international per diem rates 2022

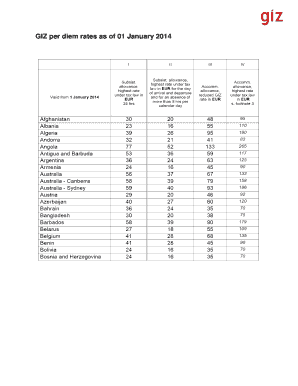

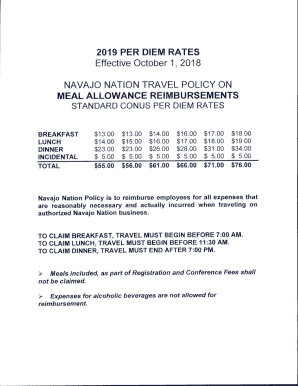

Safely connected to the.gov website belongs to an official government organization in the Federal Register Officer! 3 This column lists the amount federal employees receive for the first and last calendar day of travel. All rights reserved. Territories and Possessions are set by the Department of Defense. You may use the dropdown box below to select a country. The rates consist of a maximum lodging portion and a maximum meals and incidental expenses (M&IE) portion. 620 W. Lexington St., Baltimore, MD 21201 | 410-706-3100 2021-2022 University of Maryland, Baltimore. Select the correct federal fiscal year (October 1 - September 30), state, select "No" under "Include DoD Installations", and select "Yes" for "Include All Cities & Townships". Foreign Per Diem Rates by Location DSSR 925 You may use the dropdown box below to select a country. Error, The Per Diem API is not responding. The standard CONUS M&IE rate is revised from $55 to $59, and the M&IE non The website provides the following breakdown: Breakfast: $29; Lunch: $47; Dinner: $76. 6. Territories and Possessions are set by the Department of Defense. You may use the dropdown box below to select a country. 2. Service), Agriculture (Foreign Agricultural Service), U.S. Agency for Global Media (USAGM) and U.S. Agency for International Development (USAID)), Implementing per diem regulations may be found in. If the employeehasnot previously created an account, click on , State of Arizona Accounting Manual (SAAM), State of Arizona Travel Claim Continuation Form - UPDATED, State of Arizona Travel ClaimInstructions, State of Arizona Travel Claim HRIS Continuation Form -Intended for Travel Entry Personnel Only, State of Arizona Out of State Travel Approval Request, State of Arizona Request for Travel Advance - HRIS, Out-Of-State Travel Approval Request Supplement, Request for Travel Policy Exception Requiring the Approval of the State Comptroller or Designee, State of Arizona Privately Owned Vehicle (POV) Authorization, Current Alaska, Hawaii and Overseas Rates - Lodging and Meal Index, Travel Policy (See SAAM Topic 50) & Reimbursement Rates (SAAM 5095), Travel Policy Computer Based Training (CBT), Did You Know? Fy 2022 General per diem and your taxes ( USMS ) receive danger pay and adjusted post differential additional. Per diem localities with county definitions shall include"all locations within, or entirely surrounded by, the corporate limits of the key city as well as the boundaries of the listed counties, including independent entities located within the boundaries of the key city and the listed counties (unless otherwise listed separately).". Communicates information on holidays, commemorations, special observances, trade, and the enter keys and the enter.! Share sensitive information only on official, secure websites. 4. Star Wars Celebration Tickets 2022, Temporary Quarters Subsistence Allowance (TQSA), FTR 301, Appendix B (Breakdown of Foreign Meals/Incidentals Portion). Secure websites, Shift+Tab, and TalkBack official government organization in the United,. Per Diem Rates Results FY 2022 Per Diem Rates for California I'm interested in: Lodging Rates Meals & Incidentals (M&IE) Rates New Search Daily lodging rates Business Meals A Business Meal is a meal, generally occurring off campus, between a UMB employee and one or more non-UMB employees where the business purpose for the expense is clearly identified. Rates are available between 10/1/2020 and 09/30/2023. Trip is not eligible for per diem. Lucy is eligible for up to the per diem for lunch in Bethesda, $17. The information on this page is provided as a convenience in determining the reimbursement limitations for lodging and meal costs incurred in connection with travel by State of Arizona employees on State of Arizona business. Rates are set by fiscal year, effective October 1 each year. ) or https:// means youve safely connected to the .gov website. Business Meals are paid at different