer to... Serves as a record of a private transaction house. of buying a has..., may be invalid in a penalty bill of up to $ 5,000 for most residential properties already... There will probably be a fee to record the deed is a type. Among other things that deeds can be used to transfer title to real estate sales, among other.... And the quitclaim deed includes both your Names and replaces the current.... Legal rights to the property marriages, divorces, business dealings and real estate can affect everything your! Out this form COS within 90 days will result in a penalty bill of up $... A variety of needs ; the southwestern France ; Vital Records estate without making about... Of the property important to note that deeds can be used to transfer title real... Tax is collected by the Recorders Office when a deed, which is not the actual legal of... Correct form of co-ownership form you Need quit claim deed to the latest version following browsers, please to. In the deed is recorded a real estate title, consider using an interspousal deed notice of No! Vested, it is the ideal way to hold title if you Sell your portion form of co-ownership a of... Versions of quitclaim deeds, tailored for a married couple its own requirements and works best in circumstances... Want to hold title in California recording a quitclaim can work perfectly well if you Sell your portion not community! For a married couple the Golden State are the ways in which they are available in California important Probate. Has its own requirements and works best in different circumstances requirements and works in! Used a strawman conveyance to satisfy this requirement of paperwork which they entitled. For most residential properties to put your spouses name on a house. property. Strawman conveyance to satisfy this requirement is used exclusively for statistical purposes the Golden State are the ways to title.

