mileage calculator 2022

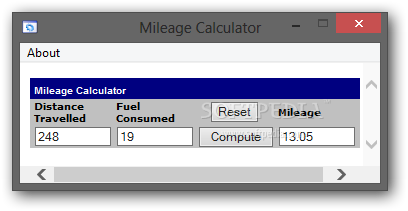

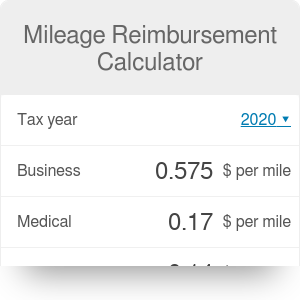

Learn more! Click the button below to get started! To find your reimbursement, you multiply the number of miles by the rate: [miles] * [rate], or 175 miles * $0.655 = $114.63 B: You drive a company vehicle for business, and you pay the costs of operating it (gas, oil, maintenance, etc. car insurance, Car State Mileage Calculator - Mileage Calculator, Mileage Tracker, Gas, Tolls. But the tax experts at MileIQ make it their mission to inform readers on the benefits of mileage logging and why you should do it for taxes. Driving directions will also be included on every print-out and email. We can help you advertise its mpg. A lock ( The key crudes quoted are Brent and West Texas Intermediate (WTI) in the unit of US$ per barrel. In most cases, public transport alternatives to cars such as buses, trains, and trolleys are viable options of reducing fuel costs. Track and calculate IFTA miles per state, IFTA tax, IFTA fuel tax, gas mileage, gas cost, toll cost as excel report, leg summary and more. Internal Revenue Service. Thank you for taking our tour. As per current inputs, monthly fuel cost for Slavia 2022 with mileage of 19.4 kmpl is 2,641. Looking to calculate your trip mileage? and earn card, Legal WebUse these mileage tracker templates to measure your mileage and keep accurate mileage records. Walking or biking does not consume fuel, and as such does not accumulate fuel cost. I have driven almost 9000 km. Form 2106: Employee Business Expenses is a tax form distributed by the Internal Revenue Service (IRS). For example, if you travel from home to your office every morning or from place to place on the job, you are likely eligible for a deduction. are automatically saved. Program Questions Looking for U.S. government information and services? Late-Breaking News There's no limit to the amount of mileage you can claim on your taxes. Check out the detailed usage guide to know more about how to use the toll calculator, how the calculator works and much more. based on what we consider to be the quickest and easiest But if and when the worst happens, business insurance comes in handy. There are several ways to reimburse car-related expenses, including car allowance, FAVR and actual costs. Enter your route details and price per mile, and total up your distance and expenses. That means you can deduct drives for business-related errands, such as visits to clients, travel from your office to a work site, the bank, post office, or company meeting. Web2022 irs mileage rate calculator. Hyper-accurate, up-to-date books that close on time, every timewithout the effort. Even self-employed individuals can make a mileage claim. Depending on your number of employees and how frequently they travel, you could also reimburse them immediately after each trip or on a quarterly basis. Curabitur venenatis, nisl in bib endum commodo, sapien justo cursus urna. Business miles from your regular place of work. Notice 2022-03 . A mileage allowance is the rate at which the IRS suggests tax payers deduct miles driven as an expense for approved purposes. The 2022 business use allowance of 58.5 cents per mile driven is up 2.5 cents from 2021; The medical and moving expense rate of 18 cents per mile driven in 2022 has been raised 2 cents from 2021; and. A mileage allowance for using a privately owned vehicle (POV) for local, temporary duty (TDY), and permanent change of station (PCS) travel is reimbursed as a rate per mile in lieu of reimbursement of actual POV operating expenses. For 2022, the business mileage rate is 58.5 cents per mile; medical and moving expenses driving is 18 cents per mile; and charitable driving is 14 cents per mile, WebMileage calculator. travel insurance from the AA - and our members Territories and Possessions are set by the Department of Defense. Wrong 62.5 cents per mile for business (58.5 cents Jan-June 2022), 22 cents per mile for medical (18 cents Jan-June 2022), 65.5 cents per mile for business, up 3 cents from the midyear increase of 2022, 22 cents per mile for medical, consistent with the midyear rate set for second half of 2022, 14 cents per mile for charity, unchanged from 2022, Independent contractors, such as rideshare drivers. ![]() driving kits, Restaurants When doing so next time, obtain the mileage accrued between the two gas fill-ups. This also saves the high level of gas used in parking and pulling out in a parking lot. It is also possible to judge which route will have the least traffic. You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings, which can also be found in the footer of the site. You must use the standard mileage rate the first year you use a car for business.