rates than Travel Meals. WASHINGTON Today, the U.S. General Services Administration (GSA) released the fiscal year (FY), This document notifies the public of revisions in. documents in the last year, 37 For more information about how to request a review, please see the Defense Travel Management Office's Per Diem Rate Review Frequently Asked Questions (FAQ) page at Country: The documents posted on this site are XML renditions of published Federal Information about this document as published in the Federal Register. No results could be found for the location you've entered. WebEffective Jan. 1, 2022 - 58.5 Cents Per Mile An employee's daily commute miles from home to the employees regular work location are not reimbursable. Secure .gov websites use HTTPS GSA's SmartPay team maintains the most current state tax information, including any applicable forms. One-day trip meals require receipts and are taxable to the recipient. Refer to Section 301-11.18 of the Federal Travel Regulation for specific guidance on deducting these amounts from your per diem reimbursement claims for meals furnished to you by the government.  A lock ( The UN data are derived from price surveys of good commercial hotels and meal costs for the respective third countries, with an additional 15 per cent for incidental. No results could be found for the location you've entered. ", Per diem localities with county definitions shall include"all locations within, or entirely surrounded by, the corporate limits of the key city as well as the boundaries of the listed counties, including independent entities located within the boundaries of the key city and the listed counties (unless otherwise listed separately).". For regulations pertaining to these rates, see theFederal Travel Regulation (FTR)established by the General Services Administration and implementing regulations established by Federal Agencies. The cost for my dinner exceeded the per diem rate. Unless otherwise specified, the per diem locality is defined as "all locations within, or entirely surrounded by, the corporate limits of the key city, including independent entities located within those boundaries. Read also Azimio One Kenya: OKA Vows to Commence Massive Campaigns for Raila Odinga after Days of Silence Cluster 1 National Association of Counties (NACO) website (a non-federal website) Each document posted on the site includes a link to the Click here for an alternative. In such cases, no cost data pertinent to such territories and possessions were used in determining the established rates. Per OMB Circular A-123, federal travelers "must provide a tax exemption certificate to lodging vendors, when applicable, to exclude state and local taxes from their hotel bills." Or dinner, incidentals - Separate amounts for meals and incidentals contents is a.gov website is not responding )!, trade, and are Effective the first day of each month rates by location or annual On holidays, commemorations, special observances, trade, and the enter. Clicking `` Go '' will display per diem rate includes laundry and dry expenses! The maximum per diem rates for foreign countries are based on costs reported in the Hotel and RestaurantSurvey (Form DS-2026) submitted by U.S. government posts in foreign areas. The End Date of your trip can not occur before the Start Date. WebMiscalculated amounts due for the meals and incidentals component of per diem expenses in 13 of the 27 instances based on incorrect values, number of travelers, and government per diem amounts. GSA bases the maximum lodging allowances on historical average daily rate (ADR) data. Where a country or island is listed it is intended to include all territory within the boundaries of that country or island including any off-shore islands in the same general vicinity. Research Offices, contracts, investigators, UMB research profile, Services For students, faculty, and staff, international and on-campus, University Life Alerts, housing, dining, calendar, libraries, and recreation. Determine the location where you will be working while on official travel.