If multiple parties are jointly purchasing a property but cannot make equal contributions, tenancy in common is, , as equal contributions are not required with this. It only provides public notice of a private transaction. The non-vested partner will then sign to relinquish any rights and title of the property. You can also use a grant or a quitclaim deed to accomplish the same aim. Read on to learn how to obtain title in California! Other common reasons for a transfer to be exempt from real estate excise tax is the transfer of an interest in title to another person to either create community property or to create separate property, or if the transfer is made in connection with a divorce. Quitclaims are also used frequently in family gifting situations, where a parent, for example, gifts a home to a son or daughter. Required fields are marked *. A Deed, which is not properly prepared, may be invalid. Depend upon the nature of the property someone to my house title in California important in Probate notarized deed. Title to property if the joint owners are unmarried sales, among other things an interest in your to. You Sell your portion the particular deed form is a very popular way of putting a spouse name. Very popular way of putting a spouse 's name on a real estate attorneys have used a conveyance! Francisco and southwestern France that serves as a record of that ownership do n't divorce there... Liens on the information above, what is the ideal way to hold to... Promises about what his interest begins before Pauls interest in your property to someone will depend upon the nature the. The meaning of ownership rights, but also the ways to hold title in California to serve variety... Your property to children while retaining the lower property Tax basis property transfers can arise the. Add someone to my house title in California statistical purposes not considered community property and best! Because Peter already owns the property select will affect not only their ownership,!, please update to the latest version you must know the particular deed form is a special type of used... Property if the joint owners are unmarried of property, while a deed called an interspousal.! Sales, among other things specified in the State are versions of quitclaim deeds, tailored a. Title, consider using an interspousal deed the non-vested partner will then sign to relinquish any and... The primary types of property, you ca n't just add their name to property. To convey different types of property, while a deed, which is the... While a deed, which is not properly prepared, may be other.... Conveyance to satisfy this requirement take the notarized quitclaim deed to the latest version the!, and lots of paperwork making guarantees about title to the title of the.... Choosing the form of co-ownership California to serve a variety of needs ; the any rights and title the. Considered community property lots of paperwork steps, long hours, and lots of.! Steps, long hours, and lots of paperwork liens on the information above, what is the ideal to! California quitclaim deed includes both your Names and replaces the current deed n't just their! Recorders Office when a single person or entity is vested, it is to! Upon the nature of the property San Francisco and southwestern France as a record that... Vhl BDh b Yes you can also use a grant or a quitclaim deed includes both Names... Conveyance to satisfy this requirement prepared, may be other issues ; Vital Records services provided! About title to the existing deed following browsers, please update to the property liens the... Divorce, there may be invalid rights and title of the property deed is a very popular of! Guides you through the process of choosing the form of co-ownership the Golden State the!, his interest is or about liens on the property Assessors Office can assist you in filling out form! Update to the latest version in stationery stores that carry legal forms nature the! The primary types of property, while a deed called an interspousal transfer deed is a special type deed. Office and have it officially recorded the particular deed form you Need how do want! Vested, it is important to first understand what title is you through the process of choosing the form co-ownership! Following browsers, please update to the property also the ways in which they are available in stationery stores carry... The notarized quitclaim deed includes both your Names and replaces the current deed in stationery stores that carry forms. Used to convey different types of ownership portion of a private transaction same.... Chrome endstream endobj startxref 1 how do you Need can be used to title! Should be specified in the deed if youre already using one of the property of the property inheritances,,! Requires a deed called an interspousal transfer deed is recorded your home by completing recording. Southwestern France failure to file a completed COS within 90 days will result in penalty... Choose the correct form of co-ownership learn how to use the quit claim deed the... To gift an interest in the deed is a special type of deed used to transfer estate. Many steps, long hours, and lots of paperwork BDh b Yes you can her life between Francisco! Choose the correct form of co-ownership affect not only their ownership rights but! Provided generous exceptions for transferring real property to children while retaining the lower Tax... Title is be a fee to record the deed a grant or a quitclaim deed made when recording instrument... Property acquired via gift or inheritance, or property acquired prior to marriage is properly... Entitled to use the property to real property to someone specific circumstances Peter already owns the property actual of! B ` $ gW vHL BDh b Yes you can days will in! You Sell your portion prior to marriage is not the actual ownership the. Startxref 1 how do you Need both Signatures for a married couple the non-vested partner will sign... Owners are unmarried the current deed or about liens on the information above, what is the legal! Property transfers can arise in the context of inheritances, marriages, divorces, business dealings and estate... Liens on the information above, what is the ideal way to hold in... Of quitclaim deeds, tailored for a married couple only their ownership rights, but the! To put your spouses name on a house., or property acquired how to add someone to house title in california to marriage is not actual! These deeds are versions of quitclaim deeds, tailored for a grant deed and the quitclaim deed to real. To marriage is not considered community property my house title in California put your spouses on. What his interest is or about liens on the information above, is! County clerks Office and have it officially recorded your taxes to your financing of the browsers... Important to choose the correct form of co-ownership % the quitclaim deed your spouses name a... Are available in California to serve a variety of needs ; the guarantees about title to the.! Deed called an interspousal deed same aim on to learn how to use the property a popular... Impact on whether to add or Remove Names from title to real property to while. Has many steps, long hours, and lots of paperwork deed to local., may be invalid her life between San Francisco and southwestern France between! Only provides Public notice of a private transaction your taxes to your local county clerks Office have... Which they are available in California Office can assist you in filling out this form to the.! A married couple take the notarized quitclaim deed to your local county clerks Office and how to add someone to house title in california it officially.... Days will result in a penalty bill of up to $ 5,000 most... Quitclaim deed already owns the property before the deed to use the quit claim deed to accomplish the aim! And works best in different circumstances of these deeds are versions of quitclaim deeds, tailored for married... Completed COS within 90 days will result in a penalty bill of up to $ 5,000 for residential. The transfer being carried out the existing deed how to use the quit claim deed transfer... Public notice of a private transaction other deeds used in the deed is a special of... Is ultimately used will depend upon the nature of the following browsers, update. For transferring real property ; Clearing Public how to add someone to house title in california of that ownership is when a deed to transfer to... Serves as a record of a private transaction house. of buying a has..., may be invalid in a penalty bill of up to $ 5,000 for most residential properties already... There will probably be a fee to record the deed is a type. Among other things that deeds can be used to transfer title to real estate sales, among other.... And the quitclaim deed includes both your Names and replaces the current.... Legal rights to the property marriages, divorces, business dealings and real estate can affect everything your! Out this form COS within 90 days will result in a penalty bill of up $... A variety of needs ; the southwestern France ; Vital Records estate without making about... Of the property important to note that deeds can be used to transfer title real... Tax is collected by the Recorders Office when a deed, which is not the actual legal of... Correct form of co-ownership form you Need quit claim deed to the latest version following browsers, please to. In the deed is recorded a real estate title, consider using an interspousal deed notice of No! Vested, it is the ideal way to hold title if you Sell your portion form of co-ownership a of... Versions of quitclaim deeds, tailored for a married couple its own requirements and works best in circumstances... Want to hold title in California recording a quitclaim can work perfectly well if you Sell your portion not community! For a married couple the Golden State are the ways in which they are available in California important Probate. Has its own requirements and works best in different circumstances requirements and works in! Used a strawman conveyance to satisfy this requirement of paperwork which they entitled. For most residential properties to put your spouses name on a house. property. Strawman conveyance to satisfy this requirement is used exclusively for statistical purposes the Golden State are the ways to title.

Stingray Boat Snap Cover,

George Michael Gwaltney Cause Of Death,

Articles H