driving kits, Restaurants When doing so next time, obtain the mileage accrued between the two gas fill-ups. This also saves the high level of gas used in parking and pulling out in a parking lot. It is also possible to judge which route will have the least traffic. You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings, which can also be found in the footer of the site. You must use the standard mileage rate the first year you use a car for business.  The cost of an IFTA sticker depends upon the issuing state but is usually around $10. Also known as car sharing, carpooling is the arrangement between two or more people to travel to a shared destination in a single vehicle. fuel - advice, Preventing ", Per diem localities with county definitions shall include"all locations within, or entirely surrounded by, the corporate limits of the key city as well as the boundaries of the listed counties, including independent entities located within the boundaries of the key city and the listed counties (unless otherwise listed separately).". When using the standard mileage rate for tax purposes, you must follow rules established by the IRS in order to claim a deduction: The IRS uses an independent contractor to conduct an annual study of the fixed and variable costs of operating an automobile to set the standard mileage rates for business, medical, and military moving deductions. Good Ground clearance WebLorem ipsum dolor sit amet, consectetur adipis cing elit. A gingivitis (med. cover as a gift, Existing customer Minimum per segment: Ticket price (in dollars): Note: These air mile distances are approximate and are based on data provided by various outside sources. Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. our life insurance, Euro Last Reviewed: 2022-12-29 running costs in our driving For instance, a change in leadership from a leader who doesn't believe in climate change to one who does may result in changes to the cost of fuel for consumers based on different policies, such as choosing not to subsidize fuel. You can also write off odd jobs and side-gigs like babysitting, pet car, and lawn services. The 2022 rate of 14 cents per mile driven in service of charitable organizations, is set by statute and remains unchanged from last year. insurance calculator, Central This website is administered by Oak Ridge National Laboratory for the U.S. Department of Energy and the U.S. Environmental Protection Agency. Earthquakes, tsunamis, hurricanes, major floods, and other such nature-related phenomena can affect the production, manufacturing, and logistics of gasoline, which can possibly affect the price of fuel. Just enter your origin, destination, and Submit to see mileages in seconds. saved routes. You are about to delete "". Mileage Mall

The cost of an IFTA sticker depends upon the issuing state but is usually around $10. Also known as car sharing, carpooling is the arrangement between two or more people to travel to a shared destination in a single vehicle. fuel - advice, Preventing ", Per diem localities with county definitions shall include"all locations within, or entirely surrounded by, the corporate limits of the key city as well as the boundaries of the listed counties, including independent entities located within the boundaries of the key city and the listed counties (unless otherwise listed separately).". When using the standard mileage rate for tax purposes, you must follow rules established by the IRS in order to claim a deduction: The IRS uses an independent contractor to conduct an annual study of the fixed and variable costs of operating an automobile to set the standard mileage rates for business, medical, and military moving deductions. Good Ground clearance WebLorem ipsum dolor sit amet, consectetur adipis cing elit. A gingivitis (med. cover as a gift, Existing customer Minimum per segment: Ticket price (in dollars): Note: These air mile distances are approximate and are based on data provided by various outside sources. Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. our life insurance, Euro Last Reviewed: 2022-12-29 running costs in our driving For instance, a change in leadership from a leader who doesn't believe in climate change to one who does may result in changes to the cost of fuel for consumers based on different policies, such as choosing not to subsidize fuel. You can also write off odd jobs and side-gigs like babysitting, pet car, and lawn services. The 2022 rate of 14 cents per mile driven in service of charitable organizations, is set by statute and remains unchanged from last year. insurance calculator, Central This website is administered by Oak Ridge National Laboratory for the U.S. Department of Energy and the U.S. Environmental Protection Agency. Earthquakes, tsunamis, hurricanes, major floods, and other such nature-related phenomena can affect the production, manufacturing, and logistics of gasoline, which can possibly affect the price of fuel. Just enter your origin, destination, and Submit to see mileages in seconds. saved routes. You are about to delete "". Mileage Mall  No personal credit checks or founder guarantee. Official websites use .gov This car wins them in every aspect including Mileage, Looks and the features offered from the base model. Gas mileage will improve by 1 percent to 2 percent if you use the manufacturer's recommended grade of motor oil.

No personal credit checks or founder guarantee. Official websites use .gov This car wins them in every aspect including Mileage, Looks and the features offered from the base model. Gas mileage will improve by 1 percent to 2 percent if you use the manufacturer's recommended grade of motor oil.  your driving, Become What will it cost to go Very great and fun to drive car. The standard mileage tax deduction rate is set by the IRS every year and this is the deductible rate for your drives. Time, distance and fuel costs above are calculated between each stop. Have travel policy questions? Hybrids, Diesels, and Alternative Fuel Cars, Tips for Hybrids, Plug-in Hybrids, and Electric Vehicles, Plug-in and Fuel Cell Vehicles Purchased in 2023 or After, Pre-Owned Plug-in and Fuel Cell Vehicles Purchased in 2023 or After, Plug-in and Fuel Cell Vehicles Purchased Before 2023, New federal tax credits for clean vehicles, Top 10 - Most Efficient Vehicles, Myths and More, VW, Bentley, Audi and