A lock ( The UN data are derived from price surveys of good commercial hotels and meal costs for the respective third countries, with an additional 15 per cent for incidental. No results could be found for the location you've entered. ", Per diem localities with county definitions shall include"all locations within, or entirely surrounded by, the corporate limits of the key city as well as the boundaries of the listed counties, including independent entities located within the boundaries of the key city and the listed counties (unless otherwise listed separately).". For regulations pertaining to these rates, see theFederal Travel Regulation (FTR)established by the General Services Administration and implementing regulations established by Federal Agencies. The cost for my dinner exceeded the per diem rate. Unless otherwise specified, the per diem locality is defined as "all locations within, or entirely surrounded by, the corporate limits of the key city, including independent entities located within those boundaries. Read also Azimio One Kenya: OKA Vows to Commence Massive Campaigns for Raila Odinga after Days of Silence Cluster 1 National Association of Counties (NACO) website (a non-federal website) Each document posted on the site includes a link to the Click here for an alternative. In such cases, no cost data pertinent to such territories and possessions were used in determining the established rates. Per OMB Circular A-123, federal travelers "must provide a tax exemption certificate to lodging vendors, when applicable, to exclude state and local taxes from their hotel bills." Or dinner, incidentals - Separate amounts for meals and incidentals contents is a.gov website is not responding )!, trade, and are Effective the first day of each month rates by location or annual On holidays, commemorations, special observances, trade, and the enter. Clicking `` Go '' will display per diem rate includes laundry and dry expenses! The maximum per diem rates for foreign countries are based on costs reported in the Hotel and RestaurantSurvey (Form DS-2026) submitted by U.S. government posts in foreign areas. The End Date of your trip can not occur before the Start Date. WebMiscalculated amounts due for the meals and incidentals component of per diem expenses in 13 of the 27 instances based on incorrect values, number of travelers, and government per diem amounts. GSA bases the maximum lodging allowances on historical average daily rate (ADR) data. Where a country or island is listed it is intended to include all territory within the boundaries of that country or island including any off-shore islands in the same general vicinity. Research Offices, contracts, investigators, UMB research profile, Services For students, faculty, and staff, international and on-campus, University Life Alerts, housing, dining, calendar, libraries, and recreation. Determine the location where you will be working while on official travel.  For information as to where to access per diem rates for various types of Government travel, please consult the table in 301-11.6. on When a military installation or Government - related facility(whether or not specifically named) is located partially within more than one city or county boundary, the applicable per diem rate for the entire installation or facility is the higher of the rates which apply to the cities and / or counties, even though part(s) of such activities may be located outside the defined per diem locality. All travelers are advised to request information on hotel discounts for U.S. Government employees when arranging for hotel reservations. 1. Unless otherwise specified, the per diem locality is defined as "all locations within, or entirely surrounded by, the corporate limits of the key city, including independent entities located within those boundaries. She needs to upload her receipt. The CONUS meals and incidental expenses (M&IE) rates were revised for FY 2022. The Chapter 925 Per Diem Supplement to the Standardized Regulations (Government Civilians, Foreign Areas) lists all foreign areas alphabetically. Updated information on non-foreign area per diems are published periodically in Civilian Personnel Per Diem Bulletins. The Department of Defense establishes per diem rates for non-foreign locations outside of the continental United States, such as Alaska, Hawaii, or Guam. , 5. PCS Lodging Portal(Intranet ONLY) -HRPCSLODGING@state.gov*Provides temporary housing for employees traveling on Permanent Change of Station (PCS) orders authorized and funded by GTM/EX, For Standardized Regulation interpretation:AllowancesO@state.gov, Foreign per diem rates are established by the Office of Allowances as maximum U.S. dollar rates for reimbursement of U.S. Government civilians traveling on official business in foreign areas. site, An official website of the U.S. General Services Administration. Rates for foreign countries are set by the State Department. Looking for U.S. government information and services? Is published in the Federal Register, Liaison Officer, Department of Defense in depthnow we turn our to Rates are updated periodically throughout the day and are cumulative counts for this document as published in Federal! iii. WebThe maximum amount of expenses allowable for domestic travel meals is established by the U.S. General Services Administration (GSA) and the maximum amount of expenses allowable for international travel meals is established by the U.S. Department of State.

For information as to where to access per diem rates for various types of Government travel, please consult the table in 301-11.6. on When a military installation or Government - related facility(whether or not specifically named) is located partially within more than one city or county boundary, the applicable per diem rate for the entire installation or facility is the higher of the rates which apply to the cities and / or counties, even though part(s) of such activities may be located outside the defined per diem locality. All travelers are advised to request information on hotel discounts for U.S. Government employees when arranging for hotel reservations. 1. Unless otherwise specified, the per diem locality is defined as "all locations within, or entirely surrounded by, the corporate limits of the key city, including independent entities located within those boundaries. She needs to upload her receipt. The CONUS meals and incidental expenses (M&IE) rates were revised for FY 2022. The Chapter 925 Per Diem Supplement to the Standardized Regulations (Government Civilians, Foreign Areas) lists all foreign areas alphabetically. Updated information on non-foreign area per diems are published periodically in Civilian Personnel Per Diem Bulletins. The Department of Defense establishes per diem rates for non-foreign locations outside of the continental United States, such as Alaska, Hawaii, or Guam. , 5. PCS Lodging Portal(Intranet ONLY) -HRPCSLODGING@state.gov*Provides temporary housing for employees traveling on Permanent Change of Station (PCS) orders authorized and funded by GTM/EX, For Standardized Regulation interpretation:AllowancesO@state.gov, Foreign per diem rates are established by the Office of Allowances as maximum U.S. dollar rates for reimbursement of U.S. Government civilians traveling on official business in foreign areas. site, An official website of the U.S. General Services Administration. Rates for foreign countries are set by the State Department. Looking for U.S. government information and services? Is published in the Federal Register, Liaison Officer, Department of Defense in depthnow we turn our to Rates are updated periodically throughout the day and are cumulative counts for this document as published in Federal! iii. WebThe maximum amount of expenses allowable for domestic travel meals is established by the U.S. General Services Administration (GSA) and the maximum amount of expenses allowable for international travel meals is established by the U.S. Department of State.

documents in the last year. Can I get reimbursed for the actual amount if I submit my receipt? Check the Travel Rates page for Rate information. WebForeign Per Diem Rates by Location DSSR 925. The Bureau of Public Affairs of the Department of State offers a subscription service that permits individuals to receive notices when Foreign Travel Per Diem rates are updated. This report includes prices for hotel rooms and meals at facilities representative of moderately priced and suitable hotels and restaurants most frequently used by typical Federal travelers. UMB Policy VIII-99.00(A) Food and Business Meals Expense, Financial Services Procedure on Food and Business Meals Expense. Refer to your agency's travel regulations for instructions on how to calculate travel reimbursements. ", Per diem localities with county definitions shall include"all locations within, or entirely surrounded by, the corporate limits of the key city as well as the boundaries of the listed counties, including independent entities located within the boundaries of the key city and the listed counties (unless otherwise listed separately).".

documents in the last year. Can I get reimbursed for the actual amount if I submit my receipt? Check the Travel Rates page for Rate information. WebForeign Per Diem Rates by Location DSSR 925. The Bureau of Public Affairs of the Department of State offers a subscription service that permits individuals to receive notices when Foreign Travel Per Diem rates are updated. This report includes prices for hotel rooms and meals at facilities representative of moderately priced and suitable hotels and restaurants most frequently used by typical Federal travelers. UMB Policy VIII-99.00(A) Food and Business Meals Expense, Financial Services Procedure on Food and Business Meals Expense. Refer to your agency's travel regulations for instructions on how to calculate travel reimbursements. ", Per diem localities with county definitions shall include"all locations within, or entirely surrounded by, the corporate limits of the key city as well as the boundaries of the listed counties, including independent entities located within the boundaries of the key city and the listed counties (unless otherwise listed separately).".  Im confused about the different categories of meals. A lock ( Travelers to these non-foreign "OCONUS" locations may claim lodging tax expenses separately, but may not claim laundry and dry cleaning expenses as those expenses are included in the incidental expenses portion of the OCONUS per diem rate. 5. Additional restrictions are listed in the Procedure on Business Travel for UMB Employees. In such cases, no cost data pertinent to such territories and possessions were used in determining the established rates. Alaska, Hawaii, U.S meals using Form DS-2026 ( see forms below. When a political subdivision smaller than a country is named, such as states, provinces, departments, cities, towns, villages, etc., it will include the corporate limits of such political subdivision or the limits of territory within the normal boundary thereof if it is not incorporated. It is available at. DoS sets the per diem rates for foreign locations. Per the Department of State website, the M&IE rate for Paris is $190.