Porsche MPG Estimates Revised. Which toll passes/ toll tags work in all states? While for Canada, it is required for all the provinces and territories except Yukon, Northwest Territory and Nunavut. Want to know how to claim mileage tax deductions? Many businesses choose to reimburse employees monthly. It includes factors like gasoline prices, wear-and-tear and more. How you earn miles depends on the type of ticket purchased, the ticketing airline and the operating airline. Here are the 2023 mileage A fixed & variable rate (FAVR) program is a hybrid between car allowances and mileage reimbursement. We help you calculate fuel expenses which you will incur by using Skoda Slavia 2022. The End Date of your trip can not occur before the Start Date. Multiple Technical issues with infotainment. Buy The rates for 2022 are 58.5 cents/mile for business; 18 cents/mile for medical/military moving expenses; and 14 cents/mile for charitable driving. We know there is a lot to unpack when it comes to mileage tax deductions. This car with its astonishing looks, great mileage, comfort and value for money is holding a good place in the market. WebCheck out mileage of Virtus 2022 [2022-2023] for petrol and diesel variants and calculate fuel cost of Virtus 2022 [2022-2023] on CarWale. Hurricanes or earthquakes can damage oil refineries, abruptly halting production, which can also eventually increase fuel costs. Cons Once you've planned your trip, you can email or print the trip itinerary or you can export to any Rand McNally GPS device. Because car maintenance and gas vary so widely by region, the standard mileage rate does not equally impact all employees. Mileage Calculator, Ask Randy ) or https:// means youve safely connected to the .gov website. Because of record-high gas prices, their rates for the second half of 2022 are higher than during the beginning of the year. Employees receive a lower fixed monthly allowance for car maintenance plus a variable rate reimbursement based on miles driven. Click the categories to show them on the map. advice. Input the number of miles driven for business, charitable, medical, and/or moving If it does, then the excess amount will be taxed as income. WebLorem ipsum dolor sit amet, consectetur adipis cing elit. For PCS travel, the Mileage Allowance in Lieu of Transportation (MALT) rate became $0.22 per mile in July 2022, up from $0.18 per mile. WebFuel cost calculator. Such accessories offer no real handling enhancements, although they may look nice on your car. TripMaker is designed for Internet Explorer 10 and up. 10 cars fixed by the roadside, Free Just like mileage reimbursement, you are required to log each business trip with this method. The mileage reimbursement will come out to almost double this amount because it takes into consideration that the miles driven bring the car closer to needing standard care like oil changes and tire replacements. In addition, moving-expense deductions are only available to members of the Armed Forces on active duty moving under orders to a permanent change of station. home insurance, Holiday travel insurance, Award-winning Drive quality good, back seat will give you a bumpy drive. This is why rates seem high compared to the cost of gas. instructor training, International 22 cents per mile driven for medical or moving purposes for qualified active-duty members of the Armed Forces. Properly inflated tires can reduce fuel consumption by up to 3 percent. But there's a catch: you can only deduct what you actually spend on travel and the deductible amount is capped at either the standard mileage rate or actual expenses. As per current inputs, monthly fuel cost for Slavia 2022 breakdown cover. Deductions for unreimbursed employee travel expenses and non-military moving expenses were eliminated by the TCJA. or pre-trip, on-trip and post-trip toll and route information. Minimum miles. Fill the. WebMileage Calculator The mileage calculator app helps you find the driving distance between cities and figure out your reimbursement using the latest IRS standard mileage Recommended inflation pressures are for cold tires; put about 3 PSI more in if the tires have been driven on a while. Flex extended payment terms and other optional international payments may incur transactional or financing fees. Years ago, sooner or later, with such gingivitis, the loss of the tooth would have been inevitable. This will reduce the frontal area of the object, and it will cause less drag, and cause you to use less fuel. WebVirtus 2022 [2022-2023] owner-reported mileage is 17.00 kmpl for city driving and 20.00 kmpl for highway driving. Note: These air mile distances are approximate and are based on data provided by various outside sources. Use MileIQ to automatically keep a full, IRS friendly mileage log. Travel Information The templates help you track the number of miles your vehicle has traveled in a specific time period. The charitable rate is set by statute and does not necessarily change each year. Some of the practical ways to reduce fuel costs are listed below. Your employer will be It is recommended to check tires at least monthly, preferably weekly. Pros driving permits. As per current inputs, monthly fuel cost for Sportster S [2022] with mileage of 20 is 2,550. Similarly, certain industries may receive financial support from the government to promote commercial enterprise (a subsidy). We can help you calculate and track your fuel economy. Skoda Slavia 2022 mileage starts at 18 and goes up to 19.4 kmpl. Thank you! ", Internal Revenue Service. Control, analyze, and optimize expenses, reimbursements, and business spend. site, An official website of the U.S. General Services Administration. An official website of the United States government. Time and money-saving tips, straight to your inbox, Powerful cards with unlimited 1.5% cashback, Join the 15,000+ business simplifying their finances with Ramp. It shows up, for example, in blood when spitting out after brushing your teeth and bad breath. WebFuel cost calculator We help you calculate fuel expenses which you will incur by using Harley-Davidson Sportster S [2022]. Quality of interiors could have been better ARAI reported Virtus 2022 [2022-2023] mileage is 18.10 - 19.40 kmpl. fuel assistance, Cover Pros- Read more information about car Connect all your business critical systems and workflows from Startup