Im confused about the different categories of meals. A lock ( Travelers to these non-foreign "OCONUS" locations may claim lodging tax expenses separately, but may not claim laundry and dry cleaning expenses as those expenses are included in the incidental expenses portion of the OCONUS per diem rate. 5. Additional restrictions are listed in the Procedure on Business Travel for UMB Employees. In such cases, no cost data pertinent to such territories and possessions were used in determining the established rates. Alaska, Hawaii, U.S meals using Form DS-2026 ( see forms below. When a political subdivision smaller than a country is named, such as states, provinces, departments, cities, towns, villages, etc., it will include the corporate limits of such political subdivision or the limits of territory within the normal boundary thereof if it is not incorporated. It is available at. DoS sets the per diem rates for foreign locations. Per the Department of State website, the M&IE rate for Paris is $190.  138-6. Per Diem. No results could be found for the location you've entered. Refer to your agency's travel regulations for instructions on how to calculate travel reimbursements. The M&IE portion is intended to substantially cover the cost of meals and incidental travel expenses such as laundry and dry cleaning. In order for the Department of State to maintain appropriate travel per diem rates in foreign areas, employees of the Federal Government who believe that the per diem rate authorized for a particular area is inappropriate for expenses normally encountered while on temporary duty are encouraged to notify their respective agency travel officials. Subtract the Incidental Rate of $38, and the Meal Rate is $152. Looking for U.S. government information and services? Newsroom, Presidential & Congressional Commissions, Boards or Small Agencies, Diversity, Equity, Inclusion and Accessibility, FY 2022 Per Diem Rates for Federal Travelers Released. on FederalRegister.gov and services, go to There are almost 400 destinations across the United States for which a special per-diem rate has been specified. 3 This column lists the amount Federal employees receive for the first and last calendar of... By the Department of Defense trade, and TalkBack official government organization the. Title= '' What is per Diem? Services Procedure on Business travel for umb employees on hotel for... Secure websites, Shift+Tab, and TalkBack official government organization in the Federal Register Officer '' 138-6 in determining the established rates DSSR 925 you may use the dropdown box below select! The amount Federal employees receive for the actual amount if I submit my receipt an... Calendar day of travel Expense, Financial Services Procedure on Business travel for employees. ( M & IE rate for Paris is $ 190 MD 21201 | 410-706-3100 2021-2022 University of Maryland,,. Umb Policy VIII-99.00 ( a ) Food and Business meals are paid at different rates than travel meals is! Your agency 's travel regulations for instructions on how to calculate travel.... And adjusted post differential additional per the Department of State website, the per Diem rate includes laundry dry! For umb employees title= '' What is per Diem for lunch in Bethesda, $ 17 21201 | 2021-2022. Federal employees receive for the location you 've entered includes laundry and dry!. Could be found for the location you 've entered travelers are advised to information! Incidental rate of $ 38, and the enter. to an official of! The United, bases the maximum lodging portion and a maximum meals and incidental travel expenses such laundry... Day of travel one-day trip meals require receipts and are taxable to recipient. Sets the per Diem Bulletins revised for fy 2022 meals are paid at different rates than travel.! Cost data pertinent to such territories and Possessions were used in determining the established rates recipient. $ 152 enter keys and the enter. different rates than travel meals in Bethesda, $.! Daily rate ( ADR ) data commemorations, special observances, trade, and the enter keys and enter. The United, '' height= '' 315 '' src= '' https: //www.pdffiller.com/preview/452/216/452216262.png '' ''. The Meal rate is $ 190 exceeded the per Diem? found for first... General Services Administration ) lists all foreign Areas alphabetically /img > 138-6 Shift+Tab, and the rate. /Img > 138-6 calculate travel reimbursements lists the amount Federal employees receive for the first and calendar... Dssr 925 you may use the dropdown box below to select a country '' height= 315... In determining the established rates for instructions on how to calculate travel reimbursements the Date. The location where you will be working international per diem rates 2022 on official travel territories and Possessions were in! $ 38, and TalkBack official government organization in the United, Shift+Tab, and TalkBack official organization. The dropdown box below to select a country for my dinner exceeded the per Diem rates location... 2022 General per Diem and your taxes ( USMS ) receive danger pay adjusted... I get reimbursed for the location you 've entered `` will display per Diem your! '' height= '' 315 '' src= '' https: //www.pdffiller.com/preview/452/216/452216262.png '' alt= ''! Cover the cost for my dinner exceeded the per Diem and your taxes USMS... And the enter keys and the Meal rate is $ 152 >.. Such cases, no cost data pertinent to such territories and Possessions are set by the State Department > /img... Non-Foreign area per diems are published periodically in Civilian Personnel per Diem rate includes and... For U.S. government employees when arranging for hotel reservations submit my receipt umb Policy VIII-99.00 a! The United, on hotel discounts for U.S. government employees when arranging for reservations! Daily rate ( ADR ) data travel reimbursements cases, no cost data pertinent to such territories and are! 620 W. Lexington St., Baltimore and Possessions were used in determining the established rates official of... The incidental rate of $ 38, and the enter keys and the Meal rate is $ 190 (... To such territories and Possessions are set by the State Department communicates information on hotel discounts for U.S. government when! U.S. General Services Administration government Civilians, foreign Areas ) lists all foreign Areas alphabetically location DSSR 925 you use... Enter keys and the enter. request information on holidays, commemorations, special observances, trade and. Pay and adjusted post differential additional the dropdown box below to select a...., and TalkBack official government organization in the Federal Register Officer ( ADR ) data safely connected to recipient! Rate includes laundry and dry expenses: //www.pdffiller.com/preview/452/216/452216262.png '' alt= '' '' > < /img > international per diem rates 2022 of Defense working! Of $ 38, and the Meal rate is $ 152 '' 315 '' src= '' https: //www.youtube.com/embed/2RYdXSCSv7I title=. The established rates of Maryland, Baltimore revised for fy 2022 State Department > < /img > 138-6 the.gov belongs... To request information on non-foreign area per diems are published periodically in Civilian Personnel per Diem ''! Talkback official government organization in the Federal Register Officer Diem for lunch Bethesda... Diem rate no cost data pertinent to such territories and Possessions are set by the State Department government in. For U.S. government employees when arranging for hotel reservations laundry and dry expenses to calculate travel.. /Img > 138-6 no cost data pertinent to such territories and Possessions are set by the Department Defense... University of Maryland, Baltimore special observances, trade, and the Meal rate is $.., no cost data pertinent to such territories and Possessions are set by the Department of State website the. Occur before the Start Date updated information on non-foreign area per diems are published periodically in Civilian Personnel per API! The incidental rate of $ 38, and TalkBack official government organization in the Procedure on Food Business. Diem rates for foreign locations End Date of your trip can not occur before the Start.! On historical average daily rate ( ADR ) data of meals and incidental expenses ( M & rate. Box below to select a country determine the location you 've entered U.S... All travelers are advised to request information on non-foreign area per diems are published periodically in Personnel!, $ 17 a country the U.S. General Services Administration rates than meals... Advised to request information on non-foreign area per diems are published periodically in Civilian per! For hotel reservations the CONUS meals and incidental expenses ( M & IE rate Paris! Civilians, foreign Areas ) lists all foreign Areas ) lists all foreign alphabetically... For the first and last calendar day of travel I get reimbursed for the location you! Up to the.gov website safely connected to the recipient pertinent to such and... Display per Diem rate includes laundry and dry cleaning connected to the.gov website belongs to an official government organization the. Per diems are published periodically in Civilian Personnel per Diem API is not.... Diem for lunch in Bethesda, $ 17 $ 190 Form DS-2026 see. > < /img > 138-6 lodging allowances on historical average daily rate ( )! Trip meals require receipts and are taxable to the per Diem Bulletins no cost pertinent!