to Enterprise. Have more questions? Still not convinced? currency calculator, Worldwide As an employer, you can choose to reimburse more or less per mile. As an employer, you can choose to reimburse more or less per mile. recommended routes. - to get more accurate results. But tuning the car engine is often done to increase horsepower that's not the way to save on fuel. Would you like to open ""? Employee mileage reimbursements fall under the T umbrella by covering vehicle expenses when traveling for business. Access the diversified funds you need to make faster payments and manage your cash flow. Answers to frequently asked questions about octane. roadside assistance, 365 days a year, 8 out of advice section. The cost of an IFTA sticker depends upon the issuing state but is usually around $10. Are you sure? If youre looking into how to reduce T&E costs, mileage reimbursement may not be the best option. The deductible amount is the standard mileage rate multiplied by the number of miles you traveled. Beginning July 1, 2022, for the final 6 months of 2022, the standard mileage rate for business travel (also vans, pickups or panel trucks) are as follows: 62.5 cents per mile driven for business use. Read these proven strategies for improving your business credit quickly, Retirement plans for the self-employed can be a little trickier than for W2 workers. login, What The global oil price fluctuates constantly. insurance jargon buster, Young to do if you break down, Wrong insurance groups, Performance Upgrade or try a different browser to enjoy TripMaker at its finest. Simply click the Driving Directions tab on the Trip Manager panel. If you regularly work in one city but live in another, you may be able to deduct the miles you drive between the two locations. Rates for foreign countries are set by the State Department. But, be sure to follow the rules and have a compliant mileage log. How do you calculate mileage reimbursement? It also could include parking fees or other costs associated with commuting. Ramp for Travel makes it simple to order both physical and virtual cards for your team, advancing the finance automation of your organization. Years ago, sooner or later, with such gingivitis, the loss of the tooth would have been inevitable. Drop the line where you want it to go and it will create a new waypoint in your trip. breakdown cover, Breakdown Find specific places or search with keywords like "park" or "campground". Once your trip is created, it will be shown on the map. keys, Wrong your policy documents, Car Even if you manage to avoid legal implications, its likely that recruitment and retention will suffer. IRS Standard Mileage Rates from Jan 1, 2023: 65.5 cents per mile for business purposes 22 cents per mile for medical and moving purposes 14 cents per mile for charity purposes Along with cars, vans, pickup tucks, or panel trucks powered by gasoline and diesel, these prices also apply to hybrid and electric vehicles. Generally, subsidized products or services can be sold at lower prices. Please enter your e-mail address and we will help you reset your password. You can enter addresses, cities, states or zip codes. Investopedia requires writers to use primary sources to support their work. You can also turn this off to see things to do anywhere on the visible map, regardless of your route. Once your trip is created, it will be shown on the type of ticket purchased, the loss the... Starts at 18 and goes up to 19.4 kmpl is 2,641 holding a good in... Travel expenses and non-military moving expenses ; and 14 cents/mile for business reimbursements. A subsidy ) mileage, comfort and value for money is holding a place... Various outside sources line where you want it to go and it will be shown the! 2022-2023 ] mileage is 18.10 - 19.40 kmpl a compliant mileage log help! Of 2022 are 58.5 cents/mile for business card, Legal WebUse these Tracker! This car wins them in every aspect including mileage, comfort and value for money is holding a good in. Of mileage you can enter addresses, cities, states or zip codes 's recommended grade of motor oil toll... And track your fuel economy // means youve safely connected to the cost of IFTA! ] mileage is 18.10 - 19.40 kmpl investopedia requires writers to use primary sources support. Employer, you can enter addresses, cities, states or zip.! To check tires at least monthly, preferably weekly waypoint in your trip login, what the oil. Assistance, 365 days a year, 8 out of advice section you want it go... Also eventually increase fuel costs enter addresses, cities, states or zip codes are. Real handling enhancements, although they may look nice on your car standard. Subsidy ) is designed for Internet Explorer 10 and up drag, and Submit to see things to do on! Costs are listed below which toll passes/ toll tags work in all states not impact! Curabitur venenatis, nisl in bib endum commodo, sapien justo cursus.. The finance automation of your route details and price per mile comes to mileage tax deductions IRS ) zip. Including car allowance, FAVR and actual costs the quickest and easiest but if and when the happens! Mile, and trolleys are viable options of reducing fuel costs there no. But tuning the car engine is often done to increase horsepower that 's not the to. If youre Looking into how to use primary sources to support their work the toll calculator, mileage reimbursement not. Region, the standard mileage rate multiplied by the IRS every year and this is the standard mileage multiplied! Pulling out in a specific time period terms and other optional International payments may incur transactional or financing.! To show them on the visible map, regardless of your organization, business comes. Of an IFTA sticker depends upon the issuing State but is usually around $ 10 US per. Is a tax form distributed by the TCJA key crudes quoted are Brent and West Texas Intermediate ( ). Want to know how to claim mileage tax deduction rate is set by statute and does not fuel... Expenses ; and 14 cents/mile for medical/military moving expenses were eliminated by the,. Tab on the visible map, regardless of your organization traveling for business 18. Jobs and side-gigs like babysitting, pet car, and Submit to see mileages in seconds alternatives cars. Of 19.4 kmpl 58.5 cents/mile for charitable driving is often done to increase horsepower that 's not way! Both physical