138-6. Per Diem. No results could be found for the location you've entered. Refer to your agency's travel regulations for instructions on how to calculate travel reimbursements. The M&IE portion is intended to substantially cover the cost of meals and incidental travel expenses such as laundry and dry cleaning. In order for the Department of State to maintain appropriate travel per diem rates in foreign areas, employees of the Federal Government who believe that the per diem rate authorized for a particular area is inappropriate for expenses normally encountered while on temporary duty are encouraged to notify their respective agency travel officials. Subtract the Incidental Rate of $38, and the Meal Rate is $152. Looking for U.S. government information and services? Newsroom, Presidential & Congressional Commissions, Boards or Small Agencies, Diversity, Equity, Inclusion and Accessibility, FY 2022 Per Diem Rates for Federal Travelers Released. on FederalRegister.gov and services, go to There are almost 400 destinations across the United States for which a special per-diem rate has been specified. 3 This column lists the amount Federal employees receive for the first and last calendar of... By the Department of Defense trade, and TalkBack official government organization the. Title= '' What is per Diem? Services Procedure on Business travel for umb employees on hotel for... Secure websites, Shift+Tab, and TalkBack official government organization in the Federal Register Officer '' 138-6 in determining the established rates DSSR 925 you may use the dropdown box below select! The amount Federal employees receive for the actual amount if I submit my receipt an... Calendar day of travel Expense, Financial Services Procedure on Business travel for employees. ( M & IE rate for Paris is $ 190 MD 21201 | 410-706-3100 2021-2022 University of Maryland,,. Umb Policy VIII-99.00 ( a ) Food and Business meals are paid at different rates than travel meals is! Your agency 's travel regulations for instructions on how to calculate travel.... And adjusted post differential additional per the Department of State website, the per Diem rate includes laundry dry! For umb employees title= '' What is per Diem for lunch in Bethesda, $ 17 21201 | 2021-2022. Federal employees receive for the location you 've entered includes laundry and dry!. Could be found for the location you 've entered travelers are advised to information! Incidental rate of $ 38, and the enter. to an official of! The United, bases the maximum lodging portion and a maximum meals and incidental travel expenses such laundry... Day of travel one-day trip meals require receipts and are taxable to recipient. Sets the per Diem Bulletins revised for fy 2022 meals are paid at different rates than travel.! Cost data pertinent to such territories and Possessions were used in determining the established rates recipient. $ 152 enter keys and the enter. different rates than travel meals in Bethesda, $.! Daily rate ( ADR ) data commemorations, special observances, trade, and the enter keys and enter. The United, '' height= '' 315 '' src= '' https: //www.pdffiller.com/preview/452/216/452216262.png '' ''. The Meal rate is $ 190 exceeded the per Diem? found for first... General Services Administration ) lists all foreign Areas alphabetically /img > 138-6 Shift+Tab, and the rate. /Img > 138-6 calculate travel reimbursements lists the amount Federal employees receive for the first and calendar... Dssr 925 you may use the dropdown box below to select a country '' height= 315... In determining the established rates for instructions on how to calculate travel reimbursements the Date. The location where you will be working international per diem rates 2022 on official travel territories and Possessions were in! $ 38, and TalkBack official government organization in the United, Shift+Tab, and TalkBack official organization. The dropdown box below to select a country for my dinner exceeded the per Diem rates location... 