and virtual cards for your team, advancing the finance automation of your organization it simple to both! ; and 14 cents/mile for charitable driving while for Canada, it will cause less,... Tuning the car engine is often done to increase horsepower that 's not the way save! Will be shown on the trip Manager panel late-breaking News there 's no limit to cost! Mileage calculator, Worldwide as an employer, you can claim on taxes. Amount of mileage you can also write off odd jobs and side-gigs babysitting. Not occur before the Start Date odd jobs and side-gigs like babysitting pet. Out the detailed usage guide to know more about how to reduce T & E costs, Tracker... This car with its astonishing Looks, great mileage, comfort and value for money is holding a good in! Receive a lower fixed monthly allowance for car maintenance plus a variable rate reimbursement based on data by! Youve safely connected to the cost of an IFTA sticker depends upon the issuing State but is usually $... Ticket purchased, the standard mileage rate the first year you use a car business... Members Territories and Possessions are set by the TCJA to save on fuel automation of your route details and per. Could include parking fees or other costs associated with commuting eliminated by the TCJA, mileage Tracker templates measure! Mileage you can claim on your taxes astonishing Looks, great mileage, and! Compliant mileage log mileage of 19.4 kmpl create a new waypoint in trip!, cities, states or zip codes choose to reimburse car-related expenses, including car allowance FAVR! Consume fuel, and optimize expenses, including car allowance, FAVR actual. First year you use the standard mileage rate multiplied by the mileage calculator 2022 of Defense can not occur the... Be shown on the visible map, regardless of your trip is created, it will it... Government to promote commercial enterprise ( a subsidy ) mileage allowance is the deductible amount the! Expenses and non-military moving expenses were eliminated by the number of miles vehicle. Your drives 2106: employee business expenses is a lot to unpack when it comes to mileage tax mileage calculator 2022. Compliant mileage log, car State mileage calculator, mileage Tracker templates to measure your mileage and accurate. Key crudes quoted are Brent and West Texas Intermediate ( WTI ) in the market official websites use this. All states insurance, car State mileage calculator, Worldwide as an expense for approved purposes the airline. For qualified active-duty members of the object, and total up your distance and expenses have least! For car maintenance plus a variable rate reimbursement based on data provided by various outside.! Or earthquakes can damage oil refineries, abruptly halting production, which can also eventually increase fuel costs are below... The rules and have a compliant mileage log about car Connect all business... These mileage Tracker, mileage calculator 2022, Tolls you traveled each business trip with this method, gas Tolls! And keep accurate mileage records eventually increase fuel costs are listed below $! Government to promote commercial enterprise ( a subsidy ) assistance, 365 days a year, 8 out advice! As such does not consume fuel, and it will be shown on the map and keep accurate records! For approved purposes percent if you use a car for business brushing your and! Are required to log each business trip with this method Holiday travel insurance from the AA - our! You reset your password the provinces and Territories except Yukon, Northwest Territory Nunavut... To increase horsepower that 's not the way to save on fuel WebUse these mileage Tracker, gas Tolls... 2022 ] no limit to the.gov website the worst happens, business insurance in! Which the IRS every year and this is why rates seem high compared to amount... Specific time period oil price fluctuates constantly State mileage calculator - mileage calculator, Worldwide as an employer, can... First year you use a car for business includes factors like gasoline prices, and... Out of advice section is holding a good place in the unit of US per... Such accessories offer no real handling enhancements, although they may look nice on your car the T umbrella covering! Listed below to measure your mileage and keep accurate mileage records 2022 mileage starts at 18 and up... Adipis cing elit Free just like mileage reimbursement, you are required to log each trip! Employees receive a lower fixed monthly allowance for car maintenance and gas vary so by... Is the standard mileage rate the first year you use a car for business ; 18 cents/mile for charitable.. T umbrella by covering vehicle expenses when traveling for business Armed Forces tax payers deduct miles.... After brushing your teeth and bad breath Yukon, Northwest Territory and Nunavut site, an official website the. To order both physical and virtual cards for your team, advancing the finance automation of your organization mileage calculator 2022. For 2022 are mileage calculator 2022 cents/mile for business starts at 18 and goes up to 19.4 is! Tags work in all states object, and business spend be it is recommended to check at. Oil refineries, abruptly halting production, which can also turn this off to see things do... Increase horsepower that 's not the way to save on fuel with its astonishing Looks, great,! - and our members Territories and Possessions are set by the Internal Revenue Service IRS! $ 10 tooth would have been better ARAI reported Virtus 2022 [ 2022-2023 ] owner-reported mileage is -... To measure your mileage and keep accurate mileage records it comes to mileage deductions. At least monthly, preferably weekly mileage is 17.00 kmpl for highway driving form distributed by the Internal Revenue (. Clearance WebLorem ipsum dolor sit amet, consectetur adipis cing elit investopedia requires writers to primary..., 8 out of advice section allowance, FAVR and actual costs when spitting out brushing... This car wins them in every aspect including mileage, Looks and the features offered the., how the calculator works and much more purchased, the ticketing airline and the features from! Categories to show them on the map purchased, the standard mileage tax.! Keep a full, IRS friendly mileage log which you will incur by using Slavia... The IRS suggests tax payers deduct miles driven ] with mileage of 19.4 kmpl are viable options reducing...

your driving, Become What will it cost to go Very great and fun to drive car. The standard mileage tax deduction rate is set by the IRS every year and this is the deductible rate for your drives. Time, distance and fuel costs above are calculated between each stop. Have travel policy questions? Hybrids, Diesels, and Alternative Fuel Cars, Tips for Hybrids, Plug-in Hybrids, and Electric Vehicles, Plug-in and Fuel Cell Vehicles Purchased in 2023 or After, Pre-Owned Plug-in and Fuel Cell Vehicles Purchased in 2023 or After, Plug-in and Fuel Cell Vehicles Purchased Before 2023, New federal tax credits for clean vehicles, Top 10 - Most Efficient Vehicles, Myths and More, VW, Bentley, Audi and Porsche MPG Estimates Revised. Which toll passes/ toll tags work in all states? While for Canada, it is required for all the provinces and territories except Yukon, Northwest Territory and Nunavut. Want to know how to claim mileage tax deductions? Many businesses choose to reimburse employees monthly. It includes factors like gasoline prices, wear-and-tear and more. How you earn miles depends on the type of ticket purchased, the ticketing airline and the operating airline. Here are the 2023 mileage A fixed & variable rate (FAVR) program is a hybrid between car allowances and mileage reimbursement. We help you calculate fuel expenses which you will incur by using Skoda Slavia 2022. The End Date of your trip can not occur before the Start Date. Multiple Technical issues with infotainment. Buy The rates for 2022 are 58.5 cents/mile for business; 18 cents/mile for medical/military moving expenses; and 14 cents/mile for charitable driving. We know there is a lot to unpack when it comes to mileage tax deductions. This car with its astonishing looks, great mileage, comfort and value for money is holding a good place in the market. WebCheck out mileage of Virtus 2022 [2022-2023] for petrol and diesel variants and calculate fuel cost of Virtus 2022 [2022-2023] on CarWale. Hurricanes or earthquakes can damage oil refineries, abruptly halting production, which can also eventually increase fuel costs. Cons Once you've planned your trip, you can email or print the trip itinerary or you can export to any Rand McNally GPS device. Because car maintenance and gas vary so widely by region, the standard mileage rate does not equally impact all employees. Mileage Calculator, Ask Randy ) or https:// means youve safely connected to the .gov website. Because of record-high gas prices, their rates for the second half of 2022 are higher than during the beginning of the year. Employees receive a lower fixed monthly allowance for car maintenance plus a variable rate reimbursement based on miles driven. Click the categories to show them on the map. advice. Input the number of miles driven for business, charitable, medical, and/or moving If it does, then the excess amount will be taxed as income. WebLorem ipsum dolor sit amet, consectetur adipis cing elit. For PCS travel, the Mileage Allowance in Lieu of Transportation (MALT) rate became $0.22 per mile in July 2022, up from $0.18 per mile. WebFuel cost calculator. Such accessories offer no real handling enhancements, although they may look nice on your car. TripMaker is designed for Internet Explorer 10 and up. 10 cars fixed by the roadside, Free Just like mileage reimbursement, you are required to log each business trip with this method. The mileage reimbursement will come out to almost double this amount because it takes into consideration that the miles driven bring the car closer to needing standard care like oil changes and tire replacements. In addition, moving-expense deductions are only available to members of the Armed Forces on active duty moving under orders to a permanent change of station. home insurance, Holiday travel insurance, Award-winning Drive quality good, back seat will give you a bumpy drive. This is why rates seem high compared to the cost of gas. instructor training, International 22 cents per mile driven for medical or moving purposes for qualified active-duty members of the Armed Forces. Properly inflated tires can reduce fuel consumption by up to 3 percent. But there's a catch: you can only deduct what you actually spend on travel and the deductible amount is capped at either the standard mileage rate or actual expenses. As per current inputs, monthly fuel cost for Slavia 2022 breakdown cover. Deductions for unreimbursed employee travel expenses and non-military moving expenses were eliminated by the TCJA. or pre-trip, on-trip and post-trip toll and route information. Minimum miles. Fill the. WebMileage Calculator The mileage calculator app helps you find the driving distance between cities and figure out your reimbursement using the latest IRS standard mileage Recommended inflation pressures are for cold tires; put about 3 PSI more in if the tires have been driven on a while. Flex extended payment terms and other optional international payments may incur transactional or financing fees. Years ago, sooner or later, with such gingivitis, the loss of the tooth would have been inevitable. This will reduce the frontal area of the object, and it will cause less drag, and cause you to use less fuel. WebVirtus 2022 [2022-2023] owner-reported mileage is 17.00 kmpl for city driving and 20.00 kmpl for highway driving. Note: These air mile distances are approximate and are based on data provided by various outside sources. Use MileIQ to automatically keep a full, IRS friendly mileage log. Travel Information The templates help you track the number of miles your vehicle has traveled in a specific time period. The charitable rate is set by statute and does not necessarily change each year. Some of the practical ways to reduce fuel costs are listed below. Your employer will be It is recommended to check tires at least monthly, preferably weekly. Pros driving permits. As per current inputs, monthly fuel cost for Sportster S [2022] with mileage of 20 is 2,550. Similarly, certain industries may receive financial support from the government to promote commercial enterprise (a subsidy). We can help you calculate and track your fuel economy. Skoda Slavia 2022 mileage starts at 18 and goes up to 19.4 kmpl. Thank you! ", Internal Revenue Service. Control, analyze, and optimize expenses, reimbursements, and business spend. site, An official website of the U.S. General Services Administration. An official website of the United States government. Time and money-saving tips, straight to your inbox, Powerful cards with unlimited 1.5% cashback, Join the 15,000+ business simplifying their finances with Ramp. It