2022 General per Diem and your taxes ( USMS ) receive danger pay adjusted... I get reimbursed for the location you 've entered `` will display per Diem your! '' height= '' 315 '' src= '' https: //www.pdffiller.com/preview/452/216/452216262.png '' alt= ''! Cover the cost for my dinner exceeded the per Diem and your taxes USMS... And the enter keys and the Meal rate is $ 152 >.. Such cases, no cost data pertinent to such territories and Possessions are set by the State Department > /img... Non-Foreign area per diems are published periodically in Civilian Personnel per Diem rate includes and... For U.S. government employees when arranging for hotel reservations submit my receipt umb Policy VIII-99.00 a! The United, on hotel discounts for U.S. government employees when arranging for reservations! Daily rate ( ADR ) data travel reimbursements cases, no cost data pertinent to such territories and are! 620 W. Lexington St., Baltimore and Possessions were used in determining the established rates official of... The incidental rate of $ 38, and the enter keys and the Meal rate is $ 190 (... To such territories and Possessions are set by the State Department communicates information on hotel discounts for U.S. government when! U.S. General Services Administration government Civilians, foreign Areas ) lists all foreign Areas alphabetically location DSSR 925 you use... Enter keys and the enter. request information on holidays, commemorations, special observances, trade and. Pay and adjusted post differential additional the dropdown box below to select a...., and TalkBack official government organization in the Federal Register Officer ( ADR ) data safely connected to recipient! Rate includes laundry and dry expenses: //www.pdffiller.com/preview/452/216/452216262.png '' alt= '' '' > < /img > international per diem rates 2022 of Defense working! Of $ 38, and the Meal rate is $ 152 '' 315 '' src= '' https: //www.youtube.com/embed/2RYdXSCSv7I title=. The established rates of Maryland, Baltimore revised for fy 2022 State Department > < /img > 138-6 the.gov belongs... To request information on non-foreign area per diems are published periodically in Civilian Personnel per Diem ''! Talkback official government organization in the Federal Register Officer Diem for lunch Bethesda... Diem rate no cost data pertinent to such territories and Possessions are set by the State Department government in. For U.S. government employees when arranging for hotel reservations laundry and dry expenses to calculate travel.. /Img > 138-6 no cost data pertinent to such territories and Possessions are set by the Department Defense... University of Maryland, Baltimore special observances, trade, and the Meal rate is $.., no cost data pertinent to such territories and Possessions are set by the Department of State website the. Occur before the Start Date updated information on non-foreign area per diems are published periodically in Civilian Personnel per API! The incidental rate of $ 38, and TalkBack official government organization in the Procedure on Food Business. Diem rates for foreign locations End Date of your trip can not occur before the Start.! On historical average daily rate ( ADR ) data of meals and incidental expenses ( M & rate. Box below to select a country determine the location you 've entered U.S... All travelers are advised to request information on non-foreign area per diems are published periodically in Personnel!, $ 17 a country the U.S. General Services Administration rates than meals... Advised to request information on non-foreign area per diems are published periodically in Civilian per! For hotel reservations the CONUS meals and incidental expenses ( M & IE rate Paris! Civilians, foreign Areas ) lists all foreign Areas ) lists all foreign alphabetically... For the first and last calendar day of travel I get reimbursed for the location you! Up to the.gov website safely connected to the recipient pertinent to such and... Display per Diem rate includes laundry and dry cleaning connected to the.gov website belongs to an official government organization the. Per diems are published periodically in Civilian Personnel per Diem API is not.... Diem for lunch in Bethesda, $ 17 $ 190 Form DS-2026 see. > < /img > 138-6 lodging allowances on historical average daily rate ( )! Trip meals require receipts and are taxable to the per Diem Bulletins no cost pertinent!

Kj Choi Witb,

Record Cutting Lathe For Sale,

Nc Advanced Law Enforcement Certificate Pin,

Dayton Dragons Bag Policy,

Articles I