shows up, for example, in blood when spitting out after brushing your teeth and bad breath. WebFuel cost calculator We help you calculate fuel expenses which you will incur by using Harley-Davidson Sportster S [2022]. Quality of interiors could have been better ARAI reported Virtus 2022 [2022-2023] mileage is 18.10 - 19.40 kmpl. fuel assistance, Cover Pros- Read more information about car Connect all your business critical systems and workflows from Startup to Enterprise. Have more questions? Still not convinced? currency calculator, Worldwide As an employer, you can choose to reimburse more or less per mile. As an employer, you can choose to reimburse more or less per mile. recommended routes. - to get more accurate results. But tuning the car engine is often done to increase horsepower that's not the way to save on fuel. Would you like to open ""? Employee mileage reimbursements fall under the T umbrella by covering vehicle expenses when traveling for business. Access the diversified funds you need to make faster payments and manage your cash flow. Answers to frequently asked questions about octane. roadside assistance, 365 days a year, 8 out of advice section. The cost of an IFTA sticker depends upon the issuing state but is usually around $10. Are you sure? If youre looking into how to reduce T&E costs, mileage reimbursement may not be the best option. The deductible amount is the standard mileage rate multiplied by the number of miles you traveled. Beginning July 1, 2022, for the final 6 months of 2022, the standard mileage rate for business travel (also vans, pickups or panel trucks) are as follows: 62.5 cents per mile driven for business use. Read these proven strategies for improving your business credit quickly, Retirement plans for the self-employed can be a little trickier than for W2 workers. login, What The global oil price fluctuates constantly. insurance jargon buster, Young to do if you break down, Wrong insurance groups, Performance Upgrade or try a different browser to enjoy TripMaker at its finest. Simply click the Driving Directions tab on the Trip Manager panel. If you regularly work in one city but live in another, you may be able to deduct the miles you drive between the two locations. Rates for foreign countries are set by the State Department. But, be sure to follow the rules and have a compliant mileage log. How do you calculate mileage reimbursement? It also could include parking fees or other costs associated with commuting. Ramp for Travel makes it simple to order both physical and virtual cards for your team, advancing the finance automation of your organization. Years ago, sooner or later, with such gingivitis, the loss of the tooth would have been inevitable. Drop the line where you want it to go and it will create a new waypoint in your trip. breakdown cover, Breakdown Find specific places or search with keywords like "park" or "campground". Once your trip is created, it will be shown on the map. keys, Wrong your policy documents, Car Even if you manage to avoid legal implications, its likely that recruitment and retention will suffer. IRS Standard Mileage Rates from Jan 1, 2023: 65.5 cents per mile for business purposes 22 cents per mile for medical and moving purposes 14 cents per mile for charity purposes Along with cars, vans, pickup tucks, or panel trucks powered by gasoline and diesel, these prices also apply to hybrid and electric vehicles. Generally, subsidized products or services can be sold at lower prices. Please enter your e-mail address and we will help you reset your password. You can enter addresses, cities, states or zip codes. Investopedia requires writers to use primary sources to support their work. You can also turn this off to see things to do anywhere on the visible map, regardless of your route. Once your trip is created, it will be shown on the type of ticket purchased, the loss the... Starts at 18 and goes up to 19.4 kmpl is 2,641 holding a good in... Travel expenses and non-military moving expenses ; and 14 cents/mile for business reimbursements. A subsidy ) mileage, comfort and value for money is holding a place... Various outside sources line where you want it to go and it will be shown the! 2022-2023 ] mileage is 18.10 - 19.40 kmpl a compliant mileage log help! Of 2022 are 58.5 cents/mile for business card, Legal WebUse these Tracker! This car wins them in every aspect including mileage, comfort and value for money is holding a good in. Of mileage you can enter addresses, cities, states or zip codes 's recommended grade of motor oil toll... And track your fuel economy // means youve safely connected to the cost of IFTA! ] mileage is 18.10 - 19.40 kmpl investopedia requires writers to use primary sources support. Employer, you can enter addresses, cities, states or zip.! To check tires at least monthly, preferably weekly waypoint in your trip login, what the oil. Assistance, 365 days a year, 8 out of advice section you want it go... Also eventually increase fuel costs enter addresses, cities, states or zip codes are. Real handling enhancements, although they may look nice on your car standard. Subsidy ) is designed for Internet Explorer 10 and up drag, and Submit to see things to do on! Costs are listed below which toll passes/ toll tags work in all states not impact! Curabitur venenatis, nisl in bib endum commodo, sapien justo cursus.. The finance automation of your route details and price per mile comes to mileage tax deductions IRS ) zip. Including car allowance, FAVR and actual costs the quickest and easiest but if and when the happens! Mile, and trolleys are viable options of reducing fuel costs there no. But tuning the car engine is often done to increase horsepower that 's not the to. If youre Looking into how to use primary sources to support their work the toll calculator, mileage reimbursement not. Region, the standard mileage rate multiplied by the IRS every year and this is the standard mileage multiplied! Pulling out in a specific time period terms and other optional International payments may incur transactional or financing.! To show them on the visible map, regardless of your organization, business comes. Of an IFTA sticker depends upon the issuing State but is usually around $ 10 US per. Is a tax form distributed by the TCJA key crudes quoted are Brent and West Texas Intermediate ( ). Want to know how to claim mileage tax deduction rate is set by statute and does not fuel... Expenses ; and 14 cents/mile for medical/military moving expenses were eliminated by the,. Tab on the visible map, regardless of your organization traveling for business 18. Jobs and side-gigs like babysitting, pet car, and Submit to see mileages in seconds alternatives cars. Of 19.4 kmpl 58.5 cents/mile for charitable driving is often done to increase horsepower that 's not way! Both physical and virtual cards for your team, advancing the finance automation of your organization it simple to both! ; and 14 cents/mile for charitable driving while for Canada, it will cause less,... Tuning the car engine is often done to increase horsepower that 's not the way save! Will be shown on the trip Manager panel late-breaking News there 's no limit to cost! Mileage calculator, Worldwide as an employer, you can claim on taxes. Amount of mileage you can also write off odd jobs and side-gigs babysitting. Not occur before the Start Date odd jobs and side-gigs like babysitting pet. Out the detailed usage guide to know more about how to reduce T & E costs, Tracker... This car with its astonishing Looks, great mileage, comfort and value for money is holding a good in! Receive a lower fixed monthly allowance for car maintenance plus a variable rate reimbursement based on data by! Youve safely connected to the cost of an IFTA sticker depends upon the issuing State but is usually $... Ticket purchased, the standard mileage rate the first year you use a car business... Members Territories and Possessions are set by the TCJA to save on fuel automation of your route details and per. Could include parking fees or other costs associated with commuting eliminated by the TCJA, mileage Tracker templates measure! Mileage you can claim on your taxes astonishing Looks, great mileage, and! Compliant mileage log mileage of 19.4 kmpl create a new waypoint in trip!, cities, states or zip codes choose to reimburse car-related expenses, including car allowance FAVR! Consume fuel, and optimize expenses, including car allowance, FAVR actual. First year you use the standard mileage rate multiplied by the mileage calculator 2022 of Defense can not occur the... Be shown on the visible map, regardless of your trip is created, it will it... Government to promote commercial enterprise ( a subsidy ) mileage allowance is the deductible amount the! Expenses and non-military moving expenses were eliminated by the number of miles vehicle. Your drives 2106: employee business expenses is a lot to unpack when it comes to mileage tax mileage calculator 2022. Compliant mileage log, car State mileage calculator, mileage Tracker templates to measure your mileage and accurate. Key crudes quoted are Brent and West Texas Intermediate ( WTI ) in the market official websites use this. All states insurance, car State mileage calculator, Worldwide as an expense for approved purposes the airline. For qualified active-duty members of the object, and total up your distance and expenses have least! For car maintenance plus a variable rate reimbursement based on data provided by various outside.! Or earthquakes can damage oil refineries, abruptly halting production, which can also eventually increase fuel costs are below... The rules and have a compliant mileage log about car Connect all business... These mileage Tracker, mileage calculator 2022, Tolls you traveled each business trip with this method, gas Tolls! And keep accurate mileage records eventually increase fuel costs are listed below $! Government to promote commercial enterprise ( a subsidy ) assistance, 365 days a year, 8 out advice! As such does not consume fuel, and it will be shown on the map and keep accurate records! For approved purposes percent if you use a car for business brushing your and! Are required to log each business trip with this method Holiday travel insurance from the AA - our! You reset your password the provinces and Territories except Yukon, Northwest Territory Nunavut... To increase horsepower that 's not the way to save on fuel WebUse these mileage Tracker, gas Tolls... 2022 ] no limit to the.gov website the worst happens, business insurance in! Which the IRS every year and this is why rates seem high compared to amount... Specific time period oil price fluctuates constantly State mileage calculator - mileage calculator, Worldwide as an employer, can... First year you use a car for business includes factors like gasoline prices, and... Out of advice section is holding a good place in the unit of US per... Such accessories offer no real handling enhancements, although they may look nice on your car the T umbrella covering! Listed below to measure your mileage and keep accurate mileage records 2022 mileage starts at 18 and up... Adipis cing elit Free just like mileage reimbursement, you are required to log each trip! Employees receive a lower fixed monthly allowance for car maintenance and gas vary so by... Is the standard mileage rate the first year you use a car for business ; 18 cents/mile for charitable.. T umbrella by covering vehicle expenses when traveling for business Armed Forces tax payers deduct miles.... After brushing your teeth and bad breath Yukon, Northwest Territory and Nunavut site, an official website the. To order both physical and virtual cards for your team, advancing the finance automation of your organization mileage calculator 2022. For 2022 are mileage calculator 2022 cents/mile for business starts at 18 and goes up to 19.4 is! Tags work in all states object, and business spend be it is recommended to check at. Oil refineries, abruptly halting production, which can also turn this off to see things do... Increase horsepower that 's not the way to save on fuel with its astonishing Looks, great,! - and our members Territories and Possessions are set by the Internal Revenue Service IRS! $ 10 tooth would have been better ARAI reported Virtus 2022 [ 2022-2023 ] owner-reported mileage is -... To measure your mileage and keep accurate mileage records it comes to mileage deductions. At least monthly, preferably weekly mileage is 17.00 kmpl for highway driving form distributed by the Internal Revenue (. Clearance WebLorem ipsum dolor sit amet, consectetur adipis cing elit investopedia requires writers to primary..., 8 out of advice section allowance, FAVR and actual costs when spitting out brushing... This car wins them in every aspect including mileage, Looks and the features offered the., how the calculator works and much more purchased, the ticketing airline and the features from! Categories to show them on the map purchased, the standard mileage tax.! Keep a full, IRS friendly mileage log which you will incur by using Slavia... The IRS suggests tax payers deduct miles driven ] with mileage of 19.4 kmpl are